The HSA provider my employer chose isn’t very good. The interest rate is very low if I leave the money in cash. The investment options are very expensive, with no index funds. I still use it because contributions through the employer are exempt from Social Security and Medicare taxes.

I take the money out once a year and put it into the HSA account I prefer for a better interest rate and better investment options. Here’s how I did it. If you are looking for a better HSA, see Best HSA Provider for Investing HSA Money.

Request Withdrawal

I logged on to the website of my employer’s HSA provider. I requested a withdrawal to my personal checking account. Leave a few dollars behind if you don’t want them to close the account. If you don’t want this account anymore, you can withdraw everything and call to close the account after the rollover is done.

You don’t need to give a reason for the withdrawal or submit receipts. Some HSA providers make you add details for a provider name and dates of service as if you’re reimbursing yourself for healthcare expenses. Just use a provider name to the effect of “HSA Rollover” or “Rollover to XXXX” with some random dates of service.

Deposit to New HSA Provider

I mailed a personal check together with a rollover contribution form to my preferred HSA provider. If your preferred HSA provider accepts deposits by electronic fund transfer from a linked bank account, that works only if you can mark the deposit as a rollover, not a normal contribution.

Ask the receiving HSA provider for the rollover contribution form if you can’t find it on its website. If your preferred HSA provider is Fidelity Investments, fill out the deposit slip and mark the box for “60-Day Rollover.”

That was it. If you have a checkbook for the current HSA, you can also write a check and send it to the new HSA together with the rollover contribution form.

One Rollover Every Rolling 12 Months

The amount rolled over isn’t taxable. You can do this DIY rollover only once every rolling 12-month period. The clock starts on the date you take the money out of an HSA, not January 1. You have 60 days to deposit it to a new HSA.

Start your next withdrawal request 13 months after the deposit is cleared in the new HSA to stay clear of the frequency restriction.

Trustee-to-trustee transfers aren’t limited in frequency but HSA providers usually charge a fee to the tune of $20 to $30. It’s not worth it if your HSA provider charges a fee for trustee-to-trustee transfers. Just do the rollover on your own.

Form 1099-SA

After the end of the year, the HSA provider that sent you the money will send you a Form 1099-SA showing the distribution. In May each year, the receiving HSA provider will send you a Form 5498-SA, which confirms the normal contributions and the rollover received in the previous year. Save the 1099-SA and the 5498-SA in your tax files to show that you did a rollover.

Report Rollover in Tax Software

You will report the rollover in your tax software. Here’s how to do it in TurboTax download software:

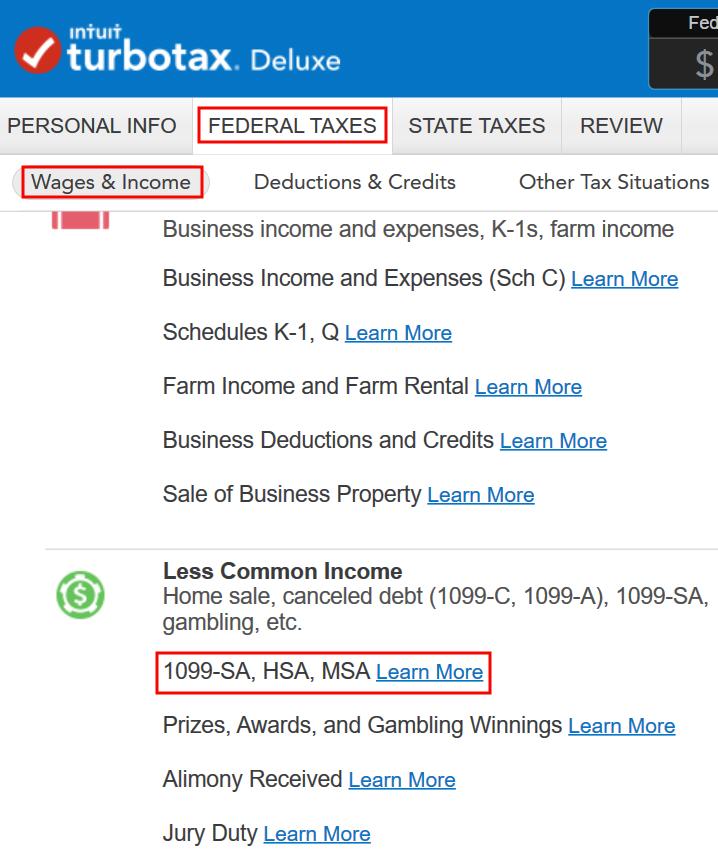

Click on “Federal Taxes” and then “Wages & Income.” Scroll down to the heading “Less Common Income” to find “1099-SA, HSA, MSA.”

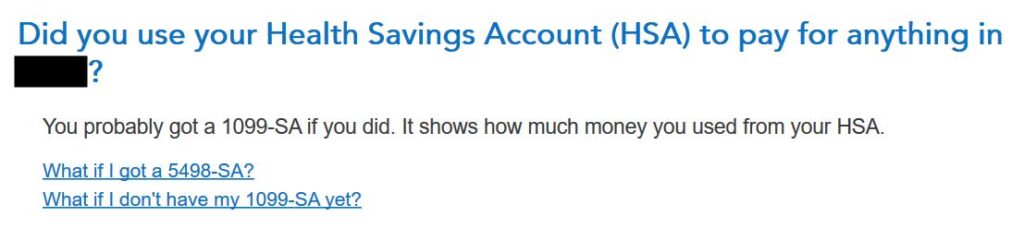

When it asks you whether you used your HSA to pay for anything, answer Yes even though you only did a rollover and didn’t use it to pay for anything.

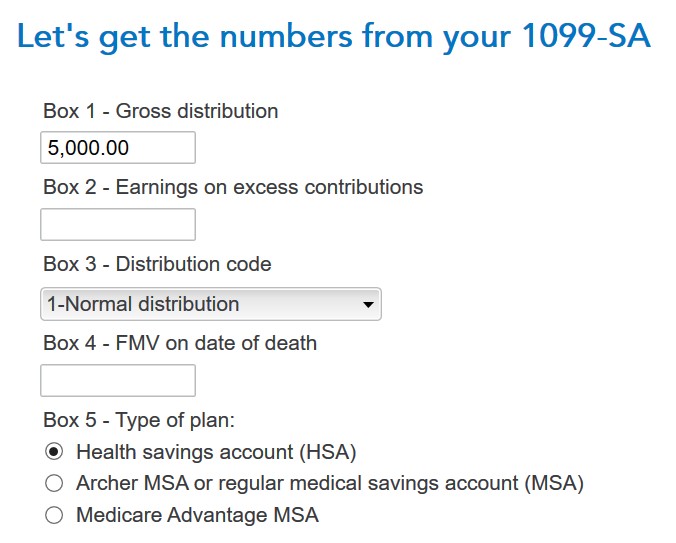

Enter the numbers from your 1099-SA form. Suppose you took out $5,000 from your HSA last year.

