My previous posts covered buying I Bonds with your tax refund, buying I Bonds in a trust, buying I Bonds in your kid’s name, and buying I Bonds for your business. Let’s look at another way to buy I Bonds this time: buying them as a gift. For background on I Bonds in general, please read How To Buy I Bonds.

Gift Box and Delivery

You buy I Bonds as a gift in two stages: buying and delivering.

You must give the recipient’s name and Social Security Number when you buy a gift. The recipient doesn’t need to have a TreasuryDirect account at this time. Only a personal account can buy or receive gifts. A trust or a business can neither buy a gift nor receive a gift.

The bonds you buy as a gift go into a “gift box.” You can’t cash out the bonds stored in your gift box. This is analogous to you going to a store and bringing back the gift to your closet. The gift already has the recipient’s name permanently etched on it. You can’t steal the gift for yourself.

The recipient doesn’t know you bought a gift for them until you deliver the gift to them. This is analogous to bringing the gift from your closet when you visit family. The recipient must have a TreasuryDirect account now to receive the delivery. You’ll need the recipient’s account number to deliver a gift.

I Bonds stored in your gift box are in limbo. You can’t cash them out because they’re not yours. The recipient can’t cash them out either because the bonds aren’t in their account yet.

There’s a minimum wait of five business days between buying and delivering to make sure your bank debit clears. There’s no maximum stay in the gift box. You can pre-purchase gifts and wait to deliver them at a much later time. You can also choose to deliver gifts in bits and pieces as opposed to in one lump sum.

Purchase Limit

The principal amount of delivered gifts counts toward the $10,000 annual purchase limit of the recipient in the year of delivery. You can still buy gifts for others even if you already bought the maximum this year for yourself.

You can buy a maximum of $10,000 for any recipient in one purchase but there’s no limit on how many recipients you buy for or how many times you can buy for the same recipient in any calendar year. If you’d like, you can buy $10,000 worth of I Bonds for each of your 20 family members or you can make five separate purchases of $10,000 each for the same family member, all in the same calendar year.

If the recipient already received $10,000 in principal amount as gifts this year, buying additional I Bonds on their own will put them over their annual purchase limit. They’ll have to wait until they’re not receiving the maximum gifts.

Interest and Holding Period

Interest and the holding period start in the month of your purchase. If you pre-purchase gifts and wait to deliver them to the recipient at a later time, you still lock in the same fixed rate and inflation rate as other bonds bought in the same month. Interest earned while the gift savings bonds wait in the gift box belongs to the recipient. It’s exempt from state and local income tax.

The holding period for cashing out also starts right away. If five months have passed between the time of purchase and the time of delivery, the recipient only has to wait another seven months before they can cash out, as opposed to the full 12 months for freshly purchased bonds.

Gift to Kids

It’s not necessary to buy as gifts for your own kids under 18 unless you’re pre-purchasing for future years. As a parent, you can open a minor linked account in your account and buy directly in your kid’s name. See the previous post Buy I Bonds in Your Kid’s Name.

Buying I Bonds as a gift works when you buy for a grandchild or a niece or a nephew under 18. You only need the child’s name and Social Security Number when you buy the gift but you’ll need the child’s TreasuryDirect account number before you can deliver the gift. The child’s parent needs to have an account for themselves first and then open a minor linked account for the child under the parent’s account.

When Gifts Are Useful and When They Are Not

If you’re thinking of “borrowing” other people’s names and Social Security Numbers to buy more I Bonds as gifts but keep the bonds for yourself, it doesn’t work. Only the named recipient can cash out the bonds. If you don’t deliver them, the bonds stay in your gift box, and neither you nor the specified recipient can cash them out. After you deliver the gift bonds, it’s the recipient’s money, and they can do whatever they want with the bonds.

If you’re thinking of letting others buy I Bonds as gifts for you to double up the $10,000 annual purchase limit, it doesn’t quite work either. Gifts delivered to you count toward your annual purchase limit. If you receive the maximum in gift bonds for the year, buying additional bonds in the same calendar year will put you over the limit.

Buying I Bonds as a gift works when you want a family member to have some I Bonds but they don’t have spare cash. It works the same as giving them money and letting them buy themselves.

