My previous posts covered buying I Bonds with your tax refund, buying I Bonds in a trust, buying I Bonds in your kid’s name, and buying I Bonds for your business. Let’s look at another way to buy I Bonds this time: buying them as a gift. For background on I Bonds in general, please read How To Buy I Bonds.

Gift Box and Delivery

You buy I Bonds as a gift in two stages: buying and delivering.

You must give the recipient’s name and Social Security Number when you buy a gift. The recipient doesn’t need to have a TreasuryDirect account at this time. Only a personal account can buy or receive gifts. A trust or a business can neither buy a gift nor receive a gift.

The bonds you buy as a gift go into a “gift box.” You can’t cash out the bonds stored in your gift box. This is analogous to you going to a store and bringing back the gift to your closet. The gift already has the recipient’s name permanently etched on it. You can’t steal the gift for yourself.

The recipient doesn’t know you bought a gift for them until you deliver the gift to them. This is analogous to bringing the gift from your closet when you visit family. The recipient must have a TreasuryDirect account now to receive the delivery. You’ll need the recipient’s account number to deliver a gift.

I Bonds stored in your gift box are in limbo. You can’t cash them out because they’re not yours. The recipient can’t cash them out either because the bonds aren’t in their account yet.

There’s a minimum wait of five business days between buying and delivering to make sure your bank debit clears. There’s no maximum stay in the gift box. You can pre-purchase gifts and wait to deliver them at a much later time. You can also choose to deliver gifts in bits and pieces as opposed to in one lump sum.

Purchase Limit

The principal amount of delivered gifts counts toward the $10,000 annual purchase limit of the recipient in the year of delivery. You can still buy gifts for others even if you already bought the maximum this year for yourself.

You can buy a maximum of $10,000 for any recipient in one purchase but there’s no limit on how many recipients you buy for or how many times you can buy for the same recipient in any calendar year. If you’d like, you can buy $10,000 worth of I Bonds for each of your 20 family members or you can make five separate purchases of $10,000 each for the same family member, all in the same calendar year.

If the recipient already received $10,000 in principal amount as gifts this year, buying additional I Bonds on their own will put them over their annual purchase limit. They’ll have to wait until they’re not receiving the maximum gifts.

Interest and Holding Period

Interest and the holding period start in the month of your purchase. If you pre-purchase gifts and wait to deliver them to the recipient at a later time, you still lock in the same fixed rate and inflation rate as other bonds bought in the same month. Interest earned while the gift savings bonds wait in the gift box belongs to the recipient. It’s exempt from state and local income tax.

The holding period for cashing out also starts right away. If five months have passed between the time of purchase and the time of delivery, the recipient only has to wait another seven months before they can cash out, as opposed to the full 12 months for freshly purchased bonds.

Gift to Kids

It’s not necessary to buy as gifts for your own kids under 18 unless you’re pre-purchasing for future years. As a parent, you can open a minor linked account in your account and buy directly in your kid’s name. See the previous post Buy I Bonds in Your Kid’s Name.

Buying I Bonds as a gift works when you buy for a grandchild or a niece or a nephew under 18. You only need the child’s name and Social Security Number when you buy the gift but you’ll need the child’s TreasuryDirect account number before you can deliver the gift. The child’s parent needs to have an account for themselves first and then open a minor linked account for the child under the parent’s account.

When Gifts Are Useful and When They Are Not

If you’re thinking of “borrowing” other people’s names and Social Security Numbers to buy more I Bonds as gifts but keep the bonds for yourself, it doesn’t work. Only the named recipient can cash out the bonds. If you don’t deliver them, the bonds stay in your gift box, and neither you nor the specified recipient can cash them out. After you deliver the gift bonds, it’s the recipient’s money, and they can do whatever they want with the bonds.

If you’re thinking of letting others buy I Bonds as gifts for you to double up the $10,000 annual purchase limit, it doesn’t quite work either. Gifts delivered to you count toward your annual purchase limit. If you receive the maximum in gift bonds for the year, buying additional bonds in the same calendar year will put you over the limit.

Buying I Bonds as a gift works when you want a family member to have some I Bonds but they don’t have spare cash. It works the same as giving them money and letting them buy themselves.

Pre-Purchase/Frontload

It also works to a limited extent if you think the high interest rates on I Bonds are only temporary. You can buy a gift for your spouse and hold it in your gift box. Have your spouse do the same for you. Wait to deliver the gift to each other in a future year. The older gift bonds will have earned the high interest rates in the years past and they have aged enough for immediate cashout.

We’re buying each other a gift this year to keep undelivered in the gift box in addition to our normal purchases. If the interest rate is still good next year, we’ll deliver the gift and buy a new gift in the gift box. If the interest rate isn’t good anymore, we’ll skip the purchase, deliver the gift, and cash out immediately.

Don’t Forget About Undelivered Gifts

As with physical gifts, most gifts are purchased and delivered in short order. If you hold gifts in your closet for a long time, you may forget that you bought the gifts in the first place. If you’re intentionally pre-purchasing gifts to take advantage of temporarily high interest rates, tell the recipient you’re holding a gift. Set recurring calendar reminders to tell yourself and the recipient you still have undelivered gifts in the gift box.

Remember that gifts are in limbo until they’re delivered.

Unexpected Death

You can include a second owner or a beneficiary for the I Bonds you buy as a gift. If the gift recipient dies before you deliver the gift, the designated second owner or beneficiary will inherit your gift. You can’t name yourself as the second owner of the gift but you can name yourself as the beneficiary of the gift. The recipient can change the second owner or the beneficiary after you deliver the gift. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

If you die before you deliver the gift, the gift still belongs to the recipient. Whoever handles your affairs after your death should notify the recipient that you had an undelivered gift for them. Then the recipient can claim it through TreasuryDirect. Again, it’s important that you tell someone about the gift if you’re going to hold it undelivered. If no one knows you bought a gift, the gift will be in limbo.

Gift Tax Form 709

There’s no tax for receiving gifts. Gift tax is on the gift-giver.

Buying I Bonds as a gift counts as a completed gift in the year of the purchase (not the year of the delivery). There’s no limit on how much you can give as gifts to your spouse (unless the spouse isn’t a United States citizen). Each person has an annual gift tax exclusion amount for “present interest” gifts to each non-spouse recipient, which is 16,000 in 2022 and $17,000 in 2023. If the total “present interest” gifts (in I Bonds and other forms) during the year from one specific giver to one specific non-spouse recipient go above this annual gift tax exclusion amount, you’re required to file a gift tax return on IRS Form 709.

The gift tax annual exclusion amount for gifts to a non-spouse recipient is $0 for “future interest” gifts. You’re always required to file a gift tax return when you give “future interest” gifts to anyone except your spouse. It’s not clear to me whether the I Bonds you buy this year as a gift but hold for delivery in a future year count as a “present interest” gift or a “future interest” gift. To avoid ambiguity in determining whether it’s a “present interest” gift or a “future interest” gift, only give gifts to your spouse or deliver all gifts to non-spouse recipients within the same calendar year.

Unless you’re also giving the same non-spouse recipient gifts in other ways, buying and delivering $10,000 worth of I Bonds as a gift in the same calendar year falls below the annual gift tax exclusion amount, which doesn’t trigger the requirement to file the gift tax return.

If you’re required to file a gift tax return, it’s separate from the federal income tax return. The gift tax return goes to a special address. The typical consumer-grade tax software packages such as TurboTax and H&R Block software don’t support filling out a gift tax return. You’ll have to go to a tax professional or fill out the gift tax return on your own.

Having to file a gift tax return on Form 709 doesn’t mean you’ll pay gift tax out of pocket. Most people just use up part of their lifetime estate and gift tax exemption amount, which is more than $12 million in 2022. However, after you file the gift tax return once, you’ll have to keep track of how much of your lifetime estate and gift tax exemption amount you already used. See IRS Instructions for Form 709 if you decide to give gifts that will require a gift tax return.

Avoid Mistakes

Although TreasuryDirect has an official video walkthrough for how to buy a gift, it’s very easy to make a mistake if you follow the video when you’re buying a gift for the first time. I read many reports from people intending to buy a gift but ending up buying bonds for themselves.

