I’ve been buying I Bonds for 20 years. I only realized now I’ve been writing as if everyone already knew what they were and how they worked. If you buy I Bonds before November 1, 2023, you will get a 0.9% fixed rate plus a variable rate that continues to match inflation in the previous six months. If you’re new to I Bonds, this post walks you through from soup to nuts.

What Are I Bonds?

I Bonds are short for Series I Savings Bonds. They are bonds issued by the U.S. government directly to retail investors. Currently, I Bonds carry a favorable yield over other CDs and bonds. This makes I Bonds the best low-risk investment at the moment.

How I Bonds Work

Think of I Bonds as flexible-term variable-rate CDs.

You’re required to hold them for at least one year. After that, you can cash out at any time you’d like before the maturity date, or you can choose to hold them for up to 30 years from the original time of purchase. If you cash out within five years, you forfeit interest earned in the previous three months, whereas the early withdrawal penalty on a typical commercial CD is often six months or 12 months of interest. The flexibility to cash out after one year with a low early withdrawal penalty or to hang on for as long as 30 years makes I Bonds good for both short-term and long-term investing.

Similar to a CD, the value of I Bonds never goes down. They are guaranteed by the full faith and credit of the U.S. government. Unlike a typical CD with a fixed interest rate for the entire term, the interest rate on your I Bonds changes in six-month cycles. You stay on the current rate for the full six months and then you go on a new rate for another six months, and a new rate after that for another six months, and so on.

The interest rate is guaranteed to at least match inflation. If the inflation rate goes up, the interest rate on your I Bonds automatically goes up. Some older I Bonds earn a positive rate above inflation. The I Bonds you buy now only match inflation. Even merely matching inflation makes I Bonds attractive when other CDs and bonds don’t keep up with inflation.

Tax Treatment

The interest on I Bonds is credited monthly and automatically reinvested every six months. You get all the accumulated interest when you cash out. You don’t get a separate payout monthly or quarterly.

By default, you pay federal income tax on the interest from I Bonds only when you cash out, whereas you must pay taxes on the interest from CDs and bond funds every year even if you reinvest the interest. The interest from I Bonds is exempt from state and local income taxes. I Bonds are more appealing than other CDs and bonds because you have the tax deferral and the exemption from state and local income taxes.

You can choose to pay tax in a different way but it gets complicated. Staying with the default makes it easy for everyone. See Taxes on I Bonds Get Complicated If You Go Against the Default.

If you meet an income limit and other requirements, it’s possible to cash out your I Bonds tax-free when you use the money for qualified higher education expenses. See Cash Out I Bonds Tax Free For College Expenses Or 529 Plan.

Where to Buy I Bonds

There are only two ways to buy I Bonds:

1. Buy electronic bonds online at the government website TreasuryDirect.

2. Buy paper bonds with money from your tax refund when you file your tax return with the IRS each year. See details in Overpay Your Taxes to Buy I Bonds.

You can only use regular after-tax money to buy I Bonds. They’re not available in any tax-advantaged accounts such as 401k-type plans, IRAs, or HSAs. Nor are they available through any brokerage firms such as Fidelity, Charles Schwab, or Vanguard.

Purchase Limit

I Bonds are such a great deal that the government puts a limit on how much you can buy each year. At current rates, you should get your full quota before you buy any other CDs or bond funds.

When you buy on the government website TreasuryDirect.gov, the limit is $10,000 each calendar year per Social Security Number as the primary owner in a personal account. When you buy using money from your tax refund, the limit is $5,000 per tax return (not per person when you file jointly).

If you have a trust, you’re allowed to buy another $10,000 each calendar year in a trust account. See Buy More I Bonds in a Revocable Living Trust.

If you have a business, the business can also buy $10,000 each calendar year. See Buy I Bonds for Your Business: Sole Proprietorship, LLC, S-Corp.

If you have kids under 18, you can also buy $10,000 each calendar year in each of your kids’ names. See Buy I Bonds in Your Kid’s Name.

