I’ve been buying I Bonds for 20 years. I only realized now I’ve been writing as if everyone already knew what they were and how they worked. If you buy I Bonds before November 1, 2023, you will get a 0.9% fixed rate plus a variable rate that continues to match inflation in the previous six months. If you’re new to I Bonds, this post walks you through from soup to nuts.

What Are I Bonds?

I Bonds are short for Series I Savings Bonds. They are bonds issued by the U.S. government directly to retail investors. Currently, I Bonds carry a favorable yield over other CDs and bonds. This makes I Bonds the best low-risk investment at the moment.

How I Bonds Work

Think of I Bonds as flexible-term variable-rate CDs.

You’re required to hold them for at least one year. After that, you can cash out at any time you’d like before the maturity date, or you can choose to hold them for up to 30 years from the original time of purchase. If you cash out within five years, you forfeit interest earned in the previous three months, whereas the early withdrawal penalty on a typical commercial CD is often six months or 12 months of interest. The flexibility to cash out after one year with a low early withdrawal penalty or to hang on for as long as 30 years makes I Bonds good for both short-term and long-term investing.

Similar to a CD, the value of I Bonds never goes down. They are guaranteed by the full faith and credit of the U.S. government. Unlike a typical CD with a fixed interest rate for the entire term, the interest rate on your I Bonds changes in six-month cycles. You stay on the current rate for the full six months and then you go on a new rate for another six months, and a new rate after that for another six months, and so on.

The interest rate is guaranteed to at least match inflation. If the inflation rate goes up, the interest rate on your I Bonds automatically goes up. Some older I Bonds earn a positive rate above inflation. The I Bonds you buy now only match inflation. Even merely matching inflation makes I Bonds attractive when other CDs and bonds don’t keep up with inflation.

Tax Treatment

The interest on I Bonds is credited monthly and automatically reinvested every six months. You get all the accumulated interest when you cash out. You don’t get a separate payout monthly or quarterly.

By default, you pay federal income tax on the interest from I Bonds only when you cash out, whereas you must pay taxes on the interest from CDs and bond funds every year even if you reinvest the interest. The interest from I Bonds is exempt from state and local income taxes. I Bonds are more appealing than other CDs and bonds because you have the tax deferral and the exemption from state and local income taxes.

You can choose to pay tax in a different way but it gets complicated. Staying with the default makes it easy for everyone. See Taxes on I Bonds Get Complicated If You Go Against the Default.

If you meet an income limit and other requirements, it’s possible to cash out your I Bonds tax-free when you use the money for qualified higher education expenses. See Cash Out I Bonds Tax Free For College Expenses Or 529 Plan.

Where to Buy I Bonds

There are only two ways to buy I Bonds:

1. Buy electronic bonds online at the government website TreasuryDirect.

2. Buy paper bonds with money from your tax refund when you file your tax return with the IRS each year. See details in Overpay Your Taxes to Buy I Bonds.

You can only use regular after-tax money to buy I Bonds. They’re not available in any tax-advantaged accounts such as 401k-type plans, IRAs, or HSAs. Nor are they available through any brokerage firms such as Fidelity, Charles Schwab, or Vanguard.

Purchase Limit

I Bonds are such a great deal that the government puts a limit on how much you can buy each year. At current rates, you should get your full quota before you buy any other CDs or bond funds.

When you buy on the government website TreasuryDirect.gov, the limit is $10,000 each calendar year per Social Security Number as the primary owner in a personal account. When you buy using money from your tax refund, the limit is $5,000 per tax return (not per person when you file jointly).

If you have a trust, you’re allowed to buy another $10,000 each calendar year in a trust account. See Buy More I Bonds in a Revocable Living Trust.

If you have a business, the business can also buy $10,000 each calendar year. See Buy I Bonds for Your Business: Sole Proprietorship, LLC, S-Corp.

If you have kids under 18, you can also buy $10,000 each calendar year in each of your kids’ names. See Buy I Bonds in Your Kid’s Name.

If you’d like to buy I Bonds as gifts to others, see Buy I Bonds as a Gift.

A married couple each with a trust and a self-employment business can buy up to $65,000 each calendar year, and more if they file separate tax returns, buy in their kids’ names, or buy as gifts for family members.

- $10,000 in Person A’s personal account with Person B as the second owner

- $10,000 in Person B’s personal account with Person A as the second owner

- $10,000 in an account for Person A’s trust

- $10,000 in an account for Person B’s trust

- $10,000 in an account for Person A’s business

- $10,000 in an account for Person B’s business

- $5,000 using money from their tax refund if they file jointly (or $5,000 each if they file separately after making sure they won’t lose other tax benefits)

- $10,000 in the name of each of their kids under 18

- $10,000 as a gift for each member of the extended family

We had only one trust before. We created a second trust with software to buy another $10,000. For buying I Bonds in a trust account in general, please read Buy More I Bonds in a Revocable Living Trust.

Open Account

If you never bought I Bonds before, you need to open an account at the government website treasurydirect.gov. You can buy more in the same account in subsequent years. Find the Open Account link at the top right.

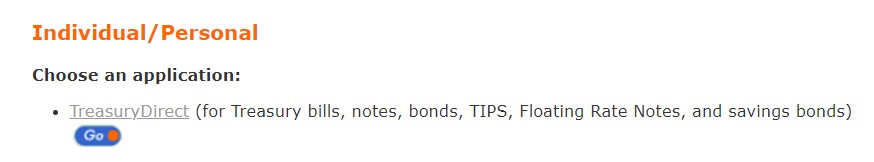

Choose the first option for Individual/Personal. Go here for a trust account or a business account as well.

