I’ve been buying I Bonds for 20 years. I only realized now I’ve been writing as if everyone already knew what they were and how they worked. If you buy I Bonds before November 1, 2023, you will get a 0.9% fixed rate plus a variable rate that continues to match inflation in the previous six months. If you’re new to I Bonds, this post walks you through from soup to nuts.

What Are I Bonds?

I Bonds are short for Series I Savings Bonds. They are bonds issued by the U.S. government directly to retail investors. Currently, I Bonds carry a favorable yield over other CDs and bonds. This makes I Bonds the best low-risk investment at the moment.

How I Bonds Work

Think of I Bonds as flexible-term variable-rate CDs.

You’re required to hold them for at least one year. After that, you can cash out at any time you’d like before the maturity date, or you can choose to hold them for up to 30 years from the original time of purchase. If you cash out within five years, you forfeit interest earned in the previous three months, whereas the early withdrawal penalty on a typical commercial CD is often six months or 12 months of interest. The flexibility to cash out after one year with a low early withdrawal penalty or to hang on for as long as 30 years makes I Bonds good for both short-term and long-term investing.

Similar to a CD, the value of I Bonds never goes down. They are guaranteed by the full faith and credit of the U.S. government. Unlike a typical CD with a fixed interest rate for the entire term, the interest rate on your I Bonds changes in six-month cycles. You stay on the current rate for the full six months and then you go on a new rate for another six months, and a new rate after that for another six months, and so on.

The interest rate is guaranteed to at least match inflation. If the inflation rate goes up, the interest rate on your I Bonds automatically goes up. Some older I Bonds earn a positive rate above inflation. The I Bonds you buy now only match inflation. Even merely matching inflation makes I Bonds attractive when other CDs and bonds don’t keep up with inflation.

Tax Treatment

The interest on I Bonds is credited monthly and automatically reinvested every six months. You get all the accumulated interest when you cash out. You don’t get a separate payout monthly or quarterly.

By default, you pay federal income tax on the interest from I Bonds only when you cash out, whereas you must pay taxes on the interest from CDs and bond funds every year even if you reinvest the interest. The interest from I Bonds is exempt from state and local income taxes. I Bonds are more appealing than other CDs and bonds because you have the tax deferral and the exemption from state and local income taxes.

You can choose to pay tax in a different way but it gets complicated. Staying with the default makes it easy for everyone. See Taxes on I Bonds Get Complicated If You Go Against the Default.

If you meet an income limit and other requirements, it’s possible to cash out your I Bonds tax-free when you use the money for qualified higher education expenses. See Cash Out I Bonds Tax Free For College Expenses Or 529 Plan.

Where to Buy I Bonds

There are only two ways to buy I Bonds:

1. Buy electronic bonds online at the government website TreasuryDirect.

2. Buy paper bonds with money from your tax refund when you file your tax return with the IRS each year. See details in Overpay Your Taxes to Buy I Bonds.

You can only use regular after-tax money to buy I Bonds. They’re not available in any tax-advantaged accounts such as 401k-type plans, IRAs, or HSAs. Nor are they available through any brokerage firms such as Fidelity, Charles Schwab, or Vanguard.

Purchase Limit

I Bonds are such a great deal that the government puts a limit on how much you can buy each year. At current rates, you should get your full quota before you buy any other CDs or bond funds.

When you buy on the government website TreasuryDirect.gov, the limit is $10,000 each calendar year per Social Security Number as the primary owner in a personal account. When you buy using money from your tax refund, the limit is $5,000 per tax return (not per person when you file jointly).

If you have a trust, you’re allowed to buy another $10,000 each calendar year in a trust account. See Buy More I Bonds in a Revocable Living Trust.

If you have a business, the business can also buy $10,000 each calendar year. See Buy I Bonds for Your Business: Sole Proprietorship, LLC, S-Corp.

If you have kids under 18, you can also buy $10,000 each calendar year in each of your kids’ names. See Buy I Bonds in Your Kid’s Name.

If you’d like to buy I Bonds as gifts to others, see Buy I Bonds as a Gift.

A married couple each with a trust and a self-employment business can buy up to $65,000 each calendar year, and more if they file separate tax returns, buy in their kids’ names, or buy as gifts for family members.

- $10,000 in Person A’s personal account with Person B as the second owner

- $10,000 in Person B’s personal account with Person A as the second owner

- $10,000 in an account for Person A’s trust

- $10,000 in an account for Person B’s trust

- $10,000 in an account for Person A’s business

- $10,000 in an account for Person B’s business

- $5,000 using money from their tax refund if they file jointly (or $5,000 each if they file separately after making sure they won’t lose other tax benefits)

- $10,000 in the name of each of their kids under 18

- $10,000 as a gift for each member of the extended family

We had only one trust before. We created a second trust with software to buy another $10,000. For buying I Bonds in a trust account in general, please read Buy More I Bonds in a Revocable Living Trust.

Open Account

If you never bought I Bonds before, you need to open an account at the government website treasurydirect.gov. You can buy more in the same account in subsequent years. Find the Open Account link at the top right.

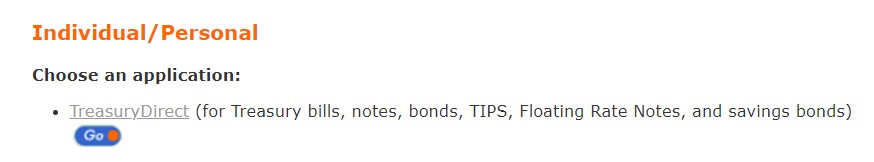

Choose the first option for Individual/Personal. Go here for a trust account or a business account as well.

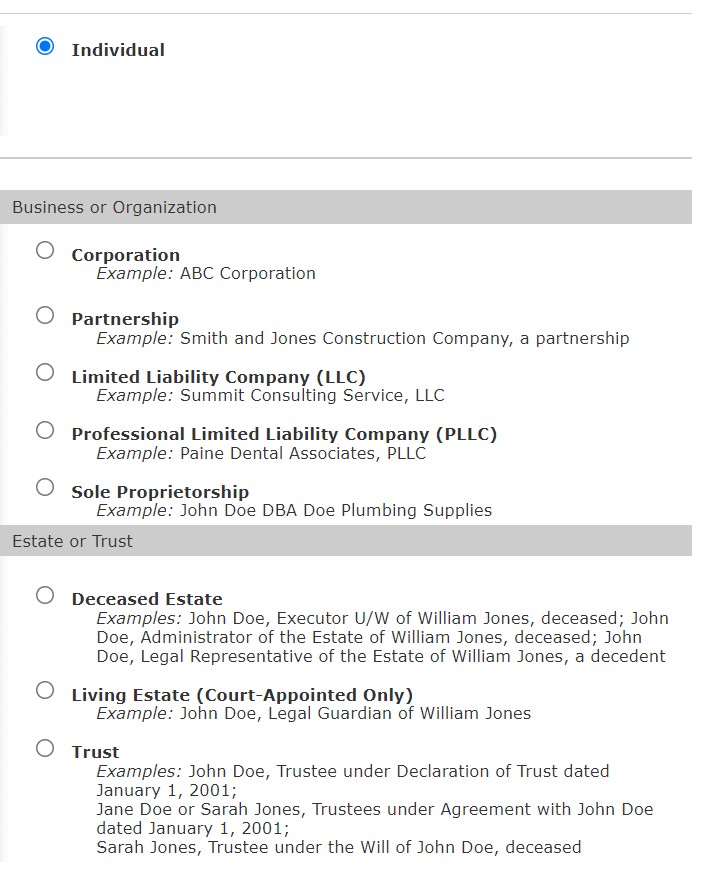

Now you can choose an individual, business, or trust account.