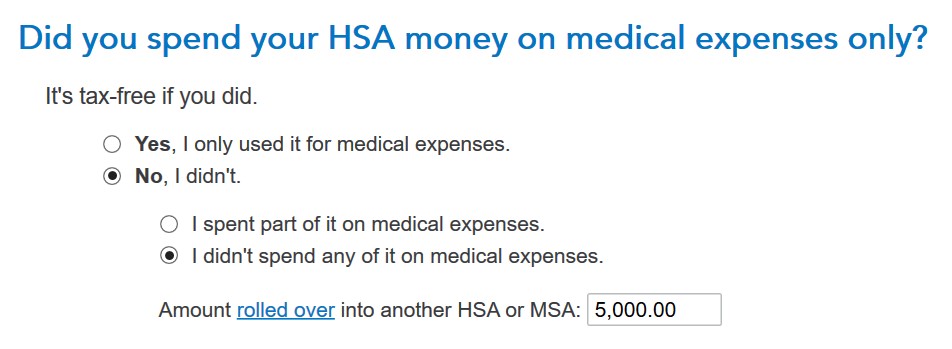

If you only did a rollover and didn’t spend any HSA money on healthcare expenses, answer No and enter the amount you rolled over.

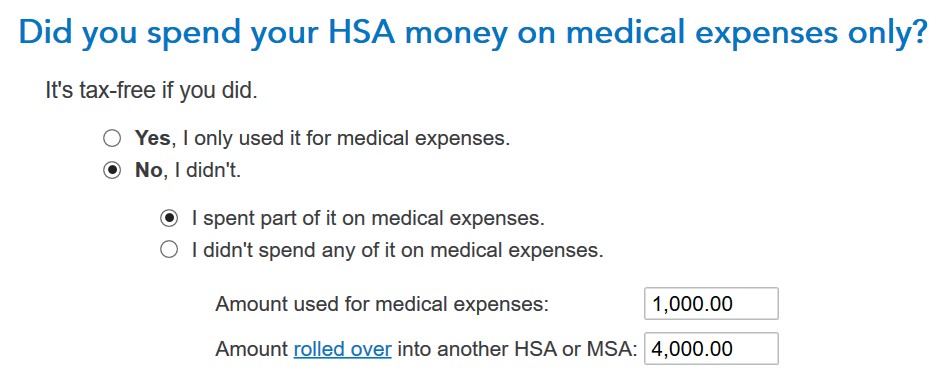

If you withdrew some money from the HSA to cover healthcare expenses in addition to a rollover, choose the option “I spent part of it” and enter the split accordingly.

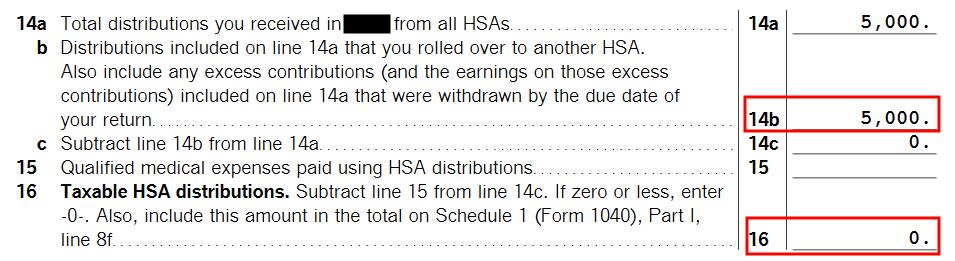

To confirm that your withdrawal is tax-free, click on Forms and look at Form 8889.

You will see the withdrawal on Line 14a and the rollover on Line 14b. Line 16 shows that the taxable amount is zero.

***

My payroll deductions and my employer’s contributions are still going to the provider chosen by my employer. I’m going to roll over the balance in the account again next year after I clear the one-year mark from this rollover.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Matt says

Harry,

Thank you very much for sharing this information. Is there a reason you chose this route vs. using the “Transfer HSA to Alliant HSA” form? Trustee-to-trustee transfers are exempt from the once-per-year rollover rule. I just completed one moving some cash from my Alliant HSA to my new employer-provided HSA to get some fee-free investments started with this money.

Harry says

As the title says, if I used the transfer form the old provider ACS Mellon would charge me $25 for transferring out.

Matt says

Note to self – engage brain before turning fingers free.

I feel foolish.

Harry says

No worries. It happens to me too.

Michael says

Won’t the previous custodian report that check simply as a distribution on the relevant tax form, when actually it was a rollover?

I guess you can account for that correctly when doing your taxes?

Steve says

What if I never received a checkbook for the old HSA account? (though I admit the possibity that I received one and promptly lost, er, filed it)

Harry says

Michael – I suppose so. Because I did it in January 2013, I won’t see the tax form until 2014. You report the amount you rolled over on Form 8889, line 14b. Then it’s subtracted from the distribution. Very easy.

Steve – I heard some HSA providers don’t issue a checkbook but they will send a check to you for self-reimbursement upon request. If you can’t find the checkbook which you may never had, ask the provider about self-reimbursement. You can deposit the self-reimbursement check to your personal account and then write a personal check to the new HSA provider for the rollover. The fee for a self-reimbursement check may be less than the fee for a trustee-to-trustee transfer.

Harry @ PF Pro says

Very timely article as my employer just switched HSA providers to from Fidelity to Chase. I don’t like the investment options/fees with Chase so I think I’m going to do a trustee to trustee transfer of old funds from Fidelity to HSA Bank and then again at the end of 2013 from Chase to HSA Bank. I know Fidelity won’t charge me a fee for this so I should be good to go with this method for Fidelity -> HSA Bank. But for Chase -> HSA Bank, I don’t know if Chase will charge a fee or not. If they do, I’ll use your method and rollover $3,250 at the beginning of 2014.

