I’ve been buying I Bonds for 20 years. I only realized now I’ve been writing as if everyone already knew what they were and how they worked. If you buy I Bonds before November 1, 2023, you will get a 0.9% fixed rate plus a variable rate that continues to match inflation in the previous six months. If you’re new to I Bonds, this post walks you through from soup to nuts.

What Are I Bonds?

I Bonds are short for Series I Savings Bonds. They are bonds issued by the U.S. government directly to retail investors. Currently, I Bonds carry a favorable yield over other CDs and bonds. This makes I Bonds the best low-risk investment at the moment.

How I Bonds Work

Think of I Bonds as flexible-term variable-rate CDs.

You’re required to hold them for at least one year. After that, you can cash out at any time you’d like before the maturity date, or you can choose to hold them for up to 30 years from the original time of purchase. If you cash out within five years, you forfeit interest earned in the previous three months, whereas the early withdrawal penalty on a typical commercial CD is often six months or 12 months of interest. The flexibility to cash out after one year with a low early withdrawal penalty or to hang on for as long as 30 years makes I Bonds good for both short-term and long-term investing.

Similar to a CD, the value of I Bonds never goes down. They are guaranteed by the full faith and credit of the U.S. government. Unlike a typical CD with a fixed interest rate for the entire term, the interest rate on your I Bonds changes in six-month cycles. You stay on the current rate for the full six months and then you go on a new rate for another six months, and a new rate after that for another six months, and so on.

The interest rate is guaranteed to at least match inflation. If the inflation rate goes up, the interest rate on your I Bonds automatically goes up. Some older I Bonds earn a positive rate above inflation. The I Bonds you buy now only match inflation. Even merely matching inflation makes I Bonds attractive when other CDs and bonds don’t keep up with inflation.

Tax Treatment

The interest on I Bonds is credited monthly and automatically reinvested every six months. You get all the accumulated interest when you cash out. You don’t get a separate payout monthly or quarterly.

By default, you pay federal income tax on the interest from I Bonds only when you cash out, whereas you must pay taxes on the interest from CDs and bond funds every year even if you reinvest the interest. The interest from I Bonds is exempt from state and local income taxes. I Bonds are more appealing than other CDs and bonds because you have the tax deferral and the exemption from state and local income taxes.

You can choose to pay tax in a different way but it gets complicated. Staying with the default makes it easy for everyone. See Taxes on I Bonds Get Complicated If You Go Against the Default.

If you meet an income limit and other requirements, it’s possible to cash out your I Bonds tax-free when you use the money for qualified higher education expenses. See Cash Out I Bonds Tax Free For College Expenses Or 529 Plan.

Where to Buy I Bonds

There are only two ways to buy I Bonds:

1. Buy electronic bonds online at the government website TreasuryDirect.

2. Buy paper bonds with money from your tax refund when you file your tax return with the IRS each year. See details in Overpay Your Taxes to Buy I Bonds.

You can only use regular after-tax money to buy I Bonds. They’re not available in any tax-advantaged accounts such as 401k-type plans, IRAs, or HSAs. Nor are they available through any brokerage firms such as Fidelity, Charles Schwab, or Vanguard.

Purchase Limit

I Bonds are such a great deal that the government puts a limit on how much you can buy each year. At current rates, you should get your full quota before you buy any other CDs or bond funds.

When you buy on the government website TreasuryDirect.gov, the limit is $10,000 each calendar year per Social Security Number as the primary owner in a personal account. When you buy using money from your tax refund, the limit is $5,000 per tax return (not per person when you file jointly).

If you have a trust, you’re allowed to buy another $10,000 each calendar year in a trust account. See Buy More I Bonds in a Revocable Living Trust.

If you have a business, the business can also buy $10,000 each calendar year. See Buy I Bonds for Your Business: Sole Proprietorship, LLC, S-Corp.

If you have kids under 18, you can also buy $10,000 each calendar year in each of your kids’ names. See Buy I Bonds in Your Kid’s Name.

If you’d like to buy I Bonds as gifts to others, see Buy I Bonds as a Gift.

A married couple each with a trust and a self-employment business can buy up to $65,000 each calendar year, and more if they file separate tax returns, buy in their kids’ names, or buy as gifts for family members.

- $10,000 in Person A’s personal account with Person B as the second owner

- $10,000 in Person B’s personal account with Person A as the second owner

- $10,000 in an account for Person A’s trust

- $10,000 in an account for Person B’s trust

- $10,000 in an account for Person A’s business

- $10,000 in an account for Person B’s business

- $5,000 using money from their tax refund if they file jointly (or $5,000 each if they file separately after making sure they won’t lose other tax benefits)

- $10,000 in the name of each of their kids under 18

- $10,000 as a gift for each member of the extended family

We had only one trust before. We created a second trust with software to buy another $10,000. For buying I Bonds in a trust account in general, please read Buy More I Bonds in a Revocable Living Trust.

Open Account

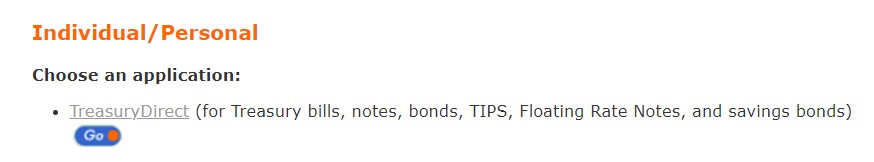

If you never bought I Bonds before, you need to open an account at the government website treasurydirect.gov. You can buy more in the same account in subsequent years. Find the Open Account link at the top right.

Choose the first option for Individual/Personal. Go here for a trust account or a business account as well.

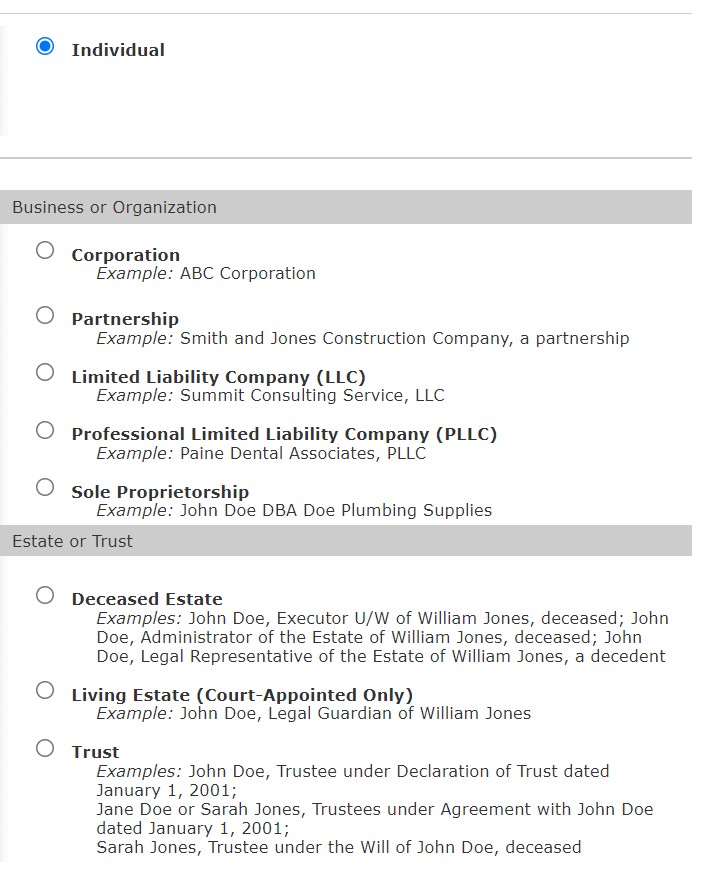

Now you can choose an individual, business, or trust account.