Pre-Purchase/Frontload

It also works to a limited extent if you think the high interest rates on I Bonds are only temporary. You can buy a gift for your spouse and hold it in your gift box. Have your spouse do the same for you. Wait to deliver the gift to each other in a future year. The older gift bonds will have earned the high interest rates in the years past and they have aged enough for immediate cashout.

We’re buying each other a gift this year to keep undelivered in the gift box in addition to our normal purchases. If the interest rate is still good next year, we’ll deliver the gift and buy a new gift in the gift box. If the interest rate isn’t good anymore, we’ll skip the purchase, deliver the gift, and cash out immediately.

Don’t Forget About Undelivered Gifts

As with physical gifts, most gifts are purchased and delivered in short order. If you hold gifts in your closet for a long time, you may forget that you bought the gifts in the first place. If you’re intentionally pre-purchasing gifts to take advantage of temporarily high interest rates, tell the recipient you’re holding a gift. Set recurring calendar reminders to tell yourself and the recipient you still have undelivered gifts in the gift box.

Remember that gifts are in limbo until they’re delivered.

Unexpected Death

You can include a second owner or a beneficiary for the I Bonds you buy as a gift. If the gift recipient dies before you deliver the gift, the designated second owner or beneficiary will inherit your gift. You can’t name yourself as the second owner of the gift but you can name yourself as the beneficiary of the gift. The recipient can change the second owner or the beneficiary after you deliver the gift. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

If you die before you deliver the gift, the gift still belongs to the recipient. Whoever handles your affairs after your death should notify the recipient that you had an undelivered gift for them. Then the recipient can claim it through TreasuryDirect. Again, it’s important that you tell someone about the gift if you’re going to hold it undelivered. If no one knows you bought a gift, the gift will be in limbo.

Gift Tax Form 709

There’s no tax for receiving gifts. Gift tax is on the gift-giver.

Buying I Bonds as a gift counts as a completed gift in the year of the purchase (not the year of the delivery). There’s no limit on how much you can give as gifts to your spouse (unless the spouse isn’t a United States citizen). Each person has an annual gift tax exclusion amount for “present interest” gifts to each non-spouse recipient, which is 16,000 in 2022 and $17,000 in 2023. If the total “present interest” gifts (in I Bonds and other forms) during the year from one specific giver to one specific non-spouse recipient go above this annual gift tax exclusion amount, you’re required to file a gift tax return on IRS Form 709.

The gift tax annual exclusion amount for gifts to a non-spouse recipient is $0 for “future interest” gifts. You’re always required to file a gift tax return when you give “future interest” gifts to anyone except your spouse. It’s not clear to me whether the I Bonds you buy this year as a gift but hold for delivery in a future year count as a “present interest” gift or a “future interest” gift. To avoid ambiguity in determining whether it’s a “present interest” gift or a “future interest” gift, only give gifts to your spouse or deliver all gifts to non-spouse recipients within the same calendar year.

Unless you’re also giving the same non-spouse recipient gifts in other ways, buying and delivering $10,000 worth of I Bonds as a gift in the same calendar year falls below the annual gift tax exclusion amount, which doesn’t trigger the requirement to file the gift tax return.

If you’re required to file a gift tax return, it’s separate from the federal income tax return. The gift tax return goes to a special address. The typical consumer-grade tax software packages such as TurboTax and H&R Block software don’t support filling out a gift tax return. You’ll have to go to a tax professional or fill out the gift tax return on your own.

Having to file a gift tax return on Form 709 doesn’t mean you’ll pay gift tax out of pocket. Most people just use up part of their lifetime estate and gift tax exemption amount, which is more than $12 million in 2022. However, after you file the gift tax return once, you’ll have to keep track of how much of your lifetime estate and gift tax exemption amount you already used. See IRS Instructions for Form 709 if you decide to give gifts that will require a gift tax return.

Avoid Mistakes

Although TreasuryDirect has an official video walkthrough for how to buy a gift, it’s very easy to make a mistake if you follow the video when you’re buying a gift for the first time. I read many reports from people intending to buy a gift but ending up buying bonds for themselves.

It’s easier if you follow these steps when you’re buying a gift for the first time.

