I have some paper savings bonds. I can keep these paper bonds in a home safe or a safe deposit box at a bank, but I much prefer to keep everything together in the online account at TreasuryDirect. Burglars stole my paper bonds when they broke into my house a few years ago.

In the usual government fashion, they don’t make it easy. Treat it as a test for how well you follow instructions. It feels convoluted the first time. It gets better after you get the hang of it.

Deposit = Conversion

First, the lingo. I think of it as depositing the paper bonds into the online account. The government calls it converting paper savings bonds to electronic form. When you deposit cash into your bank account, no one calls it converting paper currency to electronic form. You won’t find the instructions if you don’t know what it’s called.

You retain the original issue date when you deposit your paper bonds to the online account (“convert to electronic form”). You will earn the same amount of interest whether you keep the paper bonds as paper or add them to your online account.

If your paper bonds have two co-owners (“Person A OR Person B”), the two co-owners are equal. These paper bonds can be deposited into either co-owner’s online account. It doesn’t matter whose name is listed first. They will stay as co-owned bonds in the online account.

Conversion Linked Account

Next, you can’t deposit directly into your online account. You have to create a special sub-account within your main account. They call it the “Conversion Linked Account.”

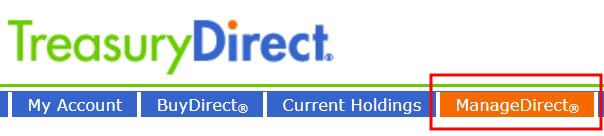

After you log in to TreasuryDirect, click on ManageDirect in the menu.

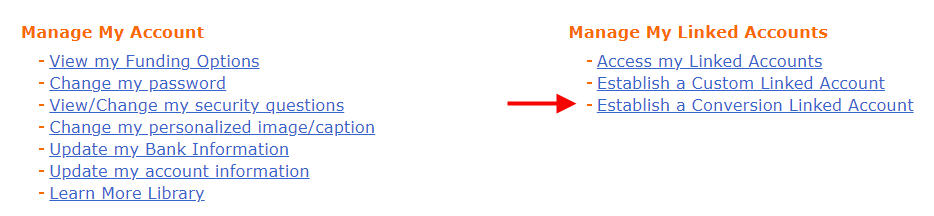

Then click on “Establish a Conversion Linked Account.”

This will create the sub-account. You only have to do this once. You can re-use this Conversion Linked Account in the future. You will see the linked account on the bottom left of the page when you log in to your main account. You go into the Conversion Linked Account by clicking on “My Converted Bonds.”

You do all the steps below in this Conversion Linked Account.

Registration List

After you get into the Conversion Linked Account, go to ManageDirect, and then click on “Create my registration list.”

