The recent upticks in inflation made Series I Savings Bonds (“I Bonds”) the best bonds you can buy, if only you can buy more of them. Because they’re indexed to inflation, if inflation goes to 20%, I Bonds will earn 20%. Other than getting I Bonds using your tax refund, the only way to buy them is through a website from the federal government. See How to Buy I Bonds: Soup to Nuts.

My wife and I have been buying I Bonds through TreasuryDirect for many years now. When we buy, we always give both our names and our social security numbers: a primary owner WITH a secondary owner. I’m the primary owner and my wife is the secondary owner of the bonds I buy in my account. She’s the primary owner and I’m the secondary owner of the bonds she buys in her account.

No Automatic Visibility

I only learned recently that when you’re the secondary owner of the electronic I Bonds issued through TreasuryDirect, you don’t automatically see those bonds in your account. The bonds have the secondary owner’s name and Social Security Number in the registration but they’re not automatically matched to the secondary owner’s TreasuryDirect account. By default, only the primary owner can see the bonds and cash out. If the secondary owner wants to see them or cash them out, the primary owner has to specifically grant View or Transact rights on those bonds to the secondary owner’s account.

The same also applies to beneficiaries. If you designated someone as the beneficiary of your I Bonds, they don’t know what those bonds are and how much they’re worth unless you specifically grant View rights on your I Bonds to the beneficiary.

TreasuryDirect describes how to do this in an FAQ: How do I grant View and Transact Rights to securities held in my TreasuryDirect account? Unfortunately, the rights are granted at the level of each bond in the account, not at the account level as a whole. Because we already own multiple bonds, we had to go through the steps one bond at a time in our respective accounts. We also have to remember to go through these steps every time we buy a new bond.

ManageDirect

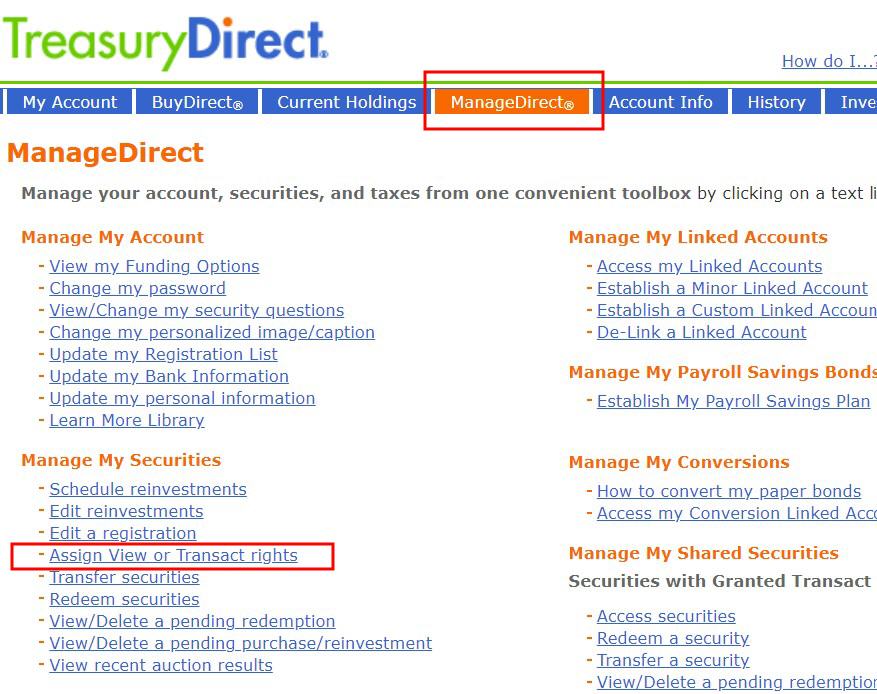

After logging into TreasuryDirect, go to ManageDirect, and then click on Assign View or Transact rights under Manage My Securities.

Grant View or Transact Rights

Select one of the bonds in your account.

