One limitation of buying I Bonds is the annual purchase limit. Each person can buy a maximum of $10,000 per calendar year as the primary owner. See How to Buy I Bonds.

If you see I Bonds as an investment, it’s true you can’t dump $500,000 into I Bonds in one shot. However, if you see I Bonds as another account, the $10,000/person limit is higher than the annual contribution limit for an IRA. You never hear people say you shouldn’t bother contributing to an IRA because the limit is only $6,000 or $7,000 per year. People go to great lengths to contribute to their IRA with a backdoor Roth.

In addition, if you have a trust, you can buy another $10,000 per year under the name of the trust. A lawyer created a revocable living trust for us back in 2018. It was surprisingly easy when I opened an account for the trust at TreasuryDirect last month. It took only 15 minutes to open a new trust account and buy another $10,000 of I Bonds.

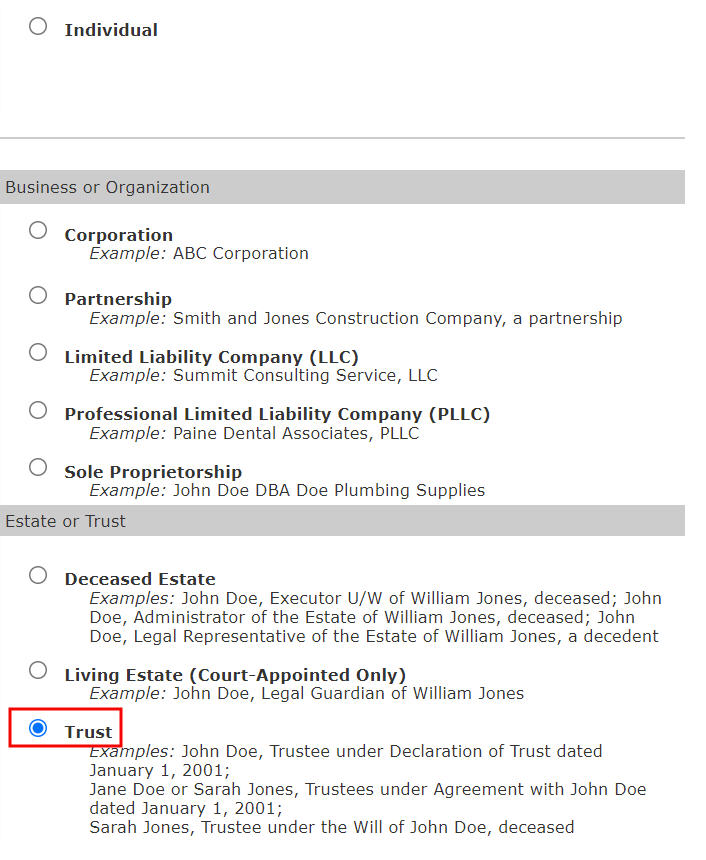

Entity Account

When you open a new account for the trust, you open an Entity Account with the type Trust. A trust account is one type of entity account. The other types include corporation, partnership, LLC, PLLC, and sole proprietorship. Please read Buy I Bonds for Your Business if you have a business.

Registration Name

TreasuryDirect has instructions for opening an entity account. The instructions look complicated but it’s not that bad if you read closely. The most tricky part is the name of the trust account. If your revocable living trust is created by a trust agreement, they want the registration to include both the trustee(s) and the grantor(s). If it’s created by a declaration of trust, they want only the trustees.

My wife and I have a joint trust. We are both trustees and grantors. The trust document says “Trust Agreement” at the top. So the name of our registration becomes:

Person A or Person B, Trustees, [Name of the Trust] U/A with Person A and Person B dated [Month Date, Year]

The second trust we created using software says “Declaration of Trust” at the top. So the registration of this second trust is:

Person A or Person B, Trustees, [Name of the Trust] U/D/T dated [Month Date, Year]

The instructions include a list of approved abbreviations. “U/A” stands for Under Agreement. “U/D/T” stands for Under Declaration of Trust. They allow 150 characters in the registration. Although the registration looks long, it fits within 150 characters. TD FS Publication 0049 also has more examples for trust registrations.

Tax ID

A revocable living trust typically uses the grantor’s Social Security Number as its Tax ID. The trust account at TreasuryDirect can still use the grantor’s Social Security Number even though the grantor also has a personal account with TreasuryDirect under the same Social Security Number.

Email Address

The trustee acts as the manager of the trust account. TreasuryDirect wants an email address for sending one-time passwords and notifications. You can use the same email address if you’d like when you also have a personal account at TreasuryDirect.

Bank Account

The new trust account needs a linked bank account. The bank account doesn’t have to be under the name of the trust. It can be the same personal bank account linked to the grantor’s personal account at TreasuryDirect.

Between the personal account and the trust account, the Tax ID, the email address, and the linked bank account can all be the same if you’d like. The account number and the account type are different.

TreasuryDirect doesn’t do any random deposits to verify the linked bank account. You can enter an order to buy as soon as you create the trust account. Make sure you give the correct bank account. If the debit bounces, your account will be locked and it’ll take effort to unlock it.

Joint Trust or Separate Trusts

Some married couples have separate trusts for each spouse. If you have two trusts, you can open a separate account for each trust and buy another $10,000 of I Bonds every year in each account.

It’s also not uncommon for a married couple to have a joint trust, in which they are both the trustees and the grantors. Although the trust can use either grantor’s Social Security Number as its Tax ID, I don’t think it can use two different Tax IDs simultaneously. If you have one joint trust, the trust can open only one account under one Tax ID and buy $10,000 per year in that one account. If you’d like to buy another $10,000 per year, you need a second trust. We used to have only one joint trust. We created a second trust with software (see below).

In addition, if the joint trust has two trustees and the trust has the word “AND” between the trustees, TreasuryDirect wants to be sure that the trust allows either trustee to act alone on behalf of the trust (versus requiring the consent of both trustees). They want documentation to demonstrate that’s the case. Please read the official instructions for what they need and where to send them.

Multiple Trusts

Some people have multiple trusts, with different beneficiaries, funded with different assets, etc. As long as each trust has its own signed and notarized formal trust document, it’s a separate trust from the other trusts even if all the trusts use the same tax ID for tax purposes. Each trust can open a TreasuryDirect account and buy up to $10,000 in I Bonds each calendar year (see comment #36 for a confirmation from TreasuryDirect customer service).

Create Trust by Software

If you don’t have a trust and you don’t otherwise need one, you can still create a trust just to buy more I Bonds. It may not be worth it if you have to go to a lawyer but if you make it really simple, you can do it with software. See Create a Simple Revocable Living Trust with Software for I Bonds.

Keep Them Separate

A trust can’t be the beneficiary or the second owner on I Bonds. The beneficiary or the second owner has to be a person (see the previous post I Bonds Beneficiary vs Second Owner in TreasuryDirect).