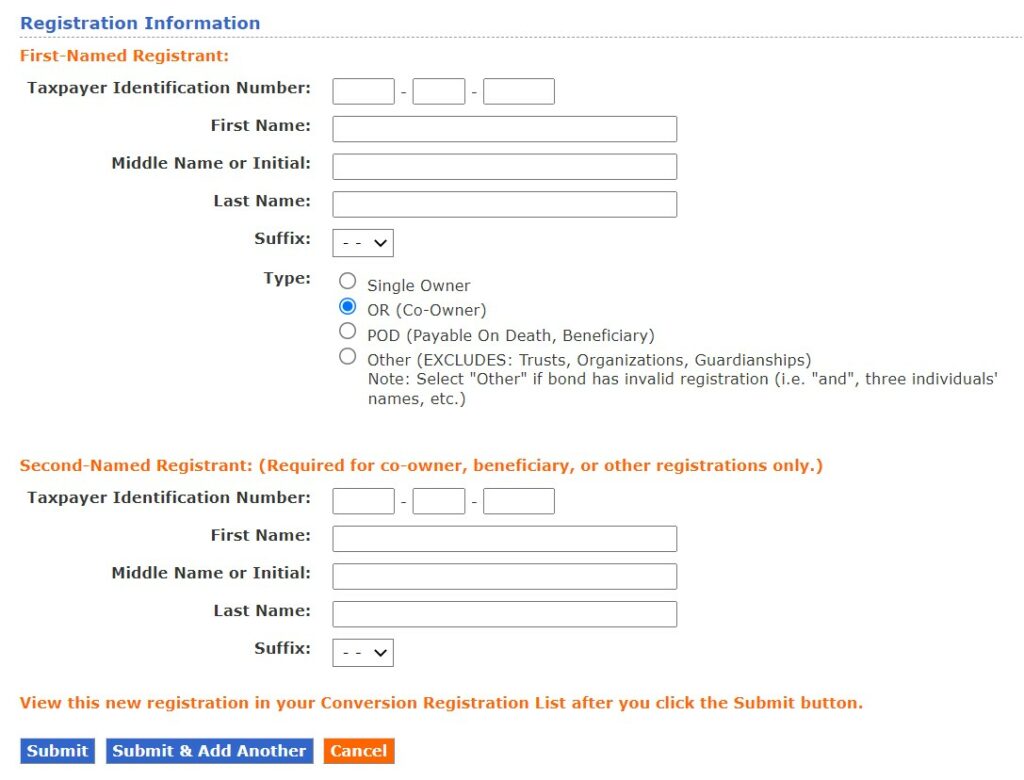

A Registration means how the bonds are owned. You need to create a registration that matches the ownership printed on the paper bonds – just you, you and a co-owner, or you with a beneficiary.

Our bonds had both our names as co-owners. So I chose the “OR (co-owner)” option.

Add to Cart

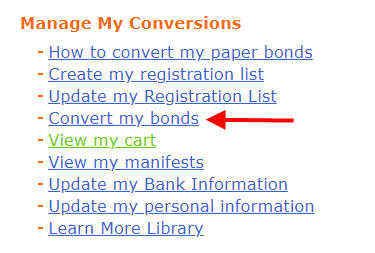

Now, back to ManageDirect. Click on “Convert my bonds.”

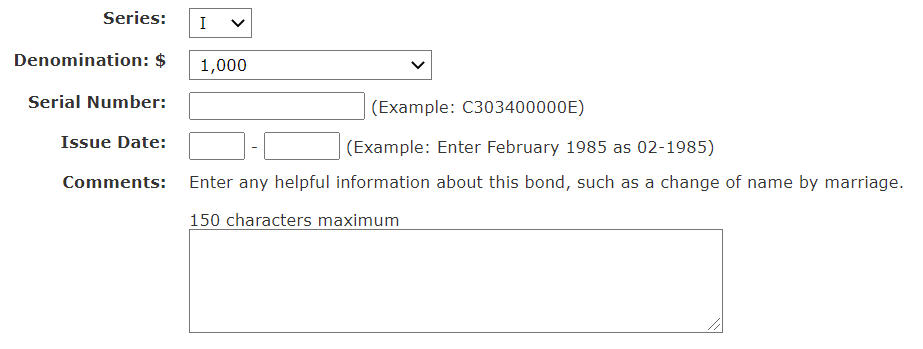

Enter each bond you’d like to deposit/convert. Make sure you enter the correct series, denomination, serial number, and issue date exactly as printed on the paper bonds. Leave the comments blank.

Create Manifest

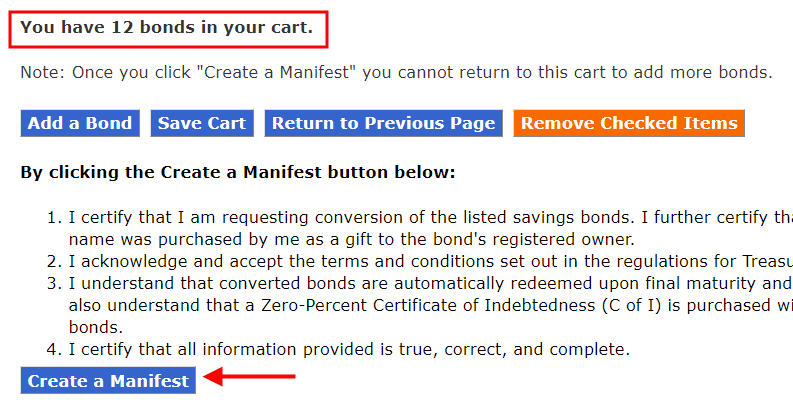

After you’re done with entering all the bonds, go back to ManageDirect. Click on “View my cart.”

You will see a list of the bonds you just entered. Double-check to make sure everything is correct. Click on the “Create a Manifest” button at the bottom.

A manifest is like the packing list that comes with your package from online shopping. They want you to print the manifest, sign it, and mail it with your bonds.

Sign and Mail

The manifest has the Treasury Department’s mailing address in Minneapolis. Sign the manifest. It doesn’t require a signature guarantee at a bank. Take photos of your bonds before you mail them with the signed manifest.

I only used plain First Class Mail when I mailed the bonds. You may need extra postage if the weight is over one ounce. If you’d like to add tracking for your peace of mind, you can pay a few dollars extra and mail it by Certified Mail. If you prefer FedEx or UPS, there’s a separate address on the manifest.

Case Number Assigned

You’ll receive an email when they receive your bonds and put the job in their work queue. I received the email seven days after I mailed the bonds. This email includes a case number in case you need to contact them. Just save the email.

