Most of you must have heard of the Marshmallow Experiment. Kids were put into a room and given one marshmallow by an adult. They were told they could eat it now or if they waited until the adult came back to the room they would get a second one. Follow-up studies revealed those kids who waited for the second marshmallow tended to have better life outcomes later as adults.

The lesson in the Marshmallow Experiment is delayed gratification. The point of waiting is to get a larger reward later. It’s the basis for saving and investing as opposed to spending the money on immediate consumption. Those who have the will and/or the means to wait end up better off.

We learn from the article Why Poor People Make Expensive Financial Decisions that if you must have cash from a $5,000 check today you’d have to pay a $100 fee whereas if you can tide over for only two or three days you would avoid the $100 fee. Those who prefer the here and now and those who are forced to prioritize the present pay a heavy penalty.

Contrasting the idea of delayed gratification is the concept of enough. It says when you have enough you stop looking for more. When it’s applied to early retirement and financial independence, practicing the concept of enough means you would become content and stop working for “the man” the soonest you have enough means to support your now content lifestyle.

It can be said the kids who ate the marshmallow without waiting for the second one actually practiced the concept of enough. One marshmallow was enough. They didn’t need a second.

Or it can be said those who declared enough early fell prey to instant gratification. They wanted it now at the cost of a larger reward later.

How do you reconcile between delayed gratification and enough? Wait for a larger reward but not forever. Smell the roses but not too soon.

Employment Income To Net Worth Ratio

Allow me to introduce the employment income to net worth ratio, EI/NW. The numerator in EI/NW is your after-tax income from working. It represents the percentage you can add to your net worth by working. It’s not just your annual savings. Living expenses are not deducted from your after-tax employment income because you will have living expenses whether you work or not.

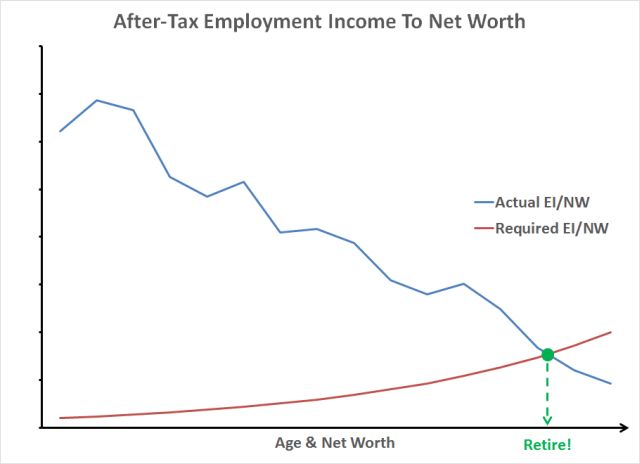

There are two versions of EI/NW: the actual EI/NW and the required minimum EI/NW.

The actual EI/NW is how much you make after tax from working right now, relative to your net worth. If you make $100k after tax and your net worth is $200k, your actual EI/NW is 50%.

It in general goes down with your age and your net worth, in part because as you become older your net worth goes up and your income usually plateaus at some point. For instance, right out of college you don’t have much in net worth and your after-tax employment income is quite large relative to your net worth. As years go by, even though your income increases, your net worth increases even more. When you make $150k after tax and your net worth is now $1 million, your actual EI/NW drops from 50% to 15%.

The required minimum EI/NW is what percentage of your net worth you must earn to make you feel “worth it” for you to continue working. Right out of college when you don’t have a choice not to work, even if you make only 1% of your net worth you would still work. This 1% is your required minimum EI/NW.

The required minimum EI/NW in general goes up with your age and your net worth. All else being equal, the older you are, and the wealthier you are, working must offer a compelling addition to your net worth in order to keep you there; otherwise you’d do something else. With a $1 million net worth, 1% no longer cuts it. Maybe you require at least 10% now. At $2 million net worth, maybe even 10% doesn’t cut it, because now you have the choice to say no.

The required EI/NW goes up with your age and your net worth but it’s never infinity. When people say they have enough therefore they retire, it only means the offer in front of them isn’t sufficiently high. When you pay the asking fee you can get a former politician or CEO to show up at a corporate event. Even Warren Buffett auctions off a lunch for charity to the highest bidder. Given the right opportunity, a retired person can be convinced to unretire.

The required minimum EI/NW is also not static. If you identify with the work, you like the schedule and the people you are working with, you can set it low. If you hate it, you will set it high.

