I participated in a panel discussion on Financial Independence Retire Early (FIRE) at a South Bay Bogleheads meeting on March 12. South Bay Bogleheads is a local group of people who read or post on the Bogleheads Investment Forums. Here’s a gist of what I told the group.

Sensationalized Clickbait

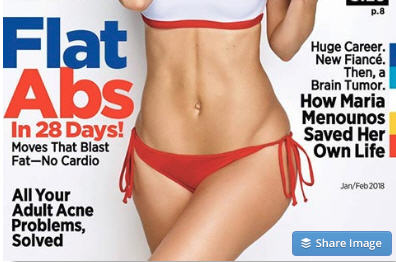

I don’t really like the FIRE acronym, especially when it’s linked to a young age. I see it as more of a sensationalized clickbait, akin to the headlines on magazine covers like “Flat Abs in 28 Days!” The techniques may still be helpful. Just the results can be overblown. Magazines know these headlines attract our attention. That’s why they use them. We just can’t take them too literally.

I don’t really like the FIRE acronym, especially when it’s linked to a young age. I see it as more of a sensationalized clickbait, akin to the headlines on magazine covers like “Flat Abs in 28 Days!” The techniques may still be helpful. Just the results can be overblown. Magazines know these headlines attract our attention. That’s why they use them. We just can’t take them too literally.

Instead of FIRE, I prefer Financially Comfortable and Pivot. Being financially comfortable means having assets that may not support your lifestyle for a lifetime without working but your assets are large enough to give you some options. Pivot means going off your current track onto something else. There are many ways to pivot, such as:

- Change career — work on something you identify with but doesn’t pay as much

- Go from working full-time to working part-time

- If you are married or in a committed relationship, go from both partners working at an employer to just one partner working at an employer

- Take a gap year or several gap years

- Start a business that may not become fabulously successful

You don’t have to wait until you are truly financial independent before you pivot because a pivot greatly reduces your risk than retiring early. If your pivot comes with healthcare, you just removed a huge unknown from retiring early. If the income from your pivot still covers your expenses, you will withdraw 0% from your portfolio. If it even covers half of your expenses, you will withdraw 2% instead of 4%.

The level of risk you have when you pivot is completely different than the level of risk you have when you support yourself only from portfolio withdrawals.

Second Childhood

Former Wall Street Journal columnist Jonathan Clements wrote a blog post in January with the title Second Childhood. It described the pivot very well.

Jonathan said now that he’s working on his own projects, he’s working harder than ever while making only 1/3 of what he used to make. He’s happy because he gets to choose his work: how much work, what he works on, when, and where. With the freedom to explore in this second childhood, you are allowed to make mistakes. He thought he would enjoy teaching, but after trying it for one semester he realized he didn’t. So he just dropped it, and that’s totally OK.

My wife wasn’t with me at the meeting that evening. She was enjoying her second childhood with a group doing backcountry skiing in Canada. The pictures she sent were just amazing.

Our Journey

You become financially comfortable by saving and investing. My wife and I maxed out our 401k’s every year since our very first job. Shortly after we also maxed out our IRAs and invested in taxable accounts. We made some mistakes along the way. Fortunately they were made early enough when we didn’t have as much money. After those mistakes we followed Bogleheads principles, which worked very well for us.

We took our first pivot three years ago when my wife quit her job (see From Aggressive Saving To Living Paycheck To Paycheck). We cut our income by 50% but the remaining income still covered our expenses. We still have health insurance. We don’t worry about withdrawal rates at all because we are not taking any withdrawals. Our spending actually increased as our income decreased. We landscaped our yard. We remodeled our kitchen. We bought a new car. The spending made our life more enjoyable.

Future Challenges

When we take our second pivot, we will cut our income again, to a point where it won’t cover 100% of our expenses. We will have to take withdrawals and also buy health insurance on our own. We will see challenges from three major areas:

1. Low expected returns. Equity valuation is very high by any measure. Bond yields are still very low. The expected returns of a globally diversified portfolio would be 4-5% before inflation as opposed to the historical returns of 5%+ after inflation. That’s a big difference. Low expected returns means we won’t be able to withdraw from our portfolio as much as historical returns would indicate. Our defense: income from the pivot reduces our dependency on portfolio withdrawals.

2. Sequence of returns risk. Low expected returns would be bad enough. If even poorer returns happen in the early years it will make the situation worse. Here the pivot becomes helpful again. It allows us to keep it gentle in tapping our portfolio in the early years.

