[Update on August 30, 2024: TreasuryDirect announced that starting January 1, 2025, you will no longer be able to buy paper I Bonds with your tax refund. The annual purchase limit is still $10,000.]

I Bonds are the best bonds you can buy at the moment if only you can buy more of them.

Maximum $5,000 Per Tax Return

In addition to buying I Bonds on the government website TreasuryDirect (see How to Buy I Bonds), you can buy another $5,000 per year indirectly, but only if you’re due at least that much in tax refund and you tell the IRS to use part of your tax refund to buy I Bonds. You can’t send a check with your tax return and ask them to buy I Bonds for you.

The $5,000 maximum is per tax return, not per person. If you’re married filing jointly, you still can buy only a maximum of $5,000 for both of you combined, not $5,000 for each of you. If you’re married filing separately, each of you can buy a maximum of $5,000, but of course you should make sure you won’t lose other tax benefits when you choose to file separately. From IRS Form 8888 instructions on page 3:

You may request up to three different savings bond registrations. However, each

registration must be a multiple of $50, and the total of lines 4, 5a, and 6a can’t be more than $5,000 (or your refund amount, whichever is smaller).

Because the amount you can purchase is also capped to the amount of your tax refund, if you normally don’t have a tax refund that large, you can increase your tax refund by overpaying ahead of time. Since I’m self-employed and I pay quarterly estimated taxes, I just pay extra for the fourth quarter.

Pay with Automatic Extension

If you don’t pay quarterly estimated taxes, you can make a one-time payment through IRS Direct Pay. After a year is over, you can still pay toward the previous year’s taxes with an automatic extension. When you say your payment is for an extension, the payment automatically files the extension. You don’t need to fill out another form.

You get extra time with an extension but you don’t have to use it. You can still file your tax return on time before April 15. Choose “Extension” as the reason for payment. Select “4868” in the “Apply Payment To” field, and choose the previous year for the tax period for payment.

The “Extension” option will become available after the IRS opens up the tax season for the previous year, usually around the end of January. If it isn’t available yet, just wait.

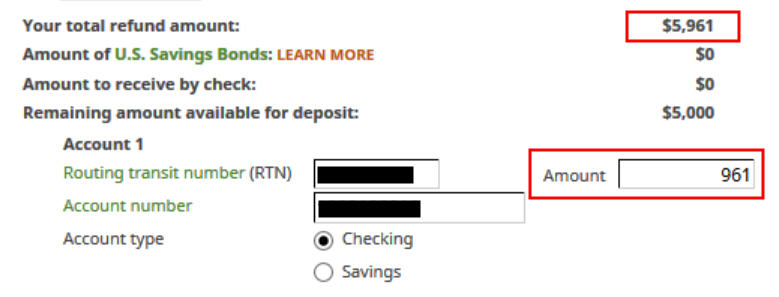

When you pay extra, don’t make your refund exactly $5,000. Make it a small odd amount above $5,000 so that you’ll still have a small refund after buying I Bonds. For example, if you’re expecting a refund of $2,136, pay $3,000 with your automatic extension. Now your expected refund is $5,136. When you see $136 deposited to your bank account, you’ll know the other $5,000 is sent to buy I Bonds.

Pay in Whole Dollars

Also make sure you pay in whole dollars, not dollars and cents. If you make estimated tax payments, also make sure those are in whole dollars. If you already made estimated tax payments with dollars and cents, make another payment to make your total estimated tax and extension payments add up to whole dollars.

Cents in your total estimated tax and extension payments will cause the IRS to adjust your refund, resulting in not issuing I Bonds to you. This doesn’t apply to tax withholdings. Your tax withholdings from your income can have dollars and cents.

Wait

Wait at least a week after you make the extension payment before you file your tax return. This gives some time for your payment to be reflected in your account at the IRS. While this may not be strictly necessary, giving the computer systems a little more time to sync up can’t hurt.

Report Payment on Your Tax Return

After you pay extra with an automatic extension, make sure to account for it on your tax return. Here’s how to do it in TurboTax and H&R Block downloaded tax software.

