I have some paper savings bonds. I can keep these paper bonds in a home safe or a safe deposit box at a bank, but I much prefer to keep everything together in the online account at TreasuryDirect. Burglars stole my paper bonds when they broke into my house a few years ago.

In the usual government fashion, they don’t make it easy. Treat it as a test for how well you follow instructions. It feels convoluted the first time. It gets better after you get the hang of it.

Deposit = Conversion

First, the lingo. I think of it as depositing the paper bonds into the online account. The government calls it converting paper savings bonds to electronic form. When you deposit cash into your bank account, no one calls it converting paper currency to electronic form. You won’t find the instructions if you don’t know what it’s called.

You retain the original issue date when you deposit your paper bonds to the online account (“convert to electronic form”). You will earn the same amount of interest whether you keep the paper bonds as paper or add them to your online account.

If your paper bonds have two co-owners (“Person A OR Person B”), the two co-owners are equal. These paper bonds can be deposited into either co-owner’s online account. It doesn’t matter whose name is listed first. They will stay as co-owned bonds in the online account.

Conversion Linked Account

Next, you can’t deposit directly into your online account. You have to create a special sub-account within your main account. They call it the “Conversion Linked Account.”

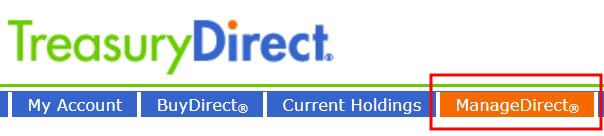

After you log in to TreasuryDirect, click on ManageDirect in the menu.

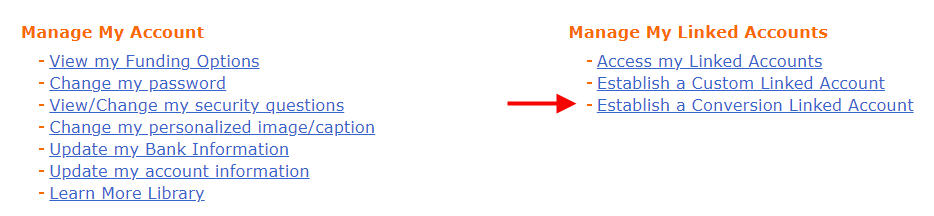

Then click on “Establish a Conversion Linked Account.”

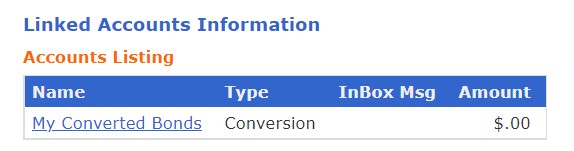

This will create the sub-account. You only have to do this once. You can re-use this Conversion Linked Account in the future. You will see the linked account on the bottom left of the page when you log in to your main account. You go into the Conversion Linked Account by clicking on “My Converted Bonds.”

You do all the steps below in this Conversion Linked Account.

Registration List

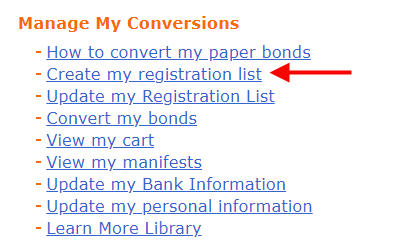

After you get into the Conversion Linked Account, go to ManageDirect, and then click on “Create my registration list.”

