[Update on August 30, 2024: TreasuryDirect announced that starting January 1, 2025, you will no longer be able to buy paper I Bonds with your tax refund. The annual purchase limit is still $10,000.]

I Bonds are the best bonds you can buy at the moment if only you can buy more of them.

Maximum $5,000 Per Tax Return

In addition to buying I Bonds on the government website TreasuryDirect (see How to Buy I Bonds), you can buy another $5,000 per year indirectly, but only if you’re due at least that much in tax refund and you tell the IRS to use part of your tax refund to buy I Bonds. You can’t send a check with your tax return and ask them to buy I Bonds for you.

The $5,000 maximum is per tax return, not per person. If you’re married filing jointly, you still can buy only a maximum of $5,000 for both of you combined, not $5,000 for each of you. If you’re married filing separately, each of you can buy a maximum of $5,000, but of course you should make sure you won’t lose other tax benefits when you choose to file separately. From IRS Form 8888 instructions on page 3:

You may request up to three different savings bond registrations. However, each

registration must be a multiple of $50, and the total of lines 4, 5a, and 6a can’t be more than $5,000 (or your refund amount, whichever is smaller).

Because the amount you can purchase is also capped to the amount of your tax refund, if you normally don’t have a tax refund that large, you can increase your tax refund by overpaying ahead of time. Since I’m self-employed and I pay quarterly estimated taxes, I just pay extra for the fourth quarter.

Pay with Automatic Extension

If you don’t pay quarterly estimated taxes, you can make a one-time payment through IRS Direct Pay. After a year is over, you can still pay toward the previous year’s taxes with an automatic extension. When you say your payment is for an extension, the payment automatically files the extension. You don’t need to fill out another form.

You get extra time with an extension but you don’t have to use it. You can still file your tax return on time before April 15. Choose “Extension” as the reason for payment. Select “4868” in the “Apply Payment To” field, and choose the previous year for the tax period for payment.

The “Extension” option will become available after the IRS opens up the tax season for the previous year, usually around the end of January. If it isn’t available yet, just wait.

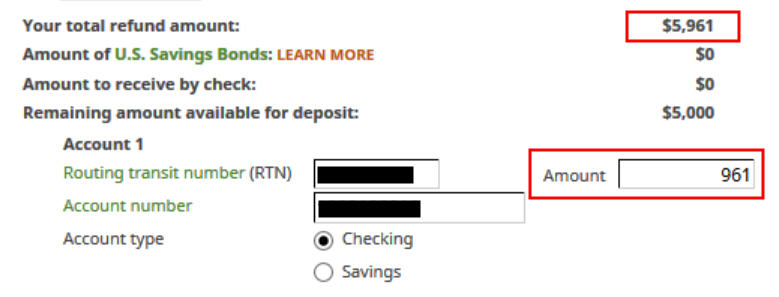

When you pay extra, don’t make your refund exactly $5,000. Make it a small odd amount above $5,000 so that you’ll still have a small refund after buying I Bonds. For example, if you’re expecting a refund of $2,136, pay $3,000 with your automatic extension. Now your expected refund is $5,136. When you see $136 deposited to your bank account, you’ll know the other $5,000 is sent to buy I Bonds.

Pay in Whole Dollars

Also make sure you pay in whole dollars, not dollars and cents. If you make estimated tax payments, also make sure those are in whole dollars. If you already made estimated tax payments with dollars and cents, make another payment to make your total estimated tax and extension payments add up to whole dollars.

Cents in your total estimated tax and extension payments will cause the IRS to adjust your refund, resulting in not issuing I Bonds to you. This doesn’t apply to tax withholdings. Your tax withholdings from your income can have dollars and cents.

Wait

Wait at least a week after you make the extension payment before you file your tax return. This gives some time for your payment to be reflected in your account at the IRS. While this may not be strictly necessary, giving the computer systems a little more time to sync up can’t hurt.

Report Payment on Your Tax Return

After you pay extra with an automatic extension, make sure to account for it on your tax return. Here’s how to do it in TurboTax and H&R Block downloaded tax software.

Online tax software doesn’t have all the features of downloaded tax software, and it’s often more expensive. See Tax Software: Buy the Download, Not the Online Service.

