[Update on August 30, 2024: TreasuryDirect announced that starting January 1, 2025, you will no longer be able to buy paper I Bonds with your tax refund. The annual purchase limit is still $10,000.]

I Bonds are the best bonds you can buy at the moment if only you can buy more of them.

Maximum $5,000 Per Tax Return

In addition to buying I Bonds on the government website TreasuryDirect (see How to Buy I Bonds), you can buy another $5,000 per year indirectly, but only if you’re due at least that much in tax refund and you tell the IRS to use part of your tax refund to buy I Bonds. You can’t send a check with your tax return and ask them to buy I Bonds for you.

The $5,000 maximum is per tax return, not per person. If you’re married filing jointly, you still can buy only a maximum of $5,000 for both of you combined, not $5,000 for each of you. If you’re married filing separately, each of you can buy a maximum of $5,000, but of course you should make sure you won’t lose other tax benefits when you choose to file separately. From IRS Form 8888 instructions on page 3:

You may request up to three different savings bond registrations. However, each

registration must be a multiple of $50, and the total of lines 4, 5a, and 6a can’t be more than $5,000 (or your refund amount, whichever is smaller).

Because the amount you can purchase is also capped to the amount of your tax refund, if you normally don’t have a tax refund that large, you can increase your tax refund by overpaying ahead of time. Since I’m self-employed and I pay quarterly estimated taxes, I just pay extra for the fourth quarter.

Pay with Automatic Extension

If you don’t pay quarterly estimated taxes, you can make a one-time payment through IRS Direct Pay. After a year is over, you can still pay toward the previous year’s taxes with an automatic extension. When you say your payment is for an extension, the payment automatically files the extension. You don’t need to fill out another form.

You get extra time with an extension but you don’t have to use it. You can still file your tax return on time before April 15. Choose “Extension” as the reason for payment. Select “4868” in the “Apply Payment To” field, and choose the previous year for the tax period for payment.

The “Extension” option will become available after the IRS opens up the tax season for the previous year, usually around the end of January. If it isn’t available yet, just wait.

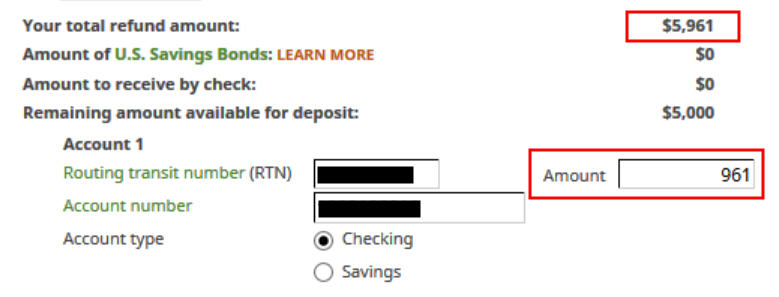

When you pay extra, don’t make your refund exactly $5,000. Make it a small odd amount above $5,000 so that you’ll still have a small refund after buying I Bonds. For example, if you’re expecting a refund of $2,136, pay $3,000 with your automatic extension. Now your expected refund is $5,136. When you see $136 deposited to your bank account, you’ll know the other $5,000 is sent to buy I Bonds.

Pay in Whole Dollars

Also make sure you pay in whole dollars, not dollars and cents. If you make estimated tax payments, also make sure those are in whole dollars. If you already made estimated tax payments with dollars and cents, make another payment to make your total estimated tax and extension payments add up to whole dollars.

Cents in your total estimated tax and extension payments will cause the IRS to adjust your refund, resulting in not issuing I Bonds to you. This doesn’t apply to tax withholdings. Your tax withholdings from your income can have dollars and cents.

Wait

Wait at least a week after you make the extension payment before you file your tax return. This gives some time for your payment to be reflected in your account at the IRS. While this may not be strictly necessary, giving the computer systems a little more time to sync up can’t hurt.

Report Payment on Your Tax Return

After you pay extra with an automatic extension, make sure to account for it on your tax return. Here’s how to do it in TurboTax and H&R Block downloaded tax software.

Online tax software doesn’t have all the features of downloaded tax software, and it’s often more expensive. See Tax Software: Buy the Download, Not the Online Service.

TurboTax

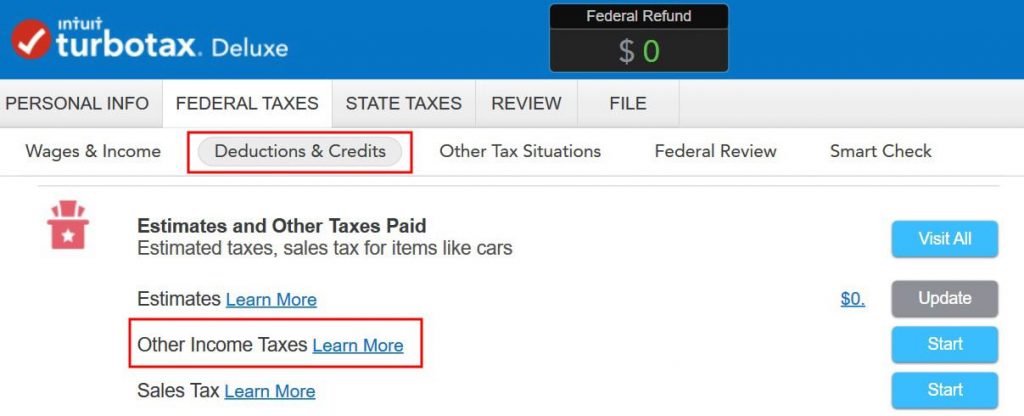

In TurboTax (downloaded software), it’s under Federal Taxes, Deductions & Credits, Estimates and Other Taxes Paid, Other Income Taxes.

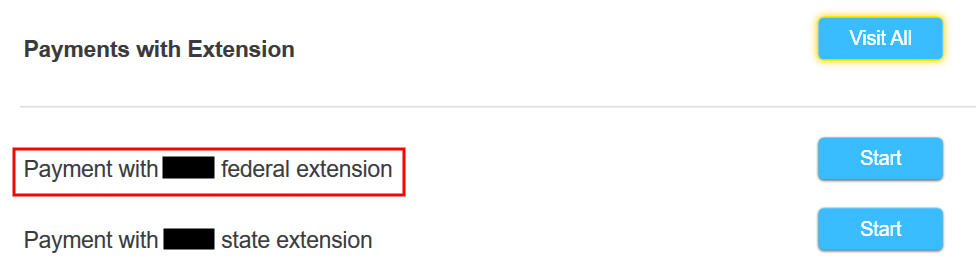

Then choose payment with the federal extension for the previous year.