3. Healthcare. We don’t know how stable the Affordable Care Act will be. High healthcare cost inflation will keep putting pressure on the system. Nobody has a magic wand. We will just to have to be prepared to deal with it. Because we treat it as a pivot, if we have to go back to work we will.

In short, our approach to Financial Independence Retire Early (FIRE) is not retiring early but taking a pivot, in a way, “retiring” early by not retiring early.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Physician on FIRE says

I like the approach, Harry.

I had the opportunity to see Jonathan Clements speak earlier this month — he was excellent, of course — and I stepped up to the mic to ask him if he considers himself to be financially independent or retired early. He said yes to FI and busier than ever with projects he has chosen.

When I discovered the FIRE concept, I figured I’d work a few more years, pedal to the metal, and pull the ripcord. Instead, I’ve dropped to part-time, spend time on my own FIRE blog (my pivot) and do my best to be honest about what FIRE actually means for me.

I believe that most of us who are industrious enough to reach FI at an early age are unlikely to be comfortable ceasing all revenue-generating activities once a magic number is reached. We just get to pick and choose and work or play on our own terms.

Cheers!

-PoF

Harry Sit says

When you aim for financially comfortable not financially independent, you can go off sooner or have a higher living standard with a pivot. The income and health insurance from the pivot are still important parts of your financial plan. You very much depend on them. So you don’t claim the FI badge or the RE badge, but you are on a more relaxed, safer, and more enjoyable and engaged path.

freebird says

A few years ago I made the transition into exactly what you describe. Some family obligations came up and since I had reached financial independence, rather than requesting a FMLA, I gave notice of my retirement. My management felt the need for the expertise I accumulated over two decades, so they got creative and cooked up an alternative proposal that worked around my new constraints. I was skeptical this new arrangement could possibly be win-win, but they persuaded me to give it a try.

I ended up staying on with my employer, but in a different position that allowed me control over my work location, schedule, and most importantly work content. Thankfully my family situation stabilized for the better, and much to my surprise my job satisfaction went way up. Apparently my employer is happy with my results as well.

So I agree with you that the FIRE acronym really should be taken as a special case, the advantage to attaining the FI part is that you can choose to RE, or you may be able to negotiate changes to your work environment that may extend your career as I did. I think reaching FI is just as worthwhile to those who plan to ‘never retire’.

Don says

One of the nicest, most encouraging things I’ve read on the internet in a while. I’m very happy for you (including the turnaround in the family situation), and I’m sure you earned the extra consideration from your company. They say karma is a b*tch but it’s the reverse in this case. Congrats.

Doug @ The-Military-Guide says

The FIRE acronym has been around for at least 20 years (since the 1990s Motley Fool forums).

I think it’s had a good run during its 15 minutes of fame, but the trend seems to be shifting toward simply using the FI acronym. This neatly avoids the entire debate about whether you’ll earn another dollar ever during the rest of your life without coming to the attention of the Internet Retirement Police.

So maybe we should all just start calling it FI and let everyone make their own choices from there.

Harry Sit says

Doug – FI is linked to not needing to work. With the uncertainty of healthcare — ACA repeal failed by just one vote — unless someone has guaranteed pension and guaranteed healthcare as you do, it’s very difficult to claim true FI. Just one person changing their mind can change the whole thing. Calling it FI is still very fragile. If you treat it as a pivot, and you are fully prepared it may very well be temporary, then you are not fooling yourself.

Leigh says

This is something I’ve been thinking about a lot lately. I think it’s more realistic than a black and white “retirement”. I would love to hear from you more about how you and your spouse decided that she would retire first and you would continue working. Did she dislike her job more or find it more stressful than you do? We developed a list of questions that we are each to ponder and then we will start some discussions around this. We have enough income with only one of us working to still save a substantial portion of our income and are substantially far along the FI path.

Harry Sit says

Leigh – She contributed more, therefore she finished sooner. The activities she enjoys also require more dedicated time (see picture in the post).

Vikash says

I would love if someone was willing to share hard numbers on their track to FI. i understand completely that it is dependent on individual’s lifestyle, expenses, etc. but still having few numbers helps in realizing this concept with greater impact.

so is it like 500K or 5MN?? at what age – 40 or 50 or 60?

the discussions to max out 401Ks, and IRAs is pretty common. but have not come across many places which discusses the hard numbers.

