My previous posts covered buying I Bonds with your tax refund, buying I Bonds in a trust, buying I Bonds in your kid’s name, and buying I Bonds for your business. Let’s look at another way to buy I Bonds this time: buying them as a gift. For background on I Bonds in general, please read How To Buy I Bonds.

Gift Box and Delivery

You buy I Bonds as a gift in two stages: buying and delivering.

You must give the recipient’s name and Social Security Number when you buy a gift. The recipient doesn’t need to have a TreasuryDirect account at this time. Only a personal account can buy or receive gifts. A trust or a business can neither buy a gift nor receive a gift.

The bonds you buy as a gift go into a “gift box.” You can’t cash out the bonds stored in your gift box. This is analogous to you going to a store and bringing back the gift to your closet. The gift already has the recipient’s name permanently etched on it. You can’t steal the gift for yourself.

The recipient doesn’t know you bought a gift for them until you deliver the gift to them. This is analogous to bringing the gift from your closet when you visit family. The recipient must have a TreasuryDirect account now to receive the delivery. You’ll need the recipient’s account number to deliver a gift.

I Bonds stored in your gift box are in limbo. You can’t cash them out because they’re not yours. The recipient can’t cash them out either because the bonds aren’t in their account yet.

There’s a minimum wait of five business days between buying and delivering to make sure your bank debit clears. There’s no maximum stay in the gift box. You can pre-purchase gifts and wait to deliver them at a much later time. You can also choose to deliver gifts in bits and pieces as opposed to in one lump sum.

Purchase Limit

The principal amount of delivered gifts counts toward the $10,000 annual purchase limit of the recipient in the year of delivery. You can still buy gifts for others even if you already bought the maximum this year for yourself.

You can buy a maximum of $10,000 for any recipient in one purchase but there’s no limit on how many recipients you buy for or how many times you can buy for the same recipient in any calendar year. If you’d like, you can buy $10,000 worth of I Bonds for each of your 20 family members or you can make five separate purchases of $10,000 each for the same family member, all in the same calendar year.

If the recipient already received $10,000 in principal amount as gifts this year, buying additional I Bonds on their own will put them over their annual purchase limit. They’ll have to wait until they’re not receiving the maximum gifts.

Interest and Holding Period

Interest and the holding period start in the month of your purchase. If you pre-purchase gifts and wait to deliver them to the recipient at a later time, you still lock in the same fixed rate and inflation rate as other bonds bought in the same month. Interest earned while the gift savings bonds wait in the gift box belongs to the recipient. It’s exempt from state and local income tax.

The holding period for cashing out also starts right away. If five months have passed between the time of purchase and the time of delivery, the recipient only has to wait another seven months before they can cash out, as opposed to the full 12 months for freshly purchased bonds.

Gift to Kids

It’s not necessary to buy as gifts for your own kids under 18 unless you’re pre-purchasing for future years. As a parent, you can open a minor linked account in your account and buy directly in your kid’s name. See the previous post Buy I Bonds in Your Kid’s Name.

Buying I Bonds as a gift works when you buy for a grandchild or a niece or a nephew under 18. You only need the child’s name and Social Security Number when you buy the gift but you’ll need the child’s TreasuryDirect account number before you can deliver the gift. The child’s parent needs to have an account for themselves first and then open a minor linked account for the child under the parent’s account.

When Gifts Are Useful and When They Are Not

If you’re thinking of “borrowing” other people’s names and Social Security Numbers to buy more I Bonds as gifts but keep the bonds for yourself, it doesn’t work. Only the named recipient can cash out the bonds. If you don’t deliver them, the bonds stay in your gift box, and neither you nor the specified recipient can cash them out. After you deliver the gift bonds, it’s the recipient’s money, and they can do whatever they want with the bonds.

If you’re thinking of letting others buy I Bonds as gifts for you to double up the $10,000 annual purchase limit, it doesn’t quite work either. Gifts delivered to you count toward your annual purchase limit. If you receive the maximum in gift bonds for the year, buying additional bonds in the same calendar year will put you over the limit.

Buying I Bonds as a gift works when you want a family member to have some I Bonds but they don’t have spare cash. It works the same as giving them money and letting them buy themselves.

Pre-Purchase/Frontload

It also works to a limited extent if you think the high interest rates on I Bonds are only temporary. You can buy a gift for your spouse and hold it in your gift box. Have your spouse do the same for you. Wait to deliver the gift to each other in a future year. The older gift bonds will have earned the high interest rates in the years past and they have aged enough for immediate cashout.

We’re buying each other a gift this year to keep undelivered in the gift box in addition to our normal purchases. If the interest rate is still good next year, we’ll deliver the gift and buy a new gift in the gift box. If the interest rate isn’t good anymore, we’ll skip the purchase, deliver the gift, and cash out immediately.

Don’t Forget About Undelivered Gifts

As with physical gifts, most gifts are purchased and delivered in short order. If you hold gifts in your closet for a long time, you may forget that you bought the gifts in the first place. If you’re intentionally pre-purchasing gifts to take advantage of temporarily high interest rates, tell the recipient you’re holding a gift. Set recurring calendar reminders to tell yourself and the recipient you still have undelivered gifts in the gift box.

Remember that gifts are in limbo until they’re delivered.

Unexpected Death

You can include a second owner or a beneficiary for the I Bonds you buy as a gift. If the gift recipient dies before you deliver the gift, the designated second owner or beneficiary will inherit your gift. You can’t name yourself as the second owner of the gift but you can name yourself as the beneficiary of the gift. The recipient can change the second owner or the beneficiary after you deliver the gift. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

If you die before you deliver the gift, the gift still belongs to the recipient. Whoever handles your affairs after your death should notify the recipient that you had an undelivered gift for them. Then the recipient can claim it through TreasuryDirect. Again, it’s important that you tell someone about the gift if you’re going to hold it undelivered. If no one knows you bought a gift, the gift will be in limbo.

Gift Tax Form 709

There’s no tax for receiving gifts. Gift tax is on the gift-giver.

Buying I Bonds as a gift counts as a completed gift in the year of the purchase (not the year of the delivery). There’s no limit on how much you can give as gifts to your spouse (unless the spouse isn’t a United States citizen). Each person has an annual gift tax exclusion amount for “present interest” gifts to each non-spouse recipient, which is 16,000 in 2022 and $17,000 in 2023. If the total “present interest” gifts (in I Bonds and other forms) during the year from one specific giver to one specific non-spouse recipient go above this annual gift tax exclusion amount, you’re required to file a gift tax return on IRS Form 709.

The gift tax annual exclusion amount for gifts to a non-spouse recipient is $0 for “future interest” gifts. You’re always required to file a gift tax return when you give “future interest” gifts to anyone except your spouse. It’s not clear to me whether the I Bonds you buy this year as a gift but hold for delivery in a future year count as a “present interest” gift or a “future interest” gift. To avoid ambiguity in determining whether it’s a “present interest” gift or a “future interest” gift, only give gifts to your spouse or deliver all gifts to non-spouse recipients within the same calendar year.

Unless you’re also giving the same non-spouse recipient gifts in other ways, buying and delivering $10,000 worth of I Bonds as a gift in the same calendar year falls below the annual gift tax exclusion amount, which doesn’t trigger the requirement to file the gift tax return.

If you’re required to file a gift tax return, it’s separate from the federal income tax return. The gift tax return goes to a special address. The typical consumer-grade tax software packages such as TurboTax and H&R Block software don’t support filling out a gift tax return. You’ll have to go to a tax professional or fill out the gift tax return on your own.

Having to file a gift tax return on Form 709 doesn’t mean you’ll pay gift tax out of pocket. Most people just use up part of their lifetime estate and gift tax exemption amount, which is more than $12 million in 2022. However, after you file the gift tax return once, you’ll have to keep track of how much of your lifetime estate and gift tax exemption amount you already used. See IRS Instructions for Form 709 if you decide to give gifts that will require a gift tax return.

Avoid Mistakes

Although TreasuryDirect has an official video walkthrough for how to buy a gift, it’s very easy to make a mistake if you follow the video when you’re buying a gift for the first time. I read many reports from people intending to buy a gift but ending up buying bonds for themselves.

It’s easier if you follow these steps when you’re buying a gift for the first time.

