My previous posts covered buying I Bonds with your tax refund, buying I Bonds in a trust, buying I Bonds in your kid’s name, and buying I Bonds for your business. Let’s look at another way to buy I Bonds this time: buying them as a gift. For background on I Bonds in general, please read How To Buy I Bonds.

Gift Box and Delivery

You buy I Bonds as a gift in two stages: buying and delivering.

You must give the recipient’s name and Social Security Number when you buy a gift. The recipient doesn’t need to have a TreasuryDirect account at this time. Only a personal account can buy or receive gifts. A trust or a business can neither buy a gift nor receive a gift.

The bonds you buy as a gift go into a “gift box.” You can’t cash out the bonds stored in your gift box. This is analogous to you going to a store and bringing back the gift to your closet. The gift already has the recipient’s name permanently etched on it. You can’t steal the gift for yourself.

The recipient doesn’t know you bought a gift for them until you deliver the gift to them. This is analogous to bringing the gift from your closet when you visit family. The recipient must have a TreasuryDirect account now to receive the delivery. You’ll need the recipient’s account number to deliver a gift.

I Bonds stored in your gift box are in limbo. You can’t cash them out because they’re not yours. The recipient can’t cash them out either because the bonds aren’t in their account yet.

There’s a minimum wait of five business days between buying and delivering to make sure your bank debit clears. There’s no maximum stay in the gift box. You can pre-purchase gifts and wait to deliver them at a much later time. You can also choose to deliver gifts in bits and pieces as opposed to in one lump sum.

Purchase Limit

The principal amount of delivered gifts counts toward the $10,000 annual purchase limit of the recipient in the year of delivery. You can still buy gifts for others even if you already bought the maximum this year for yourself.

You can buy a maximum of $10,000 for any recipient in one purchase but there’s no limit on how many recipients you buy for or how many times you can buy for the same recipient in any calendar year. If you’d like, you can buy $10,000 worth of I Bonds for each of your 20 family members or you can make five separate purchases of $10,000 each for the same family member, all in the same calendar year.

If the recipient already received $10,000 in principal amount as gifts this year, buying additional I Bonds on their own will put them over their annual purchase limit. They’ll have to wait until they’re not receiving the maximum gifts.

Interest and Holding Period

Interest and the holding period start in the month of your purchase. If you pre-purchase gifts and wait to deliver them to the recipient at a later time, you still lock in the same fixed rate and inflation rate as other bonds bought in the same month. Interest earned while the gift savings bonds wait in the gift box belongs to the recipient. It’s exempt from state and local income tax.

The holding period for cashing out also starts right away. If five months have passed between the time of purchase and the time of delivery, the recipient only has to wait another seven months before they can cash out, as opposed to the full 12 months for freshly purchased bonds.

Gift to Kids

It’s not necessary to buy as gifts for your own kids under 18 unless you’re pre-purchasing for future years. As a parent, you can open a minor linked account in your account and buy directly in your kid’s name. See the previous post Buy I Bonds in Your Kid’s Name.

Buying I Bonds as a gift works when you buy for a grandchild or a niece or a nephew under 18. You only need the child’s name and Social Security Number when you buy the gift but you’ll need the child’s TreasuryDirect account number before you can deliver the gift. The child’s parent needs to have an account for themselves first and then open a minor linked account for the child under the parent’s account.

When Gifts Are Useful and When They Are Not

If you’re thinking of “borrowing” other people’s names and Social Security Numbers to buy more I Bonds as gifts but keep the bonds for yourself, it doesn’t work. Only the named recipient can cash out the bonds. If you don’t deliver them, the bonds stay in your gift box, and neither you nor the specified recipient can cash them out. After you deliver the gift bonds, it’s the recipient’s money, and they can do whatever they want with the bonds.

If you’re thinking of letting others buy I Bonds as gifts for you to double up the $10,000 annual purchase limit, it doesn’t quite work either. Gifts delivered to you count toward your annual purchase limit. If you receive the maximum in gift bonds for the year, buying additional bonds in the same calendar year will put you over the limit.

Buying I Bonds as a gift works when you want a family member to have some I Bonds but they don’t have spare cash. It works the same as giving them money and letting them buy themselves.

Pre-Purchase/Frontload

It also works to a limited extent if you think the high interest rates on I Bonds are only temporary. You can buy a gift for your spouse and hold it in your gift box. Have your spouse do the same for you. Wait to deliver the gift to each other in a future year. The older gift bonds will have earned the high interest rates in the years past and they have aged enough for immediate cashout.

We’re buying each other a gift this year to keep undelivered in the gift box in addition to our normal purchases. If the interest rate is still good next year, we’ll deliver the gift and buy a new gift in the gift box. If the interest rate isn’t good anymore, we’ll skip the purchase, deliver the gift, and cash out immediately.

Don’t Forget About Undelivered Gifts

As with physical gifts, most gifts are purchased and delivered in short order. If you hold gifts in your closet for a long time, you may forget that you bought the gifts in the first place. If you’re intentionally pre-purchasing gifts to take advantage of temporarily high interest rates, tell the recipient you’re holding a gift. Set recurring calendar reminders to tell yourself and the recipient you still have undelivered gifts in the gift box.

Remember that gifts are in limbo until they’re delivered.

Unexpected Death

You can include a second owner or a beneficiary for the I Bonds you buy as a gift. If the gift recipient dies before you deliver the gift, the designated second owner or beneficiary will inherit your gift. You can’t name yourself as the second owner of the gift but you can name yourself as the beneficiary of the gift. The recipient can change the second owner or the beneficiary after you deliver the gift. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

If you die before you deliver the gift, the gift still belongs to the recipient. Whoever handles your affairs after your death should notify the recipient that you had an undelivered gift for them. Then the recipient can claim it through TreasuryDirect. Again, it’s important that you tell someone about the gift if you’re going to hold it undelivered. If no one knows you bought a gift, the gift will be in limbo.

Gift Tax Form 709

There’s no tax for receiving gifts. Gift tax is on the gift-giver.

Buying I Bonds as a gift counts as a completed gift in the year of the purchase (not the year of the delivery). There’s no limit on how much you can give as gifts to your spouse (unless the spouse isn’t a United States citizen). Each person has an annual gift tax exclusion amount for “present interest” gifts to each non-spouse recipient, which is 16,000 in 2022 and $17,000 in 2023. If the total “present interest” gifts (in I Bonds and other forms) during the year from one specific giver to one specific non-spouse recipient go above this annual gift tax exclusion amount, you’re required to file a gift tax return on IRS Form 709.

The gift tax annual exclusion amount for gifts to a non-spouse recipient is $0 for “future interest” gifts. You’re always required to file a gift tax return when you give “future interest” gifts to anyone except your spouse. It’s not clear to me whether the I Bonds you buy this year as a gift but hold for delivery in a future year count as a “present interest” gift or a “future interest” gift. To avoid ambiguity in determining whether it’s a “present interest” gift or a “future interest” gift, only give gifts to your spouse or deliver all gifts to non-spouse recipients within the same calendar year.

Unless you’re also giving the same non-spouse recipient gifts in other ways, buying and delivering $10,000 worth of I Bonds as a gift in the same calendar year falls below the annual gift tax exclusion amount, which doesn’t trigger the requirement to file the gift tax return.

If you’re required to file a gift tax return, it’s separate from the federal income tax return. The gift tax return goes to a special address. The typical consumer-grade tax software packages such as TurboTax and H&R Block software don’t support filling out a gift tax return. You’ll have to go to a tax professional or fill out the gift tax return on your own.