Check Manifest

TreasuryDirect will work on your deposit/conversion, but they won’t send another email when they’re done. Because you’ll retain the original issue date, and you’ll earn the same amount of interest regardless, I don’t worry how long it takes them to complete the process. It doesn’t make any difference whether it’s done in a week, a month, or three months.

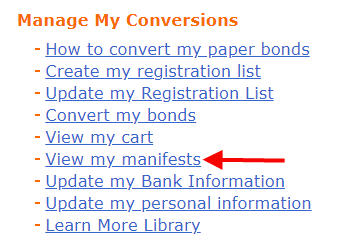

If you’d like to check the progress, log in and click on “My Converted Bonds” at the bottom left to go into your Conversion Linked Account. Then go to ManageDirect, and click on “View my manifests.”

It’s close to completion when you see the status changing from blank to “In Progress.” It’s done when the value of your Conversion Linked Account goes up.

You don’t need to check the status every day. I checked periodically only for the purpose of writing this post. Here’s the complete timeline of my recent submission:

- Day 1: Mailed the bonds by First Class Mail.

- Day 8: Received email with the case number.

- Day 26: Status of the manifest changed from blank to “In Progress.”

- Day 27: Conversion completed.

Set a reminder to check the status in 30 days. If it’s not done yet, check back in another 30 days.

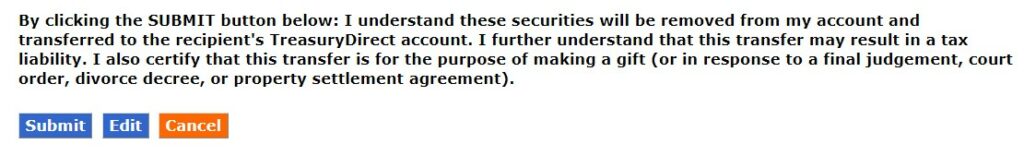

Transfer to Main Account (Optional)

You can leave the converted bonds in the Conversion Linked Account, but I find it easier when the bonds are all together in my main account.

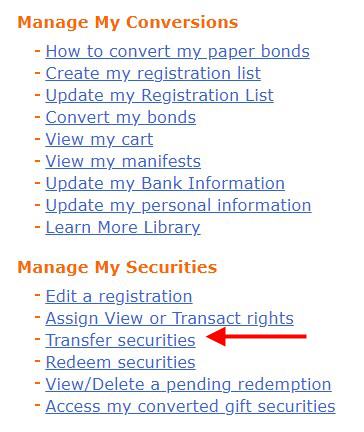

Go into the Conversion Linked Account and then go to ManageDirect. Click on “Transfer securities.”

Go into Series I savings bonds, and check the box for each bond you’d like to transfer. Even though the bonds are in electronic form now, they’re still separate individual bonds, not merged into one large bond.

Put in your Social Security Number and the account number of your main account.

Scroll down to the bottom and submit. It isn’t taxable when you transfer between your Conversion Linked Account and your main account.

Your Conversion Linked Account is empty again after you transfer the converted bonds to your main account. You will use the Conversion Linked Account if you need to deposit/convert more paper bonds.

Grant Transact or View Rights

If you have a co-owner or a beneficiary on the bonds, the co-owner or the beneficiary doesn’t automatically see the converted bonds in their account. You still need to go through each bond and grant the Transact or View right to them. See How To Grant Transact or View Right on I Bonds to the Second Owner or Beneficiary.

Co-Ownership Preserved

If your paper bonds were issued to two people as co-owners, these bonds will still have the two of you as co-owners after you deposit them into your online account. Normally you can change the second owner on your bonds at any time, but you can’t do that to these co-owned bonds. The deposited co-owned bonds become “restricted securities” in your account. They will stay in the original co-owned form.

***

It feels quite convoluted when you do it the first time. After you get the hang of it, it comes down to:

- Enter the serial numbers online. Print and sign a manifest (“packing list”). Mail it with the bonds to Minneapolis.

- Receive an email with a case number. Check back after 30 days. Check again in another 30 days if necessary.

- (Optional) Transfer the converted bonds from the special sub-account to the main account.

- Grant Transact or View right to your co-owner or beneficiary on the bonds.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Oliver says

I’ve never purchased I-Bonds. I am retired 63. I have money in Brokerage, Traditional and Roth IRAs. I-Bonds seem like a lot of trouble for someone in my situation. What am I missing?

Harry Sit says

I admit these paper bonds from tax refund require a bit of work but it’s much easier to buy I Bonds online. A married couple without a self-employment business can buy $40,000 in I Bonds in personal accounts and trust accounts. You will have $200,000 in five years. That’s not chump change.