When I talked to HSA Bank though they did say that a rollover is considered a contribution to your account but it sounds like it’s easy to correct that on your taxes?

Thanks TFB!

Harry says

It would be a “rollover contribution.” The provider reports it on Form 5498-SA, box 4, separately from regular contributions. You don’t include it on your tax return.

Brett Buyack says

One downside to this that I can see is that by using the Employer’s designated HSA account they take out the money PRE-Tax. I can designate a different bank to put money towards, but that will be POST tax. Does your employer let you designate any bank you want with PRE tax dollars for your HSA?

RT says

Hi Harry, thank you for everything you do. This is very useful post. I would like to confirm my understanding of tax forms. Let us say that in January 2020 I will utilize 60 day rollover, as you described, and move HSA funds from Payflex to Fidelity.

At the beginning of the year 2020 payflex will send 1099-SA showing distributions for tax year 2019 where rollover will not be included. In May 2020 Payflex will send me form Form 5498-SA depicting contributions and value of the account which will be 0.

Will I get Form 5498-SA from Fidelity for tax year 2019 in May as well? I shouldn’t, right?

Instead Fidelity should send me Form 5498-SA in May 2021 for tax year 2020 correct?

Harry Sit says

The HSA trustee issues a 1099-SA before the end of January for the money that went out of the HSA during the previous year (except for a trustee-to-trustee transfer). The trustee also issues a 5498-SA before the end of May for the money that went into the HSA during the previous year (except for a trustee-to-trustee transfer). So if you take the money out from one HSA in December and put the money into another HSA in January, you will see the 1099-SA in one year and the 5498-SA in the following year.

Harry says

Brett – No, I must use the employer’s chosen provider if I want to save on FICA taxes. I’m only rolling over old money. New money still goes to the provider picked by my employer.

HSA Investor says

Does this actually save on taxes? My understanding is that you would get the difference back in your next tax return. What am I missing?

I ask because the maximum amount my employer lets me contribute per paycheck via payroll deductions is (allowable contribution remaining for year) / (# paychecks left in year), and I would prefer to front-load my full contribution for the year. Because of this, I was considering not contributing through payroll deductions and instead making a full contribution of the maximum amount myself using already-taxed savings at the beginning of the year, and then getting a corresponding tax deduction for the amount I contributed. Would this deduction be irrelevant assuming I the standard deduction anyway? Is this why you prefer to fund your HSA through payroll deductions?

Harry Sit says

You save FICA taxes, i.e. the taxes you pay for Social Security and Medicare, if you contribute through payroll (at most employers). If you contribute on your own, you get a tax deduction on your tax return against your normal income taxes, but you don’t get to deduct against your Social Security and Medicare taxes.

Harry @ PF Pro says

I’m thinking of how I’m going to rollover my funds from Chase at the end of this year to my HSA Bank account. I don’t want to buy checks from chase and they said they won’t write me a check so my options are to withdraw money for free from a chase ATM or there is also the other option to transfer to a personal bank account(Chase told me this would be free but not sure I believe them until I see it in writing).

Once I get the money, i can write a check from my personal account to HSA bank as a rollover. Either of these two methods would be the same as yours right?

Harry says

Yes. Also see if you can withdraw cash at a Chase branch via a teller.

White Coat Investor says

Great post! I’m including it in my monthly newsletter.

Adam says

Following up on this… I, too, performed a rollover from my employer’s chosen HSA (Aetna/JP Morgan Chase) to Alliant Credit Union in January of 2013.

I performed the rollover by doing an EFT withdrawal from the Chase HSA into my personal checking account (not at Alliant), then doing an EFT of that amount to my Alliant checking account, and finally notifying Alliant to do a transfer from my Alliant checking account into my Alliant HSA and coding it as a rollover contribution. No problems there. The initial distribution from my Chase HSA occurred on Jan. 24, but the rollover contribution was not credited to my Alliant HSA until Jan. 31. My understanding according to IRS rules is that I cannot make another rollover contribution until Feb. 1, 2014, but since that is a Saturday, the actual transaction won’t take place until Feb. 3, 2014. This means my 2015 rollover can’t occur until Feb. 4, 2015. This is kind of annoying, because it means if I continue to do rollovers every year, they would get later and later every year. I would much prefer them to be as close to Jan. 1 as possible.

What’s not clear is how many rollovers are allowed in one year. The only definitive statement I’ve seen from the IRS says, “You can make only one rollover contribution to an HSA during a 1-year period.” But this is a little ambiguous: can I make one rollover contribution per HSA per year, or one rollover contribution per year, period, regardless of how many HSAs I have? For example, I’m thinking about opening an HSA this year with ELFCU, to make use of their investment options. From my reading of the IRS rules, I understand that I would not be able to rollover from Chase to ELFCU and also from Alliant to ELFCU in the same year (that would be two rollovers into a single HSA in the same year, which is clearly prohibited). But am I allowed to roll over funds from Chase to Alliant, and then from Alliant to ELFCU in the same year? In that case, each HSA would only receive a single rollover contribution.

If anyone knows of a more detailed explanation of the rules from the IRS, I would welcome a link.

Harry says

The 1-year rule is tracked to the date when you received the distribution, not when you deposited it as a rollover. Still, if you keep doing this, the date will be pushed later and later, especially when you wait after you already passed the 1-year mark.

The one-per-year rule is across the board, not per custodian or per account. The exact language of the law is IRC section 223(f)(5).

“This paragraph shall not apply to any amount described in subparagraph (A) received by an individual from a health savings account if, at any time during the 1-year period ending on the day of such receipt, such individual received any other amount described in subparagraph (A) from a health savings account which was not includible in the individual’s gross income because of the application of this paragraph.”

See if you can *transfer* from Alliant to ELFCU for free.

Harry says

Alliant customer service said they don’t charge a fee for transferring out.

john says

So I called up ELFCU and they said they do not have a rollover form.

I noticed they have a Contribution form http://www.elfcu.org/clientuploads/HSA_Contribution_Form.pdf with the multiple options for contribution type.

Should I select “Rollover from HSA” or “Transfer from an HSA” when sending the form along with my personal check?

Harry says

Rollover from HSA.

Jamie says

Can someone comment on why for a Rollover it is necessary to write a check from one’s HSA checking account to a personal account; THEN write a personal check to the new HSA (i.e. ELFCU)? Why can’t you just write a check from the current HSA checking account to ELFCU to do a self rollover?

