Congress passed the CARES Act to mitigate the negative economic impact brought by the coronavirus pandemic. The most publicized part for individuals is the economic impact payment of $1,200 per adult plus $500 per child. If you’re under the income limit, the payment is coming. If the IRS has your direct deposit information, they will send the money there. If not, they will set up a website soon where you can give your direct deposit information.

CARES Act also provided funds to help small businesses and the self-employed. Many businesses were ordered to close. Even if they weren’t, many small business had huge declines in revenue and profit. Many independent contractors lost their jobs. Even my 100%-online business is seeing a large drop. Advertising revenue from my blog dropped 50% in March compared to March last year. Nearly half of my clients canceled their requests for finding a financial advisor. I expect it will be worse yet in April. When the economic outlook is uncertain, everyone tightens up.

CARES Act created two loan programs for small businesses and the self-employed: Economic Injury Disaster Loan (EIDL) and Paycheck Protection Program (PPP). Because the two programs are so new, detailed rules and procedures are still being created and published. Many lawyers and CPAs are reading the law and the information coming out of the government agencies. They are trying to explain how these programs are supposed to work: who’s eligible, what counts and what doesn’t, how much you will be able to borrow, and how much of the loan can be forgiven. I like this take by retired CPA Peter Reilly:

SBA has to come up with what the rules are and let the banks know. Then the banks have to implement procedures. As far as you are concerned what matters is what the bank you go to thinks.

Peter J. Reilly, Paycheck Protection Program Looks Like A Very Sweet Deal For Employers

I will take it one step further. What matters is finding a bank that takes your application and actually processes it. It’s all moot if you can’t get your application in or your loan application only sits in a big pile and nobody looks at it. The finer details of the loan programs don’t change your immediate action items.

If you are self-employed, here’s what you need to do, now:

Economic Injury Disaster Loan (EIDL)

The federal Small Business Administration (SBA) runs the Economic Injury Disaster Loan (EIDL) program directly. The interest rate for the EIDL will be 3.75%. A part of the loan may be forgiven.

You apply online at covid19relief.sba.gov. It doesn’t cost anything to apply. You answer the questions in the application truthfully to the best you can. You check the box to be considered for an advance before your loan is finalized. You give a bank routing number and account number for them to deposit the loan advance.

The SBA will determine how much loan advance they will give you, and when they will send the loan advance. If you receive a loan advance, the advance won’t have to be repaid. The loan advance may be $10,000, or it may be less. Nothing happens until you apply. So just apply now and worry about the rest at a later time. Even the SBA says:

When in doubt, apply!

After you receive the loan advance, to continue the loan processing, you will be asked to submit some documents. Go with the flow and do what you are asked. If the SBA approves your application, they will offer you the complete loan terms. Just take the loan. If the economy becomes worse, you may be offered additional relief down the road. If the economy returns to normal and you don’t need the loan anymore, you can repay the loan without any prepayment penalty.

Paycheck Protection Program (PPP)

The primary purpose of the Paycheck Protection Program is to cover payroll. For a self-employed person, payroll includes paying yourself for services you perform. The PPP loan will be a two-year loan at 1% interest rate. Up to 100% of the PPP loan may be forgiven.

The government runs this program through participating banks and credit unions. It’s probably easier if you go through the institution where you already have a business checking account. I for one don’t have a business checking account, because I use the business account from Fidelity Investments and Fidelity isn’t a bank. Many independent contractors only use a separate personal checking account, not one officially designated as a business checking account. In that case you may have difficulty in finding a bank that takes your application.

For example, Bank of America at first required that you must have a business checking account and a business lending relationship with them since February 15, 2020. Only opening accounts now doesn’t work. After people protested, now they still require a business checking account since February 15, 2020 and you don’t have a business credit card or business lending relationship elsewhere. That means if you have a business credit card with Chase, Bank of America doesn’t take you; they want you to go to Chase. Meanwhile Chase requires that you have a Chase Business checking account that’s been active since February 15, 2020. If you have your business checking account with Bank of America and your business credit card with Chase, neither bank takes you.

