Many people bought I Bonds as a gift and kept them for the future when I Bonds had a good interest rate last year. These bonds started earning the good rate while they were held in a “gift box.” They are eligible for delivery to the registered recipient now.

No Change in Terms

Delivering a gift bond moves the bond from one account to another. It doesn’t change the terms of the bond — how much interest the bond earns, when the bond can be cashed out, or when the early withdrawal penalty will stop. Those terms were set on the bond itself at the time it was originally purchased. The bond carries the same terms as it moves from one account to another. It doesn’t matter which account the bond resides in.

Limit Resets by Calendar Year

I Bonds received as gifts count against the recipient’s annual limit in the calendar year of receiving the delivery. Because the annual limit resets on January 1 each year, you can deliver a gift early in the year even though you bought it last October. You don’t have to wait 12 months.

Reason to Postpone

If the gift recipient wants to preserve the annual limit for their own purchase, they may want you to postpone the gift delivery but it doesn’t matter between spouses because you can always buy a new gift and hold it in the gift box again.

When you deliver the current gift and buy a new gift to replace it, the gift recipient has a bond and you have a bond in the gift box. If the gift recipient were to buy directly, the new bond has to wait 12 months before it can be cashed out, whereas the 12-month clock on the delivered gift bond already started last year.

Example: Suppose you bought one bond in your main account and another bond in your gift box for your spouse last year, and your spouse did the same. Your base plan is to repeat it this year — buy one bond in your main account and one for your spouse in the gift box. You’ll end up with two bonds in your main account and two bonds in your gift box.

Alternatively, you deliver the existing gift, receive a gift delivery, and buy two bonds for your spouse in the gift box. You’ll also end up with two bonds in your main account — one from last year, and one from receiving the gift delivery — and two bonds in your gift box. The difference is that the received gift delivery is eligible for cashing out sooner than the bond you would’ve bought directly.

Postponing delivery to preserve the annual limit makes sense only when you’re unwilling to buy a new gift.

Delivering the gift now clears the gift out of your gift box. It closes the loop. You will have one less thing hanging in the air. Unless you have a good reason to postpone, just deliver the gift and move on.

Full Delivery

The principal value of the received gift counts against the recipient’s annual limit. The interest earned doesn’t count against the limit. You can deliver a $10,000 bond in full to the recipient even though the bond is worth more than $10,000 at the time of delivery because it earned some interest.

To deliver the gift, log in to your TreasuryDirect account and click on Gift Box on the right in the menu at the top.

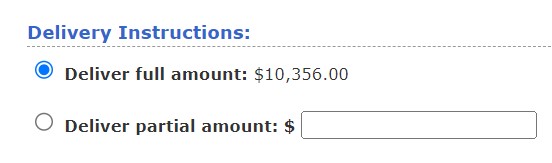

Go into the bond in the list and click on Deliver. Choose the option “Deliver full amount.”

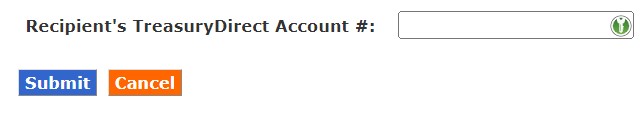

You need the recipient’s TreasuryDirect account number. The name on their TreasuryDirect account and the name on your gift must match exactly including the use of the middle initial versus the full middle name.

Edit Registration

The gift bond moves into the recipient’s account as soon as you click on Submit to deliver the gift.

The rightful owner of the gift takes full control of it now. If you made yourself the beneficiary when you bought the gift, the owner can edit the registration to make you the second owner and grant you the transact rights now. Or they can put a different second owner or beneficiary on the bond. See How to Add a Joint Owner or Change Beneficiary on I Bonds and How To Grant Transact or View Right on Your I Bonds.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Brad says

> Reason to Postpone

> If the gift recipient wants to preserve the annual limit for their own purchase, they may want you to postpone the gift delivery but it doesn’t matter between spouses because you can always buy a new gift and hold it in the gift box again.