Add Registration

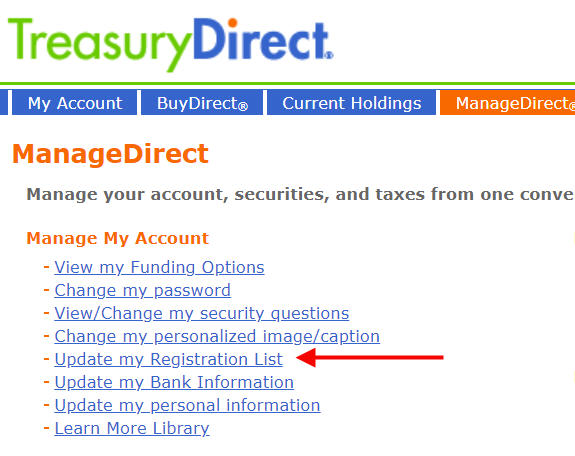

Click on ManageDirect in the top menu. Then click on the link “Update my Registration List.”

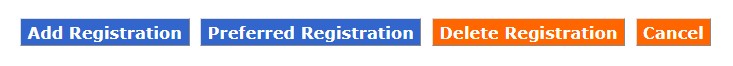

You’ll see a list of existing registrations in your account. Click on “Add Registration” to create a new one.

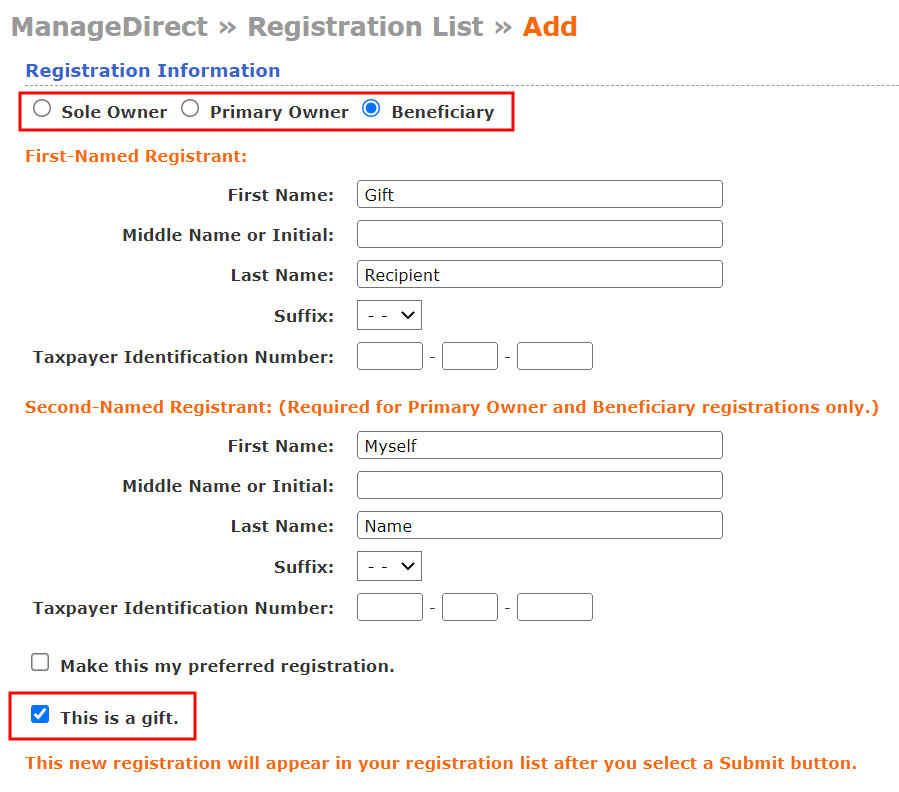

The radio buttons at the top show the registration types.

- Sole Owner means the gift recipient alone, without a second owner or a beneficiary.

- Primary Owner means the gift recipient with another person as the second owner.

- Beneficiary means the gift recipient with another person as the beneficiary.

If you choose Primary Owner or Beneficiary, enter the gift recipient as the First-Named Registrant and the second owner or the beneficiary as the Second-Named Registrant. You need the Social Security Number of both the gift recipient and the second owner or the beneficiary. You can’t name yourself as the second owner but you can name yourself as the beneficiary.

