[Updated in November 2019 after Fidelity and other major online brokers lowered their commission for online ETF trades to $0.]

What are the best index funds and ETFs for long-term investors using Fidelity? I have more money in Fidelity accounts than in Vanguard accounts. I will give my choices. These are purely my opinion. Fidelity didn’t make me write any of this.

All-In-One: Fidelity Freedom Index Funds

The all-in-one Fidelity Freedom Index Funds package other Fidelity index funds. You just pick one based on your target year and risk tolerance. They are convenient, low cost, broadly diversified, and automatically rebalanced. Unless you’d like to manage your own mix, these are great choices. All of them have no minimum investment requirement. You can literally start with just $1 and instantly have a low-cost globally diversified portfolio.

- Fidelity Freedom Index 2005 Fund (FJIFX, 0.12% net expense ratio)

- Fidelity Freedom Index 2010 Fund (FKIFX, 0.12% net expense ratio)

- Fidelity Freedom Index 2015 Fund (FLIFX, 0.12% net expense ratio)

- Fidelity Freedom Index 2020 Fund (FPIFX, 0.12% net expense ratio)

- Fidelity Freedom Index 2025 Fund (FQIFX, 0.12% net expense ratio)

- Fidelity Freedom Index 2030 Fund (FXIFX, 0.12% net expense ratio)

- Fidelity Freedom Index 2035 Fund (FIHFX, 0.12% net expense ratio)

- Fidelity Freedom Index 2040 Fund (FBIFX, 0.12% net expense ratio)

- Fidelity Freedom Index 2045 Fund (FIOFX, 0.12% net expense ratio)

- Fidelity Freedom Index 2050 Fund (FIPFX, 0.12% net expense ratio)

- Fidelity Freedom Index 2055 Fund (FDEWX, 0.12% net expense ratio)

- Fidelity Freedom Index 2060 Fund (FDKLX, 0.12% net expense ratio)

Please note these Fidelity Freedom Index Funds are not the same as the similarly named Fidelity Freedom Funds (without the word “Index” in the names). Read more in Fidelity Freedom Index Funds: Hidden Gems For Your IRA and 401k.

Mix Your Own – Index Funds and/or ETFs

Fidelity offers more than 20 Fidelity-branded index funds. All of them have no minimum investment requirement. Fidelity also charges no commission on all ETFs if you place the trades online. Whether you prefer mutual funds or ETFs, you can come up a great portfolio with only Fidelity index funds, only ETFs, or a mix-and-match between Fidelity index funds and ETFs.

US Broad Stock Market

Fidelity has an index fund Fidelity Total Market Index Fund (FSKAX) with an expense ratio of only 0.015%. Fidelity also offers a newer Fidelity ZERO Total Market Index Fund (FZROX) with 0% expense ratio.

Outside retirement accounts, an ETF is slightly more tax efficient. You can buy Vanguard Total Stock Market ETF (VTI, expense ratio 0.03%) or iShares Core S&P Total U.S. Stock Market ETF (ITOT, expense ratio 0.03%).

International Broad Stock Market

Fidelity’s index fund Fidelity Total International Index Fund (FTIHX, expense ratio 0.06%) is a well-rounded fund. It includes both developed and emerging markets and international small-caps. Fidelity also offers a newer Fidelity ZERO International Index Fund (FZILX) with 0% expense ratio, although it doesn’t cover international small-caps.

If you prefer an ETF, Vanguard Total International Stock ETF (VXUS, expense ratio 0.09%) and iShares Core MSCI Total International Stock ETF (IXUS, expense ratio 0.09%) both cover the same broad international stock markets.

US Fixed Income

Fidelity offers Fidelity U.S. Bond Index Fund (FXNAX, expense ratio 0.025%), which tracks the broad U.S. bond market. If you prefer an ETF, you can buy Vanguard Total Bond Market ETF (BND, expense ratio 0.035%) or iShares Core U.S. Aggregate Bond ETF (AGG, net expense ratio 0.05%).

For inflation-protected bonds, Fidelity offers Fidelity Inflation-Protected Bond Index Fund (FIPDX) with a 0.05% expense ratio. If you prefer an ETF, Schwab U.S. TIPS ETF (SCHP, expense ratio 0.05%) is a good choice.