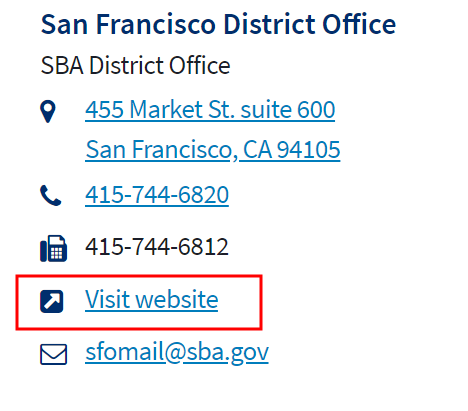

What if you are like me and you also don’t have a business checking account, or the bank that has your business checking account doesn’t take your application? If you go to SBA’s website and find their district offices near you, you will see that each district office has a website.

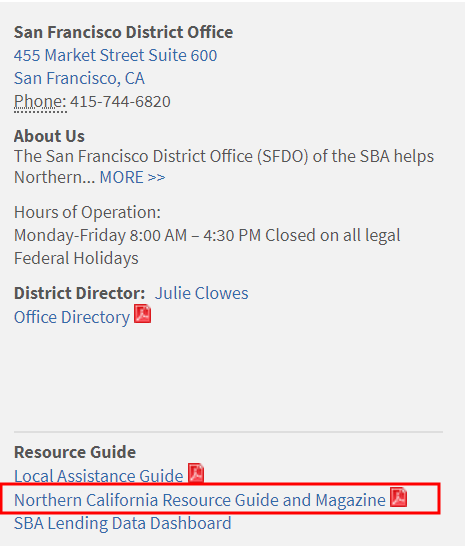

Each SBA District Office has a Resource Guide for its district.

In the middle of each Resource Guide, there is a list of local SBA lenders in the district. For example, the list for Northern California is on page 30 of the 52-page Resource Guide. Start calling and visiting those lenders’ websites and see which bank or credit union will take your application for the Paycheck Protection Program. Start with credit unions and banks that you have never heard of. They are more likely to take you than mega banks with a huge volume to existing customers.

Using the Resource Guide for my district, I found a local credit union that has an online application for PPP loans. I completed and signed the application online. I attached Schedule SEs from our 2019 tax return as evidence for our payroll. If this credit union accepts my application, I will happily open accounts there.

If you are willing to go beyond your local area, you can try Sunrise Banks in Minneapolis. According to its website, “Sunrise Banks is accepting applications from all eligible borrowers, no matter who they bank with.”

After you find a bank that takes your application, you will follow the bank’s procedures and give them whatever information and documents they ask from you. The bank will determine how much they will lend to you under the program.

After you take the loan and you use the loan for eligible purposes, you can apply for loan forgiveness. The bank will determine how much of the loan will be forgiven. It may be 100% of the loan amount, or it may be less. Right now you first need to find a bank, put your application in, and hope they will process it soon. You worry about loan forgiveness later. You won’t have any amount forgiven if you don’t get the loan in the first place.

Reference

COVID-19 Relief for Small Business, U.S. Small Business Administration

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

John says

If I’m buying and reselling items and have a schedule C filed last 2 years; can I still apply for EIDL.

This Schedule C is in addition to my W2 which is still continuing at the moment. Also the reselling made only $100 profit since I started last 2 years although revenue was over $20k. Can I still apply for the full amount of loan and expect forgiveness?

Don’t have any payroll setup so I’m skipping the second program

Harry Sit says

SBA says when in doubt, apply. The application asks for your gross revenue and your cost of goods sold. When the difference small, it may affect the amount you will qualify. They haven’t published a clear formula.

KD says

Can a self-employed person who has laid themselves off and claimed unemployment apply for PPP?

Harry Sit says

Unemployment benefits have been expanded to include self-employed persons. Maybe you don’t have to lay yourself off in order to claim unemployment. The business can apply for the PPP loan. When the loan is used to pay yourself, you are no longer unemployed.