Next, fill out the required information and choose a security image, a password (not case sensitive), and security questions. Important: Save your answers to the security questions. You will be asked to answer one of the security questions when you perform certain actions at a later time. Your account will be locked if you can’t answer the security questions.

Separate Account for Spouse

TreasuryDirect doesn’t support joint accounts. The individual account you’re opening now is only for yourself. If your spouse also wants to buy I Bonds, he or she must open a separate account. However, you can specify a second owner or beneficiary on the bonds you buy in your personal account. You do that at the holdings level at the time of each purchase. We’ll cover that in the Registration section of this post.

If you’re opening a trust account, see Buy More I Bonds at TreasuryDirect in a Revocable Living Trust for what to use as the name of your account.

Link a Bank Account

The application also asks you to link a bank account. Make sure you enter the bank routing number and account number correctly. TreasuryDirect doesn’t send any random deposits to verify the bank account.

Save Account Number

You will receive your TreasuryDirect account number by email. Important: save your account number. You’ll need it to log in.

Most people can start buying right away after receiving the account number. A small percentage of people need to complete an extra step for identity verification. If you’re among the unlucky few, please read Where to Get a Signature Guarantee for I Bonds at TreasuryDirect.

Schedule Purchase

Log in with the account number. The system will email you a one-time password (OTP). Important: Don’t use the back and forward buttons in the browser when you use the TreasuryDirect.gov website. Only use the “submit” and “return” buttons on the web pages.

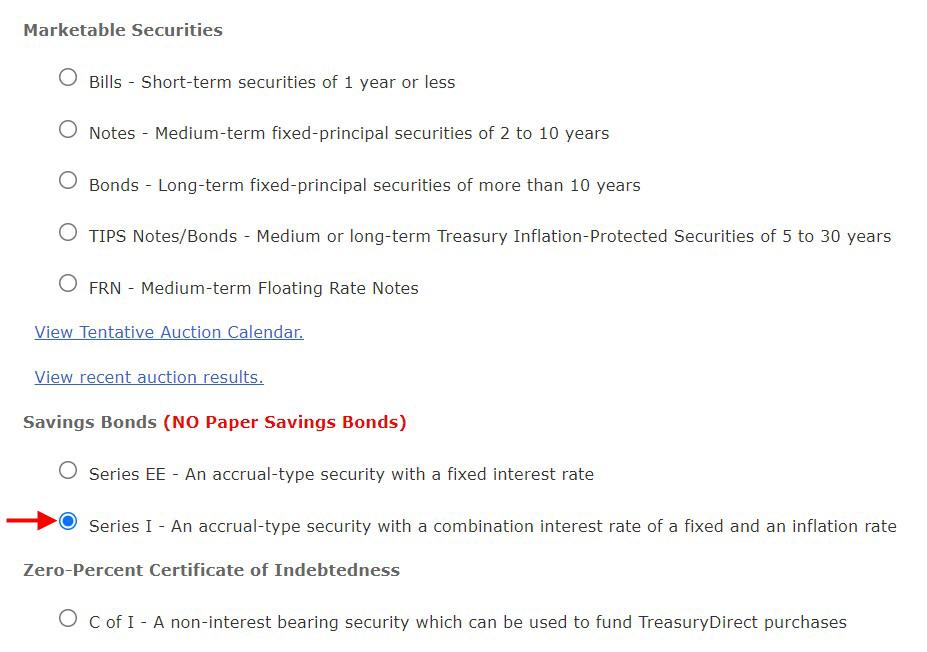

After you log in, go to BuyDirect in the menu.

Although we use TreasuryDirect only to buy I Bonds, the account can be used for other products as well. Choose Series I near the bottom of the list.

Registration

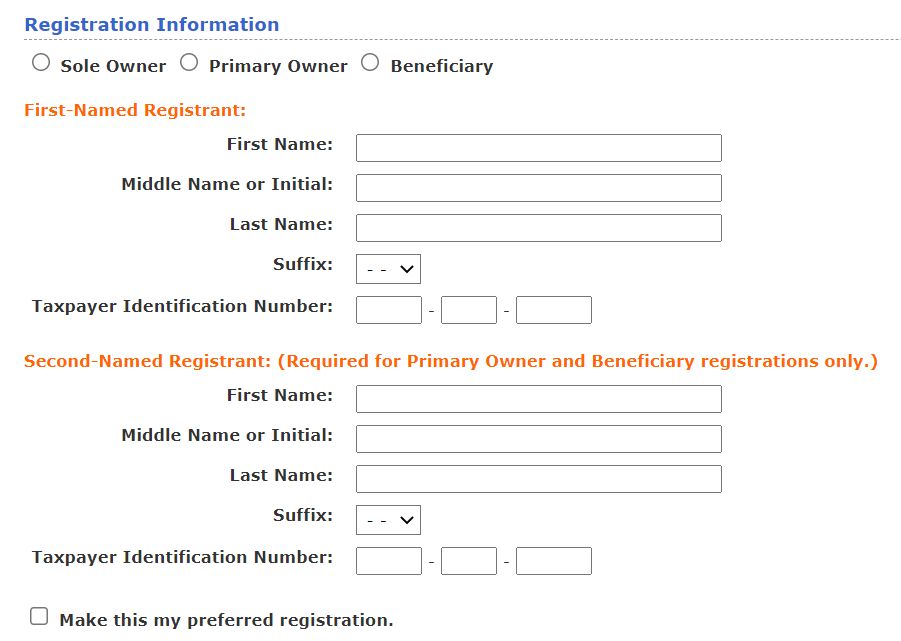

If you’re buying I Bonds for the first time in a personal account, you need to create a Registration, which means whether you want the bonds to have:

- Just yourself as the only owner; or

- You as the primary owner and another person as the second owner; or

- You as the owner and another person as the beneficiary.

Choose the “Sole Owner” radio button if you want yourself as the only owner with neither a second owner nor a beneficiary. Choose “Primary Owner” if you want yourself as the primary owner with another person as the second owner. Choose “Beneficiary” if you want yourself as the primary owner with another person as the beneficiary. See I Bonds Beneficiary versus Second Owner for the difference between a second owner and a beneficiary.

Unlike in typical commercial accounts, the second owner and the beneficiary in TreasuryDirect are at the holdings level, not at the account level for all holdings. You can have some bonds with Person A as the second owner, some other bonds with Person B as the beneficiary, and so on.

No Contingent Beneficiary

Each bond can have only one second owner or one beneficiary but not both at the same time. You can’t specify a contingent beneficiary. The second owner or beneficiary also has to be a person. It can’t be a trust or a charity. Trust accounts and business accounts can’t buy bonds with a second owner or a beneficiary. The trust or the business will be the only owner.

A married couple can choose to:

(a) Name each other as the second owner or beneficiary and live with the risk of simultaneous death; or

(b) Name someone such as a child or grandchild who isn’t likely to die simultaneously. The child or grandchild will get an early inheritance when you die. The surviving spouse will live on other assets.

