I covered buying I Bonds in a trust, buying I Bonds in your kid’s name, and buying I Bonds as a gift in other posts. This time we look at buying I Bonds in the name of a business. For background on I Bonds in general, please read How To Buy I Bonds.

A Business Is Separate From the Owner

Many people have a business when they sell products or provide services. Some people have a separate LLC for each of their rental properties. A key principle in business is that a business is separate from its owner. When you buy flowers from Carol’s Flowers you’re buying from Carol’s business, not from Carol herself.

A business may be organized as a sole proprietorship, a partnership, an LLC, an S-Corp, or a C-Corp. An LLC, S-Corp, or C-Corp usually requires registering with the state. A sole proprietorship or a partnership may have a fictitious name filing (“DBA”) with the state or the county. Some counties and cities also require business licenses. Having any of these shows it’s a business. The business exists separately from the owner as a person.

An S-Corp or a C-Corp has a separate tax ID (“EIN”). An LLC or a sole proprietorship can have an EIN or it can use the owner’s Social Security Number as its tax ID. Which tax ID a business uses and how the business is taxed don’t change the fact the business is still a separate entity from the owner as a person.

Side Hustles and Gig Work

Many people engage in side hustles and gig work such as driving for Uber, delivering for DoorDash or Amazon, etc. They don’t register an LLC. They just report the income on Schedule C when they file their personal tax returns.

That’s still a business. It’s a sole proprietorship. To make it more obvious, it’s probably better to file for a fictitious business name (“DBA”) and/or get a business license from the county or the city. The county or the city may actually require a business license but many people don’t know. Google the name of your city and county and “business license” to see what the requirements are.

Where I live, it costs $22 to register a DBA and it’s good for three years. Where I used to live, the city requires a business license that costs $200/year but the fee is waived if the business’s annual revenue is less than $25,000.

A Business’s Investments Belong to the Business

A business as a separate entity can (and should) have its own bank account to keep the business’s financial affairs separate from the owner’s personal financial affairs. In addition to receiving revenue, paying business expenses, and paying the owner, the business can invest its excess cash in stocks, bonds, mutual funds, ETFs, real estate, and what have you. And that includes I Bonds as well.

All the business’s assets, including cash in the bank, vehicle, equipment, inventory, and all its investments still belong to the business. If the business changes ownership, the new owners get everything the business owns. If the business gets a judgment against it, all the assets the business owns are subject to the judgment. This creates a risk in keeping financial assets in the business’s name.

Entity Accounts at TreasuryDirect

If you’re OK with the risk of buying I Bonds in the name of your business, you can open an entity account for your business at TreasuryDirect.

A business can buy up to $10,000 per calendar year. If you own multiple business entities, each separate business entity can buy up to $10,000 per calendar year in its own separate account. Because you’re using the business’s cash to buy I Bonds, it doesn’t matter how much revenue the business has in a year as long as the business has that much cash in its bank account.

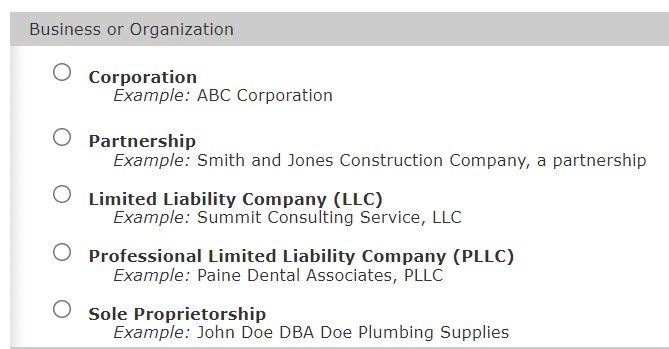

Choose the correct business type that corresponds to your business and go from there.

You’ll be the Account Manager of the business account. You can give the same email address that you use on a personal account with TreasuryDirect. The business account at TreasuryDirect should link to the business’s bank account, not your personal bank account. Write down the account number you receive by email after you open the account. You’ll need it to log in.

Repeat the process if you have multiple business entities.

Buying and Cashing Out

You use the excess cash in the business to buy I Bonds. If you normally pay out the cash as an owner’s draw, that money has to stay in the business now, which reduces your owner’s draw. If your business is a pass-through entity (sole proprietorship, LLC, or S-Corp), you’re still taxed on the money even if you don’t actually pay out the draw.