Although there’s a way to transfer existing bonds held in a personal account to a trust account, TreasuryDirect doesn’t like it. They allow you to do either one of the following but not both:

- Buy $10,000 per calendar year in a personal account and another $10,000 per calendar year in a trust account; OR

- Transfer existing bonds from a personal account to a trust account (for example after you set up a trust) or transfer existing bonds from a trust account to a personal account (for example right before you revoke a trust).

You’ll get a stern warning if you buy the maximum in both accounts and transfer from one account to the other in the same year because a transfer counts against the annual purchase limit of the destination account. So if you’re buying the maximum in both a personal account and a trust account, you should just keep your personal account and your trust account separate. Designate a second owner or a beneficiary on the bonds in your personal account and grant the necessary rights. See the previous post How To Grant Rights on I Bonds to the Second Owner or Beneficiary.

When you’re done with buying the maximum in both accounts and you wish to only use one account going forward, you can consolidate your holdings into one account in a year when you’re not buying I Bonds in the destination account. Go to ManageDirect and then “Transfer securities.” It may ask you to use FS Form 5511 and get a signature guarantee.

After You Die

The trust account has only one Account Manager. After the designated Account Manager dies, a co-trustee or a successor trustee must take over as the new Account Manager. The co-trustee or successor trustee needs to fill out FS Form 5446 to make the change and attach the required documentation.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Steve Johnson says

As always, I enjoyed reading your article. My understanding is that you and your wife are the grantors of your revocable living trust. To purchase more than the $10,000 annual limit, you have established at least two Treasury Direct accounts; one in the name of the trust, and a personal accounts in your name. Can the trust be designated as the beneficiary of the personal account? If so, wouldn’t that be the best way to ensure that the proceeds are distributed to your heirs without the potential bother of probate?

Harry Sit says

The trust can’t be designated as the beneficiary. The beneficiary has to be a person.

PDB says

I’m not sure if this has been covered or would be obviated by the $10k per account type ss#:

Similar to establishing multiple bank accounts and gaining excess FDIC coverage , could I establish multiple “payable on death” totten trusts (an informal revocable trust) with a different beneficiary for each, fund each with $10k, but use my ss# as I would for such an account at a bank?

Harry Sit says

“Payable on death” in TreasuryDirect isn’t treated as a trust. It’s only a “registration” within your personal account. It doesn’t increase your purchase limit. You need a formal trust document to open a trust account at TreasuryDirect.

John Letzkus says

can a trust holding an ibond gift another trust?

Harry Sit says

A trust can neither give nor receive a gift bond.

Mary F says

I read this as saying you couldn’t do this since my trust has the same SSN as I do. You have actually done this and it works?

https://www.treasurydirect.gov/indiv/research/faq/annualpurchaselimitchangeqa.htm

What is the annual purchase limit for U.S. Savings Bonds?

Effective January 4, 2012, the annual (calendar year) purchase limit applying to electronic Series EE and Series I savings bonds is $10,000 for each series. The limit is applied per Social Security Number (SSN) or Taxpayer Identification Number (TIN). For paper Series I Savings Bonds purchased through IRS tax refunds, the purchase limit is $5,000 per SSN.

Harry Sit says

Yes it works because the personal account and the trust account are of different account types. That Q&A must be talking about personal accounts only or accounts of the same type.

Jonathan says

I think it is tracked per SSN … so unless the revocable living trust has a distinct TIN, then it won’t work.

Tom E. says

I read the restriction the same way you do. The Treasury Direct website states “The limits are applied per Social Security Number of the first person named as owner of a bond or, for an entity, per Employer Identification Number”. So, it seems clear that, if your Living Trust does not have a unique EIN (and uses your SSN), the $10,000 limit would apply to both. But it does that their website might let you place orders in both account that exceed this overall annual limit. Regarding this, their website also states that “Any purchase in excess of $10,000 is in violation of the regulation and will be refunded; refunds may take up to 16 weeks. Continued violation may cause your account to be closed/suspended.” I emailed Treasury Direct to make sure I was reading this correctly. Unfortunately, their automated reply stated that “Due to heavy volume, we are temporarily limiting our communication by email” (and will not respond). But, from the language on their website, it appears that: (1) it’s possible to purchase $10,000 in both your personal and living trust accounts, even if they use the same number; however (2) at some point, the IRS will or may recognize that you’ve exceeded the limit and will refund the excess amount (whether or not you would be entitled to any interest is unclear); and (3) they might also suspend your account if you continue. Good luck. I would be interested in knowing if anyone that’s been doing this (putting the max into both a personal and trust account that use the same SSN) has ever had the IRS take the actions their website says they may.

Dunmovin says

Tom, I’ve had/have several accounts over the years at TD and some were a little more difficult than some to get off the ground but the most recent was over a year ago. It’s my understanding that an individual account and a trust account can have the same SS number with $10k for each for each year…that is the way mine works. Interest is currently posted for each and I continue to make purchases in separate years. I believe I’ve read where some have set up multiple (bona fide) TD trust accounts and of course they could have same SS numbers. I don’t have the time/inclination to do that. I also have business account with unique tax Id number (a pain to set up at TD but working fine for last year plus). Hopefully this helps

Philip Zion says

I asked this direct question to Treasury Direct customer service this morning and received an immediate “Yes.”

“Good morning

“I have a question about annual purchase limits for Series I.

“I am the trustee on a family living trust.

“Can I have an individual TD account and an entity TD account under the same SSN, to purchase $10,000 in each.”

Treasury Direct says “yes” 10/17/22 @ 8:31 AM.

Kevin says

I had wondered if I could have 2 accounts using my trust and actually wrote Treasury Direct last week. Their reply was a bit legalese but matched this blog post. So my wife and I could have 4 accounts beteen us. 2 trust accounts (with each of us as a lead) and 2 individual accounts. I just need the $40k to max them out!

Burt Peterson says

Kevin, is your Trust a single Joint Living Trust with you and spouse as Trustees or do you have two separate trusts? Thanks.

Kevin says

It is a single trust. But both of us have full authority to buy, sell, etc. So my understanding is that I could be lead on one account and she could be lead on other. Each would have separate lead and SSN. Is this incorrect? It doesn’t matter much to us (we are not positioned to add $40k per year) but could matter to others.

Harry Sit says

Our joint trust has two trustees but only one Tax ID. The Tax ID is designated in the trust document. It doesn’t matter which trustee acts on behalf of the trust. The trust’s Tax ID is still the same.

Burt Peterson says

Our Trust is a Joint Living Trust and is revocable, hence is considered a Grantor trust; as such, it does not have its own TIN but using the SSN of a Grantor. I’m wondering whether we can establish two separate Trust-type accounts at TD by each of us creating one using our individual SSNs. That is, it seems, what Kevin was initially referring to here. I have not tried this at TD, but it seems it should work since each Trust-type of account would have a different TIN (SSN).