Make sure the spelling of the recipient’s name matches exactly what the recipient has or will have on their TreasuryDirect account. If the recipient has their full middle name on their account, you also include their full middle name. If the recipient only has their middle initial or no middle initial, you do the same in your gift registration. A mismatch between the names can cause a problem when you deliver the gift.

Check the box “This is a gift.” After you click on Submit, the new combination will be added to your list of registrations. You will use this registration when you buy the gift.

You only need to do this once per gift recipient.

Place Gift Order

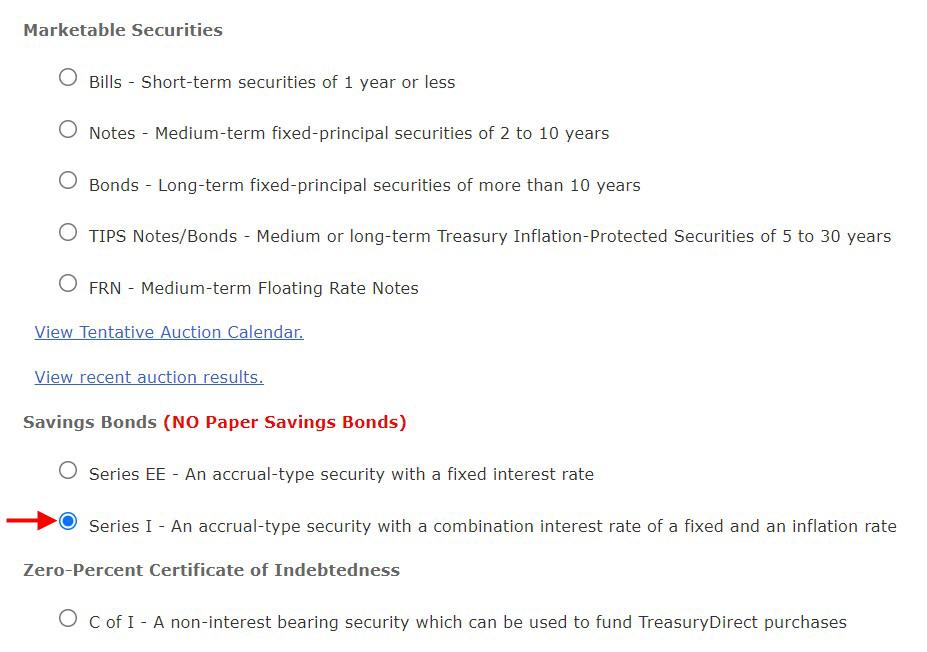

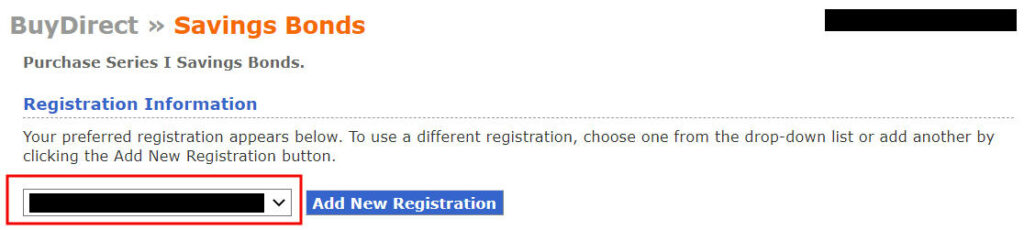

Now click on BuyDirect in the top menu.

Select “Series I.”

This is important. Use the dropdown to select the gift registration. The name of your gift recipient should appear first, for instance, “Gift Recipient POD My Name.”

Now enter the purchase amount and the rest of the information.

Pay attention to the registration information on the final purchase review page and make sure the purchase is for the intended gift recipient before you click on Submit.

Deliver Gift

See a walkthrough in Deliver I Bonds Bought as a Gift in TreasuryDirect. You need the gift recipient’s TreasuryDirect account number. If they don’t have a TreasuryDirect account, they need to open an account to receive the gift delivery even if they’re not buying any savings bonds on their own.

If the gift recipient is a minor, a parent needs to open a Minor Linked Account for the minor under the parent’s account (see Buy I Bonds in Your Children’s Names). The parent needs to open an account for themselves before they can open the account for the minor even if the parent isn’t buying any bonds.