DS says

Thank you very much for this great article. I was able to finally find a bank that will take my application. If I understand correctly, you are advocated that self-employed people apply to both programs. When I look at the PPP application form it says that the borrow “Cannot apply for any other programs through the SBA for the same purpose.”

How can we apply for both?

Harry Sit says

You can use the EIDL for a different purpose.

Dorothy says

If I’m self employed and recieve a 1099, will the bank use the 1099 to figure out how much they will lend me?

rp says

If I file taxes as a sole proprietorship (the only employee is me with 1099-MISC income), can i borrow PPP money (quantity based on net income from last year) from a bank and I don’t have to pay it back because the loan is forgiven? It seems too good to be true.

Harry Sit says

You can apply for PPP loan starting on April 10. They may or may not approve. You won’t have any loan or any part of it forgiven if you don’t apply.

Tanya says

If I do not have a business account, and use my Chase personal checking account to receive my 1099 payments as an independent contractor / self employed, can I apply for a PPP loan? I have already submitted my 2019 tax returns.

Harry Sit says

You can apply for a PPP loan, but not through Chase at this time. Chase says:

“You’ll need to meet this criteria:

You have an existing Chase Business checking account that’s been active since February 15, 2020.”

You will have to find another bank or credit union that’s willing to take your application.

Sherrie says

Which Credit Union did you find? I’m from the Bay Area as well and am not seeing anyone who is taking new customers. I’m also self-employed and have had payments go straight to my regular checking accounts so I don’t have any business checking relationships anywhere but I do have plenty of 1099-Misc to prove income.

Harry Sit says

The one I applied with is not in the Bay Area. I still haven’t heard anything from them. I only used the San Francisco district office as an example.

Sherrie says

Now that self-employment applications are open I have filed paperwork with Ready Capital, Fountainhead, Kabbage and Lendio. They each had their own interface and similar document requirements. None seemed very well set up for self-employed applicants – some are asking for payroll documents (which wouldn’t have for self-employed so I just uploaded my Schedule C and Long Schedule SE). Will report back if any get past the 1st phase.

Tanya says

I have not begun to look but will try this afternoon. I live in Colorado. I would like to think that we would still be afforded the opportunity to apply as we pay our business taxes, the only difference is that our 1099-Misc income goes into a personal checking account. Surely we still have the same rights?

Rich says

I live in Boulder, CO and am having the same issue. I have a sold proprietorship and run all my business through a personal bank acct but I pay all my taxes on income, etc as a business and it doesn’t seem fair to be sit out by Wells Fargo bc I don’t have a business checking or credit card w then. Let me know if you figure something out.

James says

I have an LLC with one employee on payroll. I file a schedule C for myself as the sole member of the LLC. Will I be able to file the payroll based PPP Loan for my employee and then file a self employed PPP loan for myself? This would mean filing for two PPP loans which they said we can’t do. Do I have to chose?

Harry Sit says

You just apply for one loan. Add up the payroll cost for your employee and for yourself and use that number as the monthly payroll cost in the application.

Alex says

I use a personal checking account as an independent contractor. BofA is only accepting applications through business accounts created before mid feb. Is there a way to search for SBA lenders that are accepting new account and PPP loan applications?

Harry Sit says

I haven’t found any shortcut other than checking with each one on the list from the Resource Guide for your SBA district.

Harry Sit says

According to its website, “Sunrise Banks is accepting applications from all eligible borrowers, no matter who they bank with.”

https://sunrisebanks.com/paycheck-protection-program/

Alex says

Thank for the post and reply – great work.

serbeer says

Harry, thank you for all this information. If I have part-time business as independent contractor (1099-MISC), and have not been using separate business checking account so far, using my joint spousal checking account so far, should I necessarily open business account to be used to deposit proceeds of the loan? Or new personal checking account solely in my name for accounting purposes would work as well?