H&R Block Software

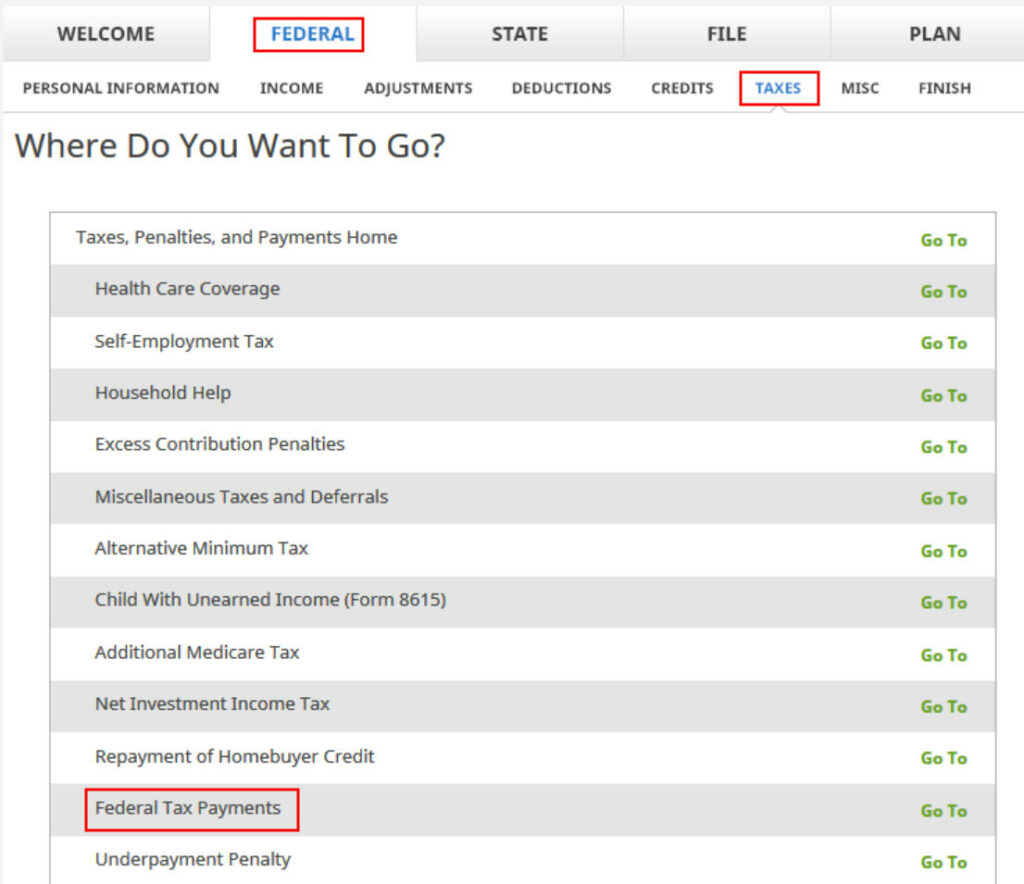

It works similarly in H&R Block downloaded tax software. The payment with extension is under Federal, Taxes, Federal Tax Payments.

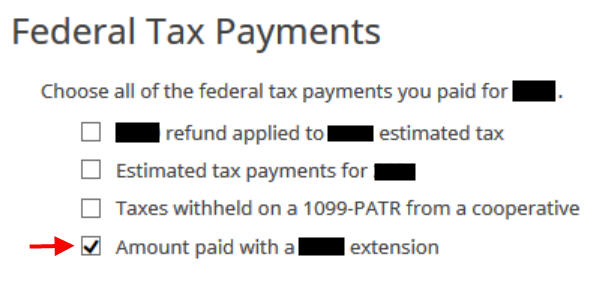

Check the box for “Amount paid with a 20xx extension.”

Split Refund for I Bonds

When it comes to asking for I Bonds, it’s in the final steps before filing your return. Here’s how to do it in TurboTax and H&R Block downloaded tax software.

Online tax software doesn’t have all the features of downloaded tax software, and it’s often more expensive. See Tax Software: Buy the Download, Not the Online Service.

TurboTax

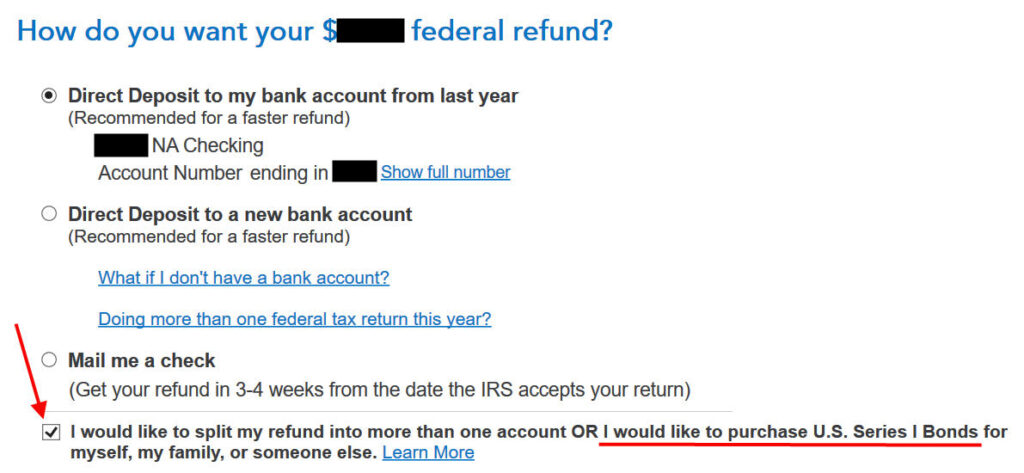

When TurboTax (downloaded software) asks you whether you’d like to receive your refund by direct deposit or by check, choose direct deposit. You check a box at the bottom to say you want to split your tax refund and use part of it to buy I Bonds.

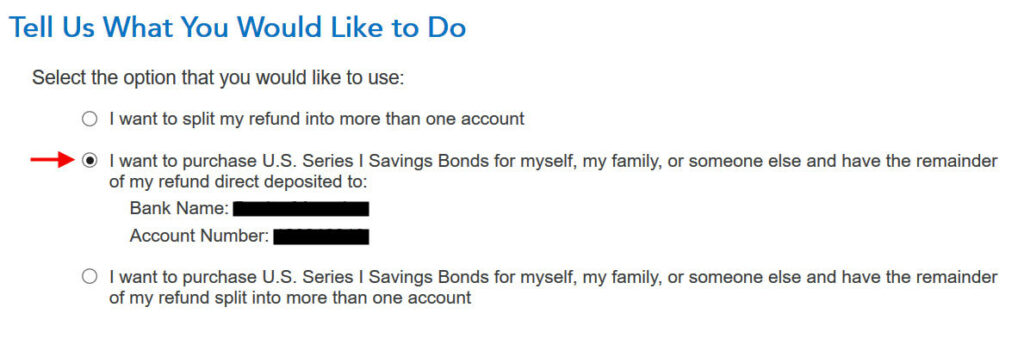

Then choose to buy I Bonds and direct deposit the leftover refund.

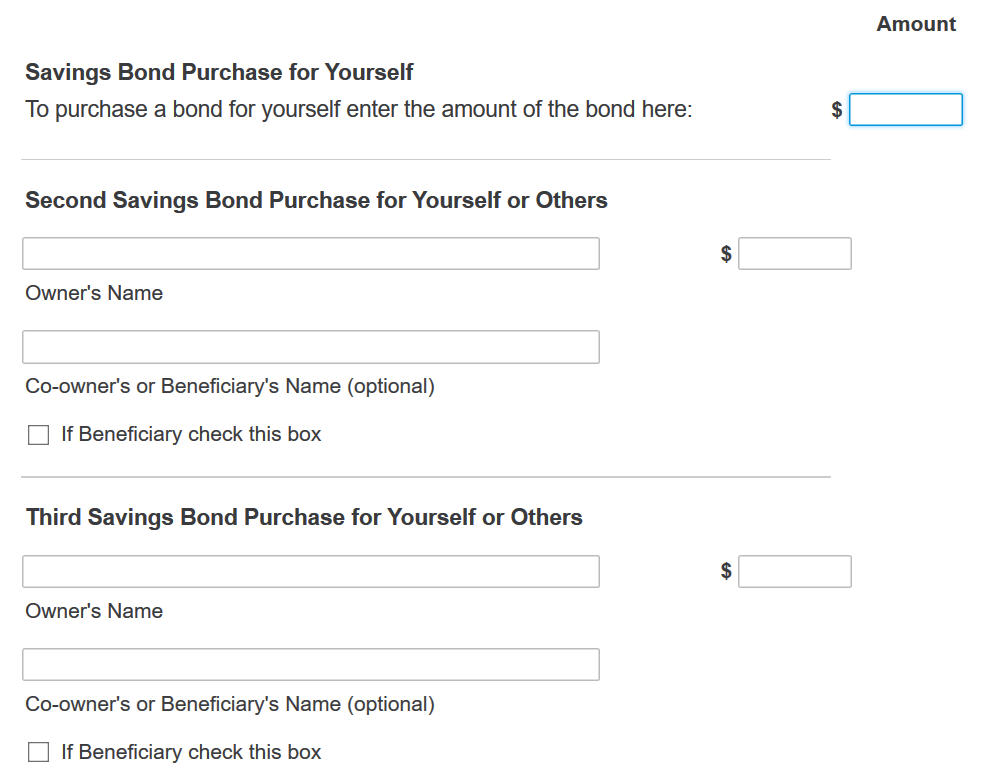

Then you will say how much you’d like to buy and whose name(s) should be on the bonds.

You can split the I Bonds purchase into an amount for yourself plus up to two free-form named recipients. Each owner must receive a multiple of $50 and the total for all three can’t exceed $5,000.