It’s easier if you follow these steps when you’re buying a gift for the first time.

Add Registration

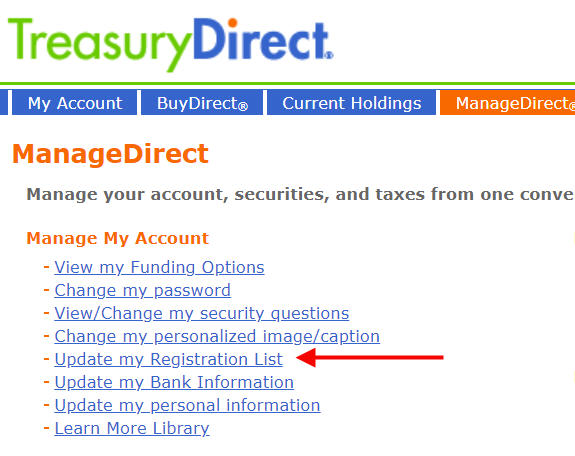

Click on ManageDirect in the top menu. Then click on the link “Update my Registration List.”

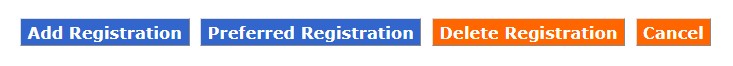

You’ll see a list of existing registrations in your account. Click on “Add Registration” to create a new one.

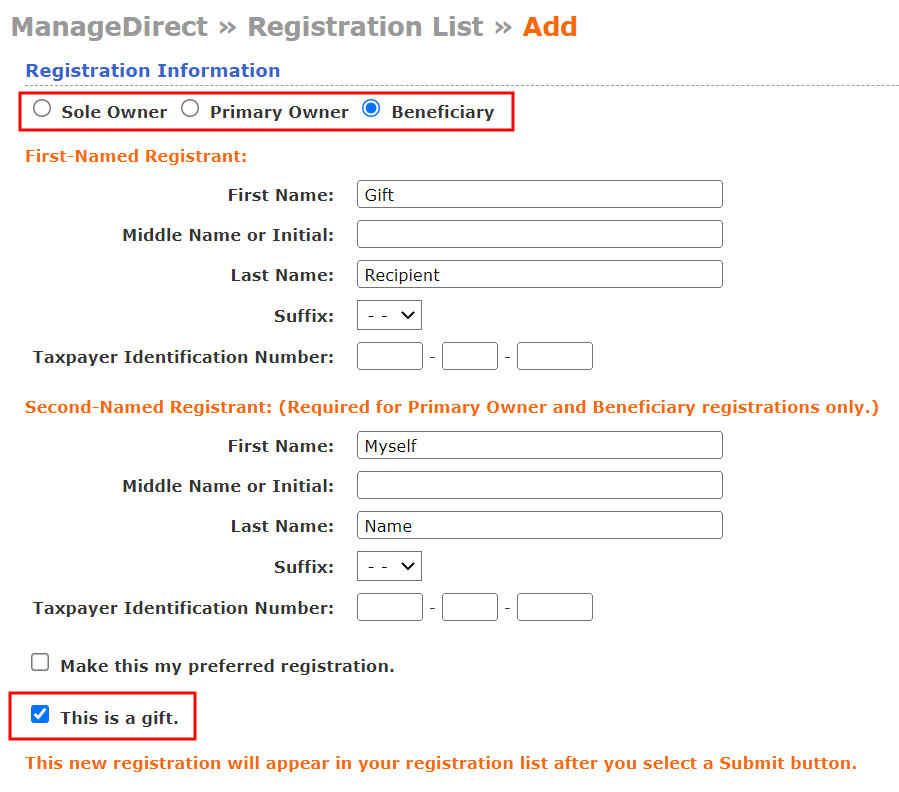

The radio buttons at the top show the registration types.

- Sole Owner means the gift recipient alone, without a second owner or a beneficiary.

- Primary Owner means the gift recipient with another person as the second owner.

- Beneficiary means the gift recipient with another person as the beneficiary.

If you choose Primary Owner or Beneficiary, enter the gift recipient as the First-Named Registrant and the second owner or the beneficiary as the Second-Named Registrant. You need the Social Security Number of both the gift recipient and the second owner or the beneficiary. You can’t name yourself as the second owner but you can name yourself as the beneficiary.

Make sure the spelling of the recipient’s name matches exactly what the recipient has or will have on their TreasuryDirect account. If the recipient has their full middle name on their account, you also include their full middle name. If the recipient only has their middle initial or no middle initial, you do the same in your gift registration. A mismatch between the names can cause a problem when you deliver the gift.

Check the box “This is a gift.” After you click on Submit, the new combination will be added to your list of registrations. You will use this registration when you buy the gift.

You only need to do this once per gift recipient.

Place Gift Order

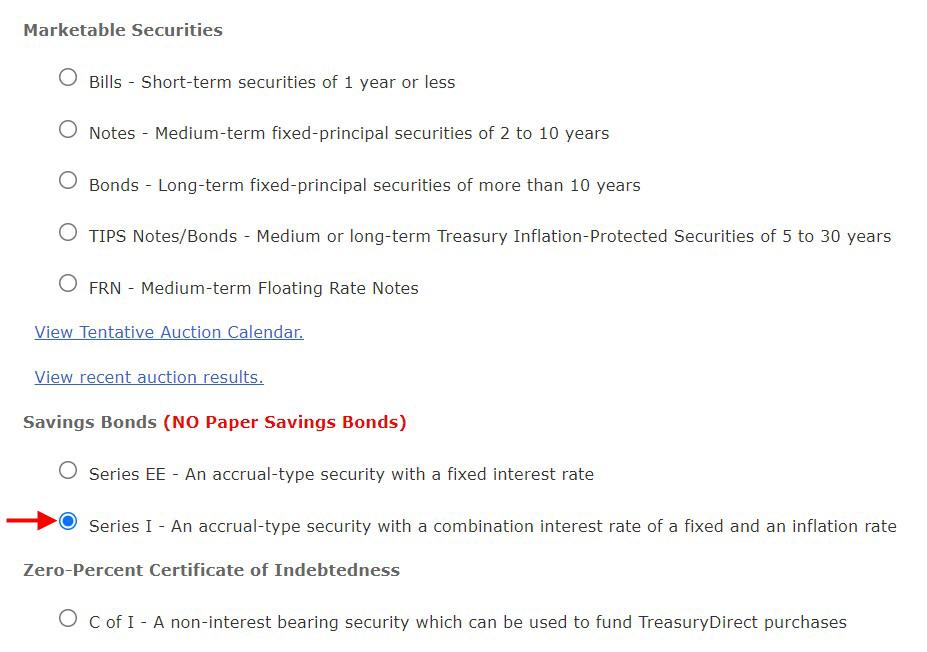

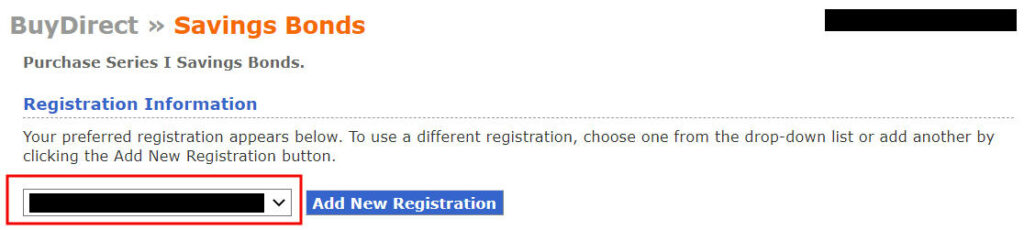

Now click on BuyDirect in the top menu.

Select “Series I.”

This is important. Use the dropdown to select the gift registration. The name of your gift recipient should appear first, for instance, “Gift Recipient POD My Name.”

Now enter the purchase amount and the rest of the information.

Pay attention to the registration information on the final purchase review page and make sure the purchase is for the intended gift recipient before you click on Submit.

Deliver Gift

See a walkthrough in Deliver I Bonds Bought as a Gift in TreasuryDirect. You need the gift recipient’s TreasuryDirect account number. If they don’t have a TreasuryDirect account, they need to open an account to receive the gift delivery even if they’re not buying any savings bonds on their own.