If you’d like to buy I Bonds as gifts to others, see Buy I Bonds as a Gift.

A married couple each with a trust and a self-employment business can buy up to $65,000 each calendar year, and more if they file separate tax returns, buy in their kids’ names, or buy as gifts for family members.

- $10,000 in Person A’s personal account with Person B as the second owner

- $10,000 in Person B’s personal account with Person A as the second owner

- $10,000 in an account for Person A’s trust

- $10,000 in an account for Person B’s trust

- $10,000 in an account for Person A’s business

- $10,000 in an account for Person B’s business

- $5,000 using money from their tax refund if they file jointly (or $5,000 each if they file separately after making sure they won’t lose other tax benefits)

- $10,000 in the name of each of their kids under 18

- $10,000 as a gift for each member of the extended family

We had only one trust before. We created a second trust with software to buy another $10,000. For buying I Bonds in a trust account in general, please read Buy More I Bonds in a Revocable Living Trust.

Open Account

If you never bought I Bonds before, you need to open an account at the government website treasurydirect.gov. You can buy more in the same account in subsequent years. Find the Open Account link at the top right.

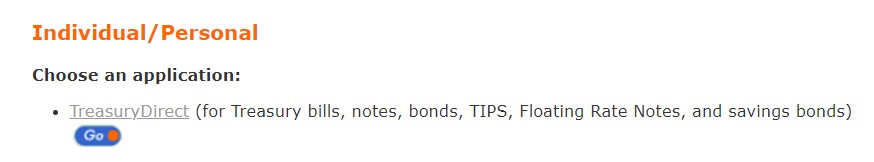

Choose the first option for Individual/Personal. Go here for a trust account or a business account as well.

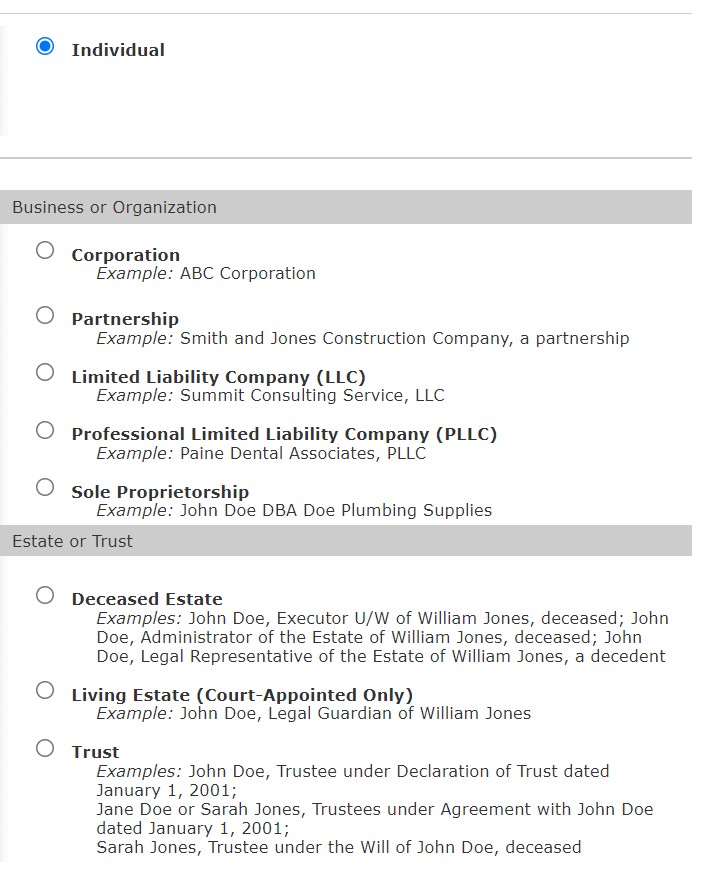

Now you can choose an individual, business, or trust account.

Next, fill out the required information and choose a security image, a password (not case sensitive), and security questions. Important: Save your answers to the security questions. You will be asked to answer one of the security questions when you perform certain actions at a later time. Your account will be locked if you can’t answer the security questions.