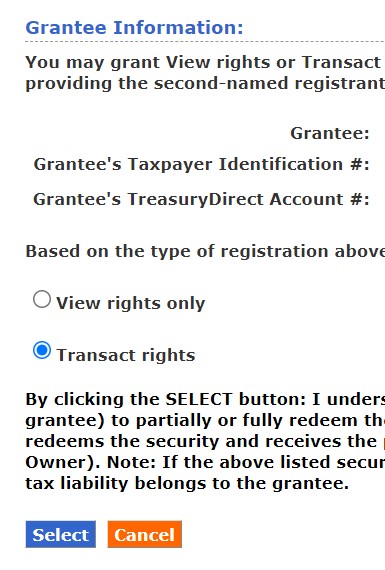

If you have a secondary owner or beneficiary on the bond, the secondary owner’s or the beneficiary’s name and Social Security Number will show up automatically. You need to enter their TreasuryDirect account number. If your secondary owner or beneficiary doesn’t have a TreasuryDirect account yet, they need to open an account even if they’re not buying any I Bonds for themselves. They will exercise the rights you grant to them through their account.

If you choose “View rights only” the secondary owner or the beneficiary can only see the bond but can’t redeem it. If you choose “Transact rights” the secondary owner can both see and redeem the bond. Transact rights only apply to a secondary owner. A beneficiary can be granted only View rights.

After you grant the rights for one bond, you go back to the list of your bonds, choose another bond, and repeat. There’s no way to grant rights to multiple bonds in one pass. The list doesn’t show you which bonds you have already granted rights and which bonds you haven’t. You’ll have to remember your progress and pick the next bond.

Troubleshooting

If the Transaction rights option isn’t available, that means this bond isn’t registered with a secondary owner. You need to change the bond’s registration to you with a secondary owner. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

If you get an error after you click on the “Select” button, make sure the name and the social security number you put on your bond’s registration as the secondary owner or the beneficiary match exactly with the name and the social security number they used in their TreasuryDirect account. If they used their full middle name, only the middle initial, or no middle name, you need to do exactly the same on your bond registration when you name them.

You’ll see how you named the secondary owner or the beneficiary on your bonds under Current Holdings. They can see how they registered their TreasuryDirect account under Account Info. If you need to edit your registration to make them match, see How to Add a Joint Owner or Change Beneficiary on I Bonds.

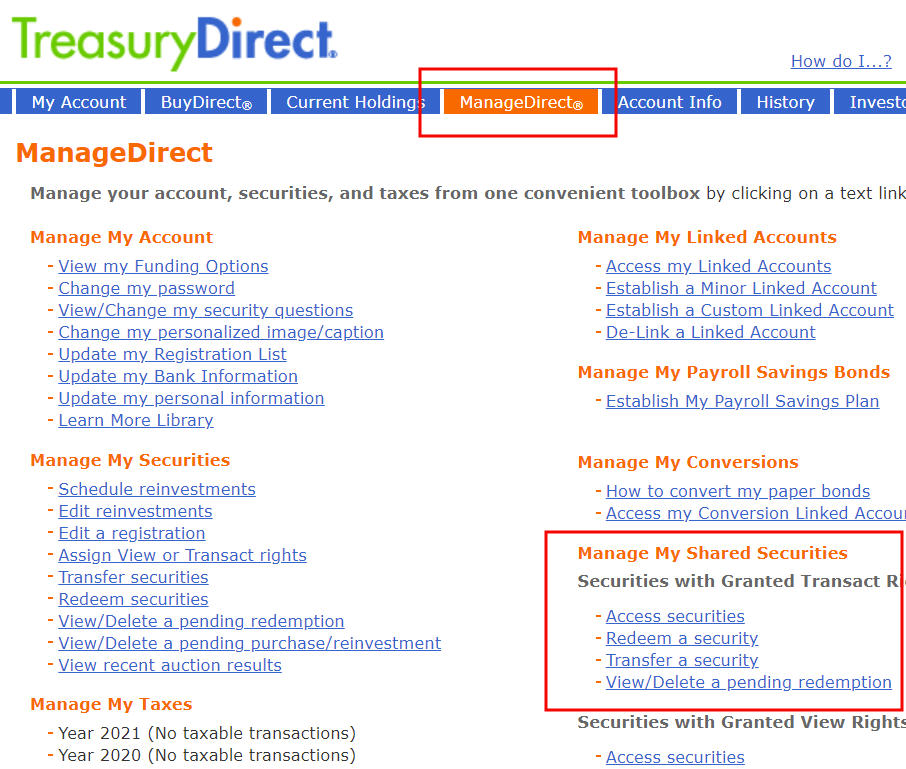

Shared Securities

After the primary owner grants View or Transact rights to you as the secondary owner or beneficiary, you still don’t see those bonds in the same view as the bonds of which you’re the primary owner. To see the bonds on which you’ve been granted rights, go to ManageDirect, and then find the links under “Manage My Shared Securities” on the right. The “Access securities” link gives you a list of the bonds you were granted rights to see. If you’d like to redeem a bond, use the “Redeem a security” link.