If the gift recipient is a minor, a parent needs to open a Minor Linked Account for the minor under the parent’s account (see Buy I Bonds in Your Children’s Names). The parent needs to open an account for themselves before they can open the account for the minor even if the parent isn’t buying any bonds.

Remember to check with the recipient how much they are planning to buy themselves this year because delivering gifts to them counts toward their annual purchase limit.

There’s no way to pre-schedule delivery for a future date. You’ll have to log in every time you’d like to deliver a gift. If you’re keeping undelivered gifts in your gift box, set calendar reminders for yourself and the recipient to make sure you don’t forget the undelivered gifts.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Jim says

Harry, thank you for your work on understanding I bonds. In reading this today, I see a few broken links to the educational 2-minute films on delivery of gifts. I am sorry that TD left this for you rather than redesigning the website with broken links! I was clarifying that gifts can be delivered in part. For instance, I purchased two $5,000 gifts for my spouse to be delivered in future years. I could actually decide to delivered the gifts in $2,500 of principal amount, creating more flexibility to mix gift and purchases in future years, depending on fixed rates and future inflation rates.

Harry Sit says

I updated the links to their short videos on the new site. Yes, you can choose to deliver gifts in part, as noted at the end of the “Gift Box and Delivery” section.

Marc says

Harry,

Nice shout out in yesterday’s MarketWatch article focusing on the possibility of a fixed rate being included in the November 1 I Bond rate announcement. “Though there’s no way of knowing whether the U.S. Treasury will in fact increase the I-bond fixed rate in early November, Harry Sit of The Finance Buff, said in an email that he would be “disappointed” if they don’t.

You feel the fixed rate possibility is justified, huh? I agree, even though the decision-making process is still quite a mystery. It’s just, I’m not sure a small fixed rate in the tenths of a percent would really make much of a difference even if it becomes a permanent part of the next I Bond term. My thought is that it’s still preferable to buy I Bonds before the end of October, if possible, to lock in the higher interest rate for the next six months. If a fixed rate comes to fruition on In November and is substantial enough, one really doesn’t miss out. You can just wait until January and buy the November term Bond in the new year.

Then again, the author doesn’t know the difference between Dr.Spcck, the famous pediatrician, and Mr. Spock of Star Trek, so I have to take his advice with a grain of salt. “ As Dr. Spock once said on Star Trek, “A difference that makes no difference is no difference.” In this case, the right Spock does make a difference. 😂

On a serious note, nice to see you quoted as an expert about I Bonds in this article. It’s “richly” deserved.

Marc says

Article a link:

https://www.marketwatch.com/story/theres-no-rush-to-buy-i-bonds-11665771545

Harry Sit says

A higher fixed rate won’t make much difference for the bonds you buy in 2022. You’re still better off buying now to catch the 9.62% rate for six months. I hope they’ll fix the bug in buying gifts soon.

The fixed rate will make a difference for the bonds you buy in 2023. If they don’t raise the fixed rate, I’ll stop buying in 2023 and shift to TIPS. The yield on 5-year TIPS is +1.8% now. TIPS are a different beast but the yield is attractive. See More Inflation Protection with TIPS.

RT says

Regarding Gift Tax Form 709:

During year 2022 we contributed $10,000 to 522 plan. If I chose to gift $10,000 iBonds this month (provided website is fixed) to a friend will I have to fill out

Form 709?

sscrla says

I assume you meant 529. Is the friend the beneficiary? If not your total gift to your friend is $10k, and you don’t need to fill out a gift tax return (absent other gifts).

Dunmovin says

RT…read some of the other comments on gifting for outyear delivery to a non-spouse and whether or not it is a present or future gift for purposes of gift tax law, i.e.. not the Ibond “law.”

RT says

Yes I meant 529

MS says

Just read the article and got puzzled about the interest rate, it says if you buy in Oct you will get 9.62% until the end of March 2023, doesn’t the rate reset to the new 6.48% (+ possible fixed rate) in November 2022?

sscrla says

You get your rate for six months (the May rate; make sure you can count six months from October). For the next six months, you will get the new rate (the November rate). Rinse and repeat for the next 30 years.

rnam says

The Gift Box Purchase is working again. The error of exceeding annual limit no longer appears. Instead you get a boilerplate message warning you about $10K annual limit and that it will be refunded. No specific mention of Gift Box exemption to $10K limit.

Mariel says

Thanks for letting us know.

Harry Sit says

Now the purchase page correctly distinguishes buying for yourself and buying gifts. I tried buying for myself and I got the previous “limit exceeded” error message. I was able to proceed to the next page when I changed the registration to a gift. This stops accidentally exceeding the limit when you forget to select the gift registration.

While introducing a bug was unfortunate, the intention was good, and fixing the bug within a week exceeded my expectation.

Marc says

This disclaimer is new after ordering an I Bond and before the purchase transaction takes place:

IMPORTANT – As stated in the Code of Federal Regulations

The principal amount of book-entry savings bonds that you may acquire in any calendar year is limited to $10,000 for Series EE savings bonds and $10,000 for Series I savings bonds. Any purchase in excess of $10,000 is in violation of the regulation and will be refunded.

The excess bond(s) will be removed from your TreasuryDirect account and refund will be made to the bank account of record. Continued violation of federal regulations may cause your TreasuryDirect account to be closed/suspended.

Helpful tips:

The limit is applied per social security number (SSN) of the first-named registrant or employer identification number (EIN) of an entity.

You may purchase additional Series I bonds in TreasuryDirect using your IRS tax refund, in accordance with IRS guidelines, up to $5,000 or your refund amount, whichever is smaller.

If this purchase will cause you to exceed the $10,000 annual limitation, a refund of the full purchase amount will be made to the bank account where the purchase originated.

NOTE: It may take up to 12 weeks to receive your refund.

Do you want to proceed?

Even though it’s qualified with the “book-entry” phase, the first sentence (and the second sentence) could easily be misconstrued by purchasers as including gifts in the $10,000 limitation, which we know is not the case. Wouldn’t it make sense to add “excluding I Bonds purchased as a gift” somewhere in the text to acknowledge that gifting is not only legitimate but encouraged?

Dunmovin says

Marc, what would really be nice is the solicitation by TD of public comments on proposed changes. I sent a message to TD suggesting same which was to no avail…those with media connections can make it happen! The problem I found is the terminology is different…no consistency. I purchased some gift ibonds Sunday and today on various accounts…and everything seemingly is going ok…but who really knows…no way to manage an organization…no free pass from me!

The real big problem is those with trusts and perhaps earlier being driven to legally wrongfully changing a title merely b/c of punctuation! Seriously!

Then there is… what else was changed which we don’t know about!

Auditors luv these inconsistencies…again where is the IG?

Marc says

You make some valid points about the need for public input beyond calling or emailing the TD representatives. My observation was specific to gifting because it is NOT allowed and encouraged bit also a limit workaround, and yet not mentioned in that disclaimer which displays when buying a gift. That wording can easily be misconstrued to mean gifting is forbidden over the limit when it is not. I can see someone reading that disclaimer and questioning whether to proceed with a gift after reaching their personal purchasing limit. It is a very heavy-handed message, which would be fine if the wording and meaning were crystal clear.

Regarding the media, I am still shocked that only Harry, one financial YouTuber, and a message board were the only places I could find online which mentioned the gifting glitch. Even with all the attention I Bonds have gotten because of the 9%+ interest rate, I couldn’t find a single mainstream article from a major news or financial outlet mentioning it during the week it was down. That’s almost unheard of in today’s media overload culture.

Lastly, I don’t want to beat a dead horse, but the mystery of how and when the fixed rate is determined absolutely needs some degree of transparency. I love a good mystery, but not when managing my finances.

Harry Sit says

This tells us again that gifting is only a secondary or tertiary use case in the whole operation. It felt like the whole world to some of us when it was down for a week but the rest of the world carried on not noticing it. Most people don’t think about gifting when they read that message because they don’t even know that gifting is an option. So don’t read too much into it when gifting isn’t specifically called out. It’s a corner case in the grand scheme.