Steve says

Burt, In your recent post you said that your revocable living trust does not have its own TIN but uses the SSN of a grantor of the trust. Like most revocable living trusts, my trust is similar to yours. My wife and I are grantors, but my trust documents specify that my SSN is to be used as its tax ID number. There is no allowance for the use of my wife’s SSN when transacting trust business. Since our trust uses my SSN, all taxable income that flows through the trust to me and my wife must be reported each year on Form 1040 under my SSN. All entities with federal tax filing requirements use just one TIN. Trusts are no different, and only the identification number specified in the trust documents can be used for trust business. Using someone else’s TIN for the trust violates the terms of the trust. Depending on the circumstances, such an act could be seen as fraudulent.

Kevin says

I think Burt’s reply is better than mine – I think we’d be limited to 3 accounts (2 individual and 1 trust). Now I just need $30k to fund them each year.

Burt says

I have reviewed my Trust document and it does not specify an SSN to be used as the trust’s TIN. Our attorney’s instructions state “You should give your own social security numbers when opening accounts in the name of the trust.” I am inquiring of him as to what that means for the TD registration and the proper use of our SSNs in this regard. Our trust documents expressly permit both community and separate property to be transferred “to the Trustee” and that such property is to be segregated and not commingled. Also that the Trustee may establish separate trusts ‘hereunder’ for each type of property. So, one trust document, but three revocable trusts – 1) Community property, 2) my separate property and 3) my wife’s separate property, each with distinct names. Perhaps that makes a difference.

Harry Sit says

I agree with Steve, although I’m not a lawyer. Each entity has only one tax ID. You can choose to use which grantor’s SSN as the trust’s tax ID, but the same entity doesn’t get two tax IDs simultaneously. The trustees may establish separate trusts “hereunder” for different types of properties but when did they actually do that? Where is the document that established the separate trust? You can’t create a separate entity only in your head. It’s OK to have another trust using a different grantor’s SSN as its tax ID but it should be documented. Either exercise the power in the existing joint trust to create another trust under it or create a whole separate trust using software. Give it a different name and have proper notarized signatures and all that.

Gerry Cruth says

Kevin,

Could you quote the TD response to your question please. It wopuld really be useful to have that reference.

Thanks

Gerry

erik says

this is interesting. I am just wondering if I have 10x$10K series EE bonds in my personal account with treasurydirect, can move them to a newly created account at treasurydirect that pertains to my revocable trust?

Harry Sit says

See the new paragraph at the end. It applies to EE bonds as well. You should keep them separate if you’re buying in both accounts.

Steve says

Since the revocable living trust can’t be designated as the beneficiary of an individually owned Treasury Direct account, what is the easiest way to ensure that the I Bond proceeds go to the owner’s heirs as specified in the revocable living trust when the individual I Bond owner dies? Shouldn’t the linked bank account be one that is in the name of the trust? Wouldn’t that ensure that the trust would be the recipient of the bond proceeds thereby eliminating the risk of probate?

Jacquie Traub says

That would not eliminate the risk of probate. Without a POD (or a co-owner) the bond would go through probate before the proceeds were released, regardless of their final destination, (ie, your bank account that is in the name of your trust.) To avoid probate and get the I-Bond (or the redeemed proceeds) to your “heirs as specified in the revocable living trust when the individual I Bond owner dies,” the Treasury Direct account could be opened in the name of your trust, (just like your bank account was,) rather than as an individual account.

Erik says

My question is related to Steve. I want my trust to be the beneficiary of my personal Treasury direct account (but I can’t your comment harry). Is there a work around to this problem? Can you sweep /redesignante to the newly established account pertaining to my trust that has no seed money yet ( I bond or ee bond)?

Harry Sit says

If you’re going to abandon the personal account and only use the trust account in the future, you can transfer the existing bonds from the personal account to the empty trust account. Fill out FS Form 5511 and sign in front of a certifying officer at a financial institution. Read the form instructions on taxes. When you’re considered as in control of the trust, the transfer is not taxable. They just don’t like it when you buy in both accounts and still transfer from your personal account to the trust. Either keep two accounts separate and buy in both or transfer and only use the trust account afterward.

Erik says

Meaning no taxable event.

Steve says

Harry, could you reply to my comment (#5) concerning the probate protection of linking a trust bank account to the personal Treasury Direct account rather than linking a personal bank account to it? This would keep the eventual cash payout of the I Bond under the umbrella of the trust. Do you agree?

Harry Sit says

During your lifetime, while you’re still mentally compentent, you can certainly redeem the bonds and send the proceeds to a bank account under the name of a trust. That’s just funding the trust with personal assets, as you’re allowed to do with any other assets. If you granted transact rights to a second owner, the second owner can do the same on your behalf.

After your death though, I’m not sure anyone can legally use your password to redeem your bonds. Any power of attorney ends with your death. If you don’t have a second owner or beneficiary on the bonds in your personal account, the bonds belong to your estate and your executor has to establish him- or herself through probate. If you do have a second owner or beneficiary on the bonds, those assets belong to them now and they can’t fund your trust when they’re not a grantor.

So to me, it still comes down to the same two choices:

A) Keep the personal account and add a second owner or beneficiary on the bonds. Grant the necessary rights. Take this distribution outside the trust into consideration in how you allocate the trust assets.

Or

B) Transfer everything into the trust account and abandon the personal account.

Eric L. says

Harry, enjoyed your article very much. I am a sole proprietor and I learned, after reading your article and following the links, TD allows an entity account for a sole proprietorship. It appears that I could open another account for the business and potentially purchase another $10k per year. Does that sound correct to you, and if the business is dissolved, I assume there would be some kind of form to transfer them or redeem them? Do you have any tips for this situation?

Harry Sit says

Yes, a sole proprietor account is another type of entity account. As the business owner, you should dispose of the business’s assets before dissolving the business. You can either sell the assets for cash and distribute the cash or distribute the assets in-kind. If you don’t want to sell the bonds in the sole proprietor account, use FS Form 5511 to transfer them to your personal account.

Eric L. says

Thank you Harry! Sounds like if the entity was dissolved or the bonds were transferred, it would be a taxable event. Good to know — I appreciate your answer! I will definitely be putting some of the things I’ve learned in this article into practice.

Burt says

I’m not clear that dissolution of a sole proprietorship or other reason for a transfer of I Bonds to the personal account of the sole proprietor would be a taxable event. The activities of a sole proprietorship are reported on the proprietor’s personal tax return (form 1040, Schedule C). The proprietorship is not considered a separate legal entity – it is the individual. Therefore the transfer seems that it would be, like a transfer from a grantor-type trust, considered to be from one account of an individual to another account of that same individual. I don’t see anything on the transfer document (FS Form 5511) which directly addresses the question. Does anyone have any insight into this?

Eric L. says

Burt, my best guess is that if the SP were to incorporate or be sold, that would be a taxable event if the assets are transferred from the SP to the new entity. If the SP is dissolved, those assets can be retained by the individual without tax implications, since the individual owns the assets in the SP, as you said. I can’t find anything conclusive either (if you have, please share!), but the above is what I’m going with for now.