Three-Fund Portfolio

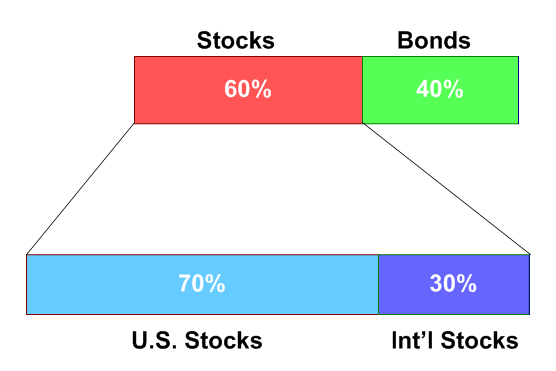

The above three broad asset classes will cover pretty much everything anyone really needs. You just make two decisions:

- How much in stocks versus bonds?

- How much stocks in international?

Here’s an example of someone who answered 60% in stocks and 70% of stocks in international:

It translates into:

- 42% in U.S. stocks (60% * 70% = 42%)

- 18% in international stocks (60% * 30% = 18%)

- 40% in U.S. bonds

Then you will have a globally diversified portfolio.

Spice Up

It’s not necessary to go much beyond a three-fund portfolio but if you prefer to add to the broad coverage and overweight in certain areas, you still can.

US Small Cap Stocks

For US small cap stocks, Fidelity offers Fidelity Small Cap Index Fund (FSSNX, expense ratio 0.025%). If you prefer an ETF, you can buy iShares Core S&P Small-Cap ETF (IJR, expense ratio 0.07%), Vanguard Small-Cap ETF (VB, expense ratio 0.05%), Schwab US Small-Cap ETF (SCHA, expense ratio 0.04%), or SPDR Portfolio Small Cap ETF (SPSM, expense ratio 0.05%).

For US small cap value stocks, Fidelity offers Fidelity Small Cap Value Index Fund (FISVX, expense ratio 0.05%). If you prefer an ETF, you can buy Vanguard Small-Cap Value ETF (VBR, expense ratio 0.07%) or SPDR S&P 600 Small Cap Value ETF (SLYV, expense ratio 0.15%).

US REITs

Fidelity offers Fidelity Real Estate Index Fund (FSRNX, expense ratio 0.07%). Good ETF choices include Vanguard Real Estate ETF (VNQ, expense ratio 0.12%), Schwab U.S. REIT ETF (SCHH, expense ratio 0.07%) and iShares Core U.S. REIT ETF (USRT, expense ratio 0.08%).

Emerging Markets

Fidelity offers Fidelity Emerging Markets Index Fund (FPADX) with a 0.08% expense ratio. If you prefer an ETF, you can buy Vanguard FTSE Emerging Markets ETF (VWO, expense ratio 0.12%), iShares Core MSCI Emerging Markets ETF (IEMG, expense ratio 0.14%) or SPDR Portfolio Emerging Markets ETF (SPEM, expense ratio 0.11%).

International Small Cap Stocks

Fidelity doesn’t offer an index fund for international small cap stocks. If you prefer to overweight international small cap stocks, you can buy Vanguard FTSE All-World ex-US Small-Cap ETF (VSS, expense ratio 0.12%).

***

For broad diversification with the easiest way to manage, just one Fidelity Freedom Index Fund will do. Just pick a year closest to your planned retirement age.

If I’m doing my own mix, I would use these:

- Fidelity Total Market Index Fund (FSKAX), Fidelity ZERO Total Market Index Fund (FZROX) or Vanguard Total Stock Market ETF (VTI) for US stocks;

- Fidelity Total International Index Fund (FTIHX) or Vanguard Total International Stock ETF (VXUS) for international stocks;

- Fidelity U.S. Bond Index Fund (FXNAX) or Vanguard Total Bond Market ETF (BND) for US bonds. Maybe add some Fidelity Inflation-Protected Bond Index Fund (FIPDX) or Schwab U.S. TIPS ETF (SCHP) for inflation protection.

If I’d like to spice it up a little more with a higher risk, I would add some of the supporting players to the 3-4 core index funds/ETFs, maybe maximum 3 more funds/ETFs. Anything more than that would be an overkill.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Dan says

Useful list. I would add Fidelity’s new-ish Spartan TIPS fund: https://fundresearch.fidelity.com/mutual-funds/summary/316146125

For a minimum investment of only $10k, you can get TIPS at an ER of 0.10%, compared to Vanguard’s VAIPX fund which requires $50k to get Admiral shares at 0.11%.

