My previous posts covered buying I Bonds with your tax refund, buying I Bonds in a trust, buying I Bonds in your kid’s name, and buying I Bonds for your business. Let’s look at another way to buy I Bonds this time: buying them as a gift. For background on I Bonds in general, please read How To Buy I Bonds.

Gift Box and Delivery

You buy I Bonds as a gift in two stages: buying and delivering.

You must give the recipient’s name and Social Security Number when you buy a gift. The recipient doesn’t need to have a TreasuryDirect account at this time. Only a personal account can buy or receive gifts. A trust or a business can neither buy a gift nor receive a gift.

The bonds you buy as a gift go into a “gift box.” You can’t cash out the bonds stored in your gift box. This is analogous to you going to a store and bringing back the gift to your closet. The gift already has the recipient’s name permanently etched on it. You can’t steal the gift for yourself.

The recipient doesn’t know you bought a gift for them until you deliver the gift to them. This is analogous to bringing the gift from your closet when you visit family. The recipient must have a TreasuryDirect account now to receive the delivery. You’ll need the recipient’s account number to deliver a gift.

I Bonds stored in your gift box are in limbo. You can’t cash them out because they’re not yours. The recipient can’t cash them out either because the bonds aren’t in their account yet.

There’s a minimum wait of five business days between buying and delivering to make sure your bank debit clears. There’s no maximum stay in the gift box. You can pre-purchase gifts and wait to deliver them at a much later time. You can also choose to deliver gifts in bits and pieces as opposed to in one lump sum.

Purchase Limit

The principal amount of delivered gifts counts toward the $10,000 annual purchase limit of the recipient in the year of delivery. You can still buy gifts for others even if you already bought the maximum this year for yourself.

You can buy a maximum of $10,000 for any recipient in one purchase but there’s no limit on how many recipients you buy for or how many times you can buy for the same recipient in any calendar year. If you’d like, you can buy $10,000 worth of I Bonds for each of your 20 family members or you can make five separate purchases of $10,000 each for the same family member, all in the same calendar year.

If the recipient already received $10,000 in principal amount as gifts this year, buying additional I Bonds on their own will put them over their annual purchase limit. They’ll have to wait until they’re not receiving the maximum gifts.

Interest and Holding Period

Interest and the holding period start in the month of your purchase. If you pre-purchase gifts and wait to deliver them to the recipient at a later time, you still lock in the same fixed rate and inflation rate as other bonds bought in the same month. Interest earned while the gift savings bonds wait in the gift box belongs to the recipient. It’s exempt from state and local income tax.

The holding period for cashing out also starts right away. If five months have passed between the time of purchase and the time of delivery, the recipient only has to wait another seven months before they can cash out, as opposed to the full 12 months for freshly purchased bonds.

Gift to Kids

It’s not necessary to buy as gifts for your own kids under 18 unless you’re pre-purchasing for future years. As a parent, you can open a minor linked account in your account and buy directly in your kid’s name. See the previous post Buy I Bonds in Your Kid’s Name.

Buying I Bonds as a gift works when you buy for a grandchild or a niece or a nephew under 18. You only need the child’s name and Social Security Number when you buy the gift but you’ll need the child’s TreasuryDirect account number before you can deliver the gift. The child’s parent needs to have an account for themselves first and then open a minor linked account for the child under the parent’s account.

When Gifts Are Useful and When They Are Not

If you’re thinking of “borrowing” other people’s names and Social Security Numbers to buy more I Bonds as gifts but keep the bonds for yourself, it doesn’t work. Only the named recipient can cash out the bonds. If you don’t deliver them, the bonds stay in your gift box, and neither you nor the specified recipient can cash them out. After you deliver the gift bonds, it’s the recipient’s money, and they can do whatever they want with the bonds.

If you’re thinking of letting others buy I Bonds as gifts for you to double up the $10,000 annual purchase limit, it doesn’t quite work either. Gifts delivered to you count toward your annual purchase limit. If you receive the maximum in gift bonds for the year, buying additional bonds in the same calendar year will put you over the limit.

Buying I Bonds as a gift works when you want a family member to have some I Bonds but they don’t have spare cash. It works the same as giving them money and letting them buy themselves.

Pre-Purchase/Frontload

It also works to a limited extent if you think the high interest rates on I Bonds are only temporary. You can buy a gift for your spouse and hold it in your gift box. Have your spouse do the same for you. Wait to deliver the gift to each other in a future year. The older gift bonds will have earned the high interest rates in the years past and they have aged enough for immediate cashout.

We’re buying each other a gift this year to keep undelivered in the gift box in addition to our normal purchases. If the interest rate is still good next year, we’ll deliver the gift and buy a new gift in the gift box. If the interest rate isn’t good anymore, we’ll skip the purchase, deliver the gift, and cash out immediately.

Don’t Forget About Undelivered Gifts

As with physical gifts, most gifts are purchased and delivered in short order. If you hold gifts in your closet for a long time, you may forget that you bought the gifts in the first place. If you’re intentionally pre-purchasing gifts to take advantage of temporarily high interest rates, tell the recipient you’re holding a gift. Set recurring calendar reminders to tell yourself and the recipient you still have undelivered gifts in the gift box.

Remember that gifts are in limbo until they’re delivered.

Unexpected Death

You can include a second owner or a beneficiary for the I Bonds you buy as a gift. If the gift recipient dies before you deliver the gift, the designated second owner or beneficiary will inherit your gift. You can’t name yourself as the second owner of the gift but you can name yourself as the beneficiary of the gift. The recipient can change the second owner or the beneficiary after you deliver the gift. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

If you die before you deliver the gift, the gift still belongs to the recipient. Whoever handles your affairs after your death should notify the recipient that you had an undelivered gift for them. Then the recipient can claim it through TreasuryDirect. Again, it’s important that you tell someone about the gift if you’re going to hold it undelivered. If no one knows you bought a gift, the gift will be in limbo.

Gift Tax Form 709

There’s no tax for receiving gifts. Gift tax is on the gift-giver.

Buying I Bonds as a gift counts as a completed gift in the year of the purchase (not the year of the delivery). There’s no limit on how much you can give as gifts to your spouse (unless the spouse isn’t a United States citizen). Each person has an annual gift tax exclusion amount for “present interest” gifts to each non-spouse recipient, which is 16,000 in 2022 and $17,000 in 2023. If the total “present interest” gifts (in I Bonds and other forms) during the year from one specific giver to one specific non-spouse recipient go above this annual gift tax exclusion amount, you’re required to file a gift tax return on IRS Form 709.

The gift tax annual exclusion amount for gifts to a non-spouse recipient is $0 for “future interest” gifts. You’re always required to file a gift tax return when you give “future interest” gifts to anyone except your spouse. It’s not clear to me whether the I Bonds you buy this year as a gift but hold for delivery in a future year count as a “present interest” gift or a “future interest” gift. To avoid ambiguity in determining whether it’s a “present interest” gift or a “future interest” gift, only give gifts to your spouse or deliver all gifts to non-spouse recipients within the same calendar year.

Unless you’re also giving the same non-spouse recipient gifts in other ways, buying and delivering $10,000 worth of I Bonds as a gift in the same calendar year falls below the annual gift tax exclusion amount, which doesn’t trigger the requirement to file the gift tax return.

If you’re required to file a gift tax return, it’s separate from the federal income tax return. The gift tax return goes to a special address. The typical consumer-grade tax software packages such as TurboTax and H&R Block software don’t support filling out a gift tax return. You’ll have to go to a tax professional or fill out the gift tax return on your own.

Having to file a gift tax return on Form 709 doesn’t mean you’ll pay gift tax out of pocket. Most people just use up part of their lifetime estate and gift tax exemption amount, which is more than $12 million in 2022. However, after you file the gift tax return once, you’ll have to keep track of how much of your lifetime estate and gift tax exemption amount you already used. See IRS Instructions for Form 709 if you decide to give gifts that will require a gift tax return.

Avoid Mistakes

Although TreasuryDirect has an official video walkthrough for how to buy a gift, it’s very easy to make a mistake if you follow the video when you’re buying a gift for the first time. I read many reports from people intending to buy a gift but ending up buying bonds for themselves.