Having to file a gift tax return on Form 709 doesn’t mean you’ll pay gift tax out of pocket. Most people just use up part of their lifetime estate and gift tax exemption amount, which is more than $12 million in 2022. However, after you file the gift tax return once, you’ll have to keep track of how much of your lifetime estate and gift tax exemption amount you already used. See IRS Instructions for Form 709 if you decide to give gifts that will require a gift tax return.

Avoid Mistakes

Although TreasuryDirect has an official video walkthrough for how to buy a gift, it’s very easy to make a mistake if you follow the video when you’re buying a gift for the first time. I read many reports from people intending to buy a gift but ending up buying bonds for themselves.

It’s easier if you follow these steps when you’re buying a gift for the first time.

Add Registration

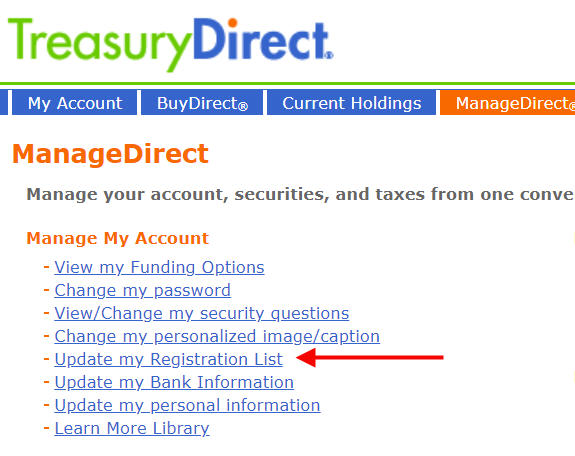

Click on ManageDirect in the top menu. Then click on the link “Update my Registration List.”

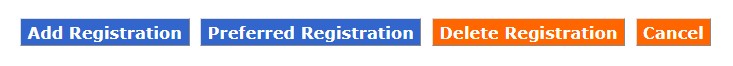

You’ll see a list of existing registrations in your account. Click on “Add Registration” to create a new one.

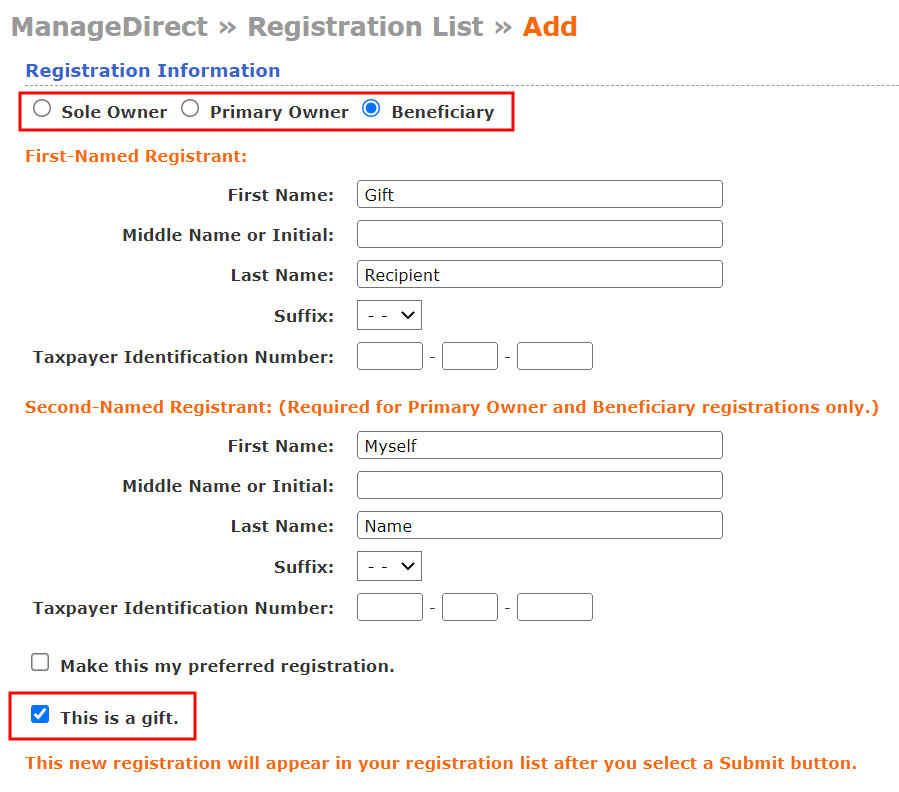

The radio buttons at the top show the registration types.

- Sole Owner means the gift recipient alone, without a second owner or a beneficiary.

- Primary Owner means the gift recipient with another person as the second owner.

- Beneficiary means the gift recipient with another person as the beneficiary.

If you choose Primary Owner or Beneficiary, enter the gift recipient as the First-Named Registrant and the second owner or the beneficiary as the Second-Named Registrant. You need the Social Security Number of both the gift recipient and the second owner or the beneficiary. You can’t name yourself as the second owner but you can name yourself as the beneficiary.

Make sure the spelling of the recipient’s name matches exactly what the recipient has or will have on their TreasuryDirect account. If the recipient has their full middle name on their account, you also include their full middle name. If the recipient only has their middle initial or no middle initial, you do the same in your gift registration. A mismatch between the names can cause a problem when you deliver the gift.

Check the box “This is a gift.” After you click on Submit, the new combination will be added to your list of registrations. You will use this registration when you buy the gift.

You only need to do this once per gift recipient.

Place Gift Order

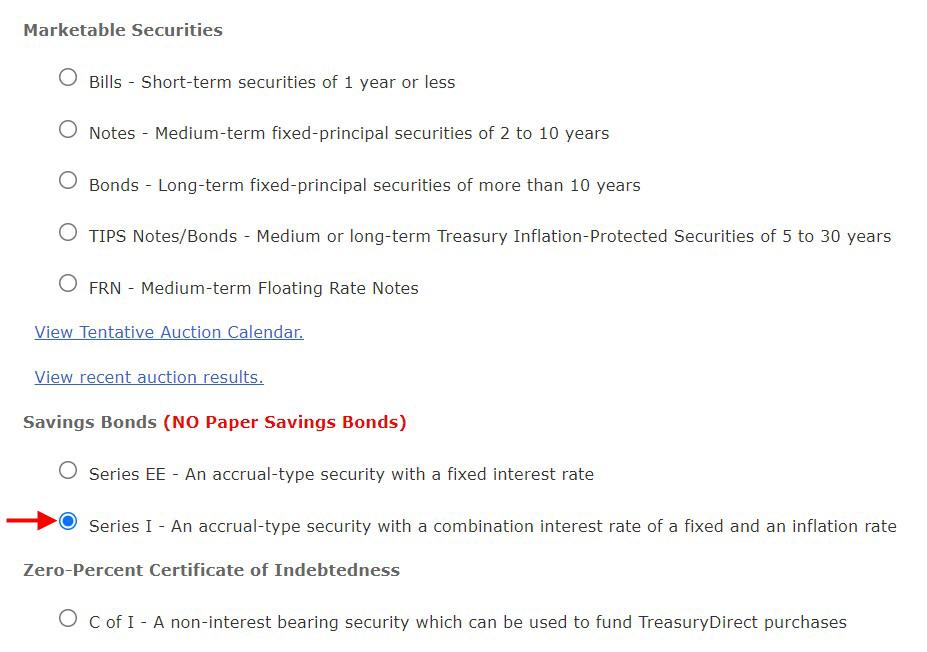

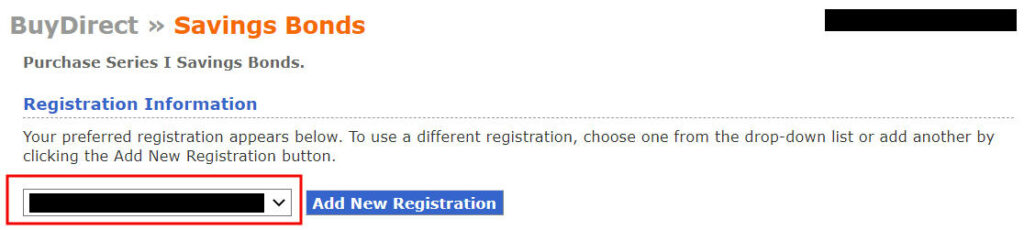

Now click on BuyDirect in the top menu.

