One limitation of buying I Bonds is the annual purchase limit. Each person can buy a maximum of $10,000 per calendar year as the primary owner. See How to Buy I Bonds.

If you see I Bonds as an investment, it’s true you can’t dump $500,000 into I Bonds in one shot. However, if you see I Bonds as another account, the $10,000/person limit is higher than the annual contribution limit for an IRA. You never hear people say you shouldn’t bother contributing to an IRA because the limit is only $6,000 or $7,000 per year. People go to great lengths to contribute to their IRA with a backdoor Roth.

In addition, if you have a trust, you can buy another $10,000 per year under the name of the trust. A lawyer created a revocable living trust for us back in 2018. It was surprisingly easy when I opened an account for the trust at TreasuryDirect last month. It took only 15 minutes to open a new trust account and buy another $10,000 of I Bonds.

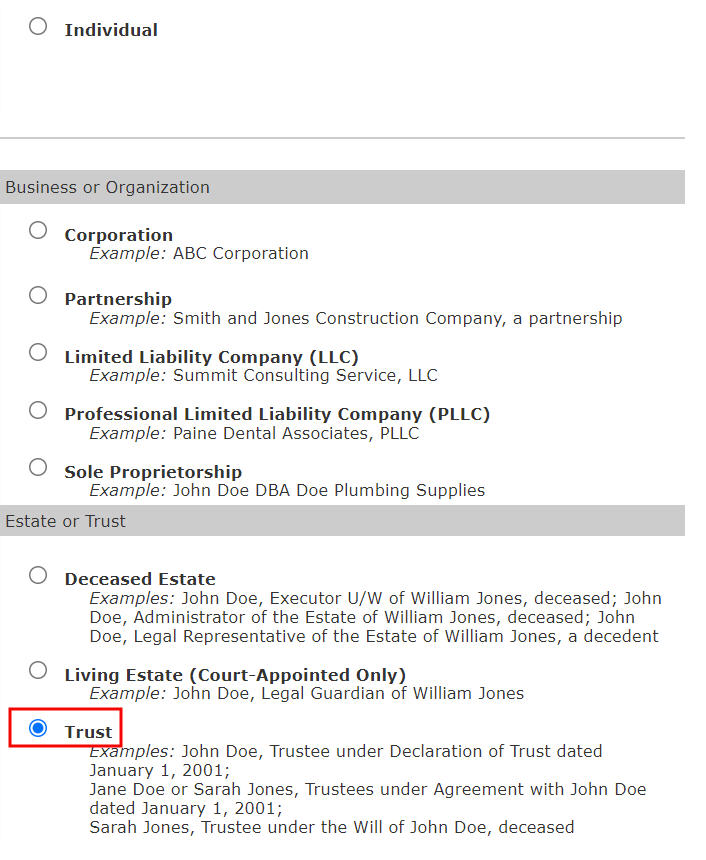

Entity Account

When you open a new account for the trust, you open an Entity Account with the type Trust. A trust account is one type of entity account. The other types include corporation, partnership, LLC, PLLC, and sole proprietorship. Please read Buy I Bonds for Your Business if you have a business.

Registration Name

TreasuryDirect has instructions for opening an entity account. The instructions look complicated but it’s not that bad if you read closely. The most tricky part is the name of the trust account. If your revocable living trust is created by a trust agreement, they want the registration to include both the trustee(s) and the grantor(s). If it’s created by a declaration of trust, they want only the trustees.

My wife and I have a joint trust. We are both trustees and grantors. The trust document says “Trust Agreement” at the top. So the name of our registration becomes:

Person A or Person B, Trustees, [Name of the Trust] U/A with Person A and Person B dated [Month Date, Year]

The second trust we created using software says “Declaration of Trust” at the top. So the registration of this second trust is:

Person A or Person B, Trustees, [Name of the Trust] U/D/T dated [Month Date, Year]

The instructions include a list of approved abbreviations. “U/A” stands for Under Agreement. “U/D/T” stands for Under Declaration of Trust. They allow 150 characters in the registration. Although the registration looks long, it fits within 150 characters. TD FS Publication 0049 also has more examples for trust registrations.

Tax ID

A revocable living trust typically uses the grantor’s Social Security Number as its Tax ID. The trust account at TreasuryDirect can still use the grantor’s Social Security Number even though the grantor also has a personal account with TreasuryDirect under the same Social Security Number.

Email Address

The trustee acts as the manager of the trust account. TreasuryDirect wants an email address for sending one-time passwords and notifications. You can use the same email address if you’d like when you also have a personal account at TreasuryDirect.

Bank Account

The new trust account needs a linked bank account. The bank account doesn’t have to be under the name of the trust. It can be the same personal bank account linked to the grantor’s personal account at TreasuryDirect.

Between the personal account and the trust account, the Tax ID, the email address, and the linked bank account can all be the same if you’d like. The account number and the account type are different.

TreasuryDirect doesn’t do any random deposits to verify the linked bank account. You can enter an order to buy as soon as you create the trust account. Make sure you give the correct bank account. If the debit bounces, your account will be locked and it’ll take effort to unlock it.

