One limitation of buying I Bonds is the annual purchase limit. Each person can buy a maximum of $10,000 per calendar year as the primary owner. See How to Buy I Bonds.

If you see I Bonds as an investment, it’s true you can’t dump $500,000 into I Bonds in one shot. However, if you see I Bonds as another account, the $10,000/person limit is higher than the annual contribution limit for an IRA. You never hear people say you shouldn’t bother contributing to an IRA because the limit is only $6,000 or $7,000 per year. People go to great lengths to contribute to their IRA with a backdoor Roth.

In addition, if you have a trust, you can buy another $10,000 per year under the name of the trust. A lawyer created a revocable living trust for us back in 2018. It was surprisingly easy when I opened an account for the trust at TreasuryDirect last month. It took only 15 minutes to open a new trust account and buy another $10,000 of I Bonds.

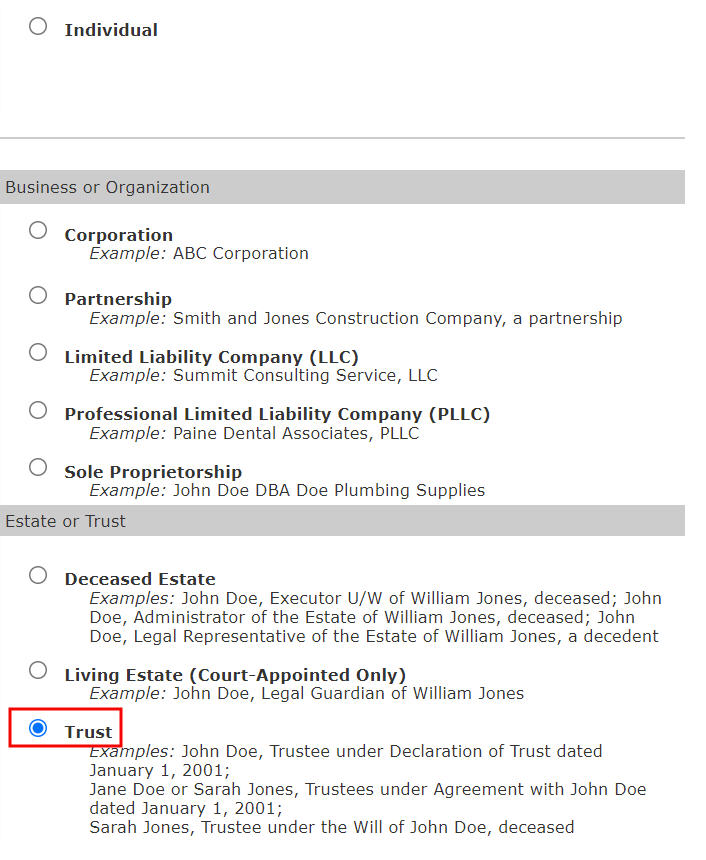

Entity Account

When you open a new account for the trust, you open an Entity Account with the type Trust. A trust account is one type of entity account. The other types include corporation, partnership, LLC, PLLC, and sole proprietorship. Please read Buy I Bonds for Your Business if you have a business.

Registration Name

TreasuryDirect has instructions for opening an entity account. The instructions look complicated but it’s not that bad if you read closely. The most tricky part is the name of the trust account. If your revocable living trust is created by a trust agreement, they want the registration to include both the trustee(s) and the grantor(s). If it’s created by a declaration of trust, they want only the trustees.

My wife and I have a joint trust. We are both trustees and grantors. The trust document says “Trust Agreement” at the top. So the name of our registration becomes:

Person A or Person B, Trustees, [Name of the Trust] U/A with Person A and Person B dated [Month Date, Year]

The second trust we created using software says “Declaration of Trust” at the top. So the registration of this second trust is:

Person A or Person B, Trustees, [Name of the Trust] U/D/T dated [Month Date, Year]

The instructions include a list of approved abbreviations. “U/A” stands for Under Agreement. “U/D/T” stands for Under Declaration of Trust. They allow 150 characters in the registration. Although the registration looks long, it fits within 150 characters. TD FS Publication 0049 also has more examples for trust registrations.

Tax ID

A revocable living trust typically uses the grantor’s Social Security Number as its Tax ID. The trust account at TreasuryDirect can still use the grantor’s Social Security Number even though the grantor also has a personal account with TreasuryDirect under the same Social Security Number.

Email Address

The trustee acts as the manager of the trust account. TreasuryDirect wants an email address for sending one-time passwords and notifications. You can use the same email address if you’d like when you also have a personal account at TreasuryDirect.

Bank Account

The new trust account needs a linked bank account. The bank account doesn’t have to be under the name of the trust. It can be the same personal bank account linked to the grantor’s personal account at TreasuryDirect.

Between the personal account and the trust account, the Tax ID, the email address, and the linked bank account can all be the same if you’d like. The account number and the account type are different.

TreasuryDirect doesn’t do any random deposits to verify the linked bank account. You can enter an order to buy as soon as you create the trust account. Make sure you give the correct bank account. If the debit bounces, your account will be locked and it’ll take effort to unlock it.