Online tax software doesn’t have all the features of downloaded tax software, and it’s often more expensive. See Tax Software: Buy the Download, Not the Online Service.

TurboTax

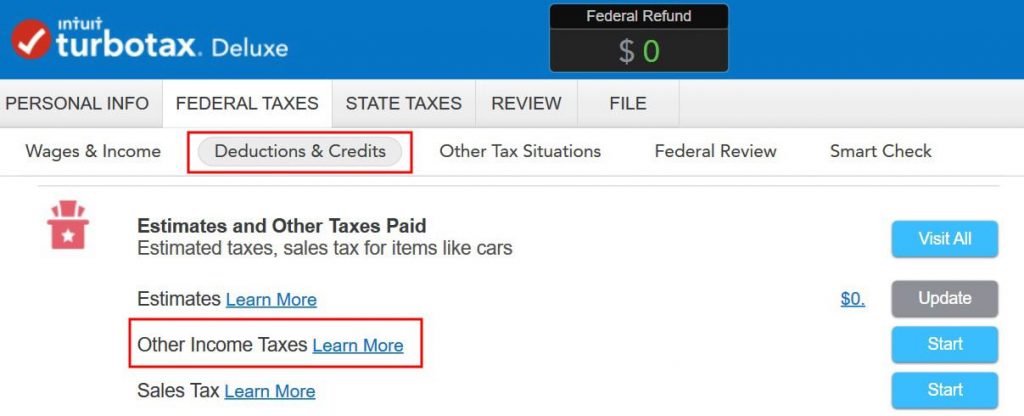

In TurboTax (downloaded software), it’s under Federal Taxes, Deductions & Credits, Estimates and Other Taxes Paid, Other Income Taxes.

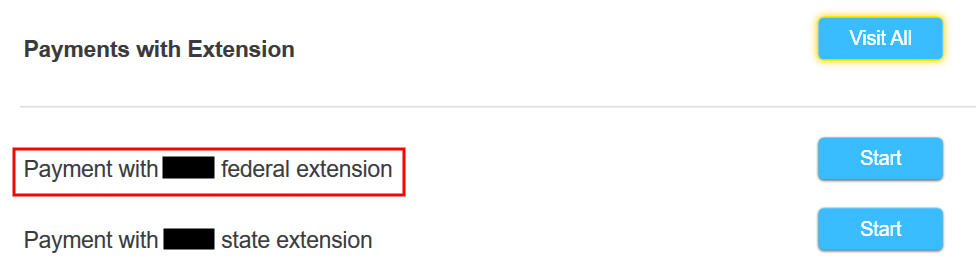

Then choose payment with the federal extension for the previous year.