Next, fill out the required information and choose a security image, a password (not case sensitive), and security questions. Important: Save your answers to the security questions. You will be asked to answer one of the security questions when you perform certain actions at a later time. Your account will be locked if you can’t answer the security questions.

Separate Account for Spouse

TreasuryDirect doesn’t support joint accounts. The individual account you’re opening now is only for yourself. If your spouse also wants to buy I Bonds, he or she must open a separate account. However, you can specify a second owner or beneficiary on the bonds you buy in your personal account. You do that at the holdings level at the time of each purchase. We’ll cover that in the Registration section of this post.

If you’re opening a trust account, see Buy More I Bonds at TreasuryDirect in a Revocable Living Trust for what to use as the name of your account.

Link a Bank Account

The application also asks you to link a bank account. Make sure you enter the bank routing number and account number correctly. TreasuryDirect doesn’t send any random deposits to verify the bank account.

Save Account Number

You will receive your TreasuryDirect account number by email. Important: save your account number. You’ll need it to log in.

Most people can start buying right away after receiving the account number. A small percentage of people need to complete an extra step for identity verification. If you’re among the unlucky few, please read Where to Get a Signature Guarantee for I Bonds at TreasuryDirect.

Schedule Purchase

Log in with the account number. The system will email you a one-time password (OTP). Important: Don’t use the back and forward buttons in the browser when you use the TreasuryDirect.gov website. Only use the “submit” and “return” buttons on the web pages.

After you log in, go to BuyDirect in the menu.

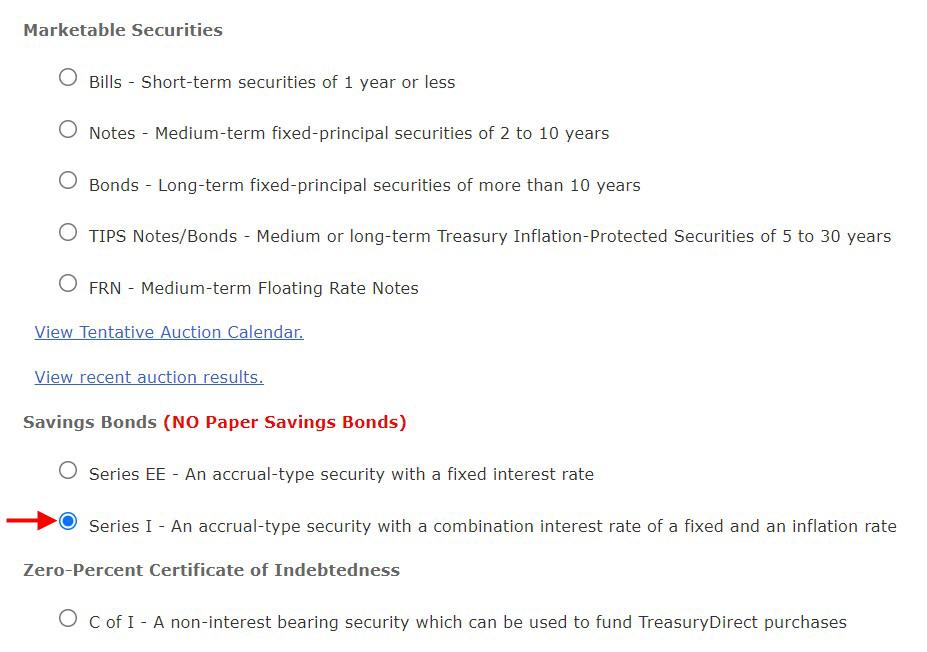

Although we use TreasuryDirect only to buy I Bonds, the account can be used for other products as well. Choose Series I near the bottom of the list.

Registration

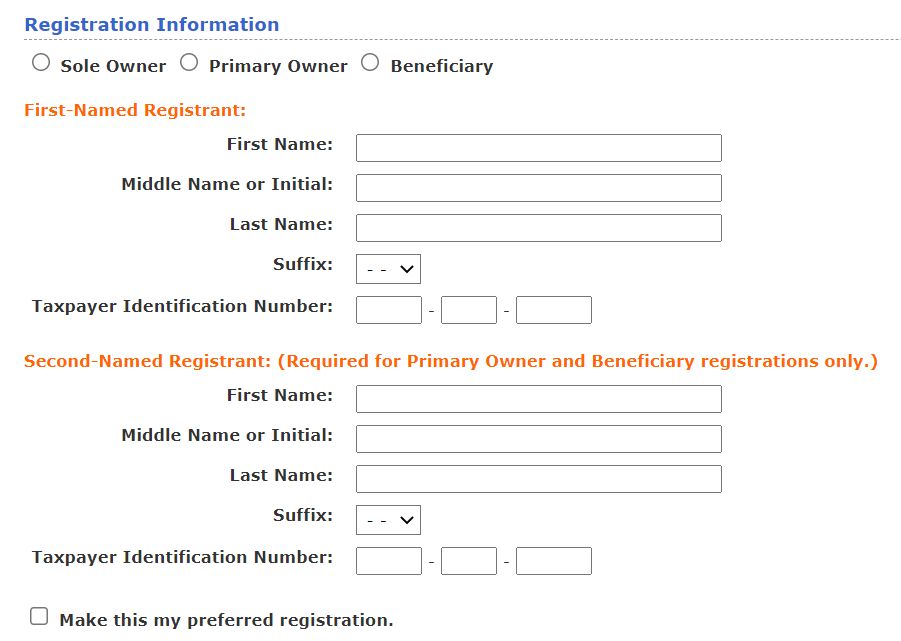

If you’re buying I Bonds for the first time in a personal account, you need to create a Registration, which means whether you want the bonds to have:

- Just yourself as the only owner; or

- You as the primary owner and another person as the second owner; or

- You as the owner and another person as the beneficiary.

Choose the “Sole Owner” radio button if you want yourself as the only owner with neither a second owner nor a beneficiary. Choose “Primary Owner” if you want yourself as the primary owner with another person as the second owner. Choose “Beneficiary” if you want yourself as the primary owner with another person as the beneficiary. See I Bonds Beneficiary versus Second Owner for the difference between a second owner and a beneficiary.

Unlike in typical commercial accounts, the second owner and the beneficiary in TreasuryDirect are at the holdings level, not at the account level for all holdings. You can have some bonds with Person A as the second owner, some other bonds with Person B as the beneficiary, and so on.

No Contingent Beneficiary

Each bond can have only one second owner or one beneficiary but not both at the same time. You can’t specify a contingent beneficiary. The second owner or beneficiary also has to be a person. It can’t be a trust or a charity. Trust accounts and business accounts can’t buy bonds with a second owner or a beneficiary. The trust or the business will be the only owner.

A married couple can choose to:

(a) Name each other as the second owner or beneficiary and live with the risk of simultaneous death; or

(b) Name someone such as a child or grandchild who isn’t likely to die simultaneously. The child or grandchild will get an early inheritance when you die. The surviving spouse will live on other assets.