Select “Series I.”

This is important. Use the dropdown to select the gift registration. The name of your gift recipient should appear first, for instance, “Gift Recipient POD My Name.”

Now enter the purchase amount and the rest of the information.

Pay attention to the registration information on the final purchase review page and make sure the purchase is for the intended gift recipient before you click on Submit.

Deliver Gift

See a walkthrough in Deliver I Bonds Bought as a Gift in TreasuryDirect. You need the gift recipient’s TreasuryDirect account number. If they don’t have a TreasuryDirect account, they need to open an account to receive the gift delivery even if they’re not buying any savings bonds on their own.

If the gift recipient is a minor, a parent needs to open a Minor Linked Account for the minor under the parent’s account (see Buy I Bonds in Your Children’s Names). The parent needs to open an account for themselves before they can open the account for the minor even if the parent isn’t buying any bonds.

Remember to check with the recipient how much they are planning to buy themselves this year because delivering gifts to them counts toward their annual purchase limit.

There’s no way to pre-schedule delivery for a future date. You’ll have to log in every time you’d like to deliver a gift. If you’re keeping undelivered gifts in your gift box, set calendar reminders for yourself and the recipient to make sure you don’t forget the undelivered gifts.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Steve says

I don’t see it explicitly asked: can you gift i-bonds without a treasury direct account?

My sister would like to put some money in my kids’ names. I assume she doesn’t have her own TD account. Can she buy and deliver I-Bonds without an account, but with their names and socials? Can I then create linked accounts for them from my own TD account and accept the gift on the kids’ behalf?

That said, it might be simpler if my sister just wrote me a check. I’m sure she trusts me enough to transfer it appropriately.

Steve says

Found the answer to my own question:

“To buy an electronic savings bond as a gift:

You must have a TreasuryDirect account”

https://www.treasurydirect.gov/indiv/planning/plan_gifts.htm#:~:text=To%20buy%20an%20electronic%20savings,must%20have%20a%20TreasuryDirect%20account

Dave says

Hi, Thank you! I found this website amazingly informative!

Question: I’m trying to figure a way to buy Ibonds for an unborn child.

Can I purchase it in my name and then next year gift it to my child?

If that’s not possible, can I add the child as a secondary owner at a later point, and if that’s done can a secondary owner do a cash-out (while the primary is still alive)?

Harry Sit says

If you buy it in your name, you can transfer it to your child at a later time. You’ll pay tax on the interest accrued up to the time of the transfer.

Alternatively, you can add your child as a second owner at a later time. If you also grant the transaction rights, your child can cash out while you’re still living but that won’t happen until your child turns 18.

Dave says

Thank you Harry.

Do you have an article describing the transfer option?

Harry Sit says

First you need to set up a Minor Linked Account for your child. See Buy I Bonds in Your Child’s Name. Then you log in to your account, go to ManageDirect, and click on “Transfer securities.” You’ll give your child’s account number and Social Security Number. If the online process asks you to fill out a paper form FS 5511, you follow the instructions on that form.

Dave says

Thank you for the info. Does it count towards my or my child’s 10k yearly allowance when “transferring securities”?

Harry Sit says

The principal value of the transfer counts toward the annual purchase limit of the recipient.

Dave says

So if I already purchased 10k this year (for both myself and my wife in return +5k return) I have no way of purchasing more for the unborn child?

I mistakenly just ran another 10k purchase for myself with wife in order to transfer next year to the child but realized that I may have gone over the top.. what will happen?

Harry Sit says

No one knows you intend to transfer next year. Only intending to transfer can’t increase your purchase limit. If the purchase is still pending, maybe you can cancel (ManageDirect -> View/Delete a pending purchase, or by calling customer service). If you can’t cancel, TreasuryDirect will notify you that you exceeded the limit and you’ll get a refund after some weeks.

Dave says

If I understand correctly when I purchase I-bonds in my account for myself it immediately counts against my 10k allowance for this year and I should not be purchasing more with my name as primary.

The only way to purchase more is to gift it to someone else?

So my option would be to gift it to my wife or my wife to myself and then next year the recipient can transfer securities to the new child?

(I canceled my mistaken purchase with my own name..)

Dave says

Thank you for all the information.

We did the gifting option.

Leo says

Are gift bonds to spouse, children & grandchildren considered future interest gifts for IRS gift tax purposes in the year of purchase?

Harry Sit says

It doesn’t matter when you gift to the spouse because the exclusion amount is unlimited either way. It’s a present interest gift when you deliver to children and grandchildren in the same year as the purchase. It’s not clear to me whether it’s a present interest gift or a future interest gift when you hold to deliver in a different year. I would deliver to children and grandchildren in the same year as the purchase to force it to be a present interest gift. See the “Gift Tax Form 709” section.

HW says

Hi Harry, here is the definition of “Future Interest” according to CFR 25.2503-3 (ALLCAPS are mine):

Ҥ 25.2503-3 Future interests in property.

(a) No part of the value of a gift of a future interest may be excluded in determining the total amount of gifts made during the “calendar period” (as defined in § 25.2502-1(c)(1)). “Future interest” is a legal term, and includes reversions, remainders, and other interests or estates, whether vested or contingent, and whether or not supported by a particular interest or estate, which are limited to commence in use, possession, or enjoyment at some future date or time. The term has NO reference to such contractual rights as exist in a BOND, note (though bearing no interest until maturity), or in a policy of life insurance, the obligations of which are to be discharged by payments in the future. But a future interest or interests in such contractual obligations may be created by the limitations contained in a trust or other instrument of transfer used in effecting a gift. A contribution to an ABLE account established under section 529A is not a future interest.”

My interpretation of this is that bonds are not counted as a future interest. I have no particular tax expertise – this is simply my own interpretation of the statute. Thoughts?

Harry Sit says

I’m not a lawyer. I think the reference to bond there only says that just because a bond pays interest and principal in the future, it doesn’t mean if you give someone a bond now, it must be a gift of future interest. It doesn’t say bonds are not counted as a future interest. They can be future interest depending on “limitations contained in a trust or other instrument of transfer used in effecting a gift.”

