One limitation of buying I Bonds is the annual purchase limit. Each person can buy a maximum of $10,000 per calendar year as the primary owner. See How to Buy I Bonds.

If you see I Bonds as an investment, it’s true you can’t dump $500,000 into I Bonds in one shot. However, if you see I Bonds as another account, the $10,000/person limit is higher than the annual contribution limit for an IRA. You never hear people say you shouldn’t bother contributing to an IRA because the limit is only $6,000 or $7,000 per year. People go to great lengths to contribute to their IRA with a backdoor Roth.

In addition, if you have a trust, you can buy another $10,000 per year under the name of the trust. A lawyer created a revocable living trust for us back in 2018. It was surprisingly easy when I opened an account for the trust at TreasuryDirect last month. It took only 15 minutes to open a new trust account and buy another $10,000 of I Bonds.

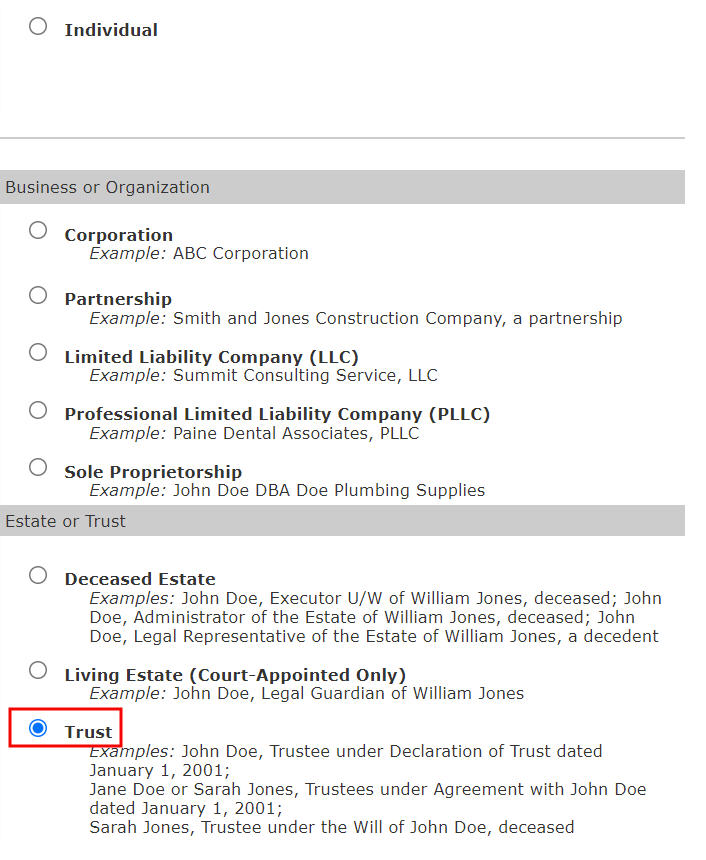

Entity Account

When you open a new account for the trust, you open an Entity Account with the type Trust. A trust account is one type of entity account. The other types include corporation, partnership, LLC, PLLC, and sole proprietorship. Please read Buy I Bonds for Your Business if you have a business.

Registration Name

TreasuryDirect has instructions for opening an entity account. The instructions look complicated but it’s not that bad if you read closely. The most tricky part is the name of the trust account. If your revocable living trust is created by a trust agreement, they want the registration to include both the trustee(s) and the grantor(s). If it’s created by a declaration of trust, they want only the trustees.

My wife and I have a joint trust. We are both trustees and grantors. The trust document says “Trust Agreement” at the top. So the name of our registration becomes:

Person A or Person B, Trustees, [Name of the Trust] U/A with Person A and Person B dated [Month Date, Year]

The second trust we created using software says “Declaration of Trust” at the top. So the registration of this second trust is:

Person A or Person B, Trustees, [Name of the Trust] U/D/T dated [Month Date, Year]

The instructions include a list of approved abbreviations. “U/A” stands for Under Agreement. “U/D/T” stands for Under Declaration of Trust. They allow 150 characters in the registration. Although the registration looks long, it fits within 150 characters. TD FS Publication 0049 also has more examples for trust registrations.

Tax ID

A revocable living trust typically uses the grantor’s Social Security Number as its Tax ID. The trust account at TreasuryDirect can still use the grantor’s Social Security Number even though the grantor also has a personal account with TreasuryDirect under the same Social Security Number.

Email Address

The trustee acts as the manager of the trust account. TreasuryDirect wants an email address for sending one-time passwords and notifications. You can use the same email address if you’d like when you also have a personal account at TreasuryDirect.

Bank Account

The new trust account needs a linked bank account. The bank account doesn’t have to be under the name of the trust. It can be the same personal bank account linked to the grantor’s personal account at TreasuryDirect.

Between the personal account and the trust account, the Tax ID, the email address, and the linked bank account can all be the same if you’d like. The account number and the account type are different.

TreasuryDirect doesn’t do any random deposits to verify the linked bank account. You can enter an order to buy as soon as you create the trust account. Make sure you give the correct bank account. If the debit bounces, your account will be locked and it’ll take effort to unlock it.