Add Registration

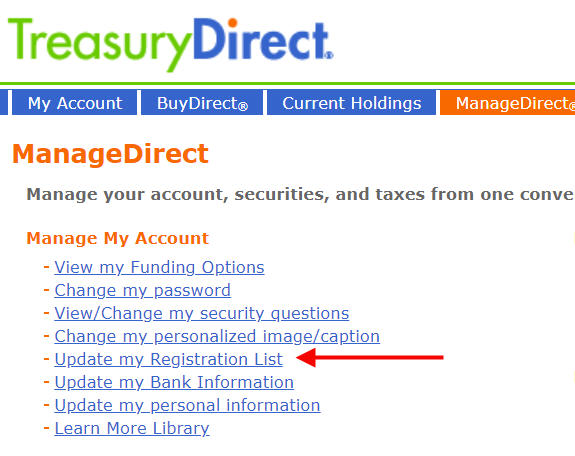

Click on ManageDirect in the top menu. Then click on the link “Update my Registration List.”

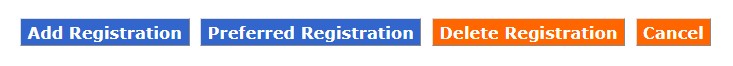

You’ll see a list of existing registrations in your account. Click on “Add Registration” to create a new one.

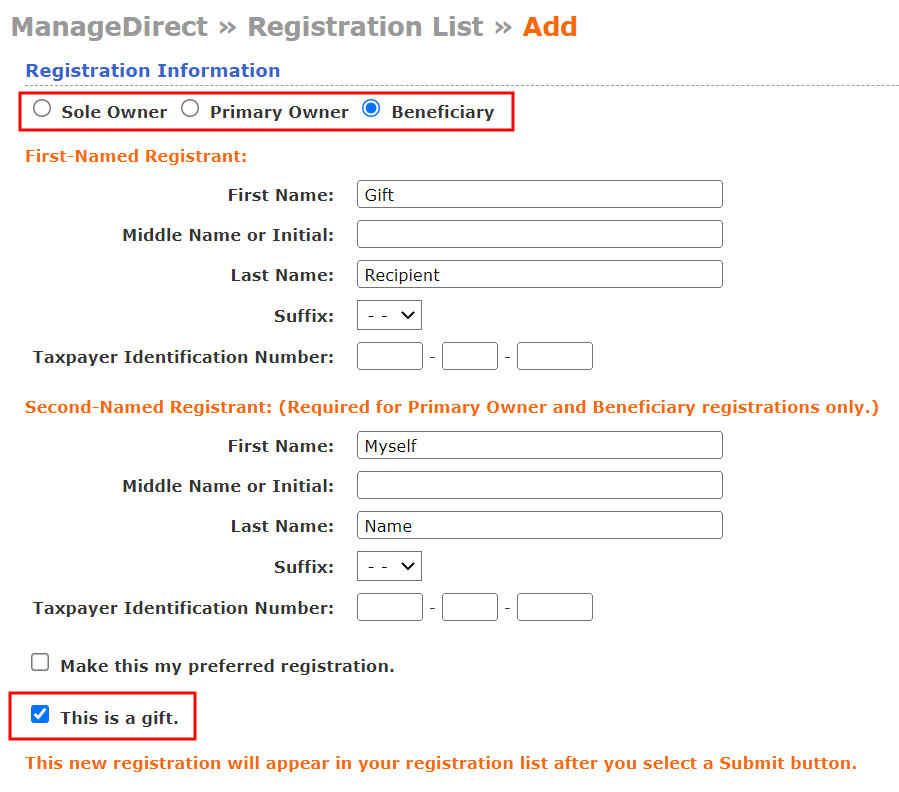

The radio buttons at the top show the registration types.

- Sole Owner means the gift recipient alone, without a second owner or a beneficiary.

- Primary Owner means the gift recipient with another person as the second owner.

- Beneficiary means the gift recipient with another person as the beneficiary.

If you choose Primary Owner or Beneficiary, enter the gift recipient as the First-Named Registrant and the second owner or the beneficiary as the Second-Named Registrant. You need the Social Security Number of both the gift recipient and the second owner or the beneficiary. You can’t name yourself as the second owner but you can name yourself as the beneficiary.

Make sure the spelling of the recipient’s name matches exactly what the recipient has or will have on their TreasuryDirect account. If the recipient has their full middle name on their account, you also include their full middle name. If the recipient only has their middle initial or no middle initial, you do the same in your gift registration. A mismatch between the names can cause a problem when you deliver the gift.

Check the box “This is a gift.” After you click on Submit, the new combination will be added to your list of registrations. You will use this registration when you buy the gift.

You only need to do this once per gift recipient.

Place Gift Order

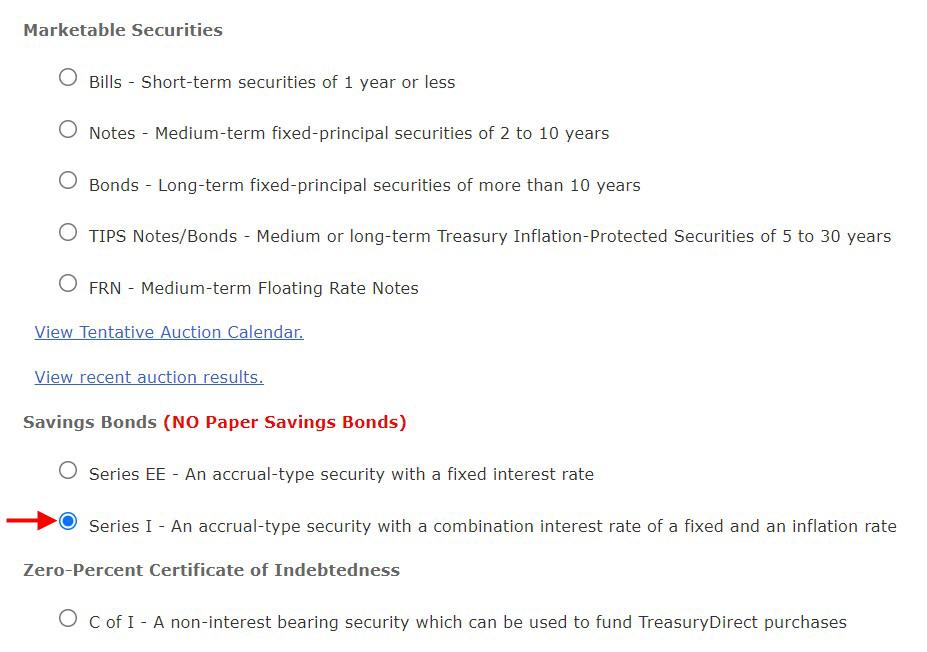

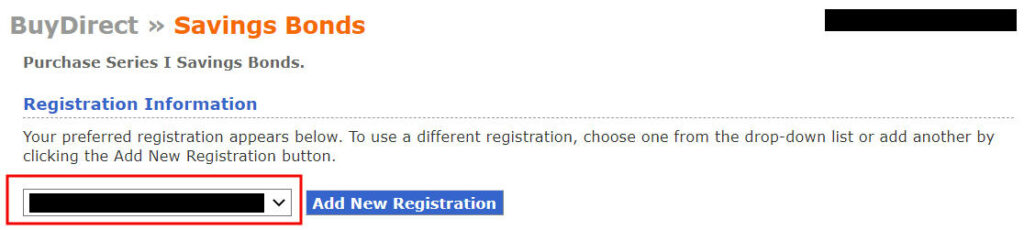

Now click on BuyDirect in the top menu.

Select “Series I.”

This is important. Use the dropdown to select the gift registration. The name of your gift recipient should appear first, for instance, “Gift Recipient POD My Name.”

Now enter the purchase amount and the rest of the information.

Pay attention to the registration information on the final purchase review page and make sure the purchase is for the intended gift recipient before you click on Submit.

Deliver Gift

See a walkthrough in Deliver I Bonds Bought as a Gift in TreasuryDirect. You need the gift recipient’s TreasuryDirect account number. If they don’t have a TreasuryDirect account, they need to open an account to receive the gift delivery even if they’re not buying any savings bonds on their own.

If the gift recipient is a minor, a parent needs to open a Minor Linked Account for the minor under the parent’s account (see Buy I Bonds in Your Children’s Names). The parent needs to open an account for themselves before they can open the account for the minor even if the parent isn’t buying any bonds.

Remember to check with the recipient how much they are planning to buy themselves this year because delivering gifts to them counts toward their annual purchase limit.

There’s no way to pre-schedule delivery for a future date. You’ll have to log in every time you’d like to deliver a gift. If you’re keeping undelivered gifts in your gift box, set calendar reminders for yourself and the recipient to make sure you don’t forget the undelivered gifts.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Dan A says

Just keeps getting better! I learned about I bonds from you, and now you published this little bonus factoid, allowing us to do another $20K:

“You can buy a gift for your spouse and hold it in your gift box. Have your spouse do the same for you. Wait until interest rates drop and the two of you don’t buy I Bonds anymore. Then you can deliver the gift to each other. The older gift bonds earned the high interest rates in the years past and they have aged enough for immediate cashout.”

