Back in August, my 401k provider sent a disclosure required by the new Department of Labor rules. It basically said they may deduct fees from my account and when they do, the amount would show up on the quarterly statement. It didn’t say how much those fees would be. See my previous post New 401k Fee Disclosure Does Not Disclose Admin Fees.

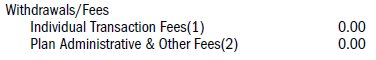

I received my quarterly statement covering July to September. This is the first statement covered by the new disclosure rules. I eagerly looked for admin fees on the statement.

To my delight, it showed that no fees were taken, at least none in this quarter.

The fees shown on the statement do not include the expense ratios of the investment options. Those were already disclosed in August.

Of course not having fees deducted in one quarter doesn’t necessarily mean I don’t pay admin fees period. If admin fees are deducted once a year at year end or in January, I will have to look for them in future statements.

401k plan providers have 45 days after the end of a quarter to issue the account statements. If you also received your statement for Q3, take a look and see how much admin fees were deducted from your account. If you haven’t received the statement yet, expect it before mid-November.

Whether you pay admin fees or not, it’s still a good idea to contribute the maximum allowed every year. According to the report from Vanguard How America Saves 2012, only 12% of the participants contribute the maximum. Put yourself in that 12%.

[Photo credit: Flickr user MPD01605]

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Roger @ The Chicago Financial Planner says

There is no better way to ensure a solid retirement than saving as much as you can. Most studies that I have read say that savings levels are more important than any other factor. That said, low fees certainly help participants. The fact that no fees came directly out of your account does not mean that you aren’t paying any fees. Depending upon how your plan is structured some of the funds could be paying revenue sharing to the administrator that are going into an ERISA account in the plan. Think of this as a “bucket” from which plan expenses can be paid. If this is the case with your employer’s plan this might mean that the funds used in the plan do not represent the most favorable share class available. Again this may not be the case with your employer’s plan, I’m speaking in more general terms here.

Harry says

Thank you Roger. I’ve been in the DC plan business on both the employer and the provider sides. My employer’s plan has room for improvement but there are some good choices. We have S&P 500 fund with expense ratio at 0.10%, extended market fund at 0.10%, EAFE index fund at 0.11%, bond index fund at 0.07%, and a number of actively managed funds with expenses from 0.4% to 1.35%. My money is of course in those index funds.