Marc says

* “not only allowed and encouraged but also a limit workaround”

Paul says

Hi Harry,

Thank you for the great articles on I-bonds. I have learned a lot from you in very little time because of your very clear research, thoughts and style.

Regarding the I-bond purchase limits for an individual each year, TD once again allows me to buy gifts for my spouse, even though I already bought myself a $10,000 I-bond earlier this year as well as a prior $10,000 gift I-bond for my spouse also this year. I am inclined to buy another $10,000 spousal gift before Oct 28, but must admit that the message about exceeding limits and getting refunds of over-limit purchases and possibly having my account closed for abuse was a bit daunting (as well as not very clearly written regarding gifting). I am pretty sure you stand by the interpretation that buying multiple $10,000 spousal gifts within a year is allowed as long as delivery is duly spaced to avoid the spouse receiving or purchasing more than the $10,000 per year. Is this correct? Also, would you happen to know which regulations establish all these limits. The TD warning vaguely references some limits, but not in a precise way that one could look up. Though I do assume the regulations are written in a style impenetrable to those of us with only an understanding of standard English, and not legalese.

Thanks again for your wonderful articles. Each one I read makes me want to read more from you.

sscrla says

The regulations are not that hard to read, but one needs to be careful. For example, the word “you” is defined in 31 CFR 363.6

“You or your refers to a TreasuryDirect primary account holder.”

Also, the regulations do not have a purchase limit, but an acquisition limit.

“§ 363.52 What is the principal amount of book-entry Series EE and Series I savings bonds that I may acquire in one year?”

(a) The principal amount of book-entry savings bonds that you may acquire in any calendar year is limited to $10,000 for Series EE savings bonds and $10,000 for Series I savings bonds.”

This is where you need to know what “you” means. You also have to know what “book-entry” means, as well as “acquire.”

It may seem daunting, but you can read the words for yourself.

Harry Sit says

Nothing changed with that message. Everything in that message is true and accurate. It doesn’t say anything about gifts. So don’t read what it doesn’t say.

M. Anderson says

It is pretty clear from subsection (b) of CFR 363.52 that bonds purchased or transferred as gifts are “included in the computation of this limit for the account of the recipient for the year in which the bonds are delivered to the recipient.”

That language seems to suggest that gifts received are not included in the definition of “acquire” in subsection (a). If they were included in sub-section (a), then sub-section (b) would be superfluous. A basic principle of construction in the law is that interpretations that render language superfluous are to be avoided.

My reading of these sections is as follows:

1. You may only acquire (e.g., buy) $10k for yourself each year. See 363.52(a). I agree with Harry that “acquire” could included receiving as a gift, but if that were the case, then there would be no need for subsection (b). My reading of subsection (b) is to indicate that gifts received are unlimited, but the amount of the gift is included in the calculation of how much you can buy for youself.

2. If you receive a gift, that gift is “included in the computation of your limit” for purchases that year under subsection (a). See 363.52(b). Note that this doesn’t mean that you have a limit on gifts received. It just means that if you receive a gift, it goes towards your purchase limit, and can impact your future purchases during the year of receipt.

3. You may only purchase $10k per receipient as a gift each year. 363.52(c).

So, if you receive a $10,000 I-bond as a gift on January 1, 2022, it will go towards your limit for that year. 363.52(b). If you try to buy an I-bond for yourself on February 1, 2022, you won’t be able to do so. You reached your limit when you accepted the gift on January 1, 2022. 363.52(a). But, if someone else bought you an I-Bond that year, they can deliver it to you anytime that year. That’s because, per (b), bonds purchased as gifts or transferred as gifts will be included in your limit for acquisitions ( purchases) but not for receipt of gifts.

Similarly, if you purchase a $10,000 I-bond on January 1, 2022, and then receive a gift of a $10,000 I-Bond on January 15, 2022, you can accept the gift. There’s no limit on the receipt of gifts in any particular year. The gift will go towards your limit, but since you’re already over the limit, it won’t matter.

Here’s the full-text of CFR 363.52:

(a) The principal amount of book-entry savings bonds that you may acquire in any calendar year is limited to $10,000 for Series EE savings bonds and $10,000 for Series I savings bonds.

(b) Bonds purchased or transferred as gifts will be included in the computation of this limit for the account of the recipient for the year in which the bonds are delivered to the recipient.

(c) Bonds purchased as gifts or in a fiduciary capacity are not included in the computation for the purchaser. Bonds received due to the death of the registered owner are not included in the computation for the recipient.

(d) We reserve the right to take any action we deem necessary to adjust the excess, including the right to remove the excess bonds from your TreasuryDirect account and refund the payment price to your bank account of record using the ACH method of payment.

Marc says

#3 can’t be right.

“3. You may only purchase $10k per recipient as a gift each year. 363.52(c)”

363.52(c) literally states “Bonds purchased as gifts or in a fiduciary capacity are not included in the computation for the purchaser. ” it says nothing about limiting gifts to a single recipient.

It is somewhat common to purchase more than $10K per gift recipient in the same year (to be delivered at a later time). Harry concurs in the article we’re all commenting on here.

M. Anderson says

So, are you saying that I could buy $1,000,000 worth of I-bonds for a single recipient, right now? Cause that definitely doesn’t seem correct.

Alex says

Very helpful post. Question below. If both spouses follow this strategy and buy each other 5 bonds at $10k each ($50k times two), keeping it in the gift box. Can 5 years later both spouses deliver all the bonds ($100k in total of principle between the 2 spouses) to each other in the same year, given that in that year they won’t purchase any more bonds? If the answer is “no” because of the $10k annual delivery limit, can these be delivered and sold right away (paying taxes on the compounded interest gain)?

Alternatively, do accumulated bonds in the gift box can only be delivered at $10k annual maximum, even if that bond would be sold on delivery from the gift box that very same year? (That limitation if true would make it less attractive for large accumulation due to a long term lock-in)

MikeG says

Not sure the answer to this question, but why not deliver each tranche on January 1 of each year. That is what we are planning to do. The recipient of the gift could then do whatever they want with the bonds (sell or hold). Only downside I suppose to this approach might be that one could be precluded from buying bonds in each year that a gift of $10,000 was delivered to them?

Harry Sit says

Selling right away after delivery doesn’t change anything if you can’t deliver in the first place. Whether you can deliver $50,000 of principal in one year depends on how you read the word “acquire” in the federal regulations quoted by sscrla, which interestingly isn’t defined elsewhere in the regulations. If you read conservatively, receiving a gift delivery is a form of acquiring, and therefore the maximum is only $10,000 of principal in one year. If you read aggressively, receiving a gift delivery isn’t a form of acquiring, and the gift amount is only “included in the computation of this limit [for acquiring].” Therefore, if you receive $50,000 of principal in one year, you have used up the $10,000 acquisition limit for the year, which only means you can’t buy more I Bonds for yourself but receiving the gift delivery itself isn’t a problem.

Whenever the answer isn’t clear, we should also pause and ask whether we really need the technical answer. Going the conservative route always works. If you truely will hold for five years, it’s better to buy TIPS at 1.8% above inflation anyway versus the current 0% plus inflation on I Bonds.

Dan A says

I’m hoping for a good answer to the same question by January: Can we deliver our multiple gifts to each other Jan 2023, or do we need to space them out @ $10,000 / year?

Dunmovin says

Harry, when the TD site was down last week I initially thought that perhaps my gift registration may have a flaw. Consequently i reentered/new registration…which didn’t accomplish the goal of making new gifts. Now there are 2 similar registration in the pull down…we all know how to add…how do we delete a registration? Thanks

Barbara Pellerino says

Go on to Manage Registration and it will give you the option to delete registrations.

Dunmovin says

Barbara, thanks, you pointed me in the right direction and I deleted one…manage my account…then Update Registration List…and I was there!

Follow on Q…I also have two duplicate Registrations and have used each, ie in my gift box and under each are the gift box purchases…I suspect it’s better to leave those 2 alone. Thoughts?