Thank you.

Paul Stifel says

If you buy $10K in I-Bonds as a gift, but don’t deliver it for a year, the bond will be worth more than $10K at delivery. Will that put the recipient over their limit, or is the limit based on the original face value of the bond?

Harry Sit says

Based on the original face value.

Steve says

What happens if you die or become mentally incompetent and forget to give them, ever. Seems like they could die never knowing there is a pile of money waiting for them.

Obviously, it can’t be a surprise gift.

Harry Sit says

That’s a risk. I’ll add a section on not forgetting about undelivered gifts.

Daniel M. says

What about tax consequences of doing this — for the giver and the recipient?

I am thinking of buying $10K as a favor for a family member since I am more “computer literate,” with them paying me the $10K later.

Harry Sit says

Taxes on I Bonds work the same as you giving them $10k and having them buy themselves. They’ll pay tax on the interest when they cash out. $10k is below the annual gift tax exemption amount (unless you also gave the same family member other gifts in the same year). No gift tax forms are required for either the giver or the recipient.

If your $10k is really a loan you’re supposed to pay tax on a minimum interest rate for intra-family loans (and forgive the interest as a gift if you’d like).

Harry Sit says

Yes, assuming you haven’t gifted more than $14,000 to them in other ways.

Dave Cherne says

What happens to the I bond if your intended recipient dies before you can gift them the I bond?

Harry Sit says

As in the bonds you buy for yourself, you can designate a second owner or a beneficiary on the gift bond. The second owner or the beneficiary gets it if the gift recipient dies. The gift recipient can change the second owner or the beneficiary after you deliver the bond.

Micaela says

What happens to the I bonds if you die before you can deliver them?

Harry Sit says

The recipient claims them through TreasuryDirect? The undelivered gifts still belong to the recipient.

Donald says

I searched T.D. site for claiming undelivered gifts from the deceased giver, but found nothing. How would one do that?

HueyLD says

Per 31 CFR § 363.96(e):

“If the purchaser dies before delivering a gift bond to the recipient, the bond belongs to the owner named on the gift bond, notwithstanding any testamentary attempts to the contrary by the purchaser, or any state law to the contrary. We will hold the bond until we receive instructions from the owner named on the gift bond.”

So, the person named on the gift bond should call TD.

Hester says

Is buying I Bonds or delivering I Bonds considered a gift to the recipient? If I buy $50,000 for someone this year and deliver $10,000 to him each year over the next 5 years, do I need to file a gift tax return?

Harry Sit says

As soon as you buy, the recipient’s name and Social Security Number are attached to the bond, which can’t be changed. Interest will start accruing to the recipient at that point. I consider that as a gift. Because $50,000 is greater than the $16,000 annual gift tax exclusion amount, I will file a gift tax return.

Mr. Smith says

No, as you can only deliver 1 gift to him each year. Until it’s delivered he has not taken possession of the gift. In the same way, I could put $30,000 into an envelop and write my son’s name on the envelope, but I don’t have to do any gift tax return until I actually deliver the gift to him, it can sit in my dresser drawer for a decade and still no gift tax return.

Mark L says

Can I buy 30k in gift I bonds for myself, saving myself the trouble of finding someone to buy them for me or will that be considered a violation of the 10k per year limit? I don’t know if I can deliver them to myself over the next years.

Harry Sit says

I haven’t tried but I don’t think you can buy a gift for yourself.

Mark L says

Harry, you’re correct. When I attempted it, I got the following error message “You may not list yourself as the first-named registrant for this security and designate it as a gift.”

Martin Anderson says

I spoke with several Treasury Direct representatives who all told me that your statements regarding the $10k limit applying in the year of delivery are not correct. The limits apply in the year of purchase, not the year of delivery.

So, if you purchase $10,000 in I-bonds in 2015 as a gift for your child, and another $10,000 of I-bonds as a gift for the same child in 2016, you can deliver all $20,000 to your child in 2022. And those gifts DO NOT COUNT against your child’s limits in 2022. They counted against your child’s limits in 2015 and 2016, when you bought them.

There seems to be some ambiguity about this on TD’s web-site. On this page:

https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds_ibuy.htm

It says:

How much in I bonds can I buy as gifts?

The purchase amount of a gift bond counts toward the annual limit of the recipient, not the giver. So, in a calendar year, you can buy up to $10,000 in electronic bonds and up to $5,000 in paper bonds for each person you buy for.

But, on this page:

https://www.treasurydirect.gov/indiv/research/faq/annualpurchaselimitchangeqa.htm#gifts

It says:

Do bonds I’ve bought as gifts through TreasuryDirect but have not yet delivered to the gift recipient apply against my annual limit?

No. Gift bonds are purchased in the name and SSN of the gift recipient. They do not count against your annual limit even if you have purchased them through your TreasuryDirect account but have not yet delivered them. Gift purchases in TreasuryDirect count toward the annual limit of the recipient in the year they are delivered.

It appears that the “No” answer and the first sentence is correct, but the second sentence is incorrect, at least according to the other Treasury Direct web-site that I quoted above and the multiple agents that I have spoken with.

Harry Sit says

You can choose to believe either the representatives or the Federal Regulations 31 CFR 363.52(b):

Ҥ 363.52 What is the principal amount of book-entry Series EE and Series I savings bonds that I may acquire in one year?

(a) The principal amount of book-entry savings bonds that you may acquire in any calendar year is limited to $10,000 for Series EE savings bonds and $10,000 for Series I savings bonds.

(b) Bonds purchased or transferred as gifts will be included in the computation of this limit for the account of the recipient for the year in which the bonds are delivered to the recipient.”

https://www.ecfr.gov/current/title-31/subtitle-B/chapter-II/subchapter-A/part-363/subpart-C/subject-group-ECFR40621f7738442c1/section-363.52

Martin Anderson says

This may turn on what the regulations define as “delivered to the recipient.” The meaning of “delivered to the recipient” in the Treasury Regulations may be different than the meaning used in TreasuryDirect.com’s “gift box.”

In legal parlance, “delivery” generally refers to receipt of title. So, when you purchase a security as a gift for someone and use the registration in their name, they bonds may be “delivered” for the purpose of the Treasury Regulations at the time you click “submit.” Delivering them from your account to their account may also use the word “delivery,” but may not be what the Treasury Regulations are referring to.

Harry Sit says

Federal Regulations thought of that already.

“Delivery means moving a minimum amount of $25 (consisting of principal and proportionate interest) of a security held as a gift from the account of the purchaser to the account of the recipient.”

https://www.ecfr.gov/current/title-31/subtitle-B/chapter-II/subchapter-A/part-363#p-363.6(Delivery)

Michelle says

Can you can put the saving bonds when you are still holding it?

Keith says

This is from CFR 363 cut and pasted from their website current as of 20 Sep 2022. It sounds like Martin was transferring a bond as a gift and not purchasing a bond as a gift and then delivering it. I think Harry’s way is correct for purchasing a gift and Martin’s way works for transferring a bond as a gift (there is a subtle difference).

§ 363.26 What is a transfer?

(a) A transfer is a transaction to:

(1) Move a Treasury security, or a portion of a Treasury security, from one account to another within TreasuryDirect ®;

(2) Move a marketable Treasury security to or from a TreasuryDirect account and an account in the commercial book-entry system;

(3) Move a marketable Treasury security to a TreasuryDirect account from a Legacy Treasury Direct® account.

(b) Transfers of a specific type of security may be limited by the subparts that refer to that security.

(c) Gift delivery is not a transfer. A transfer does not include delivery of a gift savings bond from the donor to the recipient. This is referred to as a delivery.

[67 FR 64286, Oct. 17, 2002, as amended at 70 FR 57443, Sept. 30, 2005; 76 FR 18064, Apr. 1, 2011]

Martin Anderson says

“Delivered” and “delivery” are two different words. They sound similar, and even use many of the same letters, but they do not necessarily have the same meaning.

Martin Anderson says

If your interpretation is right then:

1. Bonds purchased as gifts count against recipient’s limit TWICE. Once in the year purchased and again in the year transferred (if different than the year purchased). So, if I buy a $10k I-bond for my child in 2015, it counts against his limit in that year, and he cannot purchase any I-bonds of his own in 2015. If I then “deliver” the bond from my gift box to my child’s account in 2022, it counts against his limit a second time, and he again cannot purchase any I-bonds. $20,000 of his limit has been used over two separate years, but he has only recieved $10,000 in I-bonds.