Separate Account for Spouse

TreasuryDirect doesn’t support joint accounts. The individual account you’re opening now is only for yourself. If your spouse also wants to buy I Bonds, he or she must open a separate account. However, you can specify a second owner or beneficiary on the bonds you buy in your personal account. You do that at the holdings level at the time of each purchase. We’ll cover that in the Registration section of this post.

If you’re opening a trust account, see Buy More I Bonds at TreasuryDirect in a Revocable Living Trust for what to use as the name of your account.

Link a Bank Account

The application also asks you to link a bank account. Make sure you enter the bank routing number and account number correctly. TreasuryDirect doesn’t send any random deposits to verify the bank account.

Save Account Number

You will receive your TreasuryDirect account number by email. Important: save your account number. You’ll need it to log in.

Most people can start buying right away after receiving the account number. A small percentage of people need to complete an extra step for identity verification. If you’re among the unlucky few, please read Where to Get a Signature Guarantee for I Bonds at TreasuryDirect.

Schedule Purchase

Log in with the account number. The system will email you a one-time password (OTP). Important: Don’t use the back and forward buttons in the browser when you use the TreasuryDirect.gov website. Only use the “submit” and “return” buttons on the web pages.

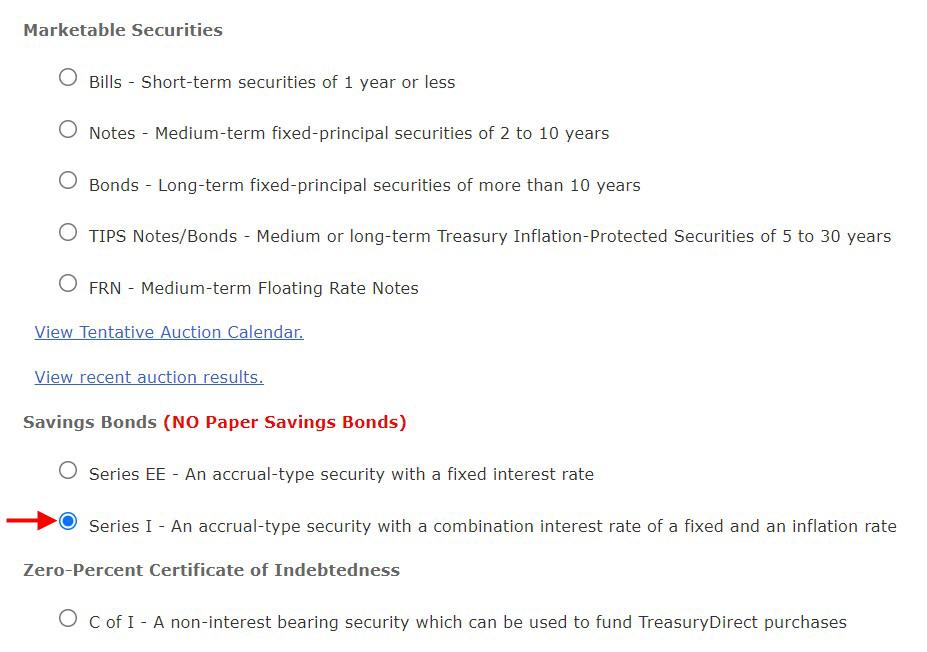

After you log in, go to BuyDirect in the menu.

Although we use TreasuryDirect only to buy I Bonds, the account can be used for other products as well. Choose Series I near the bottom of the list.