Mark Heyerdahl says

I want to add a beneficiary to my bonds. The ManageDirect >> Registration List >> Add page shows inputs for both a “First-Named Registrant” and “Second-Named Registrant (Required for Primary Owner and Beneficiary registrations only.)”. Selecting the Beneficiary radio button requires filling out both Registrant inputs. I just want to register one beneficiary, not two…?

Harry Sit says

When you add a beneficiary, you will be the first registrant and the beneficiary will be the second registrant. So just put your information in the first registrant inputs and your beneficiary’s information in the second registrant inputs.

Bryce says

Since you’re referring to a revocable trust, what happens if the trust is dissolved, that is, revoked? Are they reissued with new ownership?

Harry Sit says

Similar to having a sole proprietor account in comment #9, as the trustee you should dispose of the trust’s assets before revoking the trust. You can either sell the assets for cash and distribute the cash or distribute the assets in-kind. If you don’t want to sell the bonds in the trust account, use FS Form 5511 to transfer them to a personal account.

Burt says

This looks like It’s very helpful. It seems that for a transfer between spouses and a grantor trust to grantor, there is no taxable impact of the transfer.

Is it true that one may combine I Bonds into a single account at any desired time? Are there limits to doing so?

Donald Geo says

Seems like the registration of a living trust has to have some real names and not just family trust? Any comments?

Harry Sit says

From the instructions:

“The wording in the registration must specifically identify the trust. The registration must state:

1. The authority or document creating the trust.

2. The date the document was executed. (Not necessary in the case of a probated will.)

3. The name of a trustee who is authorized to act alone on behalf of the trust.

4. Any information that is necessary to distinguish the trust from any other trust.

5. Name of the Grantor”

You have to include at least one trustee and all the grantors. See the example in the post.

Lil says

Hey Harry,

Did you have to mail in your trust documents? Is the registration name the actual name of your trust or something just for the treasury registration?

Thanks

Harry Sit says

I didn’t have to mail in or submit trust documents. They have special requirements on the registration name. The actual name of our trust is the “[Name of the Trust]” part in the registration name.

Harry Sit says

Sorry, I misunderstood your question. The registration name is only for TreasuryDirect to meet their special requirement. The actual name of our trust is specified in the trust document. The registration name includes the actual name of the trust plus the extra information.

Donald George says

Any insight as to why TD is so picky on the registration name? Of course not really allowing more then two people on the account causes estate issues if both people die. There must be a legal something that the registration name means something?

Those quicky cheap trusts online do not let you change the registration name and have only some generic Family Trust!

Harry Sit says

Donald – Please see replies to comment #14 above. The registration name is only for TreasuryDirect. You can still have a generic Family Trust as the name of the trust.

Eric L. says

Harry is right, you don’t need to change the name of the trust.

I just got my paperwork back to open the account (they wanted a signature guarantee that I had to mail in) and despite combing the TD site and submitting what I thought was correct, they updated the registration on the account to:

Eric Y. Lxxxx, Trustee U/D/T dated [Month] [day], [year] (The Eric Y. Lxxxx Revocable Trust).

Pretty sure this is what I submitted up front, but there must be some subtle difference and I no longer have the application form to check. This isn’t a family trust like your situation, but maybe it will help.

Side note, be patient. It took over 2 months from when I mailed in the signature guarantee forms to when the account was updated and accessible.

Harry Sit says

Eric – Thank you for sharing your experience. The signature guarantee requirement seems unpredictable. I wasn’t asked to go through a signature guarantee when I opened the trust account. I’m not sure how they decide who needs a signature guarantee and who doesn’t.

Chris says

The title and all commentary mentions revocable trusts. For the experienced I-bond people, do you know if irrevocable trusts are any different?

Harry Sit says

No difference. A revocable trust typically uses the grantor’s Social Security Number as the tax ID. An irrevocable trust typically has a separate tax ID.

John says

2 questions: 1) Do you have to have a revocable trust to open a Treasury Direct Trust Entity account or can you just apply for the entity account and start buying an extra $10k of I-bonds per year registered to said account ? 2) After a parent’s revocable trust becomes irrevocable upon death can new I-Bonds continue to be purchased for a TreasuryDirect entity account created with the EIN of the now irrevocable trust using irrevocable trust cash?

ANON says

I would have to assume buying i-bonds in the name of an entity that doesn’t exist would be fraud.

Josh says

Is there a particular reason why we would want to avoid reissuing i-bonds from a personal account to a trust account, for estate planning purposes? It seems like this would be the best way to avoid probate…although, given the paper forms required, I understand that there is some extra hoops to jump through for this protection.

Harry Sit says

I added some explanation in the “Keep Them Separate” section. If you’re buying the maximum in both a personal account and a trust account, you’ll get a stern warning if you also transfer from one account to the other in the same year. You can consolidate when you’re done buying the maximum in both accounts and only use one account going forward.

Jacquie Traub says

Harry, you said TD gives a stern warning if we reissue a bond from the individual account, to the trust account in the same year. But they don’t take any other action? And what if you do that reissue the following year. Are they okay with that?

Harry Sit says

Jacquie – Here’s the text of the warning email after they do the transfer:

“Your purchase exceeds the annual savings bond purchase limitation. Please be

advised the limit is $10,000 per series and TIN per calendar year. Repeated

violations may result in an action by this office; for example, a refund of

account holdings and/or account closure may occur.”

I haven’t heard of anyone who dared to do it again after receiving this warning. You can always test it to see whether they really mean it or they’re only issuing an empty threat.

However, because they have a monopoly in selling I Bonds, if you’re buying I Bonds year after year for the long-term, I would think you want to be on good terms with them and avoid getting this warning even for the first time. If you’re only buying I Bonds for the short-term, there will be a year when you won’t be buying the maximum in both the personal account and the trust account. That’ll be the time to do the transfer. Either way, I don’t see a good reason to test their boundaries.

Aileen says

Can you comment on the difference between “transfer” and “reissuance” of i-bonds to a trust account? The above-mentioned “stern warning” seems to apply to transfers, but I remain curious if reissuance is the better path to avoiding probate. Note there is also a different form to request a reissuance (Form 1851).

Harry Sit says

Transfer applies to bonds in an online TreasuryDirect account. Reissuance with FS Form 1851 applies to paper bonds.

Anon says

Hey Harry,

Thanks for the insightful blog post.

My spouse and I both buy I-bonds under our SSN. We also have an LLC (One rental property) with its own EIN number. Can we buy an additional $10k of I-bond under the LLC name?

Thanks!

Don says

Seems like the TIN number is the key. An easy match!

linda chen says

Do personal account and trust account need separate log in ID and password?

Harry Sit says

The account numbers are different. You use your account number to log in. You can set the password to the same if you’d like.

Bob J says

The treasury direct help page says “If the legal name of your trust, as shown in your trust document, shows more than one trustee and the names are joined by the connector “AND” … you will be required to provide a Summary of Trust … or the appropriate pages of the trust showing that either named co-trustee may act independently.