First- and Second-Named Registrants

If you decide to have a second owner or a beneficiary, enter yourself as the “first-named registrant.” Enter the second owner or the beneficiary as the “second-named registrant.”

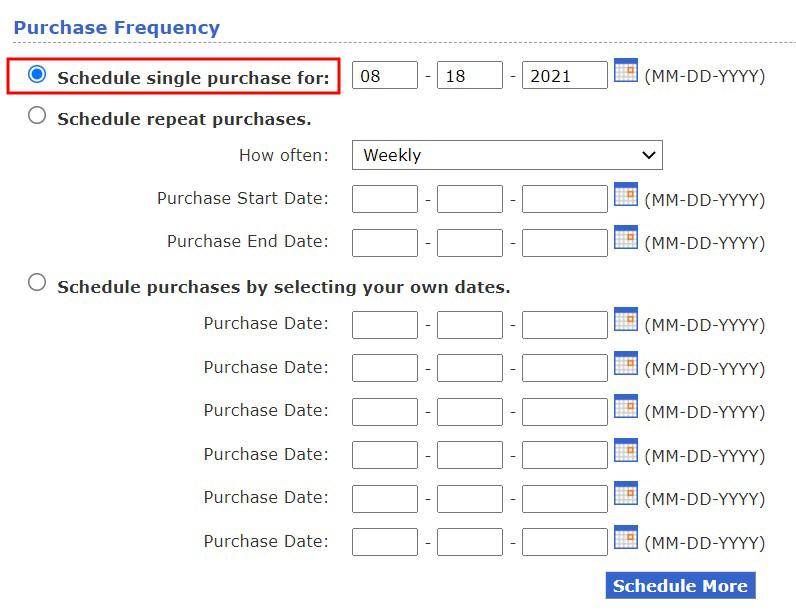

Purchase Date

Choose the purchase date. Make sure you have money available in the linked bank account. They send out the debit the night before your scheduled purchase date. The debit will hit your bank account on the scheduled date first thing in the morning. They may lock your TreasuryDirect account if the debit bounces. It’ll be difficult to unlock it.

Important: Don’t cut it too close to the end of the month, or else you may miss a month worth of interest. It takes one business day to issue the bonds and possibly more days if there’s a delay. If you buy close to the end of the month, your issue date may be in the following month and you won’t get the interest for the previous month. I schedule my purchases to a date at least a week before the end of the month.

Grant Rights to the Second Owner or Beneficiary

If you put a second owner or a beneficiary on your I Bonds, the second owner or the beneficiary doesn’t automatically see those bonds in their account. They see the bonds only when you grant them View or Transact right. The beneficiary can only be granted the right to view the bonds (“read-only”). The second owner can be granted either View or Transact right.

After the purchase completes and you see the bonds in your account, please read How To Grant Transact or View Right on I Bonds for a walkthrough on how to grant rights on the bonds you just purchased and how a second owner can transact on the bonds on your behalf after you grant the right.

Rinse and Repeat

If you’re buying additional I Bonds in the name of a spouse or a trust, repeat the steps above by opening a separate account, creating a password, linking a bank account, saving the account number, and scheduling the purchase. The different accounts can use the same email address and link to the same bank account if you’d like. Because you’ll use different account numbers to log in, you should keep notes of which account number is for which owner.

If you’re interested in buying I Bonds in the name of your trust, kid, business, or as gifts, please read:

- Buy More I Bonds in a Revocable Living Trust

- Buy I Bonds in Your Kid’s Name: You Can, But Should You?

- Buy I Bonds for Your Business: Sole Proprietorship, LLC, S-Corp

- Buy I Bonds as a Gift: What Works and What Doesn’t

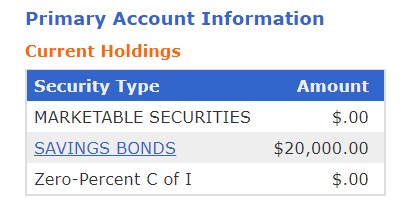

Check Balance

TreasuryDirect doesn’t send any account statements. You check your balance on the website. Your total face value is displayed on the home page after you log in. This doesn’t include any credited interest.

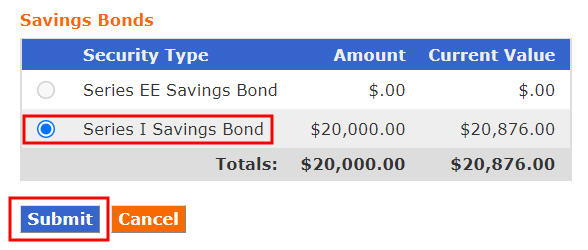

Clicking on the Savings Bonds link will show you a breakdown by savings bond type: Series EE and Series I.

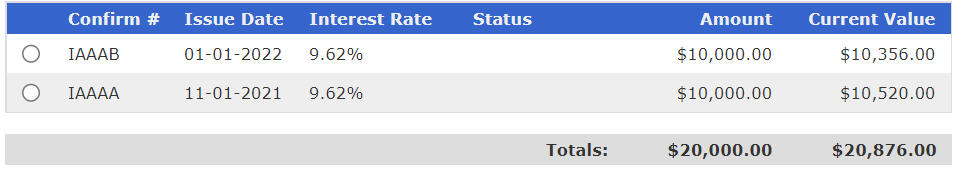

The Amount column shows the total face value. The Current Value shows the total face value plus credited interest. Click on the radio button next to Series I Savings Bond and then click on Submit. You’ll see a list broken down by the Issue Date.

Three-Month Lag in Current Value

If your bonds are still within five years from the Issue Date, the Current Value automatically excludes interest earned in the last three months. If you cash out today, you’ll receive the Current Value. That’s why you won’t see any interest in the current value during the first four months. You will start seeing a higher value in the fifth month.

Interest Rate Lag

The interest rate on your bonds doesn’t necessarily change right away when a new interest rate is announced. Each bond stays on the previous rate for the full six months before it moves on to the next rate for another six months. The rates change in different months depending on when your bonds were originally issued.

Don’t worry when you see your older bonds earning a different interest rate than the current interest rate on your newer bonds. When those older bonds “age out” the previous rate for the full six months, they will move on to the newer rate for six months. All bonds eventually go through all rate cycles.

Cash Out (Redeem)

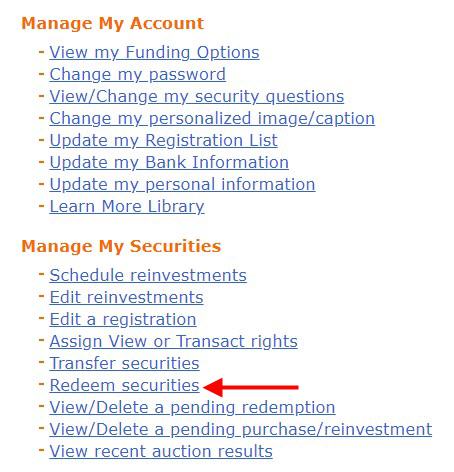

Because I Bonds are better than other bonds and there’s a purchase limit, you should hang on to your I Bonds as much as you can until you have better choices. If you need to cash out some of them (called “redeem” in the government lingo), you use the ManageDirect menu.

The option isn’t really obvious unless you know what to look for. Click on “Redeem securities” under the heading “Manage My Securities.”