JohnC says

Harry, as you indicate, iBonds are much easier to purchase online. But, I believe iBond purchases are limited to $10K per person (really per ssn?) per year. Unless the regs have changed, I am not sure two people could purchase $40k in iBonds each year. Am I missing something?

Thanks

Harry Sit says

With two trust accounts. It’s in the walkthrough linked above.

VagabondMD says

Yikes, what a mess! I am going to keep my paper bonds in paper, as I have been doing for the last 20 years!

DB says

Thank you for this useful writeup, Harry. How long after filing taxes did you receive your I-Bonds this year?

Harry Sit says

I received the paper I Bonds about four weeks after I e-filed the federal tax return.

Fiddlestix says

I followed these instructions earlier this year – it was a lot of work to avoid a trip to the bank!

Harry Sit says

I know. It’s more about keeping the bonds together and not lose them. Burglars stole my paper bonds when they broke into my home a few years ago.

Moolah Mindful says

When I bonds are transferred from a ‘Conversion Linked’ account to a ‘Main’ account, do any of the bond maturity dates change? Does the initial 12 month before able to redeem period change on the I bonds already in the ‘Main’ account?

Harry Sit says

The dates don’t change. Each bond has its own 12-month holding period. It’s not affected by other bonds.

MK says

Re transferring I bonds from the conversion to main TD accounts – do they keep the A OR B designation if you do this, or does OR change to something else? If so, does this make any practical difference? Thanks!

Harry Sit says

They keep the A OR B registration.

Scott says

For the married-file-jointly $5,000, and I convert half to my account and half to spouse’s account, or does it all need to be converted to just one account? Thanks!

Scott says

*should say “can I convert…”

Harry Sit says

Assuming you asked for the bonds to be issued to both of you jointly (Line 4 on Form 8888), the two owners have equal rights. You can split up the 12 paper bonds and deposit any subset to either of your accounts. The rights don’t change afterward either way.

Brian says

Oh man what a mess. I’m really considering doing it this year with I bonds at 7%, but this is a quite a headache.

Bill says

Thanks Harry for all of the great information. Do you happen to know why jointly owned converted paper I Bonds use “or” between the two names, and electronically purchased bonds use “with” between the two names? Is there any reason why the wording isn’t consistent?

Harry Sit says

No idea why they chose a different setup between paper bonds and bonds bought in the online account.

TN says

I have paper I-bonds dating back 20+ years. They have a single owner (me) and beneficiary (my now deceased mother). My spouse and I recently set up a revocable living trust and wish to place these I-bonds under our trust to avoid them being probated if I die before they mature. Would it be possible for me to sign up on Treasury Direct under the trust account option and deposit the paper bonds there, listing me as the owner and my mom as the beneficiary, and then after everything goes through with the conversion remove my mom’s name as a beneficiary and make my spouse co-owner of the bonds? (I assume I can’t change the beneficiary and co-ownership at the same time I do the conversion?). Or is there a different/better set of steps I should follow? Thanks for any suggestions.

Harry Sit says

It looks like FS Form 1851 is for depositing paper bonds into an online trust account. Please read the form and instructions carefully and confirm with customer service how you should fill out the form.

TN says

Dear Harry,

Thank you for your very helpful response – and for this amazing site, which I have found so helpful time and time again.

I contacted Treasury Direct per your suggestion and they corroborated your recommendation to use FS Form 1851. Below I include their instructions in case anyone else in a similar situation would find them useful.

“From: [email protected]

Sent: Wednesday, February 16, 2022 1:01 PM

To:

Subject: RE: Inquiry regarding paper I-bond conversion steps

To reissue paper bonds from the names of individuals into the name of a personal trust, all of the registrants named on the paper bonds must complete a Request to Reissue United States Savings Bonds to a Personal Trust (FS Form 1851). This form may be ordered or downloaded from our website at http://www.treasurydirect.gov/forms.htm

All bonds are reissued electronically into the Trust TreasuryDirect account. To open an account for the trust, visit our website at http://www.treasurydirect.gov/

Please be certain to complete Part 5 of the FS Form 1851. Take the completed form to your local bank or other financial institution and sign the form in the presence of an authorized certifying officer who will then affix his or her official stamp or seal. Certifying individuals include:

• Officers and employees of depository institutions.

• Institutions that are members of Treasury signature guarantee stamp and guarantee programs.

• Officers and employees of corporate central credit unions, Federal Land Banks, Federal Intermediate Credit Banks and Banks for Cooperatives, the Central Bank for cooperatives, and Federal Home Loan Banks.

• Commissioned or warrant officers of the United States Armed Forces, for signatures executed by Armed Forces personnel, civilian field employees, and members of their families.

• A judge or clerk of the court.

The form must be mailed to our office at:

Treasury Retail Securities Site

PO Box 7015

Minneapolis MN 55480-7015

Upon receipt of the properly completed and signed request, we will complete the conversion.”