Remember to check with the recipient how much they are planning to buy themselves this year because delivering gifts to them counts toward their annual purchase limit.

There’s no way to pre-schedule delivery for a future date. You’ll have to log in every time you’d like to deliver a gift. If you’re keeping undelivered gifts in your gift box, set calendar reminders for yourself and the recipient to make sure you don’t forget the undelivered gifts.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Sam says

Appreciate the replies and suggestions. Thanks

Dunmovin says

This is my second attempt to …

We’ve seen several posts on whether or not ibond purchase for nonspouses is a gift of present/future interest and when/if a gift tax return is required. Looking at IRS Form 709 under General Instructions at Joint Tenancy one sees, “If you buy a U.S. savings bond registered as payable to yourself or a donee, there is a gift to the donee when the donee cashes the bond without any obligation to account to you.” Ergo, that could be the answer to that ultimate Q. I could not locate any discussion of present/future interest in that context.

Sooo, buy multiple gift box ibonds for each donee if on death bed? How can one create “any obligation to account to you” (condition subsequent) to further extend the trigger time post-death?

What says you?

Harry?

Harry Sit says

Sorry I don’t understand what you’re asking. I probably don’t know the answer either. If I buy I Bonds as a gift for a non-spouse recipient, I keep it simple. I would buy them within the annual exclusion limit and deliver the bonds right away. They’ll have the bonds and take it from there. Nothing is ambiguous that way. If I’m dying, I won’t waste my precious last moments on buying I Bonds.

Arzel says

Spouse and I are buying I bonds as gifts for each other to be delivered in 2025. Could we also buy I bonds gifts for each other to be delivered in 2026? Can this all happen in the same tax year 2024?

Harry Sit says

There’s no limit in how much I Bonds you can buy as gifts in one year and hold in the gift box.

brian says

What are the potential risks to stockpiling say 10 years worth of ibonds in a giftbox for delivery to a spouse over the course of the following 10 years? I know one would be that the treasury could lower the limit to 5k per year (which they’ve done in the past) which would double the time it would take to transfer funds. Or the fixed rate could at some point in the the next 10 years be higher than it is now, which could throw off the schedule. But what other gotchyas might an investor face? It seems that with the giftbox option you’re in a little bit of a precarious position where its still your money…but not really in that you can’t access it. Is there a concern that at some point in the intervening years that the treasury could change the rules of the game that would in essence prevent you from accessing funds in the giftbox? Like for example, maybe they’d put a limit on how much you could transfer, or prohibit the use of a giftbox. Do you have any thoughts on this?

Harry Sit says

The government can always change the rules but I don’t see it as a major risk. The most obvious risk of putting a large amount in the gift box is that you wish you had done something else with the money. Think when the fixed rate first rose to 0.9%. It was great but now it’s 1.3%. TIPS yields were 2.5% a few months ago but you couldn’t take advantage of it if your money was locked up in the gift box.

asda says

Hi Harry

You are the resource for so many things but particularly I bonds! Thanks for all u do and the time to answer so many questions. My question relates to gifts, delivering and buying more with respect to order. If i have existing undelivered gift I bonds from previous year between spouse and me, and we plan to buy 10k more now for each close to the end of this month to avail of the higher fixed rate, does it matter whether I buy the new ones as gifts for another year and deliver the previous ones vs the other way around, namely holding off delivering the existing ones and buying these current higher rates into our accounts. The only difference I can see is as the new ones can anyway not be touched for a year may be better to buy them as gifts while the existing ones after delivery could be liquidated anytime (though with the 3 month penalty). Is there any other difference in these options. Thanks!

Abe says

So for those with trust accounts is there a loophole here to gift from one trust to another?

Wouldn’t think so as the actual SSN on these is still just the same (if personal trusts). That said given that Treasury allows the multiple trusts maybe they allow this as well for those willing to take this step?

Harry Sit says

A trust account can’t buy or receive gift bonds.

Dom Simon says

I’ve received an email from Treasury Direct to deliver gift ibonds I’m holding in the gift box to the recipient as soon as possible. I’ve read a lot on this in the Bogleheads forum and no one seems to have clarity on how this is supposed to be done. I’ve bought more than $10k in gift bonds this year for my spouse and he bought his own ibond this year, as did I. So we would be over the annual limit if we gifted ibonds to each other. Our plan was to gift them to each other over the next 4 years and not buy any in those years. But 4 years doesn’t seem to meet the definition of “as soon as possible”. What are your thoughts? Thank you.