When you have your required minimum EI/NW going up with your age and your net worth and your actual EI/NW going down, they cross at some point. That’s when you retire!

This chart explains a lot of things we saw in the previous posts Early Retirement and Opportunity Cost and Staying In Your Job After Financial Independence. If you are still young, if you don’t have a large net worth yet, or if you like what you are doing, you set a low required minimum EI/NW. If you are already feeling the biological clock, if you already have a large net worth, or if you don’t find work meaningful, you set a high required minimum EI/NW. If you make a lot relative to your net worth, your actual EI/NW line will cross your required minimum EI/NW line later. If you don’t make much relative to your net worth anyway, it’s going to cross sooner.

The specific number for the required minimum EI/NW will vary by person, by age, by net worth, and by whether the person likes the work. Those who say enough simply have a high required minimum employment income to net worth ratio at their age and net worth. When their actual employment income to net worth ratio falls below the required ratio, they say they have enough. When they don’t make much anyway relative to their net worth, it’s completely understandable why they would quit. Many people who worked on Google’s self-driving cars quit even though they were paid very high in absolute dollars because the pay is relatively small to what they already have.

Those who stay on have an actual employment income to net worth ratio higher than their required minimum ratio. When they can double their net worth in three years for the next forty years and they enjoy the growth in their skills or the intellectual challenge, I don’t blame them for staying on.

If you are still working, what are your required minimum and actual employment income to net worth ratios?

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Pedro says

Thanks for the article and conversation starter, I’m a little confused and think that having an example would be beneficial to illustrate the benefits of this metric, along with it’s pitfalls.

How does one determine enough for a required EI/NW ratio? For some it’s 1% for others it will need to be 20%, am unclear if you pick a number too high, will you cross the threshold for actuals too early?

I believe you are saying that as long as my job provides a greater increase to my net worth than I expect I should continue working, though how to set that number is unclear to me. When you are younger, each dollar you bring in helps increase your net worth by a larger amount proportionally, and when you have a larger net worth your investments and other factors will likely move the needle more than your actual job.

Also what goes into each component of the ratio can clarify what it means to add to your net worth each year. For example for employment income (numerator), in your after-tax income from working, should you exclude items like health insurance that are taken out or should they be included as living expenses? Also if you are contributing to a 401k should you add that back in to the numerator as any investments in your 401k naturally increases your net worth.

As for Net Worth, the debates of whether to include a home or exclude are numerous (for some it’s an investment and is an asset for others its a pre-payment of rent), however I’m unclear as to this calculation what impact it would have on deciding to include the value of your home (excluding mortgage) or to exclude all together.

Maybe this misses the point of the article, so appreciate your comments!

Harry Sit says

The point is to link the employment income to one’s age and net worth and think in percentage terms. I don’t suppose there would be a reference table that shows at age X with a net worth of Y your required EI/NW ratio should be Z to the precision of 0.1%. Each person will have to make up his or her own table. As such, the details in how certain things count aren’t that important as long as the person is internally consistent. To me, health care benefits and 401k contributions both count as income. The home minus mortgage also counts in the net worth.

Kevin says

You should add a made up example with numbers. Maybe I just need to read it a couple more times though.

David D says

So, I was a bit confused on this one. I think two measures having almost the same name is making it difficult to understand. It seems reasonable that the Actual EI/NW will fall as we age for all the reasons you give. However, from the definition of what EI and NW mean, I would expect Required EI/NW to act similar to the Actual EI/NW, but just not go down as fast. However, I finally got the difference. Could we call Required EI/NW something different?

I might have to see some hypothetical scenarios to fully understand this. Lastly, it is “numerator” and not “nominator”.

Harry Sit says

Absolutely, ‘numerator’, corrected. The ‘required’ metric is an internal target. I’m open to suggestions for a different name.

A 30-year-old with no much money accumulated will work even if work brings in only 1% of the net worth because they can’t afford not to. This 30-year-old only ‘requires’ 1%. To 60-year-old with more money accumulated and a tired mind and body, 1% feels no longer ‘worth it’. So the 60-year-old wants 10% per year: continue working to 65 will increase the net worth by a meaningful percentage and make the life after retirement more enjoyable. That’s delayed gratification at work. A different 60-year-old with even more money accumulated will ‘require’ 20% per year because the accumulated nest egg already provides a comfortable lifestyle. If working doesn’t bring 20% per year, this 60-year-old declares ‘enough’.