It’s easier if you follow these steps when you’re buying a gift for the first time.

Add Registration

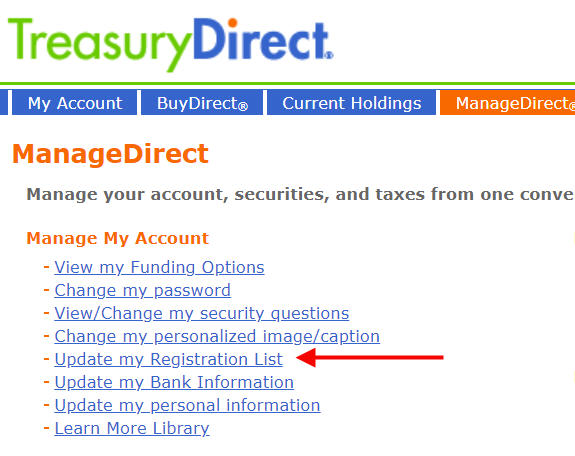

Click on ManageDirect in the top menu. Then click on the link “Update my Registration List.”

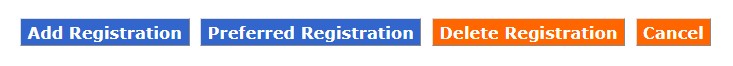

You’ll see a list of existing registrations in your account. Click on “Add Registration” to create a new one.

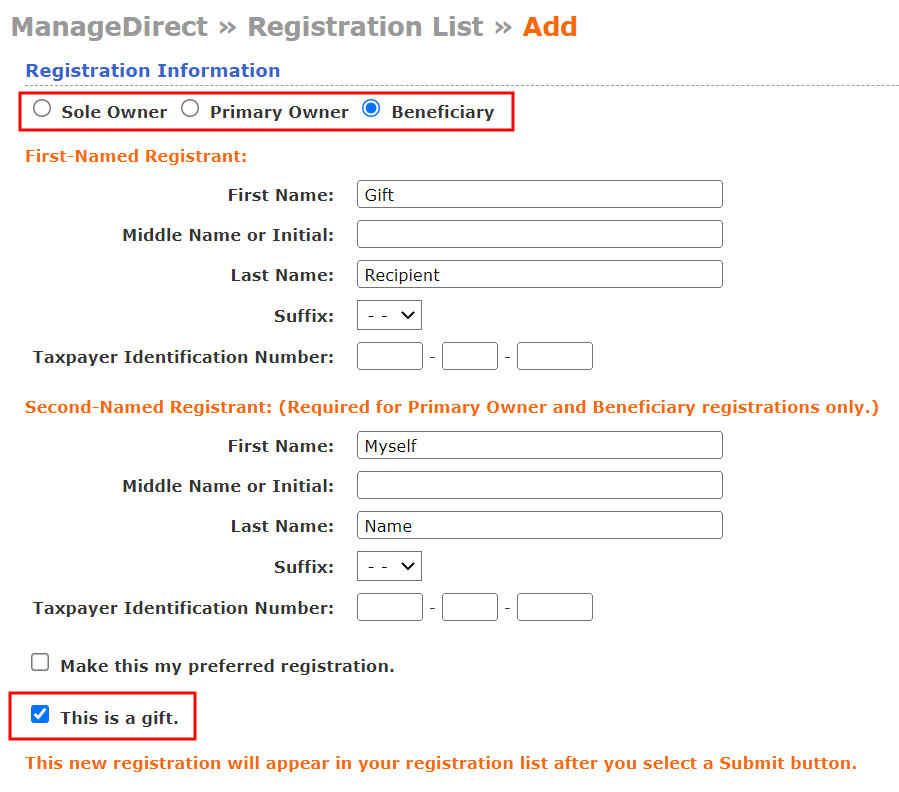

The radio buttons at the top show the registration types.

- Sole Owner means the gift recipient alone, without a second owner or a beneficiary.

- Primary Owner means the gift recipient with another person as the second owner.

- Beneficiary means the gift recipient with another person as the beneficiary.

If you choose Primary Owner or Beneficiary, enter the gift recipient as the First-Named Registrant and the second owner or the beneficiary as the Second-Named Registrant. You need the Social Security Number of both the gift recipient and the second owner or the beneficiary. You can’t name yourself as the second owner but you can name yourself as the beneficiary.

Make sure the spelling of the recipient’s name matches exactly what the recipient has or will have on their TreasuryDirect account. If the recipient has their full middle name on their account, you also include their full middle name. If the recipient only has their middle initial or no middle initial, you do the same in your gift registration. A mismatch between the names can cause a problem when you deliver the gift.

Check the box “This is a gift.” After you click on Submit, the new combination will be added to your list of registrations. You will use this registration when you buy the gift.

You only need to do this once per gift recipient.

Place Gift Order

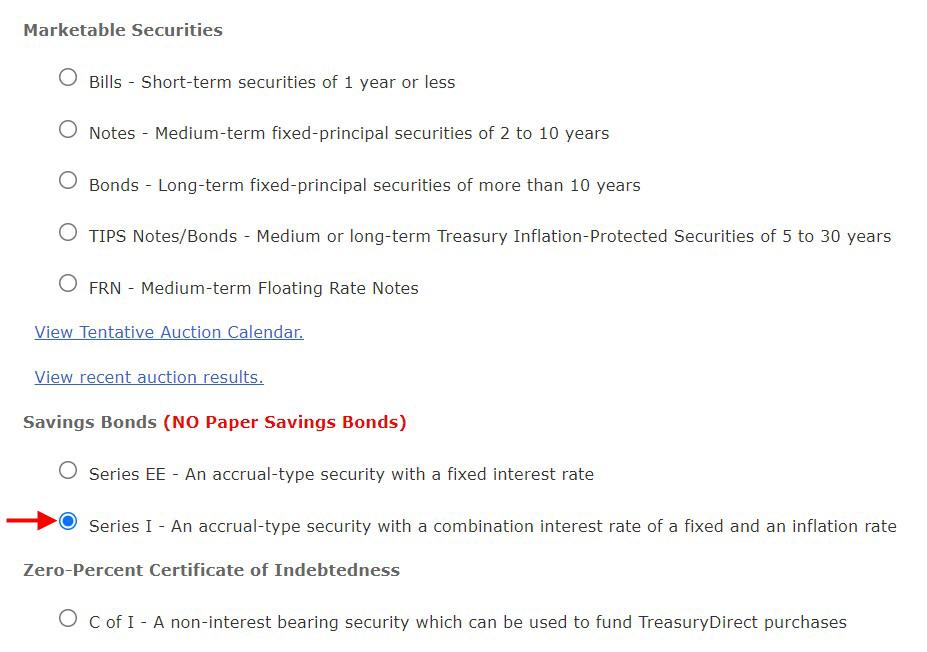

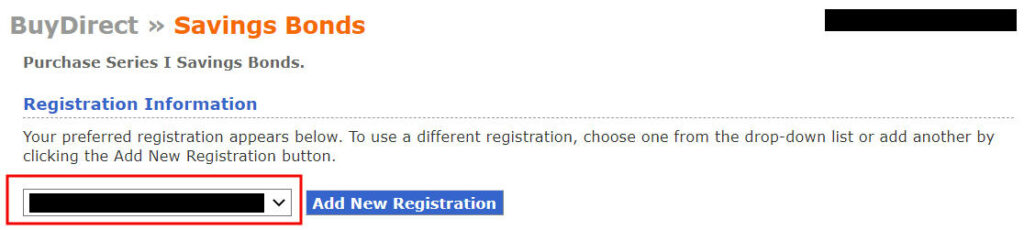

Now click on BuyDirect in the top menu.

Select “Series I.”

This is important. Use the dropdown to select the gift registration. The name of your gift recipient should appear first, for instance, “Gift Recipient POD My Name.”

Now enter the purchase amount and the rest of the information.

Pay attention to the registration information on the final purchase review page and make sure the purchase is for the intended gift recipient before you click on Submit.