Jennifer F. says

Hi Harry,

Are you able to deposit = conversion into a new account at my bank or paper to electronic conversion can only be done via Treasury Direct? If I can do it at my bank do you know if the service fee is significant or if there is any specific downside using my bank vs. Treasury Direct? Trying to keep the # and location of accounts as small as possible, which makes it easier to manage.

Harry Sit says

Only to TreasuryDirect.

Gail Mast says

Hi Jennifer, I just wanted to mention about my experience with trying to cash my ibonds in at a bank that my deceased mother left to me. There was no bank in the Portland Oregon area that would have anything to do with them. I believe it was because they were Payable on Death (POD).

In my case I had to go through the conversion process. Actually, though, I am happy to have done it that way since I could leave them in there until I wanted to cash them out and just let the interest grow. It is peace of mind to have them registered and not just owning a piece of paper that could be lost.

It was very easy to transfer the funds to our bank when we wanted to access the money. Just a few clicks of a button.

Tom P says

I just logged into my TD account and converted the 12 bonds I recently received. It took less than 15 minutes to establish the linked account, add the bonds and create the manifest… so I don’t see why some posters think this process is such a headache. Yeah, I do have to put them in an envelope and drop them in the mail but for me I’m with Harry as I’d like to have everything in one secure location. YMMV.

Rob A says

Harry, I want to thank you for all your great articles. I just did a paper I bond conversion and your instructions in this article made it a breeze. I’ve learned so much about all the facets of I bonds from your writing and am grateful for your generous knowledge…

OrlandoRon says

Do you need to sign each individual bond, or just the manifest?

Harry Sit says

Just the manifest. If I remember correctly, the manifest or on-screen instructions said do not sign the bonds.

OrlandoRon says

I suspected that – thanks!

William says

I sent in two ibonds in February via certified mail. They were received Feb. 11. Nothing shows up in the account as of yet (48 days so far). Does anyone know if these timeframes are typical, or should I contact TreasuryDirect?

Tom P says

William, I sent my bonds to TD via regular mail in early March and I got a confirmation of receipt email on March 9. The first time I checked whether they had been deposited in My Converted Bonds linked account was yesterday, March 30, and they were there. The confirmation email quoted 4-6 weeks, so it took less time than expected for me. If you received the confirmation email of receipt I wouldn’t worry about it for now.

Harry Sit says

Make sure you’re looking in the right place. The bonds will be in the My Converted Bonds linked account, not in your main account. Also check the status of your manifest. If they’re still not there, I think you should contact customer service with your case number. Did your paper bonds require special handling (original owner deceased, name on the bond not exactly matching yours, etc.)?

William says

Hi guys, thanks for your replies. I did not receive a confirmation of receipt email, but since I sent it certified mail, I was able to determine that they received the envelope on 2/11/22 (Minneapolis address).

Harry, I did look in the linked account. I can see the details of the manifest, listing the two bond serial numbers. I am helping my father with this, my mother passed away in January. The bonds are titled in the name of their family trust (has both their names on it), and the TreasuryDirect account we created was in my father’s name. He is authorized to act individually on behalf of the trust.

Harry Sit says

You should definitely contact customer service with your complicated transaction — no case number, ownership on the bonds not matching the name of the account. It’s not the same as the straight deposits we’re dealing with here.

William says

thanks Harry, I have just contacted them via their website form.

John says

I believe that when buying I bonds with your tax refund, you are limited to $5,000 in total – it’s not $5,000 each for you and your spouse. PS great article!

Rosie says

maybe I missed it, sorry if this was already mentioned, but if you already have a TD online account you can have your $5K tax refund routed directly to your account and skip the paper version. TD has the routing number, you just add it to the Form 8888. Unfortunately, my tax preparer did not do this (and I missed it on my review), so I ended up with paper. I will now follow these instructions to get it in my account . Thank you.

Harry Sit says

When you use the money directly routed to your TreasuryDirect account to buy I Bonds, it uses up part of your $10,000 annual purchase limit. If you’re going to use up part of your limit, you might as well buy directly in your TreasuryDirect account without jumping through the hoops with your tax refund. Getting paper bonds from your tax refund gives you *extra* $5,000 beyond your normal $10,000 annual purchase limit.

Rosie says

Wow, thank you Harry, I did not realize that and just did my own confrimation research. So my tax person did the right thing afterall and now I was able to maximize my buying amount. Again, thank you. I need to spend more time on your site!

dave says

FYI, after my 2021 tax returns this April 2022 they sent me a single $5000 i-bond. easier to convert!

