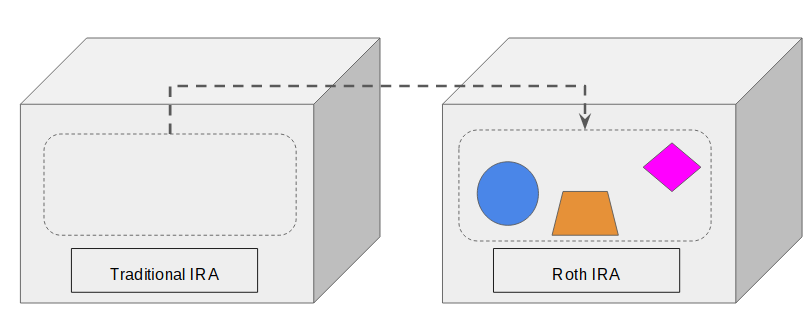

Some of you weren’t so impressed when I drew diagrams to show that an IRA conversion doesn’t really convert the IRA itself. It only moves the money from a traditional IRA to a Roth IRA, leaving the source IRA container intact afterwards.

While you may know this all along, it’s not necessarily so obvious to others. Especially in today’s world when so much is read on the go on a small screen, a graphic illustration can work much better than just words.

With that in mind, I’m repeating the topic I covered in Traditional and Roth IRA: Recharacterize vs Convert. The key takeaway is “convert” operates on a sum of money while “recharacterize” operates on a previous action. You never recharacterize an IRA. You only recharacterize a previous action you performed to the IRA. As such, you can recharacterize two different types of actions:

- recharacterize a contribution; or

- recharacterize a conversion

Recharacterize A Contribution

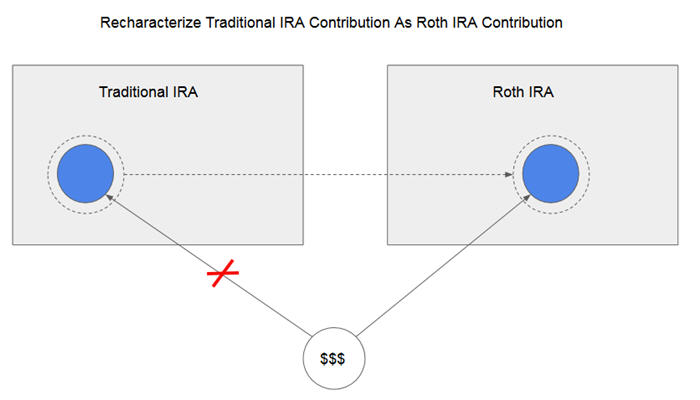

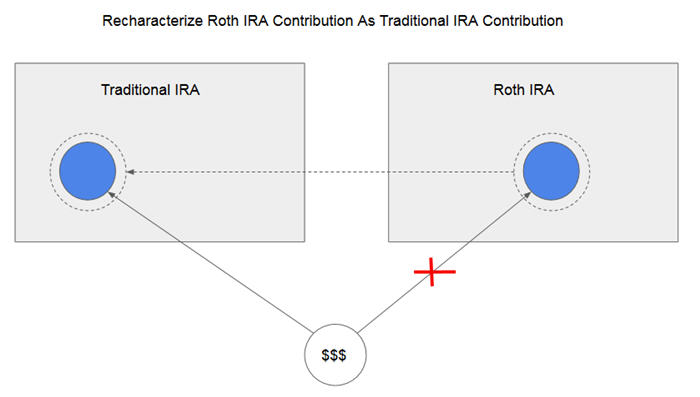

When you recharacterize a contribution, you are saying you changed your mind on which type of IRA you wanted to contribute to. You make it as if you contributed to a different type of account to begin with. It can go both ways: recharacterize a traditional contribution to a Roth contribution or recharacterize a Roth contribution to a traditional contribution.

You can only recharacterize a contribution once. After you say you changed your mind, you can’t change your mind again. You can, however, recharacterize only part, but not all, of your original contribution.

When you recharacterize a traditional IRA contribution, the IRA custodian moves your contribution plus earnings from your traditional IRA to your Roth IRA.

Because recharacterizing a traditional contribution to a Roth contribution makes it as if you contributed to Roth to begin with, you must be within the income limit for contributing to a Roth IRA.