H&R Block Software

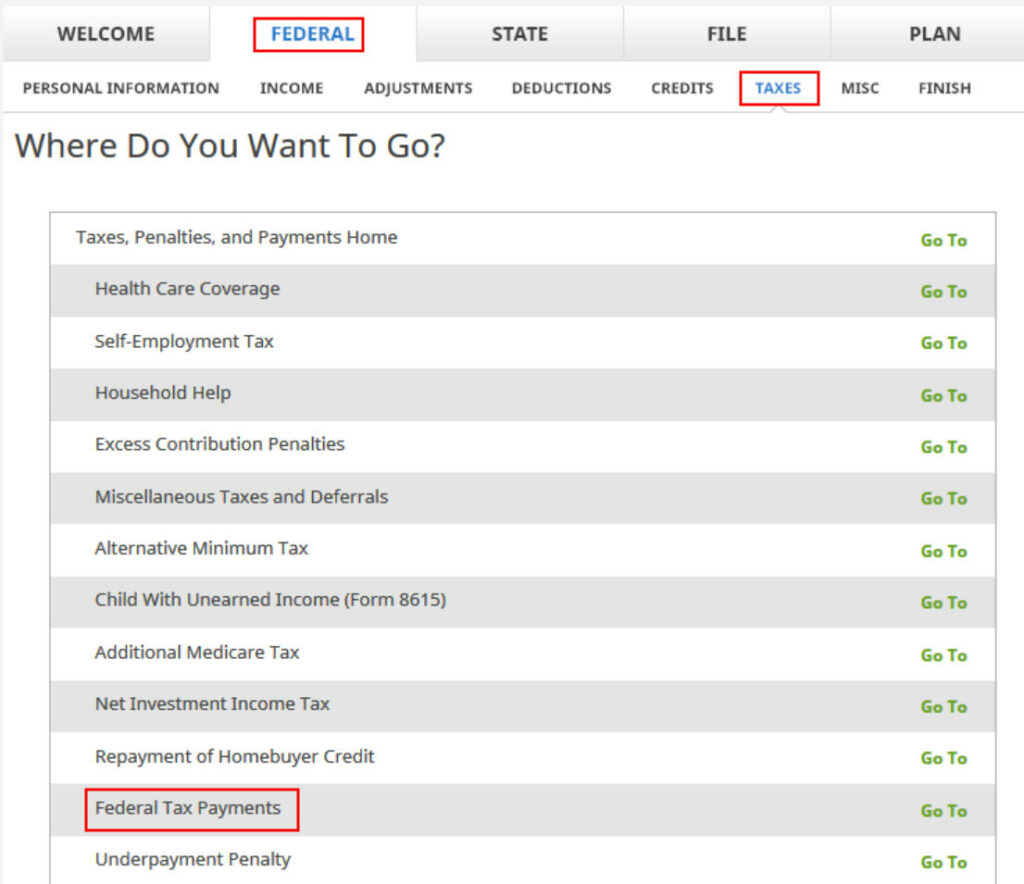

It works similarly in H&R Block downloaded tax software. The payment with extension is under Federal, Taxes, Federal Tax Payments.

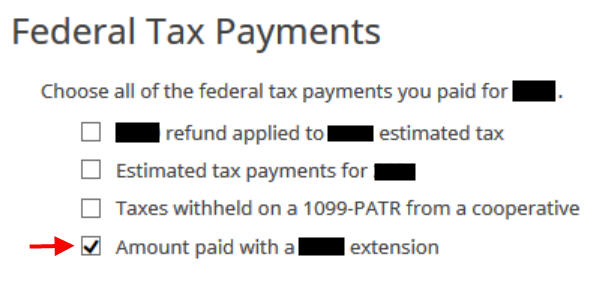

Check the box for “Amount paid with a 20xx extension.”

Split Refund for I Bonds

When it comes to asking for I Bonds, it’s in the final steps before filing your return. Here’s how to do it in TurboTax and H&R Block downloaded tax software.

Online tax software doesn’t have all the features of downloaded tax software, and it’s often more expensive. See Tax Software: Buy the Download, Not the Online Service.

TurboTax

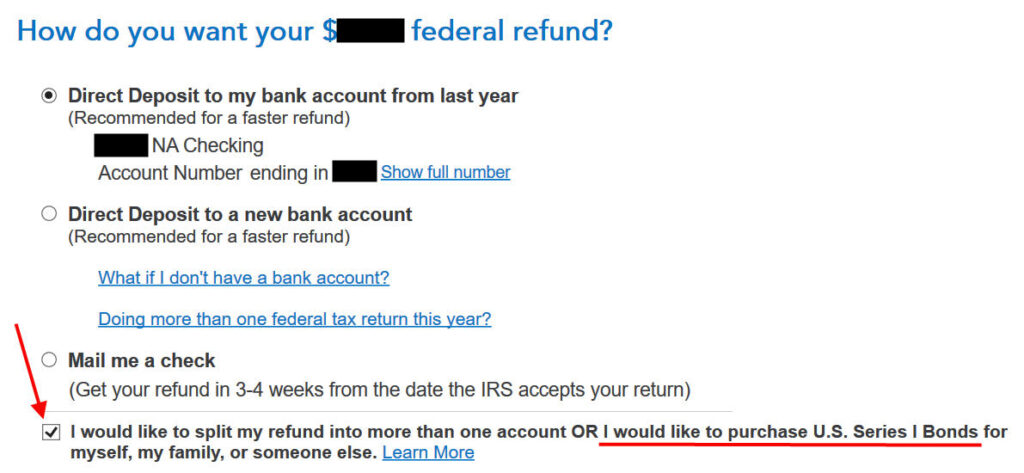

When TurboTax (downloaded software) asks you whether you’d like to receive your refund by direct deposit or by check, choose direct deposit. You check a box at the bottom to say you want to split your tax refund and use part of it to buy I Bonds.

