[Update on August 30, 2024: TreasuryDirect announced that starting January 1, 2025, you will no longer be able to buy paper I Bonds with your tax refund. The annual purchase limit is still $10,000.]

I Bonds are the best bonds you can buy at the moment if only you can buy more of them.

Maximum $5,000 Per Tax Return

In addition to buying I Bonds on the government website TreasuryDirect (see How to Buy I Bonds), you can buy another $5,000 per year indirectly, but only if you’re due at least that much in tax refund and you tell the IRS to use part of your tax refund to buy I Bonds. You can’t send a check with your tax return and ask them to buy I Bonds for you.

The $5,000 maximum is per tax return, not per person. If you’re married filing jointly, you still can buy only a maximum of $5,000 for both of you combined, not $5,000 for each of you. If you’re married filing separately, each of you can buy a maximum of $5,000, but of course you should make sure you won’t lose other tax benefits when you choose to file separately. From IRS Form 8888 instructions on page 3:

You may request up to three different savings bond registrations. However, each

registration must be a multiple of $50, and the total of lines 4, 5a, and 6a can’t be more than $5,000 (or your refund amount, whichever is smaller).

Because the amount you can purchase is also capped to the amount of your tax refund, if you normally don’t have a tax refund that large, you can increase your tax refund by overpaying ahead of time. Since I’m self-employed and I pay quarterly estimated taxes, I just pay extra for the fourth quarter.

Pay with Automatic Extension

If you don’t pay quarterly estimated taxes, you can make a one-time payment through IRS Direct Pay. After a year is over, you can still pay toward the previous year’s taxes with an automatic extension. When you say your payment is for an extension, the payment automatically files the extension. You don’t need to fill out another form.

You get extra time with an extension but you don’t have to use it. You can still file your tax return on time before April 15. Choose “Extension” as the reason for payment. Select “4868” in the “Apply Payment To” field, and choose the previous year for the tax period for payment.

The “Extension” option will become available after the IRS opens up the tax season for the previous year, usually around the end of January. If it isn’t available yet, just wait.

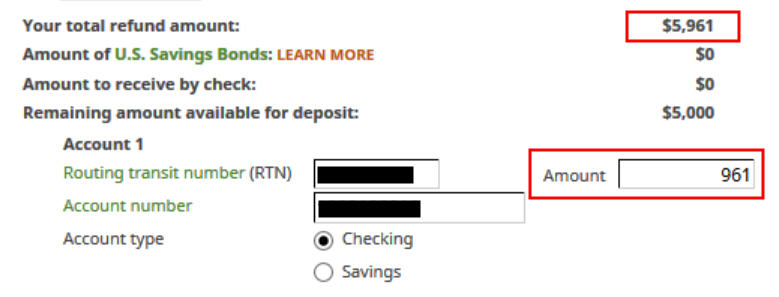

When you pay extra, don’t make your refund exactly $5,000. Make it a small odd amount above $5,000 so that you’ll still have a small refund after buying I Bonds. For example, if you’re expecting a refund of $2,136, pay $3,000 with your automatic extension. Now your expected refund is $5,136. When you see $136 deposited to your bank account, you’ll know the other $5,000 is sent to buy I Bonds.

Pay in Whole Dollars

Also make sure you pay in whole dollars, not dollars and cents. If you make estimated tax payments, also make sure those are in whole dollars. If you already made estimated tax payments with dollars and cents, make another payment to make your total estimated tax and extension payments add up to whole dollars.

Cents in your total estimated tax and extension payments will cause the IRS to adjust your refund, resulting in not issuing I Bonds to you. This doesn’t apply to tax withholdings. Your tax withholdings from your income can have dollars and cents.

Wait

Wait at least a week after you make the extension payment before you file your tax return. This gives some time for your payment to be reflected in your account at the IRS. While this may not be strictly necessary, giving the computer systems a little more time to sync up can’t hurt.

Report Payment on Your Tax Return

After you pay extra with an automatic extension, make sure to account for it on your tax return. Here’s how to do it in TurboTax and H&R Block downloaded tax software.

Online tax software doesn’t have all the features of downloaded tax software, and it’s often more expensive. See Tax Software: Buy the Download, Not the Online Service.

TurboTax

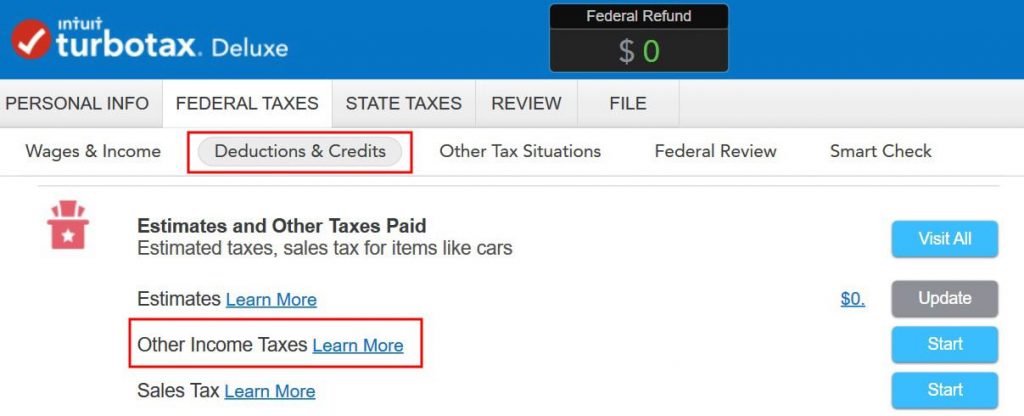

In TurboTax (downloaded software), it’s under Federal Taxes, Deductions & Credits, Estimates and Other Taxes Paid, Other Income Taxes.

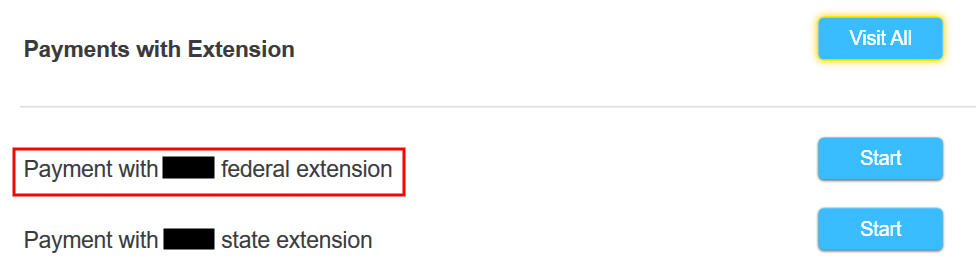

Then choose payment with the federal extension for the previous year.