If you put an amount in the first box, you don’t have to give any name. They will automatically copy the name(s) from your tax return. If you’re filing jointly, the bonds will be issued in both of your names as co-owners.

If you’d like to have the bond issued in only one name (yours or someone else’s), put an amount as the Second Savings Bond Purchase. Give the name (and a co-owner or beneficiary if desired). Check the small box if the second name is a beneficiary (not a co-owner) of the owner for this purchase. Repeat for the Third Savings Bond Purchase if you’re buying for another recipient.

H&R Block

H&R Block downloaded tax software has it in the final steps before filing the return. When it asks you whether you want a direct deposit or a check, choose direct deposit. Reduce the amount of your direct deposit by the amount of I Bonds you’d like to buy.

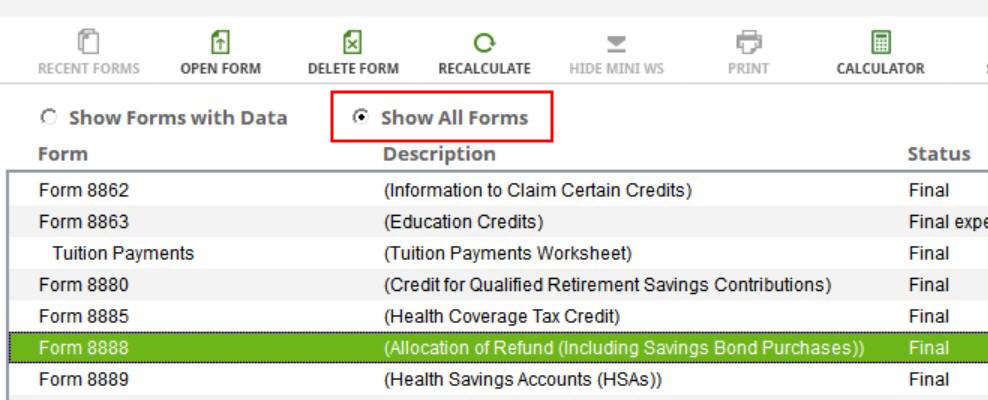

Now, find and open Form 8888:

1. Click Forms at the top of the program.

2. Select the Show All Forms option.

3. Scroll down to find Form 8888.

4. Select and open Form 8888 and fill it out to allocate amounts to savings bonds purchases.

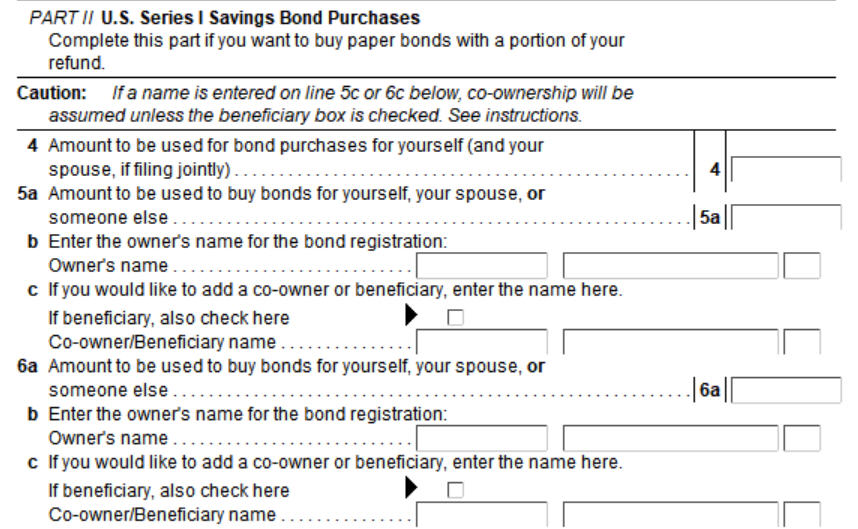

You enter the amount you’d like to buy and the names that should appear on the bonds in Form 8888.

You can split the I Bonds purchase into an amount for yourself plus up to two free-form named recipients. Each owner must receive a multiple of $50 and the total for all three can’t exceed $5,000.

If you put an amount on Line 4, you don’t have to give any name. They will automatically copy the name(s) from your tax return. If you’re filing jointly, the bonds will be issued in both of your names as co-owners.

If you’d like to have the bond issued in only one name (yours or someone else’s), put an amount on Line 5a. Give the name on Line 5b (and a co-owner or beneficiary on Line 5c if desired). Check the small box if the name on Line 5c is a beneficiary (not a co-owner) of the recipient on Line 5b. Repeat for Line 6a, 6b, and 6c if you’re buying for another recipient.

Receive Bonds by Mail

After you file your tax return, if everything goes well, you’ll receive I Bonds by mail. If you asked for $5,000, you may get one $5,000 bond or you may get multiple bonds that add up to $5,000.

If they send multiple bonds, each bond will come in a separate envelope. Because the bonds have your name and address printed on them, it’s just easier for them to put each one into a separate window envelope. Collating multiple bonds into the same envelope increases the risk of a mix-up.

Sometimes the bonds don’t come in one batch. If you receive fewer bonds than you expect, just wait. Most likely additional bonds will show up in the mail in a few days. If they don’t come in two weeks after you receive the first batch, please call TreasuryDirect customer service at 844-284-2676.

Deposit Paper I Bonds to Online Account

You can keep these bonds in paper form if you’d like. Put them in a safe deposit box. When you’d like to cash out, you can take them to your bank or credit union or a major national bank such as Bank of America or Chase. They will look up the current values in their system and deposit the money into your account or give you cash.

I prefer to consolidate the paper bonds with the bonds in my TreasuryDirect online account because it’s more secure and more convenient to have all the bonds in one place. You can mail the paper bonds to the Treasury Department and deposit them into your account. Please read How To Deposit Paper I Bonds to TreasuryDirect Online Account.

If only they ask for your TreasuryDirect account number on the tax return, they won’t have to mail you the bonds and you won’t have to mail them back in. While it is possible to direct deposit part of your tax refund into your TreasuryDirect account using a special routing number, when you use the money to buy I Bonds, you use up part of your $10,000/year quota, which defeats the whole purpose of overpaying taxes to buy additional I Bonds. The government has no incentive to make it easy. If you want more I Bonds, you’ll have to tolerate their process.

When Something Goes Wrong

Sometimes instead of receiving I bonds, you get 100% of your tax refund deposited into your bank account. It’s not clear why this happens to some people.

You can’t do anything about it. Once you receive your tax refund, it’s not possible to have the IRS take it back and buy I Bonds for you. Try your luck again next year. It may help if you make your tax refund not exactly $5,000. Make it say $5,081 and ask for $5,000 in I Bonds and $81 as a direct deposit to your bank account.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Dunmovin says

Thanks, DB. I never efiled for any year…always paper. Sooooooooo, looks like more time to wait for receipt of hard copy of ibonds. Anybody else with stories about/resulting from filing paper return?

Ed says

I filed my tax on 4/5 using H&R (fed+state) desktop version software. On 4/15, I received the 100% of the refund amount ($6004 instead of $1004) via direct deposit to my bank account. The IRS “Where’s My Refund” page indicated the purchase of bonds. It says I should get paper bonds within 3 weeks. But as of 4/22, IRS still has not taken back 5k from my bank account. On form 8888, I entered $5000 in line 4 only. So I don’t know what went wrong in my case? I happen to have federal tax overpayment of $6004 and I did NOT file any extension. I did not use cents in my tax filing.

Impossible to get through IRS by calling. Is it the issue with H&R software, IRS or US Treasury?

Is there any chance that IRS or Treasury recently changes the bond buying process so that IRS first gives 100% refund via direct deposit but Treasury debits $5,000 from your bank account later when the bonds are actually issued? Though, data points did’t suggest that other than now some people receive single bond with $5000 denomination instead of multiple smaller denomination bonds.

Harry Sit says

Once you receive 100% of your refund, it means your request to buy I Bonds failed. The IRS won’t take back $5,000 to buy I Bonds for you. No one knows why it failed. You can only try again next year.

Donald Graves says

I also e-filed with H&R Block software – the only difference from you is that I used line 5a to enter the $5,000, and then designate a beneficiary. I got the bond via USPS, and direct deposited change in 2 weeks.