The living trust for my wife and me does use the connector “AND” to join our names and my trust document says “Whenever the CREATORS conduct business on behalf of the TRUST for jointly owned property, both signatures will be required. Whenever either of the CREATORS conduct business on behalf of the TRUST for their separate property, only the signature of the property’s respective owner is required.”

So, is it possible for us to buy I Bonds under the name of the Trust somehow? If so, how do we comply with the requirements above?

Harry Sit says

The part you quoted gives the requirement for the CREATORS. Is there a separate section for the Trustees? Do you have one trustee or two trustees? If the trust has two trustees, how are they conducting business in a brokerage account? Does placing trades require two signatures?

Don says

You have to create a TD trust account. Give that registration a try! Keep us informed if you had to send them papers! Txs

Don says

What is curious about TD is that trusts are set up to have an ” easy” continuance managment of the assets. TD requiring a name seems to want to defeat this. But in the age of electronic transactions those with the logon password can make everything come out right!

DaveG says

I read a comment on another site that you could actually get $65k by adding two business accounts, also in the spouses’ name. Has anyone heard of this?

Harry Sit says

If they have two separate businesses, each business can open a separate account.

Bob says

Hi Harry,

really enjoyed all your I-bonds posts! I wanted to ask about tax rates and purchasing I-bonds in a trust.

Since the income tax brackets for a trust are quite low ($13,050 puts you in the 37% bracket), is it worthwhile to purchase I-bonds in them vs investing that money elsewhere? It seems at first glance you’d be taxed aggressively on any returns you might have.

Harry Sit says

A revocable trust doesn’t pay tax separately. It passes the income to the grantor. An irrevocable trust pays tax at the trust’s brackets only when it retains the income in the trust. If it distrbutes the income to the beneficiaries, the beneficiaries pay tax by their personal brackets.

Martin says

Harry,

Over at Treasury Direct I have an individual account limited to purchase 10K per year. I can set up an account for my business (a sole proprietorship) under a EIN or SS. If I set up with a EIN I am pretty sure I cay buy another 10K per year. If I set up the biz entity account with my SS will I be limited to 10K between both accounts (individual and business)?

Harry Sit says

A business is a separate entity from a person. That’s still the case even when the business happens to use the same tax ID as a person. Use whatever tax ID your business currently uses.

Ad says

Can i gift myself $10k series ibond through my revocable trust and then at same time purchase another $10k in my revocable trust, then purchase another$10k as an individual through my bank, and lastly purchase another $10k through my DBA? So all in all purchase $40k in series ibonds at same time?

Harry Sit says

A trust account can’t give or receive gifts.

Jacquie Traub says

Harry, Thank you for the great articles and for replying to all of our questions! I have another!! 😮

I’m trying to figure out how to register an account for my joint trust where my husband and I are both the trustees and the grantors, like you and your wife.

The TD FS Publication 0049 (https://treasurydirect.gov/forms/savpdp0049.pdf) states:

“When the trustee and the grantor are the same person, bonds are registered, “Trustee’s name” trustee under declaration of trust dated “date of trust instrument.”

When the trustee and the grantor are not the same person, bonds are registered, “Trustee’s name” under agreement with “Grantor’s name” dated “date of trust instrument.” ”

In your article, though you and your wife are both the trustees and the grantors, you chose the “Under Agreement” (U/A) clause rather than the “Under Declaration of Trust” (U/D/T). From the statement in the TD publication, I would think it would be the other way around. Am I missing something? Thanks for your input.

Harry Sit says

The trust document prepared by our lawyer literally said at the top such-and-such Trust Agreement, and in the opening sentence “This trust agreement is made on [date] between …” So I went with U/A. If your trust document says Declaration of Trust, go with U/D/T.

Jacquie Traub says

Ut oh! I jumped the gun and used your phrasing for our Trust account, and in fact, our Trust does say “declaration of trust” (not “under agreement.”) For individual accounts, you can edit registrations using the ManageDirect menu opton. But the Trust accounts do not include that option. Do you know a way to edit the registration of an established Trust Account that has a savings bond already purchased? Thank you for your help.

Harry Sit says

I don’t know how important that wording is or whether it’s a minor change that customer service can make for you. Please call TreasuryDirect customer service at 844-284-2676 during business hours.

Harry Sit says

Someone reported having long wait times on the customer service line. If you don’t get a reply via email, you can use FS Form 5446 to make changes to an entity account.

Don says

You would think the actual Trust paper work has to match the TD registration exactly to avoid issues when one really has to switch control under the trust. Just fudging the name on the reg just does not seem smart!

Tony says

We have the word “AND” in our joint trust name, does TD allow me to open a trust account immediately? or they need to do documentation verification like they do the signature guarantee for individual accounts?

“if the joint trust has two trustees and the name of the trust has the word “AND” between the trustees, TreasuryDirect wants to be sure that the trust allows either trustee to act alone on behalf of the trust (versus requiring the consent of both trustees). They want documentation to demonstrate that’s the case.”

Harry Sit says

Go ahead and try it. If they require documentation right away before you get to buy bonds, you can’t escape it. Otherwise you can mail in the documents after you buy bonds. See the official instructions for what documents they need and where to mail them.

https://www.treasurydirect.gov/indiv/help/tdhelp/help_ug_292-entityaccountslearnmore.htm#Trust

Don says

Anyone know of a DIY trust that lets you assemble the name of the trust in an acceptable manner for TD? I tried Quicken but just had some Generic family trust name, like all attorneys I have talked to wanted to do.

Harry Sit says

See comment #15 and the updated examples in the post. The name of the trust is included *as a part of* the TreasuryDirect account name. You can still give your trust a generic name.

Steve says

For opening up the Ibond for Trusts, is there any reason I can’t create an ITF with my spouse as beneficiary, and have her set up one with me as beneficiary. Or does it have to be a family type trust with the declaration for the additional 10k?

Harry Sit says

You need a formal signed and notarized trust document before you open a trust account. The trust document can be an individual trust or a joint trust.

Steven Crisp says

So my revocable trust has a name that is 62 characters long (because our full names are explicitly included in the trust name). I tried to follow your naming instructions, and ran out of space (because we have to list both of our names two more times). Am I missing something? What happens if the name cannot fit in 150 characters? Thanks in advance for a quick answer (from Harry, or anyone who feels they know the answer) — I’m hoping to get this account opened this year so I can purchase additional iBonds in 2021.

Harry Sit says

Based on comments #28 and TD FS Publication 0049, if your document is a Declaration of Trust, it appears the “by …” part can be omitted because it’s implied that the trustees and the grantors are the same in a Declaration of Trust. That publication has some more examples for the trust registration.

Steven Crisp says

Thanks Harry, that was helpful. Looking at that reference, I followed this example:

“Trustee’s name” trustee under declaration of trust dated “date of trust instrument.”