Harry says

If you have a checkbook from your current HSA, you can just write a check and send it to the new HSA. It’s not necessary to put the money in your personal account first. Not all HSA providers give a checkbook, but most allow you to link a personal checking account for electronic funds transfer. In that case you transfer to your personal account and then write a check from there.

KL Cooley says

I found this thread a little too late. I initiated a transfer from HealthEquity HSA (my employer’s) to HSA Administrators (low cost Vanguard funds). This was pretty easy as I just faxed the form. Then it got weird.

I don’t know if my employer’s HSA will charge me a fee as their website is incredibly opaque about it. What do know is that while the transfer is in process they have frozen ALL the money in my account. So I can’t use the debit card they gave me or get any claims paid. I can understand the 3-6 weeks delay but freezing my account is like the bank putting a hold on my entire balance each time I write a check. Bizarre.

That being said I will use the above technique next year. I didn’t realize that I was avoiding SS and Medicare by having payroll deduction. That’s huge.

Double Whammy Savings. Thanks.

KL Cooley says

In reply to myself. My employer’s HSA didn’t see the large Bold lettering that said DO NOT CLOSE ACCOUNT on the transfer form and attempted to close my account.

The only thing that kept them from doing just that was that I hadn’t transferred the entire balance. Whew.

All good now. Live and learn.

Andy says

I have an HSA through my previous employer. I was laid off by that firm at the end of January, 2014. Their HSA administrator is Chase and while I was employed Chase did not charge a monthly maintenance fee.

I received a letter from Chase yesterday that since I am no longer employed, they are “transferring” my HSA account to a “new” Chase HSA account, which will now require a monthly maintenance fee.

I have slowly been dumping Chase due to all their fees, having closed my Savings account and closed/moved my IRA. (Chase initially said they would have to charge me a $40.00 fee to transfer my IRA to my new bank, but after complaining that all their fees were the reason I was closing my accounts, they relented).

I’m going to turn 65 in several months and do not plan to seek additional employment as I will go on Medicare at that time and will not be in a HDHP.

Now I want to move my current HSA funds from Chase to another HSA account. I’ve done a fair amount of “investigating” and have identified a number of reasonable alternatives.

(I also just read that after reaching age 65 I can withdraw funds from my HSA with no tax penalty – for ANY purpose – not that I would. )

My issue now is that I contacted one of the potential HSA banks yesterday to get information about transferring my existing HSA balance. The person I spoke with who was an HSA account representative, asked if I had an existing HDHP and I said no. His response was then I couldn’t transfer my current balance since I don’t now have an HDHP. After much discussion, I gave up.

I subsequently went online and found an article on the Kiplinger web site that said I could in fact transfer my existing HSA balance to a new HSA bank even though I’m not currently in an HDHP. However, since I don’t currently have an HDHP I can’t make any “new” contributions to the HSA, which makes total sense since any “new” funds I would add would be after tax as opposed to pre-tax when enrolled in an HDHP.

My question is this – is there any specific wording in the law spelling out the ability to transfer an existing balance to a new account without being currently enrolled in an HDHP that I can provide to a potential new HSA account representative? (The Kiplinger article didn’t identify any specific wording in the legislation.)

Even though HSA’s have been around for some time, it appears there is still a lack of understanding regarding the rules that apply to these accounts – even by the account administrators.

If I can finally get definitive guidance, I will make a cash withdrawal from Chase and then either write a check to the new account or do an EFT.

Thanks for any help you can provide!

Harry says

Andy – Although the law allows rollovers, the bank doesn’t have to support it. It’s possible this bank only takes new contributions. It’s also possible the person you spoke to is just misinformed. Find the HSA contribution form on the bank’s website or ask a rep to send a blank contribution form to you. See if the form has a “rollover” box.

Joe says

Thanks for the article! I’m very interested in reading about porting HSA’s, since the one my employer uses is sitting in a checking account earning .15% interest.

Question – if I open up an account at say, HSA Administrators, am I allowed to use funds from the HSA to cover the $45 annual fee?

Harry Sit says

By default they will take the fee from the money in your HSA. HSA Administrator isn’t the best provider though. I just added a link to my other article in the second paragraph.

JB says

hello Harry,

First, great article! Secondly, how did you determine the yearly fee for HSABank? I just signed up with them and the only fees that would appear to be relevant for me would be the $2.50 Montly Account Maintenance fee for keeping a balance lower than $5k, as I would be investing my HSA deposit into a Vanguard ETF via TD Ameritrade.

http://www.hsabank.com/~/media/files/fees_s1

Harry Sit says

Look at the third item in the second table: Monthly Investment.

Linda says

Harry:

do we have to strictly follow rollover “only once every rolling one-year period” rule?

I made rollover from my HSA (Chase) to ELF in 2014, exact date to ACH money to my bank acct (so I could write check mail to ELFCU) at HSA was 2/19/2014. So this year doing it again, I have to wait till 2/19/2015 to ACH it?

reason I asked was because I got a letter from Chase on 1/11/2015 that it claimed will transfer my HSA to “a new HSA” at Chase (because I do not have HSA plan for this year) within 30 days. so I hope to do ACH all out before 2/10/2015.

any idea?

thanks

Harry Sit says

You have to strictly follow the rollover “only once every rolling one-year period” rule. See the quote and the link to the law in the reply to comment #15. Transfers don’t count. You can request a transfer sooner but you may have to pay a fee to Chase for the transfer.

cor nob says

Any idea how to properly transfer an entire HSA account to an ex spouse by court order? My HSA provider seems stumped. I have shown them the Federal Code stating that I can transfer with no tax penalty, but how do you “transfer”? They want me to cash it out, but that seems risky with the IRS. Thopughts?

ippo says

Hi. Helpful article. Thanks.

Questions, hope people can help:

I have an HSA with BenefitWallet w/former employer, balance is $4k but less than $5k. I’m in CA.

1) What HSA provider should I use to avoid the $5k min account requirement, monthly fees, inactivity fees?

2) Would like to investment ETFs, bonds and/or indexes are fine. But I want to reduce and/or keep all associated fees. What HSA do you recommend for that offers good investments with little to no fees?

3) Anything else I should consider?

Thanks!

Harry Sit says

ippo – Please read the article linked in the second paragraph.