H&R Block Software

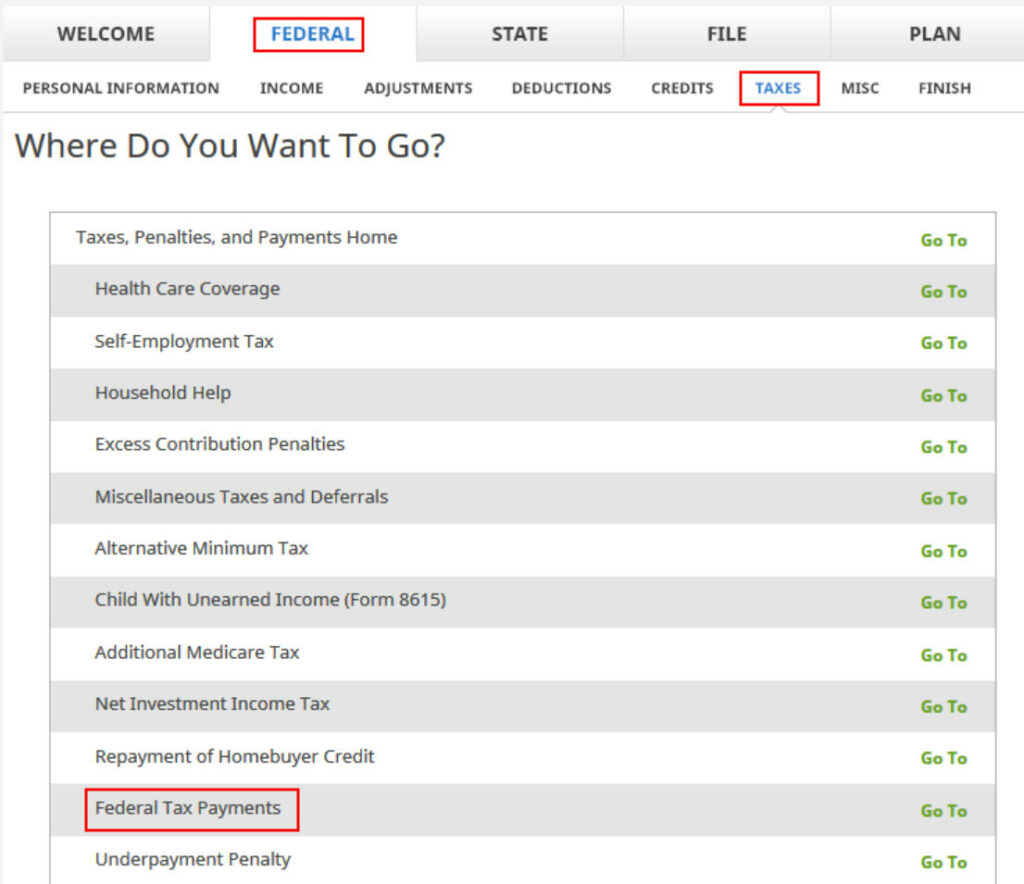

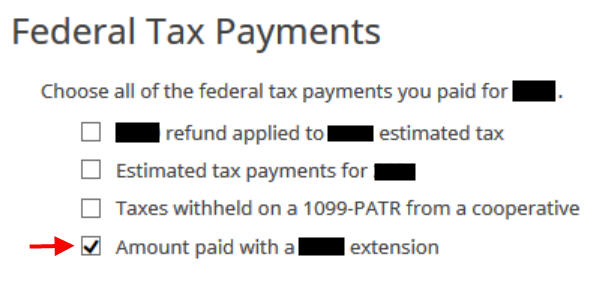

It works similarly in H&R Block downloaded tax software. The payment with extension is under Federal, Taxes, Federal Tax Payments.

Check the box for “Amount paid with a 20xx extension.”

Split Refund for I Bonds

When it comes to asking for I Bonds, it’s in the final steps before filing your return. Here’s how to do it in TurboTax and H&R Block downloaded tax software.

Online tax software doesn’t have all the features of downloaded tax software, and it’s often more expensive. See Tax Software: Buy the Download, Not the Online Service.

TurboTax

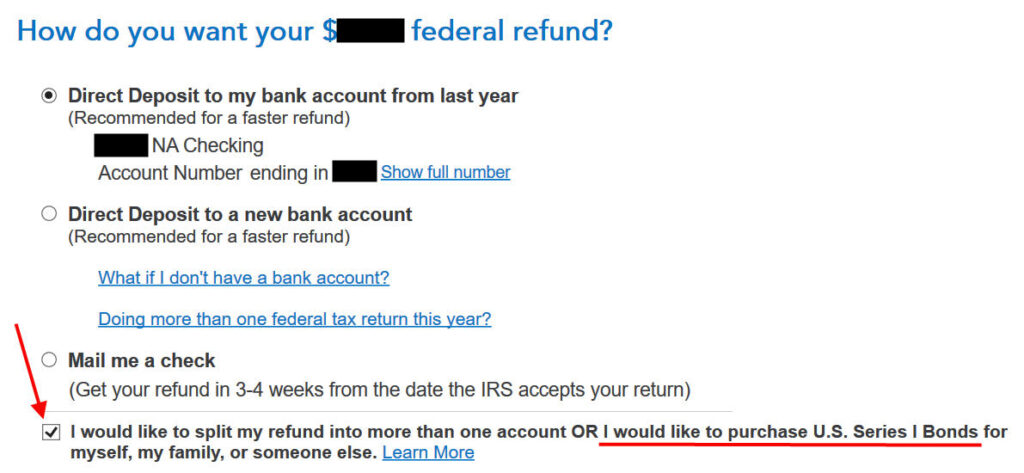

When TurboTax (downloaded software) asks you whether you’d like to receive your refund by direct deposit or by check, choose direct deposit. You check a box at the bottom to say you want to split your tax refund and use part of it to buy I Bonds.

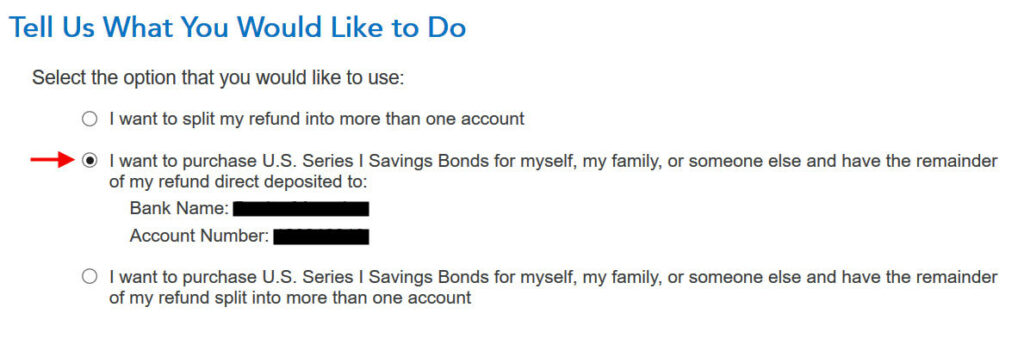

Then choose to buy I Bonds and direct deposit the leftover refund.

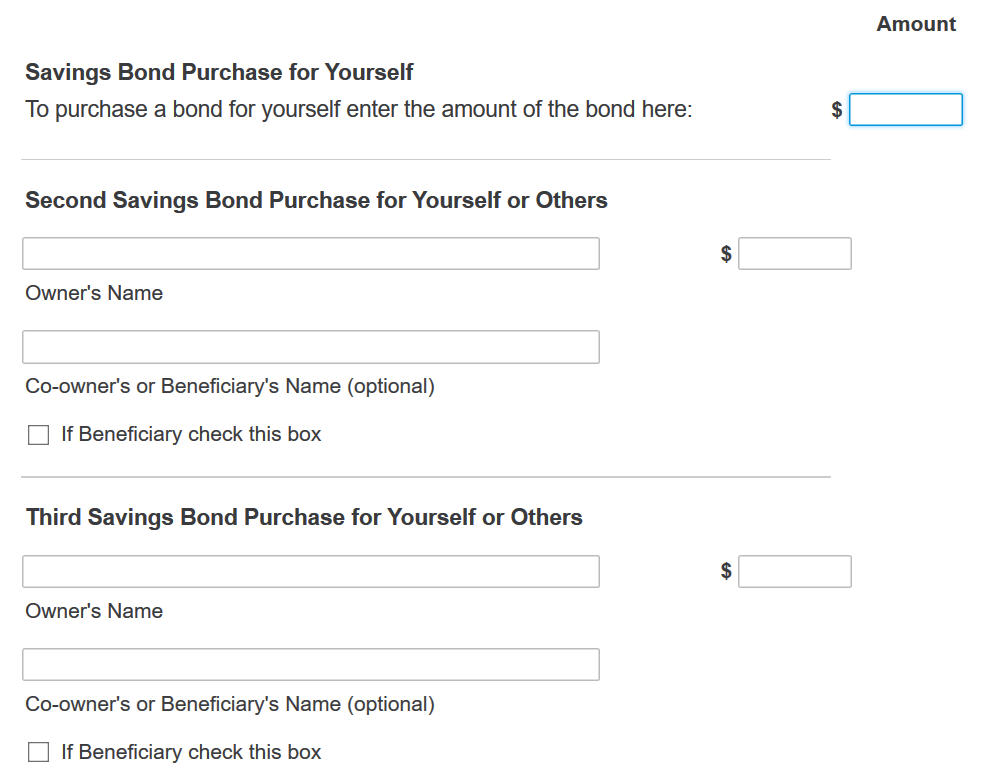

Then you will say how much you’d like to buy and whose name(s) should be on the bonds.

You can split the I Bonds purchase into an amount for yourself plus up to two free-form named recipients. Each owner must receive a multiple of $50 and the total for all three can’t exceed $5,000.

If you put an amount in the first box, you don’t have to give any name. They will automatically copy the name(s) from your tax return. If you’re filing jointly, the bonds will be issued in both of your names as co-owners.

If you’d like to have the bond issued in only one name (yours or someone else’s), put an amount as the Second Savings Bond Purchase. Give the name (and a co-owner or beneficiary if desired). Check the small box if the second name is a beneficiary (not a co-owner) of the owner for this purchase. Repeat for the Third Savings Bond Purchase if you’re buying for another recipient.

H&R Block

H&R Block downloaded tax software has it in the final steps before filing the return. When it asks you whether you want a direct deposit or a check, choose direct deposit. Reduce the amount of your direct deposit by the amount of I Bonds you’d like to buy.