2. Bonds that have accrued interest and have exceeded the $10,000 annual limit cannot be transferred at all (or not all at once). For example, if I purchase a $10k I-bond as a gift for my child in 2015, and by 2022, it has earned $500 in interest, then it’s value is now $10,500. If there is a $10,000 limit on transferred I-bonds, I cannot transfer this I-bond to my child, or at least, I can’t transfer all of it in one year. I’d have to transfer $10k this year (if my child hasn’t already bought I-bonds for himself), and then transfer the remaining $500 next year.

Neither of these seem like they should be correct.

Have you spoken with anyone at Treasury to verify your interpretation? If so, can you supply me with their contact information?

Harry Sit says

You’re grasping at straws. Now explain this:

Ҥ 363.96 What do I need to know if I initially purchase a bond as a gift?

… …

(d) You may deliver the bond upon purchase, or you may hold the bond in your TreasuryDirect ® account until you are ready to deliver the bond to the owner named on the gift bond.”

https://www.ecfr.gov/current/title-31/subtitle-B/chapter-II/subchapter-A/part-363#p-363.96(d)

Purchase and deliver are two separate events. Now read 363.52(b) again.

The regulations only say the gift counts toward the recipient’s limit in the year of the delivery, not both in the year of the purchase and in the year of the delivery. The regulations are also clear in that only the principal amount is counted toward the $10,000 limit (see 363.52(a)).

When a reply from customer service conflicts with federal regulations, I choose to go with the regulations. As I said up front, you can make a different choice.

Martin Anderson says

Here’s the official response I received from Treasury to my email asking whether the date of purchase or date of gift box delivery controls the application of $10,000 limits:

————————————–

Hi Martin,

The purchase limit is per year. It will not matter if you deliver both bonds to the gift recipient in the same year. As you stated, they were purchased in different years. There will be no issues with the limits.

Treasury Services

Sasha says

Let me start by saying I an Not an expert of any kind. But I think the discrepancy is because you are discussing purchasing an I-bond for a minor vs gifting an I-bond to another adult. These are 2 different procedures: Transferring vs Delivering.

When purchasing an I-bond for a child, it is purchased on behalf of the minor child and is counted in the year purchased, it is not ‘Delivered’ on a future date. When you log into your account you can see it in your linked accounts. Once the child turns 18 yr old, you then ‘Transfer’ the account to him/her by De- linking the minor account once he/she has set up their own adult account. All money goes to him/her at that point (and there are no limit restrictions because nothing is being purchased) So the ‘Delivery’ date is not applicable in this situation.

As opposed to when you are purchasing an I-bond as gift for another adult, it must be ‘delivered’ to the recipient at some point after you purchase it , whether it be the minimum 5 days or the max of 30 yrs. It will stay in Your Gift Box until ‘delivered’ (‘delivery’ removes it from your gift box and puts into their account). From what I understand, the actual ‘Delivery’ date of the gifted I-bond is what is used to calculate the maximum allowed yearly purchase for the recipient.

Hope this helps to clarify.

Dan A. says

I am counting on Harry’s interpretation, as not only did my wife and I purchase 10K worth, but we each bought each other a gift (10K) this year, to deliver next year. Also bought 10K in the name of our living trust (which uses my soc#), so I don’t know what happens if Harry is incorrect.

David says

Harry’s interpretation of the CFRs makes sense, but I found in dealing with with some inherited bonds that the Treasury Direct agents did not follow either the CFRs or the procedures in the Treasury Direct site help, but had their own set of procedures. In my case I was happy with the outcome, but if not, I don’t know what my recourse would have been. I don’t see any appeal or escalation procedure listed, short of contacting the OIG. Some caution might be in order if you don’t enjoy battling bureaucracy.

Martin Anderson says

I’m now convinced that Harry’s interpretations of the CFRs is wrong. Delivery means one things. Delivered means another. If the Treasury had intended to use the meaning of the word “delivery,” it would have used that word, instead of “delivered.”

For the reasons that I’ve explained above, it seems very likely to me that “delivered” refers to something different than gift box “delivery.” Among other things, those two words are different, the web-site says the opposite of Harry’s interpretation, Harry’s interpretation would lead to the absurd results I detailed above, and everyone that I have spoken with and communicated with by email at Treasury has said the opposite of what Harry says.

I’m not sure why Harry is now quoting section 393.96. It uses the word “deliver,” which also isn’t specially defined in the rules, and which is different than the word “delivery” and the word “delivered.” And it says nothing about the purchase limits.

Based upon everything that I have been able to observe, it appears that the purchase limit is based upon the date of purchase and the registration used for that purpose, and not the year that the gift box delivery. It seems likely to me that the word “delivered” in the regulations refers to a transfer of a security from one registration to another. In other words, if you purchase an I-bond in **your name (using your social)**, and then transfer it to someone else, the I-bond counts against their limit in the year it is delivered to them, meaning the year that you put it in their name. That would also be consistent with the general, legal definition of delivery under the UCC in most U.S. States.

Having said that, it also appears that the system may not cross-check between accounts.

Thus, you may be able to get away with purchasing a $10,000 gift I-bond for your spouse in the same year that your spouse buys a $10,000 I-bond for herself. However, if Treasury finds out about it, they will cancel it.

The senior agents at TD that I spoke with have indicated that TD is inundated with I-bond purchases (presumably due to the high inflation rates and the broad promotion of I-bonds on the internet), and that Treasury does plan to audit the purchases in the last 12 months for duplicate social security numbers and to refund the duplicates.

David H says

I’ve read through the above. I’ve strained hard to at least attempt to think it means a gift counts in the year purchased, versus the year delivered. The more I try, the more I am swayed that all wording means year delivered and it is not even close. The following paragraph from the website seems non ambiguous and flows with the spirit of addressing the use of “gifts” purchased directly with treasury direct.

”

Do bonds I’ve bought as gifts through TreasuryDirect but have not yet delivered to the gift recipient apply against my annual limit?

No. Gift bonds are purchased in the name and SSN of the gift recipient. They do not count against your annual limit even if you have purchased them through your TreasuryDirect account but have not yet delivered them. Gift purchases in TreasuryDirect count toward the annual limit of the recipient in the year they are delivered.

”

That is clear as day that it counts in the year they are delivered as that paragraph would not address anything except the use of the treasury direct website’s terminology and use of purchasing “gifts” and delivering “gifts.”

This cements the usage in TD.

https://www.treasurydirect.gov/indiv/planning/plan_gifts.htm

”

Two points:

Keep the bonds in your account until you’re ready to deliver them.

You must hold the bonds in your TreasuryDirect account for at least five business days before you deliver them to the gift recipient. The five-day hold protects Treasury against loss, by ensuring the ACH debit has been successfully completed before the funds are moved.

When you deliver the bond to the recipient’s TreasuryDirect account, we send him or her an e-mail announcing the gift.

”

That’s my take. If that wording on the site is wrong, then so be it. It needs to be re-written. I-bonds have been a hot topic lately and I wonder how often those on the phone have had to deal with this specifically. This wording matters and if it was incorrect, I imagine they would change it asap. You would expect those that work for TD read through the FAQs at least once a year and go “wait a minute, that’s not right!” Either that or everything in their mind is tainted by personal purchases vs gifts.

Martin Anderson says

I addressed the quotations you posted from TD’s web-page in my discussion, above, when I also quoted from other portions of TD’s web pages that say the opposite.

As I noted above, TD responded to my email and confirmed that the limit is a calendar year limit per social. So, you can buy a $10k gift I-bond for person X in 2015, another $10k in 2016, another $10k on 2017, and then transfer all $30k (plus interest) in 2022. The purchases counted against the gift recipient in the year of the transaction.

I’ll be transferring $30,000 in I-bonds to a gift recipient in a few weeks and we’ll know for sure then.

Bob L. says

Hey, Martin Anderson. I would be interested in how that turned out. Any transfer yet?

Tim Vu says

How does recipient know that they have a gift from other people before they purchase the bond themselves? Say you buy someone a gift bond without telling them until years later, how do they know that so that the can purchase one themselves?

JM says

Martin Anderson made the hypothesis: “So, you can [maybe] buy a $10k gift I-bond for person X in 2015, another $10k in 2016, another $10k on 2017, and then transfer all $30k (plus interest) in 2022.”

Provided that person X had no other purchases, my guess is Treasury might allow this because the $10k tranches were each purchased in different years…

In other words, if you remove the “gifting” aspect of Martin’s scenario, the purchases would all be allowed because they didn’t violate the limit of $10k purchase per person per year. Martin was merely acting as a proxy for the eventual recipient.