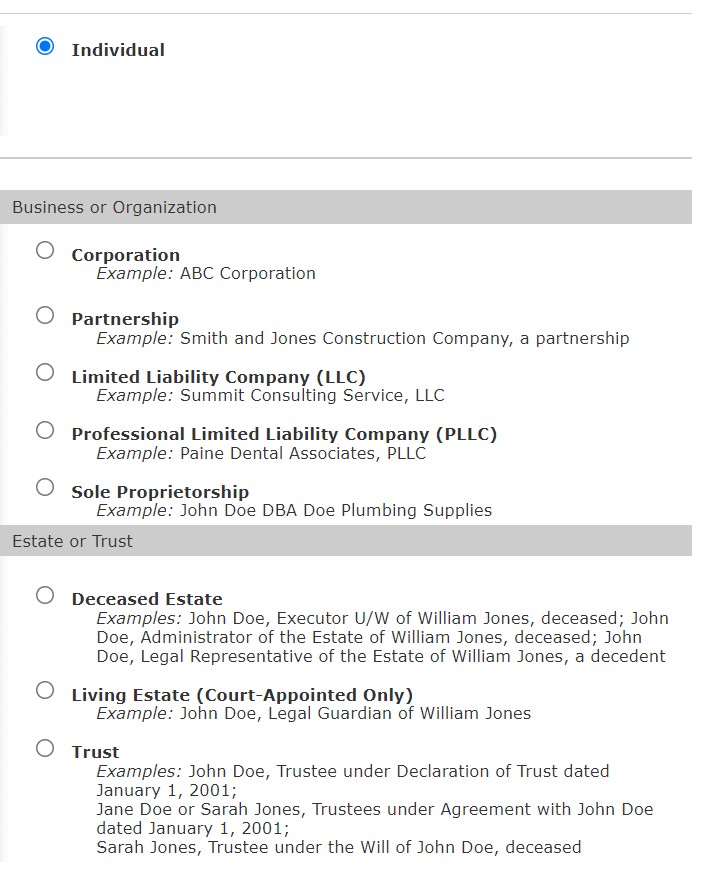

Now you can choose an individual, business, or trust account.

Next, fill out the required information and choose a security image, a password (not case sensitive), and security questions. Important: Save your answers to the security questions. You will be asked to answer one of the security questions when you perform certain actions at a later time. Your account will be locked if you can’t answer the security questions.

Separate Account for Spouse

TreasuryDirect doesn’t support joint accounts. The individual account you’re opening now is only for yourself. If your spouse also wants to buy I Bonds, he or she must open a separate account. However, you can specify a second owner or beneficiary on the bonds you buy in your personal account. You do that at the holdings level at the time of each purchase. We’ll cover that in the Registration section of this post.

If you’re opening a trust account, see Buy More I Bonds at TreasuryDirect in a Revocable Living Trust for what to use as the name of your account.

Link a Bank Account

The application also asks you to link a bank account. Make sure you enter the bank routing number and account number correctly. TreasuryDirect doesn’t send any random deposits to verify the bank account.

Save Account Number

You will receive your TreasuryDirect account number by email. Important: save your account number. You’ll need it to log in.

Most people can start buying right away after receiving the account number. A small percentage of people need to complete an extra step for identity verification. If you’re among the unlucky few, please read Where to Get a Signature Guarantee for I Bonds at TreasuryDirect.

Schedule Purchase

Log in with the account number. The system will email you a one-time password (OTP). Important: Don’t use the back and forward buttons in the browser when you use the TreasuryDirect.gov website. Only use the “submit” and “return” buttons on the web pages.

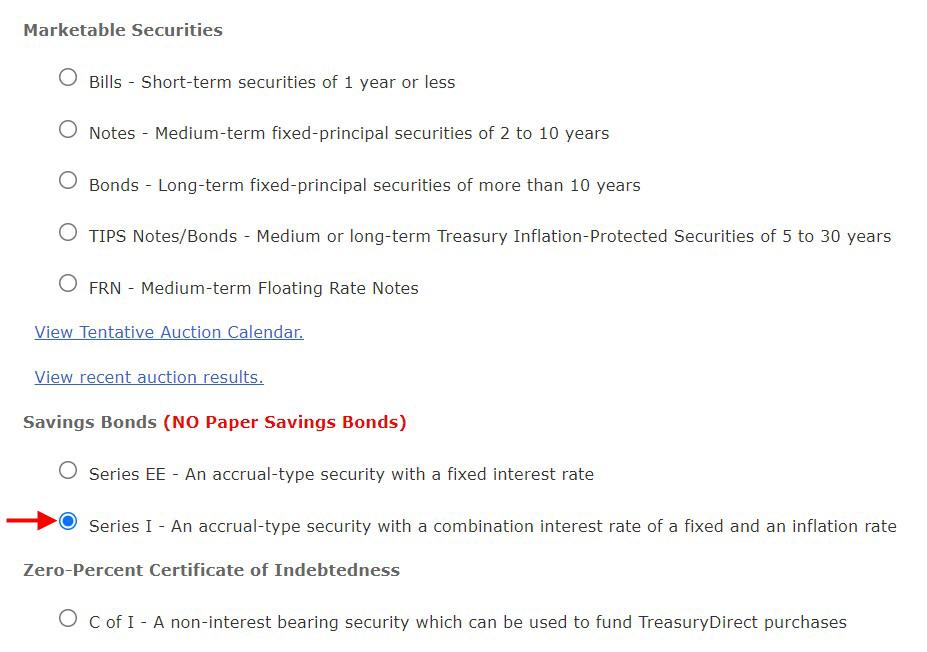

After you log in, go to BuyDirect in the menu.

Although we use TreasuryDirect only to buy I Bonds, the account can be used for other products as well. Choose Series I near the bottom of the list.