Harry Sit says

A registration is copied onto the bonds you buy. Deleting a registration from the registration list only means you can’t use it on new bonds you buy next time but it doesn’t affect the bonds you already bought. It’s like burning the blueprint after you build a car. The car still has the design after the blueprint is gone.

suncoaster says

Dunmovin – I’m not Harry, but here’s what worked for me in deleting a registration (I tried the same thing you did with the same unsuccessful result). Go to the Manage Direct button at the top of the page and press it, then select Registration List. When the box containing all the registration names appears, select the name you want to delete, then look down and there will be 4 buttons labeled Add Registration, Preferred Registration, Delete Registration, and Cancel. Click Delete & you should be good to go. Hope this works for you.

suncoaster

suncoaster says

Sorry everyone, I didn’t see Babara’s post. And yes, Dunmovin it’s probably best to leave them alone, I did.

sscrla says

I agree with Harry that you can read 363.52 (b) two ways, but don’t ignore part (d). If they see you as playing games with them, they can just return the money (without earned interest – “payment price”).

§ 363.52 What is the principal amount of book-entry Series EE and Series I savings bonds that I may acquire in one year?

(a) The principal amount of book-entry savings bonds that you may acquire in any calendar year is limited to $10,000 for Series EE savings bonds and $10,000 for Series I savings bonds.

(b) Bonds purchased or transferred as gifts will be included in the computation of this limit for the account of the recipient for the year in which the bonds are delivered to the recipient.

(c) Bonds purchased as gifts or in a fiduciary capacity are not included in the computation for the purchaser. Bonds received due to the death of the registered owner are not included in the computation for the recipient.

(d) We reserve the right to take any action we deem necessary to adjust the excess, including the right to remove the excess bonds from your TreasuryDirect account and refund the payment price to your bank account of record using the ACH method of payment.

Dunmovin says

All…this recent discussion reflects original suggestion…there should have been an opportunity to comment…shame on Treasury, ie TD! Reasonable people may differ but if comments were rightfully solicited the agency should state at time of implementation why other “inputs” were not implemented. Finally there should not be any of this “foolishness” just before a new rate date! Did someone say sham(e) on TD?

Marc says

If I had $1,000,000, I could buy a lot of things, why not bonds for a single recipient? 🤷♂️

I’m not sure if there’s an upper limit in the regulations, but if you did buy $1,000,000, it would exceed the annual gift tax exclusion by $984,000 and it would take you 100 years to deliver the entire amount. So practically speaking, the reality of the $10,000 delivery limit imposes a soft ceiling ion the purchase of gift I bonds.

Harry can give a better answe, but here’s what TD has to say:

How much can one person or entity own in savings bonds?

There is no limit on the total amount that any person or entity can own in savings bonds.

How much can I spend each year on savings bonds?

We count the limits by the Social Security Number of the first person named on the bond or, in the case of an entity, by the Employer Identification Number or Social Security Number.

A given Social Security Number or Employer Identification Number can buy up to these amounts in savings bonds each calendar year:

$10,000 in electronic EE bonds

$10,000 in electronic I bonds

$5,000 in paper I bonds that you can buy when you file federal tax forms

Notes:

Gift bonds count toward the limit of the recipient, not the giver.

If you have an individual account and an entity account in TreasuryDirect that use the same Social Security Number, you can purchase up to the limits in each of the 2 accounts.

What about bonds . . .

that I co-own?

If you co-own savings bonds with someone else, only the bonds for which you are the first named owner count toward your limit.

Savings bonds for which you are the second named owner do not count towards your limit. They count towards the limit of the other person – the one who is named first on the bonds.

What about bonds . . .

for my children?

Each child has their own Social Security Number. Therefore, no matter who buys bonds for the child, the amount of those bonds counts for the child’s limit – not the limit of the buyer.

When you open a linked account in TreasuryDirect for a child under 18, the bonds in the child’s linked account belong to the child. You do not own them. Therefore, they do not count in your limit.

Each child has the same yearly limit: $10,000 for electronic EE bonds; $10,000 for electronic I bonds; $5,000 for paper I bonds.

What about bonds . . .

I give as gifts?

This is just like the situation with your children. The gift belongs to the person to whom you give the bond. Therefore, the amount counts in that person’s limit, not in your limit.

The gift counts for that person’s limit in the year in which they get the bond.

While the gift is sitting in your TreasuryDirect account waiting to be delivered, it is in a special “gift box.” So, even then, it is not yours and does not count in your limit.

https://www.treasurydirect.gov/savings-bonds/how-much-can-i-spend-own/

suncoaster says

Harry & Others – I’m having trouble buying additional I Bonds as a gift. In the Buy Direct section of TD, I select the registration I used to buy my wife’s gift I Bond last month. I then get a warning notice below the Purchase Amount window which says (in bold red print) “* Annual Limit is $10,000”. If I try to make a purchase, I get the warning others have mentioned. I even deleted the old registration and then re-entered it making sure I checked the Gift Box, but still got the same warning. Can anyone tell me what I’m doing wrong? Thanks in advance.

Dunmovin says

Registration I used for gift purchase to spouse is

Spouse name POD your name

Harry Sit says

Everyone gets the bold red print on the order entry page and the long warning message after that. Those aren’t specific to your purchase or to gifts. They just want everyone to see and acknowledge the annual limit.

Steve says

I got the warning, decided to double check the registration was marked as a gift, which it was so I went back to buy bonds under that registration, but then the page timed out, so I tried to refresh, which eventually loaded, but claimed I had used the back button even though I hadn’t, so I had to re-log-in to the site. But it did work the next time I tried.

suncoaster says

Dunmovin and Harry – Aha! I was being scared off by the long warning on the page that appeared after pressing the purchase button. Purchases for each of us seem to have gone through without a hitch. Thanks for babysitting me!

MJ says

Hello Harry,

My TD account has got locked and I am unable to unlock the account and purchase new I series Bonds for myself?

What options, do I have to reinstate my account – My TD account was created in 2000?

MJ

Dunmovin says

Wow! My business account was locked after/during set up but was quickly resolved with calls when TD was “doing customer service”. But the Q is what we’re you doing? Inactive? Facts?

Harry Sit says

Call customer service at 844-284-2676. Or fill out Form 5444 and get a signature guarantee.

Ames says

In reading Marc’s 10/17 post which quotes the TD disclaimer, I am wondering if their statement means there’s no more point in requesting my tax refund in I Bonds. Or maybe it is different with a paper bond refund, as in past years? I had been sure to have enough taxes withheld in December for this, so will need to figure it out by then.

” You may purchase additional Series I bonds in TreasuryDirect using your IRS tax refund, in accordance with IRS guidelines, up to $5,000 or your refund amount, whichever is smaller.

If this purchase will cause you to exceed the $10,000 annual limitation, a refund of the full purchase amount will be made to the bank account where the purchase originated.

NOTE: It may take up to 12 weeks to receive your refund.

Do you want to proceed?”

Harry, you have made a very big difference to my financial well-being. Thank you so very much!!

Harry Sit says

Paper bonds from the tax refund are separate just as before.

Marc says

Ames,

The $5,000 worth of paper I Bonds that can be purchased with a tax refund is separate, and in addition to, the $10,000 annual electronic I Bond purchase limit. That has not changed despite the somewhat ominous and cryptic wording of the disclaimer.

I’ve always thought it’s cumbersome and awkward to try to manipulate one’s tax liability to max out on buying a savings bond. I think gifting is a superior, safer, and more lucrative strategy, especially with a spouse, and has the advantage at this moment in time of being able to lock in the 9.62% rate for the next six months when we know the next predicted rate is more than 3% lower than that, as opposed to waiting until 2023 to do your taxes when this high rate will be fond memory.

Steve says

How do you even use your tax refund in Treasury Direct, directly?

Manipulating one’s tax withholding (not liability, directly) isn’t too hard if you just file an extra payment with an extension in January, when you can have a pretty good idea of your taxable income and taxes for the prior year. That’s what I’ve done the past two years. Just because you file an extension doesn’t obligate you to wait past April 15th to actually file your complete taxes.

sscritic says

Steve, the instructions to form 8888 (2021) provide a link to treasury direct.

“You can request a deposit of your refund (or part of it) to a TreasuryDirect® online account to buy U.S. Treasury marketable securities and savings bonds. For more information, go to http://go.usa.gov/3KvcP.”

The joke is that the link is dead. Blame the IRS or Treasury Direct, your choice. Perhaps the 2022 form 8888 will have a correct link.