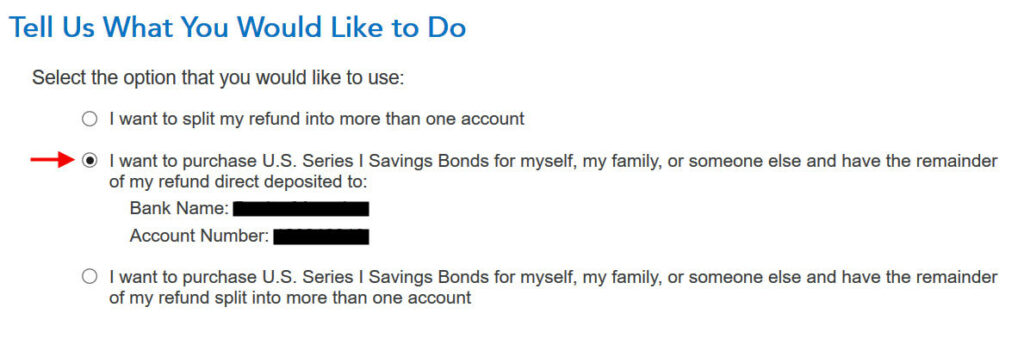

Then choose to buy I Bonds and direct deposit the leftover refund.

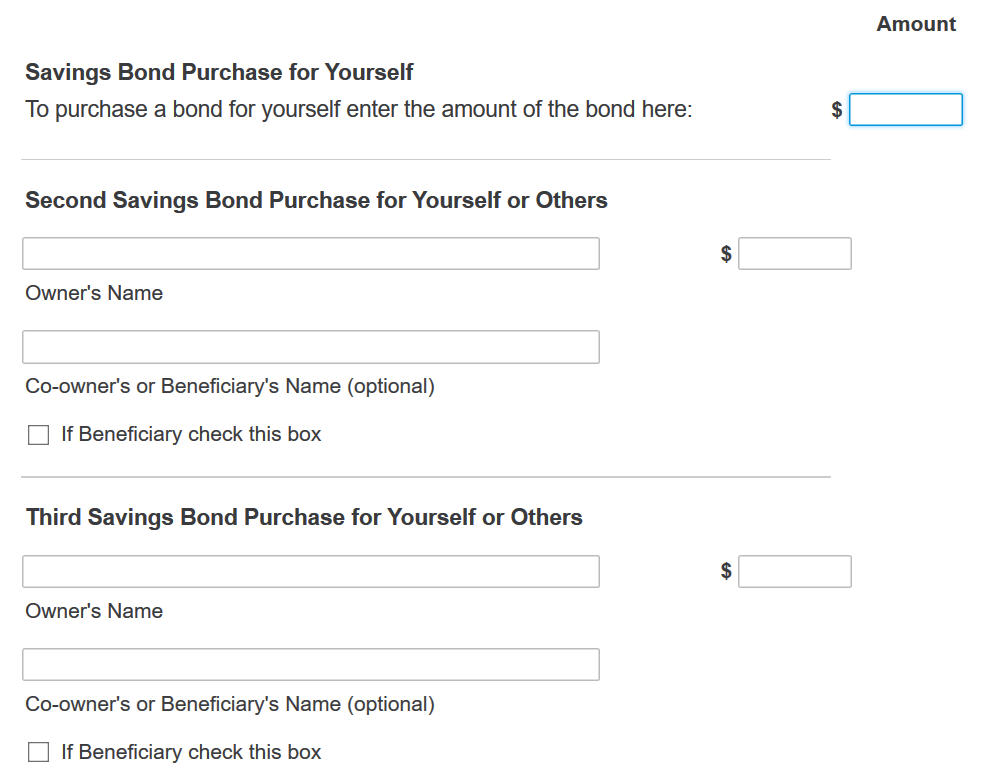

Then you will say how much you’d like to buy and whose name(s) should be on the bonds.