Registration

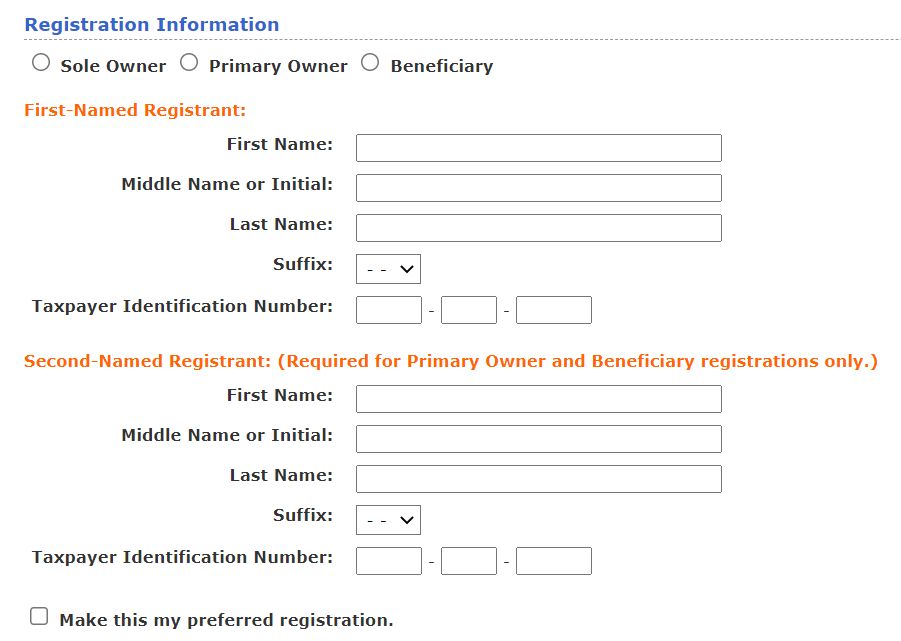

If you’re buying I Bonds for the first time in a personal account, you need to create a Registration, which means whether you want the bonds to have:

- Just yourself as the only owner; or

- You as the primary owner and another person as the second owner; or

- You as the owner and another person as the beneficiary.

Choose the “Sole Owner” radio button if you want yourself as the only owner with neither a second owner nor a beneficiary. Choose “Primary Owner” if you want yourself as the primary owner with another person as the second owner. Choose “Beneficiary” if you want yourself as the primary owner with another person as the beneficiary. See I Bonds Beneficiary versus Second Owner for the difference between a second owner and a beneficiary.

Unlike in typical commercial accounts, the second owner and the beneficiary in TreasuryDirect are at the holdings level, not at the account level for all holdings. You can have some bonds with Person A as the second owner, some other bonds with Person B as the beneficiary, and so on.

No Contingent Beneficiary

Each bond can have only one second owner or one beneficiary but not both at the same time. You can’t specify a contingent beneficiary. The second owner or beneficiary also has to be a person. It can’t be a trust or a charity. Trust accounts and business accounts can’t buy bonds with a second owner or a beneficiary. The trust or the business will be the only owner.

A married couple can choose to:

(a) Name each other as the second owner or beneficiary and live with the risk of simultaneous death; or

(b) Name someone such as a child or grandchild who isn’t likely to die simultaneously. The child or grandchild will get an early inheritance when you die. The surviving spouse will live on other assets.

First- and Second-Named Registrants

If you decide to have a second owner or a beneficiary, enter yourself as the “first-named registrant.” Enter the second owner or the beneficiary as the “second-named registrant.”

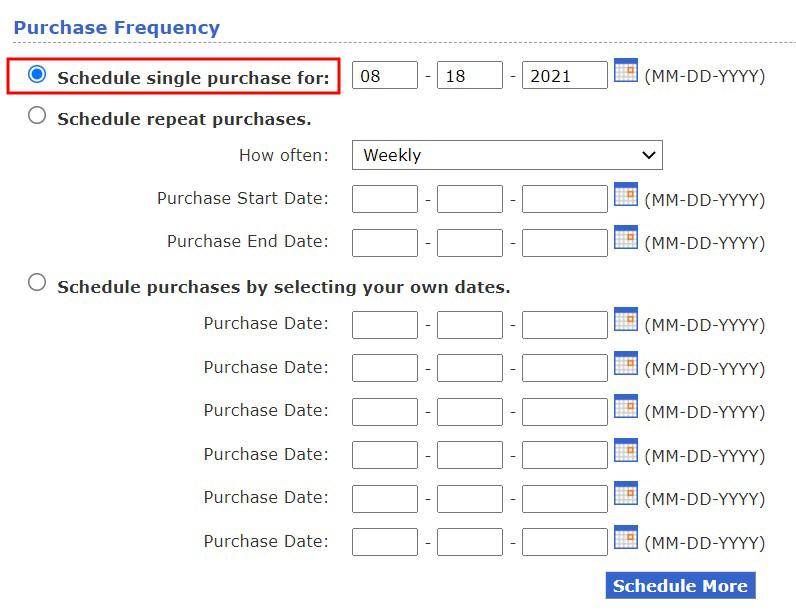

Purchase Date

Choose the purchase date. Make sure you have money available in the linked bank account. They send out the debit the night before your scheduled purchase date. The debit will hit your bank account on the scheduled date first thing in the morning. They may lock your TreasuryDirect account if the debit bounces. It’ll be difficult to unlock it.

Important: Don’t cut it too close to the end of the month, or else you may miss a month worth of interest. It takes one business day to issue the bonds and possibly more days if there’s a delay. If you buy close to the end of the month, your issue date may be in the following month and you won’t get the interest for the previous month. I schedule my purchases to a date at least a week before the end of the month.

Grant Rights to the Second Owner or Beneficiary

If you put a second owner or a beneficiary on your I Bonds, the second owner or the beneficiary doesn’t automatically see those bonds in their account. They see the bonds only when you grant them View or Transact right. The beneficiary can only be granted the right to view the bonds (“read-only”). The second owner can be granted either View or Transact right.

After the purchase completes and you see the bonds in your account, please read How To Grant Transact or View Right on I Bonds for a walkthrough on how to grant rights on the bonds you just purchased and how a second owner can transact on the bonds on your behalf after you grant the right.

Rinse and Repeat

If you’re buying additional I Bonds in the name of a spouse or a trust, repeat the steps above by opening a separate account, creating a password, linking a bank account, saving the account number, and scheduling the purchase. The different accounts can use the same email address and link to the same bank account if you’d like. Because you’ll use different account numbers to log in, you should keep notes of which account number is for which owner.

If you’re interested in buying I Bonds in the name of your trust, kid, business, or as gifts, please read:

- Buy More I Bonds in a Revocable Living Trust

- Buy I Bonds in Your Kid’s Name: You Can, But Should You?

- Buy I Bonds for Your Business: Sole Proprietorship, LLC, S-Corp

- Buy I Bonds as a Gift: What Works and What Doesn’t

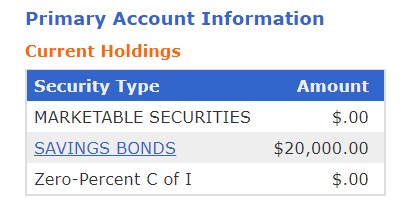

Check Balance

TreasuryDirect doesn’t send any account statements. You check your balance on the website. Your total face value is displayed on the home page after you log in. This doesn’t include any credited interest.