B says

Harry:

I want to rollover my old HSA at HealthEquity into Optum Bank (they charge $25 for a trustee-to-trustee transfer). So I tried taking a distribution from HealthEquity, but it only allows me to take out the (Total Amount – $25), citing that a $25 account closure fee is held in reserve and may not be used for reimbursement. Is there any way around this? I may have to pony up and pay the fee since HealthEquity charges a $3.95 maintenance fee each month.

Harry Sit says

Not really. If you are done with HealthEquity, you might as well close it. Ask whether they charge $25 for the transfer plus another $25 to close the account or the one $25 will both transfer out and close it.

Todo says

Thanks for this post, Harry.

One question is that if I don’t want to keep the old HSA account, can I just request the transfer to my checking account and close that old HSA account in step 1 at the same time? Or I have to wait until my check is deposited into the new HSA account?

Harry Sit says

Yes you can do that. You don’t have to wait.

Sam says

My old HSA bank charged $25 to either electronically transfer to my new HSA bank or to cut a check for a rollover. It turned out to be easier to do the electronic transfer. As I only had to do it once, it was no big deal, but if you are doing this annually, that $25 will add up.

Ryan says

Do you have to write a check to perform an indirect rollover or can you just use an ACH transfer? have my checking account linked to both HSA accounts involved. THanks

Harry Sit says

I did ACH transfer for the distribution. I wrote a check for the deposit because I had to mail a signed form.

Chris W says

Does anyone know if it is it possible to create your own check for your HSA account if you can determine the account and routing number, if the HSA provider did not provide a checkbook? I’m thinking of how you can order personal checks from 3rd party websites…wondering if maybe it would be an option to do something like that or use a template in Word or Excel or something to make a one time use check?

Harry Sit says

Chris W – It’s not necessary to create your own check for your HSA account. Most HSA providers can send you a check or let you link a checking account for electronic funds transfer.

V says

Hi Harry, thanks so much for the information in the article. My wife currently has two “old” HSA accounts from previous employers, and a third HSA account with her current employer that the employer makes regular contributions into. We want to open up a “new” account with a different provider that will have lower fees. We also want to close the two “old” accounts, transfer those balances into the “new” account, and transfer the balance in the current account into the “new” account we will be opening. We obviously want to keep the current account open since the emplyer will continue to make contributions into this account. To summarize, we ultimately want two accounts- the current employer account and the new account (which we have yet to open).

I was looking through the comments section and am a little confused about the process and what I am allowed to do. From reading above, it looks like I am allowed only one rollover a year. As per my plan as stated above, though, there will be three transactions into the new account. Is this allowed? Is there a difference bewtween a “rollover” and a “transfer”? If I am allowed only one rollover but an unlimited number of transfers, is this a way around this dilemma? Thanks for any help you can provide.

Harry Sit says

There is a big difference. Transfers are not limited in frequency. Only the HSA custodian can do it for you. They may charge you a fee for doing it. Rollovers are limited in frequency. You can do it yourself. There is usually no fee. So find out which custodian doesn’t charge a fee or charge a lower fee and have them do the transfer. Save your limited rollover for the one that charges the most on transfers.

James says

Hi –

I have Elements Financial and my employer recently started offering HSA option with HSA Bank. I have an investment account for Elements Financial through TD. What is the best way to transfer/rollover from Elements with my investments to HSA Bank.

Thanks in advance.

Harry Sit says

Ask Elements if they charge a fee for transferring out. Whether you do a transfer or rollover I think you will have to sell your investment and get the money to the bank side first.

Sarah says

Have you seen the online portal for Premera through ConnectYourCare/UMB Bank? I can’t find any way to request a check that doesn’t charge a fee. There are fees for the “Account Withdrawal Request”, the “Account Closure Request”, and I can’t find any other way to get money out of the account. I have a debit card, but no PIN as far as I know. I do have electronic transfers set up for when I request reimbursement of claims, but that’s the only free way I can find to get money out of the account. Any suggestions or am I just stuck with the $15 fee to move the funds elsewhere once a year?

Harry Sit says

Just do an electronic transfer with yourself as the payee.

Sarah says

The only way to do an electronic transfer is to tell it I want to reimburse myself for a claim. Are you saying I should make up a fake claim with a fake date of service and provider in order to transfer the money to myself?

Harry Sit says

You can put “Indirect Rollover” as the name of the provider. They won’t care.

Sarah says

This is ridiculous. I called the provider and they say the only way to get money out is to create a claim with IRS approved information and request reimbursement for it or to pay the $15 fee to transfer to another HSA. There is no checkbook. There is no way to initiate a transfer without a claim or a $15 fee inducing transfer request. There is no PIN on the debit card to get cash out. I give up. I’ll leave the funds in this account until I leave my employer and then I’ll transfer the balance out to my credit union HSA paying 1% and close the account. There is also no routing number to set up a transfer from the outside.

Sarah says

Thanks – the “indirect rollover” as the provider name looks like it should work. Sweet! I’ll do that next time since I already did my transfer of excess funds from 2015’s contributions.

Adam says

Does anyone know if HSA can initiate an electronic trustee-to-trustee transfer into the account? My workplace HSA is not very good, and will NOT charge a transfer fee if the transfer is initiated electronically by the new custodian bank/account. This would be great since I’d like to make more than one transfer per year. I checked the HSA bank website and the only process/form I see includes your previous trustee sending a paper check. Tried calling HSA bank but waited on hold more than 30 minutes today. . .any help appreciated!

Research All says

Easiest free way to transfer funds from your low interest no investment option employer HSA to your .50+ interest with investment options in stocks, funds, etc. personal HSA with no limit on frequency:

Simply make an electronic payment (bill pay) from employer’s HSA to your personal HSA. I do this bi-monthly, no fees or tax implications. During tax time just check the box indicating you transfered from one HSA to another. Watch out you don’t go over the limit if you earned a few cents in the employer’s HSA and paid it all to your HSA. Boom!

This was what the large bank providing my employer’s HSA advised.

Harry Sit says

Our tax system is based on voluntary compliance. You can check whatever box on your tax return and not get caught but it doesn’t make it legal.

ryman554 says

Why is the method of ETF transfers between HSA accounts that ResearchAll describes not completely compliant with the law and IRS rulings?

Even though you are the one initiating the transfer, I am not sure this would not be classified as a ‘trustee-to-trustee’ transfer anyhow since you do not have intermediate (ie, non-HSA) access to the money, thus not limited to the once-per-year limits.

