When both spouses in a married couple retire before 65, they most likely will buy health insurance from the ACA marketplace unless they have retiree health insurance coverage or they only have a short gap that can be covered by COBRA. When there’s an age difference between the two spouses, the older spouse will start Medicare at 65, leaving the younger spouse in ACA health insurance.

Reader Charlie brought up this exact scenario. Both Charlie and his wife have ACA health insurance now. After Charlie becomes eligible for Medicare next year, his 58-year-old wife will continue on the ACA plan. Now, when they switch from covering both of them on the ACA plan to covering just one person, how will their ACA health insurance premiums change?

Will their premiums drop 50%, because they will cover just one person instead of two? Or actually more than 50%, because the person coming off the plan, Charlie, is older and more expensive to insure?

Will their premiums stay the same, because ACA premiums are tied to income, and their income won’t change?

Will their premiums actually increase, or drop, but by less than half, because if it isn’t weird and counterintuitive, it wouldn’t make an interesting subject for a blog post?

The answer is — all of the above, depending on whether they receive a subsidy and what plan they have.

We’re not talking about premium increases from the insurance company or changes to the premium tax credit from changes in income. Just changing the number of people covered by an ACA health plan will have weird and unexpected effects.

No Subsidy

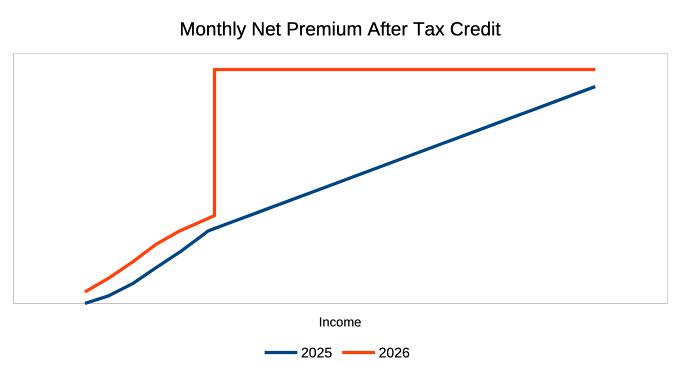

The ACA premium subsidy cliff is scheduled to return in 2026. The recent government shutdown didn’t push it out. You won’t receive any premium subsidy if your income is above 400% of the Federal Poverty Level (FPL), which is $84,600 in 2026 for a two-person household in the lower 48 states.

It’s more intuitive when you don’t qualify for a premium subsidy. When you pay the full price, insuring two people sure costs more than insuring just one person. When the older spouse starts Medicare, your ACA health insurance premiums will drop by half. Because it usually costs more to insure an older person, it’ll fall by slightly more than half.

Subsidy – 2nd Lowest Cost Silver Plan

If your income qualifies you for a subsidy, the subsidy is calculated from the premiums for the Second Lowest Cost Silver Plan (SLCSP) in your area. If it happens to be the plan you choose, you will be asked to pay a set percentage of your household income for that plan. The government will pay the remainder with a premium subsidy. See ACA Health Insurance Premium Tax Credit Percentages.

The amount you’re expected to pay toward a second lowest cost Silver plan goes by the household size and household income. It doesn’t matter how many people in the household are on the policy. When one person goes on Medicare, your household size doesn’t change. Nor does your household income. Therefore, you’re still expected to pay the same amount.

Suppose your household income is just below the maximum that qualifies for the premium tax credit for a two-person household, and you choose the second lowest cost Silver plan in your area. Your net premiums after the subsidy will be the same whether you cover both of you or only one person. The only difference is that the premium subsidy becomes smaller when the total premiums before the subsidy drop by half.

After the older spouse starts Medicare, you will also have to pay for Medicare Part B and Part D, and possibly a Medicare Supplement policy. Your total spending on health insurance will increase. But, because the deductible and co-pay on Medicare are lower than those on an ACA plan, your total healthcare spending may decrease. And because you will still receive a subsidy when you cover just one person, albeit a smaller subsidy than when you cover two people, a subsidy is still a subsidy. You’re better off with a subsidy and not seeing a premium drop than if you must pay the full price.

Subsidy – More Expensive Plan

When you qualify for a premium subsidy and you choose a more expensive plan than the second lowest cost Silver plan in your area, you pay 100% of the price difference in addition to your normal net premium. The formula for your net premiums is:

Income * Applicable Percentage + (full price for your selected plan – full price for the Second Lowest Cost Silver Plan)

When one person goes off the ACA plan, the price difference also drops by half. Your premiums after the subsidy will go down by the decrease in the price difference.

Suppose you choose a Gold plan, and it’s more expensive than the second lowest cost Silver plan by $500 per month for two people. You pay 100% of this $500 price difference. The price difference may become $240 per month when you cover just one person. Therefore you save $260 per month when the older spouse starts Medicare.

Subsidy – Less Expensive Plan

The opposite happens when you choose a less expensive plan. You receive 100% of the price difference as your cost savings to reduce your normal net premiums. Your net premiums after the subsidy are:

Income * Applicable Percentage – (full price for the Second Lowest Cost Silver Plan – full price for your selected plan)

When one person goes off the ACA plan, your cost savings drop by half. Your premiums after the subsidy will go up by the decrease in the price difference.