When you cash out I Bonds in the business account, the money goes to the business’s bank account. You can do whatever you normally do with any cash in the business’s bank account, including paying out to the owner.

The accumulated interest paid with the cashout is taxable to the business. TreasuryDirect will generate a 1099-INT form with the business’s tax ID. They don’t mail a paper 1099 form. You’ll have to remember to log in next year and download or print the 1099 form.

If the business files a separate tax return (C-Corp, S-Corp, partnership, or LLC taxed as an S-Corp or a partnership), the business has to include the interest income on its tax return. If the business issues a K-1 form to the owner, the interest income also goes on the K-1 form as non-business income, which the owner uses to include on their personal tax return. For an S-Corp or an LLC taxed as an S-Corp, that’s on Schedule K-1 (Form 1120S) Line 4 Interest Income. For a partnership or an LLC taxed as a partnership, that’s on Schedule K-1 (Form 1065) Line 5 Interest Income.

If the business is a sole proprietorship or a single-member LLC taxed as a sole proprietorship, the business doesn’t file a separate tax return. The owner files a Schedule C on the owner’s personal tax return. The interest from I Bonds doesn’t go on Schedule C when investing in I Bonds isn’t a business activity. It goes on Schedule B as a separate entry in the same way as the owner receiving a 1099 form from another bank. The IRS knows that interest income reported to an LLC’s EIN is tied to the owner’s SSN when the owner’s Schedule C has the LLC’s EIN on it.

See Report I Bonds Interest in TurboTax, H&R Block, FreeTaxUSA for how to find and save the 1099 form from TreasuryDirect and how to report the income in tax software.

Keep Them Separate

Similar to a trust’s TreasuryDirect account, when the business is ongoing, you should keep the business’s TreasuryDirect account and your personal TreasuryDirect account separate.

Transferring I Bonds from one TreasuryDirect account to another TreasuryDirect account counts against the annual purchase limit of the receiving account. You should avoid transferring when you’re buying the maximum in both accounts in the same year. You’ll get a stern warning if you buy the maximum in both accounts and transfer from one account to the other in the same year.

When you’re done buying all the I Bonds you want and you’d like to consolidate your holdings into one TreasuryDirect account, transfer in a year when you’re not buying I Bonds in the receiving account. Go to ManageDirect and then “Transfer securities.” It may ask you to use FS Form 5511. This form requires a signature guarantee. See Where to Get a Signature Guarantee for I Bonds at TreasuryDirect.

When the Business Ends

Before you wind down the business, you should dispose of the business’s assets and liabilities. Your authority to transact on behalf of the business ends when the business ceases to exist. So either sell or transfer the business’s assets to the owner(s) before you shut down the business.

If you’d like to keep the I Bonds as I Bonds as opposed to cashing out, you can transfer the bonds from the business account to the owner’s personal account. Go to ManageDirect and then “Transfer securities.” It may ask you to use FS Form 5511 and get a signature guarantee.

After You Die

A business account in TreasuryDirect can’t designate a second owner or a beneficiary. If you die, whoever takes over the ownership of the business also takes over the I Bonds the business owns. The new owner needs to change the business account’s Account Manager with FS Form 5446. This form also requires a signature guarantee.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Eric L. says

Harry, do you have any tips for filling out the form when TD wants a signature guarantee? The account authorization form doesn’t have a place to put entity name or the business TIN. I have been procrastinating and haven’t filled it out because I’m not sure how to complete the form. Do I use my personal name and the business TIN? Business name (but how would the certifying officer verify)?

Harry Sit says

I wasn’t asked to fill out any account authorization form when I opened my account for the business. Are you talking about FS Form 5444? You can always call customer service for clarification but that form looks to me is used to verify you as the Account Manager of the business account. So just fill in the business’s TreasuryDirect account number, your personal name, Social Security Number, address, and email address to match what you gave when you opened the account.

Eric L. says

Yes form FSF5444 (Feb 2021 revision). It has a space for SSN but not business TIN. (TD has a customer service number?!? I had no idea and never even thought to check!) Your explanation makes perfect sense. Thank you very much.

Ultimate Bootstrapper says

Hi Eric,

I had a similar situation where I wanted to change my bank account and needed a signature guarantee. I went to CITI bank (who I have an account with) and they did this for free.

Also, if you are a single member LLC then you are a disregarded entity and your TIN will be your SSN. Here’s a link from the IRS website:

https://www.irs.gov/businesses/small-businesses-self-employed/single-member-limited-liability-companies

Brad says

Slight correction, I think. You said:

“When you’re done buying all the I Bonds you want and you’d like to consolidate your holdings into one account, transfer in a year when you’re not buying I Bonds.”