That scenario would be quite different from buying $30k in gifts for person X all in 2021 and then wanting to deliver that amount to their account in 2022.

The latter case would violate the limit of $10k purchase per person per year, which could be the deciding factor in these cases.

In other words, Martin may be getting different answers from Treasury because he is not really talking about frontloading. He is more talking about transferring to someone who could have legally purchased the same amounts in the same years themselves without gifting.

Harry Sit says

My guess is also that a lump-sum delivery of gifts bought over several years will be allowed. While many of us are buying gifts between spouses, a generic gift recipient has no control over who buys gifts for them, when, how much, or when a gift-giver decides to deliver the gift. If grandma buys me a gift every year and she decides to hold the gifts until I graduate college and deliver them all at once, I can’t stop her. If 25 people from my extended family buy gifts for my wedding, I can’t expect them to coordinate with each other on who can deliver this year and who has to wait until next year. The best I can do is know how much purchase limit I have left after I receive the gifts. If I bought $1,000 already and I received $3,000 in gifts this year, I know I can still buy $6,000. If I already received $10k in gifts, I can’t buy any more. I think that’s what they meant by gifts counting toward the recipient’s purchase limit in the year of the delivery.

Obviously this opens up the “buy $30k deliver $30k” situation. Because TreasuryDirect is the only place that sells I Bonds and I’d like to stay on good terms for the long term, I’m not going to test the boundary with this unproven theory.

Martin Anderson says

Transfers were completed without any issues, and so it appears that Harry was incorrect.

MikeG says

Martin,

I don’t think you can compare what happened during a time when the Treasury was admittedly very lax about monitoring I Bond purchases and gifting by SS #.

There are reports over on the Bogleheads forum of people who bought I Bonds in one year and had I Bonds gifts delivered to them in the same year and not a word out of the treasury.

Given the record level of I bonds being purchased now, I would be careful to assume that what may have worked in the past will work in the future.

Marc says

Moreover, just because something happened doesn’t necessarily mean that thing is allowed. It could be sanctioned, or it could be an oversight. It’s unclear.

JM says

It may well be that $10k tranches bought in different years for someone who did not otherwise have other purchases may be tacitly allowed by the Treasury, because it does not violate their per-person annual limits.

Such a case is not really frontloading; it’s more just the gifting account acting as a proxy for the eventual recipient.

Harry Sit says

I already guessed the lump sum delivery will be allowed (April 16). If you don’t think the delivery used up their limit this year, have the recipient buy their $10k now.

Keith says

This is cut and pasted directly from CFR 363. Is sounds like a transfer and a delivery are two different transactions. One for a bond already held by a person and being transferred to another account (sounds like this is Martin’s case) and one for a bond being purchased specifically for the purchase of gifting it to another (What Harry’s article is about).

§ 363.26 What is a transfer?

(a) A transfer is a transaction to:

(1) Move a Treasury security, or a portion of a Treasury security, from one account to another within TreasuryDirect ®;

(2) Move a marketable Treasury security to or from a TreasuryDirect account and an account in the commercial book-entry system;

(3) Move a marketable Treasury security to a TreasuryDirect account from a Legacy Treasury Direct® account.

(b) Transfers of a specific type of security may be limited by the subparts that refer to that security.

(c) Gift delivery is not a transfer. A transfer does not include delivery of a gift savings bond from the donor to the recipient. This is referred to as a delivery.

[67 FR 64286, Oct. 17, 2002, as amended at 70 FR 57443, Sept. 30, 2005; 76 FR 18064, Apr. 1, 2011]

This is also copied from CFR 363 regarding the definition of delivery:

31 CFR 363.6 “Delivery”means moving a minimum amount of $25 (consisting of principal and proportionate interest) of a security held as a gift from the account of the purchaser to the account of the recipient.

Bob L says

What exactly is the penalty for overbuying in a year. Does the system stop you somehow. I dont want to be the first to try, but someone out there must have tried just to see. I know for a fact the system will not stop you from buying a gift for someone who is already maxed out for the year. Ive done it twice. So Im pretty sure the gift does not count in the year bought, just the year delivered to the named recipient.

Martin Anderson says

In some cases, the system will catch it and cancel the transaction. This seems to occur if you violate the limits using the same login.

However, agents at TD have told me that the system doesn’t monitor purchases by social, and thus if you violate the limits on two different accounts (such as buy buying $10k for yourself and then having your spouse buy a $10k gift for you), the system will not catch it. However, Treasury reserves the right to cancel excess purchases at a later time. So, you could order two $10k bonds for the same person today, only to find one of them cancelled in six months.

The three agents that I have spoken with have indicated that Treasury has been very lenient with the limits in the past, and generally ignored limit violations occurring across accounts.

However, they also indicated that Treasury is now inundated with purchases (billions of $) because of the higher rates and the broad publicity given to I-bond online, and they have heard that Treasury is planning to be more diligent about cancelling purchases that exceed the limits.

Since TD is a federal web-site, there is also the possibility of criminal penalties, though I suspect that would be reserved for someone who blatantly violated the rules, e.g., buying 100 $10k I-bonds for the same social using a series of fake accounts….

John Richter says

I did accidently purchase $10K in Ibonds for myself, at different times in the same year. The Treasury identified this in a few days and sent me an email notification of cancelation of my 2nd order. They send the money back to my bank. The system did not catch it at the time I put the order in.

Marc says

So I read this article with interest (pun intended) and was extremely impressed by the thought that went into it. It’s the most comprehensive discussion of the topic on the Internet, period. I’ve been reading I Bond articles online for weeks, and as far as I can tell, this is the only article that mentions you can go beyond the $40,000 limit per couple spanning two calendar years ($45,000 if you include the paper I Bond tax refund option) by gifting I bonds to a spouse and delivering it in a future year.

I’ve been following the debate in the comments section about whether the gift option is legitimate. My personal conclusion was that the author’s logic was 100% sound, but to confirm, I submitted the question to Treasury Direct. And unlike the commenter who disagreed, I got a response that confirmed that spouses who purchased up to the $10,000 limit in 2022 can also purchase Gift I Bonds for the other spouse, hold them in the Gift Box, and then deliver them in a future year which will then count towards the $10,000 I Bond limit of the recipient in that future year. In the meantime, the I Bond begins earning interest and the clock starts on the redemption calendar.

I have this response in writing and consider the strategy legit and confirmed.

Theoretically, I believe each spouse can also purchase a second I Bond valued at $6,000 to reach the gift tax limit of $16,000 for the year, and deliver that $6,000 bond in a subsequent year as well. This would bring the total up to $72,000 ($75,000! with the paper bond refund option), an amount no article or Treasury Direct mentions specifically but are within gifting and I Bond limits.

Marc says

*$77,000 not $75,000

Harry Sit says

Gifts to the spouse aren’t limited by the $16,000 annual exemption amount. If you’re willing to hold the gifts for many years even when the interest rate on I Bonds isn’t competitive with other alternatives anymore, you can buy a lot more than $16,000. I prefer to buy only $10,000.

Dunmovin says

I’m thinking that any gift buying for/between spouses may best done in mid-October when one knows the then current Ibond rate and can calculate the expected November 1st 6 month reset. This approach would allow one to have flexibility in only holding in gift box until January 1st (about 2 1/2 months) and then determining to do delivery OR do individual purchases (or gifts) for the following year. This latter approach would eliminate the longer gift box hold for those slightly nervous about lack of control and permit time to see about CD rates. Any thoughts? Thanks

Marc says

In my view, that logic applies even more to the mid-April timeframe just ahead. Waiting until mid-October misses out on 6 months of guaranteed 7.12% annualized interest when bank savings and CD rates are still around 1% or less. Even if inflation rises further by October and the I Bond rates goes up on November 1, you lock in the 7.12% for the first 6 months and the higher rate for the next 6 months instead of your cash is losing ground to inflation between now and then. You can always buy another gift in mid-October if you have the funds and want to push out the delivery by another year. And even if you don’t have the funds in the fall, you can always outright purchase those I Bonds at the November 1 rate after January 1 through mid-April 2023.

The whole point of I Bonds are to hedge inflation which is in full force right now. It seems illogical to not lock in another I Bond at current rates through gifting if you can. By mid-October, we will have likely seen multiple interest rate hikes by the Fed, designed to slow the economy and curb inflation, and even if bank and CD rates lag as they usually do and don’t rise accordingly, the longer you wait, the more likely it is that inflation moderates and the I Bond rate backslides. And if inflation worsens, and I Bond rates increase, you aren’t missing you. You get the current 7.12% for 6 months and the newer higher rate as well for the following 6 months.

