I’ve been buying I Bonds for 20 years. I only realized now I’ve been writing as if everyone already knew what they were and how they worked. If you buy I Bonds before November 1, 2023, you will get a 0.9% fixed rate plus a variable rate that continues to match inflation in the previous six months. If you’re new to I Bonds, this post walks you through from soup to nuts.

What Are I Bonds?

I Bonds are short for Series I Savings Bonds. They are bonds issued by the U.S. government directly to retail investors. Currently, I Bonds carry a favorable yield over other CDs and bonds. This makes I Bonds the best low-risk investment at the moment.

How I Bonds Work

Think of I Bonds as flexible-term variable-rate CDs.

You’re required to hold them for at least one year. After that, you can cash out at any time you’d like before the maturity date, or you can choose to hold them for up to 30 years from the original time of purchase. If you cash out within five years, you forfeit interest earned in the previous three months, whereas the early withdrawal penalty on a typical commercial CD is often six months or 12 months of interest. The flexibility to cash out after one year with a low early withdrawal penalty or to hang on for as long as 30 years makes I Bonds good for both short-term and long-term investing.

Similar to a CD, the value of I Bonds never goes down. They are guaranteed by the full faith and credit of the U.S. government. Unlike a typical CD with a fixed interest rate for the entire term, the interest rate on your I Bonds changes in six-month cycles. You stay on the current rate for the full six months and then you go on a new rate for another six months, and a new rate after that for another six months, and so on.

The interest rate is guaranteed to at least match inflation. If the inflation rate goes up, the interest rate on your I Bonds automatically goes up. Some older I Bonds earn a positive rate above inflation. The I Bonds you buy now only match inflation. Even merely matching inflation makes I Bonds attractive when other CDs and bonds don’t keep up with inflation.

Tax Treatment

The interest on I Bonds is credited monthly and automatically reinvested every six months. You get all the accumulated interest when you cash out. You don’t get a separate payout monthly or quarterly.

By default, you pay federal income tax on the interest from I Bonds only when you cash out, whereas you must pay taxes on the interest from CDs and bond funds every year even if you reinvest the interest. The interest from I Bonds is exempt from state and local income taxes. I Bonds are more appealing than other CDs and bonds because you have the tax deferral and the exemption from state and local income taxes.

You can choose to pay tax in a different way but it gets complicated. Staying with the default makes it easy for everyone. See Taxes on I Bonds Get Complicated If You Go Against the Default.

If you meet an income limit and other requirements, it’s possible to cash out your I Bonds tax-free when you use the money for qualified higher education expenses. See Cash Out I Bonds Tax Free For College Expenses Or 529 Plan.

Where to Buy I Bonds

There are only two ways to buy I Bonds:

1. Buy electronic bonds online at the government website TreasuryDirect.

2. Buy paper bonds with money from your tax refund when you file your tax return with the IRS each year. See details in Overpay Your Taxes to Buy I Bonds.

You can only use regular after-tax money to buy I Bonds. They’re not available in any tax-advantaged accounts such as 401k-type plans, IRAs, or HSAs. Nor are they available through any brokerage firms such as Fidelity, Charles Schwab, or Vanguard.

Purchase Limit

I Bonds are such a great deal that the government puts a limit on how much you can buy each year. At current rates, you should get your full quota before you buy any other CDs or bond funds.

When you buy on the government website TreasuryDirect.gov, the limit is $10,000 each calendar year per Social Security Number as the primary owner in a personal account. When you buy using money from your tax refund, the limit is $5,000 per tax return (not per person when you file jointly).

If you have a trust, you’re allowed to buy another $10,000 each calendar year in a trust account. See Buy More I Bonds in a Revocable Living Trust.

If you have a business, the business can also buy $10,000 each calendar year. See Buy I Bonds for Your Business: Sole Proprietorship, LLC, S-Corp.

If you have kids under 18, you can also buy $10,000 each calendar year in each of your kids’ names. See Buy I Bonds in Your Kid’s Name.

If you’d like to buy I Bonds as gifts to others, see Buy I Bonds as a Gift.

A married couple each with a trust and a self-employment business can buy up to $65,000 each calendar year, and more if they file separate tax returns, buy in their kids’ names, or buy as gifts for family members.

- $10,000 in Person A’s personal account with Person B as the second owner

- $10,000 in Person B’s personal account with Person A as the second owner

- $10,000 in an account for Person A’s trust

- $10,000 in an account for Person B’s trust

- $10,000 in an account for Person A’s business

- $10,000 in an account for Person B’s business

- $5,000 using money from their tax refund if they file jointly (or $5,000 each if they file separately after making sure they won’t lose other tax benefits)

- $10,000 in the name of each of their kids under 18

- $10,000 as a gift for each member of the extended family

We had only one trust before. We created a second trust with software to buy another $10,000. For buying I Bonds in a trust account in general, please read Buy More I Bonds in a Revocable Living Trust.

Open Account

If you never bought I Bonds before, you need to open an account at the government website treasurydirect.gov. You can buy more in the same account in subsequent years. Find the Open Account link at the top right.

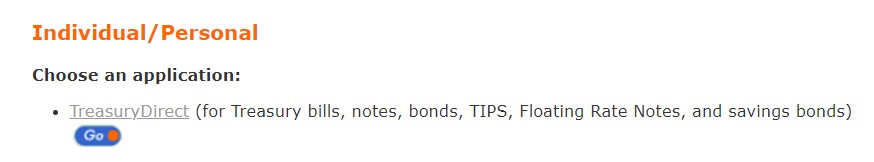

Choose the first option for Individual/Personal. Go here for a trust account or a business account as well.