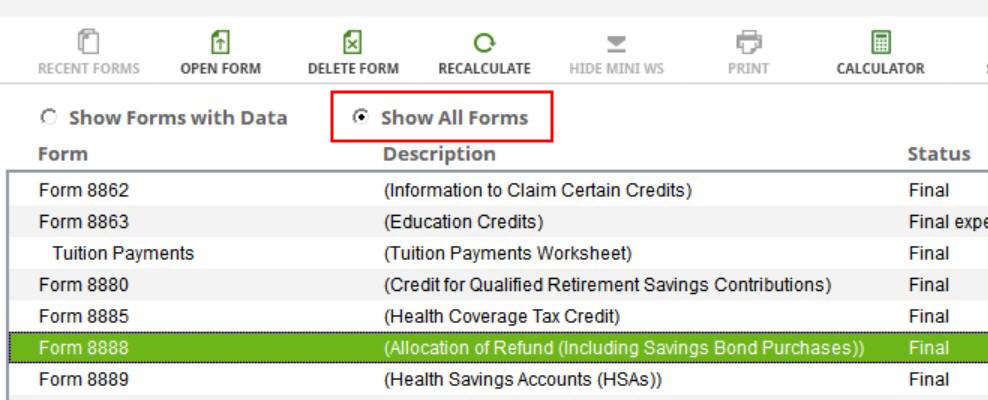

Now, find and open Form 8888:

1. Click Forms at the top of the program.

2. Select the Show All Forms option.

3. Scroll down to find Form 8888.

4. Select and open Form 8888 and fill it out to allocate amounts to savings bonds purchases.

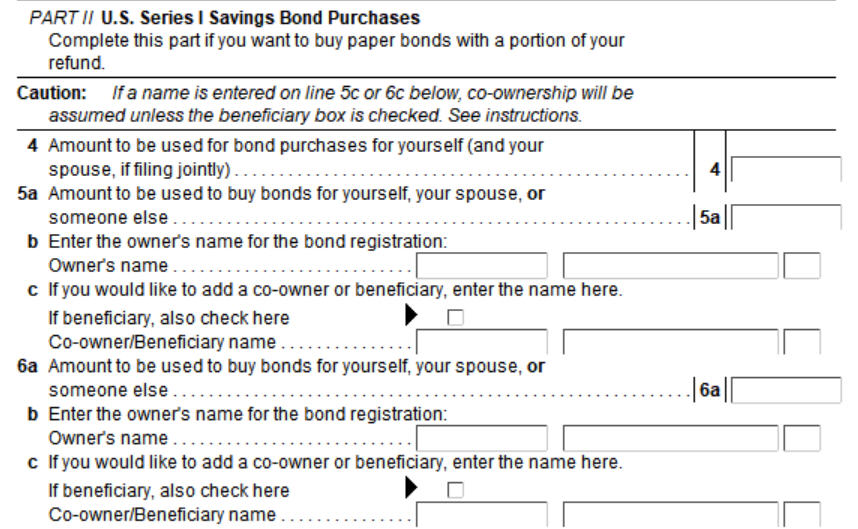

You enter the amount you’d like to buy and the names that should appear on the bonds in Form 8888.

You can split the I Bonds purchase into an amount for yourself plus up to two free-form named recipients. Each owner must receive a multiple of $50 and the total for all three can’t exceed $5,000.

If you put an amount on Line 4, you don’t have to give any name. They will automatically copy the name(s) from your tax return. If you’re filing jointly, the bonds will be issued in both of your names as co-owners.

If you’d like to have the bond issued in only one name (yours or someone else’s), put an amount on Line 5a. Give the name on Line 5b (and a co-owner or beneficiary on Line 5c if desired). Check the small box if the name on Line 5c is a beneficiary (not a co-owner) of the recipient on Line 5b. Repeat for Line 6a, 6b, and 6c if you’re buying for another recipient.

Receive Bonds by Mail

After you file your tax return, if everything goes well, you’ll receive I Bonds by mail. If you asked for $5,000, you may get one $5,000 bond or you may get multiple bonds that add up to $5,000.

If they send multiple bonds, each bond will come in a separate envelope. Because the bonds have your name and address printed on them, it’s just easier for them to put each one into a separate window envelope. Collating multiple bonds into the same envelope increases the risk of a mix-up.

Sometimes the bonds don’t come in one batch. If you receive fewer bonds than you expect, just wait. Most likely additional bonds will show up in the mail in a few days. If they don’t come in two weeks after you receive the first batch, please call TreasuryDirect customer service at 844-284-2676.

Deposit Paper I Bonds to Online Account

You can keep these bonds in paper form if you’d like. Put them in a safe deposit box. When you’d like to cash out, you can take them to your bank or credit union or a major national bank such as Bank of America or Chase. They will look up the current values in their system and deposit the money into your account or give you cash.

I prefer to consolidate the paper bonds with the bonds in my TreasuryDirect online account because it’s more secure and more convenient to have all the bonds in one place. You can mail the paper bonds to the Treasury Department and deposit them into your account. Please read How To Deposit Paper I Bonds to TreasuryDirect Online Account.

If only they ask for your TreasuryDirect account number on the tax return, they won’t have to mail you the bonds and you won’t have to mail them back in. While it is possible to direct deposit part of your tax refund into your TreasuryDirect account using a special routing number, when you use the money to buy I Bonds, you use up part of your $10,000/year quota, which defeats the whole purpose of overpaying taxes to buy additional I Bonds. The government has no incentive to make it easy. If you want more I Bonds, you’ll have to tolerate their process.

When Something Goes Wrong

Sometimes instead of receiving I bonds, you get 100% of your tax refund deposited into your bank account. It’s not clear why this happens to some people.

You can’t do anything about it. Once you receive your tax refund, it’s not possible to have the IRS take it back and buy I Bonds for you. Try your luck again next year. It may help if you make your tax refund not exactly $5,000. Make it say $5,081 and ask for $5,000 in I Bonds and $81 as a direct deposit to your bank account.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Dunmovin says

Harry, it would be nice to see the lag/timeliness of irs having treasury issue ibonds using tax refunds especially since it’s been widely reported that some refunds for 2020 have not been issued. For example, reporting by your posters of irs return date, bonds received on, etc. Personally I may file by paper certified mail and track receipt OR just get a check.

Harry, what determines the bond issued date using tax refunds?

Thanks

Harry Sit says

I received the paper bonds one week after I received the direct deposit for the tax refund. The date your tax return is processed plus a week or two to fill the bond order determines the bond issue date. If you want your bonds fast, e-file.

Dunmovin says

One week after receipt of direct deposit for (excess I assume) for tax refund is not clear. How long from filing of tax return to bonds being issued/received? Thanks

Harry Sit says

About 25 days after e-file.

Chad says

Harry, thank you for an informative article. I am using H&R Block Premium and when I get to the How do you want your Federal Refund? page I can choose Direct Deposit or Paper Check. If I choose the Direct Deposit option I can select use part of my refund to buy U.S. Savings Bonds. At this point, I don’t have the option for the Learn More link to get to Form 8888. I am trying to buy some bonds for each of my children but I am never prompted to put names in. Do you have any insight to help me? Thanks!

Harry Sit says

I updated the post with new screenshots and hopefully clearer instructions.

Chad says

Harry, I appreciate the timely response. I am using the browser version of H&R Block Premium and I do not have the Forms button anywhere on my screen. I am happy to send you a screenshot. I have reached out to their customer service and they were of no help. Any other thoughts? Thanks again!

Harry Sit says

Online tax software doesn’t have all the features of downloaded software, and it’s more expensive than downloaded software. Switch to downloaded software next year. See Tax Software: Buy the Download, Not the Online Service.

I got this when I searched for “buy savings bonds” using the online help link on the upper right in H&R Block Online:

“To purchase the bonds:

1. Fill in a dollar amount for 1 bond purchase. This amount must be:

Less than your total refund

A multiple of $50 but not more than $5,000”

Apparently H&R Block Online doesn’t support buying I Bonds for other people. You can only buy for yourself (and your spouse if filing jointly) when you use H&R Block Online.

Chris says

So I am thinking about this for next year. I always do my daughter’s taxes. If I make an estimated taxes $5000 payment under her name and social next year on IRS.gov, sufficient to have a $5000 refund, I can then on her return, buy $5000 in I-Bonds in my name, even though I also buy them for me on my tax return?

Thanks… Chris

Harry Sit says

If she’s not using the opportunity to buy paper I Bonds for herself, sure.

Roy says

You might wish to read the reply to question #50 by “old mariner”. That reply seems to indicate that there will be issues buying more than $5000 total in paper bonds via tax refunds for a single bond holder’s SSN.

DB says

Is there a limit on how many times one can make extension payments per year, if paying by a combination of credit card and Direct Pay?