—

I don’t understand your statement that “it doesn’t matter between spouses” because if I bought $10k last year for myself and a $10k gift for my spouse (as yet undelivered), and she also bought $10k for herself and a $10k gift for me last year, and we both plan to do the same this year, then it very much matters to us as married spouses. In order to do that again this year, we will want to defer transferring last year’s (and this year’s) gifts until a later year when we no longer want to purchase I bonds, correct? If this isn’t correct, I’d love a more in-depth explanation as to why. Thanks Harry!

Harry Sit says

I added an example in that section.

Kevin says

I have the same confusion Brad. I thought that the first year was the only year my spouse and I could buy a $10k bond for our both own accounts and our gift boxes ($40k total). Then in each year after that, we’d both transfer the gift to each other and replenish the gift boxes with new $10k bonds ($20k total). If we continued to purchase our own bonds after the first year, we’d have to postpone the gift transfers to a future year.

shawn says

I think what’s he saying is you’re not repeating the 4 buys. You’re only going to get 2.

this:

If the gift recipient wants to preserve the annual limit for their own purchase, they may want you to postpone the gift delivery but it doesn’t matter between spouses because you can always buy a new gift and hold it in the gift box again

means: spouse wants to still buy , it doesn’t matter because you can still gift them (essentially doing the same as buying since it’s between spouses).

Holding delivery you could do the 4 again which may make sense this year but ultimately next year you’ll have two in the gift box which can only be delivered 1 at a time, so if ibond return is low, and other choices better you could potentially have an opportunity cost there

iirc…

Marc says

Thank you for covering this topic, and in particular, for the advice about why one would postpone gift delivery. The section “Limit Resets by Calendar Year,” you are referring to the annual purchase limit. I have two questions that are related to whether there is a recipient limit. Specifically…

1) Can one spouse deliver multiple $10,000 I Bonds from the Gift Box to the other spouse in the same calendar year?

2) Can two non-spouse relatives deliver multiple $10,000 I Bonds to the same relative in the same calendar year?

John Endicott says

the answer to both questions is no. You have a 10k limit for the year. Whether you buy 10k yourself of other people gift you 10k, the limit remains 10k. So, in either case, only one 10k deliver will be successful for the calendar year (or none will, if you already purchased 10k for yourself).

BerkeleyGirl says

Spouse and I each purchased $50k in Ibonds for the other last summer when rates were high. We delivered all the bonds to each other in January of this year. The TD system did not cap our gift delivery.

John Endicott says

BerkleyGirl, interesting. While the website might not be smart enough to catch what you did, I suspect somewhere down the line that TD will eventually discover it and undo the gifting above 10k. Please post a follow-up letting us know when/if that happens.

Phillis says

I just delivered 2 10k gifts to my husband. both delivered successfully.

Marc says

Phyllis, it went through because it’s not the system that prevents you from doing it, but the rules do.

Here’s an equivalent example. I went through a red light today, did t get a ticket, and still arrived safely at my destination. It may have worked out okay for now, but it was still a violation and I might get ticket from a red light camera in the mail later.

In other words, you got away with something you’re not supposed to do for now. Maybe it doesn’t get discovered, or maybe TD catches it later and undoes the transaction.

Marc says

I have yet to redeem an I Bond, but I have a somewhat related question about redemption that I don’t recall having come up before. If you redeem an I Bond within five years of the issue date, you forfeit the last three months of interest which your I Bond earned but TD doesn’t show you online (for a somewhat confusing yet sensible reason). This begs the question — Is all the interest federally taxable including the last three months you earned but never received because it was forfeited as a penalty, or is the penalty subtracted before the taxable interest earned is declared since that’s the net interest you actually receive? I realize we’re not talking about a lot of money here, but I’m curious.