If I am thinking about it correctly, my annual salary is effectively a business net profit — line 31 of the Schedule C. So, after 3 months passes, when I apply to have my loan converted to a grant, I figure the requirement to pay out no less than 75% as salary should be easy to satisfy as I would simply draw monthly line 31 amount (or $100K if less) divided by 12. As I am the only employee, that should satisfy all the conditions I figure.

Am I thinking about it correctly? If I simply deposit loan proceeds into my regular joint spousal personal checking account as I have been doing with business income so far, then continuing to draw 100% salary is harder to demonstrate.

Am I thinking about all of it (separate checking account, just drawing line 31 or $100K / 12 amount monthly) correctly?

Thanks!

Harry Sit says

Assuming you are able to find a bank that takes your application, and your loan application gets approved and funded, I would reward that bank with a new business checking account. Here are some suggestions from CPA Steve Nelson for post-funding handling:

PPP Loan Accounting: Tips to Do It Right

Liz Picou says

I am a sole proprietor from 2004 till present. However from March 2017-Nov 2019 I got a full-time job (W2) and continued running my business (graphic designer) bringing in a much lower income (since I was working full-time). In Nov 2019 to present time, I am back as a sole proprietor full-time. What gross revenue /cost of services should I use for the EDIL Loan? If I use 2019, it is not reflective of my “normal” business income. Is there an area of the EDIL form where I can explain the above? Or additional documents to upload? Also, I do have a business checking with Chase since 2004. Thanks for your help!

Harry Sit says

EIDL loan application asks for gross revenue between Feb. 1, 2019 and January 31, 2020. It doesn’t matter whether that period represents “normal” or not.

Kevin says

I’m currently still employed (salaried) but I am listed as a independent contractor according to my company I work for. Can I still apply for the loan?

Thank you, Kevin

Harry Sit says

Yes you can apply if you find a bank or credit union that takes your application.

Harry Sit says

To be clear, you can apply for EIDL yourself. You only need to go through a bank or credit union for the PPP loan.

Paula says

Can a business quality for PPP loan if they are sole proprietor, no employee, with negative net profit on schedule C? Do they look at gross profit?

Harry Sit says

No. Payroll cost for a sole proprietor without any employee is defined as the net earnings minus one half of the self-employment tax. If that’s negative you don’t have any payroll cost.

serbeer says

Harry, I wonder, if as independent contractor I contribute 19-20% (max) into profit sharing Keogh plan (more commonly known as Solo 401K) as profit sharing portion, how does it break down between 2019 Average Monthly Payroll and 2019 Average Retirement Benefits. Eg, if total earned is $125K, and I contributed 20% into plan as profit sharing, should I answer

2019 Average Monthly Payroll: $125K/12

2019 Average Retirement Benefits: $0

or

2019 Average Monthly Payroll: $100K/12

2019 Average Retirement Benefits: $25K/12

?

In FAQs released on April 6, 2020, the Department of the Treasury clarified that employer contributions to both defined contribution plans and defined benefit plans, and health and welfare benefits, are included in the definition of payroll costs when calculating the maximum amount of a PPP loan. Further, the $100,000 cap on compensation applies only to salary; the cap does not apply to employer contributions to health and welfare plans, defined contribution or defined benefit plans.

But are profit sharing contributions the kind they ask about?

Thank you!

Harry Sit says

The latter, because a solo 401k plan is a defined contribution plan and the profit sharing contribution is an employer contribution.

rp says

Rumor has is that the EIDL $10,000 max advance is based on number of employees with the advance is equal to $1,000 x number of employees up to $10,000. Can some one who has gotten the advance please confirm that this is accurate?

Thanks.

Harry Sit says

That’s the case based on the few that reported receiving EIDL so far. If the SBA gets more funding, who knows, maybe they will grant more at a later time.

https://www.covidloantracker.com

Chris says

I applied for the PPE through Citibank. i have a business account with them. They are asking for my 941’s or a 944. I am a sole proprietor who gets a 1099-MISC from my clients each year. I pay my self employment taxes through my Schedule C. What else can I give them to show I do not have any employees other than myself and I have paid my S/E Taxes already? I called the IRS a few years ago and was told if my S/E taxes will be less than $1,000 I do not have to file 941’s.