Registration

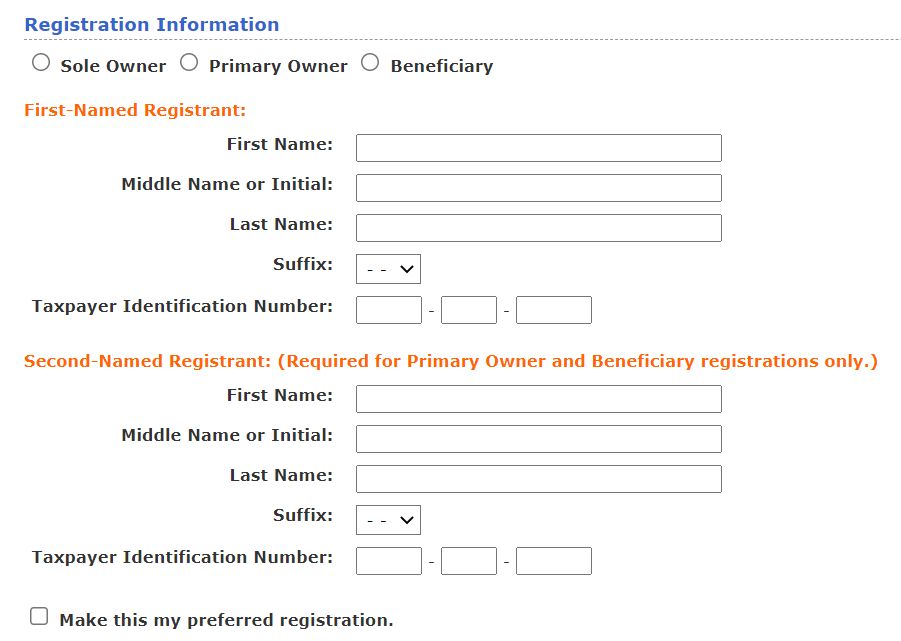

If you’re buying I Bonds for the first time in a personal account, you need to create a Registration, which means whether you want the bonds to have:

- Just yourself as the only owner; or

- You as the primary owner and another person as the second owner; or

- You as the owner and another person as the beneficiary.

Choose the “Sole Owner” radio button if you want yourself as the only owner with neither a second owner nor a beneficiary. Choose “Primary Owner” if you want yourself as the primary owner with another person as the second owner. Choose “Beneficiary” if you want yourself as the primary owner with another person as the beneficiary. See I Bonds Beneficiary versus Second Owner for the difference between a second owner and a beneficiary.

Unlike in typical commercial accounts, the second owner and the beneficiary in TreasuryDirect are at the holdings level, not at the account level for all holdings. You can have some bonds with Person A as the second owner, some other bonds with Person B as the beneficiary, and so on.

No Contingent Beneficiary

Each bond can have only one second owner or one beneficiary but not both at the same time. You can’t specify a contingent beneficiary. The second owner or beneficiary also has to be a person. It can’t be a trust or a charity. Trust accounts and business accounts can’t buy bonds with a second owner or a beneficiary. The trust or the business will be the only owner.

A married couple can choose to:

(a) Name each other as the second owner or beneficiary and live with the risk of simultaneous death; or

(b) Name someone such as a child or grandchild who isn’t likely to die simultaneously. The child or grandchild will get an early inheritance when you die. The surviving spouse will live on other assets.

First- and Second-Named Registrants

If you decide to have a second owner or a beneficiary, enter yourself as the “first-named registrant.” Enter the second owner or the beneficiary as the “second-named registrant.”

