As news on I Bonds spreads, some people are looking for ways to buy more I Bonds beyond the limit of $10,000 per person per calendar year. Buying in a trust account is one way. Buying savings bonds in your children’s names, buying with your tax refund, buying for your business, and buying as a gift are some other ways. We’ll cover buying in a kid’s name in this post. For background on I Bonds in general, please read How To Buy I Bonds.

Children Can Invest Too

First of all, we’re talking about kids under 18 here. Adult children can buy I Bonds in the same way as any other adult. If your adult children don’t have spare cash, you can give them money and they can use the money to buy I Bonds (or anything else). If you’d like to buy I Bonds and then give the bonds to them as a gift, that’s buying as a gift. We cover buying I Bonds as a gift in a different post.

Children under 18 can invest too, not only in I Bonds but also in other investments such as savings accounts, CDs, mutual funds, ETFs, etc. Because children under 18 can’t legally agree to terms and conditions when they’re a minor, an adult has to open an account for them and act as a custodian. These accounts are typically called UTMA accounts, which are named after the law that governs custodial accounts: Uniform Transfer to Minors Act.

If you already have UTMA accounts for your children and you’re just diversifying part of their investments into I Bonds, you can skip some of the discussion on whether you should open an account in your children’s name in the first place.

Money In a Child’s Name

Money in a child’s name belongs to the child. You’re only holding the money and investing on their behalf until the child becomes an adult. Even if you gave the money to the child to begin with, you can’t take the money back or spend it willy-nilly. You can spend money from the child’s account but it has to be on something that specifically benefits that child. Spending the money on their after-school programs or sports uniforms and equipment may be OK but not for general household expenses.

As the custodian, you can decide to invest the child’s money in mutual funds, ETFs, or I Bonds. Once the child becomes an adult, your duty as the custodian is over and you must turn over the investments to the child. If they decide to blow the money on a Tesla or travel to Antarctica, that’s their prerogative.

If you’re only thinking of “borrowing” a child’s Social Security Number to buy more I Bonds, and you’ll cash out the bonds for your own spending and investments before they become an adult, don’t. When you open an account in the name of a child, you represent to the government you’re giving an irrevocable gift to the child. When you cash out the bonds, you represent to the Treasury department you’ll spend the money specifically for the child’s benefit. Making false statements to the federal government is a crime.

Money in a child’s name has some tax benefits, which we’ll discuss in a later section. If God forbid, you file a tax return on behalf of the child to claim the tax benefits pertaining to the child receiving interest from the bonds when you only take the money back to yourself, you’ll engage in tax fraud, which will get you into more trouble.

529 Plan Is Better for College

If you intend to use the money for the child’s college expenses, it’s probably better to put the money in a 529 plan than a custodial account. Depending on where you live, you may get a state tax deduction or credit for contributing to a 529 plan. Earnings in a 529 plan are tax-free when the money is distributed for qualified higher education expenses whereas earnings in a custodial account are taxable.

When the I Bonds are in a child’s name, the interest is still taxable even if the bonds are cashed out for qualified education expenses. When the I Bonds are in a parent’s name, it’s possible that the interest is tax-free when they’re used for a child’s qualified higher education expenses. However, many high-income parents don’t meet the qualifying income limit to make it tax-free. See Cash Out I Bonds Tax Free For College Expenses Or 529 Plan.

If the child is still young, money in a 529 plan can be invested in stocks for possibly better returns whereas I Bonds at current rates only match the rate of inflation. When the child is ready to go to college, money in a 529 plan is also treated more favorably in financial aid considerations than money in a custodial account.

Kiddie Tax

If the money isn’t for college expenses but for some other expenses specifically for the child, there are some limited tax benefits in putting the money under the child’s name as opposed to keeping it in your own name.

When you cash out I Bonds under the child’s name (either to transfer to a custodial account elsewhere or to spend specifically for their benefit), the accumulated interest is taxable to the child. The first $1,100 in interest income is tax-free because it’s covered by the child’s standard deduction. The tax on the next $1,100 is at the child’s tax rate, which starts at 10% when they have no other income. The tax on interest income above $2,200 is at your tax rate, which would be the same had you kept the money in your own name.