I believe you should just be able to transfer in any year when you’re only buying the maximum $10,000 worth of I bonds in one account **or** the other (or in both, but not more than $10,000 total in both, e.g., you could buy $3,000 in business and $7,000 in personal, both under same SS #—as well as $5k in paper bonds via your personal (and perhaps business if you’re a corporation or partnership that files a separate tax return, not just a schedule C?) tax refund if you have one—and all should be well (even if they inadvertently give you a stern warning)?

Dunmovin says

Brad, what you’re suggesting to me …bonds do not have to reside in original accounts due to the nature of the account. To clarify, the accounts are only for original issuance of bonds and bonds do not retain that nature after original issue. Harry, what says you? Ergo, a particular account type is important only from the get-go

Harry Sit says

Getting paper bonds using the tax refund only applies to personal tax returns, not corporate tax returns.

A transfer counts against the purchase limit of the receiving account in the year of the transfer. So you should at least wait until a year you’re not buying any I Bonds in the receiving account. If you have kept two accounts separate for so long, waiting another year until everything quiets down isn’t a big deal, and it probably makes it look better.

Katie says

Hi! I have a sole proprietorship under EIN and I have already purchased my personal $10,000 in I-bonds. My sole proprietorship has a separate business account. Am I allowed to move $10,000 from my personal savings to my business account and then buy $10,000 in ibonds under the business account?

Affinity4Investments says

Katie,

Yes, you certainly can. I did the very same process, recently. Used SSN for personal TD account and EIN for SPop TD account. No problems at all. Even bought a 10K iBond in personal account and will leave it sit in the Gift Box so it accrues interest until I can gift it next year to someone who already bought their 10K for this year.

karen says

Can a nonprofit org purchase an I-bond? Below is what it says on the Treasury Direct site which seems to say we can’t but your post says corporations can purchase one?

Trust, estate, corporation, partnership and some other entities

Electronic bonds (in TreasuryDirect): Yes

Paper bonds:

Trusts and estates: In some cases, Yes

Corporations, partnerships, other entities: No

Harry Sit says

The first part you quoted says corporation yes.

Larry says

I dont have DBA for my sole proprietorship and will use schedule C for this tax year. Is that sufficient fo TD when cashing out Ibonds? Or they will require schedule C mailed?

Howard says

Can I open as many LLCs as I want with separate EIN numbers, since you can only buy up to $10,000 per year online with your social security number? The sole purpose of each LLC would be to only invest in I bonds!

Also as far as the treasury direct is concerned would I have to register each LLC in my state?

It would be quite costly and time-consuming to open and register 20 or more LLC’s!

Thanks

Howard

Harry Sit says

An LLC comes into existence only when you register it with the state. I wouldn’t register 20 LLCs just to buy I Bonds.

Howard says

I am only earning a half a percent on my money in a bank That I don’t need for a few years, so if you were in my position would you still not invest in bonds that are currently earning 7 1/8%? I have almost 0 risk tolerance And I can’t lose my invested I Bond principal and If not, why? I do realize that the rate of inflation and IBond yields will fluctuate which I’m willing to accept!

Dunmovin says

Where were you 5/10, etc years ago? Nothing is new! Just a timing issue. Personally I look at it as pin/petty cash to park…if you are still chasing capital accumulation, you, in my opinion, are on the wrong blog. Are you waiting for the next uptick in long term CD rates “for petty cash?” Welcome aboard. In my view if the treasury wanted people to be long term ibond holders, there would be a base amount for each 6 month reset. Good luck and I concur on having a better business purpose to buy for multiple entities but more importantly what is the downside and is that a risk you (or your advisor?) want to assume?

PS I max out multiple TD accounts for most years now and plan to do the same in late January and possibly redeem in early 23 or…reset and do it again

Howard says

There is no other investment as safe as this where you can currently earn

7 1/8%. I am not a risk taker and all my assets are in banks earning under 1%

so this appears to be a no brainer.

The problem is how to set up entities such as LLC’s with EIN numbers to buy as many as I choose!

Dal Kveb says

Careful. Make sure that your state minimum tax for LLCs is not going to eat up much of your interest.