Harry Sit says

Give them everything you have: Schedule C, Schedule SE, 1099-MISC.

Tanya says

Harry, as an independent contractor applying to banks accepting new clients, how many banks do you suggest I apply with? I don’t want apply to too little and then not get the funding, but I also don’t want to run into the problem of having too my applications out there and risking a fraud alert. 3, 6, 10?

Harry Sit says

I don’t know. I only applied through one credit union.

Vlad V says

Hi Harry,

Please let me know if you would suggest to open a separate business checking account for EIDL loan. I opened already for PPP but wondering if need to open a separate for EIDL.

Thanks so much!

Harry Sit says

If it’s not too much trouble, sure. Who knows what rules they will put in at a later time. When it becomes clear you don’t need it separate anymore, you can always merge.

Alan Albin says

Harry, I wish you would address the following dilemma re: loan forgiveness for a sole proprietor under the PPP, namely, do the idiots at the SBA NOT realize that “8 weeks” is NOT the same thing as “two months”??? Currently I have a loan in process in the queue for the second tranche on Monday (hopefully). I am a sole proprietor, no employees other than myself, with over $100k Sched C income last year, therefore, I am elibible for a PPP loan of up to 2.5 montly net self employment income (up to $100,000 annual, prorated). I am sure there are many other applicants in my exact same situation (i.e. solos w/>$100k annual income). Under the Second Interim Guidance, the max. amount of owner income (“payroll”) that is forgivable is 8/52 x 100,000 = $15,384.61. However, in order to be forgivable, loan proceeds must be used for “payroll” or owner earning replacement in at least 75% of the total loan obtained. The total loan obtained is not calculated based on “weeks,” but rather, “months,” i.e. 2.5 times MONTHLY income (up to 100k max, prorated). That equals 2.5 x $8,333 = $20,833. Assuming I get the max. 2.5 x monthly “payroll” loan of $20,833, the MOST that will be considered “forgivable” payroll is $15,384.61, BUT $15,384.61/20,833 = 73.847%!!!! If the current guidance from the SBA is taken literally, then it will be IMPOSSIBLE for ANY sole proprietor (with no employees) who has maxed out the 100,000 net earnings capped–and, based on that, received 2.5x MONTHLY income loan amount of $20,833–to qualify for loan forgiveness!!! It’s a mathematical impossibility!!! Because the @#$%@! SBA bureaucrats don’t seem to be aware that a MONTH Is NOT THE SAME AS FOUR WEEKS!!!!! (And apparently can’t add, multiply, or do percentages, either!!!!) Please tell me I’m wrong, or what can be done about this???? This issue is going to hit many thousands if not MILLIONS of solos who max out the $100,000 “cap” and as a result receive a maxed PPP loan of $20,8333!!! you need to get on this!!!! Thanks luv your blog.

Harry Sit says

You misunderstood. Out of the forgivable amount, at least 75% must be used for payroll. It’s not related to the original loan amount. When you have $15,385 in forgivable payroll, if you have other forgivable expenses (rent, utilities, etc.), you can have up to additional $5,128 forgiven, to make the total forgiven amount $20,513. If you borrowed $20,833, now your loan balance is reduced to $320 plus accrued interest on $20,833. If you don’t have any forgivable expenses besides payroll, your forgivable amount is just your 8 weeks of payroll of $15,835. Your loan balance is reduced to $4,998 plus accrued interest on $20,833.