First- and Second-Named Registrants

If you decide to have a second owner or a beneficiary, enter yourself as the “first-named registrant.” Enter the second owner or the beneficiary as the “second-named registrant.”

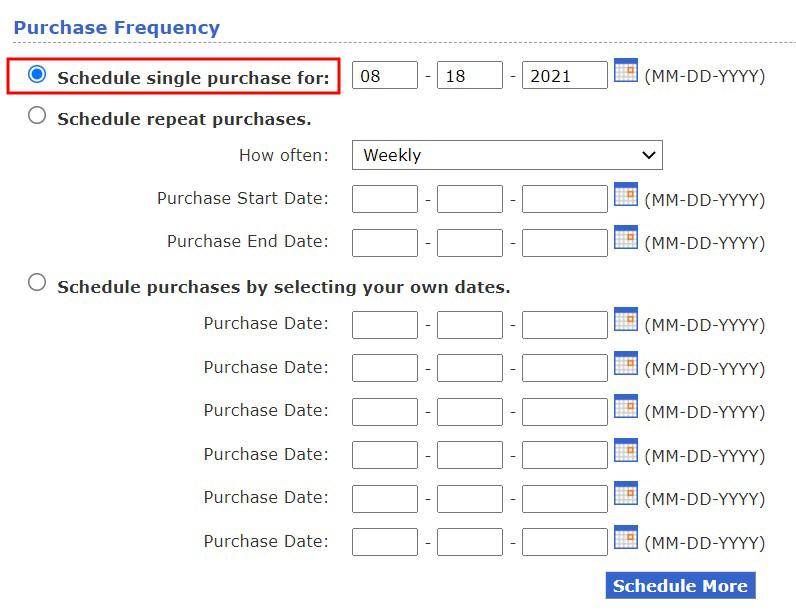

Purchase Date

Choose the purchase date. Make sure you have money available in the linked bank account. They send out the debit the night before your scheduled purchase date. The debit will hit your bank account on the scheduled date first thing in the morning. They may lock your TreasuryDirect account if the debit bounces. It’ll be difficult to unlock it.

Important: Don’t cut it too close to the end of the month, or else you may miss a month worth of interest. It takes one business day to issue the bonds and possibly more days if there’s a delay. If you buy close to the end of the month, your issue date may be in the following month and you won’t get the interest for the previous month. I schedule my purchases to a date at least a week before the end of the month.

Grant Rights to the Second Owner or Beneficiary

If you put a second owner or a beneficiary on your I Bonds, the second owner or the beneficiary doesn’t automatically see those bonds in their account. They see the bonds only when you grant them View or Transact right. The beneficiary can only be granted the right to view the bonds (“read-only”). The second owner can be granted either View or Transact right.

After the purchase completes and you see the bonds in your account, please read How To Grant Transact or View Right on I Bonds for a walkthrough on how to grant rights on the bonds you just purchased and how a second owner can transact on the bonds on your behalf after you grant the right.

Rinse and Repeat

If you’re buying additional I Bonds in the name of a spouse or a trust, repeat the steps above by opening a separate account, creating a password, linking a bank account, saving the account number, and scheduling the purchase. The different accounts can use the same email address and link to the same bank account if you’d like. Because you’ll use different account numbers to log in, you should keep notes of which account number is for which owner.

If you’re interested in buying I Bonds in the name of your trust, kid, business, or as gifts, please read:

- Buy More I Bonds in a Revocable Living Trust

- Buy I Bonds in Your Kid’s Name: You Can, But Should You?

- Buy I Bonds for Your Business: Sole Proprietorship, LLC, S-Corp

- Buy I Bonds as a Gift: What Works and What Doesn’t

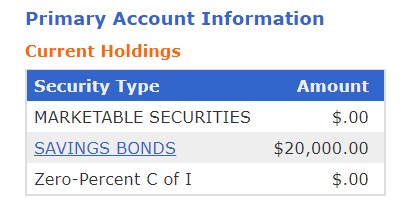

Check Balance

TreasuryDirect doesn’t send any account statements. You check your balance on the website. Your total face value is displayed on the home page after you log in. This doesn’t include any credited interest.

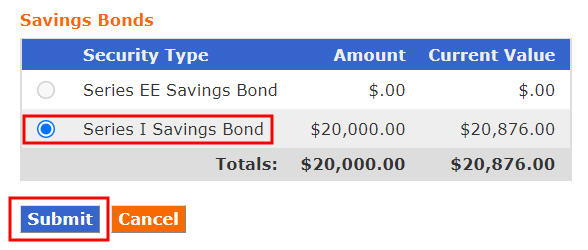

Clicking on the Savings Bonds link will show you a breakdown by savings bond type: Series EE and Series I.

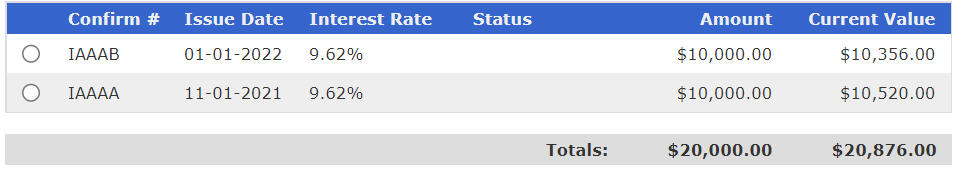

The Amount column shows the total face value. The Current Value shows the total face value plus credited interest. Click on the radio button next to Series I Savings Bond and then click on Submit. You’ll see a list broken down by the Issue Date.

Three-Month Lag in Current Value

If your bonds are still within five years from the Issue Date, the Current Value automatically excludes interest earned in the last three months. If you cash out today, you’ll receive the Current Value. That’s why you won’t see any interest in the current value during the first four months. You will start seeing a higher value in the fifth month.

Interest Rate Lag

The interest rate on your bonds doesn’t necessarily change right away when a new interest rate is announced. Each bond stays on the previous rate for the full six months before it moves on to the next rate for another six months. The rates change in different months depending on when your bonds were originally issued.

Don’t worry when you see your older bonds earning a different interest rate than the current interest rate on your newer bonds. When those older bonds “age out” the previous rate for the full six months, they will move on to the newer rate for six months. All bonds eventually go through all rate cycles.

Cash Out (Redeem)

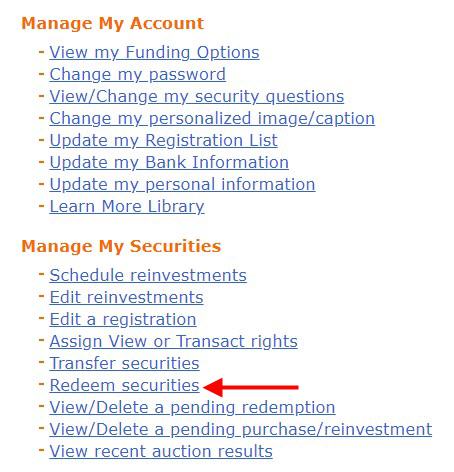

Because I Bonds are better than other bonds and there’s a purchase limit, you should hang on to your I Bonds as much as you can until you have better choices. If you need to cash out some of them (called “redeem” in the government lingo), you use the ManageDirect menu.

The option isn’t really obvious unless you know what to look for. Click on “Redeem securities” under the heading “Manage My Securities.”