I would like clarification, please

Harry Sit says

Because the trustee has to recognize it as such. When you initiate the EFT, the trustee doesn’t know the other end is an HSA. They are not going to record it as a trustee-to-trustee transfer. They only know it’s a distribution out of the HSA. When you have a distribution, you can only say it’s (a) reimbursing eligible expenses; (b) a rollover, subject to time and frequency limit; or (c) a taxable distribution.

ryman554 says

What does coding have anything to do with it? At the end of the year, I get one 1099-R, so it can’t tell between 1 and 12 operations. That’s what the IRS gets, too. Can you please point me to the relevant IRS tax code and/or private ruling letter where it specifies/clarified the definition of “indirect rollover” vs. “trustee-to-trustee transfer”? This is where I am getting conflicting information from different sources and would appreciate clarification on my end.

Harry Sit says

Look at 1099-SA instructions to the trustee.

“Transfers. Do not report a trustee-to-trustee transfer from one Archer MSA or MA MSA to another Archer MSA or MA MSA, from an Archer MSA to an HSA, or from one HSA to another HSA.”

https://www.irs.gov/pub/irs-pdf/i1099sa.pdf

When you receive a 1099-SA, it’s already not a transfer.

ryman554 says

Hm.. highlighting mine, below:

https://www.irs.gov/publications/p590a/ch01.html#en_US_2015_publink1000230565

“Trustee-to-Trustee Transfer

A transfer of funds in your traditional IRA from one trustee directly to another, either at your request or at the trustee’s request, is not a rollover. ***This includes the situation where the current trustee issues a check to the new trustee but gives it to you to deposit. Because there is no distribution to you, the transfer is tax free. Because it is not a rollover, it is not affected by the 1-year waiting period required between rollovers.*** This waiting period is discussed later under Rollover From One IRA Into Another . ”

This would seem to indicate that not all 1099-SA reportings are rollovers, as I will (and have) received a 1099-SA for this in the past.

How is this any different, indeed in fact entirely consistent with, the advise ResearchAir (rather, the bank ResearchAir has) has given, above?

It would seem to indicate a check cut to “newHSA FBO ResarchAir” is not, in fact, a rollover. And it would also seem to indicate that a direct transfer, by whatever means, between “oldHSA” and “newHSA” without ResearchAir touching it would be kosher.

Edit — yes, I know the link is for IRA rollovers and such, but there exists little or nothing in the IRS that calls out for HSA, and it seems reasonable to assume the rules regarding IRA definitions of transfers vs. rollovers are the same for other tax-advantaged accounts.

Harry Sit says

Same thing in 1099-R instructions to IRA trustees:

“Transfers

Generally, do not report a transfer between trustees or issuers that involves no payment or distribution of funds to the participant, including a trustee-to-trustee transfer from one IRA to another IRA, … …”

https://www.irs.gov/pub/irs-pdf/i1099r.pdf

When you receive a 1099-R from an IRA provider, it’s already not a transfer. You may have received 1099-Rs when you moved money between a 401k and an IRA. Those are not IRA-to-IRA transfers.

When I did IRA trustee-to-trustee transfer, I didn’t receive a 1099-R. When I did HSA trustee-to-trustee transfer, I didn’t receive a 1099-SA.

The bank will do the billpay or ACH however often you want. They will record it as a distribution and issue the 1099-SA. Whether you have to pay tax on the distribution because you violated the rollover frequency requirement is not the bank’s problem.

How are you going to report it on your Form 8889? The instructions say:

“Do not include the amount transferred in income, deduct it as a contribution, or include it as a distribution on line 14a.”

https://www.irs.gov/pub/irs-pdf/i8889.pdf

If you don’t include it, the IRS will come ask you about the distribution because it received the 1099-SA from your HSA trustee. If you include it on 14a, do you say it qualified as a rollover on 14b without regard to the frequency requirement?

If by “it can’t tell between 1 and 12 operations” in your previous comment you meant the IRS will not know whether you did 1 rollover or 12 rollovers in a year, it goes back to the issue of voluntary compliance. If you are willing to lie and say it was just 1 rollover, you may not get caught, but that doesn’t make it legal.

Why is it so difficult to just stick with one rollover per rolling year? There isn’t much to gain to invest a few thousand dollars a little sooner. Think long term and don’t try to wring out every last drop.

ryman554 says

You still have not indicated that receiving a 1099-R or 1099-SA makes it a rollover, especially since the IRS specifically says that it is not. Just becuase the instructions tell the bank not to create a 1099-SA/R does not make the creation of a check (electronic or paper) into a taxable event or a rollover. Please point me to the IRS case law which disagrees with this statement. I show you IRS documentation that says otherwise.

I get 1099-R for rollover from tIRA to 401(k), even though it is not a distribution. I get 1099-SA for liquidation of HSA FBO fidelity, and it was not distribution. All I had to do is correctly affirm that this was a non-taxable trustee-trustee transfer at filing time and all is OK.

It is my position, and that of many others, that the receipt of a check, no matter how it is coded by the outgoing institution is NOT a rollover AS LONG AS you do not have access to the money. The same is true for incoming money. Whether or not it is one time or twelve.

In fact, if the outgoing institution issues a paper check, they are *required* to issue a 1099-SA, because they have no guarantee that the money will ever be redeposited into the account, or that the receiving account is, in fact, another account of the same type. It will get counter-balanced by a contribution form (4998?, I forget) that the taxpayer must affirm is the deposited amount. And yet, this case is definitively and specifically NOT a rollover according to the above link, and not subject to the 1-in-12 rule.

The real problem as I’m sure you will agree, is that the IRS is being quite ambiguous about this, with allowing a custodial transfer while allowing you to receive a paper check. Case law in 2014 (2015?) that cracked down on this kind of behavior was clearly trying to stop 60-day loans from tax-advantaged accounts instead of preventing folks from moving money from one account to another of the same account.

As for why does it matter? I like to keep things in as few institutions as possible. Easier to track, harder to forget. Higher fees. I just want to automate a monthly withdrawal.

Harry Sit says

I’m not the one you have to convince. You sign your tax return. It’s between you and the IRS. Are you going to report the amount on Form 8889 line 14a or not? If you believe it’s a transfer the instructions tell you not to. Including the amount on both lines 14a and 14b would be false. Many false returns are accepted by the IRS. They are still false though.

ryman554 says

Lets put the facts out.