Ames says

Harry, thank you for replying–and in three minutes flat!! Very grateful for all that you share, financial and otherwise. It matters.

Mike Bennett says

Thank you so much for this very informative and helpful article.

So – if a couple were making high earnings (and tax bracket) for a period (or a career with uneven earnings (feast/famine)) and limits on what they can squirrel away in an IRA, could they theoretically gift $300,000 each to the other (with the gifter as the beneficiary) in a tax-deferred investment, so it could all be take out before they mature, and an additional $10K each year (or total $10K each x (the number of years they gift + 29), as a maximum?

Tom H says

Good question. If there is no limit to what can be purchased and stored in your gift box for your spouse, with yourself as beneficiary, and with no intention of ever delivering the I bonds, the $10.000 limitation seems to disappear. If your spouse is old and won’t live 30 years, you will inherit your gift box bonds if your spouse is first to die, or Treasury Direct will deliver your gift box to your spouse if you are first to die. Can it be so simple?

Harry Sit says

The intention to deliver and cash out will appear when other investments (including new I Bonds) start beating inflation and you wonder why you’re sitting on this thing that only matches inflation.

Mike Bennett says

Mr. Sit,

I realized the risk of permanently buying no-real-rate I Bonds that being stuck with that option – alternatively, I had loaded up on I Bonds in recent years in the era of negative-return TIPs, but am now preparing to offload all these I Bonds in the spring to buy return-optimized TIPs again (while still retaining my big stockpile of 2001-2003 I Bonds, which had 3-3.4 percent real returns, and the good old days of $60K/person/yr purchasing). What my proposed massive I Bond-gifting option might do to protect one from future legislature that is probably likely to reduce the attractiveness of future I Bonds (like they did when reduced the annual purchase limit from $60K to $10K), or further reducing purchase limits, letting I Bond real returns go negative like TIPs (gasp) or ending the program in total in the future. One could always sell those I Bonds in the future and buy positive-return TIPs at any time they are generating a better return (like now), but in the meantime it would also protect your stockpile from long-term deflection, while it is in “limbo.”

Mike Bennett says

long-term deflation, I meant to say.

Nick says

“One could always sell those I Bonds in the future and buy positive-return TIPs at any time they are generating a better return (like now)…” – In your example of gifting $300k to each other, wouldn’t you still be limited to delivering only up to $10k per year? If so, then you wouldn’t be able to quickly sell the I-Bonds and buy TIPS when they have a real yield (like now), right?

Marc says

Oh boy…

Treasury Says Orders for I Bonds With 9.62% Rate Might Not Be Completed by Deadline

https://www.wsj.com/articles/as-investors-scramble-to-buy-i-bonds-treasurydirect-site-has-outages-11666817951

Dunmovin says

To paraphrase…you snooze, you lose

John says

The I-Bond gift is considered a “present interest” gift in the year when it is delivered to the recipient IMO because it will count towards the recipient’s purchase limit in that year.

John says

Also at that time, both the principal and interest will be considered as gifts.

Dunmovin says

John, you are one of the few, if any, that have dared to go before on the gift tax issue. Any authority for such boldness? And what is it called at the time purchase for gift box before delivery…for gift tax purposes…all for nonspouse?

Marc says

According to Harry in this article (as well as other sources):

Buying I Bonds as a gift counts as a completed gift in the year of the purchase (not the year of the delivery). There’s no limit on how much you can give as gifts to your spouse (unless the spouse isn’t a U.S. citizen). Each person has an annual gift tax exclusion amount for “present interest” gifts to each non-spouse recipient, which is 16,000 in 2022. If the total “present interest” gifts (in I Bonds and other forms) during the year from one specific giver to one specific non-spouse recipient go above this annual gift tax exclusion amount, you’re required to file a gift tax return on IRS Form 709.

Dunmovin says

Marc, “ It’s not clear to me (Harry) whether the I Bonds you buy this year as a gift but hold for delivery in a future year count as a “present interest” gift or a “future interest” gift. .” No need to say more!

Marc says

Dunmovin, I think you need to quote the sentence before as well for the full context:

“ You’re always required to file a gift tax return when you give “future interest” gifts to anyone except your spouse. It’s not clear to me whether the I Bonds you buy this year as a gift but hold for delivery in a future year count as a ‘present interest’ gift or a ‘future interest’ gift.

For clarity, the word “non-spouse” in the sentence you quoted is implied meaning if you are loading up on Gift I Bonds for your spouse to deliver in future years, the tax issue is moot whether or not it’s a present or future interest gift.

Marc says

It looks like the I Bond Fixed Rate is 0.40% and the Inflation Rate is 6.48% for a Composite Rate of 6.98%. Thoughts?

https://www.treasurydirect.gov/savings-bonds/i-bonds/i-bonds-interest-rates/

Marc says

6.89% (typo correction and rounded).

Dunmovin says

Harry (others?)…given the current base rate for new Ibonds any thoughts/concepts for the next 6 months or…at various points as well as for short/long term buying/holding of same? We haven’t see this in awhile ….thanks

Harry Sit says

Still good as a short-term investment but TIPS are better for the long term. I will deliver gifts in 2023 but won’t buy new gifts. New money will go to TIPS. Possibly will sell 3 months after the end of the 9.62% period or 3 months after the end of the 6.48% period.

Morgan says

Does the bond still earn interest in the time after delivering the gift and before the recipient cashes it out? Seems like it may be a silly question, but I can’t find the answer anywhere!

Harry Sit says

Absolutely. The point of a gift is for the recipient to hold it and earn interest, for up to 30 years after the original issue date.

Matt says

Harry,

Can I have two bank accounts at TreasuryDirect or will they delete my old one if I add a second bank account? And do you know if I can use a notary to authorize the bank account change form?

Thanks. Matt

Harry Sit says

You can have multiple bank accounts. The official bank change form still says “Notary certification is not acceptable.” You can call customer service to add a bank account now. It might be easier and faster than using the bank change form.

Harry Sit says

Someone reported that you can add a bank account online now.

Brian C says

Hi Harry, thanks for the great resource. My spouse and I have gift ibonds purchased in 2022 at a 0% fixed rate sitting in our TD gift boxes. What do you think about not delivering these in favor of purchasing new ibonds at the new fixed rate? How does one analyze this scenario?

Harry Sit says

If you like the new fixed rate, deliver the existing gifts and buy new gifts at the new rate for the gift box. The delivered bonds will be eligible for cashout sooner than buying new bonds outside the gift box.

Brian Cassell says

Thanks!

Marc says

I like your answer above and would like to take it a step further. The first two months of the next inflation calculation for I Bonds are in the books:

Oct: 0.4%

Nov: -0.1%

Although we don’t know the future, that extrapolates to a tentative 0.9% I Bond inflation rate adjustment on May 1. Thusly, I am waiting until mid-April to decide whether to buy additional Gift I Bonds in 2023 to capture the 6.89% annualized rate including the 0.4% fixed rate. In the meantime, I have money invested in a short-term T-Bill that matures in April.

Hypothetically, 6.89% annualized for 6 months and 0.9% annualized for 6 months comes to 3.895% annualized (3.445% + 0.45%). This figure is prematurely calculated with only 1/3 of the data, but I think it’s realistic to say that’s probably close to the low end of what to expect. I think the one thing that’s fair to say the next I Bond inflation rate will likely be lower than the current one.

With that in mind, I wonder if we can also assume the next Fixed rate component will be lower or put back to 0%. We know it’s a mystery, but I found it interesting that when the inflation rate dropped from May to November, TD increased the fixed rate component from 0% to 0.4%. I doubt that is historically common, because then we could anticipate another raise in the fixed rate as the inflation rate drops. It seems counterintuitive to assume that would be the case.

That leads one to conclude that the current I Bond with its 0.4% fixed rate could be the most attractive to buy for a while even though 0.4% seems negligible). Or do you have a different view looking ahead?

Dunmovin says

And, 3 months into the new May 1st rate may be a good time to redeem

Marc says

Dunmovin, yes, that could turn out to be a good time to redeem a 0% fixed rate I Bond. Or if inflation continues lower in 2023, a better time might be three months after the November 1 rate is applied which also pushes the taxable interest into 2024. But that’s so hard to predict.

