[Updated on January 14, 2021. The online registration is open now.]

Due to many hacks and breaches of personal information, having a tax return filed fraudulently in your name has become a problem in recent years. Criminals gather enough information about you to file a tax return and request a refund from the IRS or the state. By the time you file your tax return, you are told they already have a return in your name. Now you have to show yours is legit and the other one isn’t. If you are due a refund, your refund may be delayed. It’ll be a problem if you’re planning to use your tax refund to buy additional I Bonds. Even if you owe, the fraud still creates more work for you to deal with the headache.

This happens because the whole tax return system wasn’t designed with security in mind. Unlike with any other financial institution, you are not required to have an “account” with the IRS.

- When you move, you are not required to notify the IRS. When a tax return next year comes in with a new address, it can be legit. The IRS is expected to trust that address and send a check there if so requested.

- You are not required to notify the IRS when you marry or divorce. If you always filed a joint return and the next return comes in as single, who knows, maybe you are no longer married.

- You are not required to link a bank account with the IRS. If a tax return requests the refund to a new bank account or even a prepaid card, it also can be legit. There’s no way to tell whether you just want your refund in a new way or it’s someone else doing it fraudulently.

- You have multiple channels to file a tax return. You can’t say “I always file on paper. Don’t accept any e-filed returns.” or “I only file through this service. Don’t accept any return on paper or from any other service.”

- On top of all these, the IRS is expected to process refunds fast. “Don’t ask questions. Just give me my money.”

When so much money is at stake, not having a tighter connection between the two parties is just amazing.

Because the lack of a direct relationship with the taxpayers is a root cause, the IRS tries to address it through its Identity Protection PIN (IP PIN) program. When you sign up for the IP PIN program, the IRS will issue you a 6-digit PIN. You put the PIN on your tax return. Any e-filed tax return without the correct PIN will be rejected. Any paper return without the correct PIN will be subject to extra scrutiny.

A specific PIN is valid for only one year. After you sign up once to participate in the program, you log in to the IRS account each year to retrieve a new PIN before the tax season starts. You always use your most current PIN. You don’t need a PIN when you amend your previous tax returns.

This adds an extra step but I think it’s a good measure for security. The IRS IP PIN program is optional. You have to sign up for it. After running it as a pilot for several years, the IRS opened up the program to everyone in 2021. It used to be limited to residents in certain states. Now everyone can sign up. You sign up directly with the IRS online. If you are married, sign up separately for each spouse. The PIN is specific to each person.

The IRS uses your credit card or loan account number to verify your identity during the signup process. If you froze your credit report with Experian, you need to lift the freeze temporarily. See Secure Access: How to Register for Certain Online Self-Help Tools from the IRS.

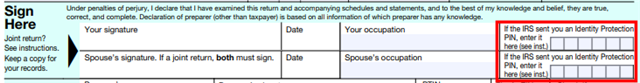

My wife and I have used the IP PINs with our tax returns for several years now. They work very well. We received our PINs for 2021 already. If you file on paper, there’s a place for them on the signature line.

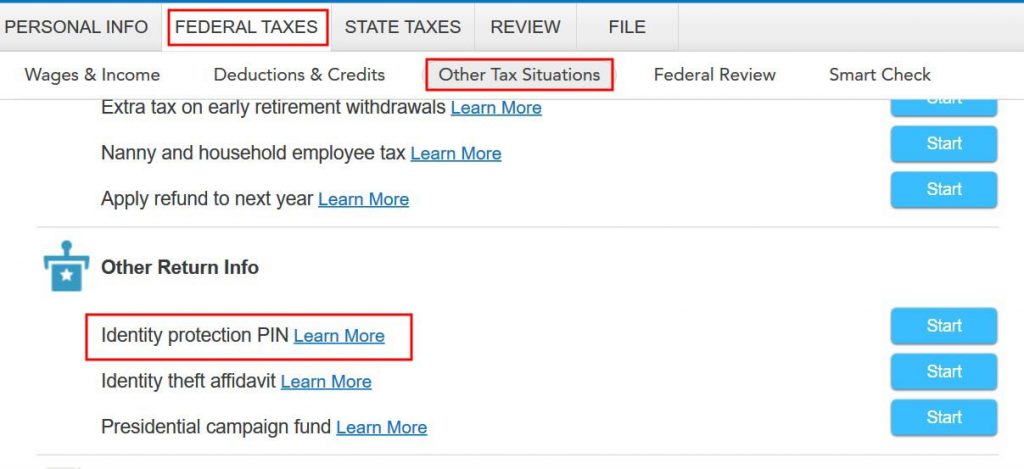

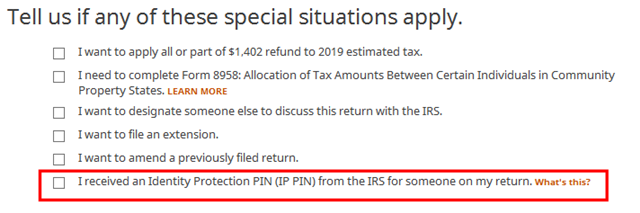

If you use tax software, you tell the software you have a PIN. In TurboTax, it’s under Federal Taxes, Other Tax Situations, Other Return Info, Identity protection PIN.