Joint Trust or Separate Trusts

Some married couples have separate trusts for each spouse. If you have two trusts, you can open a separate account for each trust and buy another $10,000 of I Bonds every year in each account.

It’s also not uncommon for a married couple to have a joint trust, in which they are both the trustees and the grantors. Although the trust can use either grantor’s Social Security Number as its Tax ID, I don’t think it can use two different Tax IDs simultaneously. If you have one joint trust, the trust can open only one account under one Tax ID and buy $10,000 per year in that one account. If you’d like to buy another $10,000 per year, you need a second trust. We used to have only one joint trust. We created a second trust with software (see below).

In addition, if the joint trust has two trustees and the trust has the word “AND” between the trustees, TreasuryDirect wants to be sure that the trust allows either trustee to act alone on behalf of the trust (versus requiring the consent of both trustees). They want documentation to demonstrate that’s the case. Please read the official instructions for what they need and where to send them.

Multiple Trusts

Some people have multiple trusts, with different beneficiaries, funded with different assets, etc. As long as each trust has its own signed and notarized formal trust document, it’s a separate trust from the other trusts even if all the trusts use the same tax ID for tax purposes. Each trust can open a TreasuryDirect account and buy up to $10,000 in I Bonds each calendar year (see comment #36 for a confirmation from TreasuryDirect customer service).

Create Trust by Software

If you don’t have a trust and you don’t otherwise need one, you can still create a trust just to buy more I Bonds. It may not be worth it if you have to go to a lawyer but if you make it really simple, you can do it with software. See Create a Simple Revocable Living Trust with Software for I Bonds.

Keep Them Separate

A trust can’t be the beneficiary or the second owner on I Bonds. The beneficiary or the second owner has to be a person (see the previous post I Bonds Beneficiary vs Second Owner in TreasuryDirect).

Although there’s a way to transfer existing bonds held in a personal account to a trust account, TreasuryDirect doesn’t like it. They allow you to do either one of the following but not both:

- Buy $10,000 per calendar year in a personal account and another $10,000 per calendar year in a trust account; OR

- Transfer existing bonds from a personal account to a trust account (for example after you set up a trust) or transfer existing bonds from a trust account to a personal account (for example right before you revoke a trust).

You’ll get a stern warning if you buy the maximum in both accounts and transfer from one account to the other in the same year because a transfer counts against the annual purchase limit of the destination account. So if you’re buying the maximum in both a personal account and a trust account, you should just keep your personal account and your trust account separate. Designate a second owner or a beneficiary on the bonds in your personal account and grant the necessary rights. See the previous post How To Grant Rights on I Bonds to the Second Owner or Beneficiary.

When you’re done with buying the maximum in both accounts and you wish to only use one account going forward, you can consolidate your holdings into one account in a year when you’re not buying I Bonds in the destination account. Go to ManageDirect and then “Transfer securities.” It may ask you to use FS Form 5511 and get a signature guarantee.

After You Die

The trust account has only one Account Manager. After the designated Account Manager dies, a co-trustee or a successor trustee must take over as the new Account Manager. The co-trustee or successor trustee needs to fill out FS Form 5446 to make the change and attach the required documentation.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Matt says

Hi again Harry – I did just open up a RLT for I-Bonds after going through your article. Have you heard of “warnings” given, or do you see any issues with, buying the max in both Trust & Individual accounts – say for five years – then closing the Trust Account in Year 6 and transferring all $50K to the Individual one? Would that put me over my Individual limit in Year 6?

Harry Sit says

That should be OK. Just don’t buy any in year 6 in the receiving account.

Brooke says

Hello,

In the year 2000, I purchased The max allowed 30,000 paper I Bonds. I never really thought about them until last month when they became popular again. Anyway, the end of April, I opened an online treasury direct individual account and an another account in my trust. I purchased the max amount in each account. I think it would be best to put the paper bonds in my account. Since they are in my individual name do I put them in my individual account?? Also, I am worried that they may get lost when I send them the treasury direct. I’ve had them for so many years in a safe place, so just concerned. On the other hand it probably would be safer to have them in an account. When people send their paper bonds into Treasury Direct, has the transfer process gone smoothly. Thank you in advance.

Harry Sit says

It’s completely up to you whether you keep the paper bonds as paper or deposit them into your online account. If you decide to deposit them to your online account, they go to your personal account. It takes about a month to process. See How To Deposit Paper I Bonds to TreasuryDirect Online Account.

Linda says

I read on the TD website that a court-ordered representative is required if your estate has more than $100,000 in PAPER i-Bonds when you die. Does this upper limit apply to electronic iBonds as well? (If not, you could have $250,000 in i-Bonds, for example, in your trust account without any such requirement, right?) If upper limit does apply, you could get around this problem simply by converting your $5000 tax-refund PAPER iBonds to electronic? (I believe you earlier stated such conversions don’t impinge on your ability to buy the full $10K worth the same calendar year in the account that receives the converted paper-to-electronic i-Bonds.)