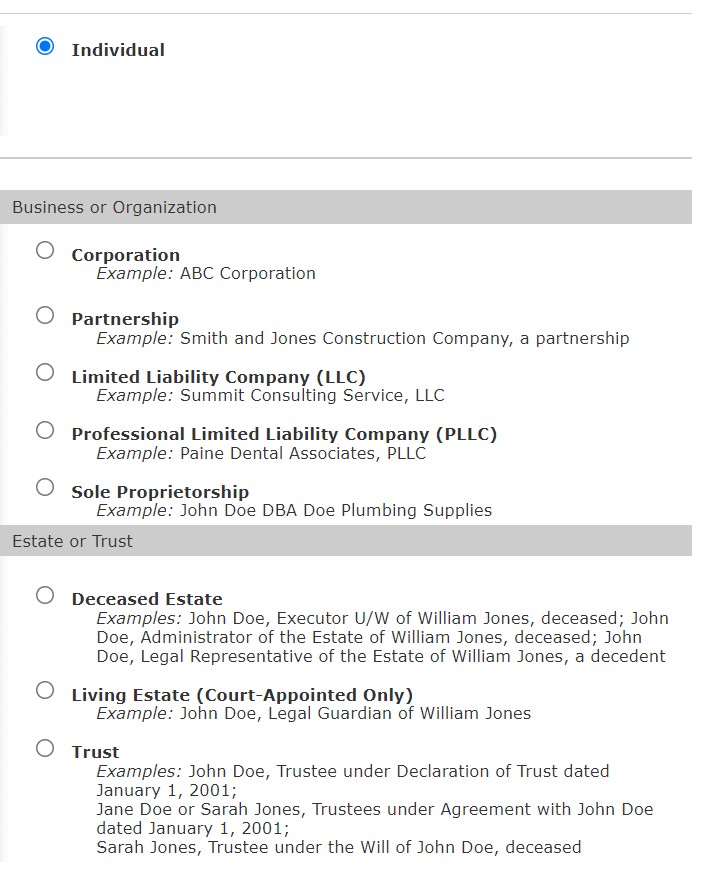

Now you can choose an individual, business, or trust account.

Next, fill out the required information and choose a security image, a password (not case sensitive), and security questions. Important: Save your answers to the security questions. You will be asked to answer one of the security questions when you perform certain actions at a later time. Your account will be locked if you can’t answer the security questions.

Separate Account for Spouse

TreasuryDirect doesn’t support joint accounts. The individual account you’re opening now is only for yourself. If your spouse also wants to buy I Bonds, he or she must open a separate account. However, you can specify a second owner or beneficiary on the bonds you buy in your personal account. You do that at the holdings level at the time of each purchase. We’ll cover that in the Registration section of this post.

If you’re opening a trust account, see Buy More I Bonds at TreasuryDirect in a Revocable Living Trust for what to use as the name of your account.

Link a Bank Account

The application also asks you to link a bank account. Make sure you enter the bank routing number and account number correctly. TreasuryDirect doesn’t send any random deposits to verify the bank account.

Save Account Number

You will receive your TreasuryDirect account number by email. Important: save your account number. You’ll need it to log in.

Most people can start buying right away after receiving the account number. A small percentage of people need to complete an extra step for identity verification. If you’re among the unlucky few, please read Where to Get a Signature Guarantee for I Bonds at TreasuryDirect.

Schedule Purchase

Log in with the account number. The system will email you a one-time password (OTP). Important: Don’t use the back and forward buttons in the browser when you use the TreasuryDirect.gov website. Only use the “submit” and “return” buttons on the web pages.

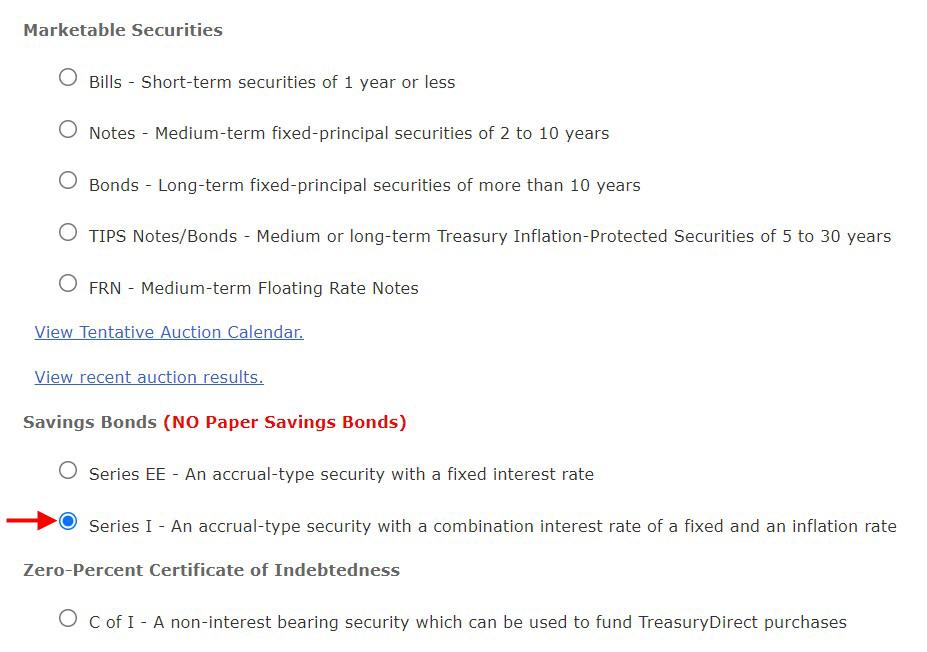

After you log in, go to BuyDirect in the menu.

Although we use TreasuryDirect only to buy I Bonds, the account can be used for other products as well. Choose Series I near the bottom of the list.

Registration

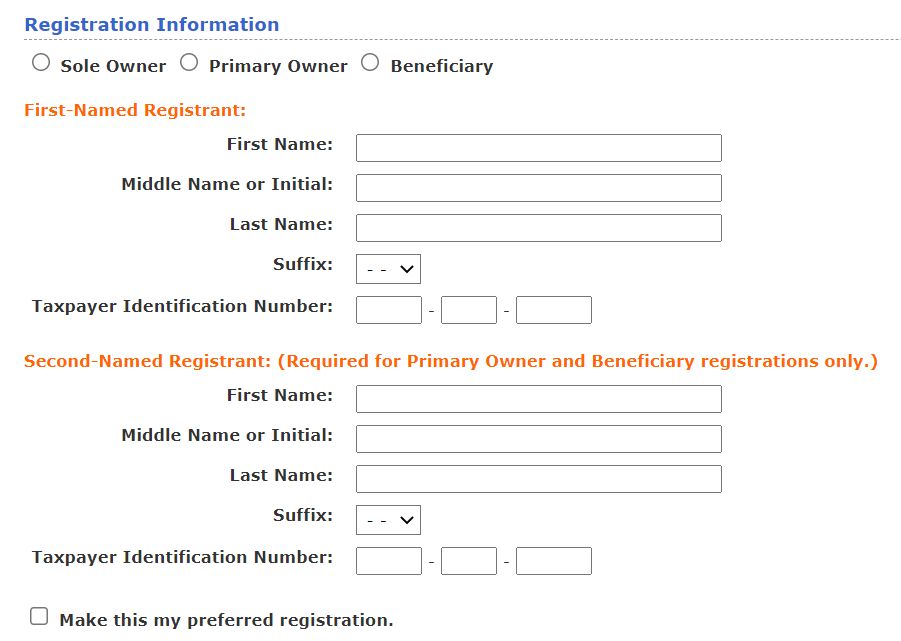

If you’re buying I Bonds for the first time in a personal account, you need to create a Registration, which means whether you want the bonds to have:

- Just yourself as the only owner; or

- You as the primary owner and another person as the second owner; or

- You as the owner and another person as the beneficiary.

