Mutual funds are priced once a day after the markets close. The fund tallies up the value of all its holdings and calculates a Net Asset Value (NAV) per share. All the buy orders and sell orders the fund received before the markets closed on this day transact at this NAV. Everyone pays the same price on the same day but you don’t know what the price will be at the end of the day when you place your order.

ETFs are priced in the market throughout the day. Their prices change by the second. You see the price when you place your order but you don’t know whether this price is high or low relative to prices at a later time in the day or when the markets close.

In some ways, ETFs’ up-to-the-second pricing is an advantage. If the market is going up, there’s an opportunity to buy earlier in the day at a lower price. If the market is going down, there’s an opportunity to sell before it goes further down by the end of the day. You can also use limit orders to have your order execute only when the price meets a preset point, whereas mutual funds only accept market orders at the to-be-determined NAV.

However, the ever-changing prices can also be a hindrance. In general, you have to place your ETF orders when the market is open. Because you may be busy with work or other activities during those hours, you may prefer to put in your orders in the evening or on weekends. If you enter a market order for an ETF when the market is closed, your order will execute when the market first opens. Prices are sometimes volatile in the opening minutes and you may not get a fair price. If you enter a limit order for an ETF when the market is closed, your order may not be executed when the market moves away from the price you set in the limit order.

When you find time during trading hours to place an ETF order, you still can’t be sure how the price you see at that moment compares with the price of a mutual fund set after the end of the day. This comes into play when you harvest tax losses between an ETF and a mutual fund.

When you harvest tax losses, you sell one investment and you buy something similar but not substantially identical. If you’re selling an ETF and buying a mutual fund, a big rally at the close will raise the price of the mutual fund, which makes you buy high and sell low. If you’re buying an ETF and selling a mutual fund, a large selloff at the close can also make you buy high and sell low.

Ideally you want to make your ETF order execute as close to 4:00 pm Eastern Time as possible in order to match the price movement in the mutual fund. It’s difficult when your schedule doesn’t allow it.

Market On Close Orders

The Market On Close (MOC) order type comes to the rescue.

A Market On Close order is a market order that’s executed at the closing price. It makes an ETF order behave like a mutual fund order. Instead of your order executing immediately (market order) or at a preset price (limit order), your Market On Close order will execute at the closing price, whatever it happens to be.

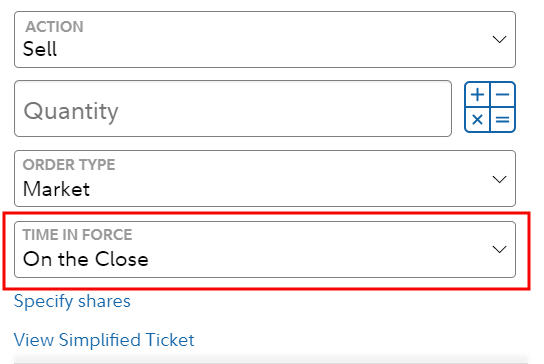

Most of the mainstream brokers except Vanguard support Market On Close orders for ETFs. Here’s how to enter a Market On Close order with Fidelity:

Choose “Market” in the Order Type field and “On the Close” in the “Time in Force” field.

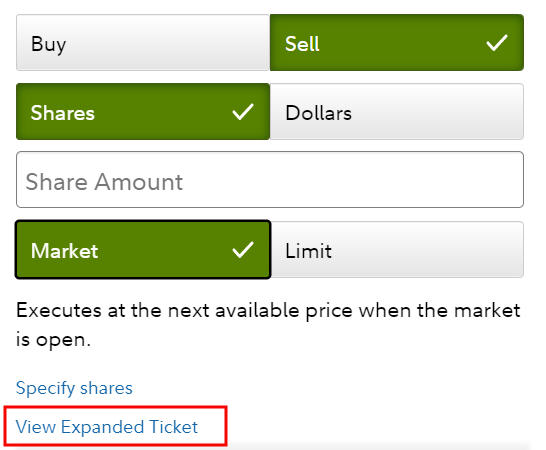

If your order entry screen looks like this, you’re on the Simplified Ticket. Click on the “View Expanded Ticket” link to open up more options.

Here are a few other things to keep in mind about Market On Close orders:

1. You can enter a Market On Close order only in whole shares. Fidelity supports trading fractional shares and trading in dollars but not for the Market On Close order type.

2. You can enter a Market On Close order only after the market opens and before a cutoff time prior to the close. Fidelity sets the cutoff at 3:40 pm Eastern Time, 20 minutes before the close.