Harry Sit says

A court-ordered representative is required only when the bonds in a personal account don’t have a designated second owner or beneficiary or the designated person also died. It doesn’t apply to bonds in a trust because a trust doesn’t die. Keep your second owner and beneficiary designations up to date for bonds in your personal account. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

Linda says

I forgot to ask about iBond tax consequences after owner’s death:

In all cases (no matter whether you registered a co-owner or a beneficiary, or did neither, and whether your i-Bond was held in a personal or trust account), when the owner dies, will income taxes on all accumulated interest have to be paid at the time of the owner’s death? EVEN IF the i-Bond is not cashed, but instead is either kept in the trust account or personal account or distributed to a beneficiary? Thank you so much for your answer!

Harry Sit says

By default, taxes don’t have to be paid at the time of the owner’s death. Whoever inherits the bonds will pay taxes only when they cash out or when the bonds mature. See I Bonds Tax Treatment During Your Lifetime and After You Die.

John K says

Hi there – why the need/desire to setup a totally new TD account for a trust – couldn’t you buy them via the Gift option and leave them in your Gift Box until you’re ready to cash them out someday? That’s what we’ve done with various purchases for spouse/kids rather than setting up and having to track multiple accounts, logins, etc.

?

Thx/great work here.

Harry Sit says

It’s not mutually exclusive. You can buy in a trust in addition to giving gifts. You can’t cash out the gifts in the gift box. The spouse/kids will need separate accounts eventually to receive the gifts. See Buy I Bonds as a Gift: What Works and What Doesn’t.

John K says

Ah, the element I was missing that you highlight in your gift narrative is that a trust cannot receive a gift – therefore, gifting from a main account to a trust would not work.

There’s an interesting idea there about buying multiple bonds in a year and simply not gifting them across until years later (keeping them in the gift box/closet in the near term), allowing one to capture today’s rate as the gifts are cascaded across over time. Sort of like stocking up on them when they’re on sale b/c you know you plan to give gifts in the future….

matt says

Harry & everyone – Can you cash out more than $10K each year? I’m assuming the answer is yes, but would like to check with all of you who are more experienced. So if I have $20K in my personal account, $20K in a business account and $100K in a trust account – all of which have been held more than 12 months, I could – cash everything in all at once?

Harry Sit says

Yes, you can cash out as much as you want after holding them for at least one year.

K C says

I am specifically wondering if my brother’s special needs Discretionary Trust (FBO) can buy the $10k/yr in I Bonds? Thank you. (It has an EIN#)

Harry Sit says

TreasuryDirect doesn’t have any restriction on the type of trust.

Matt says

Good morning Harry. I have a question about the interest calculation. From #44 above, you wrote:

“TreasuryDirect calculates accrued interest off of a $25 base unit, rounds to the nearest cent, and then scales up to larger amounts. For two months of interest on $25 at 7.12% annualized interest rate:

25 * (1 + 0.0712/2) ^ (2/6) – 25 = 0.2932 => 0.29 after rounding

Scale up to $10,000: 0.29 * (10000 / 25) = 116”

MY QUESTION: Does this mean that in month 7 (when the rate goes up to 9.62%), the calculation would be:

25 * (1 + 0.0962/2) ^ (1/6) – 25 = 0.1965 => 0.20 after rounding

Scale up to $10356 (because it’s compounded semi-annually): 0.20 * (10356 / 25) = 83

I have not found a place that can explain this properly & after 2 hours of waiting, the Treasury representative was also not entirely clear with his explanation.

Harry Sit says

Not exactly. The compounding happens on the $25 bond. Then you round, and scale up. To be honest I don’t look that closely. Whatever quirky calculation used by the Treasury is already programmed into their system. Whether it’s $83 or $80, you get what their system says you get. The month-to-month rounding difference is definitely not worth waiting two hours to get an explanation for. Just trust the system and get whatever balance is displayed in your account or the official calculator (link in reply to comment #38 from Lou).

Brooke says

For newly purchased bonds that I got at the end of April, when you you see your interest compounding, at the end of the 6 months?? Thank you

Harry Sit says

It starts compounding in October although you won’t see it until Feb. 1. Again, trust the system. It’s working whether you see it or not.

Matt says

Thank you Harry for the clarification as always.

Henry says

Hi Harry,

If I’m using a trust to buy the bonds, do I buy the bonds once I come up with the trust name? then fully create the trust document listing the serial # of the bonds? Or would I need to create the trust document first, then buy the bonds? I’m under the impression that we need to list the bond’s serial # in the trust document, therefore we would create the document after purchasing the bonds. I appreciate your detailed guide which helped me purchase my first i-bonds recently but I am seeking to purchase more using the trust trick. Thank you!

Sincerely,

Henry

Harry Sit says

You need a signed and notarized trust document first. You don’t need to list the bonds’ serial numbers in the trust document. The bonds you buy in an online account don’t have serial numbers anyway.

Henry says

That makes sense that the trust document has to be created prior to purchasing the

i-bonds. How would we go about listing the newly purchased i-bonds under the schedule assets? Does the account# or amount need to be listed? Can you please show us an example? If detailed information is needed about the bond account then I assume the trust document is modified after the initial creation and will need it notarized again. Thanks again for your help!