Choose the “Sole Owner” radio button if you want yourself as the only owner with neither a second owner nor a beneficiary. Choose “Primary Owner” if you want yourself as the primary owner with another person as the second owner. Choose “Beneficiary” if you want yourself as the primary owner with another person as the beneficiary. See I Bonds Beneficiary versus Second Owner for the difference between a second owner and a beneficiary.

Unlike in typical commercial accounts, the second owner and the beneficiary in TreasuryDirect are at the holdings level, not at the account level for all holdings. You can have some bonds with Person A as the second owner, some other bonds with Person B as the beneficiary, and so on.

No Contingent Beneficiary

Each bond can have only one second owner or one beneficiary but not both at the same time. You can’t specify a contingent beneficiary. The second owner or beneficiary also has to be a person. It can’t be a trust or a charity. Trust accounts and business accounts can’t buy bonds with a second owner or a beneficiary. The trust or the business will be the only owner.

A married couple can choose to:

(a) Name each other as the second owner or beneficiary and live with the risk of simultaneous death; or

(b) Name someone such as a child or grandchild who isn’t likely to die simultaneously. The child or grandchild will get an early inheritance when you die. The surviving spouse will live on other assets.

First- and Second-Named Registrants

If you decide to have a second owner or a beneficiary, enter yourself as the “first-named registrant.” Enter the second owner or the beneficiary as the “second-named registrant.”

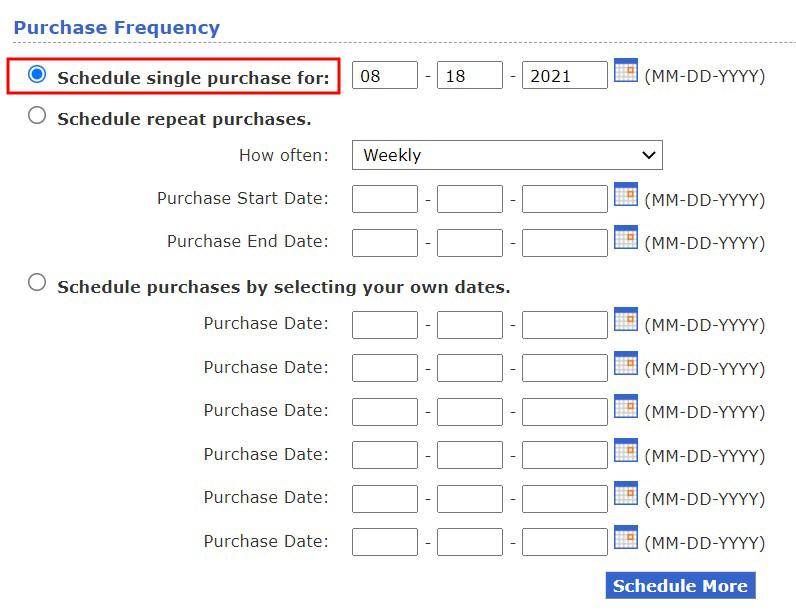

Purchase Date

Choose the purchase date. Make sure you have money available in the linked bank account. They send out the debit the night before your scheduled purchase date. The debit will hit your bank account on the scheduled date first thing in the morning. They may lock your TreasuryDirect account if the debit bounces. It’ll be difficult to unlock it.

Important: Don’t cut it too close to the end of the month, or else you may miss a month worth of interest. It takes one business day to issue the bonds and possibly more days if there’s a delay. If you buy close to the end of the month, your issue date may be in the following month and you won’t get the interest for the previous month. I schedule my purchases to a date at least a week before the end of the month.

Grant Rights to the Second Owner or Beneficiary

If you put a second owner or a beneficiary on your I Bonds, the second owner or the beneficiary doesn’t automatically see those bonds in their account. They see the bonds only when you grant them View or Transact right. The beneficiary can only be granted the right to view the bonds (“read-only”). The second owner can be granted either View or Transact right.

After the purchase completes and you see the bonds in your account, please read How To Grant Transact or View Right on I Bonds for a walkthrough on how to grant rights on the bonds you just purchased and how a second owner can transact on the bonds on your behalf after you grant the right.

Rinse and Repeat

If you’re buying additional I Bonds in the name of a spouse or a trust, repeat the steps above by opening a separate account, creating a password, linking a bank account, saving the account number, and scheduling the purchase. The different accounts can use the same email address and link to the same bank account if you’d like. Because you’ll use different account numbers to log in, you should keep notes of which account number is for which owner.

If you’re interested in buying I Bonds in the name of your trust, kid, business, or as gifts, please read:

- Buy More I Bonds in a Revocable Living Trust

- Buy I Bonds in Your Kid’s Name: You Can, But Should You?

- Buy I Bonds for Your Business: Sole Proprietorship, LLC, S-Corp

- Buy I Bonds as a Gift: What Works and What Doesn’t

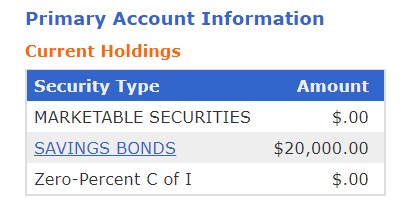

Check Balance

TreasuryDirect doesn’t send any account statements. You check your balance on the website. Your total face value is displayed on the home page after you log in. This doesn’t include any credited interest.