Tami says

These instructions were extremely helpful. Thank you so much for posting. I would not have have been able to figure out this process from the instructions posted on the Treasury Direct web site.

charles russell says

my wife has i bond in her name with a beneficiary she no longer wishs to have on bond–how can she change to her name only?does this trigger any taxes–also can you have more than i beneficiary listed on a bond??–when you pass how will beneficiary know they have the bond??how also do you pay for bond purchase?–can you cash paper bond at bank or do you need to mail them to treasury direct–if to treasury how do you get funds?

are there special instructions about adding to trust–do they need copy of trust agreements??what is telephone no.of someone you can sppek to at treasury direct??appreciate your response

Harry Sit says

If the I Bonds your wife has are a paper bonds and she wishes to remove or change the beneficiary, she should follow the steps in this post to deposit the paper bonds into her online account (open one if she doesn’t have an online account). First create the registration in the Conversion Linked Account exactly as it appears on the paper bonds with the existing beneficiary. After she mails the bonds in and they’re deposited into her online account, she can remove or change the beneficiary by following the steps in How to Add a Joint Owner or Change Beneficiary on I Bonds.

Removing or changing the beneficiary doesn’t trigger taxes. Each I Bond can have only one beneficiary but you can have different beneficiaries on different I Bonds. You can grant View rights on I Bonds in your online account to the beneficiary. They’ll need to open an online account even if they’re not buying any on their own. That way they’ll see which I Bonds they’re a beneficiary of.

If you’d like to buy more I Bonds, see How to Buy I Bonds (Series I Savings Bonds): Soup to Nuts.

You can cash paper bonds at most major banks.

If you’d like to buy I Bonds in a trust, see Buy More I Bonds in a Revocable Living Trust.

The phone number for TreasuryDirect customer service is 844-284-2676.

charles russell says

thanks harry–when i buy bonds in my name and grandchild as beneficiary do i use my soc. sec. no or theirs??–do i need to inform them of the purchase of the bond–when i pass do they need to open and acct to receive the funds?? is there something i can print out to keep in my safety deposit box so my beneficiarys will know they have an i bond that they can keep or cash–on my passing do they need to get an acct if they wish to keeo the bond??

Harry Sit says

You will need to provide both Social Security Numbers — yours as the owner and your grandchild’s as the beneficiary. They’ll need to open an account to receive the bonds after you pass if they’d like to keep them. If they open an account while you’re living even if they don’t buy any on their own, you can grant View rights to their account for them to see the bonds they’re a beneficiary of. See How To Grant Transact or View Right on Your I Bonds. Of course you can also print the list of your holdings and inform your executor and beneficiaries.

CHARLES RUSSELL says

HARRY—I DON’T WANT GRANDCHILDREN TO HAVE TO OPEN AND ACCT TO RECEIVE BONDS–CAN I MAKE THEM CO-OWNER SO SEPARATE ACCT IS NOT NECESSARY?–HOW DO THEY CASH OUT IF THAT IS WHAT THEY WANT TO DO?–I OPENED AN ACCT IN MY NAME AND ALSO A GRANDCHILD WITH HIS S.S. NO ALSO—IT DIDN’T GIVE ME AN OPTION FOR BENEFICIARY OR CO-OWNER—I COULD NO FIND A PLACE TO ENTER AMOUNT I WANTED TO BUY OR HOW TO PAY FOR IT–VERY CONFUSING–NEED HELP–THANKS

Tom P says

First off Charles, if you can’t type normally in upper and lower case just type in all lower case as typing in all upper case is regarded as “shouting.”

Sounds like you need to read or re-read Harry’s “soup to nuts” post on I Bonds. Do a search on his site.

You can’t assign a co-owner or beneficiary to an account, only to a bond purchase. Bonds are purchased using the Buy Direct tab once you login.

It sounds like you opened an account for your grandchild in their name and SSN, but you also say don’t want the grandchildren to have to open an account… so now I’m confused. Unless you are the custodian of the grandchild you should not be opening one for a minor.

It really sounds like what you want to do is purchase a Gift Bond for your grandchild. If so, you can do that now without them having an account, all you need is their name and SSN… however, for them to cash it later they will need to open their own account. I recently did just that for two of our grandkids. I purchased several $250 bonds each and I’m just holding them in my “Gift Box” until our son opens his account and establishes the minor accounts… then I will “deliver them” electronically into their accounts. In the meantime the bonds will be earning interest and maturing.

Good luck, I hope you get this figured out.

charles says

thanks Tom–i have 6 grandchildren that i want to buy I bonds for–what i did was to open and acct in my name but added ist grandchild’s name and soc. sec. no.–it didn’t say when i entered his name if it was a co-owner or beneficiary—I want them to have the ability to keep bond or cash it when i pass–i guess the best thing to do is open an acct in each grandchild’s name with me as co-owner–your thoughts would be appreciated–thanks again Charles

Tom P says

Charles, as I said, you shouldn’t be opening any accounts for your minor (I assume) grandchildren unless you are their guardian and provide support. Opening accounts for minors is the parents responsibility. If they are adults they can open their own accounts.