So, in our case it was “My name” and “Wife’s Name” Co-Trustees under declaration of trust dated “date of trust instrument.”

So far that has been accepted, and I was able to schedule a purchase of $10K I Bonds this year. Hopefully no issues down the road. If they follow up for the actual trust document, I have no problem providing that to them. “Co-Trustees” was the term used in our trust, which is why I used it here.

Lou Petrovsky says

I have several revocable living trusts. All the income is reported under my personal SS number. Will all of them qualify for the purchase of $10,000 I-Bonds annually, or only one such trust per year?

Harry Sit says

Buy in one trust first. Then check with customer service at 844-284-2676 on the others. I would argue all of them should qualify because they’re different entities under different trust documents, but check with customer service and see what they say. Be sure to report back so I can update this post to help others in the same situation.

Jacquie Traub says

My husband sent this question to Treasury.Direct via their email address.

From: J Traub

Sent: Saturday, December 18, 2021 9:35 AM

To: [email protected]

Subject: Trust Accounts

“I have two different trusts with the same TIN which is my social security number, but with different Trust names and purposes. Can I have Treasury.Direct accounts for both trusts, each with their own $10,000 purchase limitation? Thanks for your help.”

This is the response I received.

“From: [email protected]

Sent: Wednesday, December 22, 2021 5:07 AM

Subject: RE: Trust Accounts

Yes, John. You should be able to.

Barry

Securities Agent”

Note that it takes a few days for a response.

Harry Sit says

Nice. Thank you for sharing!

Jacquie Traub says

I can confirm that indeed, you can have Treasury.Direct accounts for multiple trusts that have the same social security number for their TIN. My husband and I both already had Treasury.Direct Trust accounts and we just opened two more trust accounts today that used my SS number and my husbands SS number respectively. So we now have a total of two trust accounts each using our respective SS numbers. The various trust instruments have different names and dates.

Joe Smith says

According to the IRS, “Separate EINs are needed if one person is the grantor/maker of multiple trusts…However, a single trust with several beneficiaries requires only one EIN.”

Source: https://www.irs.gov/pub/irs-pdf/p1635.pdf (bottom of page 8).

I don’t this applies if one and their spouse have only an individual trust each and a join trust. However, it sounds like if one were to create multiple independent revocable trusts, then one would have to request a different EIN for each of them. Does anyone have an opinion on this?

(It seems easy enough to request the EIN, as you can do online with IRS. I believe you have to have created the trust in question first. )

Another question. Say one creates several individual revocable trusts. Say one trust will have you book collection, another trust your vintage clothings, another your musical instruments, etc. Technically, I believe one could just put all such items in the same trust and assign the same or different beneficiaries for each. But say one wanted to put each of them in separate trusts for whatever reason. As far as I can tell, one can create as many individual revocable trusts as one wants and put whichever assets (with some restrictions or retitling necessary in some cases) one wants in each trust.

Does anyone have an opinion on this?

Harry Sit says

If a trust needs an EIN, separate trusts by the same grantor need separate EINs, but a revocable trust doesn’t need an EIN.

Gina says

Apologies if this has been covered already. Where on TD does one specify the tax withholding method for Bonds? We had setup our personal accounts many years ago and it is pay tax on maturity/withdrawal type. Not sure if that is the default. Now that I have setup the Trust acct (Huge Thanks to your instructions) I can’t seem to find info on the tax withholding for it. Any help on this matter is greatly appreciated.

Harry Sit says

Paying taxes on withdrawal/maturity is the default. TreasuryDirect doesn’t withhold taxes.

Gina says

Thank You!!! How does one change it to pay tax annually? TD is very vague about it. I looked at the following but no help there as to how to actually do it.

https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds_itaxconsider.htm

Looks like they do allow withholding of taxes but again no instructions or Form #.

https://www.treasurydirect.gov/indiv/research/indepth/tbonds/res_tbond_tax.htm

Paying taxes annually is what I want for my child in his low earning years and withholding is what I was looking at for our looming tax numbers. Two different problems. I am getting cross eyed reading Google searches on this matter. There would be a good market for a book on TD Bonds written in simple words, answering common needs. Hint! Hint!

Harry Sit says

The second link is about Treasury Bonds, not Savings Bonds. The first link is about Savings Bonds but the word “withhold” doesn’t appear anywhere.

Paying taxes annually works in theory but it’s very difficult to pull off in real life. It’s made difficult by these factors:

1) TreasuryDirect doesn’t issue any monthly or annual statements showing interest earned during the period. Just finding out what your bonds were worth as of the end of last year when you’re doing taxes in March is a challenge.

2) The value displayed in the account excludes interest earned in the last three months when the bond is within its first five years but you need to report that interest if you choose to pay taxes annually.

3) Interest rates change every six months but in different months for different bonds depending on the month of purchase. It’s difficult to calculate how much interest your bonds earned during the year.

4) The interest you report on your tax return is for the sum of all your bonds. If you cash out only one bond but keep the others, it’s difficult to figure out how much interest you already reported in previous years for that one bond you cashed out while you have a 1099 form showing all accrued interest to date for that bond.

5) If God forbid something happens to you and someone else has to do your taxes, they may not know you’ve been paying taxes annually and it’s very easy to pay taxes again when they have a 1099 in front of them.

6) If you pay someone to do your taxes, the extra tracking required to calculate interest annually easily costs more than the tax savings you may receive on a child’s tax return.

With all these complications, I say forget it. Just go with the default and pay taxes on withdrawal.

Lou Petrovsky says

For those of us who have elected to report interest on our tax returns on an annual basis:

We can track the value of each bond using a spreadsheet like Excel, using separate columns for principal and interest. The actual bond values, including accumulated interest on each bond, can be obtained at the end of each year using the Treasury’s site https://www.treasurydirect.gov/BC/SBCPrice

The site allows us to build, print and even save our bond inventory at the end of each year using December values, because bonds held for even one day in December earn interest for the entire month of December. On our spreadsheet we use separate columns for accumulated interest at the beginning of each year (= the end of the previous year), the end of the year, and the difference between end and beginning of the year, which is the interest earned for the year. Bonds redeemed during the year are input as well, except that we enter the redemption amounts instead of end of year values, so the current year’s interest is the difference between the redemption proceeds and the beginning of year values. By January 31, 2022, the Treasury (or our bank, if we redeemed bonds at our bank) will send us a Form 1099-INT showing the accumulated interest included in the total redemption amounts. When we prepare our 2021 tax return we enter the 1099-INT amount so the IRS can match it with the copy it receives from the issuer, then, on the next line, we back out the accumulated interest on those bonds as of the beginning of the year, with wording like “Minus – Reported in Previous Years” so that we are taxed only on interest earned in 2021. If spreadsheets are not our thing we should consider hiring a tax pro to do the computations, though of course that comes with a price. Either way, we need to realize that electing to pick up interest annually does mean having to keep careful track of each bond we own on an annual basis. As Harry has indicated, neither the Treasury nor the banks will do it for us.