Thanks.

Tom P says

I filed my return with TurboTax on January 31st, got my direct deposit refund on Feb 16th, and received my I-Bonds today, Feb 25th. Amazingly, all 12 envelopes were stacked in ascending denomination and serial number order: 6x$50, 1x$200, 1x$500, 4x$1000. Gotta love those Albert Einstein’s 🙂

Dave H. in Yuma, AZ says

Those are exactly the denominations I received two days ago, also with the 12 envelopes stacked in order, 50’s on top.

Tom P says

Hi Dave,

Yep, that’s exactly how mine were stacked in the mailbox, 50s on top. Maybe all 12 envelopes are mailed in another envelope to the local USPS sort facility and then the delivery person takes them out of that envelope and puts them in the mailbox? How else could they possibly show up all in order? Very weird.

I’m thinking of converting these to electronic, but it’s also nice to have something tangible.

Tom G says

I requested $4000 in paper I bonds with my 2021 return. I received $4000 face value of I bonds in the mail. I checked the value of one of the $1000 bonds on the Treasury Site and it has a value of $500, which is consistent with buying paper EE bonds, you pay half the face value of a paper EE bond. I think I lost $2000 in the transaction. Am I missing something?

Harry Sit says

If you used the online savings bond calculator, maybe you left the Series selection at EE Bonds because that’s the default? Change it to I Bonds.

mr don says

Why bother using a tax refund to buy these ibonds? It does not increase the $10K investment limit. So just send the full refund to the bank then establish an account at treasurydirect.gov and buy the IBONDs you want at your convenience. No paper will be sent it will all be tracked electronically. You don’t have to worry about bonds being lost in the mail. You just need to keep track of your account numbers. Print out the page and put a copy in your safety deposit box or put a soft copy in a secure cloud storage somewhere. I encrypt my data before sending to the cloud for storage.

Steve says

The $5k does NOT count against the $10k limit.

Tom P says

Sorry “mr don” but buying bonds using your tax refund effectively DOES increase the $10K limit. In January I purchased $10K in my TD account, then purchased another $5K of paper bonds in February with my tax refund. Not sure where you are getting your incorrect information.

Chris says

False statement.

One can buy $10k from Treasury Direct and purchase an additional $5k from their federal tax refund.

Old mariner says

How much in I bonds can I buy for myself?

In a calendar year, you can acquire:

-up to $10,000 in electronic I bonds in TreasuryDirect

-up to $5,000 in paper I bonds using your federal income tax refund

-The limits apply separately, meaning you could acquire up to $15,000 in I bonds in a calendar year

Source:

https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds_ibuy.htm

mr don says

My apologies, I will have to look to see where I got that “misinformation” that that income tax contribution to I bonds counts against the the 10K limit. Perhaps I misread it. Thanks, I am getting a ton back for 21 so I can direct it there.

thanks Don

mr don says

OK, here is where I misinterpreted.

https://thefinancebuff.com/overpay-taxes-buy-i-bonds-better-than-tips.html

“If only they ask for your TreasuryDirect account number on the tax return, they won’t have to mail you the bonds and you won’t have to mail them back in. While it is possible to direct deposit part of your tax refund into your TreasuryDirect account using a special routing number, when you use the money to buy I Bonds,>>>>>> you use up part of your $10,000/year quota,>>>> which defeats the whole purpose of overpaying taxes to buy additional I Bonds. The government has no incentive to make it easy. If you want more I Bonds, you’ll have to tolerate their process.”

The deal is if you decide to have your irs refund buy the ibonds and have the i bonds managed directly in your us treasury account and not deal with the paper $5K of bonds then the $5K is applied to your limit. So you will have to fiddle around with the paper bonds. Take the risk of lost in mail etc. It comes down to whether $350 (at todays rate) is worth the effort. I suppose its better than the mattress. 🙂

anyway thanks for pointing out my error

Old mariner says

Reporting in here:

–My return was accepted by the IRS on: 2/21/22

–My bank posted my refund on: 3/8/22

–I received all my paper bonds on: 3/12/22

I received 12 separate envelopes in this order: 6x$50, 4x$1,000, 1x$500, 1x$200.

Much thanks to Harry Sit for this article. I followed it to the letter even though I owed and paid no taxes for 2021. Only for I-bond purposes, I used Direct Pay for the first time ever, selected extension, and paid an amount similar to the $5,081 that Harry suggested.

I’ll also point out that H&R Block Deluxe 2021 doesn’t have a totally seamless way of accessing Form 8888. It instructs you to find the form and complete it. So, I had to find the form myself. Not a problem; however, it would have been better had there been a simple button to click to open the form. Also, there were no instructions on how to fill out the form. So, thanks again for this article which I read before I filled out my taxes.

I also maxxed out on the $10,000 limit for electronic I-bonds for 2022. So, now I’ll see what 2022 brings and whether I’ll do it again next tax season.

P.S. Harry Sit wrote a great article titled “How To Deposit Paper I Bonds to TreasuryDirect Online Account” (https://thefinancebuff.com/how-to-deposit-paper-i-bonds-to-online-account.html). I’ve done that previously, but for anyone who hasn’t, this is a great how-to.

Steve says

Old mariner,

I have followed that article “How To Deposit Paper I Bonds to TreasuryDirect Online Account” once and I plan to follow it again this year. It’s complicated enough that I’m happy for the step-by-step instructions.

Retired at 39 says

I also wanted to report in and thank Harry for the great articles that helped me do this. I followed your instructions with H&R block software. I filed for an extension online with form 4868 and paid 5,020 on 2/17. I also e filed my return that day.

My refund was deposited on 3/7. I received the paper bonds today in the mail.

4 $1000

2 $200

12 $50

(No $500 bond for me!)

I also had gotten a credit card with a bonus for initial spend so i got a $300 bonus that more than covered the $90 or so fee for paying with a credit card. Win win all around.

Thanks again.

Old mariner says

Just to add to my comment above, the paper I-bonds I received on 3/12/22 have an issue date of 03/2022.

Helen Keller is pictured on the $50 bond.

Chief Joseph is pictured on the $200 bond.

General George C. Marshall is pictured on the $500 bond.

Albert Einstein is pictured on the $1,000 bond.

mr don says

Several of you are using HRBlock so I am going to ask here. Maybe the problem is due to trying to use form 888. Anyway, on the 3rd page of 1040 line 35a is $36 less than line 34. I am requesting direct deposit. I tried contacting hrblock via chat and phone but in both cases I got dropped before we could discuss/chat. Maybe I’ll have to override that number and use snail mail for my return.

Have any of you other hrblock users experienced this?

Tom P says

Suggestion, switch from HR Block to TurboTax… works great and zero issues with I-Bonds 🙂 No need to fill out any special forms, TurboTax does it for you. If you file by snail mail it could takes months to receive your bonds and you’ll lose out on interest.

don says

I am using the desktop version of hrblock because last year I used TTax and it was very s–l-o-w. I think that that TTax switched to java. So that is why I switched to HRblock which runs native x86 code on a pc. I guess I could redo everything on the cloud, I just don’t like depending on the cloud in case something is wrong and I need to check it. I need to do some homework like back that 888 form out of there and then see if I still have the problem with hrblock. Only thing I can think of is that maybe hrblock is taking a cut out of the refund to pay for more e processing. However, it does not help my confidence in the whole thing if they can’t get something that simple correct.

Roy says

Please let us know what you figure out with H&R Block desktop version. I’m using the same, but I haven’t gotten far enough in my return yet to try using form 8888. If you remove form 8888 (so as if not buying any I-bonds with your refund), then do the amounts on form 1040 look correct or are they still off by $36?

Steve says

I used H&R Block Desktop edition and it worked fine for me, including form 8888.

Harry Sit says

H&R Block downloaded software works. I have the steps to split your refund into direct deposit and I Bonds in this post. Just follow the steps and make sure your split adds up to your total available refund. If your total available refund changed after you did the Form 8888 once, do it again and change the split.

https://thefinancebuff.com/overpay-taxes-buy-i-bonds-better-than-tips.html#htoc-h-amp-r-block

Old mariner says

I used H&R Block Deluxe 2021 (PC desktop version). I’m looking at pg 3 of my 1040. Line 34 is the amount of tax you overpaid. So, that’s something you would have input yourself. Line 35a is the amount of line 34 you want refunded to you in the form of papers bonds plus any cash refund (as opposed to applying it to your 2022 estimated tax). If using Form 8888, then Line 35a is the sum of Form 8888, which you also input yourself. It’s not H & R Block taking your money or charging you a stealth fee in some way. If you have $36 leftover, so to speak, then are you showing $36 on line 36 (which is the amount of line 34 that you want applied to your 2022 estimated tax)?