Thomas says

Hi Harry —

I was pleased to learn I can buy more than $10K in I bonds with both my trust and as an individual. Just in time before year end. I’m not so sure about buying an additional $10K with my rental property business though. I pay a yearly business license fee to my county and manage the properties myself, but otherwise don’t do anything that a business owner would do. I co-mingle rent received and expenses with other funds in my personal checking account, for example. What’s your take on 1-2 rental properties as a business? Thanks.

Harry Sit says

If you report your rental income on Schedule E, as most people do, your rental activity isn’t a business. You’d have to provide substantial services in conjunction with the property to make it a business.

JB says

Hi, thank you so much for your extremely helpful articles on purchasing I-Bonds!

I have a single-member LLC (registered with the state) that is taxed as a sole proprietorship on Schedule C of my personal income tax return. The business has its own bank account and EIN.

Shall I use the EIN for the business’ TreasuryDirect account, or my personal SSN? I’m guessing I should use the EIN, as that is what my business bank account uses. Are there any other implications or considerations to be aware of? Thanks!

Harry Sit says

EIN for the entity, your SSN for you as the Account Manager. I put all the implications and considerations I can think of in this post. If you have other concerns I didn’t address, please ask.

Katniss says

Thanks Harry so much for all this helpful advice!

Quick question: Is a separate business bank account necessary for sole proprietorship (with an EIN) in order to set up the business’ TreasuryDirect account?

In the post at https://thefinancebuff.com/how-to-buy-i-bonds.html it says “The different accounts can use the same email address and link to the same bank account if you’d like.”

However, on this page, it says “The business account at TreasuryDirect should link to the business’s bank account, not your personal bank account.”

Is it ok to use the same bank account for both (if the business is a sole proprietorship with EIN)? The reason I ask is there is limited time to set up a business bank account before the end of the year.

Harry Sit says

The part you quoted is more on accounts for spouse and trust. I’ll remove “business” from that part. TreasuryDirect doesn’t require it to be a business bank account but for you to maintain separate books between the business and the person, it’s better to have money moving within the business as opposed to between the business and the person. When you’re facing a deadline to buy (I believe today is the last day to buy for 2021), it’s OK to link a personal account — you’re funding the business now — but long term I think you should replace it with a bank account in the name of the business.

Rick Plonsky says

Hello Harry,

Thanks for the great explanations.

I have a question:

I have a revocable trust that uses my SSN, within that trust resides a business, an LLC that has an EIC.

The trust has one bank account linked to my SSN and the LLC has another account linked to its EIN.

Can, I purchase $10k of I bonds for the trust account and another $10 of I Bonds for the LLC, and another $10K of I Bonds for my individual account?

Harry Sit says

Yes, the person, the trust, and the business are three different identities.

Charlie says

Harry,

It seems like you could have a sole proprietorship called “Harry Sit Consulting” and file via Schedule C. While it may be a good business practice and make it easier from an accounting perspective, I don’t believe there is any IRS REQUIREMENT for a separate bank account for your consulting business. Also, there’s no requirement for a certain minimum of revenue or expenses for the sole proprietorship. You can obtain an EIN very easily for this business, but, again, you can have a Schedule C using your own SSN.

Given the above, it seems like you should be able to buy a separate I Bond for the business pretty easily.

Harry Sit says

“Harry Sit Consulting” needs a DBA filing to exist. The county or city may also require a business license. Many banks prohibit business activities in personal accounts. The point of a good business practice is to follow it. Cutting corners will eventually come back to bite you.

david rowe says

Dear Harry,

I belong to a non-profit community group. Can the non-profit buy ibonds?

By the way,

Your site is invaluable. Thank you so much for your wonderful guidance.

David

Harry Sit says

If the non-profit is registered as a corporation, yes. The Treasurer can be the Account Manager.

Rick Plonsky says

Thank you.

John says

Hi Harry, is it a problem or red flag if I use my social security number for both my individual purchase and LLC purchase? Thanks.

Harry Sit says

Not a problem. You the person and the LLC are still separate entities even though they use the same ID for tax purposes.

Mike says

Hi does this mean that one can have as many I bond accounts as I would like since one can apply for multiple sole prop with different ein and multiple llc or corporations too? Same thing with trust you can have multiple trusts each with a treasury direct acct to buy I bond correct?

Pat says

Hi Harry,

Can I set up an LLC for the purpose of investing, including purchase of Ibonds?

Thanks.

Harry Sit says

You can. The state doesn’t care what you do in the LLC. Some people use an LLC to buy real estate.