Ustaad says

Harry,

Your article is truly a great resource in the times we live in. Thank you. I would like to revisit the topic of premature withdrawal penalty which you addressed in reply to comment no. 61. Elsewhere, I have seen a different take on this issue and would very much like your opinion/confirmation on this matter. Treasury policy is such that you earn interest for the full month even if you own the bond for any part of the month. This is evident when you purchase at the end of the month. The bond issue date is always the beginning of the month. Then why is the reverse not true? That is, if the bond is redeemed at the beginning of the month, say on the 2nd of the month, you should be able to earn interest for that full month. This can be used to reduce the impact of the last 3-month interest penalty to the effective penalty of say one month plus couple of days or for all practical purposes to a penalty of one month. Assuming that one is opting for premature withdrawal in a declining inflationary environment, the impact of penalty is going to be minimal. I do not know of any bank or financial institution that will allow the depositor to get away with a 30 day interest penalty on a 5-year CD. My source for this information is a youtube video [Editor: link removed to avoid misleading others.] He talks about it quite transparently. I am bringing this up because you responded differently in your reply to comment no. 61 and I do not have any personal experience with this type of withdrawal transaction. Also, elsewhere in the comments section, I have read suggestions about the optimal time for premature withdrawal at around 15 months or so. Can you share your take on the optimum exit strategy should inflation come down at a faster pace than the current consensus view.

Harry Sit says

TreasuryDirect’s policy isn’t “you earn interest for the full month even if you own the bond for any part of the month.” Here’s the official policy:

“I bonds increase in value on the first day of each month, and interest is compounded semiannually based on each I bond’s issue date. An I bond’s issue date is the month and year in which full payment for the bond is received.”

In other words, you don’t earn any interest for the month in which you redeem. You get the full interest in the month of the purchase but the early withdrawal penalty is still the interest earned in the most recent three months. When the rate gets low, you need to stay on the low rate for three months in order to keep the interest earned at a higher rate previously.

Ustaad says

Thanks for that clarification. So, for all practical purposes, should one put in the redemption request on the last day of the month (28th,29th,30th or 31st depending on the month) as there is a lag of 1 business day in execution or on the 1st of the month when balance amount changes?

Harry Sit says

Do it on the 2nd of the month to make sure you get the interest for the previous month. It isn’t worth risking a whole month by pushing a day or two.

Ustaad says

Thanks.

Annie Hedonia says

My SO and I have already purchased our $10K this year. I’d like each of us to purchase an add’tl -$20K for each other as gifts. I use the accrual method and report interest every year. How would this work on the $20K of bonds he intends to “gift” to me???

MikeG says

That’s an excellent question.

My guess is you would accrue the interest on the gift bonds in his gift box where you are the owner and he will do the same with the gift bonds in your gift box that were purchased as gifts to be delivered to him in the future.

As I understand it, even with the first $10,000 each of you have purchased, you will simply include in your tax return the accrued interest for each year. When you sell those bonds and the Treasury issues you a 1099, you will report the entire amount of interest from the 1099 and below that (on the tax form) you will have a line for “interest previously reported” where you will deduct the interest you’ve accrued in earlier years. I don’t see why the gift bonds would work differently.

I suspect you will get a reply telling you this issue is a good reason to accept the Treasury default and not accrue the interest each year 🙂

Harry Sit says

Sorry, I don’t know. You’ll have to figure that out yourself because you chose to go against the Treasury default.

Dunmovin says

A fly in the onitment may be whether it’s a current/future gift for gift tax purposes…can one owe taxes on that which they don’t own (yet)?

I still haven’t got any paper ibonds as a result of paper tax filings in February…Harry what happens if we don’t get the paper ibonds by (when)? Thanks

Harry Sit says

The IRS will process your tax return at some point. If you get paper I Bonds, the bonds will be dated at that time with the then-applicable interest rate. If they decide not to give you I Bonds, you’ll get the refund to your bank account (or by check).

Zach F. says

Thanks for the ideas! Where did you find that you could gift more than $10,000 per recipient per calendar year? For example, I would like to gift $20,000 to my spouse, by making two separate $10,000 purchases. This however, seems in conflict with what is stated on Treasury Direct. https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds_ibuy.htm#gift

From the Treasury Direct website:

How much in I bonds can I buy as gifts?

The purchase amount of a gift bond counts toward the annual limit of the recipient, not the giver. So, in a calendar year, you can buy up to $10,000 in electronic bonds and up to $5,000 in paper bonds for each person you buy for.

Harry Sit says

Because most people buy and deliver gifts in short order, this Q&A should be read in that context. Replace every “buy” with “buy and deliver.”

sscrla says

TreasuryDirect doesn’t always tell you the whole truth. You are better off reading the Code of Federal Regulations.

§ 363.52 What is the principal amount of book-entry Series EE and Series I savings bonds that I may acquire in one year? [note, the correct word is acquire, not buy or purchase]

(b) Bonds purchased or transferred as gifts will be included in the computation of this limit for the account of the recipient for the year in which the bonds are delivered to the recipient.

https://www.law.cornell.edu/cfr/text/31/363.52

Kris B says

Can I buy an I bond in my name with my adult child as a co owner. If so who will be responsible for interest when it is cashed in? This seems like a simple question compared to everything else that has been asked.

sscrla says

First, you have to understand that there is no “co-owner.” There is A with B, and B has no rights of their own, which is not what I would call a “co-owner.” And even if there were “co-owners” as there were with paper bonds, the interest is reported by the person who bought the bond.

” If a U.S. savings bond is issued in the names of co-owners, such as you and your child or you and your spouse, interest on the bond generally is taxable to the co-owner who bought the bond.”

Publication 550, Investment Income and Expenses, page 7

Kris b says

I asked that question because I actually have an ibond several years old that has my husbands name and my name that says or. So that is why I thought I could maybe purchase one using the or with my adult daughter, thinking that she could also cash it but I would be responsible for interest. Think I will just give her the money and let her buy it. She could use it for college expenses for kids down the road without interfering with college loans, right?

Harry Sit says

If you give her the money and let her buy it, she has a chance to make the interest tax-free when she uses it for college expenses for her kids. It’s more difficult when you keep the bonds in your name. See Cash Out I Bonds Tax Free For College Expenses Or 529 Plan.

PBBG says

Harry Sid, Great articles, Thank you!

Just to be sure, given this situation:

year 1

My spouse buys 10k

I buy her 10k and keep it in the Gift Box

Year 2:

We do the same,

My spouse buys 10k

I buy her 10k and keep it in the Gift Box

Year 3:

She redeems her two 10k bonds

I deliver the two 10k bonds from the “Gift Box”

She redeems them right away.

By delivering them I have just exceeded her limit for the year.

Question:

Is this possible to do?

What if I deliver 10k, she cashes it in then I deliver the second 10k. Will this keep her under the limit?

Harry Sit says

Delivering $20k in Year 3 will exceed her limit but you may get away with it when she doesn’t buy any more. Delivering in multiple lots or cashing/not cashing won’t make any difference.

MO says

Hello,

Am I reading the scenario correctly that once the gift I Bond has been purchased for more than 12 months, it can be redeemed right after the delivery? Thank you for the clarification. Please see my purchases below.

For example, I purchased $10k in June 2022, and my spouse purchased $10k as a gift to me in June 2022. Assuming I don’t make any more purchases in 2023, the first gift can be delivered in January or June 2023. This gift I Bond can be redeemed in June 2023 or September 2023 to reduce the penalty impact, correct?

My spouse also purchased another $10k in July 2022 and planned on delivering it in January 2024. This gift I Bond can be redeemed in January 2024, soon after the delivery, correct?

Thank you in advance for anyone’s response and clarification.

Harry Sit says

That’s correct. Once delivered, a bond received as a gift is indistinguishable from a bond directly purchased on the original issue date in terms of interest, holding period, and early withdrawal penalty.