If I were you, I’d go back and make sure that what I input as my tax payments over the year is the correct amount. Then, I’d review Form 8888 to be sure that I input things there correctly. The sums of line 34 and line 35a should match, unless you are also applying some of your refund to next year’s estimated tax. If they don’t, I’m thinking somewhere along the way, there’s an incorrect input (by you…🕵️♂️sorry, just trying to steer you to find the error).

I’ve used the PC version of Block for many years. I’m happy with it (except when I’ve had problems activating it). Maybe it’s because I’m used to it. I doubt TT is any better or any more accurate, just my opinion.

Tom P says

FWIW, I used the web online versus of TurboTax, just as I have for the past 10+ years. I’ve never had an issue and it runs fast. You can try it all for free and don’t pay anything until you are ready to file.

Regarding relying on the cloud and whether the calculations are correct, during the year I estimate mine in Excel and TurboTax always has the exact same result when I have all my data at the end of the year.

don says

I looked at some previous versions where I did not have 888 and I find the same error. Somehow the amount I ask to refund is $36 less than I am entitled. That is $10 less error than what I got before. So the bug has been there all along. I just have not been looking at those numbers as I did my data entries. This the difference between line 34 and 35A on form 1040. maybe its because of some option I chose in error. The problem is right clicking does not lead to the source of the calculation. I need to chase this elsewhere, maybe reddit? I called hrb waited for about an hour and got dropped, with chat we chatted until he couldn’t provide an answer and then he dropped out. Not good support. In theory IRS should catch the error.

Harry Sit says

It probably calculated a small underpayment penalty. Go to Federal -> Taxes -> Underpayment Penalty. Change it to “I want the IRS to calculate the penalty for me (and send me a bill).”

don says

My bad, you are correct. Underpayment penalty despite the fact that IRS owes me over $10K. I think the issue is related to the fact that I had lots of income during 4Q, so hopefully by letting IRS do the calculation they will let me off the hook.

Old mariner says

If you’re seeing a penalty and your income was uneven throughout the year, you might also consider filing Form 2210 to annualize your income, in which case you might not owe a penalty.

don says

You are correct old mariner. My income was very uneven, lots in December. So HRB claimed a penalty despite my overpaying substantially. So I have decided to request a waiver for the penalty as you and others have suggested. The problem for me was that the HRB software did not indicate a penalty explicitly. Ideally, if I right click on one of those boxes it would take me to something that showed the penalty. Anyway, all is good now. This is one of those kinds of things where its best to set a problem aside and look at it a day later with fresh(er) eyes.

Thanks to all for your comments.

don

Mike says

The Form 4868 Extension of time to file workaround looked brilliant…until I tried it. On the PayUSATax online payment website, after filling in all the payment data, I got an error message: Payment may not exceed tax liability. In round numbers, my total tax liability for 2021 is $5,000, and I want to put in another $5,400 so my refund is over $5,000, for buying I Bonds.

The instructions for 4868 say nothing of this restriction.

Is there away around it? Thanks for your help.

Steve says

Does line 4 on form 4868 say “$5000” or “$10,400”?

Mike says

Thanks for the quick reply, Steve. For line 4 (estimate of total tax liability for 2021, I filled in $5107. I’m confused by the $10,400 in your question.

Steve says

I was using your round numbers. The form 4868 instructions don’t *explicitly* state that you can’t put a larger number on line 7 than line 6, but I can imagine PayUSATax interpreting them that way. Either write $10517 on line 4 and propagate the changes to lines 5-7. Or try different software to see if the programmers interpreted the IRS’s instructions differently.

Mike says

Actually, PayUSATax doesn’t even ask what I have already paid in (Line 5), via withholding and estimated payments. They object to what I’m trying to pay (Line 7) being larger than Line 4 (my total tax liability.) I feel a bit uncomfortable using $10517 in Line 4, as I know it is not true in my case, but thanks for the suggestion,

While awaiting your first reply, I did begin the process of paying it through IRS Direct, where the payment comes out of my bank account, and just short of entering my account number, I had NOT hit that same roadblock.

If even IRS Direct blocks me, I suppose I could just fill out Form 4868 and mail it to them with a check.

Harry Sit says

It sounds like it’s only an issue with PayUSATax that’s confusing you. IRS Direct Pay as shown in the body of this post doesn’t have that problem. EFTPS requires a login. IRS Direct Pay doesn’t require a login. You can make one-off payments through IRS Direct Pay.

Tom P says

Instead of filing form 4868 couldn’t you just make an “extra” tax payment via EFTPS before you file, assuming you already have an EFTPS account? Since I’m retired and don’t have much in the way of withholding I make quarterly 1040-ES payments and they are always much more than my tax liability.

Mike says

PayUSATax and Pay1040 (the credit card online options), both disallow paying more than your total tax liability.

IRS Direct makes you choose from a list of 14 reasons, among them “extension”, which then assumes Form 4868. Choosing “estimated” now lets you choose only 2022 tax year.

I don’t have an EFTPS account, but may try that if IRS Direct doesn’t work.

Thanks, all.

Old mariner says

I didn’t owe any tax for 2021 and didn’t pay any estimated tax for 2021. In February, I followed Harry’s instructions, used Direct Pay, selected extension, and paid $5,055 via a direct debit to my bank account. Direct Pay did not require me to set up an IRS account, which I do not have. Direct Pay did not ask about how much I owe. It just asks how much do you want to pay toward your 2021 tax obligation.

I didn’t owe a penny of that $5,055. It was purely to take advantage of acquiring paper i-bonds. The following day, I got confirmation of the debit to my bank account, then set about doing my taxes.

Direct Pay should work the same for you.

Mike says

Success! It worked with IRS Direct Pay. Thanks, Old mariner, and the rest of you for your guidance.

Art says

Received my fed tax refund promptly, just about a week after e-filing, and about a week later I got 1/2 my ibonds ($1000 of the $2000 that I had requested. ( I received 8 bonds total ) Hard to imagine these are processed separately, so I’m anxiously checking USPS informed delivery ( which tracked only 7 or the 8 bonds I received last week). How long should I wait … and is it best to delay e-conversion of the bonds until I have the full set in hand?

Art says

Update: Einstein showed up in my mailbox today, somewhat dog-eared but unopened … it did not get scanned by USPS informed delivery, so who knows where it’s been for the last 5 days. I’m just happy it arrived!

Old mariner says

That’s great news, Art. Good that you’ve received all of your bonds.

Tom P says

FYI, when I submitted my bonds this year to Treasury Direct the receipt email I received said it could take 4-6 weeks to process. Today I checked and they are all in My Converted Bonds linked account. The process took a max of 3 weeks, so less than expected.

Sun says

Hi Harry,

Thanks so much for the detailed post!

I made payment via direct pay, bank account. My bank account was debited on 3/28. But my IRS account still shows this extension payment as pending. How long should does it generally take for this extension payment to be credited to my account? Should I wait until it is credited to my account before I submit my tax return.

Regards,

Sun

DB says

I have noticed it takes a couple of business days for Direct Pay payments to move from Pending to processed.

I don’t know what the correct process is, but I went ahead and e-filed my taxes after IRS debited my bank account although the payment was still in pending status. It didn’t seem to have caused any problems as IRS accepted my return and sent the correct refund including I-Bonds.

DB says

I forgot to mention that IRS had already received my extension request due to an earlier extension payment using a credit card processor. If this is your one and only extension payment, then perhaps it is best to wait until IRS indicates they have received your extension request prior to filing.

Harry Sit says

I’d give them at least a week or until you see it posted. Cutting it close may still work but why take the chance? I made my extension payment three weeks before I e-filed my return.

Don G says

Can a married couple file separate tax returns, so that each can use their ($5,000 limit) refund to buy a paper I-bond? This, instead of filing jointly, and being limited to $5,000 together.

Harry Sit says

They can, but their taxes are often higher when they file separately. For example, they won’t be eligible for the premium tax credit on ACA health insurance when they file separately.

RL says

Curious if anyone else is experiencing the problem described in the “When Something Goes Wrong” heading in the article. My federal tax return, including Form 8888, was filed and accepted on 3/14/22, with a $5,000 refund in the form of paper I bonds and a low three-digit cash refund. Today (4/6/22), I received 100% of the refund amount via direct deposit, despite the IRS “Where’s My Refund?” site mentioning the purchase of bonds.

Do we have any more insight as to why this happens and how to prevent going forward?

Harry Sit says

Sometimes you do everything right and it still doesn’t work. No one knows why. You just have to try your luck again next year. Did you include cents on your tax return by any chance? It works better if everything is in whole dollars.