Pat says

Thanks Harry. I assume this would eliminate the issue of transferring from my personal checking account into my business account, even after initial deposit?

Harry Sit says

No, the LLC should have a separate bank account and separate accounting.

Doron says

Do you need revenue in the LLC for the year you buy I-Bonds? Or, could one max out their personal I-bonds for the year and then move an additional 10K from their personal to business account to buy more for the LLC?

Pan says

This is my question, too. I have a sole proprietor business that is winding down (and has an EIN for my Solo 401k)

For a last hurrah, before I shut it down, I’d like to transfer money into its account and buy max I Bonds. Is this okay, even though I may not have a $10K profit for 2022?

Harry Sit says

The business doesn’t need a $10k profit or revenue but it has to continue to exist while the business holds I Bonds. When you dissolve the LLC or end your business in other ways, your authority to act on behalf of the business also ends. Dispose of the business’s assets (including I Bonds) before you end the business.

mark says

Thank you for this post! Very interesting.

Are there any issues with doing this at scale? For example with 100 LLCs?

The net return (even after admin costs) should be about 6% in risk free return.

Anonymous says

I am unclear on what this means “avoid transferring from one to another when you’re buying the maximum in both accounts in the same year.”

I have an S-corp with its own business account. As an officer of the S-corp, I routinely draw from the business account into my personal checking account. My personal checking account is linked to my individual Treasury Direct account where I have already this year purchased $10k in I Bonds. Does this mean I cannot also purchase $10k this year through the S-corp?

Harry Sit says

You can purchase $10k in the S-Corp’s TreasuryDirect account. You just don’t want to transfer the I Bonds from the S-Corp’s TreasuryDirect account to your personal TreasuryDirect account when you’re buying $10k in both accounts. That makes it look like you really want $20k in your personal TreasuryDirect account and you’re just using the S-Corp’s TreasuryDirect account to circumvent the purchase limit.

Anonymous says

I plan to retire in around 4 years at which time I would close my S-Corp. What is the process to transfer the S-Corp’s I Bonds to my personal TD account? Is it very complex? Thanks!

Harry Sit says

You use FS Form 5511 when you transfer I Bonds from one TreasuryDirect account to another TreasuryDirect account. It requires a signature guarantee from someone at a financial institution. See Where to Get a Signature Guarantee for I Bonds at TreasuryDirect.

Anonymous says

I just called TD and asked about transferring my S-Corp I-Bonds to my Individual account and the person who answered said they might ask for me to prove I am the only employee of the S-corp. Does that seem right? If so, how would I do that?

Harry Sit says

I haven’t heard of that requirement. An S-Corp usually has a filing with the Secretary of State showing its officers and directors (“Statement of Information” or alike). If you filed online, you can download the latest from the Secretary of State’s website.

Frank says

Can you provide some clarity regarding this post? My situation is I have purchased $10000 iBond for this year. I do have a sole proprietorship consulting business. I am using my personal bank account for the business well. Can I still buy $10000 iBond for my business and link to my personal bank account/

Thanks

Harry Sit says

See reply to comment #10.

David Sharp says

My wife and I buy 10,000 each in I Bonds each year, but we own 4 LLC that are all in a trust and all of the have a EIN number how many I Bonds can I buy?

Harry Sit says

$10,000 for each LLC plus $10,000 for each trust, all in separate accounts for each LLC and trust.

Alex says

I’m a sole prop, but I have 2 separate businesses, both on my Schedule C.

Can I open one sole prop account using my SSN and another one for the second business using EIN and buy $10k for each?

Harry Sit says

You should use whatever tax ID the two businesses currently use. The IRS says “If you owned more than one business, you must complete a separate Schedule C for each business.” If you only filed one Schedule C, how do you show you really have two businesses?

Robert says

Great read! I have an single member LLC with its own EIN and bank account that is producing very little revenue right now. Am I able to seed that business account with 10k of my personal money and then buy that much in I-bonds?

Harry Sit says

Yes, the LLC doesn’t need $10,000 of revenue in order to buy $10,000 worth of I Bonds. Also see reply to comment #18.

pevend says

I have a self-directed Roth IRA that is set up as an LLC (I use it for trading in cryptocurrencies so I don’t have to worry about tax issues) that has its own checking account. Can I use the LLC to buy an additional $10K in I-bonds?

Pan says

Oooh, even I know the answer to that!

No. Because you can’t hold IBonds in a retirement account.