Dunmovin says

MARCH 9, 2022 AT 9:06 AM

I’m thinking that any gift buying for/between spouses may best done in mid-October when one knows the then current Ibond rate and can calculate the expected November 1st 6 month reset. This approach would allow one to have flexibility in only holding in gift box until January 1st (about 2 1/2 months) and then determining to do delivery OR do individual purchases (or gifts) for the following year. This latter approach would eliminate the longer gift box hold for those slightly nervous about lack of control and permit time to see about CD rates. Any thoughts? Thanks

Harry Sit says

Agree with Marc. If you’d like to wait until mid-April, fine, it’s only another month, but I don’t think you’ll learn anything new. The next rate will still be high, possibly higher than the current 7.12%. Say it’s 8%, but you’ll get it in the next cycle anyway if you buy now. If you wait until October and you see the next rate will be 10%, now what? You already missed the 7.12% by waiting. Do you give up on 8% and start with 10%? Early purchases will eventually get all new inflation adjustments but late purchases won’t get the ones they missed.

MikeG says

Marc,

Would you be willing to post the entire question asked and response received (word for word) here?

Would be good to have that as additional backup. I intend to do the same thing outlined here in the coming days (purchased the limit last week for both my wife and I).

Thanks

Marc says

Mike,

Below is the word-for-word answer I received from Treasury Direct and below that is the question I asked.

Marc

Hello Marc,

Thank you for your inquiry.

To follow up to your question, gifting each other a bond would still count toward the annual limit however, not until the bond is delivered to the gift recipient’s account. Please remember once the gift bond is delivered, it will count toward the 2023 purchase limit.

Treasury Services

[THREAD ID:1-34Y0MBN]

—–Original Message—–

Sent: 1/24/2022 01:06:52 PM

To: Treasury.Direct AT fiscal.treasury.gov

Subject: Electronic EE and I Savings Bonds (TreasuryDirect)

Submitter: Marc Message: Good afternoon, My wife and I both purchased a $10,000 Series I Bond each in 2022 recently so we have reached our purchasing limit for ourselves for this year. Here’s my question: Can we both purchase another I Bond for each other in 2022 as a GIFT, hold it in our respective gift boxes without releasing it, and then DELIVER, transfer, it to each other in 2023 instead of waiting until 2023 to buy them ourselves? The reason for wanting to do this is to lock in the current high interest rate with a gifted I Bond while it sits undelivered in our respective gift boxes. The FAQs seem to be a little contradictory on this scenario so I wanted further clarification. Thanks in advance… Marc

MikeG says

Thanks Marc for posting your written communication with Treasury Direct. That is exactly what I was looking for and addresses the concern raised by Martin Anderson. There is no issue buying (front loading / pre-purchasing) another $10,000 in gift bonds for my wife (and she for me) with the plan to deliver those securities in 2023.

Thanks Harry for so clearly articulating this strategy.

Marc says

You’re welcome, Mike. I’ve read dozens of I Bond articles and all of them emphasize the $10,000 annual limit, many of them mention doubling up with a spouse, some of them mention doubling that by purchasing just after the new year, but none of them mention exceeding the $10,000 limit through gifting and delivery in subsequent years except for Harry. When I read this, I had to confirm it with Treasury Direct because I couldn’t understand why this wasn’t made clear on their site or mentioned in any of the many articles on the topic. It still amazes me Harry is the only one who went out of his way to point this out.

The only other nuance I would add is that my wife and I are not necessarily delivering the gift I Bonds in 2023 even though that’s the way I phrased the question. If the November 1 rate remains favorable, we will let our gift I Bonds ride and purchase more of our own I Bonds in January and hold off on delivering the Gift I Bonds to each other until 2024.

You may ask why, if we’re thinking that way, we don’t just purchase more gift I Bonds now if we have the cash and play out the gifting in additional years. Well, the Fed is actively tightening money supply in order to curb inflation. There are multiple interest rate hikes planned throughout 2022. There is a lot of focus right now on fixing supply chain issues which had a lot to do with triggering inflation in the first place. Eventually, inflation will moderate due to these steps, and there may even be a recession if the tightening goes too far. Inflation could more than moderate, it could tank (which wouldn’t necessarily be a bad thing for the economy but would be a bad thing for I Bind rates). The question becomes, how many years do you front load and hold gift I bonds in the gift box when the rates will come down, lowering the yield you get before you can deliver and redeem them.

The other issue is that if rates rise, a fixed rate for I Bonds, which is now 0%, may be reintroduced into future I bonds and that’s where you might be able to compound these bonds as an even better inflation hedge.

The best argument for buying more gift I Bonds than I did and holding them is that if you buy enough of them, you can create a laddered portfolio of I Bonds with likely decreasing but still attractive yields that you can deliver annually over the next few years to further hedge inflation and balance your other riskier stock market investments. I personally have diem this in the past with triple tax free municipal bonds, but munis haven’t recovered from the current low interest rate environment enough for me to go back to thst strategy. I’m not sure if Harry has written articles on laddering a portfolio with munis, but if not,t hey also might be helpful.

Marc

MikeG says

I agree Marc.

Just submitted our gift box purchases (intended release in 2023) – my wife as owner of the one I purchased with me as beneficiary and me as owner of the one she just purchased with her as the beneficiary. Very simple and straightforward. Like you, would consider leaving there and reloading again in 2023. Unless I do the following…

I am considering doing a second set of gift bond purchases (intended release in Jan of 2024). What I know for sure is if I hold these bonds to Dec 31, 2023, we will lock in the 7.12% annualized rate from 4/1/22 to 9/30/22 and the 9.60% annualized rate from 10/1/22 to 3/31/23 – total compounded interest of $853 over that 12 month period. Even if the I-Bond composite rates goes to 0% effective 4/1/23 and stays there for the rest of 2023, we would still earn the $853 on each $10,000 – which translates to an annualized rate of ~5.0% over the 20-month period (May 2022 to Dec 2023). I don’t know of anywhere I can get 5.0% annualized in a US government guaranteed investment for 20-months. For comparison, a 20-month treasury would only yield about 1/2 that.

JM says

Harry wrote in the article:

“We’re buying each other a gift this year to keep undelivered in the gift box in addition to our normal purchases. If the interest rate is still good next year, we’ll buy normally and keep the gift in the gift box. If the interest rate isn’t good anymore, we’ll skip the purchase, deliver the gift, and cash out immediately.”

Over on Bogleheads, someone suggested instead for the first case to deliver the gift and then purchase a new gift:

“Perhaps a better strategy is if rates are still high next year, then you make delivery of the iBonds in the gift box and then buy additional bonds as gifts.

The reason is this frees up liquidity.

The bonds you purchased in a prior year and just delivered will be redeemable immediately or in a few months.

However, if you leave those previously-gifted iBonds undelivered and go out and have the recipient purchase new bonds, the newly-purchased bonds will have a one-year lockout and the gift bonds you previously purchased will still be locked out.”

MikeG says

JM,

I agree with your thought process on how to look at what to do come 2023. It’s a better approach.

Marc says

Thanks for the gift tax clarification. I agree it makes sense not to go out too many years holding gift I Bonds for a spouse for the reason you stated. Thanks again for your article.

Dunmovin says

Thanks Marc, looking also at diversity of funds/assets issue too. Loosing 7% is a stand-alone issue from my perspective and gaining flexibility with knowing the short box time is a factor given ages, etc

Harry what do you think…I believe you alluded to having already gifted this year but a further reflection on October notion?

Thanks

Alan says

Marc and MikeG, thanks for the research and discussion. My wife and I are gifting each other 20k this year. We will deliver 10k each in 2023 and 2024, depending on what the rate is at that time. A great deal!

Donald says

Alan and Mike G. So, did T.D. in fact, allow your gift purchase to go through for more than $10K to the same person this year?

TD website says this about gifts, regardless of when they are ultimately delivered,

“… in a calendar year, you can BUY up to $10,000 in electronic bonds and up to $5,000 in paper bonds for each person you buy for.”

I guess I could try it for a small amount and find out, but I’m reluctant since T.D. says they are keeping our previously disallowed purchase for 8 – 10 weeks before returning it. https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds_ibuy.htm#much

Dunmovin says

Can a trust buy for the gift box? Can a sole proprietorship (sp) buy for the gift box? Can the sp buy for a gift for that/the individual who “runs/owns” the sp? For the spouse of the owner? Any limit on either buyer? Thanks

Harry Sit says

Trust and business accounts can’t buy or receive gifts.