Joint Trust or Separate Trusts

Some married couples have separate trusts for each spouse. If you have two trusts, you can open a separate account for each trust and buy another $10,000 of I Bonds every year in each account.

It’s also not uncommon for a married couple to have a joint trust, in which they are both the trustees and the grantors. Although the trust can use either grantor’s Social Security Number as its Tax ID, I don’t think it can use two different Tax IDs simultaneously. If you have one joint trust, the trust can open only one account under one Tax ID and buy $10,000 per year in that one account. If you’d like to buy another $10,000 per year, you need a second trust. We used to have only one joint trust. We created a second trust with software (see below).

In addition, if the joint trust has two trustees and the trust has the word “AND” between the trustees, TreasuryDirect wants to be sure that the trust allows either trustee to act alone on behalf of the trust (versus requiring the consent of both trustees). They want documentation to demonstrate that’s the case. Please read the official instructions for what they need and where to send them.

Multiple Trusts

Some people have multiple trusts, with different beneficiaries, funded with different assets, etc. As long as each trust has its own signed and notarized formal trust document, it’s a separate trust from the other trusts even if all the trusts use the same tax ID for tax purposes. Each trust can open a TreasuryDirect account and buy up to $10,000 in I Bonds each calendar year (see comment #36 for a confirmation from TreasuryDirect customer service).

Create Trust by Software

If you don’t have a trust and you don’t otherwise need one, you can still create a trust just to buy more I Bonds. It may not be worth it if you have to go to a lawyer but if you make it really simple, you can do it with software. See Create a Simple Revocable Living Trust with Software for I Bonds.

Keep Them Separate

A trust can’t be the beneficiary or the second owner on I Bonds. The beneficiary or the second owner has to be a person (see the previous post I Bonds Beneficiary vs Second Owner in TreasuryDirect).

Although there’s a way to transfer existing bonds held in a personal account to a trust account, TreasuryDirect doesn’t like it. They allow you to do either one of the following but not both:

- Buy $10,000 per calendar year in a personal account and another $10,000 per calendar year in a trust account; OR

- Transfer existing bonds from a personal account to a trust account (for example after you set up a trust) or transfer existing bonds from a trust account to a personal account (for example right before you revoke a trust).

You’ll get a stern warning if you buy the maximum in both accounts and transfer from one account to the other in the same year because a transfer counts against the annual purchase limit of the destination account. So if you’re buying the maximum in both a personal account and a trust account, you should just keep your personal account and your trust account separate. Designate a second owner or a beneficiary on the bonds in your personal account and grant the necessary rights. See the previous post How To Grant Rights on I Bonds to the Second Owner or Beneficiary.

When you’re done with buying the maximum in both accounts and you wish to only use one account going forward, you can consolidate your holdings into one account in a year when you’re not buying I Bonds in the destination account. Go to ManageDirect and then “Transfer securities.” It may ask you to use FS Form 5511 and get a signature guarantee.

After You Die

The trust account has only one Account Manager. After the designated Account Manager dies, a co-trustee or a successor trustee must take over as the new Account Manager. The co-trustee or successor trustee needs to fill out FS Form 5446 to make the change and attach the required documentation.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

cathy says

Harry thank you for the clarification! That helps. Since accounts with a secondary owner would have to go through probate if both of us pass, eventually transferring all of our ibonds into a trust would be the way to avoid probate.

Dan McCarty says

Thanks so much for your good work on this topic Harry. I read the post and then the comments. I believe my wife and I can open 6 accounts; one for each of us personally, one for each of our two trusts, one for our 12 year old daughter, and one for the S Corp that is 100% owned by my wife and me. Does sound correct?

Dan

Harry Sit says

That’s correct. To be clear, the account for your 12-year-old daughter has to be created under a parent’s personal account as a “minor linked account.” All access to the minor linked account is through the parent’s personal account.

bws92082 says

I created the Trust account. But I can’t link it to my main TD account. When I followed the instructions to create a custom linked acount, it just created yet another unrelated account unconnected to the Trust account.

Harry Sit says

It’s not supposed to be linked to your personal TreasuryDirect account. The personal account and the trust account are two separate accounts. Keep them separate.

bws92082 says

Ok, I thought that might be the case. It seems to needlessly complicate matters to prevent linking and require multiple logins and account numbers. It makes it much more likely your account will be overlooked by your heirs (or yourself) when accounts are spread out all over the place in a disconnected fashion.

bws92082 says

Your example for declaration of trust says “Person A or Person B, Trustees, [Name of the Trust] U/D/T dated [Month Date, Year]”, but all the examples provided at TD and in this link (TD FS Publication 0049) merely list the name of the trustee which is NOT followed by the [Name of the Trust]. Can you confirm?

bws92082 says

So are you saying it definitely needs to be like this:

“John Doe, Trustee, Living Trust of John Doe U/D/T dated March 15, 2022”

(And if you skip the same of the trust will that be a problem?)

