[Updated in June 2019. The expense ratio on Fidelity Freedom Index Funds was lowered to 0.12%.]

While automated investment management services using ETFs get the news coverage, don’t overlook the tried-and-true target date funds. They are still a very good choice at least for the IRAs, where most people have the majority of their retirement money, and where fancy tax loss harvesting doesn’t apply.

Fidelity quietly opened up to retail investors a line of target date funds composed of index funds. Besides Vanguard, Fidelity has become a second major mutual fund company that offers target date funds based on index funds to all investors.

These funds are called Fidelity Freedom Index Funds, not to be confused with similarly named Fidelity Freedom Funds (without Index in the name). Fidelity Freedom Index Funds use index funds; the net expense ratio is 0.12%. Fidelity Freedom Funds use actively managed funds; their net expense ratios go from 0.47% to 0.75%.

Fidelity Freedom Index Funds aren’t strictly new. They had been available since 2009 but only to some 401k-type plans. Now retail investors can buy them too, say for their traditional or Roth IRA. Each fund has a target year in the name. There’s a 2015 fund for people retiring next year. There’s a 2035 fund for people retiring in 20 years, and so on.

Besides a tiny allocation to money market and commodities, Fidelity Freedom Index Funds basically allocate to three broadly diversified asset classes:

- total US stocks

- total international stocks

- total US bonds

Within stocks, US and international stocks are split roughly 70:30. In terms of asset classes covered and how US and international stocks split, they are very similar to Vanguard’s target date funds, except Vanguard also includes international bonds as 20% of the bonds allocation. The 0.12% net expense ratio is also comparable to Vanguard’s target date funds, which have an expense ratio between 0.12% and 0.15%.

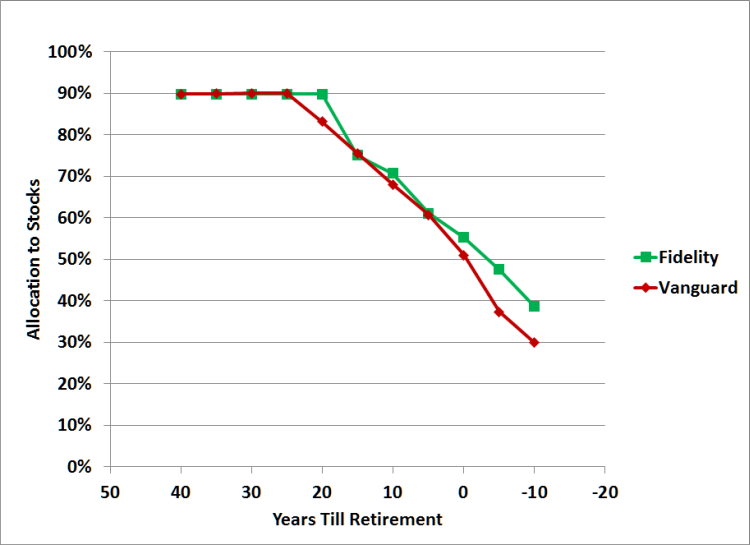

The allocations to stocks over different years (the “glide paths”) are also very similar between Fidelity Freedom Index Funds and Vanguard Target Retirement Funds.

Starting at 40 years before retirement, they both peg to 90% in stocks. Vanguard stays there for 15 years. Fidelity stays there for 20 years. Then the allocation to stocks starts to drop. At the time of retirement, Fidelity has it at 55% in stocks; Vanguard has it at 50%.

With a Fidelity Freedom Index Fund or a Vanguard Target Retirement Fund, investors achieve the same deposit-and-forget efficiency as the new online services using ETFs, arguably at a lower cost with less complexity. The fund is low cost, broadly diversified, and automatically rebalanced. You have all the service infrastructure from Fidelity or Vanguard standing behind it.

If you have a Fidelity IRA, a solo 401k, or a BrokerageLink self-directed brokerage option in your employer plan, using one of these is a very attractive option. I’m going to add these to the best index funds and ETFs at Fidelity.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Mike says

The commodities portion of these used to be much higher ~10% when commodities were booming. This shows that they don’t stay the course (and neither does Vanguard), so not exactly “set and forget” and hard for me to recommend.

Harry Sit says

Thank you for that info. Hope they learned their lesson and don’t tinker in the future.

Nick says

Right now my Roth IRA I have only purchased fidelity freedom 2050 fund, would you suggest I convert over to freedom index 2050 fund? Thanks

Harry Sit says

I would choose the index fund if those are my two choices, because I believe in low cost and indexing. Of course nobody knows which one will do better in the future.

sarabayo says

Fidelity Freedom Index funds seem to have increased their international percentage in equities since this post was written. They’re now at 39% across the board, which is almost the same as Vanguard’s TDFs which are 40-41%.

The glide path also looks slightly different now, but only slightly – rather than Fidelity’s stock allocation temporarily jumping above Vanguard’s around 10 years before retirement, now there’s a slight dip around that point, but that could just be noise.

Another difference is that Fidelity’s target date funds for years in the past seem to continue to exist indefinitely (?) and continue gliding their stock allocation down. In contrast, Vanguard doesn’t seem to have target date funds for years that have already passed — do they just merge them into VTINX, Vanguard Target Retirement Income Fund? If so, that means that Vanguard has all retirees in TDFs at the same stock allocation, while Fidelity has people in early retirement hold more stocks than people in late retirement.

Here is a graph of the glide paths, given current data: https://i.imgur.com/kPqXtmJ.png