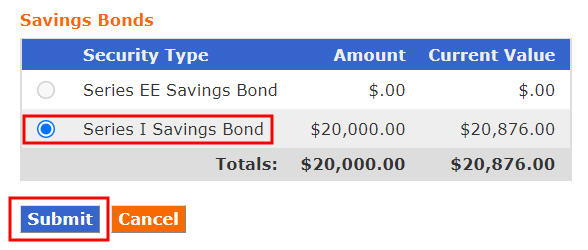

Clicking on the Savings Bonds link will show you a breakdown by savings bond type: Series EE and Series I.

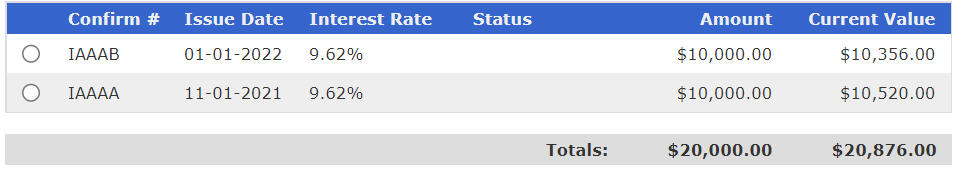

The Amount column shows the total face value. The Current Value shows the total face value plus credited interest. Click on the radio button next to Series I Savings Bond and then click on Submit. You’ll see a list broken down by the Issue Date.

Three-Month Lag in Current Value

If your bonds are still within five years from the Issue Date, the Current Value automatically excludes interest earned in the last three months. If you cash out today, you’ll receive the Current Value. That’s why you won’t see any interest in the current value during the first four months. You will start seeing a higher value in the fifth month.

Interest Rate Lag

The interest rate on your bonds doesn’t necessarily change right away when a new interest rate is announced. Each bond stays on the previous rate for the full six months before it moves on to the next rate for another six months. The rates change in different months depending on when your bonds were originally issued.

Don’t worry when you see your older bonds earning a different interest rate than the current interest rate on your newer bonds. When those older bonds “age out” the previous rate for the full six months, they will move on to the newer rate for six months. All bonds eventually go through all rate cycles.

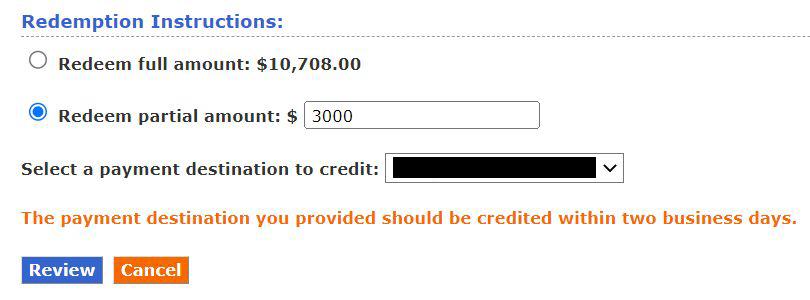

Cash Out (Redeem)

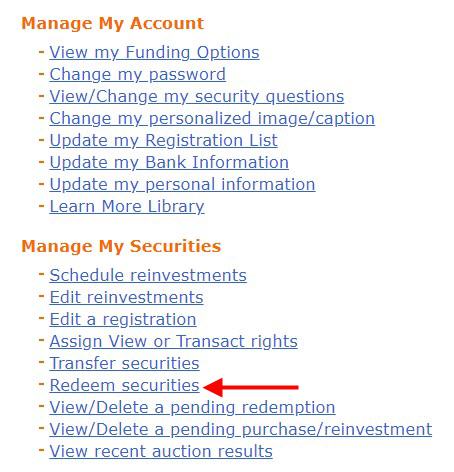

Because I Bonds are better than other bonds and there’s a purchase limit, you should hang on to your I Bonds as much as you can until you have better choices. If you need to cash out some of them (called “redeem” in the government lingo), you use the ManageDirect menu.

The option isn’t really obvious unless you know what to look for. Click on “Redeem securities” under the heading “Manage My Securities.”

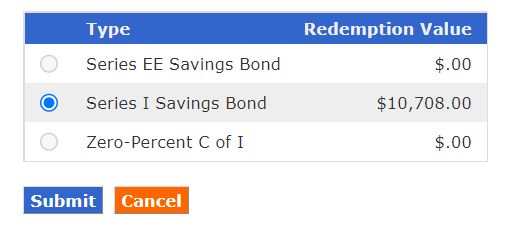

Choose “Series I Savings Bond.”

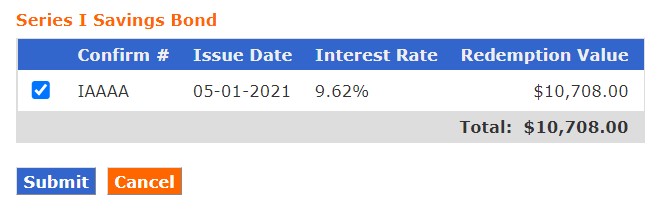

Choose the bond you’d like to cash out from.

You don’t have to cash out/redeem the full amount. Redeeming only part of it is just fine. The minimum cashout amount is $25. If you originally purchased $10,000 and it grew to $10,708, when you redeem $3,000 from it, they will prorate the $3,000 into $2,801.64 principal and $198.36 interest. You’ll pay tax on the interest.

The money will be sent to your linked bank or credit union account by direct deposit in one or two business days after you cash out.

Tax Forms

If you don’t cash out (redeem) any I Bonds in any year, you won’t get a 1099 form for the interest earned. You pay taxes only in the year you cash out.

If you do cash out (redeem) any I Bonds in any year, TreasuryDirect will generate a 1099 tax form for the interest portion. They don’t send paper tax forms. You’ll come back to the ManageDirect part of the website at tax time to get the tax form (see the screenshot above).

See Report I Bonds Interest in TurboTax, H&R Block, FreeTaxUSA for how to report the interest in tax software.