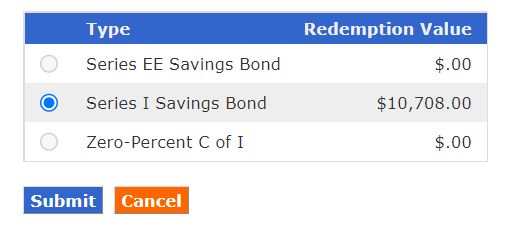

Choose “Series I Savings Bond.”

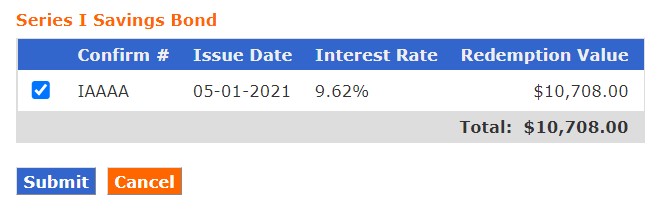

Choose the bond you’d like to cash out from.

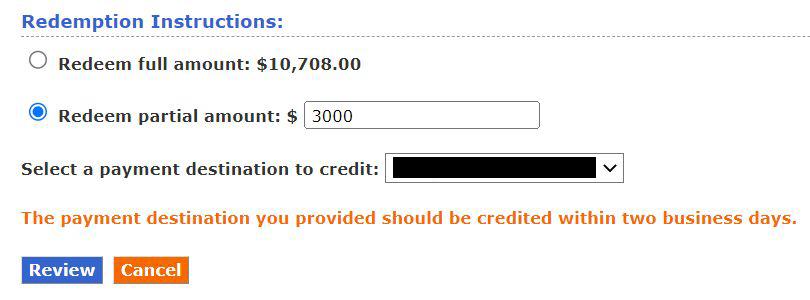

You don’t have to cash out/redeem the full amount. Redeeming only part of it is just fine. The minimum cashout amount is $25. If you originally purchased $10,000 and it grew to $10,708, when you redeem $3,000 from it, they will prorate the $3,000 into $2,801.64 principal and $198.36 interest. You’ll pay tax on the interest.

The money will be sent to your linked bank or credit union account by direct deposit in one or two business days after you cash out.

Tax Forms

If you don’t cash out (redeem) any I Bonds in any year, you won’t get a 1099 form for the interest earned. You pay taxes only in the year you cash out.

If you do cash out (redeem) any I Bonds in any year, TreasuryDirect will generate a 1099 tax form for the interest portion. They don’t send paper tax forms. You’ll come back to the ManageDirect part of the website at tax time to get the tax form (see the screenshot above).

See Report I Bonds Interest in TurboTax, H&R Block, FreeTaxUSA for how to report the interest in tax software.

You can choose a different treatment for when you pay taxes but it gets complicated. Please read Taxes on I Bonds Get Complicated If You Go Against the Default if you’re interested.

Customer Service

If still have questions or if you run into any problems, you can contact TreasuryDirect:

- Send an inquiry via their contact form.

- Send an email to Treasury.Direct AT fiscal.treasury.gov.

- Call 844-284-2676 during business hours.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Dunmovin says

Has anyone seen any numbers on purchases/redemptions for ibonds in recent months including In particular December 2021?

Mark says

Great article. I bought $10,000 for myself and then gifted $10,000 to my wife. Now I see in your article that I should have had her open her own account and buy the bonds herself. I changed my registration so that I am primary/she is secondary on my $10k. Can she change hers to make me a secondary for the gift I gave her?

I don’t want to run afoul of the limits. Thanks!

Harry Sit says

When she opens her account, she doesn’t buy again. You deliver the gift you already bought to her account. Then it will be like she bought those bonds herself. She can add you as a secondary owner after she receives the gift delivery. See Buy I Bonds as a Gift and How to Add a Joint Owner or Change Beneficiary on I Bonds.

Kay Jackson says

My folks purchased I bonds about 20 years ago. Do you know if the $10,000 per personal annual purchase limit would have been in place back then? They have some years where I think they purchased more than that limit. Would that have even been possible?

Thanks for this post. I have a lot of new things to learn now that I am helping them with their finances, and this pretty much took care of what I need for I bond education!

Harry Sit says

The limit was $30,000 per person per calendar year in the beginning. You could also charge the purchase on a credit card and earn miles or cash back reward back then.

Judy B. says

I have I Bonds nearing $100,000 and good for another 10 years so they will greatly exceed $100,000. They are in a single account with a beneficiary. I stand to inherit a similar amount of I Bonds that are in a trust with me as beneficiary, (which I will then put into my account with a beneficiary or put them into my own trust). I find TD’s information that “if the total value of the bonds and other Treasury securities is more than $100,000, federal regulations require they be administered through a court” confusing. Are accounts with a beneficiary and trust accounts exempt from this rule? If so, does that mean I can keep buying I Bonds (within the yearly limit) up to any amount in my account and still avoid probate as long as the account has a beneficiary or is owned by a trust. I definitely don’t want to subject the account to any court procedures or probate if I die so I’m trying to stay within the rules. I do not find TD’s explanation of the $100,000 rule to be clear at all and it doesn’t say any accounts are exempt.

Thank you for your site! It is the only place I’ve found to ask questions about this unnecessarily confusing topic.

Dunmovin says

Judy, I suggest you call them…a California person was told by TD that TD goes by state law and consequently in California it is over 166K. Check your state law and then contact them. And, I suggest you read really close the TD language see if it is talking about ALL assets OR only those that not covered by will or…. Good Luck…I’m sure Harry will have better info!

Harry Sit says

First of all, a TreasuryDirect *account* doesn’t have a beneficiary. The beneficiaries are set per holding in a personal account.

Next, the $100,000 threshold matters only when you let the bonds fall into a deceased owner’s estate. Bonds with a second owner or beneficiary who’s still living don’t go into the estate. So make sure you keep the second owner or beneficiary on the bonds up to date. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

A trust doesn’t die. If the Account Manager of a trust account dies, the successor trustee takes over as the new Account Manager of the trust account. Make sure you keep the successor trustee up to date in your trust.

Brad says

First off, IANAL (I’m not a lawyer), but as Harry says, the beneficiary are what matters. If you have an individual account AND a trust account, the former of those will have a beneficiary, and the latter will not (it will just have a successor trustee when you pass away)–as Harry says. For the individual account (the former), generally a beneficiary means the assets pass directly to the beneficiary, and do not stay in the owner’s estate (**if and only if** you have designated a beneficiary–see Harry’s admonition to keep the beneficiary’s name up-to-date and in the name of a **living** beneficiary). I believe–though I am not sure, again IANAL–that your living trust could be made the beneficiary of your bonds (those that are held in your individual name)–not in your trust, but with your trust as beneficiary, so they’d pass into that trust vehicle and be under the control of the trust (now after your death, an irrevocable trust) and since they are in the trust and managed by your successor trustee, would not be subject to probate. Again, IANAL! 😉 If by some chance there is no living beneficiary and/or designating your trust as beneficiary was not allowed, then as Dunmovin mentions, if you live in California and you have no other assets not in your trust (such as a car, checking account, etc.) that add up to, with the bonds in your name, to over $166k or so (I think it’s adjusted by inflation/CPI occasionally), then Calif state could allow you to skip probate, if under that amount.