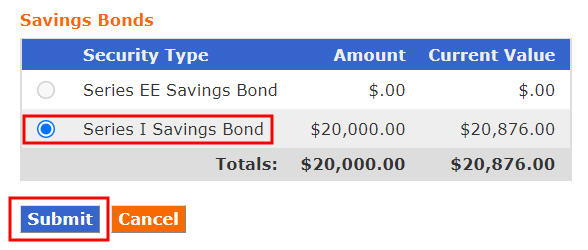

Clicking on the Savings Bonds link will show you a breakdown by savings bond type: Series EE and Series I.

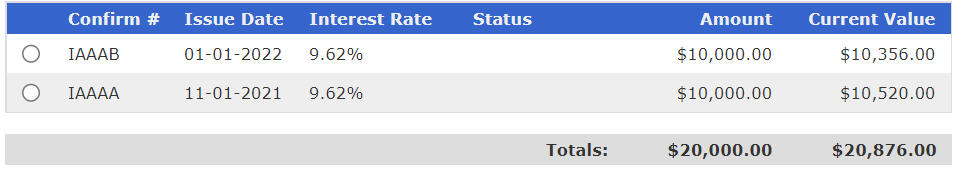

The Amount column shows the total face value. The Current Value shows the total face value plus credited interest. Click on the radio button next to Series I Savings Bond and then click on Submit. You’ll see a list broken down by the Issue Date.

Three-Month Lag in Current Value

If your bonds are still within five years from the Issue Date, the Current Value automatically excludes interest earned in the last three months. If you cash out today, you’ll receive the Current Value. That’s why you won’t see any interest in the current value during the first four months. You will start seeing a higher value in the fifth month.

Interest Rate Lag

The interest rate on your bonds doesn’t necessarily change right away when a new interest rate is announced. Each bond stays on the previous rate for the full six months before it moves on to the next rate for another six months. The rates change in different months depending on when your bonds were originally issued.

Don’t worry when you see your older bonds earning a different interest rate than the current interest rate on your newer bonds. When those older bonds “age out” the previous rate for the full six months, they will move on to the newer rate for six months. All bonds eventually go through all rate cycles.

Cash Out (Redeem)

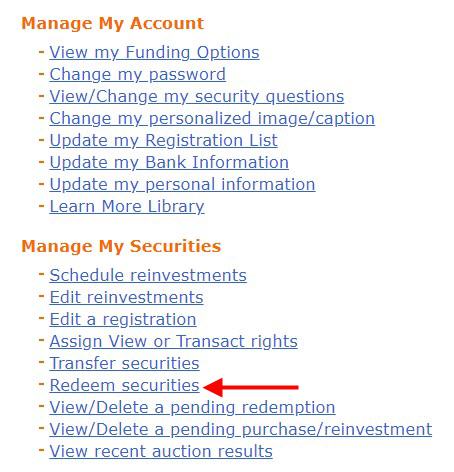

Because I Bonds are better than other bonds and there’s a purchase limit, you should hang on to your I Bonds as much as you can until you have better choices. If you need to cash out some of them (called “redeem” in the government lingo), you use the ManageDirect menu.

The option isn’t really obvious unless you know what to look for. Click on “Redeem securities” under the heading “Manage My Securities.”

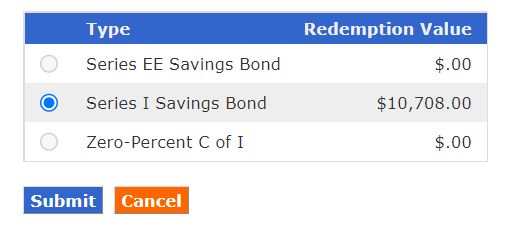

Choose “Series I Savings Bond.”

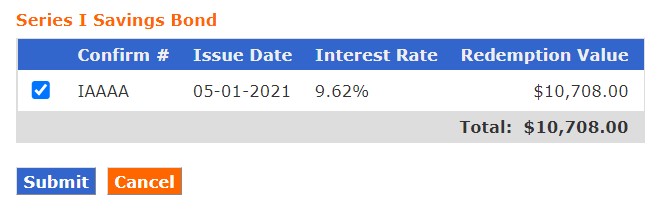

Choose the bond you’d like to cash out from.

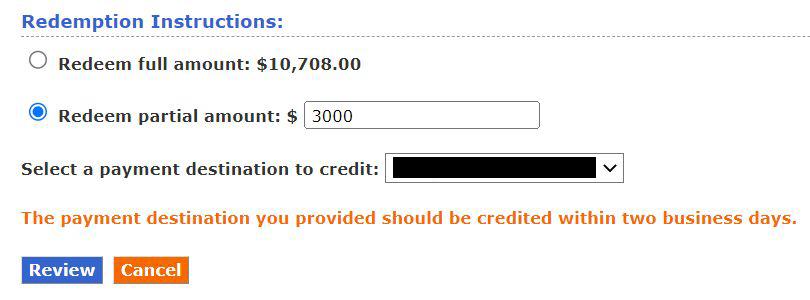

You don’t have to cash out/redeem the full amount. Redeeming only part of it is just fine. The minimum cashout amount is $25. If you originally purchased $10,000 and it grew to $10,708, when you redeem $3,000 from it, they will prorate the $3,000 into $2,801.64 principal and $198.36 interest. You’ll pay tax on the interest.

The money will be sent to your linked bank or credit union account by direct deposit in one or two business days after you cash out.

Tax Forms

If you don’t cash out (redeem) any I Bonds in any year, you won’t get a 1099 form for the interest earned. You pay taxes only in the year you cash out.

If you do cash out (redeem) any I Bonds in any year, TreasuryDirect will generate a 1099 tax form for the interest portion. They don’t send paper tax forms. You’ll come back to the ManageDirect part of the website at tax time to get the tax form (see the screenshot above).

See Report I Bonds Interest in TurboTax, H&R Block, FreeTaxUSA for how to report the interest in tax software.

You can choose a different treatment for when you pay taxes but it gets complicated. Please read Taxes on I Bonds Get Complicated If You Go Against the Default if you’re interested.

Customer Service

If still have questions or if you run into any problems, you can contact TreasuryDirect:

- Send an inquiry via their contact form.

- Send an email to Treasury.Direct AT fiscal.treasury.gov.

- Call 844-284-2676 during business hours.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Leonard says

Im thinking of buying 10k in my account for 2022 with my wife as pod. Then buying another 10k in 2022 as a gift to my wife but leaving the gift in the gift box until 2023 at which time I will transfer the gift to my wife’s account.. Then my wife will buy 10k in her account in 2022 with me as pod. She will also buy another 10k as a gift to me and leave the bond in her gift box until 2023 and then transfer the gift to me.. Will this strategy violate the 10k yearly limit per person?