So the federal income tax benefit of putting money in a child’s name is limited to the first $2,200 in investment income. The child pays a blended 5% on $2,200 versus you pay at your marginal tax rate. You need to file a tax return on behalf of the child to realize the tax savings. The child’s tax return is relatively simple when they don’t have other income. Downloaded tax software offers five federal e-files for this purpose.

Gift Tax Form 709

Both contributing to a 529 plan for the child and buying I Bonds in their name count as gifts to the child. There’s an annual gift tax exclusion amount, which is $16,000 in 2022 and 17,000 in 2023. If the total gifts during the year from one specific giver to one specific recipient go above this gift tax exclusion amount, you’re required to file a gift tax return on IRS Form 709.

If you’re bumping against the annual gift tax exclusion amount between contributing to their 529 plan and buying I Bonds in their name and you’d like to avoid filing the gift tax return, consider splitting it up between two parents. Have one parent contribute to the 529 plan and have the other parent buy I Bonds.

Minor Linked Account

After considering the limitations of holding money in the child’s name, the possibly better alternative of simply adding to their 529 plan, the limited tax benefits, and having to file a tax return for the child, if you still want to buy I Bonds in the child’s name, here’s how.

Only a parent, guardian, or person providing chief support for the child can open an account for the child. If you aren’t a parent, guardian, or person providing chief support, you should let a proper person open an account for the child. See the “Buying for a Grandchild” section below if you’re a grandparent (or aunt or uncle).

If you are a parent, guardian, or person providing chief support for the child, you need a TreasuryDirect account for yourself first even if you’re only buying in your child’s name. See How to Buy I Bonds if you don’t have an account yet.

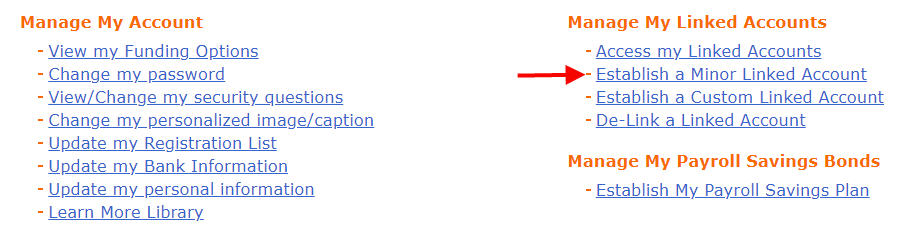

After you already have an account for yourself, log in to your TreasuryDirect account. Then go to ManageDirect. Find the link for “Establish a Minor Linked Account” on the right under “Manage My Linked Accounts.”

Fill out the required information (full name, Social Security Number, date of birth, etc.). The primary bank account linked to your TreasuryDirect account is automatically linked to this Minor Linked Account for the child.

Repeat the above if you’d like to create a Minor Linked Account for another child.

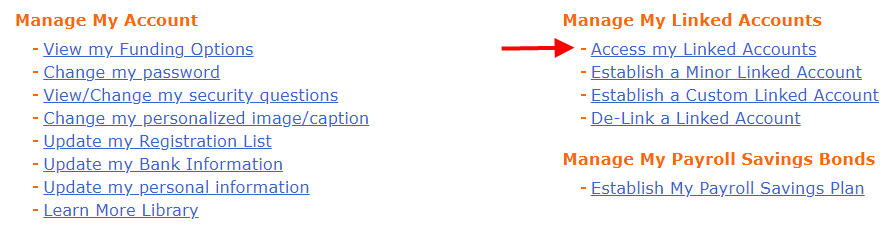

After the Minor Linked Account is created, you go into it by clicking on the “Access my Linked Accounts” link under ManageDirect.

Then you buy I Bonds as usual in each Minor Linked Account. You can name yourself as the beneficiary. See How to Buy I Bonds. The purchase limit is $10,000 per child per calendar year.

Buying for a Grandchild

There’s a tradition for grandparents to buy savings bonds for their grandchildren for Christmas or birthdays. This used to be done in paper bonds. Now it’s in electronic form.

Because only a parent, guardian, or person providing chief support for the child can open an account for the child, you should ask the child’s parent to open an account for themselves first, and then open an account for the child under the parent’s account. The parent needs to do this even if they’re not buying any I Bonds themselves.