Sincerely,

Henry

Harry Sit says

I put “TreasuryDirect Account ___________________” in my schedule. I filled in the account number after I opened the account. Someone else suggested putting $100 in an envelope as the seed asset for the trust and writing “$100” in the schedule. After opening the account, you then add “TreasuryDirect Account XXXXXX” as a new line in the schedule. Maintaining the schedule doesn’t require trust amendment or new notarization.

Lou says

On a joint trust where you have two trustees (spouses who are also the grantors), can you register the trust on TreasuryDirect with just the trustee who is also authorized to act on behalf of the trust (entity manager). In other words, do I have to include the names of both trustees in the registration name or title in TreasuryDirect?

Harry Sit says

TreasuryDirect gave this example when there are two trustees even though the trust account allows only one entity manager:

“John Doe or Sarah Jones, Trustees under Agreement with Jane Doe dated January 1, 2001”

I don’t know whether you can get away with listing only one trustee but I would follow their example and list both trustees.

michelle says

Thanks for the outstanding information!

Question Re IBond Registration for my Revocable Living Trust

Can I be confident that I will register my IBond Trust:

My name, Trustee, (my trust name) under agreement dated (date Trust created).

Thanks for the outstanding information:

I am the grantor and Trustee. (My husband is an initial Trustee and the successor and generally )

There is no mention of Declaration of Trust that I can find.

There is no mention of Trust Agreement in the Certificate of Trust.

However, there are a few mentions of “Trust Agreement” in the Trust, the first of which does not appear until Section 1.05 Grantor Trust Status”

“By reserving the broad rights and powers set forth in Section 1.04 of this Trust Agreement……”

Thanks for any assurance. Getting through to TD is hours these days.

Harry Sit says

It’s a Trust Agreement then. You need the grantor(s) in your registration as in “under agreement with [names of the grantors] dated [date].”

Lou says

Thank you for your reply (July 2at 9:32 AM). My problem is that I have two trustees (spouse and me) and were both authorized to act alone on behalf of the trust, however the trust name has the “and” in the title. I would like to use your example (John Doe or Sarah Doe) in the registration name, but I don’t want to snail mail them the trust documents. It would be technically correct to use the “or” between the trustee names in the registration since the trust authorizes it, so I don’t see why I shouldn’t do it. Also, the registration name doesn’t require I include the name of the trust in it. Do you think i can do this without going through the arduous process of sending them documents and awaiting a reply?

Harry Sit says

They want a Summary of Trust only for their records. The online account opening process won’t block you even if you include the name of the trust in the registration name. If you leave out the name of the trust, that’s OK too by their example.

Keith says

Hello Harry, I have a question regarding and/or. My wife and I have the connective “AND” between our names in our Trust Agreement. In the FS Publication 0049 it states that the connective “OR” may be used in the registration of the securities if the trust instrument permits each trustee to act independently. Then I see under “Learn More About Entity Accounts”, it states that if the connector “AND” is used, they will require a Certificate of Trust. Any thoughts? Would you change it to “OR”? I saw on your example you used “Person A or Person B, Trustees”. Thank you so much for providing this forum.

Harry Sit says

It’s quite common to have two grantors (“Person A and Person B Living Trust”) and two trustees who can act independently. It’s not a conflict when you have “OR” between the two trustees and “AND” between the two grantors. Those are two different roles. This is perfectly valid:

“Person A or Person B, Trustees under agreement with Person A and Person B dated xxxxxx”

TreasuryDirect wants a Certificate of Trust when you have “AND” between the trustees, not when you have “AND” between the grantors.

Keith says

Just to be clear. My Trust Agreement has the connective “AND” between the grantors. Can I change that to “OR” on the Treasury Direct registration? Thanks.

Harry Sit says

You don’t change it. You will still have “AND” between the grantors and you can have “OR” between the trustees at the same time if the trust allows either trustee to act independently. If you include the name of the trust in the registration, it can be like this:

“Person A or Person B, Trustees, Person A and Person B Living Trust under agreement with Person A and Person B dated xxxxxx”

Dunmovin says

Some of the “stuff” on the TD site use the words to the effect “for example,” meaning to most that that which follows is NOT the exclusive or only way. I recall a couple of years ago while in the process of setting up a colleague in a sole proprietorship, TD said “where is the dba filing,” and that colleague consistently stated that was not required by TD since it was merely stated to be an example. TD then came to conclusion (for it’s only rationale) b/c one was a “professional” the dba wasn’t required and so noted in their TD notes. She had initially only funded a small amount and then sent/wired by bank in the balance when TD got its act together. She has not heard anything on that issue and continues ibond purchases. Go figure

Keith says

Hello Harry. I have a clearer understanding. Our Trust Agreement is also like yours. My wife and I also have a joint trust and are both trustees and grantors. So, would I register like this? “Person A (myself) or Person B (my wife), Trustees, Person A (myself) and Person B (my wife) Living Trust under agreement with Person A (myself) and Person B (my wife) dated xxxxxx” . Thanks, again!