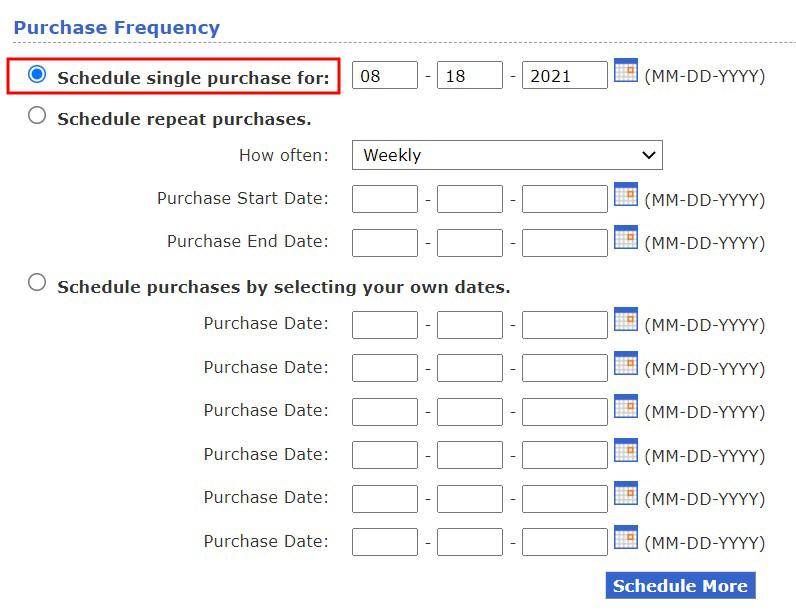

Purchase Date

Choose the purchase date. Make sure you have money available in the linked bank account. They send out the debit the night before your scheduled purchase date. The debit will hit your bank account on the scheduled date first thing in the morning. They may lock your TreasuryDirect account if the debit bounces. It’ll be difficult to unlock it.

Important: Don’t cut it too close to the end of the month, or else you may miss a month worth of interest. It takes one business day to issue the bonds and possibly more days if there’s a delay. If you buy close to the end of the month, your issue date may be in the following month and you won’t get the interest for the previous month. I schedule my purchases to a date at least a week before the end of the month.

Grant Rights to the Second Owner or Beneficiary

If you put a second owner or a beneficiary on your I Bonds, the second owner or the beneficiary doesn’t automatically see those bonds in their account. They see the bonds only when you grant them View or Transact right. The beneficiary can only be granted the right to view the bonds (“read-only”). The second owner can be granted either View or Transact right.

After the purchase completes and you see the bonds in your account, please read How To Grant Transact or View Right on I Bonds for a walkthrough on how to grant rights on the bonds you just purchased and how a second owner can transact on the bonds on your behalf after you grant the right.

Rinse and Repeat

If you’re buying additional I Bonds in the name of a spouse or a trust, repeat the steps above by opening a separate account, creating a password, linking a bank account, saving the account number, and scheduling the purchase. The different accounts can use the same email address and link to the same bank account if you’d like. Because you’ll use different account numbers to log in, you should keep notes of which account number is for which owner.

If you’re interested in buying I Bonds in the name of your trust, kid, business, or as gifts, please read:

- Buy More I Bonds in a Revocable Living Trust

- Buy I Bonds in Your Kid’s Name: You Can, But Should You?

- Buy I Bonds for Your Business: Sole Proprietorship, LLC, S-Corp

- Buy I Bonds as a Gift: What Works and What Doesn’t

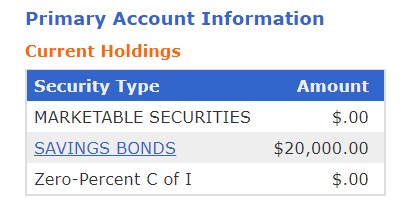

Check Balance

TreasuryDirect doesn’t send any account statements. You check your balance on the website. Your total face value is displayed on the home page after you log in. This doesn’t include any credited interest.

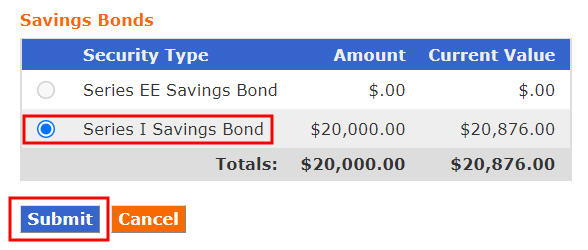

Clicking on the Savings Bonds link will show you a breakdown by savings bond type: Series EE and Series I.

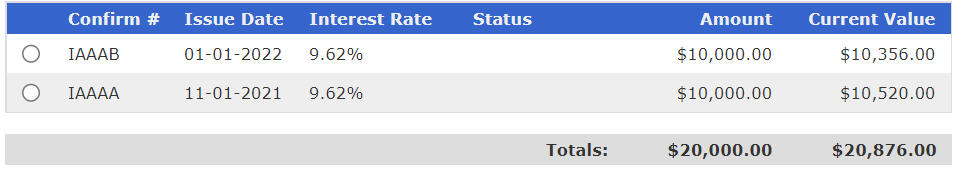

The Amount column shows the total face value. The Current Value shows the total face value plus credited interest. Click on the radio button next to Series I Savings Bond and then click on Submit. You’ll see a list broken down by the Issue Date.