Also, IRAs have a 6-7 K limit per year

Pan says

At a future time, when my business closes and I need to transfer its I Bonds to the owners TD account, will it be a problem if there are more than $10,000 in I Bonds? (Since the transfer of I Bonds counts against the receiving TD accounts yearly limit?)

Harry Sit says

Because you’ll have to mail in the FS Form 5511 with a signature guarantee anyway, if you attach a letter saying you’re transferring the I Bonds because your business is closing, I think they’ll allow it. In the worst case, you can always cash out the I Bonds in the business account before you close down the business.

Ron says

Hi. I have a rental property business. Its a LLC and owns and runs a duplex. Separate Checking, EIN and accounting. Me and my wife actually manage the property and do repairs and maintenance and everything else. So its a real business and has been 10 years. My question is, since it’s a sole owner LLC, which means it doesn’t have to file a tax return,and I file Schedule E on it with my 1040, is the company okay investing in I bonds kept in Companies name, checking and books?

Harry Sit says

Yes. If the LLC holds a balance in its checking account and earns some interest, holding I Bonds falls under the same concept. When the LLC cashes out bonds, it will get a 1099 in the same way it gets a 1099 for the bank account. You report the interest on your 1040.

Madeline Peters says

For clarification, my husband and I own a business. We have already invested 10,000 each in separate personal accounts. For our business we would open two treasury accounts, one with my husband as the manager and another account open with me as the manager? The same goes for a trust account? Therefore six treasury accounts, correct?

BTW I Just bought your book!

Harry Sit says

No. One account for each business or trust.

Bill says

I have a living revocable trust which is a grantor trust that lists my SSN for banking and investment purposes. Also I am a 50% partner in an LLC that files a partnership tax return and has a FEIN. Can I invest annually $10K in I-Bonds in each entity plus $10K personally?

Harry Sit says

Yes if you’re the trustee of the trust and you’re authorized to invest the LLC’s assets by its operating agreement.

Pan says

I’ve been filing Schedule C for two decades. Years ago, I asked for a EIN number from the IRS specifically to open a Solo 401K. I named it “casual business name” 401K Retirement. (Because I didn’t realize I was naming my business in that moment!) I have no DBA because it is not required in my area. This 401K is still open.

The Treasury Direct Entity page insists on a formal business name; the name of its legal authority. The best I have is that EIN. I’m concerned about using my EIN to open a Treasury Direct Entity account, because the name includes the words 401K and Retirement, which are not allowed for I Bonds.

Do you think this will be a problem when I try to disburse the funds eventually? Does leaving the 401K open indefinitely potentially lend credibility to this explanation?

Harry Sit says

When a corporate customer asks you to submit a W-9 form, what name and tax ID do you use? You should you that same name and tax ID for TreasuryDirect.

Pan says

Even if it is identical to the name and Tax ID # I use on my personal 1040?

Harry Sit says

Yes. A sole proprietor can use his or her personal name as the business name and the Social Security Number as the tax ID for the business.

Wendy Hamilton says

I’m looking to invest in ibonds as part of my not for profit church’s endowment. We have a tax id number but we are not a registered 5013c. It hasn’t been required so far for other investments, and we don’t need it to be recognized as non-taxed for other filings.

Do we have to register as a 5013c to buy ibonds? I’m worried we will have a problem if we just try it with the tax id.

You answered that a non for profit can buy them if registered as a corporation. Is a 5013c a corporation even if it is a church?

Harry Sit says

A church is usually registered as a corporation whether it’s a 501(c)(3) or not. It can still buy I Bonds even if isn’t a 501(c)(3).

Dunmovin says

Good to some looking for a safe place to park funds…watch out for unrelated income issues (interest shouldn’t be an issue). Most churches collect $s from various sources and put it in their account of “donations.” Fees rec’d for…e.g. renting out space or antenna placement may give cause to get good advice so that it is not deemed “unrelated” income for tax purposes

Brent Pinard says

I set up my treasury direct account as a Sole Proprietorship by accident. I realized this when I tried to set up a beneficiary for my bonds. Couple questions. Can I change ownership? What happens when I cash in my bonds? I read that if I die, my company retains ownership. I don’t have a company

Thanks

Harry Sit says

You can create a new personal account and transfer your existing bond from the sole proprietorship account to the personal account. It’s under ManageDirect -> Transfer Securities. Add a beneficiary after it’s in the personal account.