Harry Sit says

Including the name of the trust is optional. That works. If you run out of space, this also works:

“Person A (myself) or Person B (my wife), Trustees under agreement with Person A (myself) and Person B (my wife) dated xxxxxx”

Lou says

Harry, in your July 9th 7:44 AM response to Keith, you wouldn’t have to send the certificate of trust to the Treasury Dept? Are you sure about that?

Harry Sit says

TreasuryDirect said this about needing the Certificate of Trust:

“If the legal name of your trust, as shown in your trust document, shows more than one trustee and the names are joined by the connector “AND” (e.g., John Doe and Sarah Jones, Trustees under Agreement with Jane Doe dated January 1, 2001) you will be required to provide a Summary of Trust (also known as Certificate of Trust or Memorandum of Trust) or the appropriate pages of the trust showing that either named co-trustee may act independently.”

The name “Person A and Person B Living Trust” doesn’t say how many trustees it has. It only says Person A and Person B are grantors. It’s possible that you have Person C as the only trustee for this trust, which is another common setup — two parents having an adult child as the trustee of their joint trust. Including or not including the name of this trust in the registration doesn’t trigger the requirement to send the Certificate of Trust. Treasury wants the Certificate of Trust only when you have two or more trustees and the trustees are connected with “AND.”

In addition, having to send the Certificate of Trust isn’t a prerequisite to opening an account. It’s more like supplemental information for the records. If you’d like to send the Certificate of Trust anyway just in case, send it after you open the account. Meanwhile, you can do everything while it’s on the way or sits in the pile to be processed into the records.

ustaad says

Harry,

We already have two declaration of trust where each of us is both a grantor and a trustee. If we were to set up an additional trust where I am the grantor and my spouse is a trustee, whose SSN should be used? Must we use the SSN of the grantor always or can the SSN of the trustee be used? The same question applies to where there are multiple grantors and trustees. Is the SSN to be used must be that of either grantor? Is it necessary that the person whose SSN is used should appear first in the registration when listing grantors? There is also another point that I would like to get a clarification on. It is my understanding that one cannot just set up multiple trusts to buy more ibonds. Each trust must have a unique purpose. Is my understanding correct? Is it possible for TD to deny purchases if they find that the trust with a different nomenclature is not created with a unique purpose but just to circumvent the purchase limit?

Harry Sit says

A revocable trust uses the grantor’s SSN as its tax ID because the grantor is responsible for taxes. When there are two grantors, use one of the grantor’s SSN. It doesn’t matter which grantor is listed first. Pick one and stick with it. A trust can easily have a different purpose when the trust assets go to a different beneficiary (of in different percentages to the same set of beneficiaries) after the grantor’s death.

Ustaad says

Very much appreciate that clarification, Harry.

Kate says

Hello, Harry,

I have set up different trusts for different family member almost at the same time for I bonds. I am the trustee for all of these trusts. If after one year, the interest rate is not that good any more, so I myself want to cash out all of those trusts at almost the same time. Can I do that? How to cash out the I bonds for the trust? Do I need to fill out a form? Do I need to submit all the trust documents which have been notarized? Thank you. Looking forward to your reply.

Harry Sit says

Each trust account has a linked bank account. When you’d like to cash out the bonds, log in to each account and go to ManageDirect -> Redeem securities. It’s all online. You don’t need to fill out a form or submit trust documents when you cash out.

Roland says

Hi Harry,

what is the difference between these two trust registrations, ” John Doe AND Sarah Jones, Trustees under Agreement with John Doe AND Sarah Jones dated January 1, 2001″, and ” John Doe OR Sarah Jones, Trustees under Agreement with John Doe AND Sarah Jones dated January 1, 2001″? Why only the first trust with AND between two trustees need to mail in the certificate of trust? If John Doe dies, will Sarah Jones becomes the sole account manager/trustee automatically without sending in FS Form 5446?

Thanks.

Harry Sit says

When you have AND between the trustees, TreasuryDirect suspects that the two trustees must both consent before any action can be taken on behalf of the trust. They want documents to show that’s not the case. When you have OR between the trustees, they don’t suspect such and they don’t need documents. A trust account can have only one account manager at a time. Either way, the successor has to fill out a form to change the account manager after the account manager dies.

John says

Hi Harry,

I don’t quite understand the meaning of this paragraph: “In addition, if the joint trust has two trustees and the trust has the word ‘AND’ between the trustees, TreasuryDirect wants to be sure that the trust allows either trustee to act alone on behalf of the trust (versus requiring the consent of both trustees). They want documentation to demonstrate that’s the case. Please read the official instructions for what they need and where to send them.”

Does this mean that if your trust is named “John Doe and Sarah Jones Revocable Living Trust”, you have to send in extra paperwork? Or it just means if you use “And” in your Registration Entity Name when buying I-Bonds, you have to send in extra paperwork?

Thanks.

John

Harry Sit says

“John Doe and Sarah Jones Revocable Living Trust” only shows there are two grantors. It doesn’t say how many trustees this trust has. The requirement to send documents is only triggered by a specific setup of the trustees. See comments 115, 116, 118, and 119.

John says

Thank you Harry for the clear explancation!