The main reason you may want to purchase Gift Bonds instead of purchasing a bond in your name with the grandchild as beneficiary is gift bonds don’t count toward your yearly purchase limit, they count toward the yearly limit of the recipient in the year they are delivered. You can purchase gift bonds at any time and just hold them in your TD gift box until an account is established for each grandchild.

If you really wanted to go hog wild you could purchase a $10,000 gift bond for each grandkid (lucky them if you do!) You do this through the “BuyDirect” tab. Click that tab and then click the button for Series I if that’s what you want, then click the Submit button. What you need to do next is “Add New Registration” via the blue highlighted text. You’ll probably want to select the Beneficiary button and the First Named Registrant should be the grandchild, with the second registrant probably one of their parents if they are a minor. If they are adults you could select the “Sole Owner” button. At the bottom check the “This is a gift” box. This is critical! After you click submit you can select the newly created registration from the drop-down and then enter the purchase amount of each gift and whether this is a single purchase or a series of purchases. You’ll need to create a registration for each of your 6 grandkids, and if you want to buy more bonds for them later these registrations will be in your drop-down list.

Again, Harry has this all spelled out in great detail on the website.

Scott says

I sent my single $5k tax refund paper i-bond to the address listed on the manifest in late April. To date, have not received an email confirming receipt, and no action in the TD Converted Bonds section. Anyone else having this type of delay? Seems it may be “lost”, which I’m sure will be a pain to deal with. Thanks.

DB says

I am having the same issue. Mailed paper i-bond on April 26, never received an email confirmation, no changes in the TD Converted Bonds section as of June 3. I emailed an inquiry to TD and got an automatic response but no further information even though I sent the email from within my TD account.

William says

I did make a phone call to them last week (2 hour wait, but I had been locked out of my account so I had to persist and get it unlocked). My situation has some extra Trust complications (see my post from Mar. 31). What I was told on the phone was that in my case everything had been received, but it was in a queue to be reviewed, and it would be 16 weeks. It would seem that they are extremely backed up, but it was reassuring to hear that they did have an estimated date for handling things.

Scott says

I’m happy to report I finally received an email confirmation from TD for receipt of the $5k paper i-bond that was mailed ~April 22. The email says to allow up to 13 weeks for full processing, which doesn’t bother me. What did was not knowing whether they were actually in possession of the bond. Thanks to all for their feedback.

Scott says

To fully close the loop, the $5k bond now shows up in the “My Converted Bonds”, transaction complete!

Ross T says

I mailed mine plain First Class Mail on 15-July

Haven’t got got confirmation email yet

Ross T says

Happy to report thar as of 08 September conversion has been completed

Christian says

This is such a handy guide — thank you! I did this for $5K of tax return paper I Bonds and it all worked out. Total time needed was about 3 months.

Lord Dima says

Thank you so much! Very helpful step-by-step. I did have to google where to find the serial number on the I bond so maybe having a picture in that step would help.

Flannelman92 says

Just for those wondering how long the conversions currently take:

1 July 2022: Mailed bonds to Treasury Direct with manifest

5 August 2022: Email from TD acknowledging receipt “Please allow up to 13 weeks for review and processing”

3 Sept 2022: Bonds showed up in my conversion account (no email received)

Kris B says

I have several paper ibonds with my name and my husbands name. He is deceased 13 years. If I send them to TD do I fill out both names and send copy of death certificate? Will I then be able to remove his name and add a beneficiary? Thank you for having this site where questions can be asked.

Harry Sit says

Just fill out your name. Include a letter and the death certificate. You can add a beneficiary after the bonds are deposited into your online account in your name alone.

James says

Your article is really helpful. It’s been slightly over a month and it still shows “In progress” for me, so I’m just patiently waiting for it to be converted.

Laurel says

I can’t believe they make this so difficult. I have some paper I bonds that have no co owner or beneficiary and I would like to add one. If I follow this process, how and when in the process can I add one to each bond?

Laurel says

Another question…my father is recently deceased and has paper bonds in his name only. My mother is still alive and we need to put them in her name and add beneficiaries. Do we need to open an online account first then mail them with a death certificate? What forms would be needed?

Thank you

Elizabeth says

I am trying to redeem paper savings bond purchased to pay for my son’s college education but I bank at online bank with no branches near me and I can’t find a bank that will look at them for anyone without an account. Can anyone tell me how long would I have to wait to redeem them if I converted the bonds to electronic?