You can split the I Bonds purchase into an amount for yourself plus up to two free-form named recipients. Each owner must receive a multiple of $50 and the total for all three can’t exceed $5,000.

If you put an amount in the first box, you don’t have to give any name. They will automatically copy the name(s) from your tax return. If you’re filing jointly, the bonds will be issued in both of your names as co-owners.

If you’d like to have the bond issued in only one name (yours or someone else’s), put an amount as the Second Savings Bond Purchase. Give the name (and a co-owner or beneficiary if desired). Check the small box if the second name is a beneficiary (not a co-owner) of the owner for this purchase. Repeat for the Third Savings Bond Purchase if you’re buying for another recipient.

H&R Block

H&R Block downloaded tax software has it in the final steps before filing the return. When it asks you whether you want a direct deposit or a check, choose direct deposit. Reduce the amount of your direct deposit by the amount of I Bonds you’d like to buy.

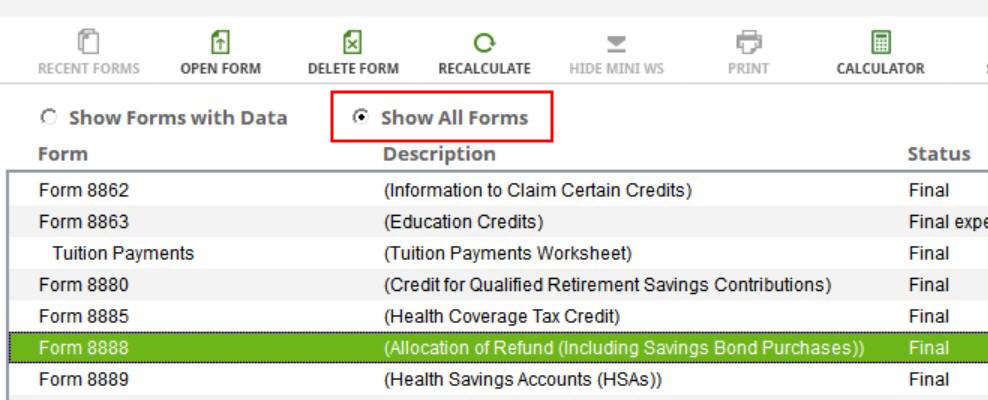

Now, find and open Form 8888:

1. Click Forms at the top of the program.

2. Select the Show All Forms option.

3. Scroll down to find Form 8888.

4. Select and open Form 8888 and fill it out to allocate amounts to savings bonds purchases.

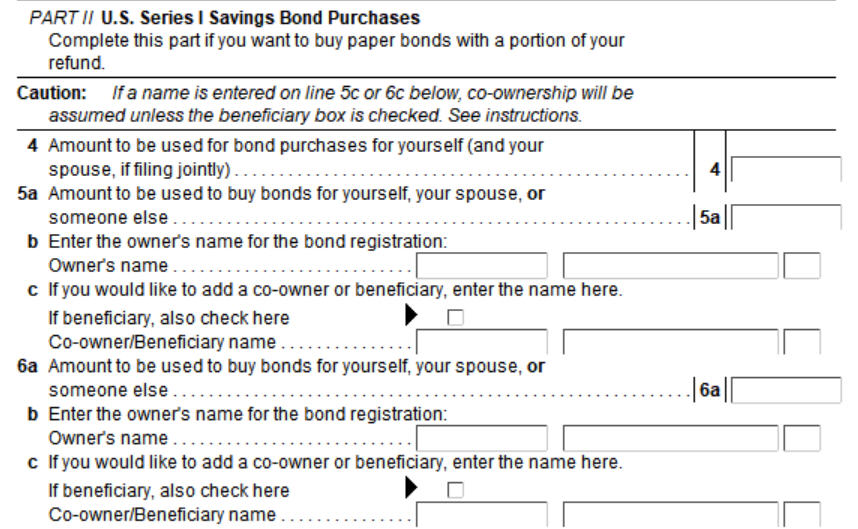

You enter the amount you’d like to buy and the names that should appear on the bonds in Form 8888.