Harry Sit says

Many FIRE bloggers share hard numbers. Here’s a place to start:

https://rockstarfinance.com/best-early-retirement-blogs/

freebird says

For current snapshots with lots of detail you might want to look at the interview series at ESI https://esimoney.com/category/millionaires/ . It’s mostly about married couples of various ages with net worth in the 1M to 3M range. They break down asset allocation, income history, and spending budgets.

indexfundfan says

I FIRE before 50. Moved out of silicon valley. I’m now preoccupied with a lot of my own hobbies and I’m not interested in any revenue-generating activities.

Accidental FIRE says

People get so hung up in the “RE” part of FIRE. I get it, you can argue that even if you get paid by the local salvation army once a year to sort clothes then you’re “working”. Whatever. Anyone who reads a few of these blogs and sees what FIRE bloggers are either doing or trying to do can see that they mean “retire from their traditional W2 job”. Unfortunately that doesn’t make for a catchy acronym.

Harry Sit says

This is not about arguing semantics, denying someone’s achievement, or saying who figured out a better way of life. It’s about thinking how we’d like spend our time. indexfundfan in comment #6 above is not interested in any revenue-generating activities. Neither is my wife. I on the other hand would like to stay engaged and continue using my knowledge and experience in a different way than the W-2 job. Both are perfectly fine.

However, we should avoid minimizing what it takes to get there and stay there, as some magazines do with their sensationalized headlines. Getting paid by the local salvation army once a year to sort clothes does not change your risk level. It’s completely different when you have a working spouse or blog that covers 100% of the expenses plus health insurance. These options may not be available or preferable to others.

Accidental FIRE says

We’re in violent agreement Harry. I’m the postcard for your comment. I’m easily FI, have no working spouse, nothing extra. And unlike what most ‘retirement police’ think, my blog makes me zilch. But I’ve stayed part-time at my W2 due to healthcare cost risks. I want to stay on my employers plan – going to the ACA which may or may not exist next year or even next week is FAR too risky for me. My risk tolerance is set, and right now it doesn’t involve the “RE” part of FIRE. So part time is ideal as I get to step back, destress some, and still keep my healthcare plan.

Chris @ CanIRetireYet? says

Very interesting read and something I think about a lot as I blog about the topic and share my story which sounds extremely similar to your own. I classify myself as retired, b/c I left my relatively high paying career (physical therapist) and don’t have any work obligations or need to make money for a long time, possibly forever. However, I am careful to disclose to readers what I am doing and how it is possible. This included my wife continuing to work 30 hours/week for health care benefits which also provides us an abundance mentality b/c we’re not worried about low investment returns or poor sequence of returns. I think that transparency is key to what we who blog about FIRE write about. You call it a pivot. I call it redefining retirement. I think this is a better alternative to traditional retirement which requires deferring gratification to an age that may never come. Whatever you call it, it’s not the same as traditional retirement, it requires a different mindset to plan for, and the risks involved are very different. That’s important to clarify.

Dave says

@Chris, nice points here. I dont feel getting wrapped in the terminology is particularly meaningful. As both of us stated, its the non-traditional approach to bettering your situation financially to allow for increased independence and control over your life that is important. The details and decisions of what you actually do with yourself are nearly infinite, and that degree of independence in things is neat. No need to “drill it down” to a science.

Mrs. Kiwi @ KiwiAndKeweenaw.com says

We’ve definitely planned for more of a pivot than early retirement. When we first started saving for FIRE, I never would have imagined us doing that. But as our wealth grew and we challenged ourselves to find our real passions it became obvious we would want to work in some capacity well past our early thirties. Thus, my husband is going back to school for his PhD now, which included a major pay cut, but is well worth it. He keeps reminding himself that this is work that he truly chose, which has been a major mindset shift from his corporate and government jobs.

aGoodLifeMD says

Pivot is a great way to put it. As PoF says in his comment, most of us who have the drive to reach FI don’t want the classic do nothing Retirement.

For me, I want the chance to pursue passions that I put in hold to become a doctor.

Now that we are FI I’m surprised to see all the latent interest come out. Sure, some are infatuations but one or 2 will rise above the chaff and maybe be my pivot.

Medicine is a passion, sure, but what got me into medicine was curiosity and a desire to learn. Those traits cut both ways and can make one restless in a long term career.

I think Mr Clements who you mention may have given the advice to take the highest paying job while young so one can pursue what they really want after FI. Seems likes he’s doing that at least.

That’s my plan. Can always pivot back to medicine. Nice post.