Flingo says

Harry,

Just wanted to get your thoughts on any issues with the below:

1. My revocable trust for nephew 1 (use my TIN)

2. My revocable trust for niece 1 (use my TIN)

3. My revocable trust for niece 2 (use my TIN)

4. My spouse revocable trust for nephew 1 (use spouse TIN)

5. My spouse revocable trust for niece 1 (use spouse TIN)

6. My spouse revocable trust for niece 2 (use spouse TIN)

Do you see any issues with each trust being able to purchase $10,000/year in i-bonds? If you do not see any issues, do you see any issues with any/all of the trusts redeeming any/all of the i-bonds sometime in the next one to two years?

FYI, Treasury is longer responding to email queries per an email I received from Treasury the end of July.

Thanks for all the great info on the website,

Harry Sit says

I don’t see any issues when you have a separate trust document for each trust. See comment 122 on cashing out.

John says

Thank you Harry for the clear explanation!

Ted says

Hi Harry!

I’m a still a bit confused about Declaration of Trust vs Trust Agreement, and whether the Successor Trustee needs to be named.

My trust title is “The [Person A] Revocable Living Trust Agreement Dated [date]”

And the first paragraph says…

This trust agreement is made on [date] between [Person A], (“Settlor”) and [Person A] (“Trustee”), [Person B] (“Successor Trustee”). The Trust created hereby shall be titled the [Person A] Revocable Living Trust.

There’s no “and” or “or” in the trustees… and initially the trustee is really just me…

I thought of a few options, but at this point all of them could be wrong!

Opt 1. I’m overthinking it; it’s just a Declaration of Trust with an easy entity name…

[Person A], Trustee U/D/T dated [date]

Opt 1b. Like option 1 but add the trust title since there’s room…

[Person A], Trustee, [trust title] U/D/T dated [date]

Opt 2. Agreement style but leaving out the specific successor…

[Person A], Trustee, [trust title] U/TR/A with [Person A] dated [date]

Opt 3. Trying to include the successor; removing title because it won’t fit…

[Person A], Trustee, [Person B], Successor Trustee U/TR/A with [Person A] dated [date]

What do you think?

Thanks,

Ted

Harry Sit says

Option 2. The successor trustee has no power until you die.

Terry says

Harry,

After reading all these comments, I want to see if you agree with my understanding of things. My wife and I have individual accounts. I have a trust with me as trustee and we have a joint trust with me and my wife as joint trustees with the “and” connector. I understand I can purchase $10,000 worth of I-bonds in each account for a total of $40,000 each year using my ss# on both trust accounts and the same bank account for all 4 accounts. Then after a few years we could transfer $30,000 from our individual accounts into either trust account as long as I do not purchase new I-bonds into the account it goes into. In other words there is no limit on transfers and I can keep the individual accounts low and build up the trust accounts which would help me to avoid probate in my state. Do I understand all this correctly?

wallies says

Hi Harry,

My trust account was opened on 7/1/22 in the amount of $10,000. Since then, the account doesn’t show any interest. My personal account accrues interest every month and shows the new total. This is a huge problem. Do you know why my trust account is not showing any interest?

Thanks,

Sandra

Steven H says

https://thefinancebuff.com/how-to-buy-i-bonds.html#htoc-three-month-lag

“If your bonds are still within five years from the Issue Date, the Current Value automatically excludes interest earned in the last three months. If you cash out today, you’ll receive the Current Value. That’s why you won’t see any interest in the current value during the first four months. You will start seeing a higher value in the fifth month.”

Mark N. says

Harry: Thanks for the information you provide. After reviewing all the Qs and As above, I have a a couple a question or two.

1. I want to simply buy $20k of I bonds for my wife and me (one each) in each of the next several years. I want them to be part of our joint living trust. From what is indicated above, we cannot simply open a TD account in the name of the trust and buy two $10k bonds per year (one for each of the two grantors)? Rather we have to have a combination of at least two TD accounts, and accumulate at least half of the bonds outside of the trust in an account in the name of one of us individually. Then, when we are done investing, we wait a year and transfer the accumulated bonds to the trust’s TD account. Correct?

But from what you are saying the transfer of the accumulated bonds always count against the purchase limit. Because the transfer would be multiples of the limit, wouldn’t that violate the TD purchase rules and make the account subject to closure and perhaps the loss of accrued interest?

This seems pretty critical. What is the source of the information on the transfer to a trust being counted against the purchase limit? And what is the source of the information that TD allows bulk transfers exceeding $10k to a trust in a year where it had no purchases?

Thanks again.

Harry Sit says

The federal regulations that govern savings bonds in TreasuryDirect are in 31 CFR Part 363. You can search for the word “transfer” there. 363.52(b) says “Bonds purchased or transferred as gifts will be included in the computation of this limit for the account of the recipient for the year in which the bonds are delivered to the recipient.” 363.55 gives a minimum amount for a transfer but not a maximum amount.

https://www.ecfr.gov/current/title-31/subtitle-B/chapter-II/subchapter-A/part-363

Ron Shiffler says

Is it possible to buy I bonds in an irrevocable unitrust? I saw this mentioned in #16, but I also read the discussions where the beneficiary must be an individual. Our unitrust beneficiary is a 501(c)(3) organization, so I think the answer is “no.” Is it still possible? Thank you.