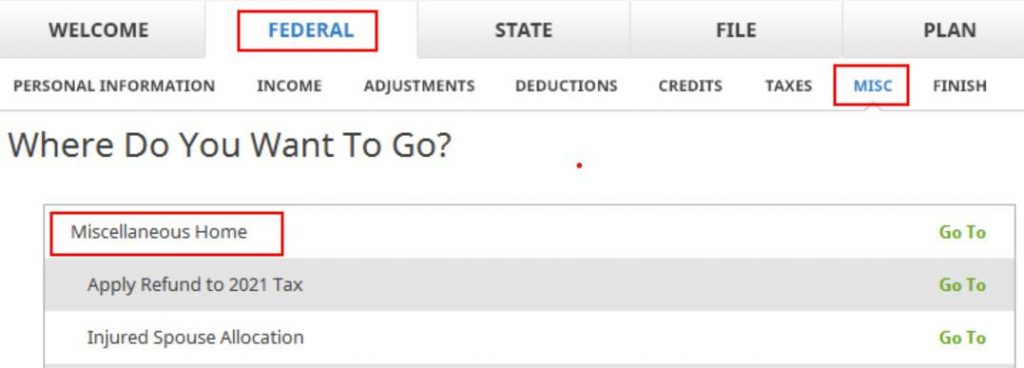

In H&R Block tax software, it’s under Federal, Miscellaneous, Miscellaneous Home.

More info: FAQs about the Identity Protection Personal Identification Number (IP PIN) from the IRS.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

always_gone says

Dang, I hope my state is added soon.

Harry Sit says

Seven states were added in 2019. According to this article on Journal of Accountancy,

“Once the IRS determines its systems can handle the expansion of the program to the additional states, it hopes to be able to offer it to taxpayers in every state.”

https://www.journalofaccountancy.com/news/2019/feb/irs-identity-protection-pins-201920605.html

RT says

Neither I or my spouse have accounts with IRS. Do we have to create new ones similar to SSA? Can only one of us do it?

Harry Sit says

You do have to create a new account similar to the account with Social Security. The account is specific to each person, as is the account for Social Security. If you want an IP PIN for each of you, you will have to sign up separately. If you only get an IP PIN for the primary Social Security Number on your joint tax return, you can still file your joint tax return with only one PIN, but that doesn’t stop criminals from filing a fraudulent return as the other person.

Jess says

Hi Harry,

Once someone has opted in the IRS IP PIN program, can he ever opt out in the future? I seem to hear it’s a lifetime thing and that one cannot opt out again. Would you happen to know? Thanks!

Harry Sit says

I don’t know. The IRS doesn’t address that question in its FAQs either.

https://www.irs.gov/identity-theft-fraud-scams/frequently-asked-questions-about-the-identity-protection-personal-identification-number-ip-pin

Joe says

My spouse and I live in Maryland and tried to sign up. During the process the IRS could not text its verification codes to either of our phones. Then a message came up saying they would also need to set up some kind of special user profile first. So, they will mail the verification codes to set up the user profiles, and then I guess mail verification codes to set up the PINs themselves? Since each mailing takes up to 15 days, it could be a while before we get this going. I guess all we can do at this point is wait and hope for the best.

Harry Sit says

Not all mobile carriers are supported for texting the verification code during registration. After you receive your verification code by mail, you will be able to complete your online registration by following the instructions in the letter. After that you go back to “Get an IP PIN” and log in with the account you just set up. Only receiving the verification code is by mail when your mobile carrier isn’t supported or when the mobile number isn’t registered to your name. The other steps are done online.

More info here: https://www.irs.gov/individuals/secure-access-how-to-register-for-certain-online-self-help-tools

Joe says

We received the CP301’s in the mail today and put in the activation codes. It’s a little strange that we were then prompted to use our phones to get a text from the IRS with a security code number to pass their ID check. Anyway, we did get our 2018 IP PINs — further to RT’s question, do you know whether the 2019 and later-year PINs should be mailed to us automatically or do we have to request them each year?

Harry Sit says

It comes automatically in the mail in December or January. Just make sure you update your address when you move.