Joint Trust or Separate Trusts

Some married couples have separate trusts for each spouse. If you have two trusts, you can open a separate account for each trust and buy another $10,000 of I Bonds every year in each account.

It’s also not uncommon for a married couple to have a joint trust, in which they are both the trustees and the grantors. Although the trust can use either grantor’s Social Security Number as its Tax ID, I don’t think it can use two different Tax IDs simultaneously. If you have one joint trust, the trust can open only one account under one Tax ID and buy $10,000 per year in that one account. If you’d like to buy another $10,000 per year, you need a second trust. We used to have only one joint trust. We created a second trust with software (see below).

In addition, if the joint trust has two trustees and the trust has the word “AND” between the trustees, TreasuryDirect wants to be sure that the trust allows either trustee to act alone on behalf of the trust (versus requiring the consent of both trustees). They want documentation to demonstrate that’s the case. Please read the official instructions for what they need and where to send them.

Multiple Trusts

Some people have multiple trusts, with different beneficiaries, funded with different assets, etc. As long as each trust has its own signed and notarized formal trust document, it’s a separate trust from the other trusts even if all the trusts use the same tax ID for tax purposes. Each trust can open a TreasuryDirect account and buy up to $10,000 in I Bonds each calendar year (see comment #36 for a confirmation from TreasuryDirect customer service).

Create Trust by Software

If you don’t have a trust and you don’t otherwise need one, you can still create a trust just to buy more I Bonds. It may not be worth it if you have to go to a lawyer but if you make it really simple, you can do it with software. See Create a Simple Revocable Living Trust with Software for I Bonds.

Keep Them Separate

A trust can’t be the beneficiary or the second owner on I Bonds. The beneficiary or the second owner has to be a person (see the previous post I Bonds Beneficiary vs Second Owner in TreasuryDirect).

Although there’s a way to transfer existing bonds held in a personal account to a trust account, TreasuryDirect doesn’t like it. They allow you to do either one of the following but not both:

- Buy $10,000 per calendar year in a personal account and another $10,000 per calendar year in a trust account; OR

- Transfer existing bonds from a personal account to a trust account (for example after you set up a trust) or transfer existing bonds from a trust account to a personal account (for example right before you revoke a trust).

You’ll get a stern warning if you buy the maximum in both accounts and transfer from one account to the other in the same year because a transfer counts against the annual purchase limit of the destination account. So if you’re buying the maximum in both a personal account and a trust account, you should just keep your personal account and your trust account separate. Designate a second owner or a beneficiary on the bonds in your personal account and grant the necessary rights. See the previous post How To Grant Rights on I Bonds to the Second Owner or Beneficiary.

When you’re done with buying the maximum in both accounts and you wish to only use one account going forward, you can consolidate your holdings into one account in a year when you’re not buying I Bonds in the destination account. Go to ManageDirect and then “Transfer securities.” It may ask you to use FS Form 5511 and get a signature guarantee.

After You Die

The trust account has only one Account Manager. After the designated Account Manager dies, a co-trustee or a successor trustee must take over as the new Account Manager. The co-trustee or successor trustee needs to fill out FS Form 5446 to make the change and attach the required documentation.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Steven H says

Thanks.

In TurboTax, it looks like I need to enter the interest as a 1099-INT, into only Box 3. Is this how it appears on Treasury Direct 1099-INT forms for savings bond redemptions?

Lou Petrovsky says

Yes. Per the IRS instructions, do not also include it in Box 1. Using Box 3 only ensures that your federal Form 1040, Schedule B will include it in income. If you also file a state return, entering in Box 3 will also ensure that the TurboTax software will show the interest as tax free on your state return.

The fact that you received the interest as part of your redemption proceeds has no tax effect unless you used some or all of your redemption proceeds to pay for qualifying tuition expenses, in which case you will need to look for the box where you enter the interest amount that is federally exempt (you may want research 2022 Form 8815 and instructions before entering anything in that box). The exempt amount should show on your federal Schedule B, line 3, and that will be subtracted from the total interest income shown on line 1 of that Schedule.

Mandy D says

Hi Harry,

How can I simply Redeem the full amount from my Trust accounts online? I don’t see that option!

Or is the only way to Transfer to my personal acct in the year I don’t buy? Will that require a Form? I live mostly in Italy now so that might be a nuisance!

Harry Sit says

ManageDirect -> Redeem Securities -> Series I -> pick the bond(s) to redeem.

If the bonds are less than five years old, you may want to wait until at least August 1 to minimize the early withdrawal penalty. See this table for the best time to redeem by which month your bonds were issued:

https://thefinancebuff.com/when-to-sell-i-bonds.html#htoc-when-to-cash-out-0-i-bonds

Praye says

I understand that one can create a TD account for a trust and purchase $10,000 of I Bonds in the trust account. Is it also possible to purchase $5000 of I Bonds with the tax refund for a trust?

Kate says

Of course. $10,000 is maximum

Srinath Kalluri says

Harry, Your links for the instructions on Treasury Direct for opening accounts for entities are no longer working. It seems like Treasury Direct may have updated their websites since you wrote up the instructions…in particular I was trying to find out what documentation needs to be sent for the signature authority on a joint trust. In any case, you provided lots of useful info so I thought I would flag the link in case you wish to correct it.