Harry Sit says

That works. Be careful when you buy the gift. Many people make a mistake and end up buying double for themselves. See the “Avoid Mistakes” section in the post on gifts.

Pan says

I hope this isn’t a dumb question, but do the earnings from I Bonds ‘compound’?

I ask because it occurred to me that they reflect an increase in Inflation, not an interest rate.

Thank you

Harry Sit says

They compound every six months.

Matt says

My mom has her bank accounts in a living trust, where she’s the trustee and grantor. Can she use this to fund her I-Bond purchase in her individual account?

Harry Sit says

She can use the bank account in the name of her trust to buy I Bonds in her individual account.

Dunmovin says

Matt, why not buy for a trust entity? And for herself as in individual account?

Matt says

My mother is a strange person & I try not to get too involved, but she is getting older now. It seems she did the reverse of most people – she already bought for her trust account. It seems she never realized you can also have an individual account at Treasury Direct. 😐

Dunmovin says

I initially used a separate checking account for TD business account but later changed it to another checking account that is used for other TD accounts but all four use the same last name (only) for TD bank registration…the latter in my view is important. Harry?

Harry Sit says

If you already changed it and it’s working, what’s the problem?

Brad says

Btw Matt, if your mother’s trust is for probate avoidance purposes, any bonds owned in her individual name rather than trust may need to go through probate when she dies—most states now have an exemption amount, but you might want to check that her individual purchases (particularly that are over multiple years) don’t add up to more than the limit to avoid probate, though the process to probate some savings bonds might not be too onerous, it could negate (via probate fees) any gain in interest rates she gets via the Series I bonds… a consideration anyway.

Old mariner says

Probate can be avoided by designating a second owner or a beneficiary on the bond. Neither of those can be the Trust, however.

Brad says

Oh true. One cannot have a beneficiary or second owner for a trust account, but one can of course on an individual account. So as long as that accords with her wishes, that works! Thanks Old Mariner.

Matt says

Thank you Harry. I’m really happy I stumbled onto your site a few weeks back. Keep up the great work.

Peter says

When redeeming a portion of your I bond after 1 year, can you just withdraw accrued interest without touching the principal and not be penalized by losing the previous three months interest?

Harry Sit says

No. All withdrawals will be proportional with both principal and interest, and subject to the early withdrawal penalty in the first five years.

Matt says

Harry – Is there a practical reason for my wife to open her own TreasuryDirect account if she doesn’t care about managing it? Can I just simply add a new registration under my own account where she is the primary and I am the secondary or beneficiary? Any issues with this? Thanks as always.

Harry Sit says

You’ll see it doesn’t work after you try it that way. The registration with her as the primary in your account will have to be marked as a gift. You can’t cash out a gift for her in your account. The gift will be in limbo until she opens her own account to receive the gift.

Matt says

Alright – got it. Thank you again for all your help.

Mike C says

Thank you! I had been apprehensive up until now to set up a DirectTreasurey account. Your post made the process successful without any glitches.

Gaylene Vitale says

I wish to check the beneficiary for my account. I cannot remember the answer to the security question they posed. What can I do?

Thank you, Great website and answer

Gaylene

Harry Sit says

You see the beneficiary on your bonds when you click on “Current Holdings” in the top menu. It doesn’t ask the security question. The holdings are grouped by “registration.” When it shows “Your Name POD Beneficiary Name” you know who’s the beneficiary on those bonds.

Not knowing the answer to the security questions will eventually block you from certain actions. You set three security questions when you opened the account. Go to ManageDirect and then “View/Change my security questions.” Hopefully you’ll be asked a different security question and you still remember the answer to that one. You will then see the answers to all three security questions. This time write those down and save them in a safe place.

Leighton says

Re the penalty of last 3 months of INTEREST: I read on another site that the penalty is for the interest portion only (which is 0 now), and NOT the inflation portion (which is the big part). Is that true? If so, there is essentially no penalty now. Thanks.

Harry Sit says

Not true.

Lou Petrovsky says

No. Interest is a composite of the fixed and inflation components. The penalty is not only on the fixed component. An argument can be made that the inflation component is not true (economic) interest in the sense that it protects your principal, but it is still Interest for the purposes of the rules, including the tax rules, which require all interest to be reported either annually or upon redemption, without regard to the two components. Inflation protection is therefore reduced by the taxes. When calculating the values of savings bonds held for less than 5 years, the TD calculator subtracts composite interest for the final three months of ownership when computing the values of bonds, so you can prove that for yourself.

wallies says

Has anyone successfully withdrawn their ibonds using TreasuryDirect? The customer service is nearly non-existent. I opened a new account and sent in the authorization form. Days after mailing this form, I received several suspicious phishing texts with information from the form. I waited two hours to speak to a clueless representative who asked went overboard with personal questions to “confirm my identity” before he basically told me he couldn’t find my authorization form even though it was mailed several weeks ago and to call back next week. I emailed my concerns and received an automativc reply that stated “Due to the large volume of e-mails we currently are receiving, we are temporarily limiting our communication by e-mail.” TreasuryDirect gets TERRIBLE online reviews and many people are unable to get their money after MONTHS of waiting. Before promoting what a great investment ibonds are, I believe you need to be frank and honest about the rabbit hole many investors will be getting themselves into. It’s not worth it to have your identity stolen and your money in limbo.

Harry Sit says

I cashed out I Bonds before using the online interface shown in the “Cash Out (Redeem)” section. The money showed up in my bank account the next business day. I mailed in a form to change the bank account in December. I received no phishing texts. If many people are unable to get their money after months of waiting, they must have a more complicated case than simply logging in and cashing out (lost account number, forgot password, can’t answer the security question, closed bank account, …).

Leighton says

This is exactly what my wife and I are concerned about – any deviation from the narrow norm: the person opening the account, being the one to withdraw electronically to the same funding account.

This is especially of concern for my beneficiary (wife) on my death, and even more so with my T.D. trust account, which doesn’t list the beneficiary. (It’s on the trust document, which requires sending in paperwork. What could go wrong there?) She is not as proficient at figuring things out, and not as much of a bulldog, as I am, to see it through (complaining to my Congressman/Senator, etc). “Who ya gonna call?”