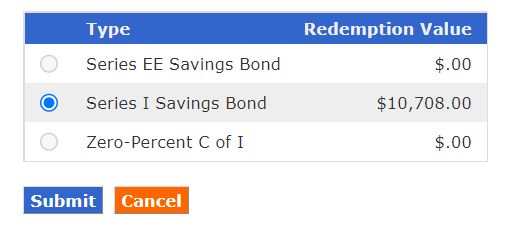

Choose “Series I Savings Bond.”

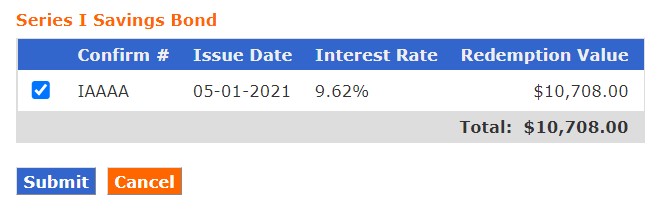

Choose the bond you’d like to cash out from.

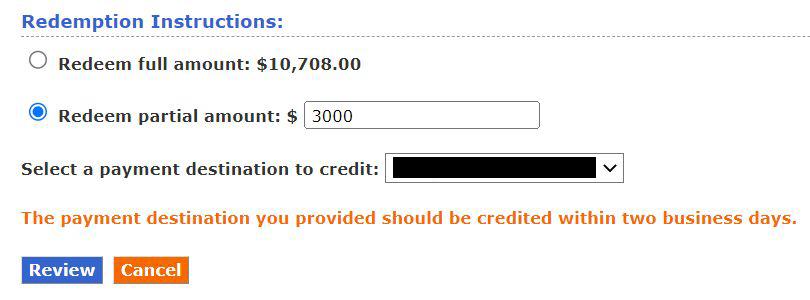

You don’t have to cash out/redeem the full amount. Redeeming only part of it is just fine. The minimum cashout amount is $25. If you originally purchased $10,000 and it grew to $10,708, when you redeem $3,000 from it, they will prorate the $3,000 into $2,801.64 principal and $198.36 interest. You’ll pay tax on the interest.

The money will be sent to your linked bank or credit union account by direct deposit in one or two business days after you cash out.

Tax Forms

If you don’t cash out (redeem) any I Bonds in any year, you won’t get a 1099 form for the interest earned. You pay taxes only in the year you cash out.

If you do cash out (redeem) any I Bonds in any year, TreasuryDirect will generate a 1099 tax form for the interest portion. They don’t send paper tax forms. You’ll come back to the ManageDirect part of the website at tax time to get the tax form (see the screenshot above).

See Report I Bonds Interest in TurboTax, H&R Block, FreeTaxUSA for how to report the interest in tax software.

You can choose a different treatment for when you pay taxes but it gets complicated. Please read Taxes on I Bonds Get Complicated If You Go Against the Default if you’re interested.

Customer Service

If still have questions or if you run into any problems, you can contact TreasuryDirect:

- Send an inquiry via their contact form.

- Send an email to Treasury.Direct AT fiscal.treasury.gov.

- Call 844-284-2676 during business hours.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Anand Kumar Sankaran says

Thanks Harry.

Ralph says

Set up a second bank account, linked to their primary account, and only put the money they want to use for purchasing the I-Bond in it.

Kevin says

Be sure to read this – the bank/brokerage that they use to originally transfer the $10K (or $20K, for two I-Bonds) may matter down the road when they wish to cash them out. Changing to a different bank to cash out can be a hassle:

https://www.reddit.com/r/Bogleheads/comments/q8oh1u/sold_on_ibonds_what_about_withdrawing_cash/?sort=old

Robin says

Thanks for all the great feedback. After much review, they have decided to open a secondary bank account in their name, soley for this transaction.

Harry Sit says

When the secondary bank account is rarely used, make sure the bank doesn’t close it due to zero balance or inactivity.

R says

The problem is the so-called link. Even without it, the rule on offsets would permit the bank to take the funds from all other accounts in case of something bad happens. Has to be at another bank with enforced no overdraft protection (with no ties to any other accounts). However, redemption has the funds coming back. I submit the parents receive or will social security or other direct e-payments and where do they think they received stimulus checks?

Ralph says

The rule of offsets does not apply to hacking situations, which is what I think Robin’s parents are concerned with.

R says

One doesn’t know it is a hack (ever try to prove a wrongful ACH, good luck) until way later and in the interim who advanced the $s…bank.

Eric P says

Thank you for a great article.

I have a spouse and 2 kids. So two invest 40K for this year, I would need to:

1. Create TreasureDirect account for me and put 10K

2. Create account for my spouse and put 10K

3. Create linked accounts for 2 kids and put 10K in each account

Is that correct?

Would it be possible to add my spouse and kids directly to my account using “Add New Registraton” on BuyDirect screen, or I have to create 4 separate accounts?

Harry Sit says

Four separate accounts. Please note the bonds you buy in a kid’s name belong to the kid. It’s similar to a UTMA account. The money can only be used for the kid’s benefits. Here’s some basic information on custodial accounts:

https://www.schwabmoneywise.com/essentials/custodial-accounts

Todd says

I sent that stupid form in 2 weeks ago. A got a generic email a few days ago saying it was received and will be reviewed but the website still says that it hasn’t been received. Do you know how long this process will take and if all that sounds correct? Thanks!

Harry Sit says

Not sure which stupid form. If you’re talking about depositing paper I bonds, my last deposit took 26 days. See How To Deposit Paper I Bonds to TreasuryDirect Online Account. Just wait and check every 30 days. You keep the original issue date and interest rate. You don’t lose anything while waiting.

If you’re talking about switching banks or other ID verification, see comments #40 and #41. Two weeks is normal. It’s probably going to take longer with more people wanting I Bonds now. Contact customer service if it’s not done in another week.

Steve says

How long can you leave an I bond in the gift account after purchase before it has to be transferred to a new account? Does the newly purchased I bond generate interest while it remains in the gift account?

Harry Sit says

No time limit before the bonds mature in 30 years. The gift bonds earn interest before getting delivered to the intended owner.

E$ says

If I buy I-Bonds for my LLC, how do I then get the money to me? Can I sell them and then just take the proceeds as a draw to myelf from the business? And if it is from an LLC that we currently do nothin with (long story), would that mean we have to do taxes for that LLC that year? THANKS IN ADVANCE!

Harry Sit says

The bonds belong to the LLC. If the LLC sells them, the money goes to the LLC’s checking account. You can do whatever you normally do with any other money in the LLC’s checking account. The LLC earns interest income that year. Taxes must be handled however the LLC is taxed (sole prop, partnership, S-Corp, etc.).

john says

It appears that multiple LLC’s partnerships, s-Corps, etc. can EACH purchase $10K of bonds per year (as long as they have a separate EIN number) even if the various entities are owned/controlled by the same person(s). Is that correct. Thank you!

Harry Sit says

That’s correct, in the same way each of those separate business entities can have its own bank account.

R says

Harry, in your reply to John, are you suggesting separate bank accounts are required or merely advisable for different businesses? Having a different tin or Soc sec number coupled with schedule c irs filing should be suffice… right?

Harry Sit says

There must be good reasons to set up those business entities separately. Having separate businesses share a bank account with each other or use the owner’s personal bank account defeats the purpose (“piercing the corporate veil”). I don’t know whether TreasuryDirect cares but I would think you want a separate bank account for each business anyway.

R says

Thanks, Harry

John says

If I invest $10,000 in an I Bond can someone gift me another $10,000 of I bonds in the same year?