TurboTax

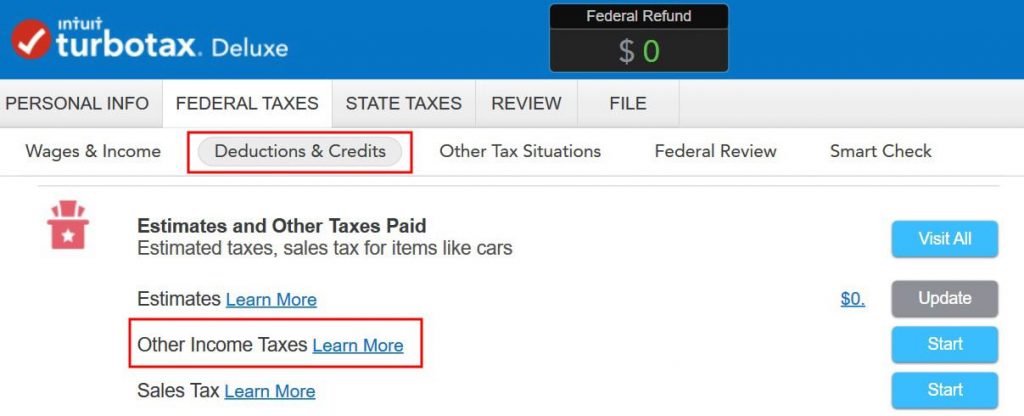

In TurboTax (downloaded software), it’s under Federal Taxes, Deductions & Credits, Estimates and Other Taxes Paid, Other Income Taxes.

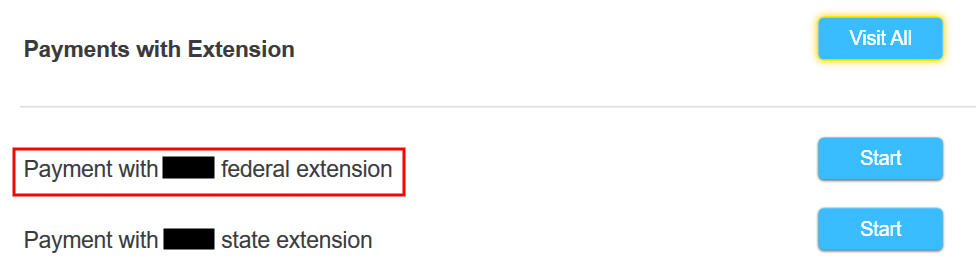

Then choose payment with the federal extension for the previous year.

H&R Block Software

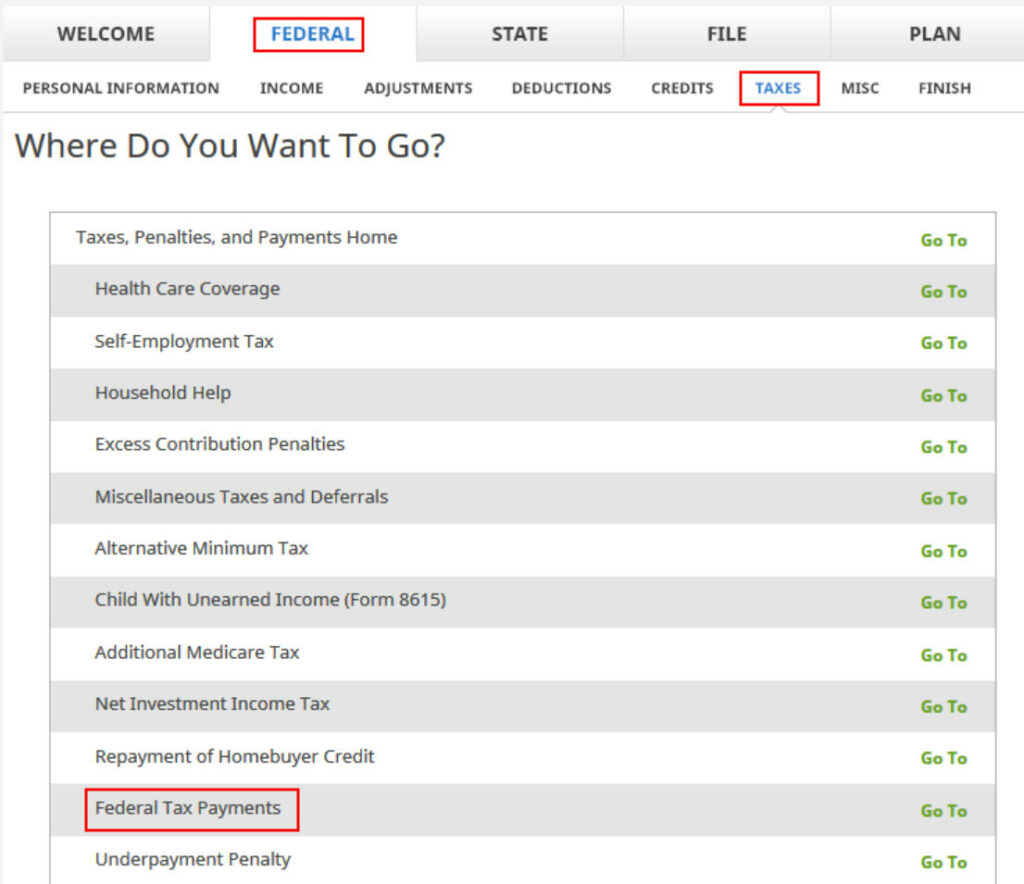

It works similarly in H&R Block downloaded tax software. The payment with extension is under Federal, Taxes, Federal Tax Payments.