Primary Owner Rules

Another quirk in TreasuryDirect is that the primary owner can revoke the rights or remove the secondary owner or beneficiary altogether at any time. It’s something to be aware of if your relationship with the other owner changes.

If you granted a secondary owner the Transact right and that secondary owner cashes in the bond, you still pay tax on the interest because you’re the primary owner. Remember to look for the 1099 form in your account when that happens.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Sharon says

Thank you! I thought the “with” registration established transact rights. I’ve now established transact rights for my spouse. Very helpful post!

JAMES L GAINES says

When I select a bond I only get an option to give view rights. There is no option for transact rights.

Harry Sit says

That happens when the bond only has a beneficiary (A POD B) as opposed to a second owner (A WITH B). If you want to give someone Transact right you need to change the bond’s registration to A WITH B.

Lowell cathey says

Thanks Harry, new to I bonds and I’ve been searching for clarification on how to register husband and wife as co-owners and still both be able to buy the 10k limit.

Jim Y says

I’m having the same problem trying to setup transact rights for my wife. When I select assign view/transact rights, I only get the option to give view rights. There is no option for transact rights. I read your response about changing the registration from a POD to a WITH. I went in to edit registration but was unable to figure out what needed to be changed. Can you aim me toward more detailed instructions on what needs to be done? Any help would be appreciated.

Jim

Harry Sit says

I’ll have to write a separate post for it. Quick pointers until then:

1. ManageDirect -> Update my Registration List -> Add Registration. Choose the Primary Owner button. Put yourself as the first-named registrant and your second owner as the second-named registrant. This creates the desired registration (A WITH B ownership type) but it’s not associated with any bonds yet.

2. ManageDirect -> Edit a registration -> Series I. Check the box for all the bonds you’d like to change, select. Choose the desired registration in the dropdown (you WITH so-and-so), submit. This changes the registration on the selected bonds to the new ownership type.

Now do the steps in this post to grant Transact rights.

Jim Y says

Thanks, Harry. This worked perfectly.

Al Hott says

Still having a tough time getting to transact out of just view. I tried steps and not good. Sorry and old guy not getting it.

Can you do a step by step on how to get fron view to transact.

you are the best for helping all of us navigate the I Bond.

I followd your quick pointers

Not your explaination,but my thick head.

Thanks

Harry Sit says

Al – See if this helps: How to Add a Joint Owner or Change Beneficiary on I Bonds.

jon says

I accidentally bought too much! I bought 10k for me in one account and 20k for my wife in another. How do I assign 10k to my minor child’s SS number to be within legal mits?

Harry Sit says

Contact Customer Service.

https://thefinancebuff.com/how-to-buy-i-bonds.html#htoc-customer-service

pradcliffe says

Thank you for your wonderful, clear explanation of everything I Bonds. The treasury direct website is quirky, clunky, and oh so dated. My husband and I managed to buy several I Bonds on the site with different registrations but it took far longer than it should or would have using a modern, updated system. Your articles will help people navigate the current website. Thank you.

aepalisades says

Thanks for your tips! I just found out Ibonds were 7.12% on 12/28/21 after listening to an earlier podcast from Clark Howard. I didn’t have much time to figure out how to create accounts and buy ibonds for my husband and me. I figured buy fast, then figure it out as I go. Your tips have been very helpful on how to add a secondary owner and how to allow the secondary owner to view or sell the ibonds. thanks!