You then buy a gift for the child. You’ll need to ask the parent for the child’s TreasuryDirect account number and Social Security Number. Then you follow the steps in Buy I Bonds as a Gift. The same process also works when you’re buying for a niece or a nephew.

Cashing Out / Redemptions

When you cash out I Bonds from a Minor Linked Account for your child, the money goes to the linked bank account. After that, you can transfer the money to the child’s UTMA account elsewhere for some other investments for your child or spend the money on expenses that specifically benefit the child.

Just like cashing out I Bonds in any other account, by default the accumulated interest is taxable to the child in the year you cash out. TreasuryDirect will generate a 1099-INT form but they won’t send it by mail. You’ll have to remember to come into the Minor Linked Account and download or print the 1099 form. You use the 1099 form to file the tax return for the child.

You can choose to declare interest annually on behalf of the child. The child pays lower taxes this way but you’ll have to do more work. See I Bonds Tax Treatment During Your Lifetime and After You Die.

Reaching Adulthood

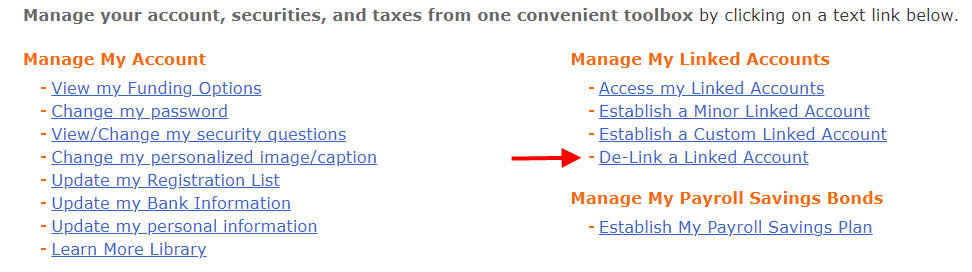

When the child reaches 18, they can set up their own TreasuryDirect account as an adult. You “de-link” in ManageDirect and transfer the bonds in the Minor Linked Account to their adult account. They’ll take over from there.

Only moving the bonds from the Minor Linked Account to their adult account in TreasuryDirect doesn’t trigger taxes. Cashing out does.

***

Buying I Bonds in a child’s name is relatively simple. The more important questions are:

1. Do you want to give money to the child in the first place, as opposed to adding to their 529 plan or keeping full control of the money in your own name?

2. How much of the child’s money should you invest in I Bonds that match inflation as opposed to in mutual funds and ETFs for long-term growth?

Remember money in a child’s name belongs to the child.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Barry Dreayer says

Love your emails/articles. As a CPA, I started referring to them, especially about I bonds.

What about the strategy of not deferring interest income on the I bonds? Might that be advantageous for some kids if their other investment income is low, keeping them out of the kiddie tax?

Keep up the great work.

Harry Sit says

I’m leaving it out as an “advanced” tactic. It works in theory but it introduces a lot of complications when there are multiple purchases and redemptions. You’d have to track the accrued interest bond by bond. It’s not easy because TreasuryDirect doesn’t issue any monthly statements. You only see the current redemption value, and it’s displayed without the last three months’ worth of interest when the bond is within its first five years. You need the redemption values on January 1 with the three months’ worth of interest added back.

If a client comes to you and wants you to track and report the accrued interest on multiple bonds purchased at different times, you’d probably have to charge the client more than the tax savings. And if they go to a different CPA after they move, the next CPA may not know what you did, and it’s very easy to pay tax again on the redemption when there’s a 1099 form showing all accumulated interest.

It works if you use a spreadsheet to track and calculate interest for your own children when you don’t charge your children for your time.

Steve says

In addition to the tax differences, there could be even larger effects on financial aid. I believe Treasury bonds in the student’s name count as a student asset, and the FAFSA calculations would expect the student to contribute 20% of their assets to their own education. Typically 529s are held in the parents’ names and are only expected to be used up at a rate of 5.64% per year.

Tony says

When buying I Bonds in linked minor account, what should I put in ‘registration’?

my kid’s name as sole owner? or my name and my kid’s name as co-owners?