Harry Sit says

The beneficiary has to be a person. It can’t be a trust.

Dunmovin says

As a footnote to Brad’s excellent post that the California amount also applies to what treasury will allow for redemption w/o court intervention and I’m reminded that a business account does not have beneficiaries and thus one has to watch the total holdings and manner to get the funds out after death…see earlier posts for relevant treasury forms. Clear as mud

Judy B. says

Thank you all for your quick and informative replies! All IBonds I have now or will have in the future will be in my name with a beneficiary or be titled in the name of my trust so it appears either way they should stay out of my estate as long as my beneficiaries are up to date and living. I will still call TD to see what kind of response I get from them just to be on the safe side. Life should not be this complicated!

Thanks again.

Chris Kyrios says

Paper purchase question:

If your expected refund is less than $5K, and you want to buy $5k, is a way around this that you pay enough estimated taxes to ensure your refund will be at least $5k? Or can you designate the purchase of the $5k when filing & owe/include the difference if the refund would be under $5K. i.e. expected refund is $3k. I send in est tax prior to Jan 15th of $2.5k. Then when I file, I can send $5k for the iBond, and get a $500 refund.

Harry Sit says

If your refund is less than $5,000, your bond purchase will be limited to your refund rounded down to the nearest $50. If you want to buy $5,000, you need to pay enough estimated tax or make a payment with an extension to get your refund over $5,000. See Overpay Your Taxes to Buy I Bonds.

Jeff Somers says

You should be able to pay the IRS any amount you want as an additional estimated payment whenever you want. Just make sure you allow enough time for it to be credited to your account before your return is processed. I believe you can even establish and make a payment online. I would make sure it has posted before you file your return and be sure to indicate on your check that it is for 2021 1040 Tax Return and has your correct social security number on it if you send a check. I’m not sure how the system would handle an additional payment with your tax return when the return itself would show a refund. It might confuse it and think you are making an estimated payment for the 2022 tax year. Also, the address for sending a return with payment is due is different than the one for a return with a refund so the address for a refund may not be a bank lock box or set up to handle payments and that could delay things.

Dunmovin says

And I believe I read submitting a “request” for filing extension for tax return with $x could perhaps do it …it’s getting close to being late for final 2021 est tax submission . What says you Harry?

Chris says

Excluding any discussion of filing an extension, 1/18/2022, is the last date to make an estimated tax payment for 2021 through the IRS Direct payment site. I recently made another direct estimated taxes payment, to make sure I receive a $5k refund, from which I will purchase the additional $5k of I-Bonds.

Jeff Somers says

Dunmovin, Yes, if you are filing for an extension, anyway, you can always make an additional payment with that.

Jim says

Thanks for the helpful info!

1. I previously bought bonds with my wife as the other owner online. If I file taxes jointly with my spouse and buy I-bonds with the refund, I understand that the bonds would be named under both of us – so to then deposit them electronically into my account, could the bonds end up in this existing account where my wife is the other owner? Or because the tax refund bonds came from a “joint” tax return, then they have a special designation and the bonds would have to be registered in another category account?

2. For cashing out these joint tax return bonds in the future, can either me or my wife do that, or do both of us need to agree to cash out? I was not sure if there are special cashing out restrictions when the bonds are purchased through a joint tax return.

Thanks!

Harry Sit says

You can deposit them into an existing account. Either owner can cash out. See How To Deposit Paper I Bonds to TreasuryDirect Online Account.

Chris says

When I purchased I-bonds for both my wife and I, I then added my name as a second owner to the bonds purchased under her SS, and added her as the second owner of the bonds purchased under my SS.

Dunmovin says

Chris and others (so-inclined) should (re)read #93 above note about the conflicting provisions on limit of paper bond purchases…perhaps someone should make pitch in phone call to TD and report back?

Chris says

I don’t see a link to information on 93. I did find IRS disaster relief for the 10 affected counties in Kentucky, but I see no mention of I-Bonds. https://www.irs.gov/newsroom/for-kentucky-tornado-victims-irs-extends-2021-tax-filing-deadline-other-deadlines-to-may-16

Dunmovin says

Sorry I wasn’t clear…

The concept is …TD provides waivers and perhaps b/c of those “weather” waivers , a waiver for the 5k bond limit should be granted by TD when there are conflicting provisions on amount of paper bonds one can buy…

I copy here my earlier post

Dunmovin says

DECEMBER 28, 2021 AT 11:17 AM

Pan, reading the “news” from time to time on the TD website one currently sees…

“Fiscal Service Aids Savings Bonds Owners in Kentucky Affected by Severe Storms, Straight-line Winds, Flooding, and Tornadoes; One-year minimum holding period waived”

NOW…in addition to that possibly important news to some is the use of waivers…a big kicker is the $15K tax refund in Ibonds cited above…why don’t you email/write for a waiver of the flaw in the instructions in form 8888 so that one can comply/use the import of q/a also cited above AND say this will clear up any confusion, be conforming, i.e. not changing anything, and allow for Treasury to conform/coordinate all their documents in a proper rule promulgation process!!! TD’s interpretation should (also) control since it is the ibond issuing organization, not IRS! We only have one Treasury Department! Go for it! Harry, do you have a plan B?

janine s says

What is the minimum contribution amount to open/purchase a treasury ibond?

Harry Sit says

The minimum purchase is $25.

bws92082 says

I understand how the initial rate your purchase gets lasts for 6 months, but what happens in subsequent 6-month periods? Say you buy the bond in Feb 2022 and get the Nov 2021 rate. After 6 months, in Jul 2022, your rate changes to the latest May 2022 rate. So does this new rate remain in effect for you for another 6 months, etc? In other words, your 6-month rates will have a 3-month lag time to take effect from the official treasury rate change date?

Harry Sit says

That’s correct. You stay on every rate for six months.

TJ says

The I-bonds shows interest for one month added today for the first time since purchase. The bond was purchased on October 27, so it earned interest for Oct, Nov, Dec, & Jan. TreasuryDirect holds back the last 3 months of interest until the 5-year mark when there is no early redemption penalty.

The interest added today was $28 on $10,000 bond. I wonder why it isn’t $29.50 ($10,000 x 0.0354 / 12) ???

Harry Sit says

They have complicated rounding rules. Don’t look too closely from month to month. It will catch up next month.

Dave says

Thank you for a very helpful article. I bought an I-Bond before reading this and see that I made a mistake. I didn’t list my wife as the beneficiary so I went back and tried to do this by adding a new registration for a beneficiary. Then I tried to delete my original registration but was not allowed to delete it. So I designated the new registration as my preferred registration. Do you know if this will work? What does it mean to have more than one registration?

Chris says

You can name a person a co-owner. Wife is listed as co on mine and vice versa.

Harry Sit says

Making a registration your preferred registration only affects the default when you buy I Bonds again in the future. It doesn’t change the bonds you already bought. To do that, please follow the steps in How to Add a Joint Owner or Change Beneficiary on I Bonds.

Brad says

I’m not a CPA nor a tax attorney, but is it possible that if spouse is a beneficiary rather than a co-owner, that the basis for accumulated interest over a number of years would be stepped up—meaning no (ordinary income) tax owed on all the gains on that interest?