You can split the I Bonds purchase into an amount for yourself plus up to two free-form named recipients. Each owner must receive a multiple of $50 and the total for all three can’t exceed $5,000.

If you put an amount on Line 4, you don’t have to give any name. They will automatically copy the name(s) from your tax return. If you’re filing jointly, the bonds will be issued in both of your names as co-owners.

If you’d like to have the bond issued in only one name (yours or someone else’s), put an amount on Line 5a. Give the name on Line 5b (and a co-owner or beneficiary on Line 5c if desired). Check the small box if the name on Line 5c is a beneficiary (not a co-owner) of the recipient on Line 5b. Repeat for Line 6a, 6b, and 6c if you’re buying for another recipient.

Receive Bonds by Mail

After you file your tax return, if everything goes well, you’ll receive I Bonds by mail. If you asked for $5,000, you may get one $5,000 bond or you may get multiple bonds that add up to $5,000.

If they send multiple bonds, each bond will come in a separate envelope. Because the bonds have your name and address printed on them, it’s just easier for them to put each one into a separate window envelope. Collating multiple bonds into the same envelope increases the risk of a mix-up.

Sometimes the bonds don’t come in one batch. If you receive fewer bonds than you expect, just wait. Most likely additional bonds will show up in the mail in a few days. If they don’t come in two weeks after you receive the first batch, please call TreasuryDirect customer service at 844-284-2676.

Deposit Paper I Bonds to Online Account

You can keep these bonds in paper form if you’d like. Put them in a safe deposit box. When you’d like to cash out, you can take them to your bank or credit union or a major national bank such as Bank of America or Chase. They will look up the current values in their system and deposit the money into your account or give you cash.

I prefer to consolidate the paper bonds with the bonds in my TreasuryDirect online account because it’s more secure and more convenient to have all the bonds in one place. You can mail the paper bonds to the Treasury Department and deposit them into your account. Please read How To Deposit Paper I Bonds to TreasuryDirect Online Account.

If only they ask for your TreasuryDirect account number on the tax return, they won’t have to mail you the bonds and you won’t have to mail them back in. While it is possible to direct deposit part of your tax refund into your TreasuryDirect account using a special routing number, when you use the money to buy I Bonds, you use up part of your $10,000/year quota, which defeats the whole purpose of overpaying taxes to buy additional I Bonds. The government has no incentive to make it easy. If you want more I Bonds, you’ll have to tolerate their process.

When Something Goes Wrong

Sometimes instead of receiving I bonds, you get 100% of your tax refund deposited into your bank account. It’s not clear why this happens to some people.

You can’t do anything about it. Once you receive your tax refund, it’s not possible to have the IRS take it back and buy I Bonds for you. Try your luck again next year. It may help if you make your tax refund not exactly $5,000. Make it say $5,081 and ask for $5,000 in I Bonds and $81 as a direct deposit to your bank account.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

old mariner says

I did the paper bond thing again.

— Used H&R Block Deluxe + State

— Submitted return on 3/22/23

— Rec’d direct deposit refund on 4/6/23

— Rec’d one $5,000 mailed bond on 4/11/23.

— Bond is dated April 2023.

In H&R Block, the one-line mention of paper bonds was not in the Federal section, but in the File section. Weird. If I hadn’t been looking for it, I would have missed it.

Dunmovin says

Update from last year and the …of the IRS when paper filing…in summary, filed Feb 2022 and had overpaid $5K in taxes in 2021 for Ibonds for kids/grandkids…IRS waited so long that interest was due by it and ergo, no longer $5K! Instead of adding interest “for account” for the following year it deprived the grandkids of their ibonds! Check received then of $5k plus interest. Fast forward this year and paper filed March 2023 with only request of minor overpayment be made by paper check. Received paper check one month to the day! IRS doesn’t need the billions, all it needs is new management and (start to) think of the grandkids!