David D says

Thanks for the reply. Maybe Required EI/NW should be called “Income Desired to Prevent Retirement”.

Physician on FIRE says

I’m a couple years away, but I predict my lines will cross in a couple years when my EI/NW is a bit less than 10%.

I came up with a similar looking graph that I called the “likelihood of regret” scale. It’s best to retire when the likelihood of retiring too soon and the likelihood of regretting working too long intersect. Same concept, different terminology. Your graph is prettier. My graph and post can be found here: http://www.physicianonfire.com/early-retirement-likelihood-regret/

Cheers!

-PoF

KD says

Harry, this post may be easier to follow if you start with explanation of actual EI/NW ratio. May be put a graph of how that would vary with age and NW. Then introduce the concept of required EI/NW for retirement/financial independence etc. Draw a graph explaining how it would decrease with increasing age and net worth. Then get into the concept of intersecting curves indicating point of retirement etc. I believe most people are lost when they read required EI/NW first.

Harry Sit says

You are right. The actual is more concrete and straight forward. The required is more abstract, but it’s actually driving the decision here. “How much of a difference does it have to make for me to feel it’s worth it?” I switched the order of presenting the two concepts.

FullTimeFinance says

Interesting concept. Our earned income is not static which means the line regularly shifts not unlike a supply demand curve. So the end net worth target can change over time. That makes planning difficult. In my case my current target is four percent, but to the above point that’s after a massive income decrease this year when my wife became a stay at home mom.

Martdoc says

This is interesting, trying to define when someone should retire. The actual EI/NW is easy enough, the required EI/RI is more complicated since it takes something that is very subjective and changes from person to person and tries to make it objective. That might be interesting in some type of study, if there was a way to take the subjective part to show where people of different incomes, job types, and net worth (who saved, who did not) and compare them. Looking at mine now, it is around 14% for actual, I see PoF said his required is around 10%. I am a military doc, enjoying what I do, I think I will put mine closer to 5%. But due to the subjective nature, a year from now you could feel differently about your job, if I moved on to a new assignment and hated it, it could raise my required to 15% and retiring would make sense. It is just hard because many factors can impact the required EI/NW, your health, families health, job satisfaction changes,etc.

Harry Sit says

It’s subjective, and I’m not trying to make a benchmark table that suggests what the required EI/NW should be for a given age, net worth, and job type. I’m hoping just thinking in these terms will help people see better. The employment income may be high in absolute dollars but it may have become much smaller as a percentage of net worth. On the other hand when you set a high required EI/NW because you don’t like it, the solution may be to find something you enjoy with a low required EI/NW as opposed to retiring outright.

KD says

When I consider the spectrum of activities I like to do and that I have monetary impact on net worth – with varying degrees of liking – I find that many are interconnected, doing X enables or complements Y even though I like Y better than X. So Harry’s advice is extremely important. Retirement may ultimately be a binary decision, but the criteria to get there is unlikely to be a binary. It is subjective. It is always possible to rejig the bouquet of activities that pay/save/incentivize such that you do not have dwell on the binary of whether to continue or quit monetizing your human capital aka job.

Doug @ The-Military-Guide says

Harry, thank you for one of the most insightful posts I’ve read in months. As a guy who has “more than enough”, I get it. It’s the best explanation I’ve seen yet of how I feel when I’m offered a payment.

I like working, but I can no longer tolerate all of the dissatisfiers that go with our work culture: commuting, rush hours, meetings, dress codes, or mandatory anything. Even as an author and a blogger, there’s deadlines and “branding”. Being paid for work implies a willingness to tolerate the dissatisfiers, and my EI/NW ratio will never rise high enough for that degree of reciprocity.

I know volunteers at non-profits who are so highly prized for their skills that they were offered a job. They were worth their salary, but it was disheartening to see the social contract change once money was involved. They went from “indispensable volunteer” to “valued headcount” as soon as the employee indoctrination began.

Eric B says

Neat concept! The key takeaway for me is 1) while working, there is a point at which your net worth will be high enough relative to your employment income that it no longer makes sense to work and 2) while retired, there is an income level that, if offered, could pull you back into employment.

Hari says

I wonder of we could extend this concept to:

Income/(Required NW – Actual NW)

Provided one knows a fixed required NW, it leads to counter-intuitive percentages, where the closer one gets to the required NW, the higher the ratio becomes (irrespective of earnings changing)?