Harry Sit says

Thank you for the heads up. TreasuryDirect moved its link after I wrote this post. I updated the link to their current page.

Joe Smith says

Harry, based on what you wrote in this informative article, it sounds like I can include the actual name of my trust when establishing an entity account. I am in the process of creating two revocable trusts with myself as the Trustee and Grantee. And I think if I can include the respective trust’s name, then I could get both notarized on the same day. By being able to include the name of the trust, they can be differentiated by Treasury Direct.

For example, I could register one trust as:

Bob Jones, Trustee, Bob Jones “Trust Number 1” Revocable Living Trust, U/D/T March 1st, 2024.

And the other as:

Bob Jones, Trustee, Bob Jones “Trust Number 2” Revocable Living Trust, U/D/T March 1st, 2024.

Does this make sense? Would I be naming them correctly and properly differentiating them given they would be notarized on the same day?

Thanks in advance, Harry!

Harry Sit says

That works. There’s nothing wrong with creating two trusts on the same day.

Roland says

Is transferring I bond from my trust account to my personal account a taxable event? Are filling out paper form and signature guarantee absolutely required? Thanks.

Harry Sit says

The Transfer Request form FS Form 5511 only talks about transfers from a personal account to a trust account, not the other way around. Please call TreasuryDirect customer service and ask about the other direction.

Adam says

Hi Harry. I’ve purchased your book on TIPS from Amazon and read all your ibonds articles. Here is my question.

My mother and I have an LLC together and have been purchasing ibonds each year in the name of the LLC and in our personal names. I’m 60% owner and she’s 40% owner.

Suppose in several years, the LLC treasurydirect account has $100,000 in ibonds, and we are going to dissolve the LLC.

If neither my mom nor I purchase ibonds in our individual names that year, can we transfer $60,000 in ibonds to my personal account and $40,000 to my mom’s personal account? Meaning, transfers do count against the purchase limit but the transfer itself can exceed the purchase limit? That is, you can transfer more than 10k in one year?

In a similar vein, suppose my mother passes with $100,000 in her personal treasurydirect account, with me as sole beneficiary, can I inherit the entire $100,000 in ibonds in one year?

Thanks so much again. I also really loved your recent article on “Pascal’s Wager and Taxes.” As well as “Making Fewer Things Matter.”

Harry Sit says

You can transfer but it takes a long time. TreasuryDirect says it takes “6 months or more to process” at this time. The transfer triggers tax on the accrued interest to the LLC, which flows to the owners of the business. It’s easier to just sell the bonds owned by the LLC before you dissolve it and divide the cash because you’re paying tax on the interest anyway.

Unrelated to the LLC, yes, you can inherit the entire $100,000 in I Bonds in one year. The estate has the option to pay the tax on the accrued interest up to that point or let you pay the tax on the whole thing when you eventually cash out. See I Bonds Tax Treatment During Your Lifetime and After You Die.

Mel says

If I redeemed the Trust I-Bond (Principal and Interest) outright in 2024 without transferring to personal, what are the tax filing consequences? Can that trust income be shown on my personal 1040 while filing?

Dunmovin says

And, the tax ID for the account is… why wouldn’t it be reflected there AND in the tax summary for 2024 for the account?

Lou Petrovsky says

The answer will depend on what kind of trust you have and on the terms of the trust document.

If the trust is revocable, it does not need its own tax ID number and your trust’s separate account with Treasury Direct (TD) should ideally show your personal Social Security number. If it does, TD will issue a 1099-INT to the trust showing your SS number and you can report the interest on your personal income tax return. If you applied for and received a separate Tax Identification Number (TIN) for the trust, a U.S. Fiduciary Income Tax Return (Form 1041) will need to be prepared, together with a “Grantor Letter” showing you as the “grantor” and you will again report the income on your return, showing the trust as the payer.

If the the trust is irrevocable, the trust must file Form 1041 and report the income.

If the terms of the trust document require that income earned by the trust must remain in the trust and not be distributed by the trustee to any beneficiary, the trust must pay the appropriate income tax.

If the terms of the trust document require the income to be paid out to the beneficiary or beneficiaries, the Form 1041 must report the income but must show that the income is passed through to the beneficiaries. In this situation it will be the beneficiaries, not the trust, that will owe the tax. The return will need to include a Schedule K-1 for each beneficiary. A copy of the applicable Schedule K-1 must be issued to each applicable beneficiary, who, in turn, will report the share of the income on that individual’s personal income tax return and pay the appropriate tax.

Ideally, the preparation of any Form 1041 should be taken care of by a tax professional because it requires specialized knowledge to file fuducuary returns.

Mel says

Thanks Dun and Lou.

To clarify, its a revocable trust in which I am the sole trustee and sole beneficiary and my SSN is on the trust account. Trust was done exactly like Harry had guided. I’ve redeemed the I bond from the trust account directly. Its nice to hear that I can claim the interest on my personal taxes without any paperwork (1041 or Schedule K1). If its as simple as that, then that’s great. Otherwise let me know.