In the case, Fidelity’s offering is an index fund while Vanguard’s is not, but their duration and composition are very very similar.

SH says

What is the catch? It is hard to believe that this is done out the goodness from the resident bleeding hearts in Wall Street.

Dan says

@SH, I think BlackRock and Fidelity rightly fear losing market share to investors who focus on passive indexing approaches. Charles Schwab and TD Ameritrade–and of course Vanguard–currently have better low-cost offerings in this area, so BlackRock and Fidelity are teaming up to compete.

In the short run, all these brokerages chasing the low-cost investors’ business is good for the investors, but I’m not sure about the long run. In the long run, they won’t make as much money as they expect because–surprise!–investors are going for a low-cost approach and don’t want to trade often.

The managers of all these index funds could raise the ERs and effectively lock in many long-term investors who don’t want to pay capital gains to move their money elsewhere. For this reason, I won’t hold anything other than Vanguard funds in my taxable accounts, because I consider the interests of the investors to be misaligned with the interests of the fund managers for all other fund families.

Harry says

Investors are more cost conscious. Instead of selling them load funds, their advisors can put together a portfolio of ETFs and still charge the investors 1-2% for that effort. Advisors get to preserve their revenue. ETF providers get new revenues from the retail investors. Brokerage firms get compensated from ETF providers. They can also upsell the customers other things. Load funds lose. Customers win.

Edmund says

Good post, Harry. I read your blog frequently and really enjoy it.

I invest at Fidelity as well, and have one correction and one question for you. IJS is not new on the list – it’s been there as part of the 30 commission free ETFs, I have been buying it myself.

The question is what would you buy for fixed income in Fidelity TIRA account? I have been buying BND for large purchases, and AGG for small ones. Would you continue with this strategy, or would you buy FBIDX (total bond index fund) instead?

Harry says

Edmund – Thank you for the correction. I will edit it later. I’m not buying bond funds in traditional IRA but if I have to I would by Spartan U.S. Bond Index Fund Advantage Class (FSITX). The minimum purchase was lowered from $100k to $10k earlier this year.

Edmund says

Thanks for your suggestion, Harry. I run 80/20 stock/bond index fund portfolio in accumulation phase. It’s all in TIRA or 401k, both at Fidelity. I have no other accounts. What do I buy for my fixed income portion of a portfolio, if not total bond fund?

Harry says

Not much you can do in the 401k but you can transfer part of the IRA out to a bank or credit union to buy CDs. Same yield as a bond fund but with no credit risk and no interest rate risk.

Richard says

Wish I started indexing in 2000, keep adding to it and left it alone versus trying to pick funds that would beat FSTVX, etc. Always keep between 5 and 20% cash on hand for the drops!

Frugal Professor says

Any thoughts on the new zero expense ratio funds? They look pretty appealing to me, though the capital gains distributions appear to make them inferior to the Vanguard equivalents until Vanguard’s patent (in dealing with cap gains) runs out.

Harry Sit says

The existing funds at reduced fees are plenty good enough to me. We will wait and see how the new funds do. Most people have most of their money in tax advantaged accounts where capital gains distributions aren’t an issue. For taxable accounts, the commission-free iShares ETFs are also an option. If those still don’t do it, paying $5 to buy a Vanguard ETF isn’t the end of the world either when you buy a large amount, because the $5 is just a one-time cost.

ej76az says

The new ZERO funds are intriguing. These are total market indexes, so how much different could Fidelity’s internal/proprietary indexes be from the licensed ones?

Also, Fido lowered the expense ratios for many index funds. For example, short-term Treasury fund FSBAX and intermediate-term Treasury fund FIBAX now have ERs of only .03%. Unless you have a huge amount to invest, the ERs are so tiny that there’s no reason to endure the time, effort, and hassle of buying individual Treasury bonds, IMHO.

Harry Sit says

I don’t think they will be much different but then again the 0.015% and 0.06% expense ratios on the existing funds aren’t that much different than zero anyway. I agree the 0.03% expenses on the Treasury funds and the 0.05% expenses on the TIPS fund make it compelling to just buy a fund unless you are trying to match maturity with scheduled spending.

Chris says

do you see any risks or downside getting into the ZERO funds? why hesitating?