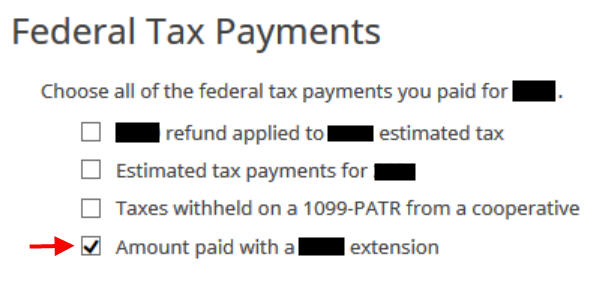

Check the box for “Amount paid with a 20xx extension.”

Split Refund for I Bonds

When it comes to asking for I Bonds, it’s in the final steps before filing your return. Here’s how to do it in TurboTax and H&R Block downloaded tax software.

Online tax software doesn’t have all the features of downloaded tax software, and it’s often more expensive. See Tax Software: Buy the Download, Not the Online Service.

TurboTax

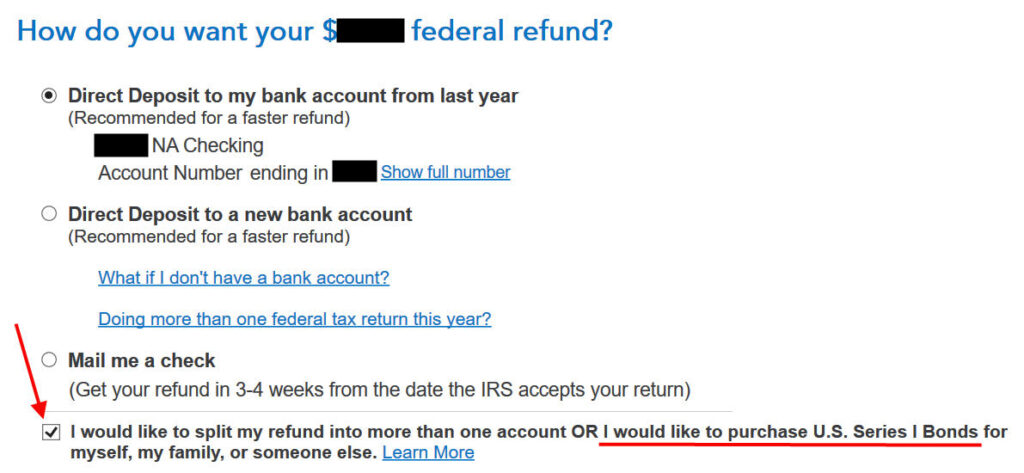

When TurboTax (downloaded software) asks you whether you’d like to receive your refund by direct deposit or by check, choose direct deposit. You check a box at the bottom to say you want to split your tax refund and use part of it to buy I Bonds.

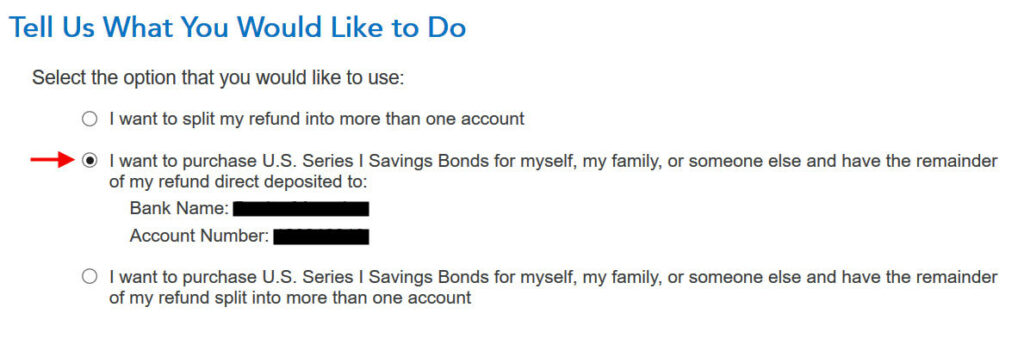

Then choose to buy I Bonds and direct deposit the leftover refund.