Larry says

I am surely “FI” in my early 50’s but the “RE” discussions are fruitless since the word “retire” can mean just about anything you want it to. If you have the freedom to change careers or mode of living, that’s great. However, the uncertainty of healthcare keeps me in a job that I no longer need for its income, only for its insurance package. I suspect I’m not alone. I would pay a reasonable (maybe even a high) price to lock in good health coverage for the rest of my life, but this is simply not available at any price.

Many of the FIRE bloggers sneak in a comment in their fine print about getting health coverage through a spouse’s employment or as a military or gov’t retirement benefit, and that’s where I tune them out. I am locked into my mode of living until further notice, unless I elect to go without _good_ health insurance. The other options (ACA, various extremely limited private insurance coverages, and health-sharing) simply do not meet my standard.

BucketBabe says

I agree wholeheartedly. I recently decided to take a sabbatical. I don’t know for how long but I do plan to keep my Nurse Practitioner credentials up to date and licenses active in case I want to pivot back to a relatively high wage. It was thru an aggressive savings rate that the opportunity for a break to pursue my creative, artistic, and travel passions became a reality. In FIRE, the RE can mean anything but for hard driving types that comprise this community, I doubt seriously that it will not afford the opportunity to make some money while “retired early”. Thanks for articulating this well. I’m embracing the pivot for a while….we’ll see where this new path leads 🙂

Dave says

I agree with Doug @The-Military-Guide. The FI acronym is better positioned, and avoids the part of the concept you identified as problematic.

I must say though, the full term “Financially comfortable and pivot” to me is odd, as the “pivot” part of it just doesn’t flow well. In my opinion anyway, it leaves too much ambiguity as not everyone pivots to another hustle. I would certainly advocate for the Financially Comfortable (FC) concept though. That seems to work.

Bottom line here folks – the FIRE community strives to put themselves in a position earlier in life where they dont have to depend on their day job to financially support their household. Its non-traditional (and very cool, I might add!). So, why do we need to be concerned with what we call it? Just getting on the path and pushing toward a goal of any degree of FI (or FC) is a good thing.

Lastly retirement doesn’t mean not remaining occupied. Keep in mind, if we retire early we are likely young and still full of vigor, energy, ideas, interests and …life! Plus, for those obtaining FI we are a driven bunch. 95% or more of us are not merely going to sit around and veg out. We are going to keep engaged in life – whether that is working in a job we love (for the love of the thing because we WANT to, not for the money), or completely engrossing in our hobbies.

Hopefully this makes sense.

Harry Sit says

I’m not concerned with what it’s called, but I am concerned with using the time to achieve a status as the single most important goal. Dropping to part time in the same job is a form of a pivot. It can be a non-optional part of someone’s financial plan. Their financial future very much depends on the income and the health insurance from this job. It probably qualifies neither as FI nor RE because they are not working only for the love of it. However, their pivot can be safer and just as enjoyable.

Dave says

Thanks Harry. Again, just the fact that someone is working toward the end goal of FIRE is worthy, at least for me. Its the course, not the destination.

Since you mentioned working part-time, that actually applies to my situation. As I work on my path to FIRE, I decided the “all or nothing” approach was not for me. Why continue to push things off and get stuck in the “one more year” work thing, if I am able to make the mini-move now. There are no requirements here. The freedom and independence of the process is key. So, I made the change. My approach is still non-traditional and allows me freedom that which is greater than the majority of my cohorts in their 30s. I have 3-day weekends for life and work 24-26 hours per week. Whether that is partial FI or financially comfortable or in-line with anyone else’s definitions – i cannot be concerned.

Something else worth noting, I dont blog professionally. So, I dont tout myself as being fully FIRE or whatever. I’m not misleading folks. Anyone who wants details (within reason) can merely ask.

Harry Sit says

Absolutely. When your arrangement gives you enough freedom to do things you want, you can continue in this mode into your 60s. You don’t have to grab the independent badge (as in not depending on the job), the retired badge (as in having left the job or only working for love), or the early badge (whatever counts as early these days).

Kyle @ NYPFG says

Really like how you explained this idea. I understand the FIRE movement but am not the biggest fan of it because it places too much stress and possible misery on the next 5-15 years. Life is to be enjoyed, and you never know what could happen. Speeding up retirement to 10-15 years from now instead of 30 is still the same strategy, just with a different timeline.

Much better to change the whole strategy and to a way of enjoying life to the fullest NOW.

Bill Hewitt says

Excellent thoughts. Keep them coming.