When you recharacterize a Roth IRA contribution, the IRA custodian moves your contribution plus earnings from your Roth IRA to your traditional IRA.

Recharacterizing a Roth contribution to a traditional contribution is especially useful for lowering your AGI when you qualify for a deduction. It’s also useful when you find out after the fact you exceeded the income limit for contributing to a Roth IRA.

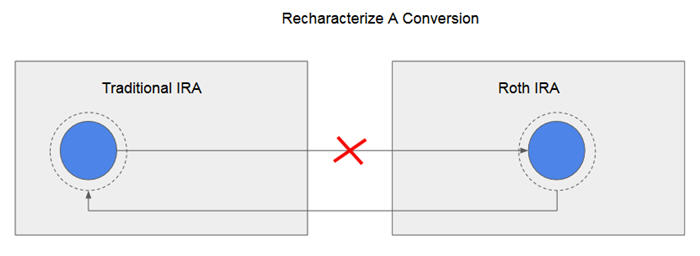

Recharacterize A Conversion

When you recharacterize a conversion, you undo the conversion. You make it as if you didn’t convert to begin with (or didn’t convert as much). It can only go one way (Roth to traditional) because the original conversion could only go one way (traditional to Roth).

When you recharacterize a conversion, the IRA custodian moves the converted amount plus earnings from your Roth IRA back to your traditional IRA.

There’s no income limit for recharacterizing a conversion. You can recharacterize only part, but not all, of the original conversion.

Recharacterizing a conversion is useful when you realize you don’t want to pay that much tax yet on converting your IRA.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

msf says

“Earnings” on a contribution (or conversion) is roughly the percentage gain (or loss) of the whole IRA between the time of the contribution and the time of the recharacterization.

Suppose you had an IRA with $45K in an S&P 500 index fund, and contributed $5K to a money market fund. Now suppose that market was hot, and the $45K turned into $50K (so you had a total of $55K in your IRA). Your IRA jumped by 10% ($50K became $55K). Now when you recharacterize your full contribution, the custodian will move $5500 ($5K contribution plus 10% earnings). That might not be what you expected.

If this is of concern, you can open a separate IRA for the contribution. Then, if you want to recharacterize, you’ll move only that contribution plus what that new investment made, regardless of how your other IRA investments did.

This is useful when doing Roth conversions. You can convert two different investments into two different Roths. You wait to see which one does better and recharacterize (undo) the other. But this only works if you keep the two conversions in separate Roths.

Harry Sit says

That’s correct and expected, because money is fungible. Once the money goes into the account, whether old money or new money works harder makes no difference.

msf says

“Once the money goes into the account, whether old money or new money works harder makes no difference.”

It depends on what you mean by “account”.

For example, last year I converted IRA shares of a T. Rowe Price fund in kind into my existing Roth IRA. T. Rowe Price created a separate account for this fund, but not a separate Roth.

At T. Rowe Price, holdings in different funds are coded as separate accounts with different account numbers even if they are titled the same. In this respect, Price is different from brokerages where there is just a single account number for an IRA account holding multiple positions (funds).

If I had done a full recharacterization, not only would I have had to move all the shares (including reinvested dividends) in that mutual fund account back the original IRA, but I would have had to move extra shares from other, different fund acounts (with different account numbers) into the traditional IRA.

That’s because those other accounts, technically part of the same Roth, had earned more (percentage) than the one I’d converted.

T. Rowe Price was correct, and I expected this, because I had done my homework before doing the initial conversion. But I doubt this is what most people would have expected.

clydewolf says

Is this accurate:

Conversions are done in a calendar year. A recharacterization from a Roth conversion must be completed by the due date plus extensions, October 15 of the year after the year the conversion is made.

A contribution made during 2016 would need to be recharacterized by October 2017.

Because we have until April 15 to make our contributions for the prior year. An early 2017 contribution made for 2016, reported on our 2016 form 1040, would not need to be recharacterized until October 2018. This recharacterization would be reported on our 2017 from 1040 and of course the form 8606 for 2017.

Harry Sit says

It’s not accurate because a contribution is not a conversion. You have to make up your mind for 2016 by the tax filing due date plus extension, no matter when you actually contribute.