You can choose a different treatment for when you pay taxes but it gets complicated. Please read Taxes on I Bonds Get Complicated If You Go Against the Default if you’re interested.

Customer Service

If still have questions or if you run into any problems, you can contact TreasuryDirect:

- Send an inquiry via their contact form.

- Send an email to Treasury.Direct AT fiscal.treasury.gov.

- Call 844-284-2676 during business hours.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

KD says

Very helpful. Thank you!

CP says

If one has a sole proprietorship with separate TIN and checking account, can one buy $10k of Ibonds using the exact same name (no dba, etc) as using for that individual to buy $10k(using in the latter case that individual’s Soc sec no. and different checking acct (total being $20k)? If so, ibonds would be issued in same name AND who can be a joint owner of proprietorship ibonds…spouse? No requirement of gross income for business? If it all works, then the difference is merely Soc sec no. verses TIN

Harry Sit says

The sole proprietorship account and the personal account are of two different account types. Having the same name is just a coincidence. A sole proprietorship account can’t have a second owner or a beneficiary.

always_gone says

TreasuryDirect says a minor can own them with a linked account from the parent. Can I assume that if we buy some with our kids SSN’s, it would end up being like a UTMA or could we redeem them for any reason?

Harry Sit says

From TreasuryDirect: “Minor Account: This is a custodial account that a parent, natural guardian, or person providing chief support establishes for a child under the age of 18.” I’m not a lawyer. I would treat it as a UTMA account.

Andie says

But if the parent is the second owner, then wouldn’t you be able to redeem for any reason?

Mia says

Yes, you can redeem it for any reason. According to treasurydirect.gov–“You may purchase, redeem, receive gift deliveries, and perform other transactions within the account on behalf of the minor. ” https://www.treasurydirect.gov/indiv/help/TDHelp/help_ug_126-LinkedAccountLearnMore.htm

Waldemar Traczyk says

Thank you.

Eric says

Really helpful info on the I Bonds purchase in the last two posts. For your future post, it will be great if you could share the step-by-step instructions on creating a simple new Revocable Living Trust with software to buy another $10,000 I Bonds in TD.

Catter says

The Suze Orman kit does exactly this. It’s about $65? And sharable with friends and family.

Matt says

Do you have to repeat this account opening process and create separate accounts every year? Or once you open the account, for subsequent years, can you just buy more I-bonds into the same account?

Harry Sit says

You can buy more in the same account in subsequent years.

Walt says

When you receive the current interest rate, is that good for 6 months, or does the rate you receive change on October 1st?

Harry Sit says

You stay on the current rate for the full six months and then you go on a new rate for another six months, and the new rate after that for another six months, and so on.

Greg W says

And it gets even better – subject to AGI phase outs, when redeemed ibonds can be used for qualifying educational purposes, which includes a 529 account, tax free!

Harry Sit says

Good point, Greg. If you intend to use the money for qualifying educational purposes, it’s probably better to contribute to a 529 plan directly. You aren’t subject to AGI limits in a 529 plan and you can invest in stocks there for long-term growth. If you can stay under the AGI limit, I Bonds are good for the fixed income portion of a college fund. A topic for another day!

Michael Jones says

Do make sure you use a good account the first time. I used a savings account from my credit union, who last year decided to start cracking down on using a savings account as a ‘transaction account’. So they denied my ACH transfer request.

Treasury Direct will only let you modify account information through an old-fashioned paper form that REQUIRES a signature validation from your financial institution. Can’t be notarized, etc. There is a list of people/ways that can validate, but it’s super annoying.

So, in sum, pick an account you intend to keep for some time and make sure your financial institution won’t squash your transfer request.

Robin Coe says

I have $95,000 in Series EE bonds that all mature in 2022. I don’t need the money and CD rates are so low I don’t have any idea what to do with the money. I do have mutual funds, but this is part of my “safe portfolio” . Might you have any suggestions?

Harry Sit says

Consider buying I Bonds as outlined here if you can commit to holding at least a year.

Brad says

You likely already know this, but be sure that “mature” really means they don’t earn interest any longer. EE bonds can earn interest for many years beyond “maturity” which is usually defined as five years after purchase. EE bonds earn interest for 30 years, even though they mature after five. However, if these are very low interest rate bonds, it may very well be worth cashing them in before 30 years, for all the proceeds that you can convert to I-bonds for instance (which right now are earning 7.12% for the next six months, but be warned that the I-bond rate fluctuates based on inflation/CPI, whereas your EE bonds’ interest rates do not fluctuate).

And of course, like I say you may know all this already and if you bought your EE bonds in 1992, congratulations on earning all that interest and I’m guessing the 1992 interest rate you are earning until they stop earning interest in 2022 is a much higher rate than you can get now!! (I think EEs are paying 0.10% now.)

John Endicott says

Brad, be careful with your terminology.

5 years is not maturity for any EE bond ever. The shortest maturity date ever for an EE bond was 8 years for EE Bonds issued in 1981 and 1982. What 5 years is the amount of time you have to hold the bonds to avoid being subject to losing 3 months of interest for early withdraw.

Maturity (also known as original maturity) has a specific meaning for EE bonds. It’s when the bonds are guaranteed to double in value. For current EE bonds (those issued since May 2005) that happens at 20 years.

Then there’s the final maturity, which for EE bonds means when the bonds stop earning interest, is at 30 years.

you can find more information at treasury direct

https://www.treasurydirect.gov/indiv/research/indepth/ebonds/res_e_bonds_eeratesandterms.htm

Coriander says

Thanks, very helpful! I see that Treasury Direct allows the purchase of I-bonds as a gift for another person. If I’ve already bought my $10,000 limit for the year, can someone else give me more as a gift? Or am I limited to $10,000/year no matter who buys them?

Harry Sit says

A gift counts toward the recipient’s quota.

NRS says

I have an account for my LLC and I want a personal account for emergency savings. Can I create a custom linked account or do I need a completely separate account?

Harry Sit says

I would create a completely separate account. One of the rules of running a business is to keep personal matters and business matters separate.

Walt says

TreasuryDirect lists 1.77% as the semi-annual inflation rate. They then multiply that by 2 to get 3.54%. Is that not just a projection for the next 6 months? How does that work for an individual account to earn 3.54% for 6 months? All I see is 1.77% listed.