Harry Sit says

The Savings Bond Calculator is helpful, but it’s explicitly stated as “for paper bonds only.” Also, the December redemption values don’t include interest in December. Holding a bond on December 1 and redeeming it on December 2 doesn’t earn the interest for December. You have to set the as-of date to January to include interest in December. For bonds within their five years, the redemption values don’t include interest earned in the last three months. It needs to be included if you’re reporting interest annually. The as-of date should be set to April for those bonds. If you do any partial redemption, you need some more adjustments.

Gina says

Good Lord!! Thanks a million for the advice! Yes. It would be a major headache to pay taxes annually on the Bond interest. Will not do it. Again, nowhere do I see advice like this. As for the links I included in my post above, sure glad I asked you. Else would have gone down another rabbit hole. Thanks again for everything you do to educate people on finance matters.

Ami says

Great, helpful article!! Sorry I could not find this answer in the Q/A comment section, apologies if I missed it. I have an individual TD account already using my SSN. I buy 10k I Bonds each year in that account. I also have a sole proprietorship and a revocable living trust. I have not opened any TD entity accounts for either of those, but are you saying that I could buy 10k under a TD entity account for my sole proprietorship, plus ALSO another 10k for a TD entity account for my revocable trust? So does this mean I can actually be buying 30k Ibonds per year under my SSN? Thanks in advance for any clarity!

Jacquie Traub says

That’s exactly right. The SSN is only one part of the account registration. The different names and types of entities qualify for their own account with the $10,000 purchase limit each. I have two separate revocable living trust accounts and an individual account, all using the same SSN, each with their own $10,000 bonds. But if I wanted, I could add a sole propietor account, or any of the other entities listed on the entites page at Treasury.Direct (assuming I had the type of entity/business listed.)

Lou Petrovsky says

“The Savings Bond Calculator is helpful, but it’s explicitly stated as “for paper bonds only.”

Agreed, but I found it can still be used for electronic bond calculations, though it cannot be used to print out and/or save our bond inventory. That was why I suggested creating one’s own spreadsheet, though admittedly it can be a hassle and may not suit everyone. We can use one of the face value (for I-Bonds, the principal) denominations on the calculator (say $1,000) as base amounts, then compute our bond values as of the required date using that base. Example: long ago, I had purchased I bonds electronically with a face/principal/issue value of $10,000 and in 2020 I redeemed $2,000 (total proceeds). My Treasury Direct account broke out principal and interest of $1,550 and $450, respectively. At that time I was able to prove that breakdown by using the paper bond calculator as follows:

Using $1,000 face as a base, the calculator came up with a redemption value of $1,290. Therefore, the total value of $2,000 included principal of 1,000/1,290 x 2,000 = $1,550, and interest of $450. So, those numbers matched the amounts shown on my electronic account to the penny. The adjustments that you noted would be needed for bonds less than 5 years old and for very recent purchases would need to be computed on a separate worksheet and transferred to the main worksheet. Again, I have to concede that all this effort may not suit everyone. For those who have elected to be taxed on an accrual basis and forego the default tax deferral, the annual Forms 1099-INT numbers for interest reported by the Treasury and/or bank can be compared with the computed amounts, though of course that will happen only in the new year.

Wishing you a Very Happy and Safe 2022!

Andy N. says

Is it possible to purchase Series I bonds in an IRREVOCABLE Trust, and if so are there any differences in the registration process? Happy New Year!

Harry Sit says

An irrevocable trust also works. See comment #16. The linked bank account probably should be in the name of the trust to keep the money within the trust after cashing out.

Ace M says

Is there a HOW TO on getting a qualifying i bonds trust for a single individual with no family? I am a disabled vet so all my income is tax free, i am the founder of an animal rescue non profit, i could temporarily name the NP as the trustee if that at all helps

I currently do not want to purchase any i bonds under the NP name and EIN

Harry Sit says

See Create a Simple Revocable Living Trust with Software for I Bonds. The referenced software and book work for both single individuals and families.

Steven H says

I would like to report savings bond interest annually to the IRS, and after reading the comments by Lou Petrovsky and Harry Sit, have a question.

I made my first savings bond purchase in November 2021 of $10,000 in electronic bonds. In the future I plan to buy both paper bonds with tax refunds and electronic bonds. I already use Excel for my personal finances and would like to use it to keep track of interest.

To find out how much interest to report to the IRS for the 2021 tax year, in the Treasury Direct calculator I entered an as-of date of April 2022, an issue date of 11/2021, and a denomination of $1,000. It gives an interest amount of $11.60, corresponding to $116.00 on $10,000. I then used Excel: 61 days (November + December) / 365 days * 7.12% * 10000 = 118.99. Wondering whether the calculator was looking at Feb + March, I tried 59 days, which gives 115.09.

What is the correct calculation?

Thanks.

Harry Sit says

TreasuryDirect calculates accrued interest off of a $25 base unit, rounds to the nearest cent, and then scales up to larger amounts. For two months of interest on $25 at 7.12% annualized interest rate:

25 * (1 + 0.0712/2) ^ (2/6) – 25 = 0.2932 => 0.29 after rounding

Scale up to $10,000: 0.29 * (10000 / 25) = 116

Now, it’s debatable which exact months you should use to calculate the increase in redemption values:

A) December to December (includes interest from December of the prior year through November, excludes last three months in the first five years);

B) January to January (only includes interest through September in the first year, 15 months of interest in the fifth year);

C) April to April in the first five years, January to January after five years (12 months of interest in all years).

If you decide to report interest annually you have to accept the ambiguity in exactly how it’s supposed to be calculated.

Steven H says

Harry, thanks for your response. Is this method of calculation documented anywhere? In comparison to calculation using actual days held, this sometimes results in slightly less interest.

For IRS reporting, I am thinking of using the following method that will reflect what a 1099 would show for a redemption the January following the tax year, and avoids reporting interest not realizable in such a redemption. Please let me know whether this method seems reasonable to you. My understanding is that in an ambiguous tax reporting situation, the IRS will accept a method with clear rules that are arguably reasonable.

– Within the first 5 years: Do not report interest for the last 3 months of the tax year, but report that interest next tax year. For each tax year, report the first 9 months + the last 3 months of the previous tax year. To obtain the incremental interest in the Treasury Direct calculator, the issue date is October of the previous tax year, and the as of date is the January following the tax year. For my bond purchased in November 2021, for 2021 there will be no reportable interest, for 2022 there will be 11 months (11/2021 issue date, 1/2023 as of date), and for each of the subsequent 3 years, 12 months.

– In the year of the 5th anniversary: report the entire tax year + the last 3 months of the previous tax year (15 months). In the calculator, this will again be October to January; the calculator will now not omit the last 3 months.

– Thereafter: the entire tax year (12 months), January to January.

Treasury Direct’s lack of annual and monthly statements is surprising. In a brief search I did not find online or downloadable calculators for this purpose, but found references to a Treasury Direct Savings Bond Wizard that is no longer available, that apparently offered more functionality than their present calculator.