3. A Market On Close order can’t be canceled when it’s only a few minutes before 4:00 pm Eastern Time.

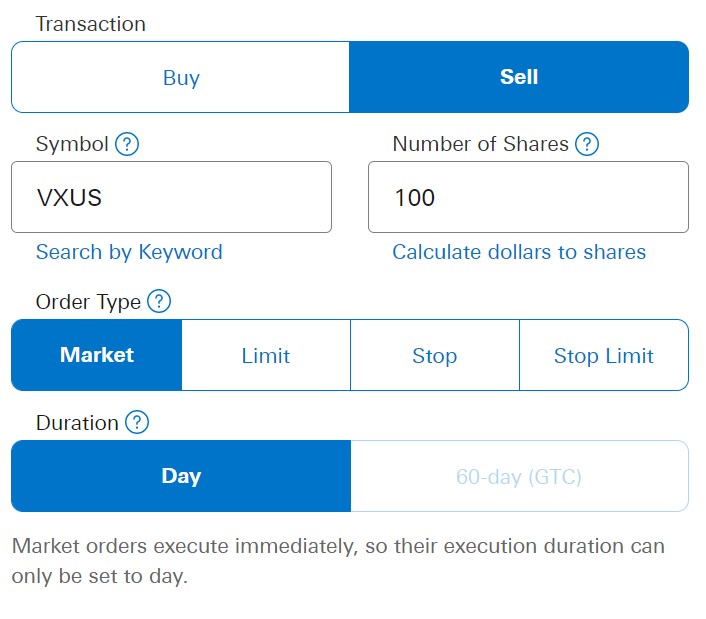

Vanguard

Vanguard doesn’t support Market On Close orders. The only option for the duration of a market order is Day.

If you prefer the simplicity of mutual funds, using Market On Close orders makes buying and selling ETFs close to the experience in buying and selling mutual funds. More importantly, when you harvest tax losses between an ETF and a mutual fund (similar but not substantially identical), using a Market On Close order makes both your ETF order and your mutual fund order execute at the closing price. This minimizes the price fluctuation between your orders.

It’s too bad Vanguard doesn’t support Market On Close orders. Consider using a different broker if you’d like to use Market On Close orders.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Mike says

” If the market is going up, there’s an opportunity to buy earlier in the day at a lower price. If the market is going down, there’s an opportunity to sell before it goes further down by the end of the day.”

This is something I’ve never cared about. I’m investing for the long run, not trying to be a day trader or market timer. When I rebalance my portfolio or invest new money, my assumption is I’ll hold it for years and at that point the total gains will have rendered the daily fluctuations irrelevant.

MDM says

Thanks Harry – hadn’t noticed that option!

Luke says

When selling ETFs any proceeds are usually available immediately and can be used to buy mutual funds. I’m assuming with the end of day order, one will have to float the funds? This can be a problem when large sums are involved.

Horton says

I was wondering the same thing. When converting from an ETF to a mutual fund, is it best to try to sell the ETF 15-30 minutes before market close and then use the proceeds to place the mutual fund order before market close?

Harry Sit says

If you have margin enabled on the account you can place the buy order for the mutual fund before the close without having to sell the ETF first.

Kevin says

Harry, what is the typical fee for margin use for a single day?

(I checked my brokerage account and margin was already enabled, but I have never used it.)

Harry Sit says

It goes by the margin rate on your account. If you use $100,000 of margin and your margin rate is 5% per year, the daily cost is approximately $100,000 * 5% / 365 = $13.70.

GMShedd says

Harry, you may want to point out to any readers who are unaware that selling an ETF and buying the equivalent mutual fund (or vice versa) could generate a disallowance of the loss by the IRS under the wash sales rule if the ETF and mutual fund are “substantially similar.” Under the rule, a tax loss will be disallowed if the same (or substantially similar) security is purchased within 30 days before or after the date of the sale that incurs the loss.

Harry Sit says

From IRS Publication 550:

“A wash sale occurs when you sell or trade stock or securities at a loss and within 30 days before or after the sale you:

– Buy substantially identical stock or securities,

– Acquire substantially identical stock or securities in a fully taxable trade,

– Acquire a contract or option to buy substantially identical stock or securities, or

– Acquire substantially identical stock for your individual retirement arrangement (IRA) or Roth IRA.

If you sell stock and your spouse or a corporation you control buys substantially identical stock, you also have a wash sale.”

The standard is “substantially identical.” Buying or selling a similar fund is OK when it’s not substantially identical. I’ll add “but not substantially identical” to the place where I mentioned “similar.”

Steve says

Never knew about Market on Close order type. Thanks.

Allan says

I talked to Vanguard this week about selling their ETF’s at Market Close. They are working on this option for on-line orders, but for now, if you want to sell a ETF at market close, all you have to do is call their trading desk and they will submit the Market Close order.

Sammy_M says

This may be fine on high volume ETFs, but on less popular, thinly-traded ETFs, it is generally best to avoid placing orders the last half hour of the day. Market On Close seems to be doing exactly this. You’re not getting the NAV of the underlying securities as you are with the mutual fund. With ETFs, you’re getting the price that someone else in the market is willing to sell to (or buy from) you.

calwatch says

Market on Close is a special auction that is specifically designed for liquidity. It is the time with the greatest amount of market participants. https://www.nyse.com/article/nyse-closing-auction-insiders-guide

Kevin says

With Fidelity and if placing market orders during trading hours, make sure you have turned on Fidelity’s *real-time* quotes. Otherwise, you are looking at data (prices/quotes) that is around 15 minutes old.

https://www.fidelity.com/customer-service/how-to-get-real-time-quotes