Thank you.

Harry Sit says

3.54% is the annualized rate. If a bank offers a 6-month CD that pays 3.54% annualized rate, for each $10,000 you deposit into this CD, you will receive $177 in interest when the CD matures in six months. It’s different than a 12-month CD that pays 1.77% annualized rate where you receive the $177 interest after you tie up $10,000 for 12 months.

The Crusher says

This article was so very helpful! Thank you!!

I have one question for clarification that I would love your insight on. If I want to buy $10K of I-Series Bonds for both myself and my wife, do I need to create two accounts or can I use one account and set up two registrations with one each as a primary owner (and the respective partner as beneficiary)?

Can you help answer this question? THANKS!

Harry Sit says

Two accounts. Set spouse as the second owner or beneficiary and grant transact or view rights.

The Crusher says

Thank you! Super helpful post!!

Cheryl Stewart says

Great post. Under your heading “Where to Buy I Bonds”, you are very clear that “You can only use regular after-tax money to buy I Bonds. They are not available in any tax-advantaged accounts such as 401k-type plans, IRAs, or HSAs.” However, since LLCs may purchase iBonds, is it possible to purchase iBonds from a SDIRA LLC checking account? The SDIRA LLC would own the iBond. The LLC has its own EIN and its operating agreement allows bond purchases.

Harry Sit says

TreasuryDirect won’t treat your SDIRA LLC differently than any other LLC. When the LLC cashes out the bonds, they will issue a 1099-INT (and report to the IRS) for the taxable interest. I don’t know what you do with the 1099.

JW says

Great post. You say interest rates could go up to 7%. Does this mean you’d wait until November if you hadn’t invested in I bonds yet this year?

Harry Sit says

No. Every rate lasts six months. If you buy now, you’ll still get the ~7% rate in the second cycle.

Mike says

Thanks I just finished purchasing I-bonds using your instructions. So helpful! When setting up my account they originally put a hold on my account and I had to get a signature guarantee from my bank. That was a minor inconvenience. Will look into setting up a trust later in the year to buy more I-bonds so that article will come in handy soon. Thanks for sharing with us! I refer your article to several family members that are interested in I-bonds.

Harry Sit says

Nice! I don’t know what triggers requiring a signature guarantee. They don’t require it from everyone. It’s great to hear you overcame that extra step easily.

robert just says

I would appreciate any advice or information on what people have done recently when selecting a term for I bonds. Is there any information on how the base rate changes with inflation, Federal debt etc.?

Harry Sit says

If you meant predicting when the fixed rate will go up from zero (matching inflation), don’t hold your breath. I say it won’t go up until the 5-year TIPS yield turns positive. I don’t think the I Bonds fixed rate was ever positive when the 5-year TIPS yield was negative. The 5-year TIPS yield is currently -1.6%. It has a long way to go.

https://fred.stlouisfed.org/series/DFII5

Kevin says

Is there a good calculator or website to determine the value of a $10,000 I-Bond at any given time (realizing that you can only determine the value through the time-frame for which rates have been announced)? (Is current value available within your account on the Treasury Direct website? I don’t remember seeing it.)

Thanks for a fantastic blog and article, Harry!

Harry Sit says

The current value is displayed within the account (less three months of interest if the bond is still within five years). See screenshots under the “Check Balance” heading. This online calculator says it’s for paper bonds only but it works just as well for electronic bonds.

https://www.treasurydirect.gov/BC/SBCPrice

Kevin says

Thanks, Harry. I found the screenshots in your article above. Thanks!

I earlier tried to use the paper I-Bond calculator but don’t know what to enter for “Bond Serial Number”. My bond is electronic and I don’t see a serial number in any of my screenshots.

Harry Sit says

You can use any letters and numbers as the serial number in that calculator.

John Endicott says

Try this again (as the first time it didn’t post in the right place)

You don’t have to enter any value in the serial number field if you don’t want to. it’s optional and purely there for informational purposes and does not affect the value calculations

RT says

Just enter month, year, and amount and it will tell you how much it is worth:

http://eyebonds.info/ibonds/home10000.html

Chris says

https://eyebonds.info/ibonds/index.html

M says

Others have already pointed out eyebonds, which is a good resource.

Another to check out is https://www.yourtreasurydirect.com/ which has nice modern dashboard.

Alex says

I have a question about a self-employment business. If I don’t have LLC and just sell stuff on ebay (not a lot of profit) do I still can buy additional I-bonds as “business”?

R says

A recent experience from a colleague was not an shining moment for Treasury. Even with a TIN, sole proprietorship, and many years filing schedule C, etc and not having a dba was the first of many hang ups. Then no beneficiaries. No properly promulgated rules. Have fun and patience…and you too shall succeed

The Crusher says

Thanks again! This information is so helpful!

I opened my account with your help. What points will I see the account value grow? I ask because I opened my account in early September and yet when I checked in October the value sits at $10K. Thanks!!!!

Harry Sit says

In the fourth month. It’s mentioned in the paragraphs under Check Balance.

The Crusher says

Thanks again! Sure helpful!!

Mark says

I’m interested in maxing out our opportunities for buying iBonds for my wife and I. We’ve already bought them in each of our names and in the name of our Joint Trust and we plan to buy some with our next tax refund.

We both also have sole proprietorships and I’m curious as to the long-term implications of buying iBonds in the name of a business. What happens to the business iBonds if one or both of our businesses ceases to operate or gets sold down the road? Would we just need to redeem them at that point or would there be some opportunity to transfer them to the business owner’s personal Treasury account?

R says

It isn’t easy dealing with Treasury on sole proprietorships…read all the other posts above. I have a unique checking account linked to sole proprietorship ibond account and any change requires paper submission as does a so-called bank “guarantee “ (it really isn’t one, just a bank stamp) for verification of who you are. At the end of the day look at their forms 5512 and 5336…they were the ones of interest to me…perhaps to you. I suspect Treasury has many more forms. Expect an unnoticed hold to be placed on account. When I get to a live person they are most helpful.