Harry Sit says

TreasuryDirect has assured and encouraged people to empty their gift box. So just take them up on the offer. See more recent comments in Deliver I Bonds Bought as a Gift in TreasuryDirect.

Alan says

Thanks for the article. Does this mean that if I have already delivered $10,000 from the gift box to my spouse earlier this year that I can deliver another $10,000 this year?

Harry Sit says

Yes, because TreasuryDirect has encouraged everyone with undelivered gifts to deliver them now.

Marc says

So, today I received the following email from Treasury Direct:

Help Shape The Future of TreasuryDirect

Dear TreasuryDirect customer,

The US Treasury is building a new experience for customers to purchase, manage and gift government securities and is seeking input on the experiences from current customers. If you are interested in participating in research that will inform and improve the future of purchasing and gifting government securities, please take this brief survey via SurveyMonkey.

[survey link]

Details: 17 questions. Estimated time to complete: 10 minutes

Please note that the US Treasury has not provided any information to SurveyMonkey, and that you may simply ignore this invitation if you do not wish to participate.

Thank you for your interest in helping improve the design of our products for all the public. We look forward to hearing your feedback!

If you have questions about the validity of this e-mail, please visit https://www.treasurydirect.gov/indiv/research/email/

U.S. Treasury Services

—

Please do not reply to this e-mail, this mailbox is not monitored.

I verified the email was legitimate using the link provided:

https://www.treasurydirect.gov/indiv/research/email/

The entire survey is focused on the gifting process. The key TD comment in the survey was as follows:

Gift Delivery/Acceptance Window

In the future, there may be a window of time in which a gift bond must be delivered and accepted. If the gift is not accepted within that timeframe, the gift bond would become the property of the gift giver and can be redeemed or kept by the gift giver. The following questions are about gift delivery timeframe.

8. What are your thoughts on this approach for gifting?

The gifting loophole to boss the $20K purchase limit might be the target here.

Marc says

Sorry, the last sentence should read:

The gifting loophole to bypass the $10K purchase limit might be the target here.

Marc says

This has been discussed over at TIPSWATCH but I wanted to get your take on what you think will happen. Although there have been past government shutdowns, I don’t think the topic ever came up in your discussion of I Bonds (because in the past, it was an unlikely scenario). I wasn’t sure where to post this so I put it in this thread.

There is a real possibility that the government shutdown will last through the month of October and that there will be no mid-October CPI report for the month of September. If that happens, I wanted to get your take on what would happen before and after the November 1 I Bond rate change. In your opinion, will the current rate being carried over until the CPI report is finally released, will the new rate be delayed with no announcement and then paid retroactively (seems like a logistical nightmare TD is unlikely to be prepared for), will there be an alternate source for CPI data used to determine a new variable inflation rate, will I Bond purchases be shut down entirely on November 1, or is something else likely to happen?

Dunmovin says

Related Q is what are the actual terms and conditions associated with ibonds…is there a “in the event a new cpi is not publicized then TD will do….? Harry , any idea what the t&c are?

Thanks

Harry Sit says

They will announce a number regardless, either based on the actual, but slightly delayed, CPI report, or based on a number calculated in a different way.

“If the CPI-U for a particular month is not reported by the last day of the following month, we will announce an index number based on the last 12-month change in the CPI-U available. Any calculations of our payment obligations on the inflation-indexed savings bonds that rely on that month’s CPI-U will be based on the index number that we have announced.”

31 CFR Appendix-C-to-Part-359 1.(d)

Marc says

Thank you. I have a follow-up.

If they announce a calculated index number because the government remains shut down, would they still publish the September CPI Report retroactively after the government reopens? And if there is a discrepancy between the two, which is likely, how would they account for that moving forward?

Harry Sit says

They will still publish the September CPI report eventually because it’s also used for other things. The announced rate won’t be revised. If you happen to redeem during the cycle that uses the calculated CPI number, you’ll earn a bit more or a bit less. Otherwise it’ll be caught up when the calculated CPI number is used as the starting point of the next cycle.