Ron S says

Has anyone accidentally bought too much and are expecting a refund? Any luck getting the refund? It’s been 12 weeks and counting for us.

Harry Sit says

Many people reported not receiving the refund and ending up keeping the extra bond.

Ron says

Oh so it just appears on your acct info screen?

Harry Sit says

You should still see the extra bond together with your other bonds.

Leighton says

Ron, It’s been 12 weeks for us too, whereas their email at the time said,

“You should receive your refund approximately 8 to 10 weeks from the date of purchase.”

We messaged them recently with their quote, and asked where is the refund,

But their reply didn’t even address the question, but instead was the same message one gets on initially opening an account, or probably on forgetting the password: something like “here’s your one time pass code…” Completely irrelevant to our question.

The $10,000 does still show up in the account, and I would think they would begin posting interest that purchase (being that the first 3 months early withdrawal penalty period will have passed – April, May, June.)

If they don’t apply interest, and don’t refund our money, and won’t answer email questions about it, then what???

Harry Sit says

Interest for July will show up on August 1.

Dunmovin says

I’ve started each purchase for each of my TD accounts with $100 in order to assure the process works! There have some hiccups on the road but I’ve then followed up with max for that account. Start small in case (as they will, given on the interest “now” in ibonds…pun intended) things go south!

Leighton says

We also started doing that, Dunmovin.

Then I wondered if the Feds going to consider that to be “structuring” to avoid the reporting of transactions of more than $10,000? Innocent people have their accounts seized because of that. It’s a shame we have to look over our shoulder all the time to see what our government might do next “to harass our people.” (Declaration of Independence)

Dun says

Can only buy a max of $10k and guess who’s getting $s? The feds. One can always be reported even if under $10k… your favorite FI will file a SAR…been there done that

Hoa Truong says

Hi Harry,

My spouse purchased 10K for himself. I purchased 10K as a gift with the intention of delivering it to him in a future year. However, I inadvertently delivered it to him 2 weeks after it was purchased, which pushed him beyond his annual purchase limit. What happens to my 10K? Is there a penalty? I read somewhere that if a person purchases i-bonds beyond their annual limit, that TreasuryDirect will refund the money, which can take up to 16 weeks. First, is this true? Second, if it is, would this apply to my situation, since he technically did not purchase the amount the took him beyond his limit; but rather it was delivered to him by me?

Harry Sit says

TreasuryDirect will notify you of any action they’ll take. If you don’t hear anything, carry on.

Hoa Truong says

I called TD this morning and this is what I was told. A team prints out a list. Accounts with excess purchases/deliveries will be notified by email and a refund will be processed. There is no penalty. Whether it was a purchase that pushed the purchaser over the limit or a delivered gift that pushed that recipient over the limit, the refund process is the same, and it could take up to 16 weeks. If for some reason TD does not issue your refund (i.e. it’s your first offense), then consider yourself lucky as they’ve decided not to do anything about it and to just let you keep the i-bond. In the meantime, you could continue to buy i-bond gifts and keep it in your gift box. Hoping to not hear anything from them and carry on, just like you said.

Hoa Truong says

I see. Thank you.

Dunmovin says

And no due process!

Toli says

Hi Harry,

I am aware that inheriting I bonds does not affect the annual purchase limit; as per CFR 363.52(c): “Bonds received due to the death of the registered owner are not included in the computation for the recipient. ” So far so good…

But consider this scenario: Bob purchases $50k of gift bonds for Sue. Being gift bonds, Sue (not Bob) is their owner since the time that Bob purchased these bonds. At the time of Bob’s death, the gift bonds have not yet been delivered. Bob’s death causes the delivery to occur. As a result of this delivery, Sue must apply the $50k towards her annual purchase limit in the year of delivery. 363.52(c) does not apply because the owner of the bonds was Sue from the get-go, and never Bob. Bob was the purchaser, not the owner.

If I had to guess, I’d say that the assumed intent of 363.52(c) was to cover such a case, so Bob’s death and gift delivery would not affect Sue’s annual purchase limit. But that’s only a guess. Is there some other regulation that is applicable in this instance? Something like “Bonds received via gift delivery due to the death of the purchaser are not included in the computation for the recipient. ”

Thank you.

Toli says

I think I can answer my own question, Harry, but please double-check and confirm… 363.96(e) states: “If the purchaser dies before delivering a gift bond to the recipient, the bond belongs to the owner named on the gift bond […]. We will hold the bond until we receive instructions from the owner named on the gift bond.” So delivery to Sue won’t happen automatically upon Bob’s death; instead, Sue could presumably contact TD and arrange a staged delivery ($10k per year for 5 years) so that her annual purchase limit won’t be exceeded.

Harry Sit says

I don’t know any regulation that covers this but I think TreasuryDirect will want to close out Bob’s account by transferring the undelivered gifts to Sue in one shot as opposed to dragging it out over multiple years. I read that someone was told by customer service to the effect of “The system may automatically generate a message saying you exceeded the limit but we’ll reset it if you call us.” That basically treats receiving undelivered gifts when the purchaser dies in the same way as inheriting bonds as a beneficiary.

MS says

Hi All,

Different subject: can anybody estimate what will be the interest rate on Ibonds in November if the inflation goes arond 7-8%?

Thanks,

MS

Harry Sit says

If you mean that the observed inflation will turn out to be 7-8% over the last 12 months by September, which means zero or negative inflation in the next couple of months because it has been higher than that so far, it’ll be 4-6%. If you mean that prices will continue to go up by 7-8% annualized in the next couple of months, it’ll be 8.5% – 8.9%.

MS says

Thanks! How do they get to that 9.62%, I believe there is a fixed portion which is zero and they multiply an inflation index by two?? What index is that and where is it right now?

sscrla says

FOR RELEASE AT 10:00 AM

May 2, 2022

The composite rate for Series I Savings Bonds is a combination of a fixed rate, which applies for the 30-year life of the bond, and the semiannual inflation rate. The 9.62% composite rate for I bonds bought from May 2022 through October 2022 applies for the first six months after the issue date. The composite rate combines a 0.00% fixed rate of return with the 9.62% annualized rate of inflation as measured by the Consumer Price Index for all Urban Consumers (CPI-U). The CPI-U increased from 274.310 in September 2021 to 287.504 in March 2022, a six-month change of 4.81%.

https://www.treasurydirect.gov/news/pressroom/currentibondratespr.htm

The November rate will depend on the CPI-U from March to September. The Bureau of Labor Statistics will release the September CPI-U on October 13.

September 2022 Oct. 13, 2022 08:30 AM

https://www.bls.gov/schedule/news_release/cpi.htm

dunmovin says

MS…I don’t want to steal anyone’s thunder but one should do some research on any, repeat, any investment before jumping in. I suggest one start with Harry’s multiple threads under Investment (above) dealing with Ibonds, eg “How to Buy I Bonds (Series I Savings Bonds): Soup to Nuts.” Excellent tutorial and q/a. For calculation of the next rate the CPI released on Sept 13 (for August) is important as is the September CPI released in Oct will enable calculation by anyone of the Nov. rate reset. Good luck

Harry Sit says

When 9.62% is high enough, I buy. It doesn’t matter how they got to it. When the rate is no longer competitive, I stop buying or I cash out and go somewhere else. I don’t go into the weeds even though I know how.

FinancialDave says

The number is out and by my calculation it is 6.48% annualized.

MS says

Got it, thanks for all the comments!