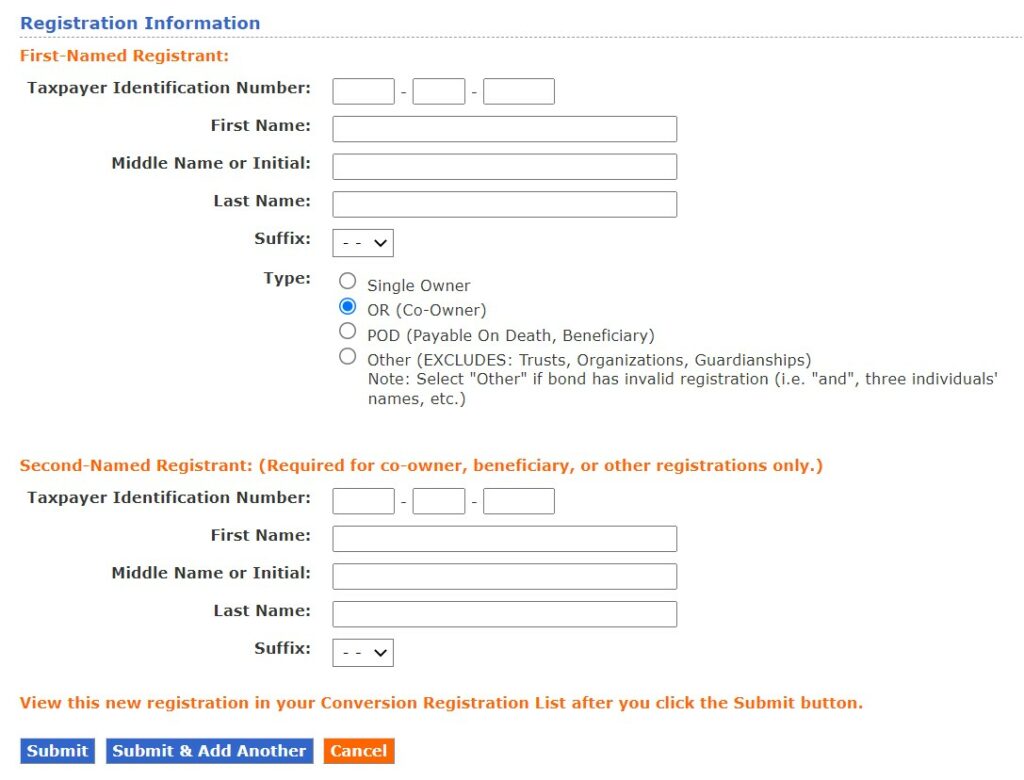

A Registration means how the bonds are owned. You need to create a registration that matches the ownership printed on the paper bonds – just you, you and a co-owner, or you with a beneficiary.

Our bonds had both our names as co-owners. So I chose the “OR (co-owner)” option.

Add to Cart

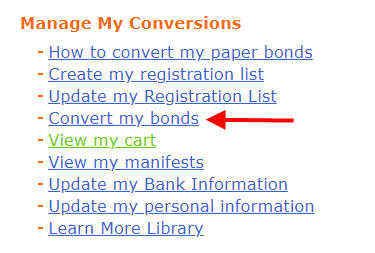

Now, back to ManageDirect. Click on “Convert my bonds.”

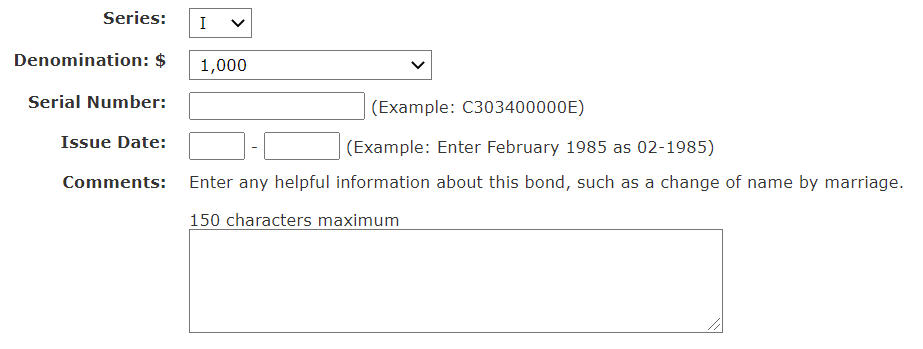

Enter each bond you’d like to deposit/convert. Make sure you enter the correct series, denomination, serial number, and issue date exactly as printed on the paper bonds. Leave the comments blank.