Sophia says

Hi Harry – Thanks for this! I have applied through Lendio. Wish I’d seen your article before I applied. Would have felt much more comfortable with someone local, though I guess in-person meetings don’t happen much these days ; ) I have the same problem you mentioned – my two banks (which I have been so loyal to all these years!) were not at all helpful because I don’t have business accounts with them. I think a local credit union would have been ideal. Instead Lendio is an intermediary that sets one up with a lender (don’t tell you who in advance). However, on the positive side, their online application is pretty streamlined and they do seem to be moving very quickly – I applied a few days ago and they just let me know (say 3 days after applying) that a lender has been assigned and the proposed loan is submitted to SBA to get an SBA “reservation number” for which I could have approval in 24-48 hours. We will see.

Meantime, I am all of a sudden getting quite worried and thinking of not taking the loan if I get it. Wish we could get some final guidance on what the forgiveness “rules” will be, but seems like we may have to wait until 2020 tax forms are out! ? I saw that Senator Ron Johnson has put forward a bill that those that have revenues in 2020 of more than 0.6 x 2019 revenues (yes, anything over 60% of your 2019 revenues) will have to pay back via 2020 taxes all or part (sliding scale) of any PPP loan amounts forgiven. While this might not be a terrible thing, as a solo entrepreneur, unemployment benefits are an alternative to PPP (if income has dropped enough with Covid-19 as it has in my case). If one foregoes unemployment benefits choosing PPP instead and then has to pay PPP back, it may represent a loss of $8-9,000 over the 8 week period of PPP. (In my case PPP if I don’t have to pay it back would offer $3,600 benefit over unemployment.) On the other hand, the gov. might also change the rules for the unemployment benefits (and my state is said to be running out of money already!) and it’s not clear people will get what they are theoretically supposed to in benefits, so hard to say what to do. I have heard people complaining that the loan agreements offered by the banks either don’t mention the repayment terms or don’t include anything specific enough to raise confidence. So, some decide not to sign and some hold their breath and sign. Any thoughts on the risk that the PPP loan forgiven would have to be paid back with 2020 taxes? I at first did not see any risk, but the senator’s proposal reminds me that I always wondered why they are using this “loan” methodology for PPP if their goal was in the end to provide mainly grants for payroll – why didn’t they just provide the grants? Was there a plan all along to bait and switch?

Harry Sit says

You had better luck than I. I applied through a local credit union in the first round but the credit union only took my application and put it in a pile. No one asked any clarification questions or requested any additional documents. I only received one email in the end saying sorry the funds ran out. The credit union said they will process for round 2 “in the order received” in round 1 but I’m not confident it will be any different than round 1.

I also applied on 4/19 through Lendio for the second round but it’s still sitting at “processing” status as of now. They only said it appears the application has everything but it’s not submitted (or assigned) to a lender yet. I guess Lendio can be fast for some people, but not everyone.

So whether or how much of the loan will be forgiven is only theoretical to me at this moment. Congress made the rules. They can always change them, or add new rules. If you think unemployment is more reliable, you can choose to take that route or take a chance with the loan.

My state is not accepting unemployment claims from the self-employed yet. I don’t know what the qualifying criteria will be or whether it will be retroactive when they start accepting claims. Is it based on revenue or do you have to document hours worked? Does applying for a loan for your business and researching how the loan works count as hours worked? 🙂

Sophia says

Hi Harry,

Thanks for this input. My original application was 4/23 and on 4/25 wee hours I went back and added some docs and made some changes and then this email that the application has been submitted to lender and typical time-scale for SBA approval is 24 to 48 hours was received mid-day 4/25. Maybe I am overestimating its significance. It was a form email, the kind I might not have noticed if not on the lookout ; ) Another thing, I read in some of the Lendio stuff that the application had changed slightly and people should go back and update, but I’m not sure if that change happened before or after you applied. The application did get a new date of 4/25 when I added stuff and I worried that put me to the back of the queue whereas I got the note of progress shortly thereafter. What I added was proof of income (bank statements) around Feb. 15, 2020 as I read somewhere proof of being in business at that date is also one of the requirements.

About unemployment, my state is accepting applications from self-employed and indicates it can be retroactive to the week filed. If your state is not accepting the applications from the self-employed they should (to be fair, but what’s fair?) make it retroactive as the money for self-employed is federal money. I have heard in some states self-employed people have to apply as regular employed people and get rejected first before going through the self-employed process.