Mark says

It sounds like if I closed my sole proprietorship down in the future, I’d have to transfer the bonds to my personal name, which would count toward my personal limit for that year. Is that correct? Or could I just leave the bonds in the name of that business indefinitely until I’m ready to redeem them?

Todd says

If you buy ibonds in November, can you then buy another 10,000 in January, or do you have to wait an entire year? Thanks!

Harry Sit says

Todd – The quota resets on January 1. See comment #26.

Jonathan says

Great information, thanks so much. I have a question on frequency of buying $10,000 of I-bonds. If I purchase $10,000 in October 2021, can I purchase another $10,000 in January 2022 (the beginning of a calendar year), or do I need to wait 12 months to purchase another $10,000? Thanks!

Harry Sit says

Calendar year. The quota resets on January 1.

Jeanne says

Great article! I have a question … if wanting a beneficiary, I see that you enter it into the second-named registrant, but what distinguishes it from being the second owner?

Thank you!

Harry Sit says

The radio button above the first-named registrant. Sole Owner means neither second owner nor beneficiary. Primary Owner means the second-named registrant is a second owner. Beneficiary means the second-named registrant is a beneficiary.

Chris says

Great article…..thanks!!

When buying bonds and listing a second owner, does that purchase reduce the amount the second owner can purchase in I bonds for themselves for that calendar year? Basically, is the $10,000 limit affected for the second owner?

Is it better to list a spouse as secondary owner versus beneficiary so the bonds can be cashed in easier upon death of the primary owner?

Harry Sit says

The purchase limit only counts toward the primary owner. The second owner is like a beneficiary plus a power of attorney. It’s the same after death.

Derek b says

Re: “The interest on I Bonds is credited monthly and automatically reinvested”

Its probably more accurate to say interest is earned monthly and compounded (credited) semiannually.

Mike says

If I am a first time purchaser of I-Bonds and want to max out for 2021 and 2022, is the best investment plan to invest $10,000 in October and $10,000 in January?

Harry Sit says

It is if you have the money in October and January. If not, buying $10,000 in November or December 2021 and again in February, March, or April 2022 works as well.

R says

One is normally looking at the delta in availability of rates …going from to. With that said I suggest toward end of a month purchase . I’m looking at march next year for tax refund purchase as well as $10k purchases in late February (CD maturity then) and to see what changes in competing long term CD rates are at that time. Thou I don’t expect anything higher than available 7.1% and I don’t buy ibonds for long term.

Mike says

My parents purchased I-bonds online in individual name only. Can they change this to add the spouse? Husband (primary owner) with Wife (secondary owner)?

Harry Sit says

The primary owner can add or remove a second owner or beneficiary online at any time. Look for “Edit a registration” under the ManageDirect menu. Select the bonds to change and go from there.

Paul says

Can I use the same email account for opening a trust and a personal account? Do they need to be separate registrations?

Coriander says

I used the same email address and bank account for both my personal and trust I-bond purchases. It was no problem.

Keith K says

Does it make any difference purchasing end of October rather than end of November (when anticipated higher rate resets for a new 6 month cycle)? Thanks

Harry Sit says

It doesn’t matter when you invest for the long term. Buy whenever you have the money. Because rates go in six-month cycles, buying in October will also catch up to the 7.12% rate and the new rates after that eventually. It’s only a matter of time. Your purchase in early 2022 will get the 7.12% rate and the new rates after that. Your purchase in 2023 will get whatever new rates in effect at that time. It makes little difference what rate you start with for six months on one of your many purchases to come.

Ben says

Yes but if I’m investing only for the short term (12-15 months) it makes a difference which 6 month rate you get.

John Endicott says

For short termers, you want to buy at the end of the month and it would be best to buy at the end of Apr or end of Oct rather than in May or Nov because then when your 6 months of one rate is up, the information needed for the next 6 month rate will be available which makes decision making on holding vs redeem easier.

R says

Purchase in October is for the then/current rate for six months from October 1st (3.54) and then on April 1st those ibonds will have a rate change to the anticipated November 1st rate of 7.1apy which goes to October 1st 2022…you won’t get 3.54 rate if you wait to November 1st and you will know the rate for only 6 months not 12

Ralph says

Jan 1 next year is on a Saturday. So Jan 3 is Monday, the first banking day. If I schedule my 2022 purchase for Jan 3, will I earn interest for January, or will it start earning 2/1?

Harry Sit says

Ralph – A bond issued on any date in a month earns the full month’s interest for that month. Whether you buy on the 3rd, 13th, or 23rd of January, you’ll earn the full interest in January.

James Bolan says

I opened an account. How long should I wait to purchase bonds make sure my account is linked?

Harry Sit says

It’s unnecessary to wait. Buy whenever you have the money in the linked account ready to go.

Jim says

I’m having a lot of difficulty understanding how the interest rates are figured. Is there info someplace that explains it to dummies?

Harry Sit says

You can go into the weeds with changes in the CPI numbers (March-to-September and September-to-March) or just know the rates will track inflation over time with a delay. The delay doesn’t matter when you keep buying every year and invest for the long term.

mangorunner says

Here is a detailed explanation of the interest rate calculation, straight from TreasuryDirect:

“How does Treasury figure the I bond interest rate?”

https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds_iratesandterms.htm#rate

Ralph says

You stated “Important: Don’t cut it too close to the end of the month, or else you may miss a month worth of interest.”

Can you elaborate on this statement, if I want to make the purchase effective on 11/1 to get the new rate of 7.1%.

R says

Read prior posts and in particular 34 and 35

Ralph says

35 does not make sense.

mangorunner says

Read this:

“I-Bond dilemma: Buy in October? Or wait until November?”

https://tipswatch.com/2021/10/14/i-bond-dilemma-buy-in-october-or-wait-until-november/

R says

Sorry, Ralph #37…didn’t (and still don’t) sense that the technical aspects are fully appreciated. A literal answer to your post for a November 1 (in order to get new rate) effectiveness…. is purchase anytime from that date until a few days before end of April 2022 will lock in the November 1st rate.

John Endicott says

#37, the entire interest for a month is earned regardless of what day in the month you purchased. So it’s best to buy at the end of the month as it’s like getting a months interest free. IE if my purchase date was 11/1 or 11/30 I get the same amount of interest for the month of November – so by waiting until the end of the month to purchase, my money can be elsewhere for nearly a full month earning interest (in a bank account) or making capital gains and/or dividends (if invested in the stock market) or even just sitting in on a shelf gathering dust.