I also saw your post on not being able to add a trust as a beneficiary. I am hoping that you can help more with this as I saw there is a form 1851 which allows ibonds to be transferred to a trust. Is this allowed just for paper ibonds, or can I buy Ibonds electronically in my name and the fill out this form and transfer it to a trust? I’m not sure why a trust can’t be a beneficiary of an Ibond- it really makes no sense.

Harry Sit says

If you want bonds in a trust, you can open a trust account and buy directly in the trust account. The limit is $10,000 per calendar year per trust. If you want to buy $20,000 per year as you do now between you and your husband, you’ll need two trusts. See Buy More I Bonds in a Revocable Living Trust.

Or you can keep buying in personal accounts as you do now. When you’re done buying all the I Bonds you want, open a trust account, and transfer the bonds from your personal accounts to the trust account. Form 1851 appears to be only for paper bonds. Form 5511 is for transferring bonds held in a TreasuryDirect account.

Janet Oresick says

THANKS!

Janet O

Evelyn Sherr says

Who pays federal tax on I-Bond interest with co-ownership?

Does the primary owner still pay tax on bond interest if the co-owner cashes in an I-bond and puts it in his own bank account?

My husband was listed as co-owner on our paper I-Bonds. He died last year. I now have the I-bonds in a Treasury Direct account as sole owner. I plan to add my son as co-owner so he can access and cash in the bonds. If he does cash a bond, who would have to pay tax on the interest on the cashed bond?

Thanks

Harry Sit says

You still pay tax on the interest when the second owner cashes in a bond using the transact right you grant.

Helen says

A trust question: If I buy a $10,000 I Bond thru our living trust which is under my husband’s SSN, does that mean he won’t be able to buy I bonds for that year through his personal account? Can I buy $10,000 I bonds for myself and still gift him a $10,000 I bond anyway and leave it in the gift box until we no longer buy I bonds for that year, say 5 years from now?

Harry Sit says

He can still buy in his personal account.

helen says

Thank you! Also could we make $10,000 gifts to each other and keep it in the gift box and distribute it later to each other’s accounts. Or are spouses not included for gifting. So essentially we can buy $40,000 worth of I Bonds per year.

Harry Sit says

TreasuryDirect doesn’t know who’s married to whom. They don’t have exceptions for spouses. See Buy I Bonds as a Gift: What Works and What Doesn’t for more on gifts.

helen says

Thank you, that was very helpful! Thank you for the website also. My husband set up his account and TD never sent him an email with a passcode so he doesn’t have an account number. Is there any way around this or will we have to spend 2 hours trying to get a call through?

Harry Sit says

Look for the email in the spam folder, wait for the email in case it’s delayed, or try setting up the account again on a different day.

Frank says

Ia a custom, linked account created under an established entity account considered a separate account for purchase limits and tax purposes?

Another way to state the question: Can I create a linked account within my treasury direct entity (trust) account to purchase I-Bonds for myself (as an individual)? Or is it necessary to create an entirely new TD account?

Harry Sit says

A custom linked account doesn’t increase your purchase limit. You need two totally separate accounts when you’d like to buy for both yourself and a trust.

Peter says

Harry, if I designate a beneficiary on a bond, what information do I need to provide them so they can access and redeem the bond? Do they need to open an account just to view and read the bond’s status?

Harry Sit says

If your beneficiary opens an account (even if they’re not buying any bonds on their own), you follow the steps in this post to let them see which bonds they’re a beneficiary of and how much those bonds are worth. If they don’t open an account, you’ll have to provide the information offline: your account number, principal amount, issue date, and confirmation number.

Marvin Raatner says

I recently purchased a $10,000 I-Bond and added a

POD Beneficiary. Kindly indicate what my Beneficiary needs to to upon my passing, to claim this I-Bond, and transfer it into their name.

Please respond ASAP to enable me to tell my Beneficiary

what they need to to upon my passing, to claim their inheritance.

I await your timely response. ( to my email )

Thank You.

In Gratitude.

Marvin Ratner

Harry Sit says

Please note this isn’t TreasuryDirect customer service. TreasuryDirect asks the beneficiary to contact customer service directly upon an owner’s death.

“Electronic bonds: If the person who died has an online TreasuryDirect account, contact the Bureau of Fiscal Service directly. We will put a hold on the account and give specific instructions for the situation.”