Harry Sit says

The kid has to be the primary owner in the minor linked account. As the custodian, you have access to the minor linked account to buy or cash out bonds even if the bonds have your kid as the sole owner. Appointing yourself or another person as the second owner or the beneficiary affects what happens if the kid dies.

Vic says

When redeeming I bonds in a minor linked account (after the initial one year hold period) and before the kid becomes an adult, will the redeemed amount be deposited back to the parents bank account? If so, what’s the risk/downsides of buying I bonds in the child’s name and redeeming back to the parents bank account?

Harry Sit says

When you open the minor account, you represent to the government that the money belongs to the child and you’re only managing it on your child’s behalf. When you redeem the bonds, you represent to the government that the money will be used specifically for the child’s benefit (or transferred to another custodian account for the child). Making false statements to the federal government is a crime.

calwatch says

This is viable if you know your kid is going to private primary or secondary school, though. The 529 limit is only $10,000 a year for private school and many states don’t treat private school as advantageous as they do college for their 529’s – California even charges the same penalty for early withdrawal as for non qualified expenses. Although I don’t think it’s worth the benefit, people do send their children to private school for religious or cultural reasons and this would cover it.

Hoa Truong says

My child is 13. I plan on transferring the money back into my bank account just prior to him turning 18. The money will be used to pay for college. Is this ok?

Harry Sit says

If you aren’t comfortable letting your son get hold of the money when he’s 18, don’t buy I Bonds in his name. Put the money in a 529 plan for your son or keep the money in your name.

Tom says

Thanks for the great info! I have a 529 for my daughter, but would prefer to earn the current interest in an I Bond as markets are pretty shaky currently and the I Bond rate is really high. I will eventually cash it out and move the money to the 529, but I am listed as the account owner and she is the beneficiary. Does that satisfy the requirement to transfer the money to a custodian account, or do I need to open a 529 where she is the account owner? Thanks!

Chris says

If I am feeding my children, paying their utilities and rent, and paying for private school then it’s obvious the money is being spent on them. I don’t understand how it would be fraud unless the child doesn’t live with the parent.

Harry Sit says

You have to follow IRS rules when you’re taking advantage of your children’s special low tax rates. General household expenses such as utilities and rent don’t count. Spending on specific expenses for the child such as private school tuition counts. If you don’t want these limitations, keep all the money in your own name.

Chris L says

Yeah I agree with your perspective. I’m highly doubtful the IRS could or would successfully prosecute someone for investing money in their children’s name and then using it for various expenses which benefit their children. I understand where the author is coming from and his low risk advice, but don’t think it’s something we need to worry about. I’m happy to be proven wrong if anyone has substantiated stories or data showing that the IRS will really go after you on this.

Harry Sit says

The rules come from the tax break on putting the money in a child’s name. You don’t have to follow those rules when you decline the tax break by keeping the money in your own name. If you want the tax break but you’re willing to not follow the rules, there are many other ways to cheat on your taxes for much larger benefits.

Peter Kos says

This is a very informative article about I-bonds and minor accounts. In fact by far the best I found after quite a long search. This is exactly what I needed. It pointed out things that didn’t cross my mind such as Form 709 if you exceed combined limit for 529 and I-bonds.

As far as the answer to your question “You Can, But Should You?” the answer is Yes. There are very few vehicles that are that safe and provide 9%+ rate (as expected to become in May). All my other kids funds in 529 or youth brokerage accounts are in stocks/ETFs so the I-bonds provide great diversification at really attractive rates. Buying them in in April will give you at least 8% annual rate. And yes, it all goes to kids…mostly for never ending school tuition fees….

Thanks again for a great article!

Elaine B says

If my child is 12 now and I buy a $10,000 I bond today for him, if I cash it out for him at age 17, who files taxes on the interest earned? This assumes he doesn’t exceed the limit and has to file his own taxes and is still claimed as a dependent on my taxes. Is it his interest and no one pays taxes on it since he doesn’t file a tax return?

Harry Sit says

It’s his money and his income. He files taxes. The current minimum unearned income required to file a return for a dependent is $1,100. His $10,000 I Bond may very well earn more interest in five years than the minimum at that time.