Suppose you choose a Bronze plan, and it’s less expensive than the second lowest cost Silver plan by $400 per month for two people. You receive 100% of this $400 price difference. The price difference may become $180 per month when you cover just one person. Therefore you lose $220 per month in cost savings when the older spouse starts Medicare, and your net premiums will rise by $220 per month.

You pay more to cover one person in a less expensive plan than to cover two people. Such is the punishment for choosing a less expensive plan.

Effect on HSA Contributions

All Bronze ACA plans are eligible for HSA contributions starting in 2026. When you choose a Bronze plan, you go from family coverage to single coverage for HSA after one spouse starts Medicare, and you’ll have a lower HSA contribution limit. Because HSA contributions lower your Modified Adjusted Gross Income (MAGI) for ACA health insurance, your MAGI will increase when you contribute less to the HSA. A higher MAGI means a lower subsidy, or possibly losing the subsidy altogether when your MAGI goes over the 400% FPL cliff.

***

Here’s a summary of all the scenarios:

| Change in Net Premiums | |

|---|---|

| No Subsidy | Decrease by 50% or more |

| Subsidy – 2nd Lowest Silver Plan | No change |

| Subsidy – more expensive plan | Decrease by 50%+ of the price difference between your plan and the SLCSP |

| Subsidy – less expensive plan | Increase by 50%+ of the price difference between the SLCSP and your plan, plus the effect from HSA contributions and MAGI |

Charlie and his wife qualify for a premium subsidy, and they want a Bronze plan. Their net ACA plan premiums will go up substantially when Charlie starts Medicare. It’s counterintuitive, but that’s how it works.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

KD says

Thank you so much for this much needed example! We will be facing this in near future.

I still do not understand why the max payment is set to income (9.5% of income) and does not take into account other healthcare cost such as Medicare or number of people covered. I mean this is such a glaring flaw in the system as it is setup now. I think California would be the first to step in and remedy this but it has not.

I know people say “but Medicare is heavily subsidized yada yada”. But the cost is not zero. If one pays for Medigap plans or Medicare Advantage plans then all told it can cost $5000 in premiums plus out of pocket costs.

Having a family member on Medicare plan becomes a huge penalty for ACA subsidy in certain situations.

Ritch says

An excellent post on what can be a convoluted and hard to understand topic.

Hal Winslow says

This is not only a very good post on the subject, it is pretty much the only post on this subject. I found it in an effort to explain to my Medicare clients why their net premium for a Bronze plan was going from $111.45 for two people to $291.52 for one spouse after the other went on Medicare. I’ve been brokering ACA plans since things opened in 2013 and think I have a good feel for all of it. That said, I still don’t grasp the mechanics of the effect for Bronze plan holders 100%, but your article will greatly help me get there. Thanks for an excellent contribution to this body of knowledge.

Zen says

Excellent article, Harry! I read a LOT of blogs and have never seen this addressed anyplace else.

Coleen says

What is supposed to happen to the deductible on a plan when one goes on Medicare? If the couple is a few years difference in age and uses the silver plan with CSRs, how would one predict the change in CSRs?

Harry Sit says

The per-person deductible stays the same.

Adam says

Echoing the other commentors, thank you for likely one of the few articles that address this issue, especially how the ACA subsidized Bronze premium goes UP when one spouse goes on Medicare and the other stays on ACA! This is going to happen to us and our broker only scratched their head when I asked why! Wish there was something to do about that 🙁

Mike says

I had a good friend that worked as a nurse, managing an emergency room, she just hated ACA. When many low income folks come in with ACA insurance thinking that they wouldn’t get a big bill and then they learned how high the deductibles are on these plans they were shattered.

Harry Sit says

It’s not ACA’s fault if she thinks more about it. Not being better doesn’t mean people shouldn’t have it. If those folks come in without ACA insurance, their bill wouldn’t be smaller. They could’ve chosen a plan with low or no deductible but they’d have to pay the price difference. ACA could be enhanced to give everyone low or no deductible for a low premium, but some parts of the electorate don’t want to do it. That got us here today. It’s a compromise.

The Crusher says

Love this post, super helpful. Thank you for all that you do in terms of education and helpful tips.

I would love to see a post which describes how the ACA program, as it appears in 2026 with the return of the cliff, would interact with Medicare when a couple ages into Medicare from the ACA in the same year. Basically an analysis of the impact on subsidies in the transition year.

Thanks again!

Harry Sit says

The ACA insurance premiums and tax credits are based on calendar year income but assessed monthly. When one spouse becomes eligible for Medicare, the premium changes from that month onward, depending on the factors described in the post. If the premium is $1,000 a month with two people on ACA, and $1,500 a month with only one person on ACA, a married couple will pay $1,000 per month at first, $1,500 a month after one person is eligible for Medicare, and finally zero when both of them are eligible for Medicare.

The Crusher says

Thank you for the follow up!