Create Manifest

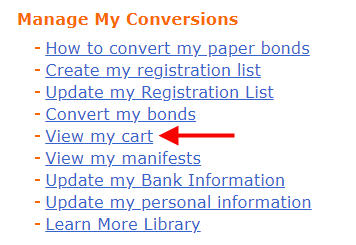

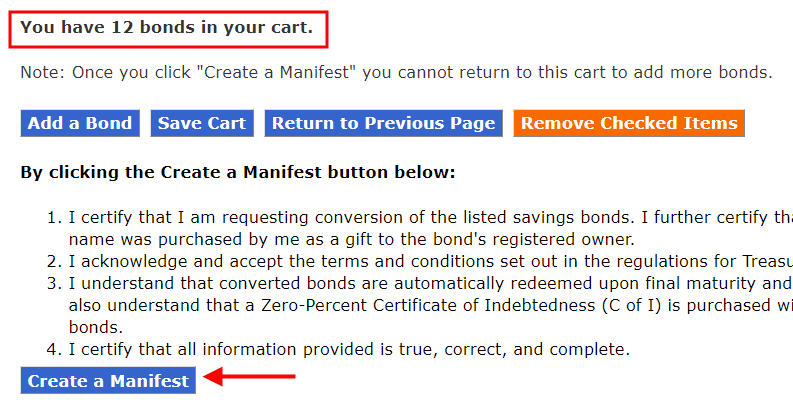

After you’re done with entering all the bonds, go back to ManageDirect. Click on “View my cart.”

You will see a list of the bonds you just entered. Double-check to make sure everything is correct. Click on the “Create a Manifest” button at the bottom.

A manifest is like the packing list that comes with your package from online shopping. They want you to print the manifest, sign it, and mail it with your bonds.

Sign and Mail

The manifest has the Treasury Department’s mailing address in Minneapolis. Sign the manifest. It doesn’t require a signature guarantee at a bank. Take photos of your bonds before you mail them with the signed manifest.

I only used plain First Class Mail when I mailed the bonds. You may need extra postage if the weight is over one ounce. If you’d like to add tracking for your peace of mind, you can pay a few dollars extra and mail it by Certified Mail. If you prefer FedEx or UPS, there’s a separate address on the manifest.

Case Number Assigned

You’ll receive an email when they receive your bonds and put the job in their work queue. I received the email seven days after I mailed the bonds. This email includes a case number in case you need to contact them. Just save the email.

Check Manifest

TreasuryDirect will work on your deposit/conversion, but they won’t send another email when they’re done. Because you’ll retain the original issue date, and you’ll earn the same amount of interest regardless, I don’t worry how long it takes them to complete the process. It doesn’t make any difference whether it’s done in a week, a month, or three months.

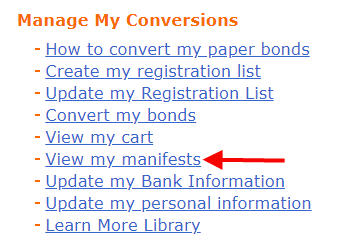

If you’d like to check the progress, log in and click on “My Converted Bonds” at the bottom left to go into your Conversion Linked Account. Then go to ManageDirect, and click on “View my manifests.”

It’s close to completion when you see the status changing from blank to “In Progress.” It’s done when the value of your Conversion Linked Account goes up.

You don’t need to check the status every day. I checked periodically only for the purpose of writing this post. Here’s the complete timeline of my recent submission:

- Day 1: Mailed the bonds by First Class Mail.

- Day 8: Received email with the case number.

- Day 26: Status of the manifest changed from blank to “In Progress.”

- Day 27: Conversion completed.

Set a reminder to check the status in 30 days. If it’s not done yet, check back in another 30 days.

Transfer to Main Account (Optional)

You can leave the converted bonds in the Conversion Linked Account, but I find it easier when the bonds are all together in my main account.

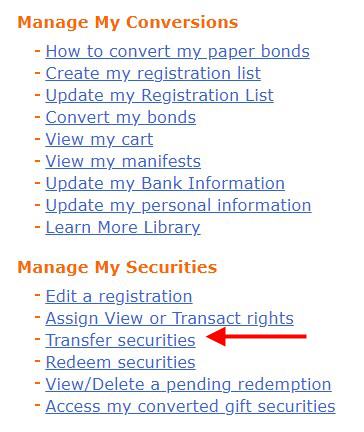

Go into the Conversion Linked Account and then go to ManageDirect. Click on “Transfer securities.”

Go into Series I savings bonds, and check the box for each bond you’d like to transfer. Even though the bonds are in electronic form now, they’re still separate individual bonds, not merged into one large bond.

Put in your Social Security Number and the account number of your main account.