Good question about revenue versus hours worked vis-a-vis UE benefits. The requirement in my state is to submit 2019 schedule C and verify past revenue and then, as I understand it, when requesting payments indicate hours worked and money paid for work during the period. Can see that verification will be tricky for self-employed, so maybe in the end there might be a similar form 1040/ 2020 tax claw back for the self-employed like the one I’m worried about with the PPP. Hadn’t thought of that!

Sophia says

The new comment here reminds me to offer an update: Despite Lendio’s earlier positive communication of me being linked with a lender (received 11 or so days ago) I never heard from them (or the unnamed lender) again. From online search, I notice some others got their Lendio linked PPP loan on a shorter time scale.

Nick Sung says

Well, here is an unexpected surprise:

I already got my $1000 EIDL advance a few weeks ago. Then, I got my full PPP of $21,000 last week. As a single sole-proprietor, that is all I need and am good to go for 8 weeks. I think all of that should be forgiveable and will cover me until I can re-open, so that is all I need. But, today, I got an email from the SBA saying that my EIDL loan qualified for $62,900. But, I don’t need it – do I? Do I have to at least ask for $1000? But, I don’t need 60 grand. What should I do???

Harry Sit says

The EIDL loan is a 3.75% loan for up to 30 years. If you don’t need it, you can decline the loan offer at the portal link you received from the SBA. It doesn’t affect your $1,000 advance. Or you can ask for a smaller amount if you still need a loan but just not the full amount you are eligible for.

Harry Sit says

On second thought, it’s safer to ask for at least a $1,000 loan. If you get extra $1,000 on top of the advance, you can always repay the extra.

Jason says

Independent contractor here— 1099 work with no other employees. My business checking account was opened after I signed the paperwork for the PPP loan with details of where to deposit the money. My PPP loan funds are scheduled to be deposited to my personal checking account which I use for business. For the sake of recordkeeping for forgiveness— how should I handle payroll payments? Should I transfer the entire loan to the new business checking account and make recurring payroll payments over the 8 weeks? (I planned to pay 75% of the loan split over the 8 allotted spending weeks.) I am having a hard time figuring out how to document “payroll” expenses when the funds are going to my personal checking account.

Harry Sit says

Nobody knows for sure. Banks are still waiting for guidance from the Treasury Department. CPA Steve Nelson recommended putting the loan proceeds into a separate business checking account and using that account only for eligible expenses. See link in reply to comment #11.

BERDINA ALLEN says

I read evrything but still not clear as to what my next step is. Do I now go to a bank (that I bank at) and apply for the loan?? Or what?

Harry Sit says

If you are talking about the PPP loan, you can go to your bank or another bank that accepts applications from non-customers (a smaller one is usually preferred). Some people had good luck and fast turnaround with tech companies such as BlueVine or PayPal. For the EIDL loan, the SBA is accepting new applications only from agriculture businesses right now.

Jeff Greene says

My Form 941 begins with a net pay number, then calculations for Soc Sec and Medicare are reflected as a multiplication of gross pay times a factor. The difference between gross pay and net pay is a substantial (but legal) salary deferral to an Owner’s 401K plan that is partially matched by the company. Am I correct that my PPP 2 1/2 x pay calculation is based off the gross pay number, not the net pay number? My lender put up quite battle with me on this issue, but eventually gave in to using my gross pay number. Assuming I’m right on the gross pay starting point, will providing the Q2 2020 Form 941 starting with net pay at the top of page 1 suffice to demonstrate that 75% of the PPP loan went to payroll? Do I need to explain further with a note or something when I submit that Q2 2020 Form 941 as evidence for the 75%?

Harry Sit says

Yes gross pay is used to determine the loan amount. For forgiveness, you need to show the payroll amount for a specific 8-week period. Just the Q2 form doesn’t give enough details for those 8 weeks.