Harry Sit says

Yes, it’s possible. The beneficiary for bonds in a personal account at TreasuryDirect must be an individual. Bonds in a trust account at TreasuryDirect can’t have a beneficiary because the trust doesn’t die. It doesn’t matter who the trust’s beneficiaries are.

Tom Smith says

Harry, you may want to reconsider this position. The limits are per SSN/EIN. If you have accounts in your individual name and your revocable Trust both in your SSN you may be in violation of the limits. TreasuryDirect states, “Note: The three purchase limits above apply separately. That is, in a single calendar year you could buy $10,000 in electronic Series EE bonds, $10,000 in electronic Series I bonds, and $5,000 in paper Series I bonds. The limits are applied per Social Security Number”

Harry Sit says

The part you quoted from the website doesn’t give you context. It’s accurate for personal accounts but it’s not true for both personal and trust accounts.

Lester E Lloyd says

Thank you for your informative site!

Concerning transferring I Bonds from a personal account to a trust account: You note one should not buy the maximum in both accounts and then consolidate by transferring one to the other in the same year. You also note that a transfer into the destination account counts as a purchase in the destination account. Does it then follow that one may add the maximum to the personal account and then transfer all the personal assets to the trust account in the same year, without adding any other funds to the trust account, and that thus one will not get a stern warning from the Treasury?

Harry Sit says

I’m not clear on what you’re thinking of doing exactly. If you’re not buying the maximum in both accounts and you eventually want all the bonds in the trust account, it’s simpler to buy in the trust account directly. If you max out both accounts, you keep them separate until you’re done buying all the bonds you want. Then you transfer in the following year.

Lester E Lloyd says

Thank you for your prompt reply. I apologize for not being clear. I do wish to maximize my purchase in 2023 and also transfer my current I Bonds in my personal account to my trust account in 2023. Thus, I am wondering if I purchase $10,000 I Bond only in my personal account in 2023 and then transfer all of my personal account to my trust account in 2023 if I am likely to get the Treasury stern warning. I suspect it sounds like I am splitting hairs, but if allowable I will be able to add $10,000 to my holdings in 2023 while still meeting my goal of consolidating my holdings into my Trust account in 2023.

Harry Sit says

That works. Or you can buy in both accounts in 2023 and transfer in 2024. That delays your transfer by one year but it gives you an extra $10k at the 2023 rates assuming you’re happy with the rates.

Pam says

I am going to transfer the full amount in my personal TD account to my revokable living trust TD account. Is it best to use form 5511 or form 1851 to do so?

In the year I do this, does the transfer of money to the revokable living trust affect my ability to purchase $10,000 in new a new I-Bond that year?

Thanks, so much for your comments on this topic!

Harry Sit says

Try the online process first, under ManageDirect -> Transfer securities. It will tell you to use Form 5511 if it doesn’t let you complete it online. A transfer counts toward the limit of the receiving account. So don’t buy any in the trust account in the same year after you do the transfer.

Terry says

Has anyone transferred more than $10,000 from one TD account to another without any problems?

Dunmovin says

Terry, go read the various threads, as I recall one transferred $10k + to one account in one year with no consequences. Of course, the ultimate is to gift multiple $10k to a terminally ill person with you or… as the bennie and upon death it all goes to you/Bennie in one year!

Sunflower says

Disgusting thought. Hope you never have a terminally ill person in your life where you take advantage of the situation.

Peter says

We all start to die when we are born! If the rules are set up a particular way, some call that death bed planning and a way to devise part of an estate

Justin B. says

I want to pass along an error message that I received when opening a new account for a Trust, and the fix I needed. When I entered the Registration Name I followed the advice here. I kept getting an error that (I can’t recall the exact wording) “You have used a character that is not allowed. Do not copy and paste.” I resolved the error by deleting all the commas in the Registration Name. I hope this helps someone else.

Harry Sit says

Thank you, Justin. I added a note in the Registration Name section.

Reggie says

I found out the same thing after hours on hold for TD since they no longer answer emails. No punctuation all in the registration name even though the examples have them. For example, just: John Doe or Jane Roe Trustees under Declaration of Trust dated October 12 2022. I would not use slashes or abbreviations either.

Dunmovin says

My Trust account Registration has several commas and, as noted, the TD examples have punctuation. This is the result when there is not notice/comment on proposed regulatory/change, e.g. now there are registrations with and also punctuation, etc. Rumor has it the public also know something and is glad to provide input when given the opportunity….What else lurks out there? All the nonconforming instructions, videos, etc.

Nancy A. says

I went ahead and got a trust iBond in my family’s trust name, not realizing the rules for registration. My father and I are co-trustees on our revocable trust, meaning we CANNOT act alone. (My father is the grantor, but I’m not.) I could have our estate lawyer add a delegation to our trust that I can act alone for a year, and send that in to TD with the trust document. But then I’d have to pay the lawyer to do that. Could I instead send TD a notarized statement that we both authorize the purchase of the iBond when I mail in our trust doc?