Elaine B says

Thanks for the quick response. As a follow-up, if he elects to claim interest each year instead of at the time it is cashed out, it is possible it would be less than the $1100 unearned income limit? For example, 10,000 X 9.6% would be approximately $960. Thus, no interested would be taxed each year?

Harry Sit says

It’s possible, but he still has to file a tax return each year because the election is evidenced by claiming the interest that year. See Taxes on I Bonds Get Complicated If You Go Against the Default.

Chuck c says

I want to take my kids on a vacation. Can I purchase bonds for them to use on vacation expenses (plane, lodging, etc).

When you purchase i bonds are they are entitled to both the principal and interest earned?

Harry Sit says

I don’t think vacation is specific enough for the kids’ benefits. Both the principal and interest are their money.

Ray says

Can I change $10000 I-bond to my family member as a gift after purchase so that I can buy more I-bond?

Harry Sit says

You can’t change the ownership post-purchase but you can buy a new bond as a gift to your family member. See Buy I Bonds as a Gift: What Works and What Doesn’t.

Brad says

I’ve seen elsewhere that one potential work-around is to set up a co-owner arrangement, whereby a parent is a secondary owner of the bonds with the child as primary. The parent would be responsible for the tax on the co-owned bonds, but it would seem to allow for a mechanism to have families get additional money into I-bonds without the complications of the above. Am I missing something?

Harry Sit says

The so-called workaround doesn’t work. True co-ownership only exists in paper bonds from the tax refund, which you can get anyway without involving your kids. The second owner of bonds in an online account is more like a beneficiary with an optional power of attorney. The primary owner owns the bonds and is responsible for tax 100%.

Mia says

Thanks for the informative post .It is I Bond – best explained. Can I confirm one thing?

If my child is under under 18, am I right that I can both gift him $10k AND opening a minor/custodial account for him and purchase another $10k? In theory, one can do that with each of his or her minor child under 18, correct?

My hope is the two things are not mutually exclusive because they are under different registrations and really totally different things.

My child is turning 18 by end of this year. Both will go to his college tuition within next 5 years.

With the college around corner, it doesn’t make sense to contribute to the sinking 529.

Thanks

Harry Sit says

Receiving a gift counts toward the child’s annual purchase limit. If you buy a gift for your child in the same year you buy directly in the minor linked account, you’ll have to hold the gift undelivered. See Buy I Bonds as a Gift: What Works and What Doesn’t.

Lucy says

Can I buy 10K I-bond for my child and my husbands also buy 10K I-bond for the same child in the same year? does it count as exceeding the limit? What about we deliver 10k I-Bond in two separate years?

Harry Sit says

No, the same child can only buy $10k in the same year. Splitting $20k into two years works.

ray says

Can the primary owner change I-bond gift person name after purchase or the primary owner has to gift this person exclusively?

Harry Sit says

The gift recipient is the owner of the bond. The gift giver can’t make any changes after buying the gift.

Julie says

When is ownership in terms of gifting established? At the time of the gift designation (I-Bond still in giftbox). If I purchase an I bond, designate my child (minor) as a recipient, hold the I-Bond in the giftbox, transfer the bond to my child at 18, the child cashes in the bond at 21 to use for educational expenses, is the interest tax-free?

Technically, the purchaser was 24 years or older at the time of purchase. Is all of the accrued interest tax-free or only the portion from transfer (18yrs) to sale (21 yrs)? That is, I would liable for the interest from the time of purchase until the time of transfer (= the whole time that the I-bond is in my giftbox.

Harry Sit says

The designated gift recipient owns the bond as soon as you purchase the gift. It doesn’t matter when you deliver the gift.

Ben Hammond says

My minor kids each have a UTMA (bank and brokerage).

I’d like to have each of them invest $10k in i-bonds this year (for reasons discussed, especially now).

I see you reference my default account linked to MY default bank account. “The primary bank account linked to your account is automatically linked to this Minor Linked Account for your kid.”

What if I want to use each of THEIR existing UTMA bank accounts to fund the I-bond purchase? Once I link a Minor linked account, can I CHANGE the banked account that is linked and the funding source?