Old mariner says

That’s disappointing.

Here’s what IRS form 8888, pg 4, states:

“Your bonds won’t be issued if any of the following apply.

• The bond request isn’t a multiple of $50.

• Your refund is decreased because of a math error.

• You enter more than one name on line 5b, 5c, 6b, or 6c.

• Your refund is offset for any reason.”

One other thing I can think of is if another taxpayer used their refund to gift you I-bonds, which then triggered a stop on your own purchase so you didn’t go over the $5,000 limit per recipient (bondholder).

If you don’t fall into one of the categories above, then I don’t know why. 🤔

Ed says

I have the same problem as you. I filed my tax on 4/5 using H&R (fed+state) desktop version software. On 4/15, I received the 100% of the refund amount ($6004 instead of $1004) via direct deposit to my bank account. The IRS “Where’s My Refund” page indicated the purchase of bonds. It says I should get direct deposit by 4/19. The description of my direct deposit says “Early Pay ACH from IRS TREAS”. I happen to have federal tax overpayment of $6004 and I did NOT file any extension. On form 888, I entered $5000 in line 4 only. So I don’t know what went wrong in my case?

Is there any chance that IRS or Treasury recently changes the bond buying process so that IRS first gives 100% refund via direct deposit but Treasury debits $5,000 from your bank account later when the bonds are actually issued? Though, data points did’t suggest that other than now some people receive single bond with $5000 denomination instead of multiple smaller denomination bonds.

RL says

Thanks for the reply, Harry. Cents were entered into TurboTax, but it automatically rounds to whole dollars so that’s how the return was submitted. The refund amount was identical to the whole dollar on Form 1040 itself, Form 8888, and as direct deposited by the IRS.

Bud B says

First, thanks to Mr. Sit for this thread on the paper bonds via tax return.

I used Turbo Tax Premier Online and my Form 8888 looks accurate, but I also got a full refund deposed into my checking account. I allocated well less then the $5000 maximum to two bonds, each in a $100 increment. My children were listed as beneficiaries for the two bonds (one each).

I called Turbo Tax and they initially said it must be the IRS. To which I replied ‘that may or may not be true’ since there is an interface between Turbo Tax and the IRS software. The Turbo Tax rep backed off and saw my point, but as a second tier customer service rep (was passed to him by the tier one rep), I don’t think he is at a level to say whether there are known problems with either the Turbo Tax software the IRS software or both. In the end, they refunded my Turbo Tax fee. Now I will pursue with the IRS after waiting to see if they correct the problem and change my direct deposit in the next week or two.

Tom P says

Ditto to Harry on this thread… very useful. I guess I got lucky in that I e-filed early on January 31 and had no issues using TurboTax Online Deluxe to split my refund via direct deposit and bond purchase. In my case I could have just indicated I wanted a bond purchase for “yourself (and your spouse…)” and indicated that amount on line 4. However, I supplied information that resulted in the amount being entered on line 5a, my name on line 5b and my spouses name on line 5c because I wanted the bonds to be in the same exact names as the bonds I had already purchased at TD, which included our full middle names instead of just initials from the 1040. Did this make a difference? Heck if I know. If Bud B’s Form 8888 is correct it seems something is amiss and the IRS should work to resolve it… but good luck with that considering the current backlog.

Harry Sit says

It just happens to some people with no rhyme or reason. You give it your best shot and leave it to fate. The IRS won’t reverse the direct deposit to re-order bonds for you. Try again next year.

RL says

So this gets even more interesting. I received today (six days after receiving the direct deposit) a CP24 notice from the IRS, which indicates that they revised my 2021 1040 in order to match their records of estimated tax payments, credits applied from another tax year, and/or payment received with an extension to file. The payment + extension filing is the only thing from that list I did in 2021, and reported it per the article’s instructions when using Turbo Tax Premier Online.

What’s odd is that the CP24 shows both my calculations and the IRS’ calculations, and THEY ARE IDENTICAL. To the cent. The IRS refund number on the CP24 is identical to the amount listed on my 1040, my Form 8888, and the amount that was direct deposited. However, on the CP24, the IRS characterizes the amount I paid under Form 4868 as an “Other payments received” instead of under the line that reads “Estimated tax payments, Form 1040 line 26, SCH 3 line 10.” I confirmed that this amount was reported on my 1040 I previewed before filing and was correctly entered in Line 10 of Schedule 3.

Seems the IRS is mischaracterizing payments made under Form 4868 as an “other payment” instead of estimated tax payment as they should have, which resulted in no bonds being purchased.

I think one of the below is the reason for the erroneous processing of the return and not issuing the requested paper Series I Savings Bond refund:

1. The IRS won’t issue paper Series I Savings Bonds in a year where the taxpayer would have owed over $1,000 in taxes and didn’t make estimated tax payments throughout the year (either quarterly or via extra payroll deduction), EVEN IF that taxpayer was not assessed any tax underpayment penalties. This happens to me in alternating years because I “double up” on charitable deductions every other year, and take the standard deduction in the other years. However, no underpayment penalty has ever been assessed because I always get a refund in the “double-up” year and have never paid less than 90% of tax owed for a given year in any event.

2. Perhaps I did not wait long enough after making my separate payment with requested extension under Form 4868 until I filed my 1040. I waited to file the 1040 until the funds had left my account and the status on the Direct Pay website had changed, but perhaps one should wait a few weeks to ensure everything is finalized on the IRS’ end.

3. There is some issue with Turbo Tax’s submission and/or integration with the IRS payment system that is affecting users. Curious to know if anyone else that had 100% direct deposited also received a CP24 notice afterward. Bud B?

Is there a recommended minimum time to wait to file one’s 1040 after they make a payment under Form 4868?

Best,

-RL

Harry Sit says

I would say wait at least a week before you file. I waited 15 days and I received I Bonds successfully. It may not be strictly necessary to wait that long, but giving it a little more time can’t hurt.

Bud B says

@RL regarding your #3:

I have not gotten a IRS CP24 unless Turbo Tax intercepted it or the USPS mail is slow.

I do pay estimated taxes via a service as I employ a domestic employee. They do all the work with the IRS and the state and send me the year end tax info, but I input all the info into the Schedule H.

I also pay payroll taxes.

All tax payments match exactly.

BuffierThanThou says

Hey Bud!

Had the exact same issue as you with TurboTax. Just another datapoint.

Bud B says

I think I found the source of my problem after reading an unrelated article about people having all sorts of problems having their refunds accepted (glad that’s not my case). It prompted me to go to the “where’s my refund” IRS site. I had not done that since I thought it was going to tell me the obvious: I had gotten my refund. Bear with me here.

Step 1:

IRS site confirmed my refund (although the date that the refund was sent was not the same as the direct deposit) and listed two possible problems:

• The bond amount you claimed was not in a multiple of $50 or it exceeded $5,000.

• You owed a past due obligation to which we applied part or all of your refund.

Since bullet one was not true, it must be bullet two. The site directed me to Topic #203.

Step 2:

Topic #203 listed these possible reasons for the Bureau of Fiscal Service (BFS) to reduce your refund (overpayment) and offset it to pay:

• Past-due child support;

• Federal agency non-tax debts;

• State income tax obligations; or

• Certain unemployment compensation debts owed to a state (generally, these are debts for (1) compensation paid due to fraud, or (2) contributions owing to a state fund that weren’t paid).

Even though I didn’t think any of these were true, the last bullet got me thinking, maybe this does have something to do with my domestic employee and the service I use to pay the estimated taxes.

Step 3:

Check the refund amount in the bank account more carefully and check both the exact estimated taxes my service paid the IRS AND the amount listed (by Turbo Tax) on Form H.

Results: (numbers changed to protect the innocent)

Refund listed by TT: $2345

Refund deposited$ $2344.67

Estimated taxes paid by service: $3333.67

Estimated taxes as listed on Form H and 1040 line 26: $3334

Voila! That cannot be a coincidence.

My conclusion is that because the exact dollars and cents do not match exactly no bonds were issued. I “owed” more than refund listed on my return and I was issued a slightly smaller refund. If there is another cause, then it is something I probably will not take the time to look into. I suggest that all of you that have had problems look at your estimated taxes paid for a clue. Appreciate any feedback and I would gladly entertain challenges to my conclusion.

It does bring up all sorts of issues though:

1. TT rounds all amounts, so this could always cause a problem if estimated taxes are rounded up. (H&R Block users?)

2. It would be interesting to see if estimated taxes are rounded down if the IRS/Treasury would issue the I-bond since I would technically be owed a slightly larger refund and may be issued a larger refund (wouldn’t “owe” that fraction of a dollar on my return). Or if they would reject also.