Brent Pinard says

Thank you

That should work great. I was able to make another account with no problems.

AngryLawyer says

Hello,

Love the website and your content. I am a lawyer, have been in practice for 12 years, and have a separate business account which is under my name with “Esq.” at the end. I do not have a separate EIN for the business and use my SSN to file taxes. Will I have any difficulty opening an additional TD account with my SSN, having the account titled “Jimmy Smith, Esq.” and buying I Bonds? Thanks

Harry Sit says

A small percentage of people run into ID verification issues when they open an account. It’s impossible to say you won’t have such difficulty but it won’t be because you use your name plus Esq. as the business name or you use your SSN as the business’s tax ID.

Dun says

I’ve seen TD ask for a dba and the person had none. With the esq they may give you pass b/c you’re an attorney…that is TD rationale. Remember examples are merely an example. The person also had TIN for over 30 years and filed sch c returns and at the time different bank account for business. She did mail in irs paperwork on the TIN. Took a couple of weeks a couple of years ago and that was after a phone call too. Good luck…Harry will get you thru the gates

Anonymous says

Hi Harry, This year I set up a Treasury Direct account for my S-Corp and purchased $10k in I-Bonds for the first time. I also purchased $10k in my individual account and another $10k in my living trust. This all happened in 2022. Now suddenly I am needing to shut down my S-Corp. Can I still transfer the S-Corp I-Bonds to myself this year (assuming I can completed that before year end), even though I already maxed out my 2022 individual contribution? Do I just need to liquidate the S-Corp I-Bonds?

Harry Sit says

The S-Corp I bonds can’t be liquidated within the first year. They have nowhere to go except being transferred to your personal account when the S-Corp is shutting down.

Anonymous says

I am looking at form FSF5511 to transfer the S-Corp I Bonds to my personal account.

1. Since the personal account is not a trust, do I still need to complete

TAX LIABILITY STATEMENT section by checking either option a or b?

2. Can the form be certified by a notary? (I read on your web site the a notary could certify FSF5444, but want to confirm for FSF5511.

3. Assuming I do the transfer in 2022, will I be penalized if I already maxed out my 2022 I-Bond purchases in the target personal account?

Harry Sit says

I would still check an option just in case. It can’t hurt if it isn’t applicable. The form doesn’t say it allows a notary certification. Maybe they’ll accept a notary certification but I would find a bank to certify it. You minimize the chance of trouble if you can wait until a year when you’re not buying in your personal account but if the S-Corp will be shut down, I would attach a letter to the transfer form to explain why I’m transferring now.

Mike McD says

Great articles on iBonds – extremely helpful! Glad I found your site. So, my dad wants to gift his adult grandchildren iBonds and has asked to help him do it. His account is currently in his trust’s name and I saw that one can’t gift an iBond from a trust TD account. Is he able to open another account in his name (vice the trust) and gift from there? Can he put another $10k into his individual account as well (the account he’ll be gifting from)? Thx!

Harry Sit says

He can open a personal account in addition to the existing trust account. He can buy another $10k in the personal account for himself and buy gift bonds for his grandchildren. Assuming we’re talking about children under 18 here, a parent of the grandchildren has to open an account for him/herself first and then open an account under the parent’s account for each child to receive the gifts. See Buy I Bonds in Your Children’s Names (same account structure even if the parent isn’t buying any bond) and Buy I Bonds as a Gift (the grandparent will follow this process to buy and deliver gifts).

Jeff says

Hi Harry, I have read all these comments, and have not seen this one asked:

I have a personal TD account with my SSN, I also have a DBA consulting business with its own checking that I file on schedule C. I also have a *non-revocable* trust of which I am the trustee and which uses my SSN.

I believe based on your assessments above that I can definitely buy 10K max in my personal and I can make another business TD account to buy 10K more. Can I also make a Trust account, even though the trust uses my SSN?

Harry Sit says

Yes, the trust is a separate entity from the person and the business. It doesn’t matter whether it happens to use the same Tax ID as the person or the business.

Learnevday says

Hi Harry,

Thanks for running your very helpful site. I would guess you would have had the most readership and Q&A this year with the I bonds rush! My question has been posed before but was looking for clarification. I am looking to buy 10K I bonds via my soul proprietorship ( I have an EIN and a business bank account for the same) this week. However my revenue (and income) may or may not hit 10k by end of this year (its a small business, closer to 8k right now). Should i limit myself to say 6K I bonds (subtracting expenses, solo 401k contribution etc) or can i buy 10K by transferring between bank accounts? I know u said Yes to question 18, but I couldnt find similar information on TD site or is this more a taxation matter and should I look somewhere else? A youtuber’s comments page on I bonds to similar question would not give a yes or no and you were the only one that had a definitive statement.