Three-Month Lag in Current Value

If your bonds are still within five years from the Issue Date, the Current Value automatically excludes interest earned in the last three months. If you cash out today, you’ll receive the Current Value. That’s why you won’t see any interest in the current value during the first four months. You will start seeing a higher value in the fifth month.

Interest Rate Lag

The interest rate on your bonds doesn’t necessarily change right away when a new interest rate is announced. Each bond stays on the previous rate for the full six months before it moves on to the next rate for another six months. The rates change in different months depending on when your bonds were originally issued.

Don’t worry when you see your older bonds earning a different interest rate than the current interest rate on your newer bonds. When those older bonds “age out” the previous rate for the full six months, they will move on to the newer rate for six months. All bonds eventually go through all rate cycles.

Cash Out (Redeem)

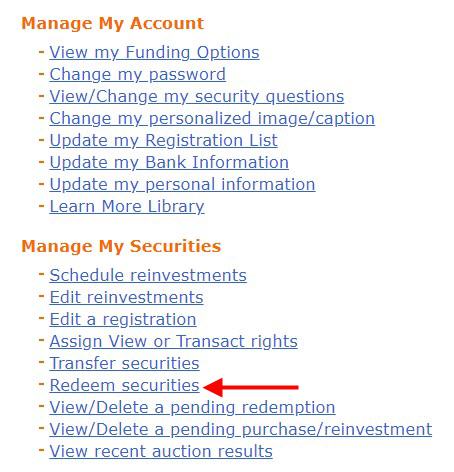

Because I Bonds are better than other bonds and there’s a purchase limit, you should hang on to your I Bonds as much as you can until you have better choices. If you need to cash out some of them (called “redeem” in the government lingo), you use the ManageDirect menu.

The option isn’t really obvious unless you know what to look for. Click on “Redeem securities” under the heading “Manage My Securities.”

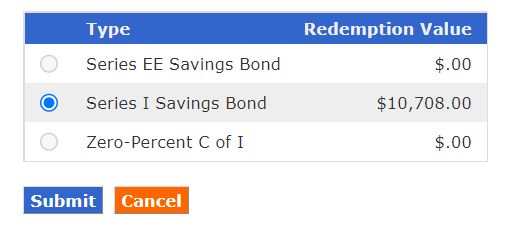

Choose “Series I Savings Bond.”

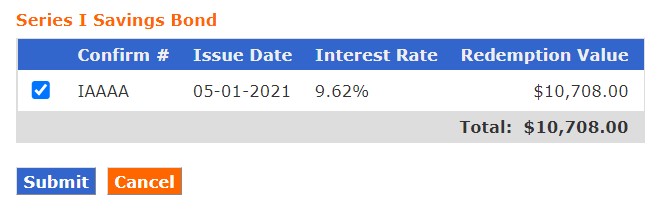

Choose the bond you’d like to cash out from.

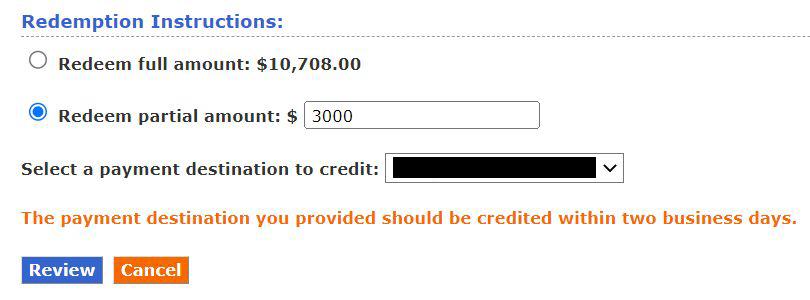

You don’t have to cash out/redeem the full amount. Redeeming only part of it is just fine. The minimum cashout amount is $25. If you originally purchased $10,000 and it grew to $10,708, when you redeem $3,000 from it, they will prorate the $3,000 into $2,801.64 principal and $198.36 interest. You’ll pay tax on the interest.