Just to compare with my 8888, you should have $1,004 on line 1a, $5,000 on line 4 (as you said), and then $6,004 on line 8. If so, then there’s no telling why the different outcome

RL says

As a follow-up to comment #80 above and subsequent responses re: my situation, I called the IRS and spoke to a helpful rep who escalated my question about why 100% of my refund was direct deposited instead of I Bonds being purchased like I had instructed. The rep escalated the matter and I received a letter in the mail recently which said in relevant part:

“The cause of the full eligible refund being issued without the designated portion being applied to the purchase of an I Bond is due to an extension filing.

“The tax due with the return was paid as remittance with the extension to file which was posted to the account the same day as the 1040 return filing. You may also purchase I Bonds if you have a TreasuryDirect account.”

Not super helpful, but guess the takeaways for next year are: (1) wait a week or two after filing the extension and having any extension payment processed before filing the 1040 and (2) try not to have any taxes owed before filing the extension, perhaps withholding more than the $5,000 throughout the year. I know other people have not had problems with #1 and filed the 1040 and extension the same day.

Not very helpful, but not sure what else I expected from the government. Wish they’d just raise the purchase limit generally and get rid of this paper I Bond refund nonsense if they aren’t going to be consistent with how they process the requests.

Tom P says

Not sure why people go to the trouble of filing an extension to “overpay” their taxes when all you have to do is make a 1040ES payment before you file to accomplish the same thing. I’ve been making 1040ES payments for years because normal withholding was inadequate due to four sources of income, and it was very easy to setup the quarterly automatic payments via EFTPS.

I do agree that the paper bond purchase restrictions are ridiculous. Why restrict purchasing to only via tax refunds; anyone should just be able to go on TD and order paper bonds, especially if you want them as gifts for grandkids or whatever.

Old mariner says

That’s a great follow-up, RL. I totally agree with your last paragraph.

Old mariner says

I didn’t know about this paper i-bond thing until I read Harry’s article in late January. It was too late to file an estimated tax, so I filed an extension through Direct Pay. I didn’t file my tax return until after I confirmed that the funds paid with the extension had been withdrawn from my bank. I don’t know if that made a difference or not.

To me, the issue is the secret, obscure, IRS procedures that deny the issuance of the bonds without explanation or remedy. My opinion is just raise the Treasury Direct limit to $15,000 (or more) and remove the IRS from the process. I don’t even know why the Treasury is issuing paper bonds. Seems like a waste of paper to me. I mean, I received 12 bonds in 12 envelopes and immediately converted them to electronic. So, a total waste of paper with respect to me.

Bud B says

Closing the loop on comments 81, 82 & 95. Thanks to all for all the feedback on this topic.

1. I received a CP53 notice in the mail yesterday from the IRS confirming that my refund was off by a few cents confirming my analysis above.

2. I’ll contact the service that calculates my domestic employee’s payroll, but doubt that they will change estimated taxes to whole dollars.

3. Marked my calendar for January 15, 2023 to examine the statement from the service, so I can make an estimated tax payment to round to an even dollar amount if desired.

4. I still think that Turbo Tax shares some of the responsibility for the non-issuance of the bonds (at least the false expectations). They could write a few lines of code that would check estimated tax payments to see if they are an exact dollar amount (after all I did enter them exactly as reported and Turbo did the rounding). That fix might result in getting feedback during the process that says: “you are not eligible for the bond purchase because your estimated taxes are not in whole dollars”.

5. Will have my children set up Treasury Direct accounts to register their bonds and buy more as desired.

6. Will consider making estimated taxes for them during the year to make the paper bond purchases, but at their age stocks are probably a better long term investment.

7. Remember to write my congressman about increasing the limit on bond purchase. In the end whatever laws they pass set the limit (guess it could also be an executive order, but I’m not taking the time to research).

Tom P says

I’m having trouble understanding why ANY 3rd party service would submit estimated tax payments in anything other than whole dollars. After all, it’s ESTIMATED, not final 🙂

mrd says

Just a guess, but I wonder if this is aimed at lower income groups who would never put money into a bond but if someone like HrBlock or just a volunteer helps them with taxes, and they typically get some kind of refund and then the helper points out how this is a good way to save which they ordinarily would not do. Its just an odd process.

Dunmovin says

Bud, make TD gift purchases now for Ibonds and deliver later …that way Ibonds start earning 7.12 this week from April 1st!!!!

Tom P says

Dunmovin, good suggestion… I did just that last week. Bought $10K for my wife and she bought $10K for me as gifts. If inflation is still high next year those may remain in our gift boxes for delivery in 2024 and we’ll buy more normally in 2023. As Harry has said, you don’t want to go crazy with this since you could be forced to hold the bonds for years before “delivering” them due to the annual purchase limit.

Art says

I must have missed the explanation. How does this work? The “deliver later” gift gets calculated against recipients’ future year $10k purchase limit, and they can still buy an additional $5k via tax refund? Sounds like the “gift” earns current interest from the date of purchase? Does the one year holding requirement countdown start immediately, or once they actually deliver the gift? Sounds complicated, but a potentially useful strategy for accruing additional interest.

Harry Sit says

Gifts are covered in Buy I Bonds as a Gift: What Works and What Doesn’t. Let’s keep this post on getting paper bonds from the tax refund.

Tom P says

Yes Art, that’s how it works. The gifts can stay in the gift box as long as you want and they start earning interest and maturing from the first day of the month you purchase. When you deliver them to the recipient they will count towards the recipient’s yearly $10K limit in the year delivered, so in my case I might decide to deliver them next year and only get another $5K via tax refund… just depends on the current rates in 2023 and whether I have any extra funds to buy more bonds in 2023 and continue to hold the gifts for another year. I just wanted to take advantage of the current high rates. Harry has a great write-up on all of this… I’m so glad I discovered his blog!

MFRP says

Not sure what exactly happened in my situation, but it sounds similar to the replies above. I used H&R Block Deluxe desktop version and followed the directions for splitting the refund between direct deposit and $5k in bonds exactly. I learned about this method after the 4th quarter estimated payment was due (I do make estimated payments normally) so I made a $4500 extension payment in late March to get my refund over $5k. I waited until a few days after the extension payment had been withdrawn from my checking account before I filed.

Today I received the full refund ($5256) in my checking account. H&R had calculated my refund as $5282. I guess the difference is what prevented the bond purchase; I’m not sure where the difference came from. I’m assuming I’ll get a letter explaining it. This is the first time in many years that I’ve had a refund ($782 before adding the $4500 extension payment) so maybe I did something wrong.

MFRP says

Just checked the IRS refund status page, it says:

You requested that part or all of your refund be used for a US Savings Bond(s) purchase. However, we could not honor your request for the savings bond purchase due to one or more of the following reasons:

The bond amount you claimed was not in a multiple of $50 or it exceeded $5,000.

You owed a past due obligation to which we applied part or all of your refund.

No idea how I had a past due obligation. I didn’t have one from the previous year, never received any sort of notice regarding such, and this year I already had a refund pre-bond-games and had made my estimated payments on time. I must be missing something.

Tom P says

MFRP, you can make as many estimated payments as you want, which would have alleviated the need to file an extension. I’ve done this several times in the past when I made a 401k withdrawal late in the year and then made an extra 1040ES payment in January to cover the taxes. Sorry you bond purchase didn’t work out as expected.

SteveR says

Using TT, had the same issue as several folks posted above, with feds refusing to issue $5K iBond I requested in Form 8888. IRS web page for my refund gave same reasons as MFRP’s.

Akin to some others, total refund was larger than $5K; TT rounded my refund up to nearest dollar; but IRS calculated refund 5 cents less than that. Would have liked $5K of the refund in iBonds, but pursuing further this year doesn’t seem worth the time and would likely be fruitless anyway.

My Question: If I receive a CP24 and it has no new info, can I just file it away and continue just to move on? Under what circumstances should a CP24 alarm me enough to follow up with phone calls, hiring an accountant, etc?

Thx much.

Old mariner says

Okay, here are my thoughts. Your CP24 was just to inform you that there was a discrepancy between what you claimed on your return and what the IRS had in its records. In your case $0.05. (Here’s where I’d insert a “shaking my head” GIF). No response is needed unless you want to dispute the $0.05. A dispute won’t help with the i-bond purchase. Once the IRS refunds you, there’s no recourse with respect to the i-bonds.