RT says

Just got the Pin, but it says Your 2018 Identity Protection PIN: XXXX

I was expecting 2019

Harry Sit says

It can be used for filing 2018 return under an extension

or amending previous year’s returns. You will receive a new PIN in the mail for 2019 return in December 2019 or January 2020.Edited: Not needed for amendments. See below.

Serbeer says

Actually, you do not need the PIN to amend your tax return, only to file a new one, so 2018 pin is not useful if you have already filed–it is security of the future returns that will be enchanced:

https://www.irs.gov/identity-theft-fraud-scams/frequently-asked-questions-about-the-identity-protection-personal-identification-number-ip-pin#q18

Steve says

I live in WA and tried to sign up to get an IP-PIN. My request was rejected by the IRS web site. It didn’t give me any reason, just told me that my request couldn’t be fulfilled and to file without an IP-PIN. I’ll try again in January.

Harry Sit says

Maybe their computer hasn’t been updated for the additional 10 states for 2020 yet. Just wait and try again in December or January.

Harry Sit says

I received my IP PIN for the new year. The tool is available now for new signups.

DB says

Thanks for this post Harry. Does IRS do a credit report pull in order to verify your identity when you signup for an IP Pin?

It looks like the signup website is down until January for maintenance. If I request a PIN in January, does IRS mail it before taxes need to be filed by 4/15/20?

Harry Sit says

The IRS uses other ways to verify your identity. More details here:

https://www.irs.gov/individuals/secure-access-how-to-register-for-certain-online-self-help-tools

When the tool is working, it will display your PIN at the end of the process. You don’t have to wait for mail.

BobS says

Wouldn’t take my credit cards. I suppose because we have a security freeze?

Harry Sit says

From the help page:

“We use Experian, a credit reporting company, to validate your financial account number. If you have issues:

Make sure you enter the correct financial account number.

Try entering a different account type:

– Credit card – last 8 digits (don’t use American Express, debit or corporate cards)

– Student loan– (Enter the student loan account number provided on your statement. The account number may contain both numbers and letters. Do not include any symbols.)

– Home mortgage loan

– Home equity (second mortgage) loan

– Home equity line of credit (HELOC)

– Auto loan

We may not be able to verify all financial account numbers.”

BobS says

Ah yes. I just kept trying cards until it took it. Then it wouldn’t take my cell phone number until I added dashes between the area code and after the first 3 digits. Crazy…

KR says

If I live in one of the 20 states and want to use IP PIN to file 2019 tax returns, do I still have time? If I start the registration process now, how long does IRS take to send the PIN by mail?

Harry Sit says

If everything is successful, the PIN is displayed to you on the screen at the end of the signup process.

Joseph Bleaux says

The IRS announced on December 2, 2020 that it was expanding the IPPIN nationwide to taxpayers who would like to opt in.

“The IRS plans to offer an opt out feature to the IP PIN program in 2022 if taxpayers find it is not right for them.”

https://www.irs.gov/newsroom/national-tax-security-awareness-week-day-3-irs-expands-identity-protection-pin-opt-in-program-to-taxpayers-nationwide

KR says

My wife and I signed up for IP PIN last year and used them for 2019 tax return. Will we get new PINs in the mail? When should we expect them?

I tried logging into our accounts to get the PINs online. I saw mine, but when logging in as my wife, it still shows logged in as me and shows my PIN instead of hers. Not sure what’s happening here.

Harry Sit says

I received my PIN by mail. My wife was able to retrieve her separate PIN online. Try again and really log out and have her log in. Use a different browser if necessary. I’d like to figure out how to make them stop sending the PIN by mail and let me only retrieve it online.

KR says

Thanks Harry! My wife opened a new private browser window and was able to retrieve her PIN. We haven’t received them in the mail yet though. Maybe in the next week or so?

FYI – we logged in by going to irs.gov and clicking on ‘retrieve IP PIN’. When we logged in, it said to click Continue if we only wanted to receive the PINs online going forward. I believe that changed the setting to online only. Try logging in as I said above instead of ‘viewing my account’ for example.

Barry Northrop says

I tried to sign up for an account with the IRS but I never received a confirmation code. I tried a second time with no luck. Maybe today is a bad day for them. Thanks, Harry, for informing your readers that PINs are now offered nationwide…first I heard.

Harry Sit says

Some mobile carriers report the subscriber’s name. Some don’t. They use the reported name for identity verification. If your mobile phone number doesn’t work, you’ll have to wait for an activation code in the mail.

Samantha says

I misplaced my pin how can I get it ASAP plz let me know !!!!