Sophia says

Another PPP question: For sole proprietor (1 person/ self-employed). If the PPP is based on annual schedule C income (net income X8/52), can the amounts that one pays oneself weekly over the 8 weeks be counted as “earned income” and thus be eligible for annual self-directed solo 401 k contributions (either employer, employee, or after tax)? At first I assumed these amounts would not be eligible as they are not really earned and no taxes are paid on them, but then I began to wonder about it. Since they are supposed to count as “owners compensation” I wondered if maybe it would be possible.

Harry Sit says

The solo 401(k) contribution is based on the profit of the business. Moving money from the business to the owner doesn’t increase the profit of the business. However much profit the business has at the end of the year, solo 401k contributions are still calculated off that number.

Sophia says

Thanks, Harry. Understand that solo 401k contributions need to be calculated off of Schedule C net profits and PPP won’t be a part of those. By the way, I contacted Lendio today as I never back heard from them (after hearing over three weeks ago from them that my application was with a lender and I should hear back in a few days) and they told me that my application is with a bank and I should hear from them, but they couldn’t tell me when! I have contacted a few other lenders that do not require you have a business banking account with them and they said it is not too late to get in an application.

Jeff Greene says

Thanks Harry. If I only have a quarterly payday near the end of each quarter (Mar, June, Sep and Dec) for my one employee – would the Q2 Form 941 be sufficient to document the 8-week period under consideration (all 8 weeks were in Q2, 2020) for forgiveness?

Harry Sit says

You apply for loan forgiveness through your lender. Your lender will tell you what will be sufficient to them. If I’m your lender I won’t take only the Q2 941 form. While all 8 weeks are in Q2, not all Q2 is those 8 weeks. I will need to verify which payrolls in Q2 were inside the 8 weeks.

Jeff Greene says

Harry – appreciate your very helpful thoughts on both my string and the others. Final question for clarification – we only have one employee, so would this change your opinion of the sufficiency of the Q2 Form 941? As you suggest, I’ll need to ask my lender . . . but if you were the lender would you assume that all earnings of the single employee were evenly distributed across the weeks of Q2 for calculation of the 75% 8 week payroll minimum for loan forgiveness?

Eunice Kelly says

Hello i just received an approval from SBA loan, but i operate my business through my personal account. Will SBA deposit the loan into my personal account or do i need to open a business account in order to get the loan

Harry Sit says

If you are referring to SBA’s EIDL, SBA has its own account verification mechanism. You will enter the routing number and account number on the SBA’s portal for EIDL. If the portal takes it, a personal account is fine. If the portal doesn’t like it, it will say “unable to verify” or something to that effect.

If you are referring to the PPP loan or other SBA loans, it’s funded by a lender, not the SBA directly. Your lender will tell you what type of account they will deposit into.

Joy says

I appreciate your advice! I am an sole proprietor operating as an LLC and was on the fence about taking the EIDL loan offer from the SBA. My business suffered but the loan approval I received was more than expected so didn’t know what to do. But with the interest rate sba offers, combined with your great advice that to take the loan until we know what the future looks like, and if things get to normal soon just pay it back since there’s no prepayment penalty—well that’s the advice I needed to hear! Thank you so much!!!

Jason says

Just a heads up Im a sole proprietor no employees and was approved for 50k EIDL. I have not used a business checking account for some time now as Ive gone from self employed to a full time job and my business is secondary. This changes when work in my industry changes and my sole income will be my business. I input my personal checking acct into EIDL app portal was accepted and was funded. with in 2 days Chase Bank froze my account and had me provide all sorts of documents and then closed my account. This all happened in 4 days. Chase has not sent funds back to SBA and Ive made complaints to every government agency and Chase is requiring an EIN established be 1-31-20. I have always used a schedule c and have never been required to get an EIN but Chase holds my funds and I cant access it which has to be illegal? what can I do?

Harry Sit says

Many people reported the same problem with Chase freezing their account on Reddit. See what other people are doing there.

https://www.reddit.com/r/EIDL/search?q=chase%20freeze&restrict_sr=1