The money will be sent to your linked bank or credit union account by direct deposit in one or two business days after you cash out.

Tax Forms

If you don’t cash out (redeem) any I Bonds in any year, you won’t get a 1099 form for the interest earned. You pay taxes only in the year you cash out.

If you do cash out (redeem) any I Bonds in any year, TreasuryDirect will generate a 1099 tax form for the interest portion. They don’t send paper tax forms. You’ll come back to the ManageDirect part of the website at tax time to get the tax form (see the screenshot above).

See Report I Bonds Interest in TurboTax, H&R Block, FreeTaxUSA for how to report the interest in tax software.

You can choose a different treatment for when you pay taxes but it gets complicated. Please read Taxes on I Bonds Get Complicated If You Go Against the Default if you’re interested.

Customer Service

If still have questions or if you run into any problems, you can contact TreasuryDirect:

- Send an inquiry via their contact form.

- Send an email to Treasury.Direct AT fiscal.treasury.gov.

- Call 844-284-2676 during business hours.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Luz says

Hi Harry, I have a question about beneficiaries. I just bought an I-Bond. Can I name my sister as beneficiary, she is a not a US citizen and a is a non-resident (living in another country)?

Old mariner says

Hi, based on what you wrote, I’d say your sister can’t be a beneficiary. According to this website: https://www.treasurydirect.gov/savings-bonds/buy-a-bond/, scroll down to “Registering savings bonds (Who owns them?)”:

“The person you name must meet these conditions:

1. The person must have a Social Security Number.

2. The person must also meet any one of these three conditions:

–a. United States citizen, whether the person lives in the U.S. or abroad, or

–b. United States resident, or

–c. Civilian employee of the United States, no matter where that person lives

Luz says

Thanks, Old Mariner

Tyler says

When a secondary owner (who has a TreasuryDirect Account) inherits an i-bond upon the death of the primary owner, does that affect the annual purchase limitations of the new owner in that same year?

Harry Sit says

Inheriting I Bonds doesn’t affect the annual purchase limit of the new owner.

Tyler says

Thanks for the quick reply Harry.

In the above scenario of inheriting:

1. Could the new owner redeem the inherited I Bond even if It was less than 12 months old?

2. Would new new owner also forfeit the last 3 months interest?

3. Could the new owner elect not to redeem but to keep it in his/her own account.

Harry Sit says

The new owner still has to follow the original terms of the bond. If it isn’t eligible for redemption yet or it’s still subject to the early withdrawal penalty, nothing changes just because the bond has a new owner. The new owner can choose to keep the bond to its original maturity (30 years from the date of issuance).

Tyler says

Harry,

I helped a married couple buy several $10,000 I Bonds in 2022. The husband died last week. The wife does not want to redeem/cash in any bonds. What advice do you have for the wife do next based on the following information:

Deceased husband has one bond in his own account.

Deceased husband has two undelivered bonds sitting in his wife’s gift box.

Wife has one undelivered bond in deceased husband’s gift box.

No bonds have been purchased by either husband or wife so far this year in 2023.

Thanks,

Tyler says

Harry, Here’s some additional information for the above couple:

The wife has access to deceased husbands TreasuryDirect account.

The wife is listed as the beneficiary on the undelivered bonds in her gift box for husband.

Wife is the secondary owner with transact rights on husbands Bond in his own account.

Harry Sit says

> Deceased husband has one bond in his own account with his wife as the second owner.

> Wife has one undelivered bond in deceased husband’s gift box.

The wife fills out Form 5511 with a signature guarantee to request transferring the bonds to her account. Sign as the account owner even though it’s her husband’s account. Attach a copy of the death certificate.