3. The IRS does not seem to have a problem with the fact that my payroll taxes (W-2) are rounded to the nearest dollar (for this year rounded down).

4. Perhaps if I send in a extra estimated tax as Mr. Sit recommends in the article I can make the TOTAL estimated taxes add to a whole number and eliminate this ‘problem’.

5. Why hasn’t TT been able to figure this out with the IRS?

Good luck to others investigating (RL, Ed, BuffierThanThou) and those commenting (Harry Sit, Old mariner, Tom P, DB, Roy, Art) and anyone I forgot.

Harry Sit says

I think you found the root cause of your case. The lesson is to keep estimated taxes in whole dollars. If a third party paid estimated tax with dollars and cents, you make it up to whole dollars. This doesn’t apply to withholding. Don’t make up the cents in withholding with an estimated tax payment in cents. This post on Bogleheads Forum explains it:

https://www.bogleheads.org/forum/viewtopic.php?p=6592439#p6592439

Old mariner says

@Question 81, Bud B reply on APRIL 16, 2022 AT 7:41 PM

Wow, Bud B, that’s an impressive analysis. I think you’ve cracked it.

You definitely deserve that beer next month on the beach.

Bud B says

I’d say this a joint problem for Turbo Tax (& other tax software products) to fix with the IRS. I cannot believe it is ‘random’. What Turbo Tax presents to me with their software is not the same as the 1’s and 0’s it sends to the IRS. Assuming there is some amount of software testing conducted jointly, the responsibility is joint and the testing in this case is incomplete. Though, I would point out that only one party in that venture is a for-profit company that presents itself as the premier tax software preparation corporation with over $9B in revenue and over $2B in net income who paid its President/CEO almost $25M (‘just the facts ma’am’ – Joe Friday).

While it would be pleasant to hear a follow-up from Turbo Tax that they have looked into it and assigned some software engineers and test & verification personnel to the problem, my initial thought is that it is cheaper for them to just issue a refund and avoid spending time, resources, and money on the problem until someone calls them out publicly for the problematic software.

By the way there are related threads on the following sites regarding this problem: Intuit, Bogleheads, Reddit.

Certainly not the end of the world, but it lowers my opinion of Turbo Tax by a few points on the scale of 0-10.

Thanks for your time.

DB says

If you suspect the problem is in between Tax SW and IRS, I’d think you can request the tax return transcript to find out exactly what Turbo Tax transmitted to IRS? Check the Form 8888 information in the transcript to check if it matches your return.

Tom P says

I agree, it can’t be random, it has to be a software error on someone’s part for certain input scenarios. As I said, I guess I was lucky, so with that in mind I’ll input the same scenario next year and see if it still works. Bud really is owed a resolution from TT even if they did refund his money. After all, they have a 100% guarantee of your return being correct. On the other side, none of this gives me any confidence that “da guvmint” knows what the heck they are doing.

Old mariner says

I used H&R Block Deluxe + State (download for PC) and did receive my paper I-bonds, but it’s possible someone else using the same software didn’t receive their bonds. I only filled in an amount on line 4 of form 8888, which was to purchase bonds for myself and spouse jointly. Maybe there’s some sort of issue when a name is added for lines 5 and/or 6.

Since the IRS is the entity that didn’t fulfill the order, it seems the IRS should be able to tell you why it didn’t. You could call the IRS, maybe after the 15th, to ask what happened.

Roy says

I used the exact same software as Old mariner – H&R Block Deluxe + State (download for PC). However, I did not enter information on form 8888 line #4, and instead entered information on lines #5a, 5b, and 5c. 4 days ago my refund was posted via direct deposit to my bank account, and the amount was as expected – $65, not $5,065, just as specified on form 8888. I expect to receive my I-bonds this coming week or next.

RL says

Bud B, I just posted an update in a reply to comment thread #81 (right above your comment #82 here). Did you happen to receive a CP24 notice from the IRS after receiving 100% of your refund via direct deposit?

Maybe we can put our heads together to try and figure out whether this is a Turbo Tax or IRS issue.

I wonder if anyone that used H&R Block had a similar issue this year.

Bud B says

RL see above for another comment. Appreciate your concern on this matter. I’m too busy to post more than weekly.

And per my earlier post, I did fill out lines 5a,b,c and 6a,b,c.

I’ll be looking for my Turbo Tax refund this weekend and certainly follow-up with them especially if it has not posted.

I’ll definitely consider H&R Block software next year as well as filling out line 4 vice 5&6.

Last on the list would be contacting the IRS. Maybe I’ll do that while I’m at the beach next month sipping a beer 😉

BuffierThanThou says

RL/Bud-

Same issue here. Used TurboTax. Over $5k refund. Filled out lines 5a,b,c.

Tax refund adjusted down by like 30c and got 100% as a DD. Got a CP24 from IRS in the mail.

Art says

Not sure what happened here, and it’s a shame that Bud’s ibond order got messed up … but for future returns, you might want to consider H&R Block software. TT was requiring a system update and I wasn’t about to stop tax prep to do a full computer backup and OS update. I was a bit nervous, since I had used TT for about 20 yrs, but it was a pretty seamless transition. The turbo tax return from the prior year imported easily and the only things missing were the annoying animations and graphics. Turbo has better “help,” but … despite a barebones design, H&R was adequate for my purposes. Decided to stick with it again this year and made a tax refund ibond purchase for the first time. The process was pretty smooth ( the only confusing part was the way it asked about bond registrations). Got my partial fed refund direct deposit in 8 days and most of the ibonds the following week. One straggler bond showed up 5 days later. My state return is still in limbo, but that’s probably more a reflection of DC tax processing than the tax software. It won’t solve your problem this year, but it might be worth considering for future ibond purchases. ( I should add that I used the downloaded software — some folks have experienced problems with the online version. )

Old mariner says

This is in reply to RL, who replied to Question 81: That’s very interesting about the CP24 Notice. It does answer why you didn’t get your bonds, i.e., the IRS adjusted something on your return. But it doesn’t answer *why* they made that particular adjustment. Is there a phone number on that notice? Maybe you could call and ask what happened. You’re on a good detecting trail.

RL says

Thanks, Old mariner. Looks like simply receiving a CP24 Notice actually *doesn’t* mean one cannot receive paper I bonds, given Retired at 39’s note below in comment #85.

There is a phone number on the CP24, along with some other ID information. I spoke with a very kind IRS representative today who walked through the issue with me and agreed that none of the listed reasons for refund request rejection in the instructions to Form 8888 applied. She could not after independent research determine why the bonds were not purchased, so has escalated the issue and I was told I’d have a paper response within 30 days. I’ll update the comment section below if I learn anything else helpful.

Retired at 39 says

Another data point.

I posted previously. I filed using H&R Block. I filed on the same day I made the extension payment. I received my $5,000 bonds without issue.

I ALSO received a CP24 indicating they were adjusting my tax payments but the tax calculation was equal. At the time, i couldn’t figure out what was different. But like RL, the payment is now shown as “other payments received.”

RL says

Thanks for sharing. Could you specify the timing of those events (i.e., how long from filing you received your direct deposit refund, paper bonds, and the CP24)?

DB says

Another data point: I filed using H&R Block download SW. I made both estimated and extension payments and filed the day final extension payment was debited from my account. I received both the refund and I-bonds as requested.

H&R Block download SW handled estimated tax payment and extension payments differently. It reported estimated tax payment on line 26 of 1040 and extension payments on Schedule 3 line 10 (also repeated in line 31 of 1040). IRS appears to have been happy with that and I did not receive a CP24.

Dougie says

Using TurboTax, I am ready to e-file my 2021 return. I owe $1052. Instead can I use TT to e-file an extension and pay say an even $6100. Then I plan to use TT In mid-May to e-file my return and ask for $5000 in I bonds plus a refund of $48 (or maybe slightly less if the IRS charges me a small amount of interest). This should work, right?? If it does, then great but since I am late at filing the extension with the large overpayment, I will miss earning 6 months interest at the current 7.12% annual rate. But better late than never! At least it looks like the May reset for I bonds interest could be at an annual rate around 9.5%. Thanks for an excellent piece of information, only wish I had read it in early March.

Harry Sit says

Filing an extension and making the extension payment through TurboTax also works. I prefer to use IRS Direct Pay because it’s more direct. You’ll need to file and make the extension payment by April 18 either way.

SP says

Don’t know if this is new for this year, but received just a single $5k bond in the mail just now. Marian Andersen on the front. (Which makes this conversion process that much easier!)

Harry Sit says

I hope they start doing that for everyone. I still received my usual 12 bonds in 12 envelopes.