Curious if anyone knows the answer to this. If so, I’d rather have my bonds specify my spouse as beneficiary and hers specify me as beneficiary, in the event (hopefully unlikely) that one of us predeceases the other prior to us cashing these series I bonds, in order to save on taxes.

Harry Sit says

No step-up either way.

Lou Petrovsky says

My CPA informed me that the basis of U.S.Savings Bonds is not stepped up on the death of the owner unless the owner had elected during lifetime to report and be taxed on the interest.

Jeff Somers says

There is no such thing as a stepped up basis for interest earned on a U.S. savings bond. Stepped up basis is only for assets where there is going to be a capital gain/loss, e.g. stocks, bonds (not Savings Bonds which are like CDs for tax purposes). Do remember that if you buy a regular U.S. Treasury Bond or Note where the principal value fluctuates in the market, you would have a stepped up basis.

Gina says

This is an amazing article, very much appreciated. The TD site is horrible. Thank you very much. I do still have a few questions. I added a co-owner on the registration, but where do I see the I-bond’s registration after I’ve registered it? Can’t find it anywhere. Also, is there a tax implication if I change the co-owner? And what if I want to set up an account and don’t have a driver’s license or state ID? The site doesn’t have anywhere to input a passport. Thank you in advance.

Harry Sit says

To review the ownership registration of your current bonds, click on “Current Holdings” at the top, choose the Series I radio button, and submit. See the link in the reply to comment #115 if you need to make a change. No tax implication to change as long as you stay as the primary owner.

Leave the driver’s license or state ID field in the account opening application blank if you don’t have one.

Dunmovin says

Harry, a little help on completing 1040 and 8888 forms. Assume $5200 overpaid in taxes (line 34 of 1040SR form) and a joint return whereby at the end of the day we want to allocate $5000 for three paper I bond purchases (checking the box for line 35a since a 8888 will be attached) with $200 to be used/applied to 2022 est taxes (line 36). The first concern is I believe we do NOT enter any dollar amount in 35a…correct? But see below

Completing the 8888 form: line 4…$4800 to us; line 5a $100 with names of owner and co-owner in lines 5b 5c; line 5b $100 with other names/owner/co-owner on 6b 6c.

Line 7 is zero. Line 8 is the $5000 total bond purchases.

The other concern is I do not see anywhere where one is to state the refund amount is the $5000. Line 8 states “The total must equal the refund amount shown on your tax return”…But as noted above there is no place to put the refund on the tax return UNLESS Line 35a (of 1040 SR) should have $5000 entered into it??? (With the noted check box noted) But if we do that won’t that trigger a paper refund check to be issued?

Thank you!

Harry Sit says

Using your example:

Form 1040:

– Line 35a, box for Form 8888 checked, amount = $5,200

– Lind 35b/c/d blank (direct deposit info is on Form 8888)

Form 8888:

– Line 1a, $200 (leftover refund after bond purchase)

– Line 1b/c/d: bank account for the direct deposit

– Line 4: $4,800 I Bonds reserved for yourselves

– Line 5a, $100 I Bonds

– Line 5b: Name of recipient 1

– Line 5c: Co-owner or beneficiary of recipient 1 (check the box if this person is the beneficiary of recipient 1)

– Line 6a, $100 I Bonds

– Line 6b: Name of recipient 2

– Line 6c: Co-owner or beneficiary of recipient 2 (check the box if this person is the beneficiary of recipient 2)

– Line 8: $5,200

Harry Sit says

Sorry, I just noticed you want the residual $200 applied to the next year. Make adjustments accordingly. Basically line 35a gives the total refund amount. Form 8888 breaks it down into specific modes of refund: direct deposit, check, and I Bonds.

Dunmovin says

Thanks, Harry let me fine tune what I’m reading sorry for my earlier confusion: $5200 over withheld on taxes. If one does not want any refund in dollars but to have $200 retained for 2022 est. taxes with $5000 used to purchase paper ibonds:

1040

Line 35a will have the box checked AND $5000 is entered in the box to the right? Right?

Line 36 will reflect the $200 entry for 2022 est taxes? Right?

8888

Part I is left entirely blank (No checks or direct deposit of refund).

Line 8 will be $5000 (total of the ibonds)…same entry as for line 35a on 1040? Right?

thank you very much

Harry Sit says

That’s correct.

Marion Julius Nesmith, Jr. says

Can you pull more money from a traditional ira ..with hold more tax and use that as your tax payment to make your i bond purchase

Dunmovin says

Of course the withdrawal rules for the IRA trustee need to be considered but generally they allow RMDs with no ewp . I do it at end of year and see what my tax liability may be and (last year) had $5k extra withheld for fed taxes to use for ibond purchase this month with return filing refund and 8888 submission. If done now it would be for 2022 taxes…I would not do it now but in December

Jeff Somers says

Any withheld taxes on your 2022 withdrawal would be for your 2022 tax year and would not be available to purchase I bonds until you file your 2022 tax return next year. Of course, you could use the withdrawn money and pay an extra estimated payment now for 2021 taxes; the IRS will always take your money. Just make sure you designate it as a 2021 payment. If you do that, you will already be set up to make I bond purchases for 2021 and 2022 with your tax refund.

Dunmovin says

Too late for paying estimated taxes for 2021

Jeff Somers says

No, it is not. The IRS will take your money at any time. Just be sure to designate it for 2021 Tax Year.

Jeff Somers says

Dunmovin, Just to clarify further. The estimated payment deadlines are to avoid any penalty due for paying too little estimated tax in a timely manner. They are not deadlines for making payments on your tax account. You can make payments any time you want; just make sure to designate the correct tax year and include your name, address and social security number.

Dunmovin says

Jeff, what irs tax form is/would that/any 2021 tax payment made in February 2022 reflected in/on? See line 25 to 1040-SR for 2021 returns

Lou Petrovsky says

It’s Form 1040-ES, and it’s Voucher #4, even though the payment is being made later than its due date of 1/18/22. The amount is entered on Line 26 of Form 1040 SR, rather than Line 25.

Jeff Somers says

Yes, you can do as Lou suggests above but payments can be sent to the IRS without a voucher as long as you include all of the necessary information on your check including, Name, address, social security number AND the Tax Year to which your payment applies, e.g. 2021 Form 1040 Payment. If you have or can print a 2021 Tax Voucher, you can go ahead and use it and it doesn’t matter which number voucher you use, but always include the information on the check as well because the IRS is famous for losing/separating documents including vouchers that come with payments.

Harry Sit says

Skip the check and the voucher. Make an extension payment online. It’ll be credited to your account sooner and for the correct year. You also get extra time to file your tax return (but you don’t have to use the extra time when you don’t need it). See Overpay Your Taxes to Buy $5,000 of I Bonds.

Gina says

Just read that if the registration is “or” then the grantee has the tax liability, but if it’s “with” then the primary owner has the tax liability. Didn’t see an option for “or”. What is the difference between the registrations?

Harry Sit says

You get “or” only on paper bonds and you keep the “or” registration when you deposit those paper bonds to your online account. You only get “with” when you buy in the online account. The two owners in the “or” registration are equal. The primary owner in the “with” registration can kick out or replace the second owner at will without notice or consent.

Dunmovin says

Soooo , that’s why she listed me second…got it! Have a super weekend

Gina says

If I have secondary owner transaction rights on an I-bond, and the primary owner dies, is there something that has to be done? Can I just leave it as is if I don’t want to redeem?