The problem in waiting too close to the end of the month is that the purchase might not finalize before the month ends, in which case your purchase date would be in the beginning of the next month (IE December) meaning you missed out on Novembers interest.

Ben says

Great Post!

Do you know if the interest accrued counts towards the investment threshold for the Earned Income Tax Credit(EITC) every year? Or is it only when you cash them out

Harry Sit says

It counts only when you cash out.

Ben says

Thanks!

Do you recommend buying in October to lock in 3.52% +7.12% or do you think the May 2022 rates will be above 3.52% so better to buy in November?

Ralph says

It is your cautionary language I quoted, about missing a month of interest if you cut it too close, that is confusing to me?

Harry Sit says

It takes one business day to issue the bonds and possibly more days if there’s a delay. If you buy close to the end of the month and they don’t issue the bonds until the beginning of the following month, you won’t get the interest for the previous month, whereas if you buy on the 20th of the month, you will have the bonds issued before the end of the month and get the interest for that month. Therefore, don’t cut it too close to the end of the month, or else you may lose a month of interest. If you buy on the 1st, 5th, 10th, or 20th of the month you’re far off from the end of the month. You’re cutting close if you buy on the 28th, 29th, or 30th especially when there’s also a weekend.

On the other hand, if you want your bonds issued in November, buy in November. The 1st, 5th, or 18th all work.

Pan Tangible says

I didn’t see your warning about switching banks until it was too late. I sent in my paper form complete with medallion about two weeks ago. Any sense of how long they will make me wait before I can purchase again?

Harry Sit says

I heard 3-4 weeks. The rate is good for six months and you always get the full six months on the rate after you buy.

R says

Call them. You want to avail yourself of purchase limits in 2021 AND 2022.

Pan Tangible says

Surprise! I emailed them and was told my new banking link is good to go! Maybe they are getting on top of this issue.

Jonathan says

Is there a phone # in order to speak to someone?

Harry Sit says

Customer Service (844) 284-2676.

Anon says

Hey Harry,

Thanks for the insightful blog post.

My spouse and I both buy I-bonds under our SSN. We also have an LLC (One rental property) with its own EIN number. Can we buy an additional $10k of I-bond under the LLC name?

Thanks!

Harry Sit says

The LLC (or other forms of business) can buy up to $10,000 each calendar year.

Pan says

I will be poised to pounce after the New Year with a ready-to-go tax return. The IRS took four months from when I filed my taxes (May) to purchase paper ibonds for me (September).

I don’t want to risk missing out on 7.12%

And this time I will adjust my refund so I get some Einsteins!

Kevin says

“And this time I will adjust my refund so I get some Einsteins!”

What are “Einsteins”?

Harry Sit says

The $1,000 denomination paper I Bond bought with the tax refund has a portrait of Einstein.

R says

I thought they were bagels 🙂

R says

Harry, any way to use irs form 8888 and supplement(?) it so that a filing couple can have more than two additional ibond individuals as entries? Seems to me that this form is just a form and one is not limited in the numbers of individuals to the number of spaces there but only the $5k total maximum. Like to have issued some paper ibonds from tax refund to all the grandkids, not just two of them. Thanks

Harry Sit says

From Form 8888 Instructions on page 3:

“You may request up to three different savings bond registrations. However, each

registration must be a multiple of $50, and the total of lines 4, 5a, and 6a can’t be

more than $5,000 (or your refund amount, whichever is smaller).”

One of the “up to three” is reserved for the tax filer (plus spouse if filing jointly). You only have two free-form entries.

R says

Thanks, Harry…Has anyone contacted Treasury on how one can buy ibonds from tax refund for more than 3 individuals? Seems to me that there is nothing magical about 3, along as total is not more than $5k. Thanks

MalMel says

Thank you for all of the very thorough info you provide.

2 questions:

I have an insurance trust (I was beneficiary from my mother’s life insurance, she had a trust setup for it). Can I buy ibonds in that trust?

Also, is there an easy answer to why ibonds are preferred over TIPS? I see much written about ibonds, not much on TIPS.

Harry Sit says

You can buy I Bonds in a trust if you’re the trustee. If you’re only the beneficiary you’ll have to ask the trustee to do it.

I Bonds are preferred over TIPS because they match inflation whereas currently 10-year TIPS are priced to lose 1.1% per year to inflation for 10 years.

Anand Kumar Sankaran says

Harry

Thank you. I started buying I Bonds. I have a question about redemption. A colleague pointed me to this thread: https://www.bogleheads.org/forum/viewtopic.php?t=204948.

How is the redemption process? Looks like treasury wants us to get a medallion signature or something? Or is it dated?

Harry Sit says

The normal redemption process is described in the “Cash Out (Redeem)” section. It doesn’t require a signature guarantee. You click on a link, choose which purchase you will cash out from, enter an amount, and that amount plus the accumulated interest will show up in your linked bank account on the next business day. You log in again next January to download the tax form for the interest.

Robin says

My parents are interested in purchasing $10k in I Bonds, but don’t feel comfortable linking their bank account to any site. They don’t have online banking and aren’t tech savvy. While I’m sure it is safe, they are still uncertain. Any suggestions? If I link my bank account (in my name) to their treasury direct account to make the purchase I assume that is a red flag? Should I instead gift them this amount? Looking for feedback.

R says

I suggest you first look at some of their bank monthly checking statements (now) and you probably see electronic payments or ACH entries. No way that I know how to stop them. They then have ebanking. Otherwise they don’t have any banking and can’t use treasurydirect as I know it. Call treasury and see what they think

Harry Sit says

Robin – You can buy I Bonds as a gift for your parents but they’ll need a linked bank account eventually when they cash out/redeem. Please contact TreasuryDirect and ask whether they have any problem with having a different name on the linked bank account. The signup page asks for the name(s) on the bank account, which implies that the bank account can be in a different name than the primary owner of the TreasuryDirect account.

As noted in the guide, please be sure to link an account that you’ll keep forever because it isn’t easy to change the link in the future.