Dunmovin says

And the verdict is? Can one set up a TD trust account exactly as the trust is set up, i.e. with commas, etc.? And if not, doesn’t that constitute 2 trusts…one with commas, etc. (the legal one) and the other (nonconforming) one? And on the latter…anyone practicing law today?

Harry Sit says

TreasuryDirect fixed the bug. Commas and other punctuation characters are accepted now.

William Baer says

All of my assets are in a revocable trust. My treasury account is set up as a revocable trust as well. My attorney advised me not to put any assets other than retirement accounts into an account set up under my name only as this would create probate issues at my death. So….it would appear that I can only purchase $10000 of I Bonds per year (other than purchasing as a Gift). In this case setting up 2 accounts appears not to work. Is this correct?

Harry Sit says

That’s a question for your attorney. A personal account holding bonds with a designated beneficiary doesn’t go to probate or your estate, but the designated beneficiary can only be one individual person, not a trust. Maybe your attorney is OK with it, maybe not.

Olson says

Do you “really” want someone to second guess your attorney? Look at TD form 5336

MH Sugiyama says

Who pays taxes when the TD bond or t-bills matures? Does the grantor receive the 1099-INT and pay the federal taxes for that year?

Harry Sit says

TreasuryDirect will issue a 1099 form against the Tax ID you gave for the account when you first opened the account. If it’s a grantor trust and you gave the grantor’s SSN as the trust’s Tax ID, the grantor will pay the tax. If it isn’t a grantor trust and you gave a separate EIN for the trust, the trust will pay the tax.

James Frank says

I want to add a beneficiary to my bonds. The ManageDirect >> Registration List -Add page shows inputs for both a “First-Named Registrant” and “Second-Named Registrant (Required for Primary Owner and Beneficiary registrations only.)”. Selecting the Beneficiary radio button requires filling out both Registrant inputs. I just want to register one beneficiary, not two??

Harry Sit says

The first-named registrant is you the owner. The second-named registrant is the beneficiary when you select the Beneficiary radio button.

Kristen says

Is is possible to create TWO Treasury Direct accounts for our Trust?

Using one grantor’s SSN for the first and the other grantor’s SSN for the other?

We want to transfer our individual I-Bonds to the 2 separate TD Trust accounts so we avoid the $10,000 transfer/buy limit for the year.

Thank you.

Harry Sit says

The same entity can’t have two different Tax IDs at the same time.

Kristen says

P.S. This suggestion was a suggested workaround for possibly not being able to transfer $10,000 from 2 individual TD accounts into a new TD Trust account in the same year. I had understood that there is a transfer limit the same as the yearly buy limit. Can you transfer $20,000 to a Trust account in the same year? No purchases made from Trust account.

Thanks again.

Harry Sit says

Imagine two individuals who have been buying I Bonds for many years. Now they created a trust and they’d like to transfer their existing bonds to their trust account. They should be able to transfer all of them. Just don’t buy new bonds in the trust account in the year it receives the transfer.

Kristen says

Thank you so much for your replies. Just to let you know, I called Treasury Direct this morning to ask if there was a limit on amount transferred to a new Trust account. Unfortunately the $10,000 purchase limit also applies to transfers. I specifically asked if a couple had, for example, $100,000 in their individual accounts, how would they transfer to a Trust account. The answer was you could only transfer $10,000 every calendar year. I’ve concluded that one could probably get away with a transfer in excess of $10,000 once, resulting in the infamous warning email, but further transfers that exceed the yearly limit could cause major problems.

Ravin says

Hi Harry,

In Dec 2021, per your post above and excellent details in the book, I setup a second trust myself with my wife’s name as first name and me as second name on the trust. Our original trust has me as first name and my wife’s name as second name. Thus, I was able to max out $10K individually for each of us and $10K in each family revocable trust account – so total of $40K for 2021 and 2022 each.

I wanted to check with you if there were any challenges you/anyone else faced if you redeemed I-Bonds in the second trust account after 1 year? I’m considering to redeem $20K in I-Bonds I have in the second trust account and deploy those in the optimal TBills ladder.

Thanks

Ravin

Harry Sit says

I haven’t redeemed my I Bonds in the second trust yet. I’m waiting for them to pass the mark of three months after 9.62% or three months after 6.48%. There’s a table in When to Stop Buying I Bonds or Cash Out and Buy TIPS. I don’t expect any challenges. The proceeds should go straight to the linked bank account.

Steven H says

I have I Bonds in a personal account and multiple revocable trust accounts of which I am the grantor, all of which use my Social Security number as the tax ID.

For the first time, in the 2022 tax year I have reportable I Bond interest, and it is from each of these acccounts.

Should I report the interest on IRS Schedule B as one aggregated figure for all accounts, or list it separately for each account?

I am doing annual interest reporting, but the question would also arise if I were not, but had redemptions in multiple accounts.

Thanks.

Harry Sit says

If you redeem, TreasuryDirect will issue a separate 1099 form for each account. You will report them on separate lines on Schedule B. You should follow the same pattern when you report interest annually on your own.