Harry Sit says

Having a gift delivered to you counts against your quota in the year of delivery. Someone can buy the bonds as a gift intended for you and keep them in limbo until you’re not buying them yourself. So technically yes but practically maybe not worth doing.

JohnD says

I’ve just run into a snag while filling out the Individual Account Application at the TD website. When I get to the “Bank Information” section, there is not enough space in the “Names on the Account” box to type both my name and my wife’s name as they appear on our joint bank account. Apparently the box only allows for a limited number of characters, so when I try to type my name and my wife’s name in full, I only get as far as JOHN WILSON / ELIZABETH WIL (for example) and then can’t type any more. How do I get around this problem? I can’t find any instruction regarding this on the website. Would it be okay to type JOHN & ELIZABETH WILSON? I can’t imagine that many other people haven’t encountered this same problem. This is pretty frustrating; our names are simple and not very long.

R says

What if there were 3 or 4 on the account? We are not asked to provide everyone…and clearly if space/character restriction it is by them! The step transaction of removing a spouse would work and then add him/her back later! But seriously…I only listed myself when checking was in the names of more. If they don’t like it…they can reject and then..

R says

John, I revisited what I used in my registration of TD accounts for bank checking accounts. I used only the last name when there were more than one on bank account…of course they all had the same last name. Good luck

R says

Just changed a checking acct to another at the same bank…did not need to have Form 5512 signature certified b/c a previous certified signature had been submitted a couple of months earlier. From time of mailing form to receipt of acct change confirmation email it took 18 calendar days.

pradcliffe says

Thank you. This is the best article on i bonds I have ever seen. Because of the level of detail, the article answered two questions I for which I could not find answers anywhere else, including the Treasury Direct website.

MK says

If I buy iBonds in the name of my (legitimate) sole proprietorship, can I leave the bonds in the name of that business indefinitely until I’m ready to redeem them, even if I stop operating the business in the future?

And with this in mind, would it be advisable to set them up with a bank account that I plan to leave open long term (even if it’s the same account I use for my personal and trust TreasuryDirect accounts), vs my business checking account that may be closed in the future?

Harry Sit says

The bonds belong to the business. You should dispose of its assets (sell or transfer to personal name) before you shut down the business. You lose the authority to act on behalf of the business once the business ceases to exist.

ccg says

What a great article! Here are my questions .

I’d like to buy 10k of bonds for each of 3 children (young adults) every year as an investment for them. Do they need a Treasury Direct account set up if they don’t plan to cash them for many years? Can I just keep adding them to the Gift box? Or must they be delivered to their account each year to count as the limit for that year?

Any other way to approach this? I can’t imagine they will have the same checking account for the next 20+ years!

Thanks!

ccg

Harry Sit says

You establish a Minor Linked Account for each of them in your own account. See instructions here:

https://www.treasurydirect.gov/indiv/help/tdhelp/howdoi.htm#openminor

ccg says

Thanks, but they are adults in their 20s, not minors.

Harry Sit says

Sorry, missed that. I was thinking of young adults in library terms (13-18). An adult needs their own account eventually to cash out. You don’t have to deliver the gift each year but the bonds are in limbo until they are delivered. If that’s intended, no problem.

Marion Julius Nesmith, Jr. says

Good morning,

I have an old laptop and plan on purchasing a new one next year.

I think you said something about using the same computer to set up the portal.

Will I be able to communicate with the new device without problems?

Thanks, Marion

Marion Julius Nesmith, Jr. says

I found my answer…One-time passcode…(OPT) Good Read

https://www.treasurydirect.gov/indiv/help/TDhelp/help_ug_274-SecFeaturesProtectAcctLearnMore.htm

Robert Just says

• Sign Up For Fiscal Service Mailing Lists: Savings Bond Lists

You may subscribe or unsubscribe to Fiscal Service mailing lists for savings bonds news and information from this page.

https://www.treasurydirect.gov/maillist/maillist3.htm

Marion Julius Nesmith, Jr. says

I have a few old…paper…savings bonds.

Is there a way that I can move these to T/D?

Marion

Harry Sit says

See How To Deposit Paper I Bonds to TreasuryDirect Online Account.

Dawn says

Received I-Bonds as a gift several years ago. Should I already have an account opened by the giver?

Harry Sit says

How did you receive the gift and where’s that gift now? If you received paper bonds and you still have those on paper, you don’t have an account. If you received the gift electronically, maybe you don’t remember you opened an account back then. The giver can’t open an account for you. Only you can open an account for yourself.

JS says

Thank you for a very well written and organized guide to the Treasury Bond purchase process. It is always a pleasure to see something that gets through the clutter and down to the basics of “how to get it done” in a straight-forward and efficient way.

Sam says

Hi,

Can I purchase 10k in ibond in my individual name with my social security number plus purchase another 10k in the name of my revocable living trust that has my social security number too in a calendar year. I am the grantor and the trustee of the Revocable Living Trust.

Thank you for your answer in advance.

Brad says

According to Harry’s articles here:

https://thefinancebuff.com/simple-living-trust-software-i-bonds.html

-and-

https://thefinancebuff.com/buy-more-i-bonds-treasury-direct-trust.html

You can. Whether this falls afoul of the intent of the Treasury Direct instructions or not, it doesn’t appear to be clear. He does offer this caveat at the top of the first link, “Please note I’m not a lawyer. I’m only sharing what we did for our own situation. I’m not recommending that you do the same. Please take this as only an anecdote.”

YMMV as they say. Harry, if you have further clarification or perhaps some language from the TD site itself on how “gray” this area is, let us know. Since it’s not totally clear, I imagine the worse thing that could happen is they could force you to redeem a bond early? Or could they confiscate any accumulated interest over decades?! I don’t know. (IANAL either!)

Harry Sit says

Brad – A trust having a separate quota from a person isn’t gray. A trust is still a separate entity from the person even if they happen to have the same tax ID. The caveat you quoted is about creating a trust, which is normally done by a lawyer but I did it myself with software.

Ted says

Thank you so much for this wonderfully informative tutorial. It made dealing with the clunky treasurydirect site bearable.

George says

I have had, and plan to continue to have, solid longstanding relationships with my credit union (which honors ACH transfers) and my brokerage account (TD Ameritrade/Schwab). Any generic advice on which would be preferable “bank” linked to Treasury Direct account? Thanks for excellent tutorial.

George says

In answer to my own post #75, I found that my brokerage firm has a separate checking account # than the brokerage account #. Never used it, but was told that cash from brokerage would automatically move to checking to cover Treasury Direct debit on ACH transfer.

Your very comprehensive and enabling blog also presents challenges on balancing short-term investing and tax management issues vs. longer-term benefits. I may be overly conservative on tax emphasis, but I currently work hard to ensure that our combined annuities as seniors and other income do not exceed the 12% taxable threshold that enables ETF and mutual fund capital gains and qualified dividends to be tax-exempt, relying heavily on tax deferred accounts and municipal bonds.

If I followed a discipline of annual I Bond purchase of $25,000 ($10,000 x 2 plus $5,000 income tax refund) and redemption at the penalty-free five-year point, for a nominal inflation rate of 2.5%, I calculate the taxable interest to be in a range (about $3,285) which would allow me to stay below the 12% “radar.” Holding too long could result in 22% taxation on capital gains and divvies as well as additional 10% (22-12%) on the I Bond interest. The downside of this scenario is limiting deferred taxation to interest on I Bond total of $125,000 (5 x $25,000). From a longer term and estate planning point of view heirs might be less concerned about the tax management. The math and other subtleties hurt my head a bit but I would appreciate any comments on the general considerations. Sometimes the best course of action is to punt – mix and match?