If so, am I going to have to get another medallion certifying that minor’s bank account – what a pain that was to open my own account! Especially for someone who doesn’t bank locally…

I take from your writeup that trying to open an account in my minor kids’ names directly is not supported… EG Treadury direct does NOT formally have UMTA accounts?

Thanks for any clarification!

Harry Sit says

The minor linked account is TreasuryDirect’s setup for a UTMA account. You’re the custodian by creating it under your account. TreasuryDirect said this about adding a bank account to the minor linked account:

“After establishing a minor account, if you wish to add any of the bank accounts listed in your Primary account, click the “Contact Us” link and provide the information or call us at (844) 284-2676. If you wish to add a new bank account, go to ManageDirect and click the “Update my Bank Information” link for further information.”

So try ManageDirect in the minor linked account and see what it says. It may ask you to fill out the FS 5512 form and get a signature guarantee though.

Mark says

Thank you for the very informative article. How does the child that turns 18 get to know they have IBonds in their name? In other words, to decrease a chance of spending on items parents may find frivolous, can the parent just wait a few more years (say until the child turns 25) to let the child know that there are these funds available in their name?

Harry Sit says

Your child won’t know unless you tell them but it’s illegal to take another adult’s assets hostage. Your child can sue you after they know. If you don’t trust your child will use the money wisely, don’t put assets under their name.

Happy Parent says

My child participated in a medical trial and earned money themselves. I’d like them to invest their own money in an I-bond. Is the process the same for opening a custodian account if the child is investing their own money?

Harry Sit says

The process is the same. If you’d like to link to the child’s bank account, you can add it to the Minor Linked Account after you create it.

Kim Jue says

My wife and I are considering purchasing a $10,000 I Bond and then leave alone for 30 years. The intent is to provide our 7 year old son a midlife cash bump when he turns age 37. Since we expect to be in a lower tax bracket when he turns 37 and we have absolutely no clue what our son’s tax rate will be, do you recommend putting the I Bond in one of our names and the other parent as primary beneficiary. Once maturity date arrives, we will cash the bond and pay the taxes and then give him the balance. In the event the primary holder of the bond dies prior to maturity, the other parent becomes primary holder and will add child as primary beneficiary; I believe this strategy keeps our child in line for the money and eases the tax burden on him. We don’t plan on telling him this bond exists until it is close time of maturity.

Do you consider this sound advice or is there a flaw we are not considering?

Harry Sit says

That sounds like a good plan. You maintain flexibility by keeping the bonds in your name. You don’t have to tell your son because the money is in your name anyway. If you have a low-income year, you also may be able to cash out the bonds tax-free for your son’s college expenses. See Cash Out I Bonds Tax Free For College Expenses Or 529 Plan.

Nick says

Two questions:

In case of co-owners with child as primary owner and parent as secondary owner, is the interest reported on the child’s tax return? Also, if you want to report it annually, but it’s below the $1,100 required to file a child’s tax return, what do you do…just keep good documentation each year?

Thank you for your help!

Harry Sit says

The interest goes to the primary owner. The primary owner is the true owner. The secondary owner is more like a beneficiary with an optional Power of Attorney. I would file the tax return every year as documentation.

Tara says

Thanks for the very helpful article. You mentioned in an answer to one comment to purchase the I bonds in your name (rather than a child’s name) to then be able to do what you want with the money upon cashing out. But, my question is then you only have $10,000 that you can buy in a given year- is that correct? If you want to buy $20,000 would not you have to buy the additional $10,000 in your child’s name as a gift (assuming you do not have a spouse)?

My second question if I want to purchase $10,000 of I bonds to earn the interest to help pay for my young children’s preschool kindergarten wouldn’t I have no choice but to but it in their names given the fact that their preschool will be greater than $10,000 each. My thought was to buy $10k for each my very young kids as well as myself (so $30k total) and then cash them out after 2 years so the interest is helping to pay for their school. I would put the proceeds in a separate account and the withdrawals would be just for their school. It is nice there is a tax benefit to the kiddie tax, but my motivation was for the current higher interest to help pay the school. My question is that since my 2 kids will have earned 2 years interest at their kiddie tax rate is that a problem to list both of them on my tax return (I am the only parent) at their respective kiddie tax rates with the 2 years interest? If I could have bought $30k in my own name I would, but it does not seem that is possible and I would need to buy the $30k all in the same year (this year needed) because both kids will be in preschool in 2 years.