Harry Sit says

You only pay tax on the net interest you actually receive.

Marc says

My daughter recently purchased a $5K I Bond and asked that I delver $5K of a $10K GiftI Bond I bought for her last year to max out her limit for this year. I had never delivered a partial I Bond before and didn’t think it through throughly enough so I simply delivered the $5K. It was only afterward that I realized I should’ve delivered $5K in principal. So I made a second small delivery covering the interest to get the full $5K in principal to her account. Even though nothing was lost by accidentally doing it this way, it’s not ideal to have an I Bond in her account with such a small value. Is there a way for her to combine the second gift delivery with the first so she doesn’t have to keep such a small amount separate? And even though you emphasized in the full delivery section in bold that the principal is what applies to the limit, does it make sense to add a partial gift delivery section about this to the article so others don’t make the same mistake I did?

Harry Sit says

I know of no way to combine two bonds of the same issue date into one. Other than how they’re displayed in the account, having separate entries doesn’t affect anything. The bonds still earn the same rate, which is the most important. If it really bothers her, she can cash out the small bond first when the need arises. Now that the fixed rate has gone up, bonds bought last year are good candidates for getting cashed out soon.

Marc says

Thanks, I didn’t think there was a way to combine the two, but it would’ve been a useful option to have even if keeping them separate doesn’t affect the interest. I definitely think the partial delivery process needs some more attention. Perhaps it’s not the norm, but the fact that you have to take the interest into account if you want to reach the annual principal limit with a partial delivery is definitely not intuitive. Live and learn…

Dunmovin says

Harry, lot of chatter this week on one of the Bogle forums on IBonds by individuals that have gift box IBonds that are not delivered being instructed by TD to deliver them asap with no mention of the annual cap on deliveries to a person. (a form of that email is on the TD site) Have you heard anything? I have several in my gift box for future year delivery (as does spouse) and have not received an email. Perhaps TD is planning on changes to the gift box??? Thoughts?

Marc says

[TreasuryDirect sent an email to remind customers with undelivered gift bonds that they should deliver their gifts.]

https://treasurydirect.gov/indiv/research/email-gifts/

Harry Sit says

TreasuryDirect doesn’t know who’s your spouse or whether you already have a plan. It’s nice of them to remind people not to forget the delivery step.

Dunmovin says

Let’s try again…sorry I wasn’t clear(er). The recipient parties have already received the max permitted (recipient has max’d out) for the year, yet receive a TD email saying it is time asap to make deliveries from gift box, i.e from the gift box where there are future deliveries planned yet for the current year the max. in deliveries have been made. See https://treasurydirect.gov/indiv/research/email-gifts/ There is the form letter…what’s happening???

Thanks!

Harry Sit says

Don’t overanalyze. TreasuryDirect wants to make sure people don’t forget to deliver the gifts. You didn’t forget. Then you’re good. Maybe they’re tired of answering calls from people saying “My aunt told me she bought a gift for me last year. I want to cash out now but I don’t see it in my account.” It would require too much work for them to cross-check each gift in your gift box to see whether the designated recipient has reached the purchase limit.

WillP says

The gift box delivery limit system appears flawed.

What would happen for example if you had 3 different relatives all gift and deliver to you the same year? Each relative has no idea another person already gifted you the annual limit.

Harry Sit says

I think gift deliveries from 3 different people are acceptable.

https://thefinancebuff.com/buy-i-bonds-as-gift.html/comment-page-1#comment-29537

Jake says

I have a question about Gift Box purchases of iBonds in the context of this email sent by Treasury Direct in October 2024:

Dear TreasuryDirect Customer,

We noticed that you still have undelivered gift bonds in your gift box. Please deliver those gifts to the recipient’s account as soon as possible. If your gift recipient does not have a TreasuryDirect account, remind them to set one up so you can deliver your gift.

For instructions on how to deliver a gift, please watch this short video.