Matt says

Great article! Quick question – when you bought the I-Bond for your wife, did you name her as the sole owner? Or was she the primary and you the beneficiary? Does doing the latter have any tax implications?

Harry Sit says

She was the primary and I was the beneficiary. No tax implications. Who’s the beneficiary or not having a beneficiary only matters when the owner dies.

Lizzie says

Hey Harry. I’m trying to convince my partner to do this & was wondering if you could help. Can you point me to any literature that says the I-bonds in the gift box accrue interest from point of purchase (not delivery) and that the minimum one-year holding period starts from point of gift purchase (again, not from delivery)? She says she spoke to a friend at work that said otherwise and neither one of us could find anything on this online. Thanks a lot! Al

Harry Sit says

Other than whose name is on the bond, a gift bond isn’t any different than the bond you buy for yourself. When a bond starts to earn interest and when it can be redeemed are already defined for all bonds. They don’t have to say it separately for gift bonds when it isn’t any different. If her friend at work is making up special rules for gift bonds, have the friend show her those special rules. Or you can confirm with TreasuryDirect customer service. Click on Contact Us on the top right of the TreasuryDirect website to find the phone number and email address for customer service.

Dunmovin says

Martin…what happened you gifted/delivered $30 K to one person? All rejected, all delivered, or partial? See your post of January 25th

Martin Anderson says

Recipient opened a TD account, which didn’t pass their online ID verification, so the recipient had to send in manual verification. We’re still waiting TD to process that. As soon as the account is opened, we plan to move several years worth of accumulated gifts to the recipient account.

Dunmovin says

Thanks for update and look forward to next one.

Harry, I did a test/small gift purchase from me to spouse B, the TD video wasn’t the clearest but there were three boxes on registration page, owner, primary, and beneficiary. And there were two places for “names.” I checked primary and entered spouse B name, etc. and for other place/name entered mine. At the end of the day, registration was reflected in the Gift Box as spouse B with soc number, then next line POD and then next line with my name and soc number.

Harry, is that what one does to ensure a beneficiary for intended recipient of gift? Thanks!

Harry Sit says

You must have chosen the beneficiary option but yes, that’s the right way. If you choose the primary option, the second name can’t be yourself the gift giver. The gift recipient can change all this after you deliver the gift. Putting in a second name when you buy the gift makes sure the designated second person will get the gift in case the recipient dies before you deliver the gift.

Wil says

Martin, do you have an update on moving those several years gifts to the recipient account? Thanks.

Dunmovin says

Harry, let me fine tune my Q from above.

There are 3 options for gifting…Sole owner, primary owner, and beneficiary. My experience was I could only check one of the boxes. As I recall I checked primary owner and entered spouse B and I did not check beneficiary when i then entered my name as the bennie. Again, the TD registration later in the purchase day was reflected in the Gift Box as spouse B with soc number, then next line POD and then next line with my name and soc number.

The 3 box option was what was confusing to me…yet only one could be selected….perhaps b/c a name (not mine) in the second entry is listed it is deemed a bennie? thanks

Harry Sit says

POD means the person after that abbreviation is a beneficiary, and you get POD only if you choose the third option. It’s not possible to choose the second option and enter your own social. You get an error that way. It won’t let you buy the gift bond. You can try it and see it yourself. The second option works only when you designate a third person on the gift bond.

Dunmovin says

Correction…the second name is mine as a bennie

Dunmovin says

Update…when makes second gift to the same person (registrant) and same beneficiary, it is in the drop down “menu” for registrations and the 3 box options never comes up

Julia says

Harry, do you know how to cancel a gift purchase after it was entered? My mother entered a gift purchase for me and chose me as a sole owner and forgot to list her as a beneficiary, which she should have done just as a precaution. We are bot finding a way to cancel this purchase and re-do the registration with me as a sole owner and her as my beneficiary. Does the cancelation option exist? Or can the registration be changed after the purchase completes and sits in her gift box? Or is the only option now for her to deliver this gift to me after 5 days and me change the registration of this gift in my own account?

Harry Sit says

I don’t see any way to cancel unless she contacts customer service and asks them to cancel and refund. You can add a beneficiary after she delivers the gift to you.

HueyLD says

Has the purchase been completed? If the purchase is still pending because your mother scheduled the purchase for a future date, then it can be canceled via “Manage Direct” menu.

Nick says

Can you also gift $10k now to your children for a 2023 delivery? Just wanted to clarify based on your post. Thank you for all you do!

Harry Sit says

Yes, in the same way a grandparent buys a gift if you’d like to pre-purchase for 2023.

Matt says

I’ve already bought 10K in my daughter’s minor-linked account for her this year. So can I buy another $10K in her minor linked account now as a gift or do I now need to buy this in my account as a gift for her?

Harry Sit says

Nick in comment #30 was talking about pre-purchasing I Bonds as a gift for next year to take advantage of the current high rates. You pre-purchase in your own account as a gift for someone else and hold it undelivered until a future year. See the “Pre-Purchase/Frontload” section in this post.

Matt says

Thanks Harry

Harry Sit says

I read several reports of people intending to buy a gift but ending up buying bonds for themselves, which caused them to exceed the annual purchase limit. I added a new “Avoid Mistakes” section at the end.

HueyLD says

Great idea.

Even I got confused initially but TD gave me an error message which allowed me to pick the right ownership the second time around.

Donald Graves says

If you do make the mistake Harry cited, T.D. keeps your money for 8 – 10 weeks:

Email from T.D: “Your purchase exceeds the annual savings bond purchase limitation. Please be advised the limit is $10,000 per series and TIN per

calendar year. A refund of the excess purchase will be made to the bank

account where the purchase originated. You should receive your refund

approximately 8 to 10 weeks from the date of purchase. You will be notified

by email when the refund transaction is processed.”

sscrla says

” Please be advised the limit is $10,000 per series and TIN per calendar year,” except it isn’t, as we know that you and your living trust can use the same SSN. They really need to write new scripts, ones written by people who understand both English and the rules.

Matt says

Harry – My wife and I bought $10K of I Bonds for each other this year and then purchased another $20k for each other as gifts to be delivered in future years. We’re named as beneficiaries on one another’s gift bonds.

What happens if she dies in 2023 before I have had a chance to gift her the $20K I bought for her? I still have $20K of her gifts (with me as beneficiary) sitting in my gift box. Does all the $20k that I gifted her come back to me automatically because I am the beneficiary and would I be able to get all of it in 2023 or do I have to space it out over 2 years so that I don’t go over the annual $10K limit?

As always, thanks.

Harry Sit says

TreasuryDirect will move the bonds to your account when you send the death certificate. Inheriting bonds doesn’t count toward your annual purchase limit.

Lizzie says

Harry – My wife and I bought $10K of I Bonds for each other this year and then purchased another $20k for each other as gifts to be delivered in future years. We’re named as beneficiaries on one another’s gift bonds.

What happens if she dies in 2023 before I have had a chance to gift her the $20K I bought for her? I still have $20K of her gifts (with me as beneficiary) sitting in my gift box. Does all the $20k that I gifted her come back to me automatically because I am the beneficiary and would I be able to get all of it in 2023 or do I have to space it out over 2 years so that I don’t go over the annual $10K limit?

As always, thanks.

Matt says

Do you ever see the interest accrue in your TD account?

John Richter says

Yes, I’ve had I-bonds for several years. I can see the accrued interest when I open the “current holdings” tab.

Alan says

Harry, my wife and I have each purchased 10k this year and have gifted each other another 10k. We are considering gifting an additional 10k each before the end of the month so we would have 20k each in our gift boxes. We would then deliver 10k each in 2023 and 10k in 2024. If the rate declines significantly by January, 2024 we could deliver them and redeem them in January since the holding time starts once the bonds are in the gift box. Do you see any downside to doing this?

Thanks for the article!

Harry Sit says

No downside as long as you’re willing to wait until January 2024 and live with whatever the rates will be in 2023.

JM says

I think this is the great advantage of the frontloading technique, and I thank Harry for publishing this article!

Unless you truly feel that the fixed portion of the I Bonds rate is going to jump up significantly, then I see no downside to arranging your future years’ purchases now, provided you’ve got the funds and would otherwise plan to buy them later anyway…

By frontloading and buying more before the end of April, you start the clock with 7.12% in the first six months and then 9.62% for the six months after that, completely risk-free. Hard to lose with numbers like that!

David says

Great article – it’s probably the best overall one I’ve seen on gifting I Bonds. One comment/clarification though, re: the following:

“When Gifts Are Useful and When They Are Not

If you’re thinking of “borrowing” other people’s names and Social Security Numbers to buy more I Bonds as gifts but keep the bonds for yourself, it doesn’t work.”