The contact methods are on this page: https://treasurydirect.gov/email.htm

John Bleazard says

My sister is beneficiary on one of my I-Bonds. She creates an account with Treasury Direct so that I can give her “View” rights. But when I try to do that, I get an error message that the account can’t be found:

The Grantee’s TreasuryDirect Account Number is not valid. Please re-enter the information and click Submit.

The account is definitely correct. And names and SSNs match between us. Is it possible that she could have set up her account wrong, in some way? She doesn’t want to buy bonds or anything else at all. I am at a loss to know what the problem might be.

It all makes me wonder what sort of nightmare she will face if she ever has to claim the money as beneficiary. I assume having “View” rights would not make that any easier anyway, right?

Does she really need to know the date of the approval of when I bought the bond, which seemed to be indicated in other info I have read here about claiming bond money as a beneficiary.

Thanks for what you do.

jb

Harry Sit says

I don’t have any better suggestions besides trying again at a later time in case it was a one-time glitch and double-checking the social security number and account number. Did you have her correct social security number when you named her as the beneficiary? Check under Current Holdings after you log in. Did she give her correct social security number when she opened the account? Check under Account Info after she logs in. Do you have her correct account number? The account numbers are in the format of X-123-456-789.

She’ll need to fill out FS Form 5511 when she claims your bonds as the beneficiary. The form needs your account number, the name on your account, your social security number, and the confirmation number, issue date, and face amount of each bond she claims. If you give her these items in other ways, she can do without the View rights.

John Bleazard says

Thank you for your speedy, helpful reply. In the end I succeeded in granting my beneficiary “View” rights. The solution had something to do with differences between my full name on my account, or my beneficiary’s full name, and my having entered my name as the “Grantor” of the “View” not using my full name, or possibly my beneficiary’s. Making sure that I was using full names everywhere finally made it possible to grant the “View.” Again thanks for your help.

Harry Sit says

That’s great you figured it out. I added a small paragraph under the Troubleshooting section in case others also run into this.

Annie says

Super helpful! My LLC has an I bond account, too. Can I grant my husband (not the LLC owner but also has an I bond account) transact right? Thanks!

Harry Sit says

No. You can grant rights only to a second owner or a beneficiary. I Bonds held in a business account can’t have either.

Blake says

What do you think is the best policy: Making your adult kids the beneficiary of the I Bond in case you and your spouse die at the same time, or making your spouse a second owner/beneficiary? I like the former scenario best except that if the primary owner doesn’t die with his spouse, now the kids own the I Bonds and not the spouse. I thought about putting the I Bonds in our trust instead but then you’re limited to $10k in the trust instead of 10K for each person in the marriage.

Harry Sit says

Making adult kids the beneficiary works well if I Bonds only represent a small percentage of a couple’s assets. Kids owning the I Bonds isn’t really a problem. The spouse still has other assets. If the spouse’s welfare depends on having those I Bonds, then the spouse should own them. Simultaneous deaths are rare anyway.

Blake says

Agreed. Good points

Cecily L Harkins says

Does a secondary owner of an electronic I Bond have the ability to sell the entire bond, not just half? Granted, I’ve given the person transact rights. I think so but need your answer. I just discovered your site and am most grateful for you full answers, links, and posting of questions and answers.

Harry Sit says

That’s correct. The granted transact right is over the entire bond, not just half.

Vin says

Hello Harry, thanks so much for all your hard work guiding so many. Very much appreciated. Have also purchased a couple of your books.

I hope I can make my scenario clear enough for you to answer.

Our situation: spouse and I have I Bonds with each other as secondary. Our adult daughter is starting grad school. Can we change registration on our I bonds, making our daughter secondary with transact rights; and can she then redeem the I bonds and use proceeds to pay for grad school without incurring taxable interest?

Thank you as well for any other insights, recommendations, caveats you think important.

Vin

Harry Sit says

You can change the secondary owner and grant the transact rights but that doesn’t make the interest tax-free. The interest still counts as the primary owner’s income when the bonds are redeemed by the secondary owner. It’s tax-free if the proceeds are used on your daughter’s graduate school education only when (a) you’re under the income limit and (b) your daughter is still a dependent on your tax return. See Cash Out I Bonds Tax Free For College Expenses Or 529 Plan.