Harry Sit says

Not everyone wants to buy more than $10,000 in the same year. Given your intended use for the money, and you understand the limitation and the tax treatment, it’s OK to buy in your children’s names.

Rick says

Thanks for the great article. Our daughter is completing her last year of grad school and would like to use her savings bonds for tuition . Since the bonds( EE) were purchased from birth to adulthood, from 1994, in her name. Her parents have some I bonds to give also. Since not our dependent anymore, I feel someone is going have to pay taxes on the interest. Would it be best to transfer our I bonds to here account for redemption? She is in the lower tax bracket. Or? Thanks.

Harry Sit says

You will pay tax on all accrued interest to date when you transfer your bonds to your daughter. She will pay tax on the interest earned after the transfer. You don’t save much in taxes by transferring.

Ryan says

Thanks for all the info. I have a question about this part mentioned in the article:

“When you cash out the bonds, you represent to the government you’ll spend the money specifically for the child’s benefit. Making false statements to the federal government is a crime and can be prosecuted.”

My child is under 1 year old now. I want to purchase I bonds because the interest rate is good for the coming year. If I cash out the bond of my child after a year (and before 5 years), and report that interest as part of my income and pay the tax accordingly, instead of claim any kiddie tax break, does that still go against the rule? My understanding is only when I file this interest under my child’s tax return I have to follow the rules to spend this money specifically for the child’s benefit. I can still reinvest this money for my child but that doesn’t fall under any specified category, which I am ok with since I am paying the tax using my income bracket. Appreciate any thoughts on this topic. Thanks!

Harry Sit says

The bonds in the minor linked account are the property of the child. Your role is only a custodian. You can’t take the money back for yourself. Who pays taxes at what rate is irrelevant.

dan says

So in the context of gifts, is the $10k/year limit only against the receiving of the bonds (not the purchase of the gift)? In other words, could I, in theory, purchase $50k this year for my child but spread the delivery out over 5 years ($10k/year) but the purchased $50k worth of bonds would be appreciating the 9.6% now?

Harry Sit says

Buying $50k as gifts for your child and spreading the delivery over 5 years works for TreasuryDirect’s $10,000 annual limit but doing so will exceed the limit for gift tax. See the “Gift Tax Form 709” section in this post and in Buy I Bonds as a Gift: What Works and What Doesn’t.

Becky says

I just purchased a $1,000 ibond in my 10 yr. old granddaughter’s name. I am the custodian of her ibond at this time. Should I designate her mom as the beneficiary in case something were to happen to me before she turns 18?

Harry Sit says

If you bought it as a gift to your granddaughter and the bond is currently in your gift box, you can’t change the registration now to add a beneficiary. You can only designate a beneficiary at the time of purchasing the gift. A parent can add a beneficiary after you deliver the gift.

If you opened a minor linked account for your granddaughter because you’re a guardian or a person providing chief support, you can add a beneficiary to the bond in her account. See How to Add a Joint Owner or Change Beneficiary on I Bonds. If you aren’t a guardian or a person providing chief support, you should’ve let her mom or dad open the minor linked account for her.

Linda Vesci says

I want to buy I bonds for my daughter and son. I have a TreasuryDirect account. Can I purchase the bonds in their names and myself and co-owner in my account? I know the money will belong to them and they will plan to use it for college when they are of age.

Harry Sit says

If you’re sure you don’t want to put the money in their 529 plan and you give up the chance to cash out tax-free for their college education, you can buy in their name. You need to open a Minor Linked Account for each of them under your account. See the “Minor Linked Account” section in this post. You can name yourself as the second owner when you buy bonds in their Minor Linked Account.

Abhishek S says

Can my wife and I buy two separate I bonds for our minor child – one from my wife’s ? And maximize the I bond savings for our child to a max of $20,000?