Or do I have to reregister it, somehow?

Thanks in advance.

Harry Sit says

You should notify TreasuryDirect and take over the bonds proactively. You can’t designate your own beneficiary or second owner until you become the primary owner.

bws92082 says

OK, so you can buy I-bonds in our revocable living trust. What happens when you have previously purchased a bond for your minor dependent child, in which you (not your trust) are the “custodian” and in which you have designated yourself (not your trust) as the beneficiary. Does TD allow you to convert all this to your trust?

Harry Sit says

The child is the owner of the bond. I assume the child isn’t a grantor of your trust. You can’t put someone else’s assets into your trust.

bws92082 says

OK, so if I die (as custodian), who becomes the new custodian? (Does custodianship transfer to the new legal guardian of the child?)

And if I die (as beneficiary) and my child also dies, who becomes the bond’s beneficiary?

Harry Sit says

I suppose the legal guardian or the successor custodian you name in your will. Please Google “UTMA account death of custodian” and check with TreasuryDirect customer service. The owner’s estate is the catch-all when all named registrants die.

Pan Tangible says

TaxSlayer program totally messed up my plans. Since I chose “send me a paper check” instead of “direct deposit” (with no warning that that choice would foreclose my options), I “clicked on through” as directed and it was filed! No opportunity to ask for IBONDS!!!

I’m furious.

Are there any recommended Tax Programs that won’t stumble over 8888? This is the second year this has happened.

Harry Sit says

I have detailed steps with screenshots for TurboTax and H&R Block software in Overpay Your Taxes to Buy $5,000 in I Bonds.

Dunmovin says

I always figure my own taxes and send by US Mail with 8888. Mailed mine last Thursday by registered mail

Dunmovin says

Update on #129…got tracking info today…delivered “to a P.O. Box,” yet no P.O. Box in / on address label AND no P.O. Box number in tracking info…only what irs provides! Go figure! Will read the riot act tomorrow to local post office

Dunmovin says

Further update to #129 below…went to PO and on their receipt screen for tracking number they had an address name and signature and got a picture of it

Pan Tangible says

I had to do that last year, but am concerned May deadline is coming up fast, so I thought efile would move it along. I’ll never use TaxSlayer again.

Now I’ll either have to lose the Tax Refund Bonds for 2021, or file an Amended which will slow down the refund even more! So screwed.

Dunmovin says

Suggestion. I rarely correctly fill out eforms if I can’t first see/read the entire blank form first, ie there may be question(s) that persuade me to go another way. I have never efiled with irs but have used/entered sample inputs on commercial e tax forms to check calculations. Sooooo try sample data first!

Mihir says

Thanks for the great article. Just so I understand this “fixed rate never changes” part.. say I had an I-Bond that was issued to me in Nov 2007 when fixed rate was 1.2%. Does this mean that on my next 6-month renewal in April 2022 I will get 1.2 (fixed) + 7.12 (composite) = 8.32% interest?

Harry Sit says

The November 2007 bonds are already earning 8.36% now.

Coriander says

Harry, can you shed any light on how the fixed-rate component of I bonds is set? I know it’s been at zero for quite a while, but I’m wondering if that might change with the anticipated upcoming increases in the fed funds rate. The only “explanation” I’ve been able to find is that it’s a complicated formula. Thanks!

Harry Sit says

There’s no formula. A person or a committee at the Treasury Department sets it at their discretion. You can study what happened in the last cycle. The Fed started raising interest rates in late 2015. The fixed rate on I Bonds stayed at 0% and 0.1% until May 2018. The yield on 5-year TIPS was +0.7% when the fixed rate on I Bonds went from 0.1% to 0.3%. The yield on 5-year TIPS is -1.0% today. We have a long way to go before we’ll see a meaningful positive fixed rate on I Bonds.

Dunmovin says

From someone’s post on another blog I saw…

“The Rauh and Warsh article in today’s WSJ advocates Treasury immediately raise individual ibond purchase limit to $100k. And states, “Over the past three months alone, I-bond purchases soared to $7.1 billion, compared with an average of $700 million a year during the decade before.” FIs are losing $s and should immediately raise CD rates OR will they advocate “Treasury stop this carnage and lower the limit!””

Jeff Somers says

The comment you posted from another blog is confusing. If I-bond purchases have soared, why would that be a reason to advocate an increase in the limit? That would seem to be an incentive to lower the limit as either you or the article or the other poster said the FIs might advocate. Personally, yes I would like to see a higher limit, but why would the government want to commit to these higher rates when it can borrow so much cheaper in the regular government bond market? One can even buy EE bonds at their pitiful interest rate but if they are put away for 20 years, one doubles his/her money, thereby locking in a compound rate a bit under 5% for that period. That’s still a lot better than what 20 year government bonds are paying right now if one wants a locked in rate. Of course, the I-bond currently pay higher but the rate is only guaranteed 6 months at a time. Then again, the I-bond only has to be held 5 years to avoid any penalty (and if the rate drops real low, even the 3 month penalty is not much to worry about) whereas, I must emphasize to any readers that you only get the double value deal if EE bonds are held the full 20 years.

Dunmovin says

Have you read the original WSJ source material? I don’t speak for the authors…. but the article makes sense to me as well as the post on another blog. Re-write if you are so inclined. Good Luck

Lou Petrovsky says

From the perspective of the Federal Reserve, their focus right now is not the issue of interest costs but the bigger-picture issue of significantly reducing inflation. Substantially increasing the annual purchase limit on I-Bonds may be helpful in achieving that goal as a very large increase in bond sales to enough purchasers may significantly reduce the huge current oversupply of money in a short time period. Yes, the current I-Bond rate is very high, but (1) if a large increase in the I-Bond purchase limit achieves that goal of reducing inflation quickly enough, the Treasury always has the option of bringing down the cap and mitigating the interest cost to the country, or even scrapping the entire program going forward, and (2) from a purchaser’s perspective, although nothing in the U.S. fixed income market currently offers such a high rate, the current I-Bond rate includes a zero fixed rate component, so it is not a return on principal invested, but partial protection of that principal (only partial, because at some point income tax will be due, except for those who apply their redemption proceeds to qualified education costs).

Howard says

Can I form an unlimited number of living trusts and purchase $10,000 of Ibonds in each one?

If so can I use the same Social Security number or tax ID number for each trust?

Thanks!

Howard

Jacquie Traub says

See replies to the first comment of this very informative article by Harry Sit

https://thefinancebuff.com/simple-living-trust-software-i-bonds.html

Andy says

Can a non-profit 501(c)3 buy I Bonds? If so, what option do we choose, corporation, LLC

Harry Sit says

A non-profit can buy $10,000 a year as a corporation.

bws92082 says

Hi Harry,

In your comment above from SEPTEMBER 22, 2021 AT 6:07 PM, you mentioned “the fixed rate…won’t go up until the 5-year TIPS yield turns positive (currently -1.6%).”

According to the link below, as of April 11, 2022, the fixed rate has shot up one percent in the last month to -0.58%. At this rate, it could go positive by May 1. Do you know when the fixed rate will be announced (or estimated with some level of certainty)?

https://fred.stlouisfed.org/series/DFII5

Harry Sit says

The fixed rate will be announced on May 2. I expect it to stay at zero.