One last specific question: If the I Bonds eventually go to beneficiaries is your caveat about choosing a “forever” Treasury Direct linked bank valid or are beneficiaries at liberty to direct their I Bonds to their own banks?

And finally – I haven’t seen the interrogatory words (adverbs?) “who, when, where, how, why and what” used together since an elementary school classmate, whose father was an English teacher, sprang them on the class as collectively covering all forms of inquiry – charming! Thanks.

Harry Sit says

Beneficiaries will transfer the bonds to their own account. They will need to link a bank account when they open their account. Ideally it should be their “forever” bank. It’s not impossible to change the linked bank account. It requires getting a form stamped by a bank officer, mailing it in, and waiting 2-3 weeks.

Pan Tangible says

My head hurts just reading this!

My strategy on this is more of a philosophy, really, because aiming for perfect maximization in an unknowable future will hurt your (my) head every time. So my philosophy is to be aware of shifting and evolving opportunities to move my money to a better place. I was in CDs when they were paying more, moved to I Bonds when CDs disappointed. Maybe the day will come when Interest Rates get high enough that I’ll gradually move out of I Bonds.

But I’ve learned I will never get an answer that gives me perfect clarity when One of the variables (the future economic situation) is unknowable.

Just my two cents.

Trust yourself . When the time comes you will make a good choice.

Brad says

George, perhaps I’m oversimplifying, but if you have (taxable) assets that you’re investing in municipal bonds and those bonds pay a better **real** interest rate after taxes: that is, adjusting for the not taxed aspect of munis (that’s a plus/+) and also adjusting for inflation (that’s a minus/-), then you should just buy more munis and not buy I-bonds, in my opinion, as you’re getting a better return from them.

If on the other hand, you get a better interest rate from an I-bond (after paying tax, even if your long-term marginal capital gains tax rate is 15% or 20%–there is no 22% for long-term gains; I believe after holding for 1 year and 1 day, it’s all long-term capital gains on an I-bond, when cashed out say, after five years as you suggest), then you should buy I-bonds, even if you’re paying 20% capital gains tax rate on the proceeds. What matters is how much money (interest earnings) you’re ending up with in your pocket, after taxes.

For example, if the munis pay, say, enough interest to earn you $2,500 in interest after five years, but your I-bonds pay $3,285 – 15% (492.75) = $2,792.25, then the I-bonds are a better deal, even though you’re paying a 15% marginal tax on them. Same goes for the 20% rate: $3,285 – 20% ($657) = $2,628. Both of those are more than the $2,500 the munis pay. Obviously if the munis pay $2,800 or more, you should buy those, unless you’re in the 0% bracket.

As for tax-deferred accounts, you will need to estimate what you’ll need to distribute from those in the future–and make a wild guess at your future tax rate. Because I-bonds cannot be purchased in these types of accounts, that calculation only applies to buying I-bonds in the sense of calculating your future marginal capital gains tax rate(s)… and of course Congress can change those at any time, so I wouldn’t rely on anything too many years out anyway.

As for prepaid tax accounts, such as Roths, there will be no tax (you paid it going in) upon withdrawal, so no affect on your marginal capital gains rates in future (again, assuming Congress doesn’t change anything on us).

Neither of the last two (neither tax-deferred, nor prepaid) are available to invest in I-bonds anyway, so you will have to choose alternate investments in those.

Am I missing anything here? You should try to make the best after-tax return you can! 🙂 One other tricky bit indeed, is estimating what the “real” (after inflation) rate of return will be, given none of us knows what inflation will be in the future, hence it’s hard to know whether a muni will be a better return or not. My guess is that your 2.5% sounds about right. We’re excited about the 7.12% these I-bonds are paying now, but if the Fed does what we have our Presidents appoint them to do, they should try to get/keep that rate down under 2%, with occasional blips like we’re seeing now. So maybe that 2.5% is about right to compare your Munis to. Are you earning 3% on a Muni (0.5% real rate)? I kinda doubt it! If you are or can, they might be a better deal. If you are getting less than that (again, we’re making a BIG assumption about long-term inflation here), then maybe I-bonds are better.

Harry Sit says

Please note that interest on I Bonds is ordinary income. The more favorable capital gains tax rates don’t apply to I Bonds.

Brad says

Oh, good to know! I missed that!!

So then the same thing applies, still best to make the best real interest rate one can (whether compared to 22%, 35% or whatever), except if I-bonds are ordinary income (accrued all at once, upon a redemption) then one may wish to spend those funds instead of purchasing I-bonds/saving them with I-bonds, rather than draw from prepaid tax accounts like a Roth. Drawing from a tax deferred account is even worse, as all of those gains are income, unlike I-bonds where the principal has had tax paid and only the interest is ordinary income…

Sound about right?

R says

My head is spinning too! May I suggest (I’m over72) a greater focus on reducing current expenses…which will increase non-taxable income! I’ve got RMD issues each year from IRAs and take the needed amount (including QCDs +) year end to target the tax bracket I want for year-end and currently put those (not needed for current expenses) into ibonds (I have multiple TD accounts) as a parking lot until CD rates change…long term hold of IBONDS not an option (given age and fluctuations in CPI over the years) and ignore as noise any 3 month EWP (which is really 2 if purchase at end of month). As a reminder, Soc sec use to be tax free and if Congress needs (more) funds an option is to target other so-called tax deferred (Roth, Muni, etc) accounts!

Chris says

I’m having trouble with the Treasury Direct website, not allowing me to add my wife’s name as secondary owner for the bond purchase. Not enough characters allowed in the box. Actually, there was no particular field to add a secondary bond owner, just the one field for owner name (s).

Setting up the account and purchase on an iPad.

How do you add a secondary owner to a bond?

Harry Sit says

The second owner is at the holdings level, not at the account level. The account has only one owner. The bonds you buy in a personal account can have one owner, one owner with a second owner, or one owner with a beneficiary. You specify that at the time of purchase. Please read the “Registration” section in this post.

Chris says

I did buy purchase the Bond after registering. Maybe it’s a display thing with the iPad, but the Name(s) field on the purchase order would only allow something like 18 charachters, and I did not see a separate field for second owner, or beneficiary.

Wish there were a screenshot of the purchase order page to look at.

Once the money gets there for the bond and it shows up on my registration page, I’ll try to add her.

When I buy the other one in her name, I will try to screenshot what I’m seeing.

Pan Tangible says

On Form 8888, to buy bonds with tax refund, they don’t want a middle name, just first and last. Does that help shorten her name?

George says

Follow-up to Post #75 (could not insert there) – Pan Tangible, Brad, Harry Sit and R: I’m a relative newbie to munis and have two bonds, two ETFs and two mutual funds, having held them all for approximately two years, with yields ranging from 5% (just recently called, fairly predictably) to 1.7%. Your replies caused me to do a little spreadsheet evaluation for periods and relative amounts held, producing a weighted average yield of 3.3%, obviously not beating “real” inflation now, and barely a nominal 2.5% Quantifying these returns reinforced your “two cents” philosophy and flexibility in finding the best after-tax returns. Thank you for indulging my head-hurting exercise, the opportunity to learn more about I Bonds and share thoughts on this blog.