Harry Sit says

There’s no waiting period for cashing out after you convert the bonds.

Elizabeth says

Thank you. I haven’t been able to locate that information online and didn’t want to end up tying up the funds long term. This site is very helpful

Mark says

Opened an account. It said it needs verification by them which could take 13 weeks and there’s a form to send in for this?? What’s with that? We have 74 paper bonds to convert and add beneficiaries! Hopefully, there is no limit if we ever get to this point. Very frustrated.

Harry Sit says

A small percentage of people run into this issue with ID verification when they open a TreasuryDirect account. Please see Where to Get a Signature Guarantee for I Bonds at TreasuryDirect. The form can be signed in front of a notary public now. Many banks and some public libraries offer free notary services. Although they say it could take up to 13 weeks, it doesn’t actually take that long (more like 2-4 weeks).

Tom P says

Mark, have you been the victum of identity theft or something nefarious in the past? My son tried to open a TD account and they wanted him to go through the same verification process (which he declined to do) because someone had made a false unemployment claim using his information in 2020. This was part of the huge unemployment theft scandal we had in WA State.

Andy M says

When I attempted to convert the paper I-Bond I just received from the IRS I got an error message “You have entered a serial number that is not valid for the series”. As the on-screen example indicated I entered the 11 characters (1 letter, 9 digits, 1 letter) as printed on the lower right corner of the I-Bond.

Any thoughts on how to proceed? I used the Contact form to ask TreasuryDirect but received an auto-email saying they are too busy to answer any email that doesn’t have a case number.

Thanks.

Harry Sit says

Make sure you select the correct series (“I”) and the correct denomination in the input fields above the serial number. If all three fields are correct, maybe try again on a different day. If that still doesn’t work, you’ll have to call TreasuryDirect customer service.

Shaun says

IMHO, anyone that wants to cash in Series EE bonds and needs the money within 1-3 months should try their hardest to cash them in with a local bank branch or credit union. I know each bank may have a different set of policies for cashing bonds in (customer account required, under $1000, etc), but from my experience and talking to others, it’s a minimum of 4 weeks from the date of receipt to having the cash deposited in your account with some experiencing 15-20 weeks of wait time. I’m at 10 weeks with no deposit. Dealing with their customer service is another headache. I’m assuming they’re overwhelmed.

Seeing as I have online banking if I had known this I probably would have opened up an account with a local branch in my city to try to cash them. Anyways, GL!

Harry Sit says

I agree. This process is more for continuing holding the bonds in an online account. If you’d like to cash out paper bonds, it’s faster to find a local bank or credit union that still cashes them.

Shaun says

And also assuming your not trying to cash in a lot of bonds**

Mark H says

I sent 9 I-Bonds in just over 2 weeks ago, regular first class and have not received an e-mail. I am now very much regretting not sending them registered. Now in a worry state as the face value was 25K and currently valued at 50+ K.

Mark H says

Still no e-mail after 3 weeks and nothing posted on my account. Spent the 2 hours on hold to talk to a representative. She verified that the bonds were received 19 days prior and were able to give me a case number. She said that it may now take up to 4 months to complete the processing.

Mark H says

Update, bonds received at Treasury on December 29, 2022. Status changed to “In Progress” on March 22, 2023.

Harry Sit says

It completed the next day after I saw the status changed to “In Progress.”

Mark H says

Harry, yes and I was able to easily move bonds to my main account today following your guide. Nice to finally have all in one place.

JohnB says

I mistakenly endorsed the I bonds I received in the mail as part of my tax refund. Now I want to transfer them to my TreasuryDirect account, but it says do not endorse the I bonds. Do you have any suggestion as to what I should do? Should I just say they were damaged and try to get repacement bonds? By the way, your article was very useful. Wish I had read it before I made the mistake.

Harry Sit says

Sorry I don’t know how particular TreasuryDirect is about endorsing or not endorsing. Please call customer service and ask them.

Gail Mast says

Hi, I tried to cash my 3 I-Bonds at my bank. They had me sign the backs and then realized that they could not do that. Well, I was worried about that as well. After spending some time on the phone finally found out that I did not need to worry about it. So all was ok and they converted them to electronic. So from my experience it was not a problem. All should be good.

Harry Sit says

Good to know. Thank you for sharing.

Johnb says

Thanks Gail. Sure hope it works out that way.

Phil says

I mailed in a paper bond in early December 2022 and it took until mid-March 2023 for it to appear in my account.

SteveM says

Just received my single paper $5K iBond that I requested using my tax return refund. The single bond is much nicer than the dozen smaller denominated bonds I received last year. Don’t think I did anything differently, maybe Treasury Direct got as tired of processing them all as we did dealing with them.