I’m not married, but my best friend and I are being what I call “I Bond Buddies”. We’re simply doing the same thing that two spouses would do. Obviously, you have to have 100+% confidence in your buddy.

sscrla says

While Harry does a good job of quoting the Code of Federal Regulations, he leaves out one important fact. There is no purchase limit; instead, there is an acquisition limit. TreasuryDirect confuses people because it doesn’t use the correct terms.

§ 363.52 What is the principal amount of book-entry Series EE and Series I savings bonds that I may acquire in one year?

(a) The principal amount of book-entry savings bonds that you may acquire in any calendar year is limited to $10,000 for Series EE savings bonds and $10,000 for Series I savings bonds.

(b) Bonds purchased or transferred as gifts will be included in the computation of this limit for the account of the recipient for the year in which the bonds are delivered to the recipient.

(c) Bonds purchased as gifts or in a fiduciary capacity are not included in the computation for the purchaser. Bonds received due to the death of the registered owner are not included in the computation for the recipient.

(d) We reserve the right to take any action we deem necessary to adjust the excess, including the right to remove the excess bonds from your TreasuryDirect account and refund the payment price to your bank account of record using the ACH method of payment.

The TreasuryDirect website also gives incorrect tax information, stating that you can’t switch from annual to deferred reporting of interest.

“Once you start to report the interest every year (for example, for a child in the child’s Social Security Number), you must continue to do so every year after that. for all your savings bonds (or, for example, all the child’s bonds) and any you acquire (or, the child acquires) in the future”

From pub 550: “Change from method 2. To change from

method 2 to method 1, you must request permission from the IRS. Permission for the change is automatically granted if you send the

IRS a statement that meets all the following requirements.”

In short, don’t trust what you read at TreasuryDirect.

Dunmovin says

Ss…And your point is? Who do you trust if not the one with the keys to magic kingdom? Not invest in ibonds! Life is gray…get use to it !😀

HueyLD says

I think sscrla’s point is that TD is not a tax authority, but the IRS is. And his points are valid.

Harry's fan says

Harry, thank you so much for this article. Your knowledge on this topic is astounding.

I wonder how the delivery to minor’s account would work? Could the fact that minor’s account is on TD online account of his/her parent be an issue?

We already maxed our gifts to each other and since we plan to send our child to a private high school in a couple years, we think saving bonds could be a better way to pay for the tuition than 529 plan. Our state doesn’t allow to deduction of 529 contribution. I guess using redeeming saving bonds to pay for the tuition shouldn’t be a problem?

Harry Sit says

Gift delivery to a minor’s account works the same as delivery to an adult’s account. The minor linked account has its own TreasuryDirect account number. Redeeming a child’s I Bonds for their private school tuition is OK.

sscrla says

Is a “gift ” even necessary? When you open the minor linked account, you put money into it. This is a gift, and would be reported on a gift tax return if you gave the child more that the annual exemption that year (unless the money came from a UTMA where the gift had been made in a previous year). Can’t you just put more money into the child’s account as a regular purchase? Another gift tax return might be required, but I don’t see that this is a “gift” that gets delivered.

Harry's fan says

I thought it’s not possible to purchase more then 10k per year in minor linked account, so decided to “frontload” 20k more, same as for my spouse

sscrla says

“We already maxed our gifts to each other and since we plan to send our child to a private high school in a couple years, we think saving bonds could be a better way to pay for the tuition than 529 plan.”

You didn’t mention that you had already “maxed” your gifts to your minor child. Yes, if you want to give your child $30,000 at today’s rate, you will need to front load $20,000 as “gifts to be delivered in future years” assuming you have already given $10,000 to your child as a regular gift (I interpret “$20k more” as more than the $10K you already bought in the child’s account this year).

Tina says

Yikes-help! How/Can I fix this? My husband and I gifted each other $10k with the plan to deliver next year. My gift to my husband went correctly. My husband added me as a registrant but when he bought the bond he did not scroll down for my name, and instead has his as the recipient. Is there a way to unwind this mistake? And if not, what are the consequences?

Thanks.

Harry Sit says

He’ll receive an email from TreasuryDirect with the next steps.

Wil says

Harry,

If I want to gift my wife $20K for future year, do I have to buy this $20K in two separate transactions or can I buy it in one single transaction and deliver $10K to her in one year and the rest $10K to her in another year?

Thanks.

Harry Sit says

Two separate transactions because each buy order is limited to $10k.

Alan says

Harry, if I redeem an I Bond before 5 years is the 3 months of interest I forego the 3 months just prior to redeeming them or the first 3 months after purchase? Thanks

Harry Sit says

The last three months.

iBondNoob says

Hope Harry or someone can help. I bought $10K iBonds for 2022. I want to gift $10K to my wife ( Spouse B) for future years and for her to gift me $10K. I have never gifted before. I am having trouble executing on this buying action on the TD site.

When I login to my TD account and go to buying screen, in the drop down next to “Add New Registration”, I see 2 entries, 1) MY NAME 2)MY NAME WITH SPOUSE B.

Should I use MY NAME WITH SPOUSE B ? or Should I do “Add New Registration” and add SPOUSE B ? If I do a New Registration, Should I choose a) sole owner or b) Primary Owner or c) beneficiary ? Eventually, when the gift is “delivered”, I want both of us to have access ( i.e Spouse B WITH MY NAME or MY NAME WITH MY NAME) with transaction rights when transfer is complete. How do I go about doing this. Thanks for your help

p.s: Excellent article by Harry and awesome comments from knowledgeable readers!

MikeG says

OK I got you.

Click add a new registration. Then click on beneficiary. Add the primary owner at the top and the beneficiary under that.

Click the gift bond selection near the bottom and hit enter.

On the next scree, click on the drop down menu for registration and select the one that says “Spouse POD you”. Do not select the one that says WITH.

Enter the amount and go ahead and submit it.

I did this the other day so been down this road already.

MikeG says

Also, don’t think you can add view or transaction rights until the gift has been delivered. May not even be able to do it then as it belongs your spouse with you as POD and NOT the second owner. Those rights may only be assignable to second owners. Not 100% certain here, but I think this is correct.

iBondNoob says

Thanks MikeG for taking the time answer my question. Does this mean I can never change the Registration from “Spouse POD You” to “Spouse WITH You” even after delivery to her in the future? not sure if there is a lot of downside for being a POD beneficiary only, but my spouse has no interest in any of the money matters so If I cannot get transaction rights to her “deliverd” iBonds in the future, it could be a hassle in the future with redemptions etc.

Rebeccah says

View rights are assignable to secondary owners and to beneficiaries. Transaction rights are assignable to secondary owners, but not to beneficiaries.

Harry Sit says

The gift recipient can change the registration after receiving the delivery to elevate you from a beneficiary to a second owner and assign transaction rights. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

MikeG says

I would THINK she can change the registration – remove beneficiary and insert a second owner (and then add view and transaction rights) once the bonds have been delivered to her and show up as her’s in her TD account.

FWIW, I originally bought my bonds as sole owner and a day later changed the registration to add my wife as the second owner. It was simple and no issues whatsoever.

iBondNoob says

Great. Thanks for helping me and making me feel comfortable with your responses.

iBondNoob says

I found this info from a SeekingAlpha article:

“You can designate a second owner or beneficiary for the I Bonds you buy as a gift, but you cannot designate yourself as a second owner. You can, however, designate yourself as a beneficiary.”

https://seekingalpha.com/article/4502473-i-bond-gift-option-suggested-in-comments-allows-you-to-double-down-on-current-8-53-percent-yield

Harry Sit says

The same info (and more) is in the “Unexpected Death” section of this post.

Roy says

Thank you so much for these write ups on I Bonds! I also read all these comments so I just want to be sure. I want to buy for my under 18 grandkids. My sons and daughters need to create an account for them first and then I can gift to their kids? I guess another way is to just give my kids the money and they can just buy the bonds in their kid’s name..

Regarding gifting to another adult, I would be the beneficiary, correct? I saw in one of the comments someone mentioned the gift giver cannot be the second owner?

Harry Sit says

Your sons and daughters first need to create an account for themselves. Then they create a minor linked account for their kids under the adult’s account. See Buy I Bonds in Your Kid’s Name. Now, either they give you the grandkids’ Social Security Numbers and account numbers and you buy and deliver gifts directly to the grandkids, or you give them money and they buy in your grandkids’ accounts.

You can name yourself as the beneficiary but not the second owner when you buy gifts for another adult. The gift recipient can remove or replace the beneficiary or add you (or someone else) as the second owner after they receive the gift.