MS

Alan H says

I have an elderly Grandfather. Can I buy $20,000 of I Bonds and deliver $10,000 this year right away and leave the other $10,000 in the gift basket for 2023? If I am the beneficiary for both bonds and he passes away this year what happens to the delivered $10,000 bond as well as the $10,000 bond in the gift basket?

Harry Sit says

You can hold gift bonds in the gift box for future delivery. See the Purchase Limit section. When the gift recipient dies, the beneficiary works with TreasuryDirect to claim both the delivered and the undelivered gift bonds.

alan H says

Harry you are a wealth of knowledge thanks so much. So then theoretically what if I gifted and held in the gift basket $30,000 to my grandfather with the intention of giving him $10,000 per year in 2023/2024/2025. I name myself beneficiary. If he dies in 2022 does that mean I could collect all $30,000 when he dies? It sounds like it could be a valuable estate planning tool. Would that work? What would stop somebody from pouring millions of dollars to a terminally ill recipient and holding it in the gift basket until he passes? Is that actually legal?

Harry Sit says

Others had the same idea. See comment #73. Also keep in mind the estate and gift tax returns. Having the gifts come back to you eats into both your lifetime exemption and the recipient’s.

JiaRose Neuenkirchen says

Hello! I’ve been reading up and into I-bonds and I had a question!

I’m wanting to open one on October 6 (this upcoming), and I was curious to know how this works:

I am aware that the interest earned will be the same regardless if I buy it on the 6th or the 30th, however what I’m sure on is the date it is credited. I do know interest is credited the first of every month, but do I get the interest I earned the month of October on November 1st or would the interest already have been added on “October 1st” so the actual value is what I put in plus the interest?

Otherwise, as quoted from the treasury direct website:

“For example, if you buy an I bond on July 1, 2022, the 9.62% would be applied through December 31, 2022.”

Does that mean that on January 1st, 2023 they would get the 9.62% interest they had earned on December?

Thank you!

Harry Sit says

If you buy in October, interest for October will be credited on November 1 but you won’t see it until February 1 because the display automatically holds back the last three months of interest for the potential early withdrawal penalty within five years.

JiaRose Neuenkirchen says

Thank you for your reply!

So in the following example;

For example, if you buy an I bond on July 1, 2022, the 9.62% would be applied through December 31, 2022.”

They would in fact get the 9.62% interest they had earned in December?

Harry Sit says

Yes, you lock into an interest rate for six months before moving on to a new interest rate for another six months. Interest earned in December will be credited on January 1 but you won’t see it until April 1 due to the three-month lag in displaying it during the first five years.

JiaRose Neuenkirchen says

I apologize I meant to add in January in my previous comment.

As in the 9.62% interest rate will be applied (technically without the penalty) on January 1st to December value (hence up until Dec 31st)

Just confirming to ensure I understand it correctly

Harry Sit says

It’s not worth getting hung up on these technical details. Look at the big picture. 9.62% is a good rate. You buy when you think the rate is good. You don’t buy or you cash out when you have better options elsewhere. That’s all. The system works the way it does in terms of how the interest is calculated and when the interest is credited. You can’t do anything to change it. You’ll get all the interest the system says you’re due. You won’t be cheated.

JiaRose Neuenkirchen says

Thank you again and yes I’m sorry I do get hung up on details sadly! I didn’t know you had answered my question before I repeated it for clarification purposes as well.

Thank you for answering me and the countless other questions you get. I think I can speak for everyone when I say I appreciate the time and effort you put into it!

William says

Assume I purchase a $10,000 I-Bond as a gift and it accrues $1,000 of interest while sitting in my gift box before I deliver it. Does only the $10,000 principal portion count toward the recipient’s $10,000 annual purchase limit?

Harry Sit says

Yes, only the principal portion.

Mark says

I noticed on the example that you did not indicate entering the TIN for the Primary or Beneficiary. Is the TIN optional? Is it better to enter these?

Harry Sit says

The Tax Identification Numbers aren’t optional. You can’t move forward if you don’t enter them.

Jonathan says

I have already bought $10,000 of I Bonds (in August 2022) for each of my kids. Can my spouse now buy $10,000 for each of our kids as a gift (then gift it in January 2023)? I would cash all of these I Bonds after 15 months, so the first I Bond will be cashed in Nov 2023 and the other in Jan 2024. This would spread the interest over 2 years so that it does not exceed the kiddie tax limit for either year. Will this strategy work?

Harry Sit says

It works on the gifting side but where will the money go when you cash out on behalf of the kids? It has to go into each kid’s UTMA account or be spent on expenses specifically incurred by that kid. See Buy I Bonds in Your Children’s Names: You Can, But Should You?

Alan Heubert says

Harry, you wrote, “If you die before you deliver the gift, the gift still belongs to the recipient. Whoever handles your affairs after your death should notify the recipient that you had an undelivered gift for them. Then the recipient can claim it through TreasuryDirect.”

Question: Will that gift be treated as an inheritance, and thus not count against the recipient’s $10,000 annual purchase limit?

Thanks so much for your fabulous articles, and in advance for your clarification on this.

Harry Sit says

See comment #120.

Yunyoung says

Thank you very much for very helpful post!

Question: Another person already asked this question above where only the principal amount of the gift I bond counts towards the recipient’s annual limit. So does that mean I can technically gift more than 10k (say the principal was 10k + X amount of accrued interest) and not affecting going over recipient’s annual limit (assuming that the recipient didn’t contribute any on his/her own)? Would TD website automatically know to transfer 10k + x when I request to send my gift principal amount 10k?

Thanks in advance!

Harry Sit says

Each gift purchase is tracked separately. Think of it as a gift certificate with the principal value and the time of purchase written on it. When you deliver a gift, your gift recipient receives that specific gift certificate, which happens to be worth more depending on the principal value and the time of purchase.

Marc says

Thought you’d all find this interesting:

https://www.barrons.com/articles/treasury-series-i-bonds-limit-51664394878

Tom says

Thanks for the great post!

Regarding the statement in your post “Only a personal account can buy or receive gifts. A trust or a business can neither buy a gift nor receive a gift.”, can you tell me where you sourced this specific information. I have read all of the pages pertaining to gifting on the TreasuryDirect site and can’t find this restriction.

We have two revocable living trusts that hold I-Bonds registered in the names of the respective trusts. We were hoping to use this gifting capability to have each trust purchase another $10K of I-Bonds as a Gift for the other trust and deliver them in January 2023 (since each trust has already met its $10K 2022 purchase limit).

Harry Sit says

Search for “entity account” in the search box on the top right of TreasuryDirect’s website. The first link in the results.

Tom says

Thanks, Harry, for the very quick reply 🙂

In the meantime, I had actually also found my answer in the eCFR at https://www.ecfr.gov/current/title-31/section-363.96

Excerpt:

§ 363.96 What do I need to know if I initially purchase a bond as a gift?

(a) An entity may not purchase a gift savings bond.

Ustaad says

Recently, I read an article on yahoo about some proposed legislation by Senators Mark Warner (VA) and Deb Fischer (NB) on increasing the ibond purchase limit to $30,000 under certain economic conditions to help savers tackle inflation. Harry, if this proposed legislation which is bipartisan passes, what impact will it have on our ability to deliver previously purchased gifts, say next year? Will we able to deliver gifts upto $30K in spousal gifts without any negative tax consequences?

Harry Sit says

Most bills die in Congress. Thinking three steps ahead ends up wasting energy. I’ll assume the status quo until the laws and regulations actually change.