One reason why some people aren’t getting bonds seems to be due to estimated payments which include cents (i.e., are not rounded). Did you happen to make estimated payments of any sort during the year that included cents? It seems the IRS accepts payments with cents, but then all tax software rounds numbers (because that’s what the IRS prefers) which then results in very small discrepancies like yours that reduce a refund. An IRS reduction of a refund is one of the reasons the IRS gives as to why they might deny the issuance of i-bonds.

Tom P says

FWIW, I don’t let TT manipulate any of my inputs, I ALWAYS round my inputs before typing them into TT, and I don’t let TT try to “amaze me” by pulling data from any of my accounts either… I just type it in myself, and I double and triple check everything. I must be doing something right because I’ve never received a correction from the IRS and my spreadsheet calcs always agree with TT.

I don’t comprehend how a refund could be reduced by 5 cents as I thought all inputs got rounded (but maybe not estimated taxes based on some posts in this thread, which may explain some of this mess)

IMO, anyone that makes (or has 3rd parties make) estimated quarterly taxes in anything other than whole dollars needs to rethink their philosophy. After all, it’s ESTIMATED, so what do submitting payments in cents have to do with the final calculations?

SteveR says

Thanks for the responses, which give me some additional comfort that I can put this issue behind me, at least for now. You are also correct that I did make an estimated tax payment in 2021 that included some cents, which I’ll try not to repeat. Of course, if I get a CP24, I’ll review it carefully. Best regards, SteveR

Harry Sit says

I added a new section “Pay In Whole Dollars” to warn people of this issue with cents in estimated tax and extension payments.

MFRP says

Yeah, each of my estimated payments included cents. I just never thought anything of it, or considered that it might cause any sort of issue. Unfortunately I already made a Q1 2022 estimated payment that included cents. Guess I’ll make the remaining 3 in whole dollars only and try to pay attention to H&R rounding vs the actual estimated payment when I do my taxes next year. In my case, though, the difference between my refund and what H&R calculated was $26, which isn’t explained by rounding errors. I’m super careful, manual entries, and check everything repeatedly as well, so hopefully I’ll figure out what happened.

Harry Sit says

If you already made a payment with xxx.37, make your next payment xxx.63 so your total estimated tax payments add up to whole dollars. Then you continue the rest in whole dollars.

Old mariner says

@MFRP, there was another poster in this thread who had a $30-something discrepancy. It turned out that the IRS calculated penalty interest for an underpayment of estimated taxes. The total of all the poster’s estimated payments was more than sufficient, but apparently at least one quarter’s worth was not. I seem to recall the poster had a big income stream in the last quarter.

If you had uneven income during the year, maybe you incurred an underpayment penalty.

Jason Boxman says

For anyone coming to this in the future, I confirmed that at least for 2021 taxes it was not possible to get a refund in i Series Savings Bonds when filing with Cash App Taxes (former Credit Karma), which is free for federal and state for all income levels. As someone with relatively simple taxes, paying Turbo Tax or H&R to file just to get an extra $5k in Savings Bonds didn’t seem to makes sense for me. Maybe next year.

Old mariner says

Well, strictly speaking, that software does claim to support form 8888, which is used to order the i-bonds.

“What forms and situations does Cash App Taxes support?

•8888 Direct Deposit of Refund”

Did you fill out that form and not receive your bonds? If so, read some of the comments above about estimated taxes including cents as a possible cause. Or did the software not offer you the opportunity to fill out that form?

Jason Boxman says

Then this changed since February when I filed, but I’d asked explicitly if they support i Series Savings Bonds on form 8888, and I was told they do not support that method, and it was not present when I filed at that time. (It was in the FAQ at the time as well.) If that’s changed, that’s great news.

Old mariner says

I only know their website today (5/1/22) states that they support that form. It’s a standard form that’s needed for other purposes, too. In any event, you should be able to use that software next year, and that is the form you’ll want to be looking for if you want to purchase the paper bonds. If you do estimated taxes, pay them with whole dollars (round up so there’s no cents).

Harry Sit says

For simple taxes, OnLine Taxes (olt.com) supports buying I Bonds with the tax refund. It costs only $10 for both federal and state.

Tom P says

That decision not to pay TurboTax or H&R seems a bit short-sighted to me. My cost for TurboTax with a $10 discount was $29 plus my local tax. For a $5K bond you would have gotten $30 in interest the first month at the 7.12% rate. Personally, I like using TT online because it’s always up to date and it remembers what I did the previous year which makes it easier to use for me.

Pete says

I purchased the 10K limit for 2021 but didn’t know that I could buy another 5K with my tax refund until after I’d submitted my 2021 return (paper format). I submitted direct deposit information for my bank account but didn’t provide form 8888 to direct 5K of my return into series I bonds.

Is there a way to update or modify the direct deposit instructions to IRS (i.e., by filing an extension or a separate form 8888) so as to take advantage of refund 5K bonds? I understand that you can’t use an amended return to accomplish this. Still, there must be a way to revise the direct deposit, in case someone moves or closes their designated account, subsequent to filing.

Do you have any insights on this issue. With Series I now commanding 9.62%, I bet there are many people wishing they’d filed for bond purchases with their returns!

Harry Sit says

You can try e-filing the same return (plus Form 8888). It’ll probably get processed before your paper return.

Old mariner says

Unfortunately, form 8888 needed to be submitted with your return. There’s no way for you to order paper bonds after-the-fact. However, if you take a look at Harry’s most recent post: “How to Buy I Bonds (Series I Savings Bonds): Soup to Nuts” at https://thefinancebuff.com/how-to-buy-i-bonds.html, you’ll see there are a few ways you might be able to purchase more bonds this year. For instance, if you have a spouse, Trust, children, or business.

Dunmovin says

Harry, I overpaid my taxes so that i can get paper ibonds for the grandkids…filed paper return in early February (have a receipt of return received in Ogden on 2/14)…and nothing received (yet). Now I see 4% interest for late payment by the feds…so what does that get me….starting 45 days after filing deadline (approx. June 3 this year) starts the interest to run. Does that mess up my request via 8888 for $5k in refunds via paper Ibonds since it isn’t (now) a round number? I do not have any refund going to any checking, bank account, etc. The other funds I “rollover” for next year’s taxes. No cash back to me.

Harry Sit says

As you have seen reports from others, you may get I Bonds or you may not. You give it your best shot. Whether you actually get I Bonds is up to the IRS. Just wait to see what happens.

Dunmovin says

Then…all, overpay taxes when rates are low, file by paper close to tax deadline, etc. IRS will process e-filing first while paying interest on refunds (45 days after due date)…ergo don’t e-file. Buy ibonds following year by tax refund. Since Treasury/IRS does not have interest charged to their budget they have no incentive to minimize interest paid on late refunds!

Patsy T says

I received a single paper bond in the mail today in the amount of $5000 dated for May 2022 after efiling on April 28. I received the balance overpaid into my bank ac 7 days prior.

I had filed for an extension with freetaxusa in early April over paying $5928 then on April 28th copied the info into the IRS web site free fillable forms which was a little difficult because I couldn’t find where freetaxusa had placed a $10 difference. When I finally found it and changed the free fillable form I assumed it would have automatically changed the amount on form 8888 to match but it did not nor did it give me an error message that form 8888 total refund did not match the tax return amount, as required. luckily I had a personal info error that caused the return to be rejected allowing me to correct the 8888 form to match the IRS tax info and resubmit.

I also created three revocable trusts with 10k each and purchased 10k for my husband and myself.

Very happy it all went smoothly.

Thank you Harry for this site and your interest in helping others.

Roy says

Did you get a separate EIN for each Revocable Living Trust?

Patsy T says

No, I used my husbands ss# for our joint trust and used our own ss# for each of our personal individual name trusts

Roy says

Interesting. Please do let us know if the IRS every “dings” you for buying more than the annual limit for a given SSN. I don’t really know if the limit is just based on SSN, or is influenced by the fact that you have more than one entity using that same SSN. Would be good to know!

Tom P says

Buying bonds with for a trust using the same SSN as a personal account is fine.