Mike says

A bit off the subject of this discussion thread, but I value the opinions and educated guesses of many of the experts here. Question: Buy some more I Bonds on TD now before the end of April, or wait for the new rate?

Dun says

Mike, there is another option, i.e. do both! Buy now and also buy for the box is an option! I also look at what fed taxes I “want ” to pay in redemption….I bought some in March 2023 in anticipation of a lower May 1 reset and planned on redeeming March 2024

Tom P says

Mike, if you buy now, you’ll get the 6.89% rate for 6 months before shifting to the much lower rate effective in May, which as of now is 3.38% plus whatever fixed rate may be added. Seems like an easy decision to buy now.

Dunmovin says

Fixed rate only applies to those ibonds purchased within 6 month operative period and then for all future ibond inflation rate resets for those specific ibonds

CO says

I am working on my 2023 taxes with a downloaded version of Turbo Tax and would like to purchase I-Bonds with my tax refund. However, I am unable to get to the place where I am supposed to select how I want to receive my refund. I’ve entered all my federal and state information and went all the way to the end, but stopped just before it e-filed. I was not asked how I want to receive the refund. The PDF says that it will all be deposited into the bank. I bought I-Bonds with last year’s refund so Turbo Tax isn’t even defaulting to what I did last year. Does anyone know how to get there?

CO says

I was able to get the “How would you like to receive your refund” option to appear by selecting paper return instead of e-file. I filled out all the I-Bond and bank account info, and then went back and selected e-file option. Now the “How would you like to receive your refund” option appears.

Miguel Cervantes says

For Turbotax 2023, Application: 2023.18.022, Build Date: 10. Feb 2024 at 13:42:00, on MacOS, I was able to get it to offer the i bonds by selecting the small tick-box on the bottom of the page following “Direct Deposit to a new bank account” radio button that says:

I would like to split my refund into more than one account OR I would like to purchase U.S. Series I Bonds for myself, my family, or someone else.

This is also documented here:

https://ttlc.intuit.com/turbotax-support/en-us/help-article/small-business-processes/buy-savings-bonds-tax-refund/L33edmEa2_US_en_US

Abe says

I’m using the online version of TurboTax (got it free…) – anyone have a link to the menus / clickthrus to get iBonds? It’s getting really hard to get the download version.

Was thinking of switching to freetaxusa as really hate Intuit/TT, even when it’s free (and the online version really annoying). Would love the same guides.

Thanks for all you post here Harry!

Harry Sit says

The link in the comment above yours says

“You’ll see the option to purchase bonds when you get to How would you like to receive your federal refund? in the File section.

When you get to that screen, select Split my refund between multiple accounts or U.S. savings bonds. Select Continue and follow the instructions.”

Jenny says

Just curious if anyone has received any I Bonds from a 2024 tax return yet. I filed the middle of February and received the direct deposit cash portion over 3 weeks ago, but still haven’t gotten any I Bonds in the mail. I’ve called the Treasury Direct phone number, and it sounds like it will be a long process to find out if they were issued and are lost. In the past, they’ve arrived shortly after the direct deposit.

Harry Sit says

Some people reported that they received I Bonds from the tax refund this year without much delay.

Old mariner says

I received a single $5K bond on Marchh 15, which was a week after I received the direct deposit refund.

Dunmovin says

I file tax returns by US mail with any refunds by US mail except Ibonds…. A couple of years ago I had my return (filed in early Feb) set up for the purchase with the refund of the $5K in Ibonds. IRS cannot process paper in a timely manner. As it turned out, IRS got to my refund request AFTER interest started to run for non-payment by IRS. Ergo, my “then” request was now for over $5K and they would not process and sent a $5+K check in the mail (with interest also required to be on return for the next year). I quit buying that way!

Old mariner says

I totally understand that was a disappointing and frustrating experience. Should you ever again want an IRS refund in bonds, another go at it might be a more satisfying experience. But you might only get one single $5K bond, not a bunch of stocking stuffer bonds.