Example: A month ago, my wife made a mistake in trying to gift me $10K (trying to do it from HER registration). T.D. notified her that she exceeded HER $10K for the year, but were taking her money anyway, and would return it in 8 – 10 WEEKS. So, we’re wondering if they will ever return it.

By the way, T.D. has been “unavailable” for opening a new account for the past 2 days now, that I know of (maybe longer). One goes through all the entries before they give that message. You can log into an existing account though.

Another example of big gov’t problems: The IRS had no record of my paper return over a year after cashing the payment check I sent. Therefore, I couldn’t e-file the following year, since they couldn’t confirm my AGI online from that previous paper return. Same next year. Endless cycle. (My Senator’s office discovered the solution is to enter 0 as my AGI, then I could e-file).

Harry Sit says

Some ways to mitigate your concerns:

– Document your account numbers.

– Cash out before you die. Most deaths don’t happen in an instant.

– Grant your beneficiary View rights on the bonds in your personal account.

– Name someone proficient as your executor and successor trustee. Someone needs to send in your death certificate to kick off the process to transfer your bonds to the beneficiary. The successor trustee needs to take over the trust account.

wallies says

Warning! TreasuryDirect is now playing a recording on their phone line that states it may take up to 13 WEEKS for them to process incoming paperwork. That’s over 3 months of lost interest!

Harry Sit says

To be clear, most people don’t need to submit any paperwork. They open the account online and they buy I Bonds in minutes. Cashing out I Bonds doesn’t require paperwork either. Most pieces of paperwork submitted don’t involve lost interest. For example, when you deposit paper bonds to your online account, your paper bonds continue to earn interest in the meantime.

wallies says

Harry, if you have any idea how to expedite this process, I’m all ears. TD is making me submit another FS Form 5444 for my trust account, even though it’s the exact same information as my personal account, which was opened last year. I mailed the form over six weeks ago. TD has yet to unlock my trust account so I can deposit money. I’ve already lost a month’s interest. Every time I call it’s a two-hour hold.

Harry Sit says

They don’t necessarily notify you when they unlock your account. Some people just see they have full access when they log in after about a month.

Old mariner says

@wallies — Try calling right at 8:00 am ET when the TD call center opens. The wait time might be shorter. Maybe even start the call at 7:59 am. Unfortunately, I’m not sure the call center can really tell you anything if the paperwork for your Trust hasn’t been processed. A six-week or more delay is pathetic.

Leighton says

Regarding your question: “TD is making me submit another FS Form 5444 for my trust account, even though it’s the exact same information as my personal account, which was opened last year.”

In short: If you saved the trust registration, look at that and your personal registration side by side for any slight differences. If you find one, just abandon the first account, and start over opening a new account for that trust.

Elaboration: Not sure if your question is similar to the problem we had opening a trust account, but here goes. They gave us an account number, but couldn’t “confirm” something on the registration (not giving us a clue what it is, of course). They said they needed a form signed by the bank confirming identity.

I looked at the attempted registration side by side with the PERSONAL account which we opened a month ago with no problem. I noticed a slight variation in our address, which apparently didn’t line up with USPS.

So, since no money could be deposited yet in that problem trust account, we just abandoned it, and tried again to open an account for that trust, everything the same, except with that slight address correction, and it went through OK. You might try that.

Old mariner says

To Leighton says on JUNE 7, 2022 AT 12:52 PM,

That’s brilliant!

wallies says

The authorization form for my trust account was mailed May 11 and my account was unlocked June 14 – a two month wait time! The account needed to be verified DESPITE the fact that the trust account has the exact same address as my personal account, which was verified last year. Now I’m afraid to put more money in these accounts. If I have anything more than a simple automatic transaction it will take months to get my money.

Lizzie says

Harry – Do you know if non-profits can buy i bonds?

Harry Sit says

See comment #137.

Vincent Hodgdon says

With current economic situation are I bonds still a save investment.

Harry Sit says

Vincent – Both the principal and the interest are guaranteed by the U.S. government. You earn enough interest to at least match inflation. I Bonds are a safe investment in any economic environment.

John Endicott says

Vincent. since they’re backed by the US government and designed to match inflation, they’re as safe an investment as you are ever likely to find in most any economic environment. The only environment in which they wouldn’t be safe is the collapse of the US economic system, but in that environment, pretty much none of your other investments (which are almost all tied to the US economic system in some form or other) would not be safe either.

John Endicott says

Oops, accidentally added a extra negative in that last sentence. But you all know what I meant these (I hope).

Matt says

Afternoon Harry – Can you just redeem just the interest portion of your I-Bond or are all redemptions made up of principal + interest? Thank you.

Harry Sit says

No, all redemptions are prorated between principal and interest.

Lizzie says

How do you close/ delete an account at TreasuryDirect?

Harry Sit says

An empty account will be automatically closed after some time (18 months?). If you’d like to close it sooner, contact customer service, although they’re quite busy these days.

Lizzie says

Thank you Harry. Two more questions- do you know how the Automatic Payroll Savings Deduction program with TreasuryDirect works? Are my contributions from my paycheck before or after tax? I can’t seem to find any information anywhere on this & the HR dept is no help.

Harry Sit says

The payroll contributions are after tax.

Lizzie says

Thanks!

Lizzie says

Harry: Which articles would you recommend for someone that is new to TIPS? Thanks a lot for all your knowledge.

Harry Sit says

This one: More Inflation Protection with TIPS After Maxing Out I Bonds.

Howard says

If you look at all the Tip Etf’s, they are Trading at or near new lows!!

So when should they be bought?

Harry Sit says

Let’s keep comments on TIPS on the TIPS post and leave this post only for I Bonds. That said, at or near new lows is usually a great time to buy.

cathy says

Harry,

Is there any way to link trust account with individual account? I just pulled up my individual account and had a moment of panic since I forgot I had to set up a separate account for the trust.

Harry Sit says

No, you can’t link them. You can use a spreadsheet to list all your accounts and the approximate values. Put it in your “Where’s My Money” document.

bws92082 says

I’ve heard the 12-month minimum hold time before selling is not true. Supposedly, depending on what day of the month you bought, you can sell in as little as 11 months plus one day. It’s 12 monthly interest payments that must pass, not 12 months. Can you confirm?

Harry Sit says

12 months from the issuing date, which is listed on your bonds.