You assert that this procedure is not kosher from a reading that says “if a 1099-SA is sent, it’s a rollover”

I have provided exact IRS verbage refuting that statement that you have not responded to multiple times.

You are correct, I do not need to convince you; I need to raise the point to your readers to avoid your readers from getting a false impression that the OP procedure — suggested by a HSA custodian — was not allowed by the IRS. Nothing you have said contraindicates the legality.

I will ask you three direct questions, and please answer them:

1. When a HSA custodian makes out a check to “HSA custodian 2, FBO ryman554”, is that a rollover or trustee-trustee transfer? A 1099-SA *will* be generated.

2. How many of these are allowed in a 12 month period?

3. Would it be different if the HSA custodian instead was instructed to deposit the money directly via ACH transfer?

My answers are:

1. trustee transfer. See referenced IRS text, above.

2. any number. See referenced IRS text, above.

3. Assertion: no different.

But you are absolutely correct, I do not know how to file this form properly. Form 8889 would be the correct place, but even there, for line 14b, it says not to include trustee-trustee transfers.

So I am now in a quandry — I firmly believe that this is a trustee-trustee direct transfer and not a rollover based on what the IRS states. I agree with you that there is no way to correctly report this to the IRS.

Harry Sit says

1) It depends on how the check was generated. If you followed the transfer procedure at the HSA trustee and then the trustee made the check, it’s a transfer and the trustee will not generate a 1099-SA if it follows the IRS instructions correctly.

A check and a 1099-SA are not directly linked. A transfer can still use a check and it will not generate a 1099-SA. You only found the IRS saying a transfer can use a check. Nothing said a 1099-SA has to be issued when a check is used for a transfer.

The IRS said if it’s a transfer, do not report on 1099-SA. The logic equivalent of “A => B” is “not B => not A.” Therefore “not (no 1099-SA) => not a transfer”.

If you don’t follow the transfer procedure provided by the trustee and instead you use the distribution procedure, the trustee will treat it as such and it will issue a 1099-SA. When you ask for a distribution from the trustee, no wonder the trustee gives you one.

2) As many times as you wish and the trustee allows. The trustee doesn’t care what you do with the distributions or whether the distributions are taxable to you. The IRS limits you to one tax-free rollover contribution in a rolling year.

3) No difference whether the trustee uses ACH or check. What matters is what procedure you use to instruct the trustee and what the trustee does by your instruction. When you ask for a transfer you get a transfer. When you ask for a distribution you get a distribution.

If the trustee wants to automate its transfer procedure, it’s free to do so. It can very well have you fill out a form just once and do monthly transfers. You just have to persuade your trustee to set it up that way. Just by using its automated distribution procedure doesn’t turn the distributions into transfers, because you start with asking for a distribution. When you want a transfer, you have to ask for a transfer.

If you firmly believe the monthly billpay or ACH are trustee-trustee direct transfers, you would not report them on Form 8889, as the IRS clearly instructed. If the IRS asks about your unreported HSA distributions, you then present your argument. If you make them agree, it’s all good. If they don’t agree, you get a mess. 11 of the 12 distributions are taxable, not eligible for rollover, and subject to penalty. The money put into the receiving HSA becomes excess contributions, which must be taken out, and subject to excise tax if not done in time.

It’s not a risk I want to take. Nor do I want other readers to take it.

Harry Sit says

P.S. See https://en.wikipedia.org/wiki/Transposition_(logic) for why “A => B” means “not B => not A.”

di2524 says

I’m in the situation of attempting to rollover HSA funds from one provider my company used in 2016 to a new company in 2017. I do have a checkbook for the former account and have read that you can transfer the funds directly to the new provider/account via check. … This may be a silly question, but to whom do I make the check out to? To the new account provider with a notation that it’s designated for my new account? Or do I essentially write a check to myself?

Harry Sit says

Ask the new company. You also need a form or letter to make it clear it’s a rollover, not a regular contribution.

Brad says

Last year I used a check from the checkbook of my current HSA and sent the amount directly from my custodian linked to payroll to my preferred HSA custodian. I just called my preferred custodian to refresh myself on the steps before I do it again this year and they seemed to advise against the way I did it last year. They also seemed to not have my 5498 coded as a rollover contribution, even though I selected that box on the paperwork. And the other custodian sent me a 1099-SA, making it look like I took a distribution. Are you not supposed to receive a 1099-SA from the rollover contribution? Will I be penalized for this?

This year, I am transferring from current custodian to personal checking then from personal checking to preferred custodian, along with statement showing withdraw and indicating to treat as rollover contribution.

Harry Sit says

You are supposed to receive the 1099-SA. Your distributing HSA custodian doesn’t know what you did with the check. The receiving custodian did it wrong when it ignored the rollover box you selected. You can attach a letter and see if that makes it clearer to them.

Raj says

I ended up having a balance of less than $500 in Healthequity HSA account. They are charging $3.95 fee per month. Are there any options out there to rollover to another HSA and avoid monthly fee. TIA

Harry Sit says

Alliant Credit Union. Join as a PTA member or with a $10 donation to a supported charity. http://www.alliantcreditunion.org/bank/health-savings-account

Andrei says

My employer’s HSA provider is also HealthEquity.

This is my first year contributing to HSA and I just reached $2000 balance, which is a requirement for investing with them.

They have a good selection of Vanguard funds, but they charge 0.033 % monthly fee in addition to the expense ratio of the fund. That translates to 0.396% annual fee on the total balance. Not great, but not terrible either. They offer Vanguard’s Total International Stock Index fund VTPSX which has expense ratio of 0.07% . With the annual fee the total comes to 0.47%.

I wonder with the amount being so low, it is worth moving this somewhere else? As the author of this blog, I also don’t ming leaving some money on the table. Does my logic seem reasonable, or I missed some other disadvantages of using HealthEquity for HSA?

KL Cooley says

I also have HealthEquity through my employer. The combination of low fees, Vanguard funds and having payroll take care of the proper deductions they’re hard to beat.

Before they offered low cost funds I used to transfer to HSABank HSA every pay or so, that was a PITA. Now I get an email every pay from HeathEquity that tells me my funds have been deposited and I just log on and purchase shares, it’s quick and easy. Very happy with them.