Donald says

It seems that one gets “dinged” immediately if trying to buy more than $10,000 for one entity (other than a gift). A couple of weeks ago, my wife made a mistake, and got a message, saying she already had the max, and they would return the additional $10,000 in 8 – 10 weeks. Meanwhile the disallowed extra $10K is still in her account, and I guess we’ll see if and when they return it, and if they pay interest for the time they had her money.

Dunmovin says

Checking to see if any paper tax filers have received their paper Ibonds? I filed in February, have a receipt by IRS in Ogden Ut in February…but nothing.

Roy says

Has the IRS processed your return yet? Receipt does not equal processed.

Dunmovin says

Not to my knowledge…nothing available on irs website. My Q is aimed at those that filed a paper return…thanks, but I sense that is not u.

Mike says

Dunmovin, I paper filed about 12 weeks ago (see my comments at #75 and 99.) Today, I tried “Check My Refund” on the IRS website, using my total refund (>$5,000), the actual refund check amount, and both of these with the cents and without; all to no avail. They professed having no information for me. I also tried on 800-829-1040, went down the rabbit hole of options, ending with high call volume message followed by “click.” BTW, are they asking for the total refund (I-bonds included), or just the check amount I’m expecting?

Harry Sit says

Use the total refund amount (including I Bonds) on the Where’s My Refund site.

Dunmovin says

I had over $5k balance from the past and rolled the small amount over $5k for next year taxes with $5k going this year for ibonds. I had gotten no info on irs website on return…I suspect it is geared only for efilers. You confirmed, so far, that seems to be true.

Anyone else???

PT says

I mailed in my paper ibonds to be converted to electronic and got this email yesterday June17th so they are way behind.

Dear Customer,

This is a system generated email to communicate we received your Savings Bonds/Treasury Marketable Securities materials.

Cases are worked in the order they are received in our office. Your request is important to us and will receive attention as soon as possible. Please allow up to 13 weeks for review and processing. If we require additional information, we will contact you. Thank you for your patience.

Please retain the Customer Number and Case Number referenced above to streamline any future actions associated with this request. Also note, you may receive multiple email notifications and Case Numbers depending on the type of transaction(s) you have requested.

If you have additional questions, please use the Contact Us link on TreasuryDirect.gov.

We appreciate your interest in U.S. Treasury securities.

Sincerely,

Treasury Services

Mike says

PT: Regarding conversion of paper bonds to electronic registration on Treasury Direct.

I mailed several EE Bonds, together with my printed manifest to a treasury office in Minnesota on April 1st, got a “delivered” notice on April 4th, and was pleasantly surprised to see they showed up in my converted bonds account on April 30th.

Still no word on the I Bond I’m attempting to purchase with the IRS tax refund.

Dunmovin says

No change here, Mike. They apparently have no incentive to process since interest is accruing now but it does not come out of their budget. Be interested in seeing how the interest is credited. Then again, IRS/TD will/may find a way to send a check or send to a financial account….with no Ibonds issued!!!

Billybob Covman says

Just a datapoint for anyone: I am an overseas taxpayer. Without reading the comments, I made an estimated payment on 14 May for $5432.10. I always punch in random numbers just to break things. I filed my taxes on 30 May, and they were accepted the same day.

The IRS „where is my refund“ page stopper tracking a week ago, but yesterday it said approved (second bar). My transaction history on the IRS shows a split payment of 432 and 5000 in bonds. Today, $432.10 showed up in my US bank account, so I guess $5000 will be coming in bonds soon.

Short story: making an overpayment with cents (likely) worked for me. I even received the $0.10 back as well 🙂

Hope this helps someone.

Robert Farrell says

I received an IRS refund for 2021 via direct deposit in April 2022 in the amount of $4,500. I did not realize at the time I could buy up to $5,000 in I bonds with my refund. Even though it is now June 2022, can I still buy up to $4,500 in I bonds for my 2021 refund of $4,500 or has that ship sailed? I already purchased my allowable $10,000 for the year. Please advise.

Harry Sit says

Already sailed. Try next year.

Tom P says

Yep, as Harry said, “it’s on the seas.” But if you have a spouse or significant other either you or they could buy a gift bond up to $10,000 and keep it in your gift box for delivery in January 2023 or any date after that in the future. I did that for both myself and my wife as I wanted to take advantage of the current high interest rates.

Robert Farrell says

Tom P-If I buy a gift bond and hold until January 2023, does that count against my 2023 purchase for both my wife and myself?

Tom P says

Yes, Robert, a gift bond purchased now and kept in your “gift box” counts in the year it is delivered. So, if you purchase gift bond(s) now for delivery in 2023 they will count towards your 2023 quota. However, you could buy gift bond(s) now and hold them for as long as you want, and they will earn interest and keep marching towards maturity. If interest rates are still “good” in 2023 you could decide to purchase additional bonds and keep the gifts in the gift box until 2024, or you could split the purchases with a $5,000 gift bond now for delivery in 2023 and another $5,000 normal purchase in 2023. The options are endless. If you haven’t previously purchased gift bonds you should read Harry’s article. It’s easy, you just need to create an added registration and check the “gift” box checkbox.

Roy says

“Tom P-If I buy a gift bond and hold until January 2023, does that count against my 2023 purchase for both my wife and myself?”

There is some confusion here. The gift I-bond counts towards the annual I-bond purchase limit of the receiver in the year in which the bond is delivered. If you buy a gift I-bond for your wife now, and then deliver it in January 2023, the value of that I-bond will count towards your wife’s annual I-bond purchase limit for calendar year 2023. Purchasing a gift I-bond for someone else never counts at all against the annual I-bond purchase limit for the giver. So, the statement “if you purchase gift bond(s) now for delivery in 2023 they will count towards your 2023 quota.” is incorrect – gifted I-bonds will never count against your annual I-bond purchase limit, they will only count against the annual purchase limit of the receiver.

Tom P says

Roy is correct. I omitted one key word, “spouse.” I should have said, ‘… they will count towards your SPOUSE’s 2023 quota.” You can’t purchase gifts for yourself, only for someone else.

visitor says

Thanks for this helpful article!

If you have two TreasuryDirect accounts (Individual and Trust), can you overpay your taxes by $10,000 and have the I-Bonds split between those two accounts with the individual tax returns?

If you think you might owe taxes, can you overpay (say $6000 instead of $5000)? Will the IRS deduct what you owe and use remainder to purchase I-Bonds?

Harry Sit says

You’ll get paper bonds. The maximum is $5,000 per tax return. It doesn’t matter how many TreasuryDirect accounts you have. The $5,000 is from your refund. If you owe $1,000 before paying, you’ll have to pay at least $6,000 to turn the negative $1,000 into a $5,000 refund.

visitor says

Thank you, Harry Sit.

Mike says

Just to clarify per your second paragraph, “visitor”, if you overpay, the entire amount that exceeds what tax you owe will show up on the appropriate Form 1040 line: “amount you want refunded.” If you want some amount (up to $5,000), going to purchase an I Bond, you need to file Form 8888 and specify exactly how your refund is divided.

visitor says

Thank you, Mike.

Bobb says

I have face value of about $6,000 in paper-hard copy Series EE bonds that are paying an average 1% annually. I could wait out the 20 years (In 2029) and ensure they double but I don’t see the financial sense in that. My question is, can I cash those Series EE bonds in now in 2022 and take the principal and interest and purchase Series I bonds and not have to pay the roughly $600 of interest these bonds have made in totality in the last 12-13 years in calendar year 2022? I guess I am asking can I rollover bonds from Series EE to Series I without being taxed on the interest they have accrued over the years.

Harry Sit says

EE Bonds were issued at 50% of the face value. If you wait another 7 years, your $3,000 original principal plus $600 interest will turn into $6,000 in 2029. That’s a 7.6% annual return in the next seven years. While you didn’t earn much in the last 12-13 years, waiting for them to double is still probably your best option at this time. You can’t roll over from Series EE to Series I without being taxed on the accrued interest unless you happen to have qualified higher education expenses in the same year.

Dunmovin says

Update from previous post on paying/filing paper 1040 with 8888…Return received by IRS in February…received a check today for the full $5000 that was to go to ibonds! And with (stated in corner of check) $50.81 as interest (probably taxable!). Bottomline, do it right and do not get paper bonds. As Harry, said before we apparently have no recourse!!! Sorry, grandkids … no santa claus/ibonds this year.