> Deceased husband has two undelivered bonds sitting in his wife’s gift box with wife as the beneficiary.

The wife writes a letter to request moving the bond out of her gift box to her as the beneficiary. Send the letter along with the Form 5511 above.

Tyler says

Harry,

I searched TD website without an answer. This makes perfect sense to me….Thanks for your help!!!!

Andy K says

Mr. Sit: Thank for all the detailed and very helpful info on I-bonds. Please clarify the following. I have set up bonds in separate accounts (each containing multiple $10K bonds) for myself, my wife and a Trust. I want to transfer all the bonds from our personal accounts into the Trust account. Can the Trust account receive via transfer more than one $10K bond per year ? Thank you

Harry Sit says

It can if you’re doing a one-time consolidation. It may become a problem if you routinely buy in three accounts and transfer them into one account each and every year.

Dunmovin says

Treasury Direct doesn’t want too many to plan on redeeming IBonds or so it seems…TD announced today:

4.30% This includes a fixed rate of 0.90%

For I bonds issued May 1, 2023 to October 31, 2023.

Lou Petrovsky says

In what way would the new, higher fixed rate deter existing I Bond owners from redeeming? If anything, would they not be incentivized to redeem 2 months and a day after their current 6 month term ends, and use the proceeds to purchase new I Bonds at the 4.30% composite rate? If I have calculated correctly, within 2 years the 0.50% fixed rate will make up for the 3 months loss of interest for early redemption.

Paula Metz says

Can I buy I-bonds for my husband from my account with him as the primary and me as secondary “S with P.”? Do I have to open an account for him? I don’t want to link my payment account with him. Apologies if you’ve covered this already.

Harry Sit says

You can. It’ll be a gift for him as the primary and yourself as secondary. See Buy I Bonds as a Gift. He still needs to open his own account after you buy the gift in your account. You’ll need his account number when you deliver the gift to him. See Deliver I Bonds Bought as a Gift in TreasuryDirect.

Paula Metz says

Thanks for your reply, but if he ultimately needs a treasury direct account I might as well create one for him and buy his bonds that way.

Thanks.

Leighton says

Re: “Forever Bank: I’ve read, understand the paperwork hassle involved with redeeming to a different bank, added later, but have they changed this policy lately?

I have added a different bank to my T.D. account (just to see), and when I go to redeem a bond, it even asks me which bank I’d like to redeem to, and this new bank is an option.

I’m afraid to click it through to completion though, for fear that T.D. will trip me up, and tell me I need to follow up and send paperwork.

It would be just like our gov’t to NOT let me simply cancel that redemption order, and instead use my “forever bank,” that the money came from initially.

Do you know if one can now simply use a different bank, like I’ve described? Thanks.

Harry Sit says

TreasuryDirect changed their policy and made it easier to add bank accounts. It shouldn’t be a problem if it’s been a while since you added the second bank account and now this new account is offered as a destination for redemption. You’ll get an error if this bank account has a “return code” that prevents your redemption from going there.

Dunmovin says

Harry, great public service you all provide! Your thoughts…it seems to me given the recent each month lower CPI, that is a possibility that the next ibond rate reset for May could show a very lower inflation rate component. If the latter is the case then Treasury may really up the fixed component to try to keep funds for moving… therefore the next 6 month fixed forever component may be a good time to buy for long term or…. Your thoughts?

Again, on deathbed planning…if one has the time, albeit short…if one has a lot of cash an easy way to transfer it “may” be to go to the ibond gift box (over $10K) …even if only to one person. Then shortly after death…recipient can take delivery and redeem all in the same year. What do you think…aside from doing something else while living. 🙂

Thanks!

Harry Sit says

Although TreasuryDirect doesn’t say how they set the fixed rate, all indications point to using TIPS yields as a guide without considering the inflation rate or the resulting composite rate. Because TIPS yields have gone down, the I Bonds fixed rate in May will likely go down, not up.

If someone is dying, yes, he or she can buy a lot of I Bonds as gifts.