Harry Sit says

Your trust has a name. The registration has enough space for it. Even if it isn’t strictly required, why not make it clear the account is for that trust? If you don’t have enough space, then omit the trust name.

bws92082 says

Yes, that definitely makes sense. But the government doesn’t always make sense, and I would worry that not following their silly arbitrary rules exactly might confuse them and cause them to botch the account.

Steven says

Love your articles on iBonds Harry, very helpful. The Quicken Willmaker & Trust Program indicates that items must be transferred into the trust with a transfer document. Even specifying that US Govenment Bonds be transferred and suggesting contacting your broker. Now I’m assuming that these transfer documents are for bonds that were issued and existed outside the Trust, while iBonds issued to the Trust would not need to be transferred in with a transfer document since they have only ever existed in the Trust. Am I correct in my assumption? Thanks.

Harry Sit says

That’s correct. Everything you buy in a trust account already belongs to the trust.

Anonymous says

Two questions:

1. If I buy $5K of paper I bonds via the tax refund, I assume I can then transfer it to my existing online account?? But more importantly, will that transfer reduce my purchase limit for the online account to $5K for the year of transfer?

2. Let’s say I accumulate the paper I bonds for 4 years (totaling $20K). Can I then transfer all $20K in one transfer? i.e. am I limited to transferring $10K/year?

TIA

Harry Sit says

You can deposit paper bonds to your online account. It doesn’t use up your purchase limit in your online account because you’re only consolidating bonds you already own, not buying new bonds. There’s no time limit or dollar limit for depositing paper bonds. See How To Deposit Paper I Bonds to TreasuryDirect Online Account.

Steven H says

I do not currently have any trusts, but would like to set up multiple trusts (possibly 3) to buy I Bonds. I may later add other assets. I am single. I have both the Clifford book and Willmaker.

Questions:

1. Do I need my full middle name in the trust documents, or is the middle initial sufficient?

2. How can I name the otherwise identical trusts to differentiate them? How about successive numbers, e.g, The John R. Doe Revocable Living Trust #1?

3. To distinguish the trusts from each other in Treasury Direct account registrations, I can create the trusts on different dates, and not have to include the trust names in the TD registrations, since the dates will differentiate them. However, it would be easier and cost less in notary fees to create all the trusts on the same date, and include the trust names in the TD registrations. Would this work?

4. As for what to put in the trust property list, in the create a trust with software post, a reader commented “‘U.S. Treasury I Bonds acquired in the trust’s name.’ Note that this doesn’t specify whether the bonds are acquired before or after the date of the trust, so no need to amend after buying the bonds” This sounds reasonable. Is this OK?

Thanks.

Harry Sit says

I’m not a lawyer. You’ll have to make a judgment call on (1) and (2) if you can’t find answers in the Clifford book or Willmaker. To your question (3), the name of the trust is more meaningful to me than the date. I’ll want it in the registration if I have enough space for it. See reply to comment #55. I put in my property list “TreasuryDirect account ___________.” Then I filled in the account number by hand after I opened the account.

Anonymous says

If I own I Bonds and T Bills in my TD personal account and want to transfer ALL I bonds in the account to an irrevocable trust.

The transfer form has 3 options: Transfer (1) ALL securities in the account; (2) securities described on the attached list; or (3) the securities described below.

Can I elect option (2) and just say ALL I Bonds in account?

Harry Sit says

I don’t know. I would just copy the I Bonds holdings to an attached list to make it clear and explicit which ones I’d like to transfer.

Anonymous says

I Bond owners can elect to recognize income on an accrual basis. I was informed by TD that if I make that election, the Accrual method will apply to All I bonds I own — including future purchase. If that true for the lifetime of the account? e.g. I sell all my I bonds; then 6 mos later, I bought more I bonds. Am I still required to use the accrual method?

And If I own I bonds in my personal account and a trust account, can each account elect its own method — i.e. one on cash method and the other on accrual method?

TIA

Harry Sit says

How to recognize income for tax purposes is a matter with the IRS. It’s not linked to your TreasuryDirect account. It applies to you as a taxpayer. Your personal account, your revocable living trust, and if you’re married filing jointly, your spouse’s personal account and revocable living trust, are all included.

The IRS describes Method 1 and Method 2 in Publication 550 (starting on page 7). You can change back and forth, but my impression is it’s a calendar year by calendar year election. The default is to postpone (Method 1). If you choose to start paying every year (Method 2), you pay up all the postponed interest through that year. If you choose to go back to postpoing, you use a specific procedure described in Publication 550 to request permission from the IRS.

Method 2 is more complicated. See Taxes on I Bonds Get Complicated If You Go Against the Default.

Livia J Squires says

Hi Harry, I was curious about this line in your article: “Be sure to link a bank account that you’ll keep using forever.” What happens if, for example, I move to another state and wish to close the original bank account? Thank you!

Harry Sit says

You’ll have to get someone at your new bank to sign a form and apply an official stamp. Not all banks know what to do or agree to do it. See Where to Get a Signature Guarantee for I Bonds at TreasuryDirect.

