It was time to pay a deposit to our tour operator in Kenya for our upcoming trip in January. When you need to transfer money to another country and the receiving party wants the money in their own currency, you can use an international money transfer service such as OFX or TransferWise.

After receiving your money in the U.S., the international money transfer service will send the converted currency to your intended recipient in the destination country. Their service fee is usually a small percentage of the amount you transfer, sometimes embedded in the marked-up exchange rate quoted to you. See previous post Best International Money Transfer: TransferWise, OFX.

However, the price for our upcoming tour in Kenya is quoted in U.S. dollars and the tour operator wanted to receive U.S. dollars, not Kenyan Shillings. Apparently they can hold U.S. dollars in their Kenyan bank account. When you don’t need to convert currency, an international wire transfer will do. When you need to send an international wire transfer, doing it through a brokerage account typically costs you less than doing it through a bank or credit union.

I used Fidelity for this wire transfer to Kenya. It was completely free to me. If you do it through Vanguard, it costs only $10; the fee is waived if you are a Flagship customer (having $1 million or more in Vanguard funds and ETFs at Vanguard). By comparison Bank of America charges $45 for an international wire transfer sent in U.S. dollars. Credit unions aren’t necessarily better. Alliant Credit Union charges $50 for an international wire.

The reason sending a wire through a brokerage account costs you less than doing it through a bank is that the broker sees the wire transfer more as an ancillary service to keep you as a customer for their bread-and-butter investment services. It’s not a profit center for them.

Fidelity Withdrawal From

To send a one-time wire transfer from a regular Fidelity brokerage account, you fill out a Nonretirement One-Time Withdrawal Form. If you don’t have enough cash in your Fidelity brokerage account, you transfer cash into it first. Remember to use ACH push, not ACH pull; otherwise the money pulled in can be subject to a hold. Fidelity shows a routing number and an account number for each brokerage account. You can use those two numbers to link it to your bank account and then push money from your bank account into your Fidelity brokerage account.

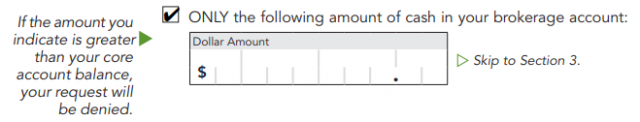

On page 1 of the withdrawal form, you enter the amount for the wire transfer.

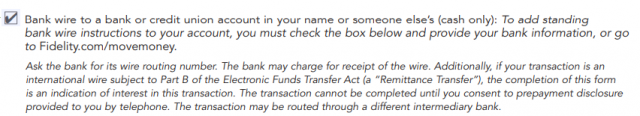

On page 3 of the form you check the box for wire transfer and you provide information for the receiving bank account. You get this information from your receiving party.

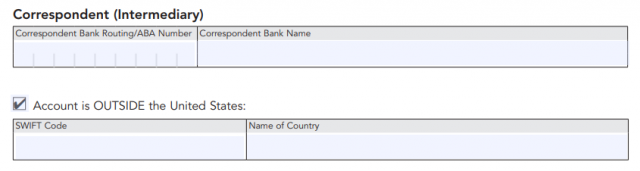

When the account is outside the U.S. you check another box and you provide the SWIFT code and the name of the country. You get the SWIFT code along with the bank account information from the receiving party.

Correspondent Or Intermediary Bank

Fidelity’s withdrawal form has a section for information about a correspondent or intermediary bank. Those two terms are used interchangeably. A correspondent bank is a bank with which the receiving bank has an account. When the sending bank doesn’t have a direct relationship with the receiving bank in a different country, the sending bank sends the money to the correspondent bank. The correspondent then acts an an intermediary (hence the name): it credits the account of the receiving bank before it tells the receiving bank to go ahead and credit the receiving party (called the beneficiary in a wire transfer).

The correspondent bank can charge a fee for acting as an intermediary, typically $10 – $15, but it can also do it for free, especially when the correspondent bank is within the same family as the receiving bank. Therefore choosing the correspondent bank well can also save you money. The receiving bank typically has one or more preferred correspondent banks for each major currency. If you don’t know which correspondent bank to use, ask the receiving party to get that information from their bank. Or you can see if the receiving bank has a sister bank in the U.S. (typically in New York).

For instance our tour operator in Kenya wanted the money wired to their account at Barclays Bank of Kenya. Barclays Bank of Kenya uses Barclays Bank PLC in New York as a correspondent bank. When Fidelity sends the wire through its bank, if they are not able to do it directly, they would send the money to Barclays Bank PLC in New York. When Barclays Bank PLC in New York gets the money, it tells Barclays Bank of Kenya to credit our tour operator’s account.

Medallion Signature Guarantee

Fidelity’s withdrawal form says a one-time wire transfer must have a medallion signature guarantee. A medallion signature guarantee isn’t the same as having your signature notarized. Only financial institutions can give a medallion signature guarantee. It’s used more in the brokerage industry for transferring assets. Many banks don’t give medallion signature guarantees any more.

When I dropped off the signed form at a Fidelity branch office near me, the representative there checked my ID. Maybe they put their medallion stamp on the form after I left their office. Anyway I didn’t have to worry about it.

A couple of hours later, I received a phone call from Fidelity’s wire department with a 817 area code in Texas. As part of the procedure, the representative in the wire department read me some disclosure statements and I had to give a verbal consent. Soon after that I received an alert by text message that the wire had been sent. A couple of days later our tour operator in Kenya confirmed they received the money. I was very pleased by Fidelity’s efficiency and cost effectiveness in doing this wire transfer.

If you do a one-time wire transfer through Vanguard, Vanguard’s form also requires a medallion signature guarantee. Because Vanguard doesn’t have retail branch offices, it will be more difficult to get the medallion signature guarantee.

The same procedure can also be used for a domestic wire transfer within the U.S. It can be useful when you need to send a down payment to an escrow account for a real estate purchase or when you pay off a mortgage.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

abc says

Assume the tour operator would not accept a credit card or charged additional to use credit card. Is this correct?

Harry Sit says

Correct. Many local providers in these developing countries don’t accept credit cards.

B. D. Paul says

For Fidelity to setup international wire transfer may take 2-3 weeks. It needs medallion signature guarantee and has to be mailed, not sending scanned copies through your secured account email. If you call Fidelity you may have to wait 20-30 min on phone and surely different advisors will give you different advice. Just mail, otherwise you will see delay, very frustrating. I am still waiting for 3 weeks.

Harry Sit says

Before COVID, I dropped off that completed form at the Fidelity office and the wire was sent on the same day. If you have a Fidelity Investor Center near you, ask if that’s still an option.

https://www.fidelity.com/branches/overview

C. J. K. says

Harry,

Is this someone plagiarizing your work?

[link removed to not give them more visibility.]

Harry Sit says

It is, and that’s a shame. I removed the link to not give them more visibility.