Tom says

I have a personal treasury direct account with $100,000 in ibonds that I want to put into my family trust. Can I transfer it to the trust account?

tom says

The family trust has its own treasury direct account which already has ibonds in it.

Harry Sit says

Log in to your personal account, go to ManageDirect, and then “Transfer securities.” If the online process asks you to fill out a paper form FS 5511, you follow the instructions on that form. Because a transfer counts toward the annual purchase limit of the receiving account, do it in a year when you’re not buying new bonds in the trust account.

Truman says

Wouldn’t it be great if the I bond purchase limit increases periodically?

You know, because of inflation. 🙂

That’s why contribution limits on retirement accounts go up every few years, and tax bracket cutoffs also rise slowly.

Dunmovin says

Truman, you mean “have the purchase limits returned to old levels”. It would also reduce the TD workload but would not get the paper bonds issued as a result of filing paper returns…why would TD management want to save taxpayers $s by not paying late payment interest. Here it is July and paper returns have not been processed yet…they were filed in February! Don’t drink too much on the fourth or the fifth may not come forth!

Ralph says

I filed on 4/15. Received the paper bond, sent it in and the acknowledged receipt. Still waiting to see it in my online TD account.

Dunmovin says

Thanks, Ralph but problem is for those that paper filed 1040/8888s

Xina Uhl says

I’m not a person who knows how to earn money on investments, but even I could follow the very helpful steps you provided. Thank you so much! I also invested money for my mother in law who had been putting it in a CD with its minuscule return. So you helped two people!

olisdad says

Question, i finally got the bank to put their stamp on the Treasury verification form for my wifes account that was flagged, should i just mail it first class or should i send it with delivery confirmation to the po box indicated? This whole process seems pretty tedious.

Harry Sit says

First class.

TomH says

You have cautioned people about waiting too long when buying I-bonds at the end of a month, so as not to lose retroactive interest. On the flip side, should redemptions be deferred until the beginning of a month, so as not to lose the interest for the preceding month?

Harry Sit says

Yes, or accelerated when holding to the 20th doesn’t earn any more interest once you pass the beginning of the month.

TomH says

I’m not sure what happens on the 20th. I thought that you had to own the bond for the whole month to get any interest for that month (except for the first month). So if you need the money by the end of the month, you may as well redeem as soon as the previous month’s interest is credited, but if you don’t need it by the end of the month, you may as well wait to redeem until early in the next month. Isn’t that right?

Harry Sit says

That’s correct. The 20th was just an example. If you’re planning to redeem on the 20th to pay a bill and you can’t wait until the next month, you might as well redeem on the 2nd or the 5th of this month.

TomH says

Is this correct?

Monthly interest earned on a Series I Savings Bond is credited to your bond on the first of the following month, but only when it is yours for eventual redemption. There is a 3-month interest penalty for redemptions in the first 5 years. So, the first 3 months of interest following a bond purchase will not be posted. The fourth month’s interest will be earned but will replace the first month’s interest as a potential forfeiture. The first month’s interest will then be posted at the start of the fifth month. The second month’s interest is posted to start the sixth month, etc.

Harry Sit says

That’s correct. You get four months of interest at the 5-year mark.

Marion Julius Nesmith, Jr. says

Good morning,

I just tried to sign in and they asked for a taxpayer id.

Never been asked this

i used my SS#

and now I’m locked out

I’m on a 1.45 hr hold

any help

Howard says

Hello

I have a sole proprietorship and a personal iBond account. If I overpay my taxes by $10,000 can each of these accounts purchase an additional $5000 of I bonds?

Thanks!

Jeff says

No. You only have one tax return and the purchase limit applies to the tax return.

Howard says

👍Thanks!

Leighton says

Good news update for those who, like us, also goofed up and bought more than the $10k yearly limit and got the message that TD would return the money in 10-12 weeks. Don’t worry.

Apparently, TD is going to let us slide by, NOT return the $10k, and let us keep the investment. Today they paid the 1st month (May) of interest ($80) on that additional $10k we erroneously bought on 5/12/2022. (Remember, we purchasers are always behind 3 months on interest, until the 5 year holding period is up.)

Brad says

If this is true, why not buy as much as one wants, I suppose it would have to be in $10k increments, or they will reject outright. Technically one can do this **within the rules they set** by creating multiple–as many as you want!–living (revocable) trusts, each with a different name, and using the same SS # for each which is perfectly acceptable to them. Perhaps they are fine if one does this, too (within their rules)?

Harry Sit says

Despite the technology I deploy to block spam, sometimes a spam comment still comes through. It isn’t feasible to review and approve every comment manually before sending the email notifications. If you see spam comments in the email notifications, please ignore them.

Flingo says

Harry,

Thanks for all your insights. I forward your links to anyone who is considering ibonds. The following should be an easy one, but I am stuck; I can’t back into Treasury’s interest rate calcs, eg,

Bought $100 ibond: 9/2021

Redeem ibond: 9/2022

ibond interest rate 9/2021-2/2022: 1.77%

ibond interest rate 3/2021-8/2022: 3.56%

My calc:

$100*1.0177=$101.77 plus

$101.77*(1+(0.0356/2)=$103.5813 (interest cut in half to reflect 3 month penalty)

My calc 1 interest on $100: $3.58

Treasury-calculated interest on $100: $3.56

What am I missing?

Joe says

First The rate u are using is incorrect Second. What number are you looking for?

Harry Sit says

You’re missing rounding and that $3.58 and $3.56 are close enough. Treasury’s calculation method is published in the federal regulations. It may not be what you expect but the prescribed method consistently applies to everyone. You can trust that Treasury’s computers are programmed correctly to the federal regulations and no one is being cheated. If you really care to know, look up 31 CFR 359.19 and 31 CFR 359.39.

Flingo says

Thanks Harry. I did not think I had caught an error, I just wanted to be able to duplicate Treasury’s calculations for my own projections.

Howard says

New bill proposing $30,000 i bond purchases!

Do you think it will pass and if so how long till can we purchase?

Thx

Howard

Harry Sit says

I don’t think it’ll pass because most (> 90%?) bills simply die.

Bugler says

I don’t see the need. I-bonds have been around for years and most people ignored them because they were a bad deal. Inflation goes up and now we should pass a law making it easier for folks to buy more when they could have purchased them all along? When Inflation goes down, no one will want them again.