Charlie says

Harry, here’s a gift box question:

If you purchase these in your gift box for a relative nearing the end of life and don’t ever transfer them, then they become yours upon death, no matter the amount in that gift box, is that correct? Seems like a bit of a “hack”.

Do you expect the November reset to change the current 9.62 rate by much? Doesn’t seem like inflation has subsided much.

Thanks for all the great material on these and other subjects.

Harry Sit says

They become yours upon the recipient’s death only if you named yourself as the beneficiary at the time of purchase. Otherwise they go to the recipient’s estate. You can’t add a beneficiary to a gift after you purchase it.

The new composite rate to be announced in November will be a lot lower than 9.62%. I expect it to be in the low-to-mid 6% range.

Nikki says

We have purchased gifts twice this year following the instructions here and it worked fine. I wanted to lock in the rates before the end of October so we decided to purchase one more set of spousal gifts. This time I am getting an error and warning message saying I have exceeded my annual limit. I am on the BuyDirect page and have selected my spouse with me as POD from the registration drop down. I put in $10K and when I submit I get an error in red saying the annual limit is exceeded. We have tried to purchase gifts from both of our accounts (just like we did it 2 times before) and we are both getting this warning. Anyone else having this problem now? Is it possible they are no longer allowing multiple gift purchases for future years?

K says

Same problem here. Same prior experience. We did gifts in past using this method without issue. Trying to do it now (P1 and P2 are maxed for 2022, P1 buying as gift to P2 to be delivered in 2023) gets the following–

The following error(s) have occurred:

Annual limit exceeded. Please edit the purchase amount or edit your pending purchases under ManageDirect, if applicable, and try again.

Nikki says

According to this article Treasury Direct has recently updated its website (though it looks just the same as ever once you log in). Perhaps this error when attempting to purchase additional I Bond gifts is a technical glitch with the new site? I am hoping that might be the case rather than an indication that they have imposed a limit on gifts.

https://tipswatch.com/2022/10/04/treasurydirect-launches-its-revamped-website-sort-of/

Harry Sit says

I tried buying a gift for a family member for whom I haven’t bought any gift before and I got the same error message. Apparently they made this change with their recent website update. When they stop people from exceeding the limit upfront, they save themselves the trouble of having to reprimand people and process refunds. It appears they cast the net a little too wide though. Like many other things, you snooze you lose. Always try to get in early while the going is good.

Marc says

Can you be more precise for clarification purposes?

Is TD now imposing a new limitation or enforcing a pre-existing one that they did not enforce in the past?

Can an individual who purchased $10 this year for himself or herself still purchase a gift of $10K for another person? More than one person?

Dunmovin says

Harry, please don’t snooze…the TD website and, most importantly, the operative regs do NOT support this lock out. If the latter is intended there needs to be notice and opportunity to see regulatory changes BEFORE they are implemented…can we see your proactive message to TD and/or Treasury leadership? Thanks

sscrla says

Today is a Federal Holiday, so the result will be similar to a message sent yesterday, a Sunday, i.e., you probably won’t get a response.

Harry Sit says

Marc – It’s a new limit. As it’s currently implemented, you have one combined $10k limit between buying for yourself and buying as gifts. This change isn’t in line with the published federal regulations. If it’s brought to the attention of the right people, maybe they’ll fix it, but change will take time, possibly beyond the end of October when the 9.62% rate ends.

sscrla says

Regulations can change overnight, as they did for Social Security a few years back. They don’t have to give you advance notice. Perhaps the new regs will be published tomorrow.

Marc says

Harry,

Thanks for the response. I’m wondering if this new limitation, in addition to being in effect all of a sudden without notice, will apply retroactively to some previous date. Since there’s no official rule change published by TD, there’s really no way to know, although I think it unlikely just from a logistical standpoint of having to identify and refund so much money to so many people given the run on high yielding I Bonds this term. All we know for sure is that it’s preventing purchases from taking place today that are allowed by federal regulation and took place as recently as last week and go back years.

I think I have the timing nailed down. The minor “refresh” of the TD website took place on Tuesday, 10/4 (see this CNBC article here: https://www.cnbc.com/2022/10/04/as-demand-soars-for-series-i-bonds-treasurydirect-gets-a-makeover.html) but the limitation did not go into effect then. l I know for a fact that Gift I Bonds continued to operate under the previous accepted rules throughout the week even after the makeover. I Bonds ordered one day typically get purchased the next business day and I am aware of Gift I Bonds over $10K in total for the year being ordered as late as Thursday and transacting on Friday, 10/7. I think the new limit was put into place on Sunday, 10/9. It coincides with the following message on the TD website: “The TreasuryDirect application will be unavailable from approximately 8:00 AM ET to 10:00 AM ET on Sunday, October 9th, 2022, for system maintenance.” Nikki posted Message #137 on Sunday evening noting she hit the new limit despite ordering earlier in the year. The timing lines up.

We also don’t really know if the limit was intentional or inadvertent om the part of TD. Either way, it is a PR disaster in the making since few people know about it yet and coming on the heels of two senators calling for the exact opposite, to raise the limit to $30K per person per year (see this Barrons article here: https://www.barrons.com/articles/treasury-series-i-bonds-limit-51664394878). It also comes at the worst possible time for consumers and for public TD scrutiny due to the upcoming rate change

A conspiracy theorist might say that perhaps it was timed intentionally with the high rate going away in a few weeks. Either way, it upends an entire financial market at a time of great uncertainty and volatility while ending an accepted past practice.

I expect confusion, complaints, and controversy to ensue once more people hit the limit who didn’t hit it previously and the media gets a hold of this. TD would be wise to get out in front of it and post a statement online for clarity and transparency.

Harry Sit says

I think this is only an inadvertent technical implementation error, not a policy change. It’s a common practice to roll out system updates on Sundays. The website used to not check against the limit at the time of purchase. After the order goes through, they check the limit and send you an email saying you’ll get a refund. The refund process is manual. Sometimes they just let you keep the excess because processing refund takes too much work. It makes sense to add a check upfront, but they forgot to distinguish between buying for yourself and buying gifts. The limit check should only apply to buying for yourself. Although people reading this post are all interested in buying gifts, gifts probably still make up only a tiny percentage of overall purchases. They should’ve been more thorough but I can see why they overlooked making an exception for buying gifts. I expect this will be fixed eventually but it may take a while.

Facts says

Harry, do we recall that the Buff was not in the speculation business? Any plan forward by you all thanks !

Harry Sit says

The plan forward:

– Alert TreasuryDirect of this latest change and point out it shouldn’t be this way, which I already did this morning.

– Wait for a fix or see that it’s a change of policy. Either way, at least for now, no gift purchases can go through after you already bought the maximum for yourself. If the change becomes permanent, only buy for yourself in the future.

– No change of plan for existing gifts in the gift box.

Dunmovin says

Harry, very nice.

This is opportunity time! You need to consider talking to media….asking, why is TD doing this to the small consumers who are getting beat by inflation? TD should right this wrong. It was not properly promulgated or implemented…

Go for it!

Dunmovin says

Harry, is it time to follow up with TD and “ask” them to take all their recent “wonderful” website improvements DOWN, put up the previous one, and when the “improvements” are ready for prime time to re-post, i.e. why isn’t there an interim fix that is customer oriented?

Thanks!!