Rishi says

Are you sure about the fact that the same bank account can be used for a personal and trust accounts? I’m not an attorney but some blog posts by attorneys seem to indicate that you are indeed required to have a separate bank account for each trust. This makes sense, as the trust is a separate legal entity and commingling of funds is usually a big no-no.

Harry Sit says

You’re not commingling funds. When you link a personal account, you’re adding assets to the trust when you buy or removing trust assets when you sell, both of which are allowed in a revocable trust. If you have irrevocable trusts or if you’d like to keep trust assets in the trust at all times, you need to link a separate bank account for each trust.

Anonymous says

According to the TD web site, more than one bank account can be used to fund an account. So does get around the problem of what happens if I want to close the original bank account used to fund the account? Thank you.

Harry Sit says

You get to add only one bank account at the time you open the TreasuryDirect account. You need to get someone at a bank to sign and stamp a form when you add another bank account. See reply to comment #62.

Ellbee says

Hopefully a simple question. I am confused by the distinction between a declaration of trust vs a trust agreement. I just set up a revocable trust for myself. I’m single so there is only one grantor (me) and one trustee (also me), and my trust document says “Trust Agreement,” not “Declaration of Trust.” You say at the beginning of this article that if the trust was set up by an agreement, you have to list both the grantor and trustee. But Pub 0049 says that if they are the same person, you use the wording “[my name] Trustee Under Declaration of Trust Dated MM/DD/YY” (it says nothing about declaration vs agreement). ALL of the examples given in Pub 0049 that use the word “agreement” include either more than one than one trustee/grantor or the trustee and grantor are different individuals. The only example where trustee/grantor are the same person uses the wording “declaration of trust,” which you seem to be saying is different from a trust agreement. So do I put “[my name] Trustee Under Declaration of Trust Dated MM/DD/YY” (which Pub 0049 says to use if the grantor and trust are the same person, but it does not address the declaration vs agreement difference) or do I use “[my name] Trustee Under Agreement with [my name] Dated MM/DD/YY”? Thanks!

Harry Sit says

Your trust document says whether it’s a declaration of trust or a trust agreement. An agreement with yourself is still an agreement. It doesn’t turn a trust agreement into a declaration of trust.

Ellbee says

Harry, that doesn’t answer my question on the wording though. Why don’t any of the IRS agreement examples use the same name? Their instructions just say to use “declaration” if grantor/trustee are the same person. There is no text that says that wording is for declarations only, not for agreements with yourself.

Harry Sit says

A declaration of trust and a trust agreement are two types of documents. Your trust document says which type it is. A declaration of trust has the same person serving both roles. A trust agreement can also have the same person serving both roles. Showing examples with different persons for the two roles doesn’t mean all trust agreements must have different persons or all documents with only one person must be a declaration of trust. When your document is a declaration of trust, use the template for declaration of trust. When your document is a trust agreement, use the template for trust agreement.

Chadk says

I’m clueless in this department too, but I found this explanation very helpful, where it states:

“If you are the sole trustee of the trust, the document with which it was created is called a “declaration of trust”. If there is an additional trustee, the document used to create the trust is called a “Trust Agreement”. ”

This would seem to jive with the info provided by TD.

Jacquie Traub says

Read your trust document. On the first page it will specify whether it is a declaration of trust or if it is a trust agreement. As Harry already said, use the wording for the type of document your trust is.

Roger says

My wife and I each have our own individual accounts. Yesterday, I set up trusts accounts. No issue. I made purchases yesterday under the trust and overnight received a message that it was rejected since I exceeded my annual limit? Not sure why?

Full disclosure…i also purchased gifts yesterday from our individual accounts . The rejection email didn’t reference which transaction was rejected but am assuming it’s for the trust purchase and not gift.

Harry Sit says

Check your accounts to see which purchase went through. Don’t assume. Maybe the gift you thought you were buying inadvertently defaulted to the registration for yourself?

Roger says

Thanks Harry. Surprisingly, I can’t tell after logging in to each account. All the $ are showing as if the transactions went through. I thought I would see the same message that was in the email but I don’t see it.

I noticed nothing is showing under the gifts section but this may be due to the 5 day holding period.

Harry Sit says

Click on History in the top menu, and then Security History. It shows a list of your purchase requests. Going into each request shows the registration in that purchase request. If your intended gift purchase has your name as the owner, and you already bought the full $10,000 for yourself, that explains why you received the email.

Roger says

Thanks. That might be it. registration shown my name under the security section. Odd because I setup my wife as the registrant and clicked ‘gift’. At least I thought I did.

Ustaad says

Currently, getting a refund takes sixteen weeks. I used the default registration instead of the one for the gift and had to wait for at least 8 weeks before I lost my patience. I called treasury and after over an hour wait got human agent on the phone and she edited the registration to make it as a gift. If you insist on getting a refund, it’ll take about 16 weeks and you’ll lose interest for 4 months.