Annual tax reporting is doable for me in Excel; I readily put together a simple spreadsheet that will get increasingly unwieldy over the years with more bond purchases, but should remain viable. A cleaner solution and/or monthly tracking would require more effort. I can use the Treasury Direct calculator to confirm the accuracy of the spreadsheet.

Harry Sit says

Interest rates change every six months and rates change in different months for different bonds depending on the issue date. A bond issued in January will have a different mix of rates than a bond issued in March. You should keep the true issue date for each bond in the calculator and not use October as the issue date for all bonds. Save your list of bonds in an HTML file (read instructions on saving inventory with Firefox). If you decide to use January-to-January, go with the redemption values as of January displayed in the official calculator. Compare with the redemption values as of January last year. Save a screenshot as your documentation. Don’t try to reproduce the redemption values on your own (too error-prone and can’t serve as the official values).

Lou Petrovsky says

Steven H, your suggestion makes sense. There is no requirement for investors who elect annual reporting of interest to notify anyone except the IRS that the election was made, so no form 1099-INT will be issued by the Treasury or the banks until, some day, the applicable bonds are redeemed and a Form 1099-INT is issued, at which point one will need to reconcile the Form 1099 amount with the aggregate of all amounts reported on the prior tax returns, and the difference will then need to be backed out on a separate line of the tax return (currently, IRS Form 1040, Schedule B, Part I). Because of the ambiguity issue the IRS will likely accept the annual numbers reported as long as the method used is reasonable and is used consistently.

After year #5 the computations are much easier. We can compare our own annual calculations with the January through January and December through December redemption values returned by the Treasury’s paper bond calculator. I found that the January through January numbers came closest, with a difference of only 20 cents. The Treasury rounds all their calculations to denominations of 20 cents. The December through December numbers were off by much larger amounts, so the January through January numbers make more sense.

Dunmovin says

Harry, read all the posts above and I’m still a bit confused on Account Manager name on Trust registration. My spouse and i have… A or B, Trustees under The …Trust for a TD account. A is identified as the Account Manager with her Soc number. There seems to be only one Account Mgr permitted but when one thinks that either A OR B could act on the account there would “seem” to imply that two should be ok since it is conjunctive (not “and”) otherwise it is only death with a death cert and form 5446 to put him acct mgr. What am I missing. How can either of us act on the TD trust account? Thanks

Dunmovin says

Harry, I think on reread my post 46 above should be deleted…let me try again, if I may.

Read all the posts above and I’m still a bit confused on Account Manager name on Trust registration. My spouse and i have… A or B, Trustees under The …Trust for a TD account. A is identified as the Account Manager with her Soc number. There seems to be only one Account Mgr permitted but when one thinks that either A OR B could act on the account there would “seem” to imply that two should be ok since it is disjunctive (not “and”) otherwise it is only death with a death cert and form 5446 to put him acct mgr. What am I missing. How can either of us act on the TD trust account? Thanks

PS I might as well set up another/new trust but with B or A and have B be Acct Mgr… OK?

Harry Sit says

Their system only allows one account manager for an entity account. Just adding another name to the name of the account won’t change their system. You can change the account manager to B while A is still living.

Setting up a new trust and creating a separate account for it works.

Leslie A. says

Thank you for all this great information! My husband and I just made separate revocable living trusts. We’ve already each purchased $10,000 in personal ibonds and yesterday I purchased another 10,000 in my trust and was planning on purchasing another 10,000 in my husband’s trust but I wonder if the name of the trust (which my attorney gave me) is adequate for this process. These are our trust names:

The (MY NAME) Revocable Living Trust, dated 1-14-2022

The (HIS NAME) Revocable Living Trust, dated 1-14-2022

I’m not seeing any reference to grantor or trustee. Mine went through without a hitch with my ss number but now I’m pausing before doing his.

Should there be more info to our trusts names when I purchase his ibond? Will I receive some kind of notification from TD saying that my bond was incorrectly purchased?

Thanks again!

Harry Sit says

The name of the trust from your attorney is what it is. TreasuryDirect doesn’t want to change that. They only say how the bonds should be registered. Depending on whether the trust is a Declaration of Trust or a Trust Agreement, the registration can be:

His Name, Trustee, [Name of the Trust] U/D/T dated [Month Date, Year]

or

His Name, Trustee, [Name of the Trust] U/A with His Name dated [Month Date, Year]

Jacquie Traub says

Hi again Harry,

From the article: “The new trust account needs a linked bank account. The bank account doesn’t have to be under the name of the trust. It can be the same personal bank account linked to the grantor’s personal account at TreasuryDirect.”

When it comes time to redeem bonds registered to a TD trust account, will the bonds seamlessly be deposited back into the linked bank account, even though that linked account is not titled to the trust? I’m wondering if the redemption is sent to the linked bank in the name of the trustee, and if so, would there would be an issue with the receiving bank since the linked account is not titled to the trust?

Harry Sit says

I have a personal bank account linked to a trust account at TreasuryDirect. My purchases went through fine and I don’t expect any problem with redemption either, although I haven’t redeemed any yet. I have trust accounts at brokerage firms linked to a personal bank account and I never had any problem with transfers both ways. Any specific bank can accept or reject transfers based on their own rules but I don’t think it’ll be an issue in general.

In a typical revocable trust, you’re allowed to put money into the trust or take money out of the trust as you wish. You’re doing just that when you transfer between the trust account and a personal account. Of course if your trust has a bank account, go ahead and link that one. That way the money will stay in the trust at all times.

Cathy says

Harry this was a great help! I have some follow up clarifications:

1. I have set up an account for myself and husband as joint. What happens if we both pass at same time? Does it just pass into our trust?

2. We each have a family trust in each of our names. In addition to our joint account I was going to purchase a trust account for each of us. It sounds like I can transfer bonds between joint ownership and trust. What is the benefit of transferring everything into trust or vice a versa? With the transfer does the account registration change?

Thank you for your help!

Harry Sit says

The personal account can’t be joint. You can add a second owner to the bonds you buy in a personal account but the account itself is only in one person’s name. If both owners die at the same time, the bonds in the personal account go to the owner’s estate (not to your trust).

Please read the section “Keep Them Separate” again. Don’t transfer until you’re done with buying all the I Bonds you want. Decide at that time whether you want personal accounts or trust accounts. Most people with a trust want assets in their trust because they set up the trust for a reason.

Cathy says

Harry thank you for the clarification. The way I understand it is that my estate passes through my trust. So does it really matter how the Ibonds are registered?

I’m going to going to open an account with a second owner and one for each of our trusts. For simplicity down the line it would probably be easier to have one versus two registrations but maybe I am overthinking it.

Harry Sit says

Where your estate passes is determined by your will, which has to go through probate. How long it takes and how much it costs to complete probate depend on where you live and the size of your estate. Assets already placed in a trust and assets with designated beneficiaries don’t go through probate.