Information on how to deliver a gift and setting up a minor account can also be found in our FAQs.

If you have questions about the validity of this e-mail, please visit https://treasurydirect.gov/indiv/research/email-gifts.

Thank you,

TreasuryDirect Customer Support

******

My question is: If the intended recipient of GiftBox iBonds already purchased his/her $10,000 allocation of iBonds for this year (2024), can I deliver previously purchased GiftBox iBonds to this person in 2024? Should we interpret Treasury Direct’s directive as allowing immediate delivery of GiftBox purchases to a person who already purchased his/her $10,000 allocation of iBonds?

Thank you.

Harry Sit says

TreasuryDirect doesn’t expect you to know whether the gift recipient has already purchased the maximum this year. That’s their privacy. I don’t think it’ll be a problem if you deliver up to $10,000 in principal.

Ustaad says

Lately, there is a lot of buzz around the issue of some ibond investors receiving email from TreasuryDirect folks to deliver gifts as soon as possible. There is a lot of speculation that TD is going to do away with the Gifting option. I have not received a formal email from TD as yet. What are my options? Is it wise to a) just do nothing or b) to buy more ibonds as gifts right now to lock in the fixed rate of 1.3% and then turn around and deliver the gifts by whatever deadline date is set by the TD?

Harry Sit says

It sounds like TreasuryDirect wants everyone to empty their gift box. If you have existing bonds in the gift box, go ahead and deliver them. I wouldn’t go as far as buying new bonds as gifts and turning around to deliver them but that’s up to you.

Dunmovin says

If I can deliver from the box I will buy for the box…that is what I’m doing. Contacts at Treasury confirm changes coming and this current endeavor by them is part of that process

Marc says

Harry, I noticed you’ve gone from “this is only a helpful reminder letter” to “TD wants everyone to empty their gift I boxes.” I have gifts in my gift box but have not received a letter but it sounds like the “sending out in waves” explanation fits. The bigger picture is a little more difficult to decipher.

TD is making an odd but noticeable tonal shift by taking this route. They are not saying you have to empty your gift box but encouraging you to do so now. There’s speculation of rule changes to come like the elimination of the gift box or higher limits in purchases, but to me it seems like the first step of a major website overhaul which is not yet imminent but in the planning stage. I’m in this field and many times a website migration to a new platform omits certain functionality and you just have to start over from scratch. I have no inside information but an inability to migrate the gift box to a new website platform to come would explain what’s going on.

Harry Sit says

Multiple people reported getting assurance and tacit encouragement to empty their gift box when they called TreasuryDirect. The bonds in the gift box only have a name and a Social Security Number attached. They don’t have the recipient’s account number (the recipient isn’t required to have an account at the time of purchase). It’ll be difficult for TreasuryDirect to force the gifts out of the gift box. The best way to avoid migrating the gift box would be to have the customers deliver the gift bonds to the right accounts themselves.

Dunmovin says

TD will assign an account number…simple and very straightforward…if declined by …then you forfeit. Very simple Watson!

Dunmovin says

Watson says, Harry why not undertake what I saw on a recent Bugle site: “Why hasn’t one of our leaders sent a compliant/inquiry to the Treasury IG Offices on all this foolishness at TD? Is it “public be damn” when some receive an ambiguous email, the text of which is “meaningless,” posted on the TD website for ALL, no clear telephonic inquiries being answered, no APA compliance for “things coming down the pipeline,” etc. One will clearly complain later if things come out in an adverse way! Why wait, beat the rush! The IG would luv to clean out TD and eliminate all their excuses for….” Why not call them Harry???

Anonymous says

“The principal value of the received gift counts against the recipient’s annual limit. The interest earned doesn’t count against the limit.”

In the Code of Federal Regulations, I don’t see any mention about the interest not counting against the limit.

Given that there is an option to “deliver [a] partial amount”, shouldn’t one instead only deliver $10,000 per year?