Susan Gluck says

Hi Harry,

I’m not very knowledgable when it comes to buying an IBond for our revocable trust. In filling out the form, I got stumped on the date. Our trust is called “Amendment and Restatement of Name 1 and Name 2 Revocable Trust.” When we’re asked to include the date on the application form, should we put the date of the original trust (same names, and addresses, except we got married) or the date of the amended and restated trust? Thanks much!

Susan

Harry Sit says

The original date.

Susan Gluck says

Thanks so much! I feel so lucky to have run into the Finance Buff and your information about IBonds. What a difference this has made to my outlook (and feeling of well-being)!

Frank says

Regarding the individual trusts for married couple, can I just put a portion of my individual assets say my Roth IRA or 401K into the trust for her to manage or do I have to put my total asset (individual retirement + taxible accounts) into the trust?

Harry Sit says

Her trust doesn’t need any other assets except the I Bonds it’ll buy.

Brian says

I’m confused by the “the trust cannot be the beneficiary” statement. Planning to buy $20K under two personal SSN’s for married couple. It think I will use the And/Or naming processing for ownership (person A and/or Person B). I assume I will need a beneficiary and it can’t be the trust? Also, may want to buy $10K more in the trust name which wouldn’t need a beneficiary would it?

Harry Sit says

A TreasuryDirect account can’t name a trust as the beneficiary for the I Bonds it owns. The beneficiary has to be a person. A trust’s TreasuryDirect account can’t name any beneficiary. The trust itself of course has beneficiaries in the trust document.

Mary C Levins says

If the TreasuryDirect account is in the name of a revocable trust, will a 1099 be issued to the trust?

Harry Sit says

When the trust redeems I Bonds, yes.

Andy K. says

Further to Comment #18 above…. You state that TD does not like the approach of transferring an I-bond from a personal account to a trust account in the same year that a person buys the maximum in both a personal account and a trust account. What if the personal bond being transferred to the trust account was originally purchased during the prior year ? If that is possible, then could one do a “rolling” process whereby every year you transfer the bond from last year’s personal account to the trust account this year (while still funding a new personal account and trust account this year) ?

Thanks for all the info and helpful responses !!

Harry Sit says

A transfer counts toward the annual purchase limit of the receiving account. It doesn’t matter whether you’re transferring old or new bonds.

Brooke says

Hello,

I have an individual account where I have I bonds. I just learned that I can open another account with my living trust that I have had for many years. This trust does not have a different EIN number. I am assuming I use my SSN, but I have no idea what the IRS name control number is since my accounts titled under my trust it is filed in my personal return with my SSN.

I also have another GST exempt trust in my name that was created after my mom passed. That trust has a different EIN number but I cannot figure out what the IRS control number is for that trust is. My concern is what if I put the first 4 letters of my last name for both trusts as the irs control number. Will that be a problem. Thank you in advance. Brooke

Harry Sit says

The IRS Name Control for a trust is the first four letters in the name of the trust. Many people with different tax IDs have the same first four letters in their last names. It’s normal to have the same IRS Name Control in different accounts.

Brooke says

Thank you so much for responding so quickly!! So for example, if one trust was called the Jack Jones living trust and the other was called the Jack Jones GST exempt trust under ………. So then the name control for both; one with a SSN and the other with an EIN number would be JONE. I am just asking because I saw some examples where the name control was the first 4 letters of the first name.

Harry Sit says

The IRS says this about the Name Control:

“If you did not use a business name and instead used your individual name, your name control will be the first four letters of your last name. … … If you applied for your EIN using a business name, the name control is assigned from the first four characters of your business name.”

https://www.irs.gov/businesses/small-businesses-self-employed/how-your-name-control-is-assigned

Therefore Jack Jones living trust using Jack’s SSN should use JONE. Jack Jones GST exempt trust using its EIN should use JACK.

Brooke says

Oh, I did not know that a generation skipping trust created for a child of a deceased parent was considered a business. It is so confusing??

Harry Sit says

The trust isn’t considered a business. That page happens to be for businesses, but it shows how the name control is assigned for an entity versus a person.

MIckie Pitts says

The article states “If you see I Bonds as an investment, it’s true you can’t dump $500,000 into I Bonds in one shot?” Can you explain how this can be done? This would be done in a Revocable Trust.

Mickie Pitts says

Adding to the question the max amount is still only $10,000? What if you have a Personal Account can you still purchase them in the trust?

Harry Sit says

The annual limit is $10,000 per trust. You can buy $10,000 each in your personal account and trust account.

ed says

Hello

To buy extra I-BONDS before end of APRIL, can I go ahead and buy them under the upcmoning revocable trust and then create the Trust ASAP.

In fact I have the Trust created, but have to do notary.

Thanks

Harry Sit says

No, your trust doesn’t exist until you sign it in front of a notary. Having it notarized takes no time though. You find a notary public in a UPS Store near you.

Frank says

Opening a trust account seems simple but I do not have a question regarding “Account Manager ” of an individual Trust Account

In a Revocable Living Trust of the State of Connecticut, the Grantor (Husband) also serves as the primary trust and the Acting Trust while the Grantor (Husband( is not incapacitated. Only under the death of or during incapacity of the Grantor (Husband), then Wife will serve as the Acting Trust.