Deliver Gift

See a walkthrough in Deliver I Bonds Bought as a Gift in TreasuryDirect. You need the gift recipient’s TreasuryDirect account number. If they don’t have a TreasuryDirect account, they need to open an account to receive the gift delivery even if they’re not buying any savings bonds on their own.

If the gift recipient is a minor, a parent needs to open a Minor Linked Account for the minor under the parent’s account (see Buy I Bonds in Your Children’s Names). The parent needs to open an account for themselves before they can open the account for the minor even if the parent isn’t buying any bonds.

Remember to check with the recipient how much they are planning to buy themselves this year because delivering gifts to them counts toward their annual purchase limit.

There’s no way to pre-schedule delivery for a future date. You’ll have to log in every time you’d like to deliver a gift. If you’re keeping undelivered gifts in your gift box, set calendar reminders for yourself and the recipient to make sure you don’t forget the undelivered gifts.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

ed says

I purchased 10K in i-bonds for my child via a child-linked account, and my wife did the same thing in April 2022. How does this work with the 10K limit rule for individuals purchasing/receiving given that they are gifts to the same child from each parent? Does each parent coordinate with one another on staggering the delivery?

JM says

You couldn’t both give your newly-purchased $10K gifts to the same child in the same year – that would violate Treasury’s rules. So, you’d have to coordinate.

And just a quick note about gifting to kids – keep in mind that if a child plans to go to college and apply for need-based financial aid, then assets in their own name will count at a much higher level towards expected family contribution (and against qualifying on need) than the same assets in their parents’ names.

sscrla says

You used the past tense, meaning your child has already acquired more than allowed in a single year. You may get away with it this year, but I suggest you follow the rules in the future. The CFR defines “you” as an account holder, and even if your child has two minor linked accounts, your child is still only one “you.”

HueyLD says

The Treasury can reverse the excess minor linked purchase ($10k) and return the money to one of the parents. The rule is very clear: “ You may purchase up to $10,000 of each savings bond type – EE or I bonds – per person each calendar year.”

https://www.treasurydirect.gov/indiv/help/tdhelp/help_ug_135-MinorAccountSum.htm

ed says

Thank you!!!

Roy says

Thanks, Harry! One final question, does a recipient need to have a TD account first? My adult aged kids don’t have one, so would they need an account for me to deliver the gift to them?

Harry Sit says

It’s covered in the “Gift Box and Delivery” section. The recipient will need to have a TreasuryDirect account eventually to receive the gift delivery but they don’t need an account when you buy the bonds. You can buy the bonds first, and then they will take their sweet time to create the account. You deliver the gift bonds afterward.

Shankar says

Excellent thread and discussions! Learned so much from this. Thank you everyone.

To clarify some points:

There are no tax reporting between the time the gift is purchased (this year) and the time the gift is given to the child when they turn 18, is that right?

We are not sure how to proceed – thinking of having the 529 plan as only stocks and having the money in this I-bond in the child’s name as only bonds.

Since only one of us have our TD accounts activated at this time and the time in April to purchase is around, we are thinking of purchasing $15,000 worth of IBonds on our child’s name and gifting it to them when they turn 18. would this need to be included during college application time for scholarship purposes?

also since my own account has not yet been approved, pending verification, we are also thinking of my wife gifting me $10,000 worth of Ibonds. In fact, as we are super risk averse and have been having all our money sit in our bank account so far, wondering whether to use the bulk of this money in our bank as a joint account for my wife to purchase as a Ibond gift in my name. or should the money only come from an account that is only in my wife’s name for it to be considered a gift?

if suppose my wife purchases $30,000 worth of Ibonds as gifts this week (to be given to me over the next 3 years), could we in the interim withdraw this money if there is a need for the money – or is the money locked until the time i am able to receive as a gift?

Thank you for all your help.

Harry Sit says

Undelivered gifts to a child are still the child’s assets. They should be reported on college financial aid applications.

Using a joint bank account is fine. Undelivered gifts are in limbo. No one can cash them out.

JM says

As noted above, about gifting to kids – keep in mind that if a child plans to go to college and apply for need-based financial aid, then assets in their own name will count at a much higher level towards expected family contribution (and against qualifying need) than the same assets in their parents’ names…

Parental assets are calculated at up to 5.64% on the FAFSA. Student-owned assets are counted at a rate of 20%.

Wil says

Hi Harry,

You mentioned there is $16,000 cap for gift to avoid filling the tax form. I am thinking to purchase $10,000 x2 ($20K in total) to deliver it to my spouse in the future, do I need to pay gift tax for 2022?

Thanks.

Marc says

I asked the same question because I also didn’t know the rule that unlimited gifts to a spouse are permitted under gift tax laws, so no gift tax form is required. The $10,000 per I Bond purchase or delivery limit still applies per year, though.

JM says

Harry wrote above:

“Gifts to the spouse aren’t limited by the $16,000 annual exemption amount. If you’re willing to hold the gifts for many years even when the interest rate on I Bonds isn’t competitive with other alternatives anymore, you can buy a lot more than $16,000.”

Someone on Bogleheads commented:

“What I wanted was an inflation-adjusted annuity as a Social Security bridge. Works well for that, at least up to what you can deliver out annually. My wife and I each have $90k sitting in the gift box at this point.”

Steve says

Harry,

Is the gift amount counted against the year the gift is purchased or the year the gift is delivered? If I purchased $20K i-bond as gift this year, and deliver $10K in 2023 and $10K in 2024, do I report the gift($20k) in 2022 or do I report $10K in 2023 return and $10K in 2024 return? If it is the latter, then nothing really needs to worry about as $10K is below the annual CAP. Thanks.

sscrla says

“Buying I Bonds as a gift counts toward your annual gift tax exclusion amount in the year of the purchase, which is 16,000 in 2022.” From Harry in the Gift Tax section.

However, this does not apply to a spouse, to whom you can make unlimited gifts.

Wil says

Harry and I-Bond guru,

I am still confused here. Since the i-bond gift will not be delivered until future years, this means the receiver really doesn’t receive the gift this year(2022). Is this counted toward this year’s tax-given limit for me?

Martin Anderson says

For financial aid purposes, most people who are under 24 are considered to be dependent upon their parents. When that’s the case, their assets and income are deemed to include their parents’ assets and your income. Financial aid won’t care whether you’ve given them a I-Bond worth $10k, or you have your own I-bond worth $10k. Either way, financial aid will assume that there is $10k available to pay for college.

There are a few exceptions, and so it may matter if your adult child is planning to marry young, have children young, or join the military.

See this link for more details:

https://finaid.org/about/contact/fafsa-independent-student

Matt says

Harry & I-Bond team – When gifting to spouse, why would you add yourself as the beneficiary instead of just co/ joint-owner? I know there’s the difference in viewing vs. transaction rights, but other than that, are there other reasons for going down the beneficiary vs. co/ joint owner route? Is there any probate involved for a beneficiary? Any other pros & cons? Thanks.

Harry Sit says

Because adding yourself as the second owner of a gift purchase isn’t an option. You get an error message when you try. The recipient can make you a second owner after you deliver the gift.

HueyLD says

I tried to make myself the secondary owner of my spouse’s gift bond but the system rejected my attempt. It does make sense that I cannot buy gift bond for myself.

And assigning myself as the beneficiary, aka POD, provides probate protection.

Martin Anderson says

A word about gift taxes…..

I’ve seen a lot of discussion about gift taxes in the comments. Many of the individual statements are correct, but there’s a lot of moving parts when it comes to taxes and so I encourage anyone who is thinking about making a gift to someone that exceeds the annual gift tax exclusion limit to research carefully.

I’ll provide a summary as I understand it, but bear in mind that I could be wrong. You should ask an accountant or do further research to determine for yourself what I’ve gotten right and what I’ve gotten wrong.

First, it is important to understand that gifts are taxed to the person making the gift, and not the recipient. The person who receives a gift has not received income and won’t have to pay any taxes under federal law. However, the gift must really be a gift. If you are giving someone a “gift” in exchange for them mowing your lawn, the IRS will probably treat that as earned income and tax the recipient (and not the giver). Similarly, if you give someone a “gift” in exchange for their car, you have bought their car, and neither gift tax nor income tax rules will apply. The gift/car transaction will likely be subject to state and local sales taxes.