R says

George, I reiterate here my past comment. And…What are “you” looking for, ie what is the goal? And remember to focus on the delta in rates, ie I can get this but in lieu thereof could get that, and the risk. If one has no debt, retired (meaning you have “enough”), etc what are you chasing? For example ETFs are merely an index fund, like Bitcoin, or (to date myself) fund of funds…there is no economic value there…in my view. Municipals have market risk. Where do you think debt instruments (except ibond) are going with higher interest rates on the horizon? Want a flyer, go to Vegas.

Guacamole says

Thank you for the great blog, Harry! I am looking to max my 2021 purchases of I Bonds. So far I did 10k personal and 10k trust.

I have a fulltime job and dabble with assorted side hustles such as tutoring, DoorDash deliveries, etc. I don’t have a separate EIN, I just report this income on Schedule C. This year, I will have far less than 10k of Schedule C income.

Can I consider myself a sole proprietor? And if so, can I purchase 10k of I Bonds as a sole proprietor, or am I only allowed to purchase up to my Schedule C income?

Harry Sit says

I added a new section for side hustles and gig work in Buy I Bonds for Your Business: Sole Proprietorship, LLC, S-Corp.

Lou Petrovsky says

Great blog!

A question regarding the purchase of up to $5,000 of paper bonds with the proceeds of a federal income tax overpayment. As 2021 tax returns cannot be filed until 2022, does that mean that I-Bonds purchased with tax refunds will be dated as of the date of filing (or IRS receipt?) of the 2021 tax returns, even though payment(s) that resulted in the refund might have been made in 2021?

Harry Sit says

That’s correct. The bonds will be dated when the savings bonds department fills your order after the IRS finishes processing your tax return. Please read more about this in Overpay Your Taxes to Buy I Bonds.

DaveG says

Do you know how to actually reach a person at Treasury Direct? My TD account is older and I haven’t accessed it for a couple years. I used to use payroll deduction. I went in yesterday wanting to buy an I bond and it told me my account was locked. Only option is to call the phone number provided there is no online or automated reset function. 2.5 hours after being placed on hold I hung up. So today 12/15/21 I called at 8AM went through the prompts and placed on hold once again. I thought I’d get an early start in their que which they will eventually answer for they say in their repeated message which I’ve now heard 100’s of times every 20 seconds for the last 8 hours that my call is very important to them. Unfortunately it’s not. No one is working that phone number. My call should have been answered within 8 hours. Resetting a locked account is a couple minute task. I also used their contact us form to send a message and remain doubtful that will go anywhere. My next step is to send my phone logs to my congressman showing how long I’ve been on hold and unable to reach anyone. He’s the only government person I know how to reach and ask for assistance. Frustrated.

Hop says

Same experience for me. Left the phone on speaker for over an hour listening to their message, and gave up.

Heaven forbid someone needs urgent help to say, redeem a bond that has some administrative issue.

Harry Sit says

I don’t know any other way to reach customer service beyond the three channels listed in the “Customer Service” section of this post: contact form, direct email, and toll-free number. When you get hold of customer service, they may want you to get a signature guarantee on FS Form 5444 anyway. I would do that and mail it in if I run into the same situation.

Pan Tangible says

I just discovered that the Wall Street Journal printed an article today advertising the 7.12% of I Bonds. Perhaps the phone lines are deluged.

Rob says

In late December (2021) I had to call for help and other than the long 31 minute hold, the service I got was great. My new trust account had an issue after I mistakenly clicked the bank account as checking instead of savings which caused the transaction to be denied. The woman I spoke with was very helpful, adjusted the account type and my transaction was put through again with immediate success. I know they get a bad rap in some comments but I experienced great customer service, other than the wait time.

I know we all want things done immediately but sometimes patience is a virtue ( as they say).

Gina says

Harry, Wonderful info on buying I-Bonds through a Trust acct that I came to know only because of you. Thank You!!

On the Treasury Direct site, they ask for an “IRS Name control” assigned by IRS for the entity. https://www.treasurydirect.gov/indiv/TDTour/open_account_entity.htm

We don’t have an “IRS Name Control” for the Revocable Trust that we have under Joint Ownership. Per our attorney and as you also state, we can use (either of our) SSN as the entity tax ID. Do we need this “IRS Name Control” to setup the Trust acct?

Also, did you have to mail the Certification of Trust paperwork to Treasury Direct?

Harry Sit says

The text below the “IRS Name Control” says to use the first four letters of the last name when you’re using a Social Security Number. So just do as instructed.

I was not asked to mail the Certification of Trust. Do so only when they ask for it.

DAveG says

Pan you don’t need to call them to setup an account or buy them so that wouldn’t generate an influx of calls and I tried yesterday too before that article…I was holding 8.5 hours for an account being locked which takes 1-2 minutes to resolve or 0 minutes for them if they allow an automated reset which modern organizations do. There’s no way I had that many people ahead of me in que given I was holding from 8AM to 5PM letting it go all day with the call never being answered. It’s clearly from no one handling calls.

Harry Sit says

If the old account is empty, you may also consider opening a new account from scratch. I hear they automatically close empty accounts after a number of months of inactivity.

Gina says

Harry, Thanks for the quick response on the IRS Name Control question. I just opened the Trust acct online with no problems. God Bless You!! You saved me so much headaches (with my OCD fears dealing with Treasury Direct) because of the simple, detailed instructions on your site. I messed up by posting the Trust acct question here instead of on the other Blog post for it. But your site has soooo much good information! I am like a kid in a candy store!

Gina says

About calling the Treasury Direct Helpline. I don’t know if things have changed much in the past 3 years since I ran in to the same issue. I did the same thing as calling at 8 AM in the morning etc. Finally after many days, when I got through and asked about it, I was told (if my memory serves right) that Mon – Wed are busy days, so Thu and Fri after 3 PM EST is a better time to call. So when I had follow-up questions, I did the same and the wait was not so bad. 99% of the Customer Support people there are good and very helpful. I was dealing with converting accounts of a Deceased relative to the spouse and it was very stressful due to my time constraints. They handled it very well when I got through.

R says

I anticipate using a tax refund to buy up to $5k in paper ibonds early next April for me and 2grandkids …but first maxing out my $10k TD account in late January. Any problem doing tax refund last?

And I cannot move the tax refund money intended for me to my TD account in April since I would have maxed out purchases for the year?

Harry Sit says

Buying paper I Bonds with the tax refund money is a completely separate process. It doesn’t count toward the $10k purchase limit. See Overpay Your Taxes to Buy I Bonds, and after you receive the paper bonds, How To Deposit Paper I Bonds to TreasuryDirect Online Account.

Pan Tangible says

The tax refund never goes into your TD account. The IRS buys the bonds for you directly using the money you already gave them.

R says

Pan. Is the example u cite for paper bonds or TD ibonds account being bought by irs ? The tax refund can go into your TD account since that is an option in part 1 of 8888. Never is not quite there

Harry Sit says

The IRS doesn’t ask for your TreasuryDirect account number. They take your tax refund money and order the bonds with the name(s) and address from your tax return. The department that fills the bond orders doesn’t look up your TreasuryDirect account number. They print the bonds with the names and address and they mail those to you. People buying paper bonds with the tax refund money aren’t required to have a TreasuryDirect account. If you want to deposit those bonds into your TreasuryDirect account, you’ll have to follow a separate process.