George says

Hello,

Thank you Harry for this very helpful site. I have some questions regarding beneficiaries:

Can a beneficiary be under 18? If so, would they need to have an account with TD or can the account be created in the event of my death so the transfer can happen at that point?

I am thinking of opening a TD account and get the 10K for this year and wanted to list my nephew, who is under 18, as the beneficiary (I am single, no kids).

Thank you,

George

Harry Sit says

I don’t see any restrictions on the age of the beneficiary. Please confirm with customer service (see contact form, email, and phone number in the “Customer Service” section). The beneficiary doesn’t need to have a TreasuryDirect account at the time you designate the beneficiary.

Old mariner says

I have beneficiaries on some of my bonds who are under the age of 18, and none of them have a Treasury Direct account. When I set up the bond registration, only two things were asked: their name and SSN. There were no questions about age, date of birth, address, or phone number.

Scott says

Is there some kind of 3 month delay in earning interest on I Bonds? I bought $10,000 4 months ago and according to Treasury Direct I have only earned $60 at inflation APR of 7.12%. I bought $10,000 3 months ago and have earned nothing according to Treasury Direct. I know there is an initial 3 month no-earning-period on EE bonds but everything I’ve read says that I Bonds start earning on the first day. I’m confused.

Harry Sit says

The 3-month lag is already mentioned in the “Check Balance” section in this post.

Scott says

Yep, and I actually noticed that 5 minutes after I posted my question – story of my life. Sorry to bother you.

E.R. says

If I sell stuff on eBay, I can call that a sole proprietorship (SP). And so in theory I can have multipole SPs.

Does this mean I can buy up to $10K of I-bonds for each of my SPs, in additional to $10K for my personal account?

If I just use my SSN as EIN for all SPs, how does treasure direct keep track of the $10K limit?

Harry Sit says

The multiple sole proprietorships can’t just exist in your head. If you’d like to pursue it, make them formal and ongoing endeavors. See Buy I Bonds for Your Business: Sole Proprietorship, LLC, S-Corp.

E.R. says

“An LLC or a sole proprietorship can have an EIN or it can use the owner’s Social Security Number as its tax ID. Which tax ID a business uses and how the business is taxed don’t change the fact the business is still a separate entity from the owner as a person.”

To sum up, for I-bond buying purposes, you can have a sole proprietorship **BUT** it has to be registered with its own EIN (not your SSN). Yes?

Harry Sit says

No, the sole proprietorship can use the owner’s SSN but it has to be a real sole proprietorship, not just a figment of imagination. See the IRS guidelines on business activities.

Jim S says

My spouse and I have set up our I Bond accounts as primary owner with second owners. (DH with DW and DW with DH). According to the TD FAQ: Upon the death of either the primary or secondary owner, the survivor will be considered the sole owner of the bond.

Is this considered a transfer of ownership? Will tax have to be paid on the accumulated interest? Will TD issue a 1099 at the end of the year?

Thanks, Jim S

Harry Sit says

By default whoever inherits the I Bonds will pay tax on all accumulated interest since the beginning when they eventually cash out. No 1099 will be issued in the year of the death of the original owner. You can do it differently but it gets complicated. See Taxes on I Bonds Get Complicated If You Go Against the Default.

Dunmovin says

Why push the envelope and kill the “golden goose?” I don’t disagree with Harry’s answer…but it use to be that a tax deferred retirement account required a TIN. I have had one for years…especially for overseas income/transfer to the states…does one think that it and other indices are supportive of an independent business? And for a mere $10k…really?

Martin…how are the deliveries working?

Bob C says

Sorry if this has already been asked, I set up a TD account and purchased 10k with me as primary and wife as secondary. She got flagged opening her account and has to do the verification thing, question is can I buy for her in my account as gift then transfer to her once she gets her account up and running? Wanting to purchase by end of April, Thanks for the informative blog.

Harry Sit says

Yes, buying a gift before the recipient sets up their account works. She can add you as a second owner after you deliver the gift. See reply to comment #102.

Marion Julius Nesmith, Jr. says

Good morning,

I purchased my bonds on December 4, 2021 and Jan. 8, 2022.

When will they qualify for the new interest rate?

Thanks,

Marion

Harry Sit says

In June and July respectively. Every bond stays on a rate for full six months before moving on to the next rate for another six months.

Ben says

Hi.

Thanks for the informative article! I found it quite helpful.

My mom wants to buy I bonds but she isn’t computer or tech saavy at all. She can barely speak English. As a result, she’s asked me to create an account in my name. Or to have the account in her name. Of course, then the email addresses and phone numbers don’t line up because the latter two will be mine. I don’t even know if this is possible legally.

I did read about the tax implications on TresuryDirect.gov. It says that I can name someone else as an owner of the bonds, and they receive all the tax implications. Yet, reading your website, it seems that that person needs to be a spouse, not a parent. Do you know if I would be able to be the primary account owner, but with my mother as the person who would hold the bonds and receive the 1099-INT?

Thanks.

Old mariner says

Well, here are my thoughts. Two people can be owners of a bond. Those two people don’t have to be related to each other. I used to own a bond with my mother. But, if an electronic bond is purchased under your account, then you are considered the primary owner. If a bond is cashed in from your account, you are the one who will receive the 1099-INT. You don’t get a 1099-INT every year. You only get one when you cash in the bond or the bond registration (ownership) changes.

In the above scenario, if she is co-owner and wants to cash in the bond, you can cash it for her, you will receive the proceeds into your bank account, and you will receive the 1099-INT. However, you can claim nominee status with the IRS effectively passing the tax liability for the interest over to her. It’s an easy process to do that and involves you issuing a 1099-INT to your Mom. That’s something for you to Google, if you’d like to learn about it.

It’s also pretty easy to set up the TD account in your mother’s name. I don’t think it matters if you share a phone number, but it’s probably better to have her own email address. It’s easy to open a Gmail, Yahoo, or other provider email account for her. It’ll all be in her name, but you’ll be the one managing it for her. If she wants, she can elect to name you the second owner or as her beneficiary. If she wants to cash in the bond, you can do it for her, she will receive the proceeds into her bank account, and she will receive the 1099-INT.

Lou Petrovsky says

If you are referring to their toll free number 844-284-2676, when I called that number this morning there was no such prerecorded message. On their Option 3 (“status of correspondence”) there is prerecorded message that it can take up to 8 weeks to respond to requests for status of correspondence. Is there a different phone number that includes the message you heard?

Dunmovin says

Martin, can you update us on delivery status? Thanks

Old mariner says

Who’s Martin? I can find no Martin in the thread.

Harry Sit says

Martin is on the post about gifts, not this one. He said the gifts were delivered successfully.

Dunmovin says

Sorry about my mispost…but briefly Martin on another thread was planning to “deliver” $30K of gifts to one individual and, as Harry stated, I found Martin’s post and the $30K gift was delivered to one person…Or so says Martin. Given there is some form of post sale “audit” by TD it could remain to see about “what happens….” But

Harry any comments on (apparently) more than $30K being delivered to one person in one year?

Harry Sit says

Let’s keep the discussion on the gift post. I’m not surprised. See my comments on April 16th there.

Frank says

Confirmed, Treasury will pay out 9.62% interest rate for the next 6 months.

https://www.cnbc.com/2022/05/02/i-bonds-to-deliver-a-record-9point62percent-interest-for-the-next-six-months.html