I’m more curious about the cost benefit of purchasing the current I Bond in April. The last time the fixed rate was > 0.5% was 2008 so 0.4% is historically decent. It would be good to hold an I Bond with a fixed rate, unless a better fixed rate comes along. With inflation decreasing, I wonder if TD will raise the fixed rate to incentivize I Bond purchases. They really need to take away some of the mystery surrounding that decision.

Dunmovin says

Marc, I just placed a redemption order for small $ amount from trust to test the process…will go thru o 27th. I still think I’ll buy more in late January

Marc says

Makes sense. Good luck.

Sam says

Harry,

I am trying to deliver a 10k gift from the gift box to my wife. Before I hit the submit button I noticed the original 10k has now accumulated interest (total amount 10,400). If I go ahead with the submission of the entire 10400 will I surpass the 10 per year limit. If select partial amount and deliver 10k what happens to the interest amount(400).

I essentially want to deliver last years gift of 10k+interest with out cashing it out or hitting any issues with crossing the limit for 2023.

M. Anderson says

As I have stated before, there is NO LIMIT to the dollar amount of gifts that you can deliver in any one year, even to the same person. For example, if you purchased a $10k I-bond for your wife every year for the last decade, you could deliver $100,000 (plus interest) in I-bonds to your wife this year.

However, whatever you deliver will go against that person’s purchase limit for that year. So, if your wife wants to buy her own I-bonds this year, she should purchase her $10,000 in I-bonds BEFORE you deliver the gift. Once you deliver the gift of $10,400, that will eat up whatever remains of her purchase limit.

Toli says

Hi Sam — see comments #128 and #145 above, as well as CFR 363.52 (https://www.law.cornell.edu/cfr/text/31/363.52). In short, the interest doesn’t count towards the limit.

Marc says

To Sam,

The interest doesn’t count towards the $10,000 annual limit so you can feel free to deliver the entire bond to your wife.

To M. Anderson,

I don’t believe what you wrote is correct. According to Harry in this article:

“The principal amount of delivered gifts counts toward the $10,000 annual purchase limit of the recipient in the year of delivery.”

Once you deliver $10,000 of the $100,000 in purchased I Bonds, the limit of the recipient is reached and no more can be delivered that year because it will exceed the $10,000 purchase limit for that year, since a gift delivery counts towards the recipient’s purchase limit.

If I have that wrong, someone else or Harry will correct me.

M. Anderson says

Correction: The interest accumulated on the gifted bond does not reduce the amount that the recipient may purchase. Only the principal. See 31 C.F.R. § 363.52(b).

Sam says

Thanks folks for the replies and links. My Wife and I were able to deliver the gifts in our gift boxes.

Dunmovin says

Anderson/Marc I note the earlier “thread” in January 2022 on the delivery issue. However, I asked, who has delivered from their gift box more $10K (forget interest) to the same person in one year???? Harry, what’s the down side of trying to move $20K purchased last year for the gift box for my spouse…what’s going to happen??

Harry Sit says

We had this discussion last year. See my reply to comment #159 on October 18, 2022 at 4:18 p.m., the reply from M. Anderson to comment #158 at 4:42 p.m., and comment #162 from sscrla at 4:49 p.m. The word “acquire” isn’t defined in the regulations. We don’t know whether it includes receiving gift delivery or not. I’m sympathetic to the reading that it doesn’t but that obviously opens up the situation of buying $100,000 as gifts in one year and delivering $100,000 the next year, or all in the same year for that matter, which laughs in the face of the annual limit.

You can try it and let us know what happens when you deliver the $20K purchased last year. Maybe nothing. You asked what’s the downside of delivering them all now. I ask what’s the upside. The bonds earn the same amount of interest whether delivered or staying in the gift box. I don’t have $100,000 sitting in my gift box. Delivering $10k in principal value each year works just fine for me.

Dunmovin says

And the down side is? Who has delivered more than $10 K from gift box any one year to one person? No one? Therefore the proof is in the pudding …all theory but no practical answer?

M. Anderson says

I did. I had purchased a $10k I-bond three years in a row for a child, and delivered them all to the recipient in a single year when that person turned 18.

Marc says

Well, we have one person who seemes to have done what Harry characterized as having “laughed in the face of the annual limit.” The question is whether it is sanctioned or whether it was overlooked.

Not that Forbes Magazine is the ultimate authority, but they took the conservative interpretation to heart in October 14, 2022:

“As odd as that may seem, it actually presents a fourth strategy for maxing out the current 9.62% rate. Spouses, those with significant others, or perhaps close friends can buy each other a $10,000 I bond as a gift.

If purchased before the new rates take effect, the I bond will earn the annualized 9.62% rate for the first six months. There is one catch, however.

When the I bond is transferred to the recipient’s account, it counts toward the recipient’s annual limit. If they’ve already purchased $10,000 in I bonds this year, you would have to wait until next year to deliver the I bond. Given that it earns the higher return from the start, this shouldn’t present an issue.

In theory, one could purchase more than $10,000 in I bonds as a gift this month for the same person. Just keep in mind that one cannot deliver more than $10,000 a year in I bonds to the recipient, and that assumes they haven’t purchased I bonds on their own”

https://www.forbes.com/sites/robertberger/2022/10/14/how-to-buy-more-than-10000-of-i-bonds-before-the-rate-drops/?sh=2de5738f15de

Harry Sit says

I don’t think buying $10,000 each year and delivering $30,000 in one year laughs in the face of the annual limit, but buying $100,000 in one year and delivering $100,000 the next year or in the same year does. As many people bought more than $10,000 as gifts last year, now the question is whether you taunt the Treasury Department or you show some respect for the limit. If you choose to exceed the $10,000 limit, do it either on the gift buying side or the delivering side but not both. That’s my take.

Marc says

Harry, your take makes sense but it seems like a recent evolution of understanding about the gift delivery process that occurred post-article publication. Does it warrant an article update? Readers are looking for that guidance and may not scroll down through all the comments to get here.

JM says

On the question of delivering more than $10K of I-Bonds to a single person in one year, this is from the TD website:

“What about bonds . . .

for my children?

Each child has their own Social Security Number. Therefore, no matter who buys bonds for the child, the amount of those bonds counts for the child’s limit – not the limit of the buyer.

When you open a linked account in TreasuryDirect for a child under 18, the bonds in the child’s linked account belong to the child. You do not own them. Therefore, they do not count in your limit.

Each child has the same yearly limit: $10,000 for electronic EE bonds; $10,000 for electronic I bonds; $5,000 for paper I bonds.

What about bonds . . .

I give as gifts?

This is just like the situation with your children. The gift belongs to the person to whom you give the bond. Therefore, the amount counts in that person’s limit, not in your limit.

The gift counts for that person’s limit in the year in which they get the bond.

While the gift is sitting in your TreasuryDirect account waiting to be delivered, it is in a special ‘gift box.’ So, even then, it is not yours and does not count in your limit.”

https://www.treasurydirect.gov/savings-bonds/how-much-can-i-spend-own/

M. Anderson says

You read what Harry wrote correctly, but you misunderstood it.

The amount delivered IS applied to the annual purchase limit of the recipient in the year of delivery.

That means precisely what I wrote before. You can deliver as much as you want in one year, but every dollar you deliver uses up any remaining amount that person can purchase for themselves in that year.

And your statement that the interest does not count is incorrect. Every dollar delivered goes towards the RECIPIENT’S PURCHASE LIMIT for that year. If you bought a $5,000 bond and it has accumulated $500 in interest, then the year you deliver it, $5,500 will go towards that person’s purchasing limit. If they haven’t yet bought an I-bond, they’ll be limited to buying $4,500. If they have already bought a $9,000 I-bond, then the $5,500 given to them will use up their remaining $1,000 purchase limit.

M. Anderson says

Correction: The interest accumulated on the gifted bond does not reduce the amount that the recipient may purchase. Only the principal. See 31 C.F.R. § 363.52(b).

olisdad says

so as a follow up to the recent post on delivery of gifts, with a 10k ibond

do you enter 10k in the amount to be delivered box or the total amount with accrued

interest?