Harry Sit says

Trust but verify. There are risks to anything new. Although I expect the ZERO funds will do just fine, passing of time is needed for the verify part, especially when the expected benefits over the existing funds aren’t that significant.

TJ says

The Zero funds apparently can’t be donated to DAF’s, including Fidelity Charitable, so that might be reason not to purchase those funds in a taxable account.

Robert Bradley says

“Fidelity Total Market Index Fund (FSTVX) with an expense ratio of only 0.015%”

Wow, that’s .025% less than my Vanguard fund! I’ll switch immediately! I’m just kidding – I’ll stick with Vanguard, because I know that ER is only one component of total fund cost. In this case, you can see that the “high priced” Vanguard competitor, VTSAX, has outperformed FSTVX over every time period. Just like it does with the low priced Schwab competitor.

Stick with the good guys. You’ll wind up with more money.

GreenDollarBills.com says

I’d have to go for the US Small Cap Stocks. If you’re saving for the decades then investment into growth companies such as these are probably the way to go!

sarabayo says

Fidelity has consolidated the share classes of many of their mutual funds now. Of the funds mentioned in your post,

– FSTVX is now only available as FSKAX

– FTIPX is now only available as FTIHX

– FSITX is now only available as FXNAX

– FSIYX is now only available as FIPDX

– FSRVX is now only available as FSRNX

– Fidelity Emerging Markets Index Fund, though you didn’t mention its

fund symbol in the post, is now only available as FPADX

Harry Sit says

Thank you. I updated the links and symbols, together with the new zero expense ratio funds.

Simon says

Great post, really helps simplify the offerings out there – thanks for putting this together and keeping it up to date!

I’m curious why you don’t suggest an international bond index fund as another potential addition to the basic three-fund portfolio. You’re covering international stocks, why not international bonds?

Vanguard has been including the Vanguard Total International Bond Index Fund in their portfolios and I noticed that Fidelity recently introduced FBIIX – would you recommend these in a potential four-fund portfolio?

Harry Sit says

If you prefer to add international bonds, Fidelity International Bond Index Fund (FBIIX) is a good choice. Whether U.S. or international, bonds are a promise to pay back the principal plus interest. Global capital movements tend to equalize the opportunities. Just having U.S. entities making those promises is good enough to me.

Megan Ka says

Thank you for the list, Harry. I’m a single mother in the process of establishing a retirement account. FZROX appears to be a good investment, especially given the 0 expense ratio. I did some research and would like to hear your thoughts on it.

Is it worthwhile to invest in a fund with no expense ratio? I’ve been reading about them and it’s making me think. According to some, the no-fee expense funds are more about Fidelity’s marketing. What are your thoughts?

Harry Sit says

The difference in expense ratios between the Fidelity ZERO funds and non-ZERO funds is minuscule. Either is fine. Go with the ZERO funds if you prefer lower expenses. Go with the non-ZERO funds and pay the small fees if you’re suspicious of some catch.

Steve says

I’m considering adding a total US market ETF (such as VTI) to my taxable (non-retirement) investment account. Purpose is to increase diversification by reducing allocation to individual securities. I have never owned an ETF before – only mutual funds.

I read that some all-market ETFs complicate income return preparation because they generate income (from REITS?) that requires additional tax return forms.

Is this potential tax reporting complexity a negative for all-market ETFs in taxable accounts? I don’t want to get into another tax reporting situation like the foreign tax credit/Form 1116 quagmire.

Harry Sit says

The 199A dividends from REITs adds another form to the tax return, but tax software automatically generates the form. There are no additional questions about it. Online tax software may use it as an upsell opportunity and demand that you must upgrade to a higher level. Desktop software doesn’t play such tricks. You can see the effect by adding a number to Box 5 of your 1099-DIV. Make it smaller than the difference between the numbers in Box 1a and 1b. You will see how your tax software handles it.

Steve says

Harry: Thanks for the information. Couple of other questions:

1. Are 199A dividends potentially distributed from total market mutual funds and ETFs, or only ETFs?

2. Any other potential tax-time complications from total market ETFs in taxable/non-qualified accounts – such as delayed 1099s, revised 1099s, Schedule K-1s, etc.? I want to avoid or at least be aware of such issues before I buy these ETFS.

Harry Sit says

199A dividends are distributed from both mutual funds and ETFs. No K-1s. I haven’t noticed any adverse effects on 1099s from VTI.