So the question about opening a TreasuryDirect trust account, who is the Account Manager? Husband or Wife?

Harry Sit says

Husband is the Account Manager. When Husband dies or is incapacitated, Wife changes the Account Manager to herself. See “After You Die” section in this post.

Frank says

My wife and I have two individual accounts. Can we create another joint trust and put joint asset (say rental Real Estate) into it and buy another $10,000 beyond the $20,000 purchased throughout individual trusts?

Harry Sit says

It’s addressed in the “Multiple Trusts” section. A person can have more than one trust. A trust can hold other assets but it can also hold only I Bonds.

Tom says

Hi Harry,

I called Treasury Direct and asked them this very question, as I have a trust with my wife using my SSN for the trust. They stated — I am paraphrasing — the amount of I bonds that are allowed to be purchased electronically is directly corresponded to each SSN. They said it doesn’t matter if that SSN is related to a trust or an individual and that, if I purchase in my trust that uses my SSN, I am not allowed to purchase in my personal account using the same SSN. So, for a married couple, that would be limited to 2x$10,000 maximum purchase per calendar year.

I am not saying the website stops one from purchasing more than $10k in I bonds for a SSN, but they stated very clearly, it is not allowed. If the trust had a different TIN, then, according to them, that would be allowed. Otherwise, theoretically, one could open multiple trusts and purchase multiple batches of $10k in I bonds…

Leslie says

I purchased ibonds for my husband and I at the end of last year and again early this year and then again in our newly formed revocable trusts (we have separate trusts) which use our SSN’s. The website did not stop me and I even emailed them to ask if I had used the proper name of the Trusts (I hadn’t and they corrected it for me). I have not been notified that it is not allowed to use my SSN to open more than 1 trust.

Tom says

Hi Leslie,

we can certainly use our SS# in a trust. Probably more than 1 trust (I don’t really know).

This comment was about the $10k limit on I bonds — being linked to one SSN (not linked to specific accounts). For instance, you cannot receive an additional 10K in I bonds as a gift, just because it was purchased in a separate account. Because the SSN is linked to purchase limits (according to what I was told).

Did you exceed $10k in I-bonds per social security number within a 1 year time frame? As in –are you saying you bought (up to) $20K in I bonds in the same year, under the one SSN? 10k of which was in a personal account and 10k of which was in your entity (Trust) account?

From my personal experience – personal accounts are not linked directly to entity accounts — they require different account numbers. And you have to login separately. So TD may not have a way of stopping you from making separate purchases (up to $10k in a given account) — I honestly have no idea.

My only point was, they explicitly stated exceeding $10k in I bonds — for a SSN — in a calendar year is not allowed.

The name on the trust isn’t a factor. The only factor they seemed to care about was the SSN/TIN.

Does this mean, we can physically do make the purchase of I bonds if the site let’s us? But we are not supposed to do so? What are the penalties for exceeding the 10K limit?

Tom says

Hi Harry,

Since what the Treasury Direct representative told me doesn’t match what is written above: “They allow you to do either one of the following but not both:

Buy $10,000 per calendar year in a personal account and another $10,000 per calendar year in a trust account; ”

Does that mean the representative had it wrong? Or that the site allows one to do so, but it’s technically not allowed?

Harry Sit says

Not all customer service agents know the correct answer. See comment 36 for a different answer from a different customer service agent. Go with whichever answer you feel is more credible. I’m going with what I wrote. I have both a personal account and a trust account using the same SSN. I bought $10,000 in each account in both 2021 and 2022.

Tom says

Thanks Harry. Found a few other discussions about this as well. Seems like the biggest issue is to not attempt to transfer the bonds from personal to trust and vice versa — at least not before one is finished buying I Bonds altogether, as you also indicated.

And also appears, different customer service agents “interpret” the rules differently, but either way, the online site generally allows each account: personal + trust to max out to $10k in I bonds . Thanks for this article, as I had called TD about this whole situation a while ago and was led astray…

Leslie says

Hi Tom,

Yes, to your question: Did you exceed $10k in I-bonds per social security number within a 1 year time frame? As in –are you saying you bought (up to) $20K in I bonds in the same year, under the one SSN? 10k of which was in a personal account and 10k of which was in your entity (Trust) account?

I created 2 different accounts- 1 for personal and 1 for the trust- and they had the same SSN. I put 10,000 in each for this year. My husband did the same.

Larry says

Let’s say my wife and I each have a personal TD account and we have a third account which is an entity account for our revocable trust so that we may buy a total of $30,000 I-bonds per year. The I-bonds in her account show me as co-owner; those in my account show wife as co-owner. If I die first, can she transfer all bonds held in my account to the trust account and continue annual purchases of I-bonds through both the trust and through her account? And what difference does it make if we list each other as co-owner vs beneficiary?