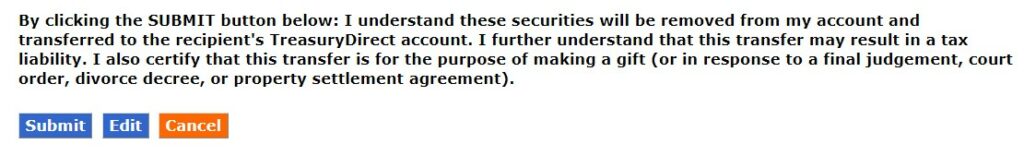

Scroll down to the bottom and submit. It isn’t taxable when you transfer between your Conversion Linked Account and your main account.

Your Conversion Linked Account is empty again after you transfer the converted bonds to your main account. You will use the Conversion Linked Account if you need to deposit/convert more paper bonds.

Grant Transact or View Rights

If you have a co-owner or a beneficiary on the bonds, the co-owner or the beneficiary doesn’t automatically see the converted bonds in their account. You still need to go through each bond and grant the Transact or View right to them. See How To Grant Transact or View Right on I Bonds to the Second Owner or Beneficiary.

Co-Ownership Preserved

If your paper bonds were issued to two people as co-owners, these bonds will still have the two of you as co-owners after you deposit them into your online account. Normally you can change the second owner on your bonds at any time, but you can’t do that to these co-owned bonds. The deposited co-owned bonds become “restricted securities” in your account. They will stay in the original co-owned form.

***

It feels quite convoluted when you do it the first time. After you get the hang of it, it comes down to:

- Enter the serial numbers online. Print and sign a manifest (“packing list”). Mail it with the bonds to Minneapolis.

- Receive an email with a case number. Check back after 30 days. Check again in another 30 days if necessary.

- (Optional) Transfer the converted bonds from the special sub-account to the main account.

- Grant Transact or View right to your co-owner or beneficiary on the bonds.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Richard from Oklahoma says

I have two paper $5,000 I-bonds. The one issued 09/2022 (the IRS processed my paper return 6 1/2 months after I submitted it) has a serial number between the V and I with 10 numeric digits, and the other issued 03/2023 between the V and I has 9 numeric digits. Anyone know if this is normal variation, or is one of them messed up? I haven’t tried to convert them to electronic and in no hurry to do so, but do want to know if I or heirs have a problem (but not badly enough to call TreasuryDirect).

Harry Sit says

You enter the serial numbers during the process of creating a manifest. You’ll get an error if a serial number is invalid. You can cancel and exit after you validate the serial numbers.

Maggee says

Your step-by-step guidance made this so easy to follow! I did one conversion and it felt like it was less than five minutes of my time from start to finish. Thank you.

George says

Received a single $5k iBond in the mail today from my 2022 federal return. Took about a month from when I filed the return. Great to receive a single bond rather than the multiples as last year.

Although I had requested that it be in my name only (doubled checked TurboTax and form 8888 shows only one name) but it came as me & my wife. I don’t think this will be a problem because with previous bonds, after conversion I have added her as a WITH registration and I believe the & on the paper bond maps to WITH on an electronic bond.

Took me about 2 minutes to create the manifest and print it off.

George says

Just updating my experience. As mentioned above, I received my iBond on March 20 and completed the conversion manifest and put it in our mail box (as outgoing mail) that evening. On March 29 (2:33 AM CDT time stamp), I received an email from “Treasury Retail Securities Submission” acknowledging receipt. It said to allow up to 13 weeks for review and processing

Patrick Farina says

I have over 50 paper ibonds that I want to convert to electronic. I have several questions. 1) can you mail more than one manifest in the same packet to TD? There is a limit of 50 bonds per manifest. Also, can they be mailed via Registered mail or only as Certified or First Class? 2) My deceased brother is listed as OR on the bonds. The instructions say to leave off deceased registrants, but to send a “certified copy” of the death certificate. Can you confirm they don’t want the original death certificate (I’m not exactly sure what they mean by “certified copy”). 3) They ask for the “Registration Type”. Although these originally were OR bonds, do I now say I want “Single Owner” since my brother is deceased? I plan to add a new beneficiary after the bonds are converted. Finally, 4) it says that “other evidence may be required” in this case where my brother on the bonds is deceased. Any idea what that might entail so I can just include it in the letter with the packet? These are pretty specific questions and I tried to send the question to them via the emailed online form but they said they are accepting any questions that don’t have a case number. So any help you can provide would be valuable. Thanks.