Second, as Harry correctly noted, there is an unlimited annual exclusion for gifts to your spouse, which means you don’t pay any gift taxes on gifts to a spouse. You can give your spouse $100 million in a single year, or at your death, and no taxes are owed.

For gifts to anyone else, there is a $15,000 annual gift tax exclusion. That means that, every year, you can make a gift to any other individual for as much as $15,000 without owing a gift tax. This limit is a per giver and per recipient limit, so you can make as many $15,000 gifts in one year as you want. Your spouse can do the same. As a result, you can give an infinite amount of money to as long you split up the recipients so that no person receives more than $15,000 in a single year. In addition, your spouse can do the same, and so effectively, you and your spouse can give $30,000 to a single person every year with no gift taxes.

Third, even if you make a gift that exceeds the $15,000 annual per giver per person limit, that doesn’t mean you’ll have to pay gift taxes. You will need to file a gift tax return so that the IRS can apply the amount of the gift that exceeds the $15,000 annual limit to your lifetime gift tax exclusion limit, which is currently $11.7 million. The impact of using some of that limit during your lifetime is that you won’t get it again when you die.

So, if you make a $16,000 gift this year to your child, you’ll be using $1,000 of your $11.7 million lifetime credit. When you die, only $11.699 million of your estate will be exempt from the gift tax. If you’re not likely to have $11.699 million in your estate when you die, the only consequence of the gift will be that you’ll need to include a gift tax return with your 1040 filing next year.

Note that the $11.7M annual exemption could change. By the time you die, it could be $20M, or it could be $1M. If your estate at death is $2M, and the lifetime exclusion goes down, then that $1,000 gift this year could make a difference in how much tax you pay at death (and thus how much your heirs receive). But, as long as your estate at death is under the lifetime limit (minus any gifts in excess of the annual limit you made during life), then it won’t matter that you exceeded the lifetime limit.

For most of us, the total value of our estate at death will be well under the limit, and so it won’t really matter if you give away more than $15,000, except that you’ll have to file an additional document (a gift tax return) at the time you file your income tax return.

My discussion relates to federal gift tax. It is possible that your State may tax gifts as well, so you shouldn’t ignore that possibility without investigating it.

When it comes to Treasury Direct, if you create POD registration, that person is not receiving a gift until your death. That won’t raise any issues with the annual gift tax exclusion, but it will be applied against your lifetime limit when you die. If you create a joint registration, that will count as a gift on the date you create it, though if that person is your spouse, it won’t matter (see above).

However, if you create a gift box gift, I suspect that will count as a gift in the year you create it, regardless of when you deliver it. Federal tax law on when a gift is completed is very complicated, but generally speaking, if you can’t undo it, the gift is completed. I’ll leave it to Harry to answer the question of whether you can undo an undelivered gift box transaction, but if you can’t, then I think it is likely treated as a gift on the day you bought it.

Steve says

Thanks a lot for the summary. One question, if I gift my spouse $16K+ in I-Bond this year(2022) though the fund will be delivered in future years, do I need to file gift-tax return in my 2022 tax return even there can be unlimited annual exclusion between spouses?

Harry Sit says

No, you don’t need to file a gift tax return for gifts to your spouse.

Martin Anderson says

I believe that specific questions like that should be directed to your accountant.

Harry Sit says

A gift box gift can’t be undone. Even if you die before you deliver the gift, the gift still belongs to the designated recipient. Even if you don’t deliver the gift in 30 years and the bonds matured, the resulting cash still belongs to the previously designated recipient.

Anon says

Sooooo, part of the US Treasury, TD says how to structure a so-called gift for its site, yet doesn’t disclose it’s also a future gift for tax purposes requiring filing of a gift tax return in EVERY situation! That’s a good gotcha! I submit TD is NOT advising the other part of Treasury, ie, IRS, “go after this person” and if not it is aiding and abetting all “gifters!” Really…I don’t buy it!

Marc says

No one says you have to buy it, but you can indeed gift up to the $16,000 annual limit to anyone without filing a gift tax return, and can gift an unlimited amount to a spouse without filing a gift tax return. In terms of I Bonds, you can do the same thing, but you have a $10,000 “deliver from the gift box” limit per person per year unless that person has also purchased $10,000 of I Bonds for him or herself, in which case you have to wait until a subsequent year.

Marc says

Thank you for this post. I just want to point out that the annual gift exclusion for 2022 is $16,000, not $15,000. Other references to the amount should be adjusted accordingly.

Martin Anderson says

I think that you’re right. Also, it appears that the lifetime exclusion was raised to $12,060,000 as well.

Anon says

Marc…if one follows Martin’s logic ibond “gifts” are not a present interest/gift and therefore a gift tax return is required. The annual exclusion only applies to present gifts…there is a difference. I concur in that logic. But where we differ…My scenario is the term for gifts are not the same

sscrla says

“Note that the $11.7M annual exemption could change. ” I believe you meant lifetime, not annual.

Technically, there is no lifetime exclusion, rather there is a lifetime tax credit, which is often converted to the amount of gift that would be paid for by that credit. Looking at the 2021 instructions for form 709, you see “The basic credit amount for 2021 is $4,625,800. ”

https://www.irs.gov/pub/irs-pdf/i709.pdf

I really suggest people read the instructions, even if you aren’t filling out the form. (You should also check where you live). If you live in a community property state and make a gift of community property, it is treated one way; if you make a gift of separate property, it is treated another.

Martin Anderson says

And if you really want to go down a rabbit whole on the gift tax thing…

The annual gift tax exclusion (which is now $16k and not $15k as my post earlier stated) only applies to gifts of a present interest. That generally means that the recipient can enjoy the gift now. If the gift is a completed gift of a benefit that they can only enjoy in the future (a “future interest”), then it subject to immediate gift tax at its net present value and there is NO ANNUAL EXCLUSION.

So, for example, if I create an irrevocable trust and I put $16,000 in it for my adult child, and the terms of the trust are that my child can receive the funds in two years, then the $15,000 gift is NOT exempt under the $16,000 annual limit. The present value of receiving $16,000 in two years (which is somewhat less than $16,000) is immediately taxable. Attorneys have created a work-around for this, which is entitled a “Crummy Power,” (Google it) to allow the gift to be treated as the gift of a present interest. Basically, you give the recipient, my child in this case, the power to accept the money now, but if he doesn’t, then it stays in the trust for two years. The lapse of the power, however, can also be treated as a gift if there are other beneficiaries, and so it can get quite complicated.

My reason for bringing all of this up is that if the recipient of the gift box gift cannot access the funds until you deliver them, then the gift might be treated as a gift of a future interest, and then it would not be eligible for the $16,000 annual gift tax exclusion and could instead be immediately taxable at the 40% gift tax rate.

Again, I’ll defer to Harry on whether a gift box recipient could force a transfer before you decide to deliver it.

Anonymous says

Annual Exclusion does not apply in this scenario. And the amount is subject to Gift Tax. However, if one has not used up her/his unified lifetime gift/estate tax credit (“UGETC”), no tax will be payable — currently that equates to over $11MM of gifts until 20025 (or until Congress lower it sooner).

Anon says

I think too many are confusing a gift of Ibonds under TD regs with the notion of gifts under taxation code. There is no gift under the latter until/unless “delivered” by TD

sscrla says

Then again, your $10k gift might result in a tax of zero (before application of the credit). The gift tax is a graduated tax, and the 40% rate doesn’t apply until you have given over $1 million in taxable gifts. At the bottom end, only if your taxable gifts are over $10k does the 18% tax on the excess apply. See Table for Computing Gift Tax in the 2021 instructions.

sscrla says

“we are thinking of purchasing $15,000 worth of IBonds on our child’s name and gifting it to them when they turn 18”

You should read again about the annual limit on acquisitions (which TD refers to as a purchase by your child).

See the section on Purchase limit.

“The limit is on how much you can deliver to the same recipient in the same calendar year.”

P.S. the gift is made when you purchase the bonds in April 2022, so there is no “gifting it to them when they turn 18.”