Thanks again for your time and assistance.

Harry Sit says

You’re using the business’s assets to buy I Bonds, not its income. Many large businesses lose money but they sure have more than $10,000 in assets. The business will have assets (cash in the bank) after you fund the business with your own money. When the business doesn’t need as much capital anymore, it can distribute its capital back to the owner.

Learnevday says

Thanks Harry! Wow that was a super fast reply, thanks! Ok, so effectively i am funding the business by adding cash (say 4k) from my personal account to its existing cash holdings and thereby funding the 10K I bonds investment. Later next year when the business revenue hopefully increases, I can send the say 4k back to my personal account. Actually now that makes sense since the previous year I did have more than 10 k in receipts and the 10K I bonds purchase this year do not have to come from just this years receipts.

I presume I do not need to indicate this when filing taxes the following year in my schedule C? (my side business is a small consultancy, so all i usually state in my return is my total gross receipts/sale and subtract expenses; and solo 401k contribution). Thanks

Harry Sit says

Schedule C reports the revenue, expenses, and profit of your business. It doesn’t report the business’s assets or capital.

Learnevday says

Thanks Harry.

Olympia says

This is a great article, thanks so much. A new question – for a sole prop a tax form will be issued with the business EIN. Is the interest earned in this account subject to SE tax?

Thanks, I’m new to SE tax and investing as a business.

Harry Sit says

It’s not subject to the self-employment tax.

Anonymous says

“When you’re done buying all the I Bonds you want and you’d like to consolidate your holdings into one TreasuryDirect account, transfer in a year when you’re not buying I Bonds.” Does this comment apply to all my TD accounts, or just the one into which I am planning to transfer the S-Corp bonds? I have a Living Trust account, a personal account, and an entity account for my S-Corp. I am planning to transfer the S-Corp I-Bonds into the personal TD account in 2023. So I’m wondering if I can still purchase I-Bonds from the trust account in 2023.

Harry Sit says

Only the account you’re transferring into.

Anon says

If a business account (sole proprietorship) transfers an I bond it purchased to an individual’s personal account at Treasury Direct, what are the reporting/tax implications for each party? Only the individual account pays taxes, and only when the I bond received from the business account is sold by that individual? Whereas the business account that made the initial I bond purchase but subsequently transferred that I bond to an individual’s account then never has to report anything about the purchase or transfer…never has to even consider it on Schedule C or anywhere else…that I Bond effectively never existed as far as the business is concerned? Thanks.

Harry Sit says

As I understand it, the transfer will trigger a 1099 to the business’s tax ID (even though it may be the same as the tax ID for the individual). The business has interest income. It passes the interest income to the individual owner in a sole proprietorship. If the business is a partnership or S-Corp, it reports the interest income on the business tax return and on the K-1 issued to the owner(s).

anonymous says

I believe Harry is correct. I recently transferred I bonds out of my S-Corp to my personal TD account. The Treasury Direct agent told me it would trigger interest reported to my EIN and to look for a 1099 in my S-Corp treasury direct account in January as they don’t mail them.

Dunmovin says

But the second prong of the original post…has it been answered? So the individual transferee will get the 1099 for the interest earned/posted prior to the transfer from the business. And the post-transfer will show at TD interest accruing to the individual? Right? Thanks

Harry Sit says

The new owner by definition gets interest from the time of becoming the new owner.

Dunmovin says

And the transferee would get the fixed component of the rate ( if any) at time of original issuance? If so may be a neat way to consolidate “at the right time”. What says you…thanks

Harry Sit says

Naturally, an object itself doesn’t change when it’s passed from one person to another.

John says

Hi Harry,

If we buy I-Bonds for my sole proprietorship and sell them later, do I report the interest on Schedule C as the revenue of my business?

Thanks!

Harry Sit says

No, you don’t report the interest as business revenue. You report it together with other interest income you receive in your personal accounts.

Dunmovin says

Throwing my oar in the water…since the 1099 reflects the owner, me, has that interest income, in the past I list it with other interest in schedule B, as I recall, as a subaccount so that irs can see it was included in gross income. Otherwise on C it would not be seen unless disclosed in an attachment. Harry?