Harry Sit says

No, a child has the same annual limit as an adult. You can pre-purchase a gift for the child and hold it for delivery in a future year. That only shifts the timing of the purchase and uses up the annual limit in a future year but it doesn’t increase the overall limit. See Buy I Bonds as a Gift.

Kay says

Hello! This is a very informative post and wish I came across it earlier. Looks like I made a mistake… so I was contributing to a 529 buying for my kids before I decided to temporarily reduce and purchase 10k each for them. Now just reading this I see that I am going to exceed the 16k limit for both of them. I am married and file jointly but all the purchases and transfers were made by me. Is there anyway to rectify this? Including possibly have the gifts withdrawn over like the next 3 years? Or transferring part of their own money to another sibling without a 529? Please let me know. Thank you so much

Harry Sit says

First, the $16k limit is per gift recipient within one calendar year. You exceed the limit only if you give more than $16k to any one kid in 2022. If you live in a community property state (CA, TX, WA, etc.) and the money comes from community property, the gift is automatically deemed as 1/2 from each of you. If you don’t live in a community property state, there’s a procedure to split the gift between spouses, which requires you to file a Gift Tax Form but it’s not that difficult. Google “gift splitting.” If automatic or manual gift splitting still doesn’t get you below the limit, you’ll have to file a Gift Tax Form.

Kay says

We live in Texas luckily. So I guess that settles that. Do we have to do anything to show that the money is from community property? Thank you so much

Harry Sit says

If the money came from a joint bank account, that should be enough evidence it was community property.

Bob says

I want to buy $10k of ibonds for my baby to earn interest for her future. However, I don’t want to gift the $10k, just the earning. So I was thinking of the following:

1. buy the $10k ibonds in my child’s name, documenting that the $10k is being provided as a 0% loan.

2. upon cash out, the $10k principal goes back to me as repayment of the loan, and the interest stays with my child or to be used for some qualified expense such as school.

3. for taxes, I was thinking of the per year treatment as it should be below the income limit.

My question if the above is legally doable? I have some concerns that I may be forced to charge interest to my child on the loan, which would defeat a good part of the purpose of the investment for her. I also would have concern that if held for the long term the child might claim the loan null and void and attempt to keep the money, including the loaned principal. This is less of a concern as I would be the custodian of the account. However, I am concerned about the potential tax issue or if the $10k would not be considered a loan.

Harry Sit says

It’s simpler to keep the $10k in your account and only buy for your child in the amount of the interest earned. Look at the bond’s value each year and top up the child’s account to the interest earned. Suppose the $10k grows to $10,700 after one year, buy $700 for the child. Next year when it grows to $11,000 and the child’s account has $730, buy $270 for the child to make it $1,000.

Richard says

What happens to funds in a 529 if not used? Say the cost of the education was lower than expected and theres $5-10,000 or more left over in the account. Does it go to the parent or the child? Does it just go into a checking or savings account? Is it taxable income?

Harry Sit says

It stays in the 529 plan account, which can be used for the child going to graduate school or professional school in the future. You can also change the beneficiary of the account to a relative of the child, say a sibling, or the child’s child when they have one. The new SECURE Act 2.0 also allows rolling over the leftover money to the child’s Roth IRA at some point.

Dustin says

Would using their I bond for a documented mission trip qualify for education expenses?

Harry Sit says

I don’t know. I would choose something more obvious.

dan says

I bought Ibonds for my 6 and 7 yo, cashed out after about a year. The interest earned is under 1k (700-800). By the time they are 18 we would spend much more on their camps, sports, etc. So I’d need to file tax on their behalf the year we cashed out, with 0 liability. Then just keep spending?

Harry Sit says

The money is your kids’ money. If you didn’t spend it all on their camps, sports, etc. right away, the money should be kept in their name in a different account elsewhere for the future.

Joe says

I incorrectly opened accounts for my grandchildren even though I am not a guardian or a person providing chief support. In a previous post you stated “If you aren’t a guardian or a person providing chief support, you should’ve let her mom or dad open the minor linked account for her.” So how do I correct this? Can I transfer these accounts to their parents? What happens to the ibonds I purchased for them?

Harry Sit says

Please call TreasuryDirect for guidance. The phone number is on their contact page.

https://treasurydirect.gov/contact-us/