CuriousDave says

We don’t know the “needs” of our elected Congresspeople who decide whether or not to even put such a bill to the vote.

The Treasury has “needs” of its own and it may depend on how keen it is to have the public own I-Bonds at any given time and what volume it would like the public to keep rather than cash out. It has options of its own, such as increasing the fixed component of the composite interest rate from the current zero percent to a level that will keep them savers from cashing out their existing holdings when inflation eventually drops to an acceptable level.

Marion Julius Nesmith, Jr. says

Good morning,

Need some help with posting of interest.

I purchased 10k in Dec 21 and again in Jan 22

When should I expect to see some type of interest posted on treasury Direct?

Thanks,

Marion

Harry Sit says

The first value you see after logging in only shows the principal value. Clicking on it will show you the current value with interest. See the “Check Balance” section of this post.

Roy says

Well it’s about that time – has anyone calculated yet what the yield for I-bonds issued on or after November 1 2022 is likely to be? An October 12 WSJ article suggested it might be in the 6.4% range…

Harry Sit says

The variable rate will be 6.48%. There’s a chance that the fixed rate will go above 0%. I expect it to be 0.4% or 0.5% to be fair with the current yields on TIPS but they have total discretion in setting the fixed rate. I’ll be disappointed but I won’t be surprised if they keep the fixed rate at 0%.

Frank says

Now the Sept CPI is released, some predicts iBond rate for Nov – Apr 2023 is 6.23%. I am confused with the prediction. Since the CPI is 8.2%, would’t the iBond rate be higher than that?

Dunmovin says

Might as well be 20% or…given the nonfictional gift purchase option

Dunmovin says

Nonfunctional …sorry… it’s a fiction option

Roy says

Not sure why you call the gift purchase option “fiction” or “non-functional”. I used it on Treasurydirect and it works fine.

Dunmovin says

Hello! You haven’t been able to this week!

Lou Petrovsky says

As late as April 15 this year people could file a request to automatically extend the time to file their 2021 personal tax returns as late as today (Oct. 17), but by April 15 they still needed to pay whatever balance they figured they might owe. If they paid an additional $5,000 (on top of what they figured they owed) on April 15, and the return they file, say, today, shows they are due a refund of at least $5,000, if they direct that $5,000 be applied to the purchase of paper I Bonds, will that be treated as a 2021 purchase even though the payment was made in 2022? Also, will the interest rate on those paper bonds be based on the date their 2022 is processed, which is likely to be after this month (Oct.) and will then earn the reduced rate that will be set as of November 1?

Harry Sit says

Bonds purchased via tax refund go by the month in which they are issued. If the bonds are issued in November 2022 after the tax return is processed, they will earn interest at the same rate as any other bonds people buy in November. The only difference is they’re in paper form and they don’t count against the $10,000 annual limit.

Lou Petrovsky says

So that would mean that in the first year one purchases I Bonds, the maximum per individual (excluding trusts) can never be more than $10,000, because a tax return for that year cannot be file earlier than (usually some time in) January of the following year? Potentially, then, refunds for extended returns for 2021 filed, say, today (10/17/22) may not be processed until early 2023, so the refund applicable to 2021 could conceivably not be used to purchase $5,000 of I-Bonds until the first quarter of 2023, though those would at least earn the same rate of interest as purchases from refunds processed in November 2022? So much for the widespread belief that in our first year, purchases could aggregate $15,000.

Old mariner says

I’d say your first sentence is correct from a tax year point of view. If a person first bought $10K from Treasury Direct in May 2022, after they had filed their 2021 taxes without requesting paper bonds, then their maximum total of bonds issued in 2022 was $10K.

However, if a person bought their first $10K in Jan 2022, then got another $5K in paper bonds in April 2022, as far as they’re concerned they were issued $15K in 2022 regardless of the tax year under which they purchased the paper bonds.

You might get your bonds this year if you e-filed. Paper filing is a whole other story as read in the comments on another of Harry’s articles: “Overpay Your Taxes to Buy $5,000 in I Bonds.”

Harry Sit says

It depends on whether you already filed your tax return when you first learn of I Bonds. Suppose I first learn of I Bonds in February. I haven’t filed my tax return for the previous year yet. I make a payment with an automatic extension to make the refund go above $5,000. I file my tax return in March and I receive $5,000 in I Bonds in April. I also make an online purchase in March. That’s $15,000 in the first year. Which year the tax return was for is irrelevant.

If you learn of I Bonds only after you filed your tax return, then you missed the boat to buy the extra $5,000 in your first year.

SamV says

Does Linked bank account has to be their own account or it can be spouse’s account also ?

Like if my wife opens her TreasuryDirect account she has to link her own bank account only or she can use my bank account also ?

Harry Sit says

It doesn’t have to be but it probably helps when the name on the bank account matches the name on the TreasuryDirect account to reduce the risk of having the account locked and requiring a signature guarantee to unlock. TreasuryDirect can’t tell it’s a spouse’s account only by the last name on the account. A joint bank account works.

Dunmovin says

I used the same checking account (joint account) as spouse and trust but entered only last name for TD registration. Use a separate checking account for business

SamV says

So atleast Bank account name has to match TD account name for payment to go through?

Mahesh Reddy says

Hello Harry Sit, the new rate from Nov 1st seems to have a fixed rate of 0.4% and a variable rate of 6.89%. Could you please clarify below for me please?

As my account is not yet opened since 2 weeks , my wife purchased $10k for her and gift me another $10k(still in the gift box). The fixed interest for that is 0% with a variable rate of 9.62%.

1. Does the 0.4% fixed rate is applicable only for new bonds that we purchase over the next 6 months or is it applicable for the bonds purchased already?

2. If my account is open now by the end of this year(before last week), I plan to do the same and depending on future interest rates, we will deliver accordingly. Will the new bonds I purchase and gift, will have the 0.4% through it’s life and the variable rate changes every 6 months?

Could you please shed more light on this or provide an example if you could? TIA.

Harry Sit says

The fixed rate in effect at the time of the purchase is fixed for the life of the bond after you purchase it. Bonds bought in October 2022 have 0% fixed rate for life. Bonds bought in November 2022 or January 2023 have 0.4% fixed rate for life. Bonds bought in May 2033 will have a fixed rate to be announced at that time for life.

Mahesh Reddy says

Ok, understood, thank you for the clarification.