Jeff Somers says

Your comment on taxation is a bit misleading. Yes, you can wait until maturity to declare the interest in you income. However, you do have the option of declaring the interest annually on your tax return. In some cases that can be better, especially for younger buyers who don’t have much (or any) taxable income to report.

Dunmovin says

I did a change in accounting from normal cash to accrual years ago for child to have income/interest on bonds recognized each year. As I recall I did have to make the request to irs which was not a problem (then).

Dunmovin says

Harry, thanks for great work and have a great Holiday Season!

Dunmovin says

Harry, I see the following

“How much in I bonds can I buy as gifts?

“The purchase amount of a gift bond counts toward the annual limit of the recipient, not the giver. So, in a calendar year, you can buy up to $10,000 in electronic bonds and up to $5,000 in paper bonds for each person you buy for.”

The above is the last q/a at

https://treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds_ibuy.htm#gift

this would strongly suggest one could buy up to $15K in tax refund paper bonds but only for the 3 entries on form 8888. Any thoughts? Thanks

Harry Sit says

From Form 8888 instructions, page 3:

“You may request up to three different savings bond registrations. However, each registration must be a multiple of $50, and the total of lines 4, 5a, and 6a can’t be more than $5,000 (or your refund amount, whichever is smaller).”

Line 4 is reserved for yourself (and spouse if filing jointly). If you’re buying for others as gifts, you have only two entries and the sum total between yourself and two gifts can’t exceed $5,000.

Pan Tangible says

So WHO to believe? The Official Treasury Direct website, or IRS form 8888 Instructions? Its a quandry!

Dunmovin says

Pan, reading the “news” from time to time on the TD website one currently sees…

“Fiscal Service Aids Savings Bonds Owners in Kentucky Affected by Severe Storms, Straight-line Winds, Flooding, and Tornadoes; One-year minimum holding period waived”

NOW…in addition to that possibly important news to some is the use of waivers…a big kicker is the $15K tax refund in Ibonds cited above…why don’t you email/write for a waiver of the flaw in the instructions in form 8888 so that one can comply/use the import of q/a also cited above AND say this will clear up any confusion, be conforming, i.e. not changing anything, and allow for Treasury to conform/coordinate all their documents in a proper rule promulgation process!!! TD’s interpretation should (also) control since it is the ibond issuing organization, not IRS! We only have one Treasury Department! Go for it! Harry, do you have a plan B?

B says

I found it super simple to open up a couple of living trusts one each for my wife and myself. So we have purchased $40k this year between the two of us. Afaict, one could create as many trusts as one wants, though I’m guessing after the 3rd 4th or 5th, the Treasury Direct folks might shut the whole thing down for whoever was so cheeky as to do that?

Technically however, a trust is an “owner” of the bonds, so as many trusts as one creates is how many you can buy…

Rick.M says

Very informative. Thank you. I’m married, file jointly and we have a joint revocable trust that holds all our assets. The trust has an entity account and we each can have individual accounts. Wouldn’t that enable us to purchase $30,000 (3 x $10k) yearly? Seems like a nice way to accumulate savings that won’t be needed for several years… funds currently wasting in bank savings accounts or money market funds.

Also, could you please clarify the process of eventually moving bonds to 1 account? More than likely getting contributed to the trust’s entity account. What are the limitations of moving Series I bonds (not redeeming)?

Harry Sit says

Yes, please read Buy More I Bonds in a Revocable Living Trust. Today is the last day to buy for 2021.

Robbie says

Hope you didn’t buy $10,000 @ 3.54% interest shown in the example? Rate is 7.12% now! May have been better to buy $833/mo.? (or at least $5000 every 6 months?)

Harry Sit says

I did buy $10,000 @ 3.54% interest shown in the example. Rates change with inflation every six months. That $10,000 started earning 7.12% in November after earning 3.54% for six months. If I didn’t buy in May, it would’ve earned only 0.5% in a bank savings account from May to October. All purchases will go through all rate cycles. The only difference is the first cycle and the last cycle. The sooner you buy, the sooner you start to earn more than the rate in a bank account. If rates go higher, you will catch up to it anyway, just as my purchase in May did.

CalifornianSS says

Harry, you mentioned in the post to initiate the purchase way before the end of the month. If I purchase it today (Dec 30th), how realistic is it for me to make it in the Dec date and also make it count towards the 2021 yearly limit. Kicking myself for forgetting about this! Thanks!

Harry Sit says

Chances are slim but you have little to lose, assuming you have the money in your bank account. Having your purchase count as 2022 has the same result as not trying and waiting to buy in January.

Brad says

I just logged in and they are still showing 12/30/2021 and 12/31/2021 as purchase dates. If you select today, it may work. I went through BuyDirect and chose 12/30/2021, it (on the final page before I would click submit) said:

Purchase Date(s): We may have changed your purchase date(s) to the next available business day.

12-31-2021

So if you put in today’s date (12/30/2021), you might get them purchased tomorrow, in 2021. Be sure funds are in the account!

CalifornianSS says

Thanks so much for your replies Harry/Dunmovin/Brad. I went ahead and do a purchase for myself and my spouse and also noticed that the purchase date allowed 12/30 and was changed to 12/31 (as Brad said; thanks for taking the trouble to login and point that out as well) so hoping it’ll go through by tomorrow!

CalifornianSS says

To close the loop on this, my purchase made on 12/30 was deposited on 12/31, so I squeaked by this time! Looks like the TreasuryDirect website was accurate when it moved my date to 12/31. My credit union account was also debited early this morning as expected. Thanks, I won’t push the limit next time!

Dunmovin says

Try it , you may (not) like it…I’ve never seen any of my purchases be consummated on the same day entered BUT today is the end of the year. You may be able to cancel if you don’t like it but why won’t you?

Jeff Somers says

My experience is that buying on the same date you are ordering results in the bond being purchased on the next day so you have to do it one business day before the last business day of the month to count for that month/year. However, when I scheduled a purchase for the 29th ahead of time (based on e-mail advice from Treasury Direct to purchase by then for 30th entry as the 31st is a holiday per Treasury Direct), I discovered that the bonds were actually in my account on the 29th and the debit processed on that evening in my checking account. So it appears when you schedule the purchase ahead of time, the purchase actually occurs on that date. If you are purchasing the same day, it will be the next business day for the bonds to be purchased and show in your account.

Jim says

Very helpful information! If I buy an I-bond today on 12/31/21 (transaction date), but when filling out the order on the Treasury website, it moves the purchase date to 1/3/22 as the next available business day. Does the annual purchase limit go by the transaction date if I submitted it on 12/31 or the actual purchase date? I know this means that I probably won’t get interest for December, but I want to at least make sure that I can then make another purchase in 2022. Thanks!

Harry Sit says

Sorry, that’s too late for 2021.

Jeff Somers says

It goes by the actual purchase date. This would not be a 2021 purchase or get you December interest. It would be a 2022 purchase. Always purchase near the end of the month but not on the last day so you get that month’s interest. Special note: If you purchase on the same day you are ordering, it will be in your account on the next business day, i.e. if you order on the 31st it will not be in your account until the next month. However, if you schedule the purchase in advance, it does show up in your account on the day you designate for purchase. In that case, you could schedule the purchase for the last business day of the month, but I would schedule it a day ahead of that just in case.