Harry Sit says

There’s a radio button for full delivery. You don’t need to enter any amount.

JPirkle says

I’ve read thru the comments pertaining to the gift rules.

In addition to our annual 10k limit purchased last year, also have 20K purchased last year in gift box for spouse. Spouse has 20K purchased last year in gift box for me.

Is it correct that this year we could each purchase our 10k limit first and then gift each other the 20k purchased and not run into the limits and/or upset the treasury folk?

Or is a better strategy to each buy our 10k allotment this year. Each buy another 10k gift for each other. Then next year gift all 30k to each other but do not make an annual purchase? Would this be less offensive….

Thanks. Great information here.

Dunmovin says

My spouse and I have gifted to the other several $10K amounts to each over the years. Nothing this year and no activity on accounts until today. …Testing the TD system my spouse “delivered” to me $5K…it went through and I saw in my TD account…however I noticed the difference in the “with” and “POD” designations/registrations and was going into my account to “attempt” to change the registration to “with” and that triggered the security question request by TD…I guessed wrong and got locked out. After a two hour phone (don’t even try email) hold (one can sure get a lot done on hold ) and everything was straightened out. But then I asked if I could then buy $10K for my TD account and the answer was “yes,” therefore it “seems” that one “could” have more than $10K delivered to the same person in same year!!! Go figure?

Dunmovin says

Has anyone giftbox delivered this year more than $10k to one person? What happened? We know $10k counts against the recipient’s annual limit BUT did the excess “go through?”

Jeff says

New to the forum.

What months would the following purchases interest run:

April 28

July 1

Oct 31

Thank You

Jeff

sscritic says

Let’s look at a calendar.

April 28 is after Nov 1 and before May 1. You will get the Nov 1 rate for the six months of April, May, June, July, August, and September

July 1 is after May 1 and before November 1. You will get the May 1 rate for the six months of July, August, September, October, November, and December.

October 31 is after May 1 and before November 1. You will get the May 1 rate for the six months of October, November, December, January, February, and March.

Jeff Knecht says

Thank you very much! I was not certain if the April 28th purchase was just good for the month of April and if it would then reset then for the 6-month period November 1 – April 3

I have read and tried to understand the comments regarding Gift purchase and delivery and annual limits and it is still a little gray to me.

For example, can three, $10K gifts be purchased and, at some point, deliver the gifts to my spouse in the same year?

It seems that would exceed her $10K annual limit, even if, she didn’t purchase her own I Bond.

During a segment of the Diamond Nest Egg blog, the hostess stated that, for example, she could purchase five, $10K I Bond Gifts and deliver them to her husband. I listened to it 3 times, but yet, maybe didn’t understand it correctly.

And, since it is her spouse, she would not have to fill out form 709, for gifts exceeding $16,000.

However, while reading the lengthy post on your forum. I thought that a similar example had been discussed and confirmed somewhat.

I really enjoy the Boglehead Forum and look forward to learning more. I followed Bob Brinker for many years as a kid, and he always spoke highly of John Bogle.

My experience with Treasury Direct got off to a rocky start. On April 28, 2022, I opened up a TD account for my wife and everything worked out after a short learning curve experience. When I tried to open an account for myself, using basically the same information, I got locked out and had to send in the dreaded 5444 form and was not able to get back into my account until July 1, 2022.

Thank you for your help.

Jeff

Mandy D says

We bought Gifts for each other in Oct 2022. If I do not buy anything in 2023 do I have to wait until Oct 2023 to transfer the Gift or could I do it in Jan 2023? In other words are all transfers such as Trust or Gift per calendar year or is it based on the date we bought it?

JFlanders says

It is by calendar year. You could have bought the end of December 2022 and then again first week of January 2023.

Redemption and interest rules i.e. 1 yr 5yr etc is by the purchased month.

Jeff Knecht says

Thank you for the clarification on Gift Delivery.

I’m quite certain that you could “Deliver” the gift to your husband on Jan 1, 2023. That would satisfy his $10K limit for 2023. You could then buy up to $10K in IBonds for yourself beginning on Jan 1, 2023, and that would satisfy your $10K maximum limit for 2023..

You could then buy $10K Gifts for each other in 2023 without exceeding yours or your husbands

$10K maximum limit for 2023.

Mandy D says

Thank you for clarifying that buying is by calendar year. Redemption is by purchase month. But since Transfers to main account is not a new purchases nor is it redemption then is it by calendar year or by purchase month?

JFlanders says

Giftbox, purchases and whatever other method is all by calendar year. Limit resets Jan 1st.

Jeff Knecht says

JFkanders. *Sorry, I thought that was a question for me and I should not have given you my thoughts.

sscritic says

Mandy said “we.” “You” not buying anything in 2023, is irrelevant to your transfer*, but if “the other” buys a bond in 2023, then that will impact the amount of any transfer to that person. For example, if the other person buys a $2000 bond and you transfer $5000 to them, the total of $7000 in 2023 is under the $10,000 limit.

*If you do not buy anything in 2023, you can receive up to $10,000 combined in transfers from your parents, children, and other.

Alan says

I bought an i bond as a gift for my father on September 1st. I put it in my gift basket but never delivered it. He passed away October 6th. I listed myself as the POD for the bond. I dont know if my father had a treasury direct account and if he did I dont know the account number. How do I redeem the bonds as I am the beneficiary and when I redeem them will that count against my $10,000 limit?

Harry Sit says

Write a letter to TreasuryDirect to explain the situation and request moving the bond out of your gift box into your account. Attach a copy of the death certificate. Inheriting a bond doesn’t count against your limit.

asdatada says

Hi Harry,

I revert to your columns every time i need to confirm I bonds both directly, gifts or via tax returns. Thank you for writing these very helpful notes and corresponding to questions. I had purchased for my spouse and vice versa gift I bonds last year given the even higher rate then, which we have not yet delivered.

In your notes above, you state that in a year that the rates are good, you would deliver the gift and buy another gift and in a year with lower interest you would just deliver the gift bonds. With the current dropping rates i have mixed thoughts about buying any new I bonds vs buying the widely traded competitive treasuries. I have been contemplating between not buying any I bonds to buying a gift for half (5k) now in April and seeing what the fixed rates would be in May to buy more later. Does it matter when in this year I take delivery of the previous years 10k gift bonds? I presume you take delivery first and then buy new gifts just for convenience and not because of any ramifications of switching the order?

Also (provided u feel ok to say so; otherwise ignore this part of the question) have you (for yourself/family) bought/gifted 5 or 10K before end april given the current rates? thanks

Harry Sit says

It doesn’t matter when you deliver the gift. I’m not buying more I Bonds because I already have enough for the short term. I plan to cash out some starting on August 1 to invest for the long term in TIPS. See When to Stop Buying I Bonds or Cash Out and Buy TIPS.

asdatada says

Thanks for the reply Harry and about not buying any more I bonds on your end this year. Yes i took a look at the other write up. Thank you. That is interesting. I have to read more on TIPS as it is a little more complex than I bonds but I have been following the rates. The TIPS rates have come down as have the treasuries since the SVB issue.

Sam says

My wife and I bought ibonds as gifts (10k each) on 05/01/2022 and delivered the gift to each other on 01/02/2023. When I go to our holdings in the treasury site, this particular delivered gift is currently earning 3.38% while our other purchased iBonds (not executed via gifts/delivered gifts)from 2021, 2022 are earning 6.48%. Can someone help me understand why the gift purchase and gift delivered approach for that particular batch is earning a lower interest rate of 3.38%.

Dunmovin says

Take a look at eworkpaper.com which gives current value and value if one cancels with 3 month penalty

Dan A says

I suppose it’s all a matter of the 6-month interval timing. All of my 2021 & 2022 bonds are at 6.48%, but next month, several of them go to 3.38%, in July – several more. The delivery date shouldn’t matter.

Dan A says

Bonds bought in May start their cycle with the newest rate, whereas if you’d bought them earlier that year, they wouldn’t start at the new rate until they had earned the previous rate for 6 months. That is why your May bonds were first to hit the 3.38% rate.

M. Anderson says

Please refer to this chart:

https://www.treasurydirect.gov/files/savings-bonds/i-bond-rate-chart.pdf