Matt says

What happens if I set up a trust for my I-Bonds, with my wife as beneficiary and both of us die? And if I DIY this, do I “add” in the I-Bonds when I set the trust up or leave it empty and amend it letter on Schedule A? Thanks.

Burt says

I believe there is no beneficiary available in the TD Account setup for a Trust.

The trust document provides what the successor trustee/s will do with the assets.

I left the TD account # blank in my Schedule A of assets to be in the trust until I set up the TD account for the trust and had the account number, which I then wrote on the schedule. My trust was a diy type using Nolo.com software.

Harry Sit says

You say in your trust who will be the trustee and who should get the assets when both of you die.

Frank says

Confirmed, Treasury will pay out 9.62% interest rate for the next 6 months

https://www.cnbc.com/2022/05/02/i-bonds-to-deliver-a-record-9point62percent-interest-for-the-next-six-months.html

Ami says

Thanks so much for this great information. We bought the book you recommended and created two shared trusts for purposes of buying I-Bonds. Since our trusts have both our names linked by “and”, I know we’ll need to send the pages of our trust documents in to Treasury Direct to demonstrate that one of us can act without the other within the trust. My question: can we buy I-Bonds as soon as we register our trust accounts with TD and send the paperwork in later? Or will they not allow us to buy I-Bonds until they receive the paperwork. We haven’t completed the trust documents yet. Is there an easier way to create shared living trusts and avoid having to send in the paperwork? Thanks again for all your help!

Jacquie Traub says

My husband and I also opened two shared trusts for the purpose of buying I-bonds. But we named our trusts without using both our names. We called them each something like: The Bluewater Security Living Trust. So we didn’t face that extra step of confirming that we could both act separately.

If you got the Quicken Willmaker & Trust book/program, they do name your trust using both your names connected with an “and.” Here’s the workaround:

In the last step of creating the document (“Previewing and Printing”), we clicked on the File menu at the very top and “exported” the trust into rtf format from which we could make changes, (although Nolo admonishes you not to.) We then changed the name of the trust to what we wanted. If you do that, remember to change the name throughout the trust document.

Ami says

Thank you!

Ami says

Dumb question: we used the downloadable forms from the Nolo book and it has a footer with page numbers 1 of 10, etc. that includes Schedule A (our only schedule) as the last page. But the Certification by Grantors and notary information is on the last page of the Declaration of Trust, which not the last page number listed on the footer since the footer page numbering includes Schedule A. Will this screw anything up if it’s notarized on page 10 of 11? Thanks for all your help.

Harry Sit says

You can remove the footer page numbers if that bothers you.

Ami says

Thanks for the lightening-fast response. It doesn’t bother me unless it’s an issue. The Schedule doesn’t need to be attached to the declaration of trust at all when the DT is signed and notarized, correct?

Harry Sit says

It needs to be attached but the notary public doesn’t read the content of your document or care about the page orders. They only confirm who signed the document.

Ami says

Do we sign Schedule too? Nolo doesn’t have any signature lines in the schedule. Thanks so much for your help! Sorry for all my questions.

Harry Sit says

You don’t sign the schedule. That’s why it doesn’t have any signature lines.

Paul Stifel says

We have purchased I bonds on two TD accounts over the years; we also elect to get $5K of paper bonds in lieu of a tax refund. We don’t want to buy more I bonds each year than we do now–we want to avoid probate in the event both of us die in the same event. Several questions:

–will transferring our holdings to Trust account(s) avoid probate, even if the value exceeds $100K?

–will we still be able to somehow make the $5K purchase from our tax refund each year? Can these paper bonds be titled to one of our trusts?

–if we both perish at the same time, the joint personal bank accounts we’ve used to fund purchases will be frozen or closed. Do we need to/or can we open a bank account in the name of our trust(s) before embarking on this activity?

–tax reduction is not one of our objectives, however we don’t want to increase the taxes in settling our estate. Will establishing trusts be neutral in this regard?

Thank you for your help and expertise, Harry.

Harry Sit says

If you already have a trust for your other assets, you can certainly open a new account for the trust and transfer your existing bonds to the trust account. Assets in the trust account avoid probate regardless of size. If you don’t need a trust for your other assets, and you’re not trying to buy more I Bonds, creating a trust only for holding I Bonds may be overkill. Naming an adult child or relative as the second owner or beneficiary on the bonds in your personal accounts also avoids probate. They’ll get an early inheritance in case one of you dies. The surviving spouse will live on other assets.

I’m not sure whether the paper bonds from tax refund can be issued to a trust. Form 8888 makes it sound like it wants a person’s name on line 5a.

If you’re concerned about the joint bank account, you can open a bank account for the trust.

Putting assets into a revocable living trust doesn’t affect your taxes.

Juan says

Hi Harry – Thanks for your great blog!

I created a Trust account at TD with a Declaration of Trust document where I am sole Grantor and sole Trustee.

I am trying to make things easy for my Successor Trustee and Beneficiaries by finding out what has to be done upon my death.

What happens to my Trust account at TD when I die?