Old mariner says

That’s a disappointing finale. Did you get a CP24 stating why you didn’t get the bonds?

I didn’t know until I read this blog back in January how persnickety this IRS paper bond thing is.

Tom P says

Well, it seems like you have only yourself to blame for this mess because you did not file electronically. If you had, you would have gotten your bonds in February just like I did. I’ve been filing electronically via Turbo Tax for many years without a single issue. To each his own, I guess.

Old mariner says

E-filing probably would have resulted in a faster response from the IRS, but he still might not have gotten bonds. Might be worth his time to ask the IRS why. Some of the taxpayers above contacted the IRS and discovered the obscure reason why the bonds weren’t issue in their case.

Dunmovin says

Old…No CP24 since everything was right…the problem in my view is the IRS drags its feet where it is beyond the June date for interest to start to accrue and ergo the amount of the refund is grown to over $5000 b/c of the interest….too much for ibonds! I won’t file anything electronically especially since I got the stimulus checks to a bank account that was ONLY used by me to receive foreign wire transfers of fees to me…my “wonderful” bank had to have filed a SAR with Treasury. Yet the tax refund was by check…go figure!

Dunmovin says

Tom, no guessing. Good testament to our IRS. No harm, no foul here. We get what we pay for. No efiling here. If the IRS paid interest out of their budget…guess who would be first in line?

Dunmovin says

Some of the posters seem to think that the IRS gets a free pass. When I went to school the parties are to suppose to deal in good faith. The IRS does not know how to deal in good faith. The Treasury fraudulently represents how to get paper bonds…there is no disclosure of the gothas and the public is not at fault.

In the case at hand Treasury could have rolled over the interest as if it was for next year’s taxes…which there was already a few bucks in my account for 2022…no, it went to great lengths to screw the public by taking away their right to purchase ibond…fraud…clear and simple!

Tom P says

Dunmovin, I think before you accuse the IRS of intentional fraud you should dig into the statutes, regulations, and procedures they are supposed to follow and figure out why your case turned out the way it did. In your case it may be as simple as the total of your refund plus the accrued interest was more than the allowed bond purchase, so the purchase was cancelled per procedures when run through the system. I seriously doubt someone at the IRS decided on their own to screw you out of buying bonds; it was all done by a computer program once the information from your paper return was entered into the system.

Why people still file paper returns today is beyond me; you are just asking for trouble since all your information must be manually entered into the system and doing that has a much higher chance of being done incorrectly by an overworked IRS employee than entering it yourself via e-file, which is then double checked by the e-file system you use.

Mike says

No progress update: I paper filed late in March after overpaying via Form 4868. No refund, no bonds as yet. When I got a human from the IRS on the phone the other day, I was told my return must be in the system somewhere, but there is no way to access it. Please wait 16 weeks before checking back.

Mike says

Update: After paper filing with electronic overpayment via Form 4868 in late March, still no progress. The IRS human being I got on the phone last week said my return must be in the system, but there is no way of locating it. Please call back in 16 weeks.

Old mariner says

Lol, I guess they’re being told to say weeks instead of months. 16 weeks somehow sounds sweeter than 4 months.

Jen says

Hi, thank you for the helpful article. Hoping you can help me figure out if I can buy for 2021 taxes. I filed an extension in April with my estimated payment (no overpayment since i didnt know about this). I have not filed the 2021 taxes yet. Can I use irs direct pay to make the $5k overpayment now and then, when I finally file the taxes, request the I bonds for the refund? Thanks.

Harry Sit says

“Extension” is no longer a choice in the “Reson for Payment” dropdown because the deadline already passed. “Balance Due” is still a choice. It might work but I’m not positive.

Tom P says

If Direct Pay won’t work, couldn’t you use EFTPS to make an extra $5000 payment before you file your taxes?

Harry Sit says

Whether you can still have the payment apply to 2021 is the question.

Dunmovin says

Harry, any suggestion on how to get paper ibonds as a result of paper filing in 2023? Specifically, for those inclined to paper file 1040/8888 and knowing irs must process return before $s go TD for ibond purchases, the fact that irs credits it’s late interest payment to refund that sets off the wrong numbers and ergo …only a cash refund check and no bonds. Sooooo, let’s assume over payment of $5.5k in taxes (any excess being used for 2024…) that the late interest that could be paid by irs in this hypo is $97 (odd number) for 2023 paper return…can one plan on buying, eg $4800 in paper ibonds (out of that $5.5k)…is that what one should do on forms? Of course even efiling of returns could have same problem if irs is late in processing it. Any suggestions on numbers and location on forms when there is a late interest payment by irs? Thanks

Harry Sit says

If you want I Bonds, don’t paper file. You have a much higher chance of getting I Bonds when you e-file. It’s still not guaranteed but you are more likely to be disappointed when you paper file.

Old mariner says

Did the IRS tell you the reason you didn’t get i-bonds was due to the interest credit?

Dunmovin says

In effect they did by refunding more than one can use for ibond purchase…see above. Thus, the reason for my suggested approach in Reply #133

Dunmovin says

Harry, you are right but that is not the lesser of…. Once more, care to venture “how to do it,” rather than another, and the e option can create a problem!! Thanks

Abe says

Will payment via the extension methodology help avoid underpayment of estimated taxes or otherwise count towards safe harbor withholding? Assuming no, but great if it does. Would save me time from calculating my withholding amounts towards the end of the year.

Harry Sit says

No, because the deadline for estimated taxes already passed when you pay with an extension.

Dunmovin says

Have taxes withheld from IRA distribution…treated as done evenly over year. I have RMD in December and have taxes withheld then on my anticipated taxes

tom says

my 2021 calendar year 1040 is under extension. in april 2022 paid in the amount i thought i needed to cover tax liability + a couple of thousand dollars as an “entension”

payment. my return now shows a bit over a 2,000 overpayment. i would like to buy 5,000 in ibonds. I pay estimated and extension payments via EFTPS. key question – can I now submit an additional payment thru EFTPS for 2021 (and classify it as for example “payment with return”) to get my total 2021 overpayment above 5,000 so i can claim 5,000 for ibonds on Form 8888 and the rest as a refund?

Mike says

Finally, resolution on my bond purchase (but not the kind I wanted.)

At the end of August, five months after paper filing, I got a check in the mail for $5,0xx.xx. No bonds, although I had requested $5,000 on form 8888.

The IRS explanation:

Not in multiples of $50 (not true), or

Exceeds $5,000, (also not true), or

You owed past due obligations which we applied (have never seen a notice of that.)

BTW, they did tack a little extra on the refund check, which amounted to about 3% interest.

Dunmovin says

As I posted earlier…the interest kicker made the total not divisible by $50. If interest posted as a credit toward next year’s taxes…paper bonds would have been issued . Called non-customer service and grandkids got stiffed

Old mariner says

If that’s what customer service told you, then that’s their story. I mean, an interest credit would increase the total amount of your refund. The form 8888 reasons listed for not issuing bonds seem to relate to decreases in the total refund. Maybe the interest credit is considered an “offset”. I dunno.

Also, it isn’t the total refund (including the interest credit) that has to be divisible by 50, it’s the amount that you designated for the bonds that has to be divisible by 50.

It’s as though the IRS is completely pi__ed off that they even have to perform this service, so they are making it as tortuous as possible just because it’s fun to crush people out of bonds.

S says

Any idea how long from when tax return is filed until the bonds are issued (don’t care about received)?

I’d want to make sure I’d lock in the 9.62%.

Harry Sit says

I e-filed on March 15 and I got the bonds with a March issuing date. There’s a chance you’ll catch the 9.62% rate if you e-file now and there are no problems with your return but everything has to work perfectly. You only do what you can and hope for the best.

Roy says

My experience was like Harry’s. I e-filed on April 7 and received bonds with an April issue date. I think it is key to make sure the math is correct in your return and to include the properly filled out form asking for the i-bonds. Be sure to e-file your return – any fee you may pay for e-filing will be more than offset by the great interest rate you will get if your bonds are issued in October. There are so many stories of late issuance and no-issuance for various reasons associated with paper filing.