I used to do my taxes by hand on paper. Then I had a CPA do them. Now, I do them myself on HR BLock Deluxe + State. My taxes this year were over and done in 2 weeks – from the date I e-filed to the date I received the bond. My taxes for 2023 were pretty simple, so maybe that made a difference.

Jenny says

Here’s an update, in case others are interested. My 2024 Tax Refund I Bond arrived in the mail today (March 28). The issue date of the bond was February 26, so it took over a month for the post office to get it to me.

Old mariner says

Crazy delay. Fortunately, you didn’t have to report it lost. Here are the estimated processing times (I edited to shorten the verbiage) according to an email I received from fiscal.treasury.gov:

— Cashing EE and I paper bonds held in your name, at least 4 weeks.

— Cashing HH bonds held in your name, at least 3 months.

— Unlocking your TD acct, updating bank info in that account, or converting your paper bonds into electronic bonds in TD, at least 4 weeks.

— Claims for missing, lost, or stolen bonds, at least 6 months.

— All other cases, at least 20 weeks.

Harry Sit says

TreasuryDirect announced that starting January 1, 2025, you will no longer be able to buy paper I Bonds with your tax refund. The annual purchase limit in the online account is still $10,000.

https://www.treasurydirect.gov/research-center/faq-irs-tax-feature/

Old mariner says

Hi, thank you for this update. I was one of the 35,000 taxpayers per year who purchased bonds in this manner, and one of the 3,500 who did it more than twice. Wow, that’s really not very many taxpayers at all. I’m not disappointed that the option is being discontinued because I thought receiving paper bonds, then having to turn around and mail them back to get them into Treasury Direct, was an inefficient process; however, I’m a bit disappointed the electronic limit won’t be raised to $15k to compensate.

I doubt very many people were even aware there was a tax refund option to purchase I bonds. In all the years I used a CPA for my taxes, this option was never mentioned to me. I discovered it when I read an article about it. Likewise, the option seems obscurely located in the HR Block software I use.

In any event, thanks for the update as well as for all the articles you’ve written about I bonds in general.

Dunmovin says

More would have e claimed it but Treasury had too many gates. For example those that file by paper never got return processed in a timely manner and when the resultant late processing interest was added to returns the amount due was not a clean round number that Treasury could ever understand. Ergo a refund check issued that was over $5k

George says

I sent in a paper single return by USMail to Kansas City, MO on 4/1/24, complete with Form 8888 for 5000.00 overpayment as I-bond, but got a late 5057.00 refund check instead. I voided the check and sent it to Phila. Refund Inquiry Unit, as instructed on 800-829-1040, to get the I-bond due me. That unit acknowledged receipt of the check and promised action by 60 days. But at 40 days, I got an Austin, TX IRS notice that my previous account balance of -5000.00 was now modified by an additional tax charge of 5000.00, leaving a new 0.00 balance (no explanation why there was additional tax). I sent a cover letter, copies of the original 1040 and 8888 forms, voided check and correspondence to Phila. and Kansas City, MO, but got a reply asking for many more forms included with my original return. An in-person visit clarified that the cover letter was likely ignored and the IRS employee assumed I was sending an amended return, despite no 1040-X being included. Further questioning revealed that e-conversion of my paper return in Kansas City, MO apparently lost of many of the attached forms, including the 8888, and added a Sch D I never submitted (though populated with all 0’s). The in-person employee sent Phila. a scan of my form 8888, with my request for the I-bond, missing inflation of principle, and any interest due to the delay. I just received another check, for 5206.00, no I-bond. From Kansas City, MO, I received a letter listing me as a decedent, and requiring a death certificate and Form 1301 to claim a refund due to a deceased taxpayer. It appears that IRS does not need to follow federal law, but also may engage in egregious behavior with few limits if you try to insist that does.

Dunmovin says

George, the earlier posts in this thread reflected the risk associated with IRS not processing paper 1040s in a timing manner especially in connection with (then) paper Ibond refund request. Due Diligence! File a complaint with Treasury IG