Tom P says

Maybe they temporarily “ran out” of the other bond denominations, or finally figured out it was less costly to send one bond instead of 12? I received the usual 12 bonds in 12 envelopes in early February. The Einstein bonds are my favorite of course, I actually hated to send them to TD for electronic conversion, but figured having them all in one location was best 🙂

Roy says

Same thing happened to me. One $5k bond arrived in the mail yesterday.

Tom P says

That’s interesting because the TD website still says paper bonds are only available in $50, $100, $200, $500 and $1000 denominations, although a search on treasury.gov shows that these plus a $75, $5000 and $10000 were introduced in 1998-1999. At the time you could purchase $30,000 per year.

Roy says

Perhaps they are running low on other denomination of paper I-bonds? I was a bit concerned with USPS Informed Delivery showed me only a single Treasury envelope on the list to be delivered, but when I opened it I found inside a single $5,000 Series I bond. FYI – also interesting is that I specified a Beneficiary when I ordered this bond via my tax return, and there is a POD (Payable On Death) name listed right on the bond.

Tom P says

Anyone else try to predict or calculate the I-Bond interest rate? I looked on TD and found this formula: I-Bond Rate = (Fixed Rate + 2 x Semiannual Inflation Rate) + (Fixed Rate x Semiannual Inflation Rate); using CPI-U numbers.

The current fixed rate is 0.00 and the current I-Bond rate is 7.12%, which means the semiannual rate calculated was 3.56% or 0.0356 as indicated on TD.

I was able to produce this result by using the CPI-U numbers from Oct 2021, 276.589 and from Apr 2021, 267.054. I rounded these to 1 digit, then calculated [(276.6/267.1) – 1.0] and rounded to 4 digits, leaving 0.0356.

Looks correct, or maybe my math was just lucky 🙂 If so, extrapolating the inflation number for Apr 2022 to 290.5 and using 276.6 for Oct 2021 shows the I-Bond rate effective in May could be about 10%.

Harry Sit says

The applicable periods are March to September and September to March. The next adjustment will be 9.62%. It’s already updated in the opening paragraph of the “How to Buy I Bonds” post.

Tom P says

Ah, that ‘splains it. Thanks Harry for the clarification. The formula works fine now.

snic says

I used H&R Block software as described here and had no issues. I also received a single $5k bond today. I guess one reason why they one might want smaller bonds is if you need to cash out less than $5k, you’d just cash out what you need. I guess I’d have to cash out the whole bond… or is there some way, once I convert the bond to electronic, to cash out just a portion of it?

(BTW, Thanks, Harry, for this very informative web page!)

Harry Sit says

Once it’s in your online account, you can cash out partial amount. The minimum cash out amount is only $25.

mrdon says

I think there was a link somewhere that explained how to transfer the paper I bonds to electronic ones but I’m not finding it. Can someone kindly point me to it? Like others I used Hrblock desktop, refund in about 2 weeks and then a 5K Ibond about a week later.

Harry Sit says

Scroll up and find the “Deposit Paper I Bonds to Online Account” section in this post.

mr don says

thanks Harry. Just doing a search on “deposit” finds it. That is quite an ordeal. I’m thinking I will put mine in the safety deposit box at the bank along with the information on accessing the E account. That way my heirs will be reminded when they see that nice colorful bond. I agree this is not the kind of thing to keep at home due to thefts, fire, etc. It does spook me how the gov’t just sends these things out in the snail mail with no tracking. At least they don’t require a Medallion signature. That’s another long story, a requirement guaranteed to slow you down.

Tom P says

Don, I’d give it a try… you have nothing to lose but a few minutes of your time. I did it for the 12 bonds I received and it only took maybe 15 min to setup the linked account, enter the bond numbers (which I already had in Excel, so just copy and paste), and print the manifest. Since you only have one bond it’s that much easier. I sent my bonds to TD in a normal #10 envelope and they received them without issue. I took pictures of the bonds before sending.

BuffierThanThou says

Had a $5600 refund. Requested $5k in bonds, $600 DD. Got all $5.6k DD. IRS letter a few days later says my refund amount changed and that’s why. But it didn’t change?

IRS sucks.

BuffierThanThou says

Apparently this is a TurboTax issue. F TurboTax.

Harry Sit says

I received I Bonds successfully using TurboTax downloaded software with lines 5a/b/c. No CP24 notice from the IRS.

Tom P says

Well, as I’ve stated I had NO issues using TruboTax online Deluxe. I filled in 5a, b, c; got $6414 DD and $5000 in 12 bonds.

Maybe the IRS is intentionally trying to screw people out of their bonds by claiming to “adjust” their refund because they are so popular right now. Dunno, but I guess I got lucky.

BuffierThanThou says

I used TurboTax online edition — maybe that makes a difference? @Tom P which version did you use?

BuffierThanThou says

Nvm, I see you used Online Deluxe. That is weird indeed.

There are people on Boglehead etc. also saying they had this issue with TT and the IRS.

Bud B says

See my comment at #81 above. Cheers.

Tom P says

Many thanks to Bud and his detective work. Nice job, but unfortunate for you! FWIW, TurboTax always calculates my 1040ES payments as whole numbers; they take 110% of taxes due, less withholding paid, divided by 4 and rounded o nearest dollar (and these calcs always agree with mine). I pay my estimated payments via EFTPS, and when I do my taxes using TT online Deluxe I round all inputs (in the normal way, anything 50 cents and above gets rounded up, i.e. using the ROUND function in Excel) BEFORE typing the numbers into TT. I don’t let TT “pull” numbers from Fidelity, etc.

My return was more complicated than the usual simple one this year because we rolled over three of my wife’s old work accounts into a rollover IRA, and I also had a Roth conversion. It all worked fine and I got my bonds as requested.

It seems like some of those criticizing TT should check their returns as closely as Bud. They might owe TT an apology.

Dunmovin says

Q Filed return with 8888 (with $5K expected in paper bonds) attached by US Mail with a tracking receipt showing IRS received it in February 2022. I’ve heard nothing. Going to Where’smyrefund results in they show nothing. Anyone having any issues with filing by US mail and getting or not getting “refunds” in paper ibonds? Thanks

Art says

Keep an eye on your bank account, as that was the first sign of progress. My direct deposit portion of the refund came 8 days after I filed. That’s how I knew the fed return had been processed. The paper ibonds appeared ( well most of them) in my mailbox about a week and a half later. After registering them and mailing them back ( with tracking) I got the post office notification of delivery online, as well as the paper return receipt about 5 or 6 days later. An email confirmation from Treasury confirmed that the paper bonds had arrived. They still haven’t been processed — I check back periodically, but it probably will take a month or so before treasurydirect account shows them credited.

Roy says

Well, you can’t get the I Bonds until you get your refund, and you can’t get your refund until the IRS processes your return, and the IRS is waaaay backed up in processing paper returns. I think the issue is likely not at all related to the fact that you asked for I-Bonds with your return, but is likely due to the large backlog at the IRS in processing paper tax returns. Nothing you can do at this point, but for next year file electronically to get a more predictable and quick response from the IRS.

Dunmovin says

Thanks…but anyone have any actual personal experience one way or the other?

Art says

Forgot to add, the refund delay is probably due to the fact that you submitted a paper tax return — the electronic ones are processed much more quickly.

Mike says

Dunmovin, I entered this discussion back in March, on post #70. Like you, I mailed my paper return to the IRS. From what I’ve heard, it may take a loooong time before anything happens due to the processing backlog. I don’t think I’ll even try “where’s my refund” until late May. Good luck to you! And please post when you learn something.

Dunmovin says

Thanks, Mike…let’s keep communicating…anyone else with ACTUAL experience of paper filing of returns by US mail with 8888 attached?

DB says

Dunmovin, I did mail the paper return with form 8888 attached last year. Filed in the second week of May. The return was not processed until October and I received the direct deposit refund and paper bonds in mid to late October. It could take just as long or even longer this year. That is why I eFiled this time around.

Donald Graves says

Late side note: If you filed a paper return for 2020 (like we did), the IRS may still not have it processed. Therefore when you try to e-file for 2021, and enter your 2020 AGI as verification, the IRS will reject your e-file (because they still don’t have record of it). Therefore, YOU NEED TO ENTER 0 AS YOUR 2020 AGI.

It was the same darn thing the year before too, and probably will be, year after year, unless you break the chain, and e-file, entering 0 as the previous year’s AGI. (I had to get this answer last year from our US Senator Mike Lee, since IRS would never reply.) Sorry, I didn’t think to post this BEFORE April 18, but if you did as suggested, and filed for extension, and paid additional $5,000, then maybe there’s still time for you.

Having done this, we got our $5,000 I-bond in a couple of weeks, and the excess deposited.