C says

What are your thoughts on purchasing I Bonds with the 2022 tax return? I’m wondering if I should withhold extra federal taxes to make that purchase. Do you have any predictions on what the interest rates will be next May?

Harry Sit says

It’s too far out to predict, which isn’t necessary anyway. You can wait until April to decide and make a payment with an automatic extension, as shown in this post.

Roy says

It’s now 3/14/2023. Any informed guesses on what the inflation portion of the i-bond rate to be announced on 5/1/2023 might be??

Harry Sit says

I would guess around 3.3%

Roy says

By 3.3%, do you mean that if that is indeed the rate then the I-bonds sold on 5/1 would pay an interest rate of 2 x 3.3% = 6.6%, plus any coupon rate?

Harry Sit says

No. Interest rates are always quoted as an annualized rate. A 3.3% variable rate plus a 0.4% fixed rate (if it doesn’t change) becomes 3.7%, which is a big drop from the current rate of 6.89%.

Jeff says

I pay estimated taxes. Last year I knew I wanted to buy a $5,000 I Bond with my tax refund (I already bought my $10k max), so I overpaid my 4th estimated tax payment enough to have the needed refund. This year I’m not sure if I want to do it again. I’d like to see how things look in April. Can I make an EXTRA estimated tax payment, after the 4th payment is made, but before I file my taxes. My 4 regular estimated tax payments will be enough to cover my tax obligation. The extra payment would be just to increase my refund enough to buy an I Bond.

Thanks,

Jeff

Tom P says

Jeff, if you use EFTPS you can easily schedule as many ES1040 payments as you want. I made an extra one November 1st to cover a withdrawal I made, and I have two scheduled for January 17th. I’m not sure I’d wait until April to make an extra payment to cover a bond purchase as you want to be sure it gets credited before you file your taxes.

Harry Sit says

The option to pay estimated tax for the previous year will disappear after Jan. 15. You can still make a payment with the automatic extension up to April 15. This post shows how to do it via Direct Pay. You can do the same with EFTPS. As Tom said above, allow some time between making the payment and filing the tax return to make sure your payment is properly credited before your tax return is processed.

Mike says

Great article. It is rare to see a financial topic article that isn’t mostly fluff and filler.. but the finance buff just brings the specifics, high value and expertise.

I pay estimated quarterly taxes and my last payment for 2022 is 1/17/2023. this appears to be the easiest method of sending overage funds.

That said, most of us do not know our actual tax / refund status till late February at the earliest and really much closer to the deadline depending on when we get them done.

For clarity, can I combine both the quarterly estimated taxes with the one time payment extension method?

In other words, I would make my normal quarterly estimated tax payments without any extra amount and then just do my overage using the extension method in say March to allow for sufficient time for the payment to be credited for the 2022 tax season and then file in mid April.

Mike says

Mike, what you’re proposing to do should work as it did for me last year, using Form 4868 (file for extension.) See my post above on March 23. My payment was successfully made using IRS Direct Pay, but the rest of the story is not so good. After several unsuccessful contacts with the IRS to track my case, my entire $5,000 was returned in August. (See my post above on Sept. 19.) Against the good advice of several gurus on this string, I paper filed as I have always done, and that is likely what caused my bond purchase to fail. I hope you have better luck than I did!

Dunmovin says

IRS would rather pay interest on your refund (different budget accounts) when you request paper bonds by paper filing of return ,ie grandkids get …. Do not paper file if you want paper bonds. Ironic part is irs has a colleague bank accounts in their system due to SARS being filed for receiving overseas wired funds!

Dougie says

For 2021, I filed an extension about April 10 last year and paid about $5500. I e-filed my return on about April 25 using TurboTax and my refund was about $5150. I elected to apply $150 towards 2022 income tax and $5,000 refunded as a paper I bond which was received by late May. I am definitely doing another extension for 2022. However, for this year I cannot file for an extension until I get a Schedule K1 from my deceased mother’s Trust that unfortunately had a first tax year that ended on 12-31-22 (estates and trusts can, and often do, have a different tax year). Assuming I get the Schedule K1 no later than by April 14, I would than have just a few days to file an extension with an accurate estimated tax payment that includes an extra $5000 to preserve the option to get another $5000 paper I bond at the new interest rate effective May 1.

Roy says

Yeah, that sucks. It could be even worse. The due date for your mother’s calendar year trust to file form 1041 and associated schedules K1 is April 18, 2023. But the trust can choose to file form 7004 to be granted an automatic 5.5 month extension of time to file.

You might try contacting the trust’s trustee to get an idea when they actually plan to file, and maybe that knowledge would help you in your planning.

Dan A. says

Ask the trustee what the K1 amount will be. Trustee probably has the return completed, but the forms are still in “draft” form, which is why they can’t be mailed yet.

Paul says

Is there anything special you need to do in Turbo Tax to indicate that you are filing as an extension?

Harry Sit says

You’re not filing “as an extension.” You do indicate how much you paid with an extension as shown in the “Report Payment on Your Tax Return” section.

Leo says

Good morning Harry. Can businesses overpay their taxes this way also & buy an additional $5K of I-Bonds each year? Thanks.

Harry Sit says

No, only individuals can.

Boyd Theodore says

Harry,

Thank you for this. I made the $5000+ overpayment on March 1st and it is still listed as pending on my IRS account a week later, though the amount was debited from my bank account on the 2nd. I looked at forums online and see that some people have waited more than a month for the tax payment to confirm on the IRS website. If I file now, should I still expect to receive the I Bonds?

Thank you,

Boyd

Dunmovin says

You must efile to even have a shot at receiving hard copy ibonds but irs filings due nlt mid-October this year …who knows about paper filing…I gave up on requesting paper bonds last year since I do not Efile!

Harry Sit says

I said wait at least a week. It’s been a week. I don’t think you have to wait until you see a status change on the website. Whether you’ll receive I Bonds is still hit-or-miss. Sometimes you do everything correctly and you still don’t get I Bonds.

Abe says

Question – is it possible to make multiple debit/credit card payments associated to Form 4868? I’d like to split the charge between 3-4 cards – just not sure how that will work.

The IRS says that you can make 2 payments, and I think it’s actually 2 payments per processor, but I’d love a finance buff style how-to so I don’t mess it up.

Harry Sit says

Sorry I don’t know how it works with multiple payments. I always make only one extension payment.

Jenny says

Thanks Harry for your wonderful blog! Last year, I followed your instructions and I got $5000 in I Bonds from my tax return. I don’t like the small dollar bonds, so this year, I only requested $4,250 in I Bonds, assuming I’d get four $1000 and five $50 Bonds. To my surprise, they sent four $1000, one $200, and one $50. Have they changed it so you no longer get 13 bonds for $5000, or are they just issued differently for less than $5000? (I wish they’d just send one $5000 bond.)

Jeff says

That’s so weird. I had a very different experience. I followed Harry’s instructions, expecting to get $5,000 in smaller bonds, but I received ONE $5,000 paper bond!

I’d attach a redacted picture of it as proof, but I don’t think we can do that here. Trust me, it’s just one bond. I then went through the (seemingly unnecessary) steps to mail it in to convert it to a digital bond.

Harry Sit says

It appears that TreasuryDirect changed the procedure. They used to say that the first $250 would be issued in $50 bonds and the rest will be issued in the fewest number of bonds. Now it seems they dropped the mandate of using $50 bonds for the first $250. They say this to keep it flexible:

“We may issue multiple bonds to fill your order. The bonds may be of different denominations. We use $50, $100, $200, $500, and $1,000 bonds. Again, the amount of your purchase can be any multiple of $50, from $50 to $5,000. You need to tell us only the amount. We determine denominations.”

I edited the section on receiving bonds by mail.

Jenny says

Wow, that is interesting! Last time I looked, they said $5000 paper bonds had been discontinued. I’m glad they brought them back. Also, it has to save on postage and improve handling efficiency.

Steve says

Ah, so that explains why it was so many bonds before. I just received my one, $5000 bond. If I had to choose between one and thirteen (with no choices in between) I would definitely choose one. Five would be better but as they say, we don’t get to make that choice.

Alex says

FreeTaxUSA has I-bonds option. Filing -> Federal Direct Deposit of Refund