Harry Sit says

If you use the online “Get an IP PIN” tool again it will display your PIN.

https://www.irs.gov/identity-theft-fraud-scams/retrieve-your-ip-pin

SS says

Anyone here have an IP PIN for just one half of a married couple? I signed up for an IP PIN years ago because I was part of an identity theft breach. I believe at that time the IRS didn’t have the IP PIN open to everyone (unlike now apparently!) We’ve efiled returns now using only my PIN and I’m wondering if I should signup for my wife after the 2020 tax season. Since we file jointly, I think we would be protected with just my IP PIN for a joint return but if someone tries to file as my wife individually, it seems like we wouldn’t be protected.

Harry Sit says

Because it’s not that hard to sign up for a PIN, why leave it to chances?

Gregory Tiller says

I’ve tired on the website and it wouldn’t go through and I can’t reach no one on the toll free number. I usually file with a new ip for the past 3 years. I haven’t received one this year. Please I need help! Do we get one this year?

Harry Sit says

When the online tool “wouldn’t go through” you’ll get a code in the mail to complete the online signup. After you get the code and complete your signup, you will get the PIN from the online tool. See the link in the reply to comment #14.

Withrite says

I am trying to retrieve my IP pin for so long I cannot do it

Gerald Gosa says

I need a ip pen for my 2020 taxes for 2021

Richard says

Hi Harry,

Thanks for the post. I applied and got the PIN in Mar 2021, but it says like this “your 2021 Identity Protection PIN is:” Does that mean, I can use this for any tax filing in calendar year 2021, ie for 2020 Tax year filing (that we do in Calendar year 2021). I tried to see IRS website on the usage of that PIN and validity time frame – there isn’t a clear explanation around this. Appreciate if you / anyone who have a better understanding of this explain if I can/should use it in 2020 tax filing (calendar year 2021, say April 15th 2021).

Thanks

Richard

Harry Sit says

Yes it’s for filing your 2020 tax return in 2021.

Tom P says

Not sure if anyone but Harry will see this since this topic is a few years old, but I wanted to pass on some info regarding filing with an IP PIN. Here’s what happened: for several years, my wife and I have been filing using an IP PIN. In 2023 we got our pins the “normal way” by signing into our IRS account via email and password. However, starting sometime last year the “normal” IRS sign-ins were no longer accepted and the user must sign in using a government id system or ID.ME account.

Last year I got an ID.ME account for use with Social Security, but my wife did not complete her verification. So, in December 2023 the IRS sent her a letter with an IP PIN to use in 2024, which is what we used this year. The letter also suggested signing up for an ID.ME account. Ok, fine. I filed our taxes on 1-22-2024 with TurboTax online and included the IP PIN the IRS sent, plus one I got by signing into the IRS with ID.ME. We also completed her ID.ME verification process but did NOT get a new IP PIN, figuring the IRS already provided one.

I expected to get our refund in three weeks or less, but it never came and checking the status just said it was taking longer than normal to process.

So, today (2-23-2024), we received a letter from the IRS stating they needed to verify our identity and confirm that we had filed a tax return. The letter did not say anything about using an incorrect IP PIN, however, I think our return was flagged for that reason. Verifying that we filed a return was an easy online process, but now the IRS says it could take up to 9 weeks to receive our refund. Hopefully, it will come much sooner.

So, in retrospect, it appears we should have gotten my wife a new IP PIN using ID.ME. It would have been helpful if the IRS stated that was needed if we completed her ID.ME account verification before we filed the return. Live and learn.

Harry Sit says

When the IRS used to send me the IP PIN by mail and I later logged in to my account, the PIN I got online was the same as the one I received by mail. So I’m not sure your issue was really caused by your wife not going into her account after she signed up for ID.me. My wife still hasn’t signed up for ID.me. She received her PIN by mail. We’ll see how it goes when we file.

Harry Sit says

We received the refund in 12 business days after filing. Using the IP PIN that came by mail didn’t cause a problem.

Tom P says

After completing the IRS verification, we finally got our refund on March 13th, 51 calendar days after filing. I still don’t have a clue why our return got flagged for verification as I thought using IP PINs would prevent that. Oh well, on to next year.

Raja says

But if you’re having a CPA file your taxes?

Harry Sit says

Give the PINs to your CPA to include in your return in their software.

Mel says

Thanks for another great article! BTW: I tried to get an IP PIN for the first time on 12/20/2024, but, just FYI, received the below message:

“The IP PIN service is unavailable due to a scheduled maintenance

This service temporarily became unavailable on November 23, 2024 due to planned maintenance. It is scheduled to be available again on January 06, 2025. Thank you for your patience.”

I just wanted to share that with others who may wish to get an IP PIN. I will try again in January 2025. Thank you!

Harry Sit says

The IRS has this blackout period every year. If you tried it before November 23, 2024, you would’ve received only a 2024 PIN. You would have to wait until January to get the new 2025 PIN anyway.

TJ says

I noticed that there is now an “Opt Out” button near my IP PIN, so apparently we can now opt out of this if we choose.