Matt says

How does the redemption penalty in the first five years work? Say that I cash out on May 10th after holding the I-Bonds for a year. Would I still get interest for the first 10 days of May or for the full month of May? Would I lose the interest from Feb, Mar & April or would I lose the interest from Feb 10 – May 9th

Harry Sit says

You don’t earn any interest in May. You lose interest from February, March, and April.

Frank says

I thought I brought $10,000 as gift to my son. But somehow it did not show up in the Gift Box. I got an email from Treasury that it would return my money since I maxed out. I am wondering if there is a way to convert an iBond to a gift online. Thanks.

sscrla says

§ 363.95 How may I give, and who can receive, a book-entry savings bond as a gift?

You may give a book-entry savings bond as a gift in two ways:

(a) An individual may purchase a book-entry savings bond online as a gift and give it to an individual; or

(b) A person who owns a bond may transfer that bond to another person as a gift with immediate delivery.

(a) doesn’t apply to your purchase as you didn’t buy it as a gift. (b) doesn’t apply since they won’t let you buy this additional bond for yourself.

What you can do is buy a new bond as a gift with the either another $10k or the $10k that will be returned to you. Of course, you won’t get an April date on it, but it will earn the May rate if you get it done this month.

Dunmovin says

Q Harry, my spouse and I have TD accounts linked to our checking account which has our adult daughter (same last name) on the checking account too. Can I buy as a gift to daughter $10K of Ibonds (my spouse as beneficiary), have daughter set up a TD account, deliver those Ibonds to her and at 12+ months from purchase she redeems with the funds going to common checking account? Subsequently, she gifts those redeemed funds to me (I write a check and withdraw and I make a gift to her to cover her income tax on interest…with an effective interest rate being, of course, greater than that at a financial institution.)? What do you think? Do it similarly with spouse gifting and using the “Martin concept above,” have a total of $20K delivered to daughter in same year.? PS We trust our daughter!

MikeG says

If you make a gift to your daughter you can’t have a side agreement for her to give the money back to you simply because you want to buy more than $10,000 in i bonds.

You can do the front loading / pre-purchasing of the 2023 and 2024 (or more years) as gifts between your wife and you. That is within the rules.

Would have been a lot better to do this in April though.

Harry Sit says

If you want to give your daughter I Bonds, buy them as a gift for her. It’ll give her a boost. She’ll appreciate it. Asking her to give the money back feels fishy and icky. I would be upset if my parents proposed it to me. Responsible parents don’t drag their children into questionable schemes.

sscrla says

The limit on acquisitions in a single year of $10k applies to your daughter. Delivery of two $10k gifts in a single year would be an acquisition of $20k and is not allowed.

Dunmovin says

Legal question? Not here.

But a partnership or a gift and then a change in mind due to… and reread the Martin “success” story on delivery of more than $10K in one year to same person

Harry, what do you think?

Lizzie says

If my partner accidentally a gift for our minor child instead of buying in our child’s minor account, can we just open a minor account for him under one of our accounts and transfer the gift into his minor account?

Also, can my partner list himself as the POD on a gift bond to our child? Can he also do that on a bond that we buy in the minor account?

Harry Sit says

The child needs to have a minor-linked account regardless. You can open one for the child under your account and then your partner can deliver the gift to that account. The POD on a gift bond can’t be modified until it’s delivered. The purchaser can name any POD at the time of purchase whether it’s a gift or not.

Lizzie says

Hi again – when does the interest from April get posted in May? Sorry for all the questions – we’re relatively new to the Bond world. Thanks,

Harry Sit says

It doesn’t matter. You can’t cash out in the first year anyway. Whatever number you see is just a number you can’t do anything with. Just put the money in and check back after a year.

Mike says

Harry wrote in this article (EMPHASIS MINE): “You can buy a maximum of $10,000 for any recipient in one purchase BUT THERE’S NO LIMIT ON how many recipients you buy for or HOW MANY TIMES YOU CAN BUY FOR THE SAME RECIPIENT IN ANY CALENDER YEAR. If you’d like, you can buy $10,000 worth of I Bonds for each of your 20 family members or YOU CAN MAKE FIVE SEPARATE PURCHAES OF $10,000 EACH FOR THE SAME FAMILY MEMBER, ALL IN THE SAME CALENDER YEAR”

Does this mean that if I had $50,000, I can buy and gift $50,000 in I-Bonds to my mother in the same calender year, such as 2022, if I just make 5 seperate purchases of $10,000 I-Bonds? In other words, I can buy and gift $10,000 worth of I-Bonds once a day for the next 5 days this week and gift them all to my mother for a total of $50,000 in I-Bonds to her this week?

Thanks for your feedback Harry (and other readers).

Harry Sit says

The emphasis is on “buy” not “buy and deliver.” If you only buy and don’t deliver, absolutely. See the “pre-purchase” section.

Alexi Assmus says

What are the differences between being secondary owner and beneficiary?

Harry Sit says

The optional transact rights during the owner’s lifetime. See I Bonds Beneficiary vs Second Owner in TreasuryDirect.

Don S says

Mr. Sit, I own 2 – $10,000 I bonds (1 purchased in 2021, 1 in 2022). After I purchased them I was able to go into Manage Direct, Edit a Registration and select the I bond I wanted to add my spouse as a POD Beneficiary and did so. I bought a $10,000 I bond in 4/2022 as a gift for her but won’t deliver it until after 12/31/2022. I would like to add myself as a POD but am unable to pull it up under “Manage Direct, Edit a Registration”. How do I add myself as a POD to this I bond prior to Delivery? I couldn’t see any way to add the POD to the Registration prior to purchasing the I Bond.

Harry Sit says

You can’t add a POD to gift bonds you already purchased but you could’ve done it at the time of purchase. See the “avoid mistakes” section at the end of this post.

Now you have to wait until you deliver the gift and the gift recipient can add you if they so choose.

David Dunn says

If my father buys a Series I Savings Bond as a gift for me, he gives my name and SSN during the purchase. Will a “resource check” done by a government agency for purposes of calculating government benefits (like Medicaid, Medicare Savings Program, food stamps, etc.) show that I own $10,000 in these bonds? Let’s say that my father never tells me about the purchase and does not deliver the bond to me, instead holding it his gift box. Will that $10,000 in my name and SSN but NOT delivered to me still count as a resource of mine? Also, regardless of whether it counts against me or not, would I get away with not disclosing it on my renewal applications for government aid? I can always claim that I had no idea of my father’s gift to me since it had never been delivered?

Affinity4Investing says

David Dunn,

What a disgusting affront to the purpose of this educational and wonderfully helpful website. Interesting how $10K can be in one hand to buy an i-Bond and “government aid” checks be in the other as you query how to milk the system for all you can get out of it. Seriously guy, give us a break.

Harry Sit says

Whether it’s delivered, the bond has your SSN on it. It’s your resource. It’s the easiest to see because it’s literally in the government’s system. You can’t get away with not disclosing it.

Old mariner says

I thought David asked an interesting question. However, if I were David, I’d get an answer to my question directly from the government aid people. The specific rules and definitions of that aid agency are what determine if he needs to declare it or not.

If I person is eligible for certain programs (whether low income, high income, job related, education related, etc.), they have every right to avail themselves of those programs in accordance with the specific rules of each program.

David Dunn says

I’m simply interested in how the regulations for these savings bonds apply to my situation–the same as everybody else posting here.

Dunmovin says

You all should give David a break. If in fact one does not know about a purported undelivered gift with no TD accounts, they can’t disclose it. But if asked later, they’ll have to explain… everything including this Q&A!

Boba T. says

Wow. Think of the possibilities with undelivered i Bonds.

1). If the account holder dies before delivery of the gift, the gift i Bonds still belong to the recipient.

2). § 363.52 Bonds received due to the death of the registered owner are not included in the computation for the recipient.

Arthur says

This seems like a loophole in the $10K limit. Suppose your spouse has a terminal diagnosis. You then gift them a boatload of i-bonds, with yourself as the beneficiary. When they die, you get all the bonds, and are not subject to the $10K limit. Is that right?