Harry Sit says

I don’t see how you mail the bonds matters. As long as the bonds and the manifests get there safely and organized, use whatever method you prefer. A certified copy of the death certificate means not a photocopy. Some may call it an original. The death certificate by itself should be sufficient evidence. When you’re the only living owner, you register the converted bonds as a single owner. You can add a second owner or a beneficiary online after the bonds are in your account. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

Patrick Farina says

Thanks Harry, you’ve confirmed what I was thinking but nice to get confirmation. Thanks for the quick response.

Art says

Just confirming how much easier it was this year — last year I got lots of $50s and $100s. It took forever to create the manifest. This year, $1000s. I filed on 4/7, got my refund on 4/15, and got the ibonds on 4/22. I’m impressed. Also glad that they processed things quickly so we lock in the November rate for another 6 months. Pretty sure it will be lower in May. I will wait til these are converted and then will try to consolidate them and the prior year’s with my regular account per instructions — I forgot to do that last year. Thanks, Harry!

DB says

Harry, thank you for yet another useful article on Savings Bonds. You mention in the comment that you can redeem them in most major banks. Do you know if they charge a fee for that purpose? Specifically Bank of America?

Harry Sit says

They don’t charge a fee. They might limit the amount they accept.

Dan B says

Hello, I have a question about establishing a registration for paper I bonds I want to help my mother covert to electronic.

She has three bonds. Three named my father (deceased) as the owner with my mother as POD beneficiary. The other three named her as the owner and my father as POD beneficiary.

So, in the first group of bonds registration do I list my deceased father as the First Named Registrant and my mother as the Second Named, and vice versa for the second group of bonds a registration for the second group of three bonds? This is how the paper bonds were printed. You seem to indicate the information must be identical to how the bond was printed.

Or, since she owns all six now can I just do one registration with her as the First Named Registrant?

Thanks. Your information is a real blessing. Very thorough and understandable

Harry Sit says

It’s much easier to get the official answer from TreasuryDirect customer service as the wait time is a lot shorter now. I would just do one group with her as the only registrant and attach a death certificate and a short letter to explain that the other registrant on the bonds deceased.

Dan Beaty says

Great. thank you!

John Cavuoto says

Hi Harry, So in the creat registration they ask for a TIN #, my paper bonds only show the SS # is this what I use or put just zero’s thatks for all you do

Harry Sit says

A TIN is Tax Identification Number. For individuals, it’s the owner’s SS #.

Patrick says

Last year I needed to convert 180 paper bonds to electronic. It took a while to get it all done and I did learn a couple of things along the way. First, once you get the bonds processed, they will be in the “Converted Bonds” sub-account. They say it’s optional to leave them in this sub-account, but I learned that you can’t do much to modify them while they’re there if you need to (e.g. if a co-owner dies and you want to replace that person, you can not do that in the converted account. I have not seen this documented anywhere and I spent hours trying to figure that out. My advice is that after you get the bonds converted, move them to your permanent account. It will provide more flexibility in the future. Finally, I agree that this becomes much easier after you go thru the process a few times. The wait time last year (2023) was up to 4 or 5 MONTHS to get them processed. It was a lot shorter later in the year. Be patient, it’s just the way it goes. No idea why it takes them so long, I guess there’s a lot of work to do to manage $34 trillion dollars of debt.

Jake says

First, thank you for your highly informative articles!

Background: My son is the owner of a paper Series EE savings bond given to him when he was born 25 years ago. It was a gift from my son’s uncle, so the uncle included himself as a POD beneficiary on the paper bond. Paper Bond [Registration = Son POD Uncle]

Situation: My son wants to convert the paper bond and deposit it into his electronic Treasury Direct account. Since we don’t know the Uncle’s SSN, we can’t create a Registration on Treasury Direct that exactly matches the ownership printed on the bond.

Question: Will Treasury Direct allow a paper saving bond with [Registration = Son POD Uncle] to be converted into an electronic bond with [Registration = Son] (i.e. no POD)?

Harry Sit says

Yes, but if you’d like to double-check, please call TreasuryDirect customer service at 844-284-2676 to confirm.

Miguel says

Timeline for conversion in 2024:

Mail bonds: 15 March 2024

Email from Treasury “Treasury Retail Securities Submission”: 26 March 2024

Bonds showed up in online converted account: 2 May 2024

Tai says

Thanks for the guide. This definitely streamlined the process for the first time.