1 Does TD allow somewhere in the online Trust account to name the Successor Trustee?

2 Can I grant “View or Transact” rights in my Trust account to my Successor Trustee while I’m alive

(I only see that individual accts allow View / Transact rights) ? https://www.treasurydirect.gov/indiv/help/tdhelp/howdoi.htm#grantview

3 Can my Successor Trustee get control of the account WITHOUT a probate court order? TD Form 5446 says Declaration of Trust document along with death certificate should be submitted in order to change the “Entity Account Manager” to the name of Successor Trustee, but not clear if court order is needed.

4 Will the Successor Trustee need to verify identity with a signature guarantee ( like some TD account applicants encounter)?

If anyone has gone through this process, I thank you in advance for sharing any details of your experience ( like how long the review is and whether certified copies are required to be submitted, etc.).

Thanks all, and again to you, Harry, for all your great blog posts.

Juan

Harry Sit says

The successor trustee is only named in your trust. TreasuryDirect has no place for it. You can’t grant View or Transact rights on bonds held in a trust account. The successor trustee doesn’t need a court order to take over as the new Account Manager after you die. Form 5446 requires a signature guarantee.

Matt says

Now that I’m on your site again – what’s everyone’s thoughts on this?

With trust software:

Create a RL trust for my wife where she is the trustee and grantor – her SSN

Create a RL trust for myself where I am the trustee and grantor – my SSN

Create a RL joint trust for the both of us where we are both the trustees and grantors (her SSN)

Upon simultaneous death, all of these trusts would feed into the joint trust agreement that we have via our lawyer? This is under my SSN already and I already purchased the max for this year.

That’s four separate trusts with two separate SSNs – would this work or not work? Or would I only be able to set up two trust accounts with our two SSNs. Thank you again everyone.

Harry Sit says

It works if you don’t mind managing additional accounts.

Matt says

Thank you again – I’ll think about this one first.

Paul Stifel says

Harry, you said, “They just don’t like it when you buy in both accounts and still transfer from your personal account to the trust. Either keep two accounts separate and buy in both or transfer and only use the trust account afterward.”

If you ONLY buy in your personal accounts, but periodically transfer ownership to your Trust, would that be OK with ‘Them’, do you think? The Trust holds, but never buys.

We don’t want to buy more bonds than we do now (two accounts plus tax refund), we just want to get them into a Trust to avoid Probate if we die together. We also would rather have a single Trust, not two.

This is a Trust just to hold I-Bonds. The Trust and the bonds in our personal accounts will have both of our names on them.

Thanks, Harry!

Harry Sit says

A transfer counts toward the annual purchase limit of the receiving account. It will work as long as you keep to that rule. For example, when you have two individual accounts between a married couple, A and B, and a joint trust account T, both individual accounts A and B can buy the annual $10,000 maximum for say 5 years. You transfer from A to T in year 6, and you transfer from B to T in year 7. That should work.

Paul Stifel says

I meant to say “TD Trust Account”; I think transferring I-Bonds to a Treasury Direct account for a Trust is a different situation than transferring to a Trust via 5511? Or am I misreading the intent of 5511?

Brian Berberet says

Please help me understand the mechanics of this example you present:

“When you’re done with buying the maximum in both accounts and you wish to only use one account going forward, you can complete the Transfer Request Form FS 5511 and consolidate your holdings into one account.”

Are you saying each spouse buys $10K of I Bonds in Year 1 and then in Year 2 they transfer the $10K+ interest in the individual’s account into their Revocable living trust, close the individual account and call it a day? OR are you saying that each account buys I bonds for a few years and then in year 4 or whatever they transfer all the $40k+ of assets from the individual account into the Revocable Living Trust account and then shut down the individual account and you refrain from buying $10k of I Bonds in the Revocable Living Trust in that transfer year? I will stop there even though I have a few more questions! Thanks!

Paul Stifel says

All three accounts stay open indefinitely. The personal accounts are ‘buying’; the trust account is ‘storing’ bonds transferred from the personal accounts (maybe leaving a single bond in the personal accounts to keep them open). I don’t understand why TD has no problem with buying in both types of accounts but doesn’t like transfers unless the accounts being transferred from are closed out. I guess we could transfer, close the personal accounts and then open new personal accounts–over and over.

Brian Berberet says

Paul I am not sure who you are or your expertise in this area. It is likely much more than mine! However you present 3 accounts where Harry only presented two accounts in his example, so already your reply seems a bit out of context to the example presented. I am going to defer to Harry’s reply if he is gracious enough to reply. Thanks in any case!

Harry Sit says

I was referring to an individual with both a personal account and a trust account. This person can buy $10k each year in each account. Say they want a total of $100k in I Bonds. So they do that for five years. Then they transfer the $50k from the personal account to the trust account in year 6 and don’t buy any in the trust account that year.

Brian Berberet says

Thanks so much Harry! That is what I thought and how I read your piece. A friend and I had a differing interpretation of what you shared and Treasury Direct’s information on the topic overall. It looks like he will be buying me a beer! Enjoy your site and I will definitely pick up a copy of your book.