Or you could find a bunch of people with terminal diagnoses (or just very elderly and frail), and gift them each $16K in i-bonds, with yourself as the beneficiary. Upon each death, you now have $16K more i-bonds. Since you never delivered the gifts, the only risk is if you die before they do. That would be weird.

Frank says

Can you please elaborate why buying I Bonds as a gift counts toward your annual gift tax exclusion amount in the year of the purchase and not the year of delivery?

sscrla says

My thought: because as Boba T. points out above, a gift given is a gift given, i.e., it no longer belongs to you. Whether the annual exclusion applies (is it a gift of a present interest?) is another question

Harry Sit says

Because the gift bond is permanently titled to the recipient as soon as you buy it. All economic benefits from that point forward accrue to the recipient. Delivering the bond doesn’t transfer ownership. It only gives them something that’s already theirs.

anonymous says

Harry,

The bond is not permanently titled to the recipient . . . in some cases.

For example, if there is a POD, and the recipient dies before delivery, the bond then becomes titled in the name of the POD recipient.

If the POD recipient is the purchaser, that means a “gift” was never given by the purchaser, because you can’t give a gift to yourself.

Which brings up the question . . . how can the purchaser be levied Gift Tax at the time of purchase if there is the possibility that the gift will NEVER be delivered to the recipient?

In the above example, there is no “future interest”. Only when a bond is delivered has a gift been actually given, and at that time it is a gift of “present interest”.

Even though Treasury may “title” someone as the “owner” of a bond, this designation is not in line with the customary definition of ownership and therefore invalid. You don’t “own” something if under some circumstances you can never take possession of it, or use it, or sell it, or give it to your heirs. With the Gift Box, the Treasury has created a limbo situation in which there is no certain “owner” of the bond until the bond is delivered.

Dunmovin says

Anon…I doubt if anyone will have a gift tax payment issue involving ibonds ($10k

purchases) but that is not the triggering event…was there a gift for gift tax purposes? Yes. The rights/title has passed (clearly beyond the control of giftor) but final delivery is conditional….not unlike other conditional gifts in estate planning, etc. That is not a present interest (where a annual gift tax exclusion may be applicable) If to a non spouse the open Q is…is a gift tax return required to be filed? Obviously no tax will be due given lifetime $ amount exemption. Now if someone has some regs/cases on the point…please share. We can all surmise whether or not this has hit the IRS radar…keeping in mind the $ amount AND TD as part of Treasury while the IRS shouldn’t be setting up gotchas for technical issues when Treasury could notify the public, and hasn’t!

This is the analysis that works for me!

cl Wu says

Help! I should have held the gift in the gift box since my husband already bought 10000 this year for himself but I hit the “deliver” button and he now has 20,000 on his account. What happens next?

Harry Sit says

Just wait. Maybe nothing. TreasuryDirect will contact your husband if they will take any action.

Pete says

Do as Harry says, just wait. I’m curious as to what will happen. After reading everything here, my wife and I each bought 10k of I Bonds this year and plan to buy another 2x10K as gifts this year for each other. But I got thinking. Since we both bought our 10K limit, why can’t we gift the 2x10K each this year as well instead of waiting and delivery later next year or so. I mean, lets say myself & wife and our 15 brothers all decided to buy I Bonds as gifts to our one niece. So 17 10K I bonds all delivered this year to our niece. So, yes, she can’t buy any herself, but she gets 17 10K I bonds. I believe Harry also gave an example above.

Leighton says

Pete: Under the heading “Purchase Limit” above, Harry says, “The principal amount of delivered gifts counts toward the $10,000 annual purchase limit of the recipient in the year of delivery.”

Crash says

Hi, I know individuals can buy / recieve gift bonds but can the other entities Ibonds (LLC, Scorp, trusts etc) also buy and / or receive gift bonds?

Harry Sit says

Entities can buy I Bonds but they can’t give or receive gifts. See Buy I Bonds for Your Business: Sole Proprietorship, LLC, S-Corp and Buy More I Bonds in a Revocable Living Trust.

HueyLD says

What Harry said is correct for GIFTING. There is a major difference between a gift and a transfer for TD savings bonds.

When one purchases a gift for another person, the purchase is irrevocably owned by the recipient upon purchase and the gifter does not own it, nor is the gifter liable for income taxes on accrued interest upon delivery to the recipient.

For a transfer, the transferor is liable for income taxes on accrued interest up to the date of transfer unless one of the three criteria is met as stated on the transfer form.

For readers of Harry’s excellent blogs, please keep in mind of the language and facts.

Martin Anderson says

Harry’s answer is not quite right. While it is true that entities cannot buy or receive I-bonds using the “gift box” feature, entity accounts can buy I-bonds and then give them has gifts (or receive gifts from others).

In order to do that, the entity would buy the I-bond for itself, subject to all the rules about purchase limits. Once the purchase was complete, the entity could then transfer the bond to another person using FS Form 5511. The transfer would count as a gift unless it was given for consideration. Unlike with a gift box, the bond wouldn’t belong to the recipient until the FS Form 5511 is signed.

Dunmovin says

Martin…exactly my point…merely b/c TD says a transaction may constitute a gift (for TD purposes) does not necessarily mean it constitutes a gift for other purposes, eg for gift taxes

Matt says

I set up a new treasury direct account but made an air in my bank account number. So before I corrected the problem my wife gifted a $10,000 Eivind to me. Subsequently my account got corrected and I purchased $10,000 I bond. And then my wife delivered the 10,000 gift band that she purchased for me and it shows up in my account as I have $20,000 in Ivonne securities. Doesn’t that put me over the limit? And what happens now? Can I return it to her gift box or will treasury eventually do that?

sscrla says

Is your wife cl Wu? She wrote ” I should have held the gift in the gift box since my husband already bought 10000 this year for himself but I hit the “deliver” button and he now has 20,000 on his account. What happens next?”

I agree with Harry’s answer: “Just wait. Maybe nothing. TreasuryDirect will contact your husband if they will take any action.”

From other websites I have seen responses where TD left the money in the account and said “never do that again.” I have also seen responses that included returning the money to your linked bank account. These were for a person buying $20k for themselves.

Sam says

Hi Harry, This is a great information. My Question is this…for someone having emergency cash of around 100K with very bad options in the index bond funds, is multiple purchases to the gift box an option. Can one ladder up on Ibonds between husband and wife with this multiple 10k gift option, wait out the CD low rates and bond index bloodbath that is happening out there? Curious on your thoughts on this approach.

MikeG says

You could but you’d have money locked up here for many years – perhaps several years after better opportunities surface in other fixed income options.

My wife and I invested $60K back in April. $10K for each of us for 2022 and then gift purchases for one another for 2023 and 2024. Did not really want to lock up money till 2025 and beyond not knowing that is going to happen with I Bond and other market rates between now and then.

Dunmovin says

Mike, try delivering the gift to one spouse now and see if it “goes through”…if it does, you can purchase more next year. Let us know what happens.

Boba T. says

If a substantial number of gift i Bonds remain in the gift box, undelivered, when the DONOR passes away, does the $10K per year per recipient limit still apply? Or the named recipient gets all that delivered in one fell swoop? Makes for interesting estate planning possibilities for older donors (since there is no limit on purchase of gift i Bonds). Does anyone know the answer? Thanks.

HueyLD says

My educated guess is that the legal owner of undelivered gift bonds, i.e. the named recipient, can call or email TD and have “all” undelivered gift bonds delivered at once.

I think it can only be settled by calling or emailing TD.

Dunmovin says

It’s still not clear to me and possibly others…

1. If ibonds are purchased as a gift to a non spouse, is a gift tax return required or is this considered a present interest transfer and subject to normal annual exemption amount?

2. And if multiple gift ibonds are again made in the same year to same nonspouse…what is the gift tax ramifications?

3. Delivery would be through various years in the future given the TD $10k per delivery year rule

Thanks

MS says

Thanks to everybody for all these great posts, I wanted to tag to the last questions:

I already purchased 10k I-bond for my daughter and want to purchase another 10k as gift to be delivered next year. Would this require gift tax filing? In other words is the first 10k considered as gift?