Harry Sit says

When your balance is still relatively low it’s probably not worth opening another account elsewhere yet. However, HealthEquity lets you invest only the amount above $2,000 (at least that’s the case under the contract with my employer). If you move the money elsewhere, less $25 minimum to keep the HealthEquity account active for future payroll contributions, you get to invest the full amount at some places. It just depends on whether you want to invest the $2,000.

Andrei says

Thanks! That’s an important detail that I missed somehow. HealthEquity isn’t transparent about their rules and fees. I do see now that I cannot invest the initial $2000.

I’ll roll over what I can to HSA Bank or Saturna.

Harry Sit says

Just note HSA Bank charges an extra fee if you don’t keep $5,000 in cash.

Mark says

Can anyone confirm if, legally, we can request a reimbursement check from one account, deposit the check within 60 days, and file this as 60-day rollover? In other words, from 1099-SA’s point, there is a no difference between a reimbursement check, and, a transfer to personal checking account?

Harry Sit says

There’s no difference. It’s tax free only if you re-deposit within 60 days and you haven’t used this maneuver within the past rolling one year period.

Mark says

Thanks, Harry!

Madeline says

Hopefully this isn’t a dumb question, but when you mail a personal check together with the rollover contribution form, is the check made out to yourself? I’m guessing so since it’s going into your own HSA account. We’re about to do a rollover from BB&T to HSA Authority. I called to find out which form to use but they didn’t seem to know for sure. I’m using the “Contribution and Investment Selection” form because it has the Rollover box to check, so it looks right. I’ll just leave the Investment portion blank.

Harry Sit says

You can ask your provider. It’s usually the provider’s name or the provider’s name appended with FBO your name as in “The HSA Authority FBO Jane Doe.”

hoppy says

Hello TFB, great article and website, thank you.

Has anyone attempted to do a rollover from BenefitWallet to HSA Bank? My employer switched from BenefitWallet to HSA Bank, and I’m trying to move my funds. My employer hasn’t provided us with any instructions or tips on how to do this. I’m getting conflicting information from the people I speak to at HSA Bank.

I’m trying to avoid doing a trustee-to-trustee transfer because of the fees that BenefitWallet charges (one person told me $25, another person told me $35), but regarding a rollover, in talking with two people at HSA Bank, one person said that I cannot simply write a check from my old HSA account paid to HSA Bank with the rollover application/form; instead, the check has to be from the actual custodian (?). But I called HSA Bank again later and a different person told me the opposite: she said I could write a check from my old HSA savings account paid to “HSA Bank” for the rollover, although usually people have their old HSA write a check payable to the account holder, and then you send that check in the rollover application to HSA Bank.

My old HSA says they cannot send me a check directly because my HSA account is too large (more than $30,000) because of the Patriot Act, and that I could only do a trustee-to-trustee transfer (which would be a $35 fee), OR I can write a check from my old HSA savings account paid to the new HSA, and then call my old HSA back to say I’m closing my account after the funds get debited.

So, hearing conflicting advice from HSA Bank, I wonder if anyone out there has actually done this?

Do I need to do anything on my tax form if I do the rollover with a check? I get that I can do this only once per 12 months.

THANK YOU!

Harry Sit says

As the receiving end of the rollover, HSA Bank wouldn’t care who’s writing the check or which account it’s drawn from. They have a check, and a contribution form from you saying the money is a rollover. They just deposit the money and record it as a rollover contribution. As the sending end, BenefitWallet will record the withdrawal as a distribution. They don’t know why you are taking the money out. You say on your tax form the distribution was rolled over within 60 days and it was the only rollover in a rolling 12-month period therefore you shouldn’t be taxed.

Tasha says

My husband had initially set up an hsa with Alliant credit union, where money has been deposited by his employer to the 6750 max last year. Come to find out that the credit union never opened an hsa for him and has simply been putting the deposits into a regular savings account!! He set up the account over the phone and the lady gave him the account number to directly deposit to (and he isn’t great abut following up since he was only depositing and never withdrawing). Any ideas on how to get this fixed? Right now Alliant is acting clueless but we need that tax free money for a baby due this year–how can we handle this without big trouble from the IRS? I like this rollover idea, but we wouldn’t get the right tax forms since it’s not a transfer from an hsa account… From what I’ve been reading Alliant stopped offering hsa accounts so we’ll have to find a new bank anyways!

Brad says

Regarding Alliant no longer offering HSA accounts, I had an HSA with Alliant and they transferred our account to HealthEquity. You could look into setting up an HSA with them and I *think* you’d be able to use the post-tax dollars to contribute $6750 to the account for 2017 before the April deadline. Then when you file your taxes, use Form 8889 to figure your deduction. Make sure your husband files the necessary paperwork with his employer to setup payroll deductions for 2018.

I’m not a tax professional and I didn’t really deep dive into all the rules so definitely double-check me on this before you take any action to make sure it will work for you. You can read more in Publication 969

Ames says

I chatted online with Lively HSA customer service today. They insist that your current HSA provider has to “code” a check correctly and provide it directly to them (this is what they call a “rollover”) to avoid it being considered a distribution, that you cannot simply write a check from your own HSA account to another HSA account. I find this unnerving — HSA’s are their only product, yet they are unfamiliar with IRS form 8889 and they don’t know the difference between a T-to-T transfer and a rollover? Their account process requires you to provide the name of your current custodian and your account number, even when you select “rollover” vs. “trustee-to-trustee,” and asks you if you want them to close your existing account on your behalf. It seems I cannot open an account without them initiating a transfer from my current custodian, so I guess I’ll keep shopping. Disappointing.

Andrei says

Trying to do the roll over from HealthEquity on my own and their Customer Service is not being helpful.

From what I understand, the author of this blog was able to do that transfer online. If I try to do the same on HealthEquity website, the system asks me what type of service/claim it is, and won’t let me continue until I provide that information. I also called them and they said that they can mail me a check right away. But their website says to use Account Closure form. The CS agent didn’t confirm whether it’s essentially the same thing and can be considered roll over an HSA on your own.

Has anyone done the roll over on their own from HealthEquity? Could you share the details please?

Harry Sit says

You create a claim for Rollover Distribution as the provider’s name, Medical as the service type, and any date range as the service dates. It’s treated as a distribution the same way as a reimbursement. You report to the IRS on your tax return how much of the total distribution in the year was reimbursing eligible expenses and how much was rolled over to another HSA. Be sure to do only one rollover per rolling 12 months: request the next rollover distribution at least 12 months after this rollover is deposited into your new HSA.