Harry Sit says

You have unrealistic expectations. Updating a government website isn’t like me updating a blog. They’re not going to roll back to the previous version only because of this bug that affects a relatively small percentage of users. At best, a fix will go in during the next release window on another Sunday. I’ll say that’s fast if it’s fixed by next Monday.

Dunmovin says

Ditto, here

I had already purchased maximum for me/spouse AND we each gifted “some” to the other and vice versa. Latter is reflected in gift box of each…less than $10k. Tried just now using the same registration as before for a gift to spouse (using the registration in TD file) pod me…token amount…same noted error message. I then entered a new registration with the same info as before and checked the gift box at the bottom and tried the same token amount for purchase and got the same error message.

Harry! Need help…I don’t want to have to get a workaround, i.e. a new spouse, the one i have is…well, I don’t want to trade him in!

I looked under TD news and saw nothing

Dunmovin says

PS

I have just noticed the notation in red under the “purchase amount” stating a maximum purchase of $10K …Harry, a “governer” has been in place and is NOT disclosed by TD!

Dunmovin says

With all due respect regulations cannot change overnight and even if they could why not ask why the purported change is not reflected in the website, ie why implemented w/o everything else being ready for prime time? Thanks

sscrla says

You used to be able to withdraw a social security application at any time, as long as you paid back all the benefits received. People would apply at their full retirement age, collect benefits, and then withdraw at age 69 and some months. At that point, they would get all their delayed retirement credits. As with other good deals, it was advertised too widely, and the rule that you had only 12 months to withdraw was added on Dec. 8, 2010. Because they wanted to close a loophole, they didn’t advertise it two months in advance.

This is the same situation. The good deal has been advertised too widely, and they want to close the loophole; they are not going to give you an extra two months to buy $40k of gifts.

Dunmovin says

Use to…Reread the due process clause…notice/comment is required. Or why is there a Federal Register and no conforming changes on TD website?

In the future do not complain if there is no notice of traffic speed and you get a ticket…on and on

andres perez says

I receive the following error message “annual limit exceeded” even though i followed the instructions to the letter and had the registrant set up as a gift. Thoughts?

Harry Sit says

See comment #137 and an update in the Purchase Limit section.

Marc says

The jig is up…

https://youtu.be/MChvdjJJH1k

https://www.bogleheads.org/forum/viewtopic.php?f=10&t=346091&p=6912556

If you read some of the comments from the video, it seems people who have called TD have been told the I Bond gifting problem is a known “glitch” they are working to fix, which is the most logical explanation. If true, hopefully it will only take days and not weeks to fix as the timing is quite unfortunate.

Quality Acceptance says

And ANY IT professional would have a better beta/final acceptance testing…some management heads should update their cv!

Jason says

I bought a $10,000 I bond for my wife that I’m holding in my gift box to give her in 2023 (as she already bought $10k in 2022). My question is that the ibond I plan to gift her in 2023 is accruing interest and worth more than $10,000 at this point. Can I gift her the full ibond amount that is worth more than $10,000 (since the PRINCIPAL investment amount was only $10,000), or will I have to break it up over 2 years since the CURRENT value on it exceeds $10,000? Also, will there be taxes due the year I gift it to her or do those not occur until she cashes it (whenever that may be). Lastly, will the rate on the ibond continue along its normal glide path (depending on its date of purchase) or does it “update” to whatever the current ibond rate is once I gift it (I’d hate to lose out on any of the 9+ percent months because I gift it to her in January 2023 before it’s “moved thru” the full 6 months at that rate)? Thanks for any info you can share on my questions!

Spoonfeeder says

Jason, I’m sure Harry will provide a more politically correct response but my 2 cents: Aren’t your inquiries ones that should have been thought out before purchase?…Yes in my view. And, aren’t most answered in the excellent write-up Harry has as well as in the thoughtful replies to prior questions? Good Luck

Jason says

Thanks spoonfeeder for your response and sorry if these questions have already been asked. There were quite a few comments on this article and perhaps I missed one with a similar question/s as I scrolled thru. As far as the article is concerned, I did not see any of my posed questions specifically answered in it – it is a great article and 1 I used to guide my decision to buy as a gift for my wife earlier this year (and vice versa). My questions are minor technical inquiries to which the answers wouldn’t have swayed our decision to buy gift ibonds for one another anyway (and will impose very minimal impact on our financial lives regardless of there answers). My plan was (and still is) to call TD and ask, but just thought I’d drop a line here with a group who seemed knowledgeable on the topic first. Regardless, thanks for your response even if it didn’t contribute in any meaningful way to my questions.

MikeG says

Jason, see the response to question #128. You will be fine with the gift being over $10,000 due to the accrued interest.

Jason says

Thank you, Mike – appreciate it.

I should also clarify the “tax” question I posed as well in my initial comment – I am referring to interest accrued on the ibond (not gift taxes or anything like that). Thanks!

MikeG says

There are no gift taxes between spouses.

Interest rate does not change simply because you remove the bonds from your gift box and deliver those bonds to your wife.

Harry Sit says

The gift recipient owns the bonds from day one. The bonds are only kept in a different place. Earning interest and taxes on the interest work the same as other bonds the gift recipient bought for themselves.

Jason says

Thanks Mike & Harry – appreciate you taking a moment to better educate me on this. You guys are great and I found the original article super helpful. Have a great day!

Marc says

Doesn’t this seem right to you?

The new November 1 I Bond rate will be 6.48% calculated as follows:

296.808-287.504)/287.504=3.24% x 2 = 6.48% Annualized

This means an I Bond purchased over the last five months or in October will get the 9.62% annualized rate plus the 6.48% annualized rate for an actual one year interest rate of 8.21%.

The only way this could be different is if TD adds a fixed rate into the calculation. This has always puzzled me about I Bonds. Is the fixed rate there to encourage people to buy I Bonds when inflation is low, or is it there to reflect current market conditions? It seems when inflation was low the past few years, there was no fixed rate, and now when inflation is high, there is no fixed rate. What gives with that?

Harry Sit says

The fixed rate on existing bonds is fixed for the life of the bonds. If they raise the fixed rate above 0%, it will only apply to bonds bought between November 1, 2022 and April 30, 2023. The new bonds will start with 6.48% plus the fixed rate. They won’t get the 9.62% rate. The fixed rate is highly correlated to TIPS yields but there’s no set formula. Someone or a committee at Treasury makes that decision solely at their discretion.

Nicole says

Just found your note on the “inadvertent lock out” with the new website update preventing me from purchasing a gift for my nephew in October before rates drop. Time is MONEY and we are going to lose out. I really hope this gets fixed. What a mess.

Marc says

Since I was able to purchase a gift I Bond before the “website update glitch” occurred, I decided I would print out one of their announcement certificates so that I’d have something to actually give the recipient. They have a number of nice choices here:

https://www.treasurydirect.gov/savings-bonds/gift-a-bond/gift-announcements/

Unfortunately, this simple little feature is broken too, though I can’t say whether the recent update broke it or if it was broken beforehand.

When you go to the Gift Announcements page, some of the images are clear and some are blurred. Regardless of which type you choose, you get a “Page Not Found” error.

I had to go to Google Images as a workaround to find an image of one of their announcements that I could print out. What an embarrassment!

Harry Sit says

I see they fixed the gift announcements now. It’s a sign they’re working on it. I’ll check the gift purchase again on Monday.

Gift says

Soooo, gift announcements is fixed…Wow! Can’t make gift purchases yet the announcements can be made. Is the horse in front or back? This is absurd