Marc says

Assuming the first $10K I Bond was a gift from you to your daughter in 2022, the second $6K in 2022 would incur no gift tax since the annual gift exclusion to anyone other than a spouse is $16K. Therefore it seems to me that the additional $4K overage would require a gift tax filing.

Martin Anderson says

If you are married, then have your wife give the second I-bond to your daughter. Your wife has a $16k annual exclusion just like you do.

Dunmovin says

Q for all…assume non spouse is recipient….why is a gift box purchase a present/current purchase and subject to annual exemption amount….there is a difference in the process for a gift purchase that vests/delivered immediately this year as compared to the gift box purchase for delivery in subsequent year(s). TD rules on $10k delivery limit per year person is a separate matter. Any authority for gift box being a present gift? Harry what do u think? Thanks

Dunmovin says

As a PS to the post above:

“Looking at other sites…I see that the Q being asked was also posed before (see below)…I haven’t seen any definitive answer BUT i did find another robust thread on this narrow topic (over 200 posts!) on/at

https://www.bogleheads.org/forum/viewtopic.php?t=306297&start=150

“Any idea what’s the gift tax treatment? Does the bond count against the gift tax exclusion in the year when the savings bond are purchased and put in the gift box (because “the registration is irrevocable”), or in the year when the bond is transferred to the recipient’s account (because until then the purchaser still has some control over it)?

Anyone see “the” answer???

Harry, what’s the verdict on tax treatment for gift box purchases? Thanks

Harry Sit says

It’s already covered in the section “Gift Tax Form 709.”

MS says

Thanks Marc! That’s a good point but my wife gifted our other daughter, so she will be limited to 6k as well. Actually that brings my next question, can I gift my other daughter $16k without reporting gift tax? If the answer is yes my wife would be able to do the same so we can buy $32k and gift them to our daughters in 2023, does that sound correct?

Marc says

I would say each individual parent can gift up to $16K per year to each individual child, regardless of the financial instrument (cash, bonds, stocks, etc.).

With I Bonds, you and your spouse can each buy $10K for each daughter now and deliver $20K to each daughter now ($40K in all).

In addition, you can each buy an additional $6K for each daughter now, but hold in the Gift Box for the remainder of 2023 and deliver $12K to each daughter any time after January 1, 2023 ($24K in all).

The total purchase comes to $64K between you and your spouse.

Of course you can add more I Bonds now by buying for yourselves and gifting to each other as well.

MS says

That’s right, although can we deliver $20k for each daughter right now? I thought the limit per person per year is $10k for I bonds

Marc says

Oops, you’re right. You can only deliver $10K to each daughter now but you can buy $32K between the two of you for each daughter now totaling $64K. You just have to stagger the delivery $10K per year per daughter. Sorry for the confusion on that point.

Dunmovin says

Harry, sorry I didn’t see anything in your discussion on form 709 dealing with gift box purchases, i.e front lot loading the gift box, on taxes…what did I miss? Should your readers know the tax consequences of gift box purchases? Thanks!

Harry Sit says

It’s the same whether you front load or not. Buying I Bonds as a gift counts toward your annual gift tax exclusion amount in the year of the purchase (not the year of delivery).

HueyLD says

To add to Harry’s comments, those who are inclined to read should carefully study the following federal laws/regulations on the definition of completed gift and irrevocability of a gift savings bond upon purchase.

31 CFR § 363.96(b) and

26 CFR § 25.2511-2(b)

Quotes:

“ The gift bond will be registered in the name of the recipient(s). The registration is irrevocable with regard to the owner named on the gift bond.”

“ As to any property, or part thereof or interest therein, of which the donor has so parted with dominion and control as to leave in him no power to change its disposition, whether for his own benefit or for the benefit of another, the gift is complete. ”

anonymous says

HueyLD

The gift of an I-Bond held in the Gift Box is NOT complete until delivery, thus not subject to Gift Tax, even though the Treasury says the recipient is the “owner”.

Here’s why:

26 CFR § 25.2511-2(b) says:

“ As to any property, or part thereof or interest therein, of which the donor has so parted with dominion and control as to leave in him no power to change its disposition, whether for his own benefit or for the benefit of another, the gift is complete. ”

That means that if the Donar still retains “dominion and control” to be able to “change its disposition”, the gift is NOT complete.

31 CFR § 363.96(b) says:

“you (the Donar) may hold the bond in your TreasuryDirect ® account until you are ready to deliver the bond to the owner named on the gift bond. ”

Thus, the Donar has “the power” to decide when, or if, the bond is delivered (“disposed”), at his sole discretion. Not the Treasury, nor the recipient. In fact, the Donar can choose to never deliver the bond at all. Or, if the bond is POD in favor of the Donar, he/she can hold up delivery hoping the recipient will die first, and then ownership of the bond will revert to the Donar.

(Example: A marriage goes sour and is heading for divorce. The Donar now wants the spouse to never receive the bond in the Gift Box. The recipient wants the bond and asks the judge for it. But according the Treasury, she already owns the bond — it is not her husbands property so cannot be obtained through division of assets. The husband could be seen as the custodian of the bond until delivery, but as such he has the statutory right to deliver the bond “when he is ready”. 31 CFR § 363.96(b).

According to 26 CFR § 25.2511-2(b), the gift is “NOT complete”. Only when the bond leaves the Gift Box and is delivered to the recipient is the gift complete. How then can the IRS justify a gift tax on something that has not yet become a gift.

Dunmovin says

Then if one gift boxes $20k to the same person for delivery in outyears, a gift tax return is required the year of purchase but no tax is due…is that what I’m reading?

sscrla says

It depends on what you mean by due. There is a tax due, and you pay it with your lifetime credit. That nothing comes out of your pocket doesn’t mean there wasn’t a tax and you didn’t pay it. Income tax works the same way. You have tax due, but you have credits you apply against that tax. That doesn’t mean you didn’t get taxed.

Marc says

Not if the person is your spouse.

Dunmovin says

The lifetime multi dollar gift/estate exemption provides no tax is due in this scenario but a return is required since the annual exemption only applies for gifts to same person is <$16k. Income tax is irrelevant. Again, a gift tax return is required…right Harry?

Dunmovin says

Harry…see your other posts on your ibond thread…let me clarify earlier posts…what do you think…does one need to file a gift tax return when greater than $16k is gift boxed to one person, a non-spouse, in one year? Is this something that may be of interest to all? Thanks

Harry Sit says

Buying I Bonds as a gift counts toward your annual gift tax exclusion amount in the year of the purchase (not the year of delivery). The gift tax annual exclusion amount is $16,000 in 2022 from any one person to each non-spouse recipient and unlimited to a spouse. If the I Bonds you buy for someone plus any other gifts you give to the same recipient in the same calendar year exceed the annual gift tax exclusion amount, you’re required to file a gift tax return on Form 709.

The gift tax return is separate from the income tax return. It goes to a special address. When you apply part of your lifetime exemption amount, you don’t pay anything out of pocket but you’ll have to keep track of how much of your lifetime exemption amount you have used up and how much you still have left. See IRS Instructions for Form 709.

sscrla says

“Not all gifts qualify for the annual exclusion. A gift must be of a “present interest in property” to qualify for this exclusion from the gift tax.” https://www.pnc.com/insights/wealth-management/transferring-family-wealth/annual-exclusion-gifting-explained.html

The law:

(b) Exclusions from gifts

(1) In general

In the case of gifts (other than gifts of future interests in property) made to any person by the donor during the calendar year, …

https://www.law.cornell.edu/uscode/text/26/2503

I don’t see how a bond given as a gift but not delivered for four or five years is a gift of present interest. It would seem that while the gift is completed, it is a gift of future interest and thus not eligible for the annual exclusion.

Harry Sit says

To avoid the tricky determination in whether it’s present interest or future interest, only gift to the spouse or deliver gifts to non-spouse within the same calendar year. There’s no ambiguity in either scenario.

Harry Sit says

sscrla – I edited the “Gift Tax Form 709” section to make the distinction between present interest gifts and future interest gifts. Gifts to non-citizens have additional nuance in the IRS instructions.

Rebeccah says

Harry, what if the spouse is a noncitizen (a permanent resident)?

Harry Sit says

Sorry, it’s not my expertise. Please search for the word “citizen” in IRS Instructions for Form 709.

Dunmovin says

To nonspouse…as long as it’s $10k or less. Thanks, Harry!

Bobby B says

Is the interest rate you receive from a purchased I bond locked in at the current rate or does it change every six months based on fixed plus inflation?

Harry Sit says

It changes every six months based on fixed plus inflation.

sscrla says

Understand the meaning of fixed. Fixed doesn’t change.

“The interest rate combines two separate rates:

A fixed rate of return, which remains the same throughout the life of the I bond.

A variable semiannual inflation rate based on changes in the Consumer Price Index for all Urban Consumers (CPI-U).” from Treasury Direct

MS says

Hi All,

A totally separate subject, is there any way to get paper I-bond other than the tax return? I owed money so I couldn’t do it this year. Paper I-bond has $5k allowance per person per year extra on the top of the electronic I-bond, is that right?

sscrla says

It is per tax return, so if you are married and file jointly, the limit is $5k total for the both of you. If you file separately, you can each get $5k. Obviously, if you are not married, your limit is $5k for your one tax return.

MS says

So no other way to get paper bonds other than tax return is that right?

Can I get gift paper bonds for the kids?

Harry Sit says

That’s right. You can use your tax refund to buy paper bonds for up to two kids (lines 5a and 6a on Form 8888).

MS says

Thanks Harry! I guess nothing to the wife if we file jointly…Also can I later convert them to electronic bonds?

Harry Sit says

The owner can deposit paper bonds into their online account. See How To Deposit Paper I Bonds to TreasuryDirect Online Account.

Marc says

All the Fed rate hikes this year got me wondering on what basis does Treasury Direct raise the fixed rate component of I Bonds? Is it a “behind the curtains’ mysterious thing they keep secret, or do they publish any criteria or threshold upon which that decision is made? Is history any guide on this?

Harry, what are the odds the November adjustment reintroduces a fixed rate portion of I bonds greater than 0%?

Harry Sit says

No published criteria. A person or a committee decides. I don’t know the odds. I’ll buy again in January if they raise it in November.

MikeG says

Harry, since you will know the rate for Nov in mid Oct, why would you not buy in Oct instead of waiting till January? You’d lock in 6 months at 9.62% that way before moving to the Nov rate.

Since I know you did some front loading (probably already bought 2023 and 2024), I am curious to better understand your though process.

FWIW, my wife and I bought our 2022 allotment in April and front loaded 2023 and 2024 in gifts for each other also in April.

Harry Sit says

We won’t know whether the fixed rate will be raised until November. We’ll only know the new variable rate in mid-October. If they raise the fixed rate in November, I’ll want the higher fixed rate. I already bought the full quota this year plus enough gifts. I can technically buy another gift in November and deliver an existing gift in January, but a regular purchase in January will work just fine.

MikeG says

Yes, we won’t know if the fixed rate moves off zero until November.

However, I think we can all agree that the largest component of the November rate will be the inflation component (not the fixed component – which is more likely than not going to remain at zero, where it has been for the last 5 rate resets). If the inflation component is attractive on its own (which it is likely to be), and if one were inclined to make a January purchase because of it, by making that purchase in Oct locks in 6-months of the current 9.62% rate for that purchase, whereas waiting till January misses that opportunity.

Further, if the purchaser had front loaded 2023 already with a gift purchase (as we have both apparently done), then the bonds bought in Oct would be a gift for delivery in or after 2024 (2025 in my case, since my wife and I have made gift box purchases with expected deliveries in 2023 and 2024 already). If we were to wait until January, that purchase would then either be for 2023 (pushing the previously purchased gift bond with expected delivery in 2023 out until 2024 or later) or it would be for 2024 or later delivery anyway. We would end up in a similar position either way, but worse off financially because we waited till January to make the purchase.

So, I am trying to understand your thinking as I am in the same boat and have concluded that I will make the decision to purchase another tranche in Oct when I know what the Nov rate reset is going to be and not wait till January. Want to make sure I am not missing or overlooking something.

Thanks,

Harry Sit says

That makes sense if you’re willing to push your last delivery to 2025. I’m not ready to commit to that far yet even if the variable rate is high. I get the high variable rate with my existing gift anyway. If they don’t raise the fixed rate I may just skip the purchase and move on to TIPS.

FinanceMom says

What are the estate/gift tax implications for this situation:

Wife purchases $50k in gift bonds naming husband as recipient and their child as beneficiary. Before gifts are delivered, both husband and wife die.

According to regulations, undistributed gift bonds are delivered to the named gift recipient upon the death of the purchaser and this amount is not subject to the annual purchase limit.

The bonds would be reissued to the child, but would they be considered part of the estate for estate tax purposes?

Harry Sit says

Delivered or undelivered, the bonds are the husband’s assets. Assets passed to the named beneficiary are still part of the estate.

FinanceMom says

That makes sense, but I’m trying to wrap my head around how it actually works. If husband dies first, would his death force distribution of the bonds to the child? Or do they sit in wife’s gift box until she chooses to distribute them,

If the bonds would part of husband’s estate, but the child is the actual recipient of the bonds (because husband died first), is it just like any other POD account or are there gift tax issues if the amount is over the annual gift-tax exclusion and the estate is subject to estate tax?

FinanceMom says

And would it make a difference if child was named as second owner rather than beneficiary?

Harry Sit says

TreasuryDirect doesn’t know the husband died until someone (presumably the wife) notifies them. Then it’s handled like other POD assets. It doesn’t make any difference when the child is named the second owner or the beneficiary.

FinanceMom says

I guess that is what I’m wondering about. What if no one notifies TreasuryDirect until after both the wife and husband have died. I’m thinking of a situation where wife buys the bonds as gifts naming husband and child but has forgotten about them by the time husband dies so Treasury is never notified and wife never delivers the bonds to child. Child learns about the bonds after wife’s death and the bonds are distributed to the child. The husband’s estate was closed years ago. Does the child have to amend the federal estate tax return to add the recently discovered bonds?

Harry Sit says

An ounce of prevention is worth a pound of cure. If you’re prone to forgetting, don’t pre-purchase gifts. Not earning some interest beats forgetting 100% of the money.

If you still want to pre-purchase gifts, document the hell of it. Add entries to the “Where’s My Money” document for the executor of the estate. Print out the web pages and add them to the statement folder. Use Google Calendar or the equivalent to set up recurring reminders each January for everyone:

Wife – Deliver gift to Husband

Husband – Ask Wife to deliver gift

Child – Mom has undelivered gifts in TreasuryDirect account XXXXX for Dad. I’m the beneficiary.

Leo says

Has anyone recently gifted an i bond to a spouse with success after maxing out their $10K limit? My brother just tried to do this & just got an email back saying that the gift will be refunded because he reached his limit for the year. Trying to figure out if it’s worth me & my wife giving this a shot. Thanks.

Sam says

My wife and I maxed out our annual limits and recently put 10k for each other in our gift box. Didn’t have any issues. We hope to deliver our gifts to each other on a year when we decide to not max our ibonds contribution.

MikeG says

I suspect your brother tried to purchase and then deliver the gift bond purchase in the same year they already purchased the $10,000 in I Bonds.

Harry Sit says

Your brother likely made the easy mistake that also tripped up others. See the “Avoid Mistakes” section. No problem with gifting if you do it the right way.

Leighton says

Leo, We had the same thing happen when my wife tried to gift to me from her personal registration. We got the same message – that they would return the $10,000 in about 10 – 12 WEEKS. (That’s ridiculous).

The secret is this: After logging in, you have to create a new registration – but in the name of the recipient, not you. Then FROM THAT REGISTRATION, you can buy the Ibonds. Somewhere along the process, there is a checkbox, saying that it is a “gift.”

Tip: If unsure about anything you do, try it first with $25. If it goes through OK, then buy the rest.

Dan A says

You have to hold the gift until a year that the recipient hasn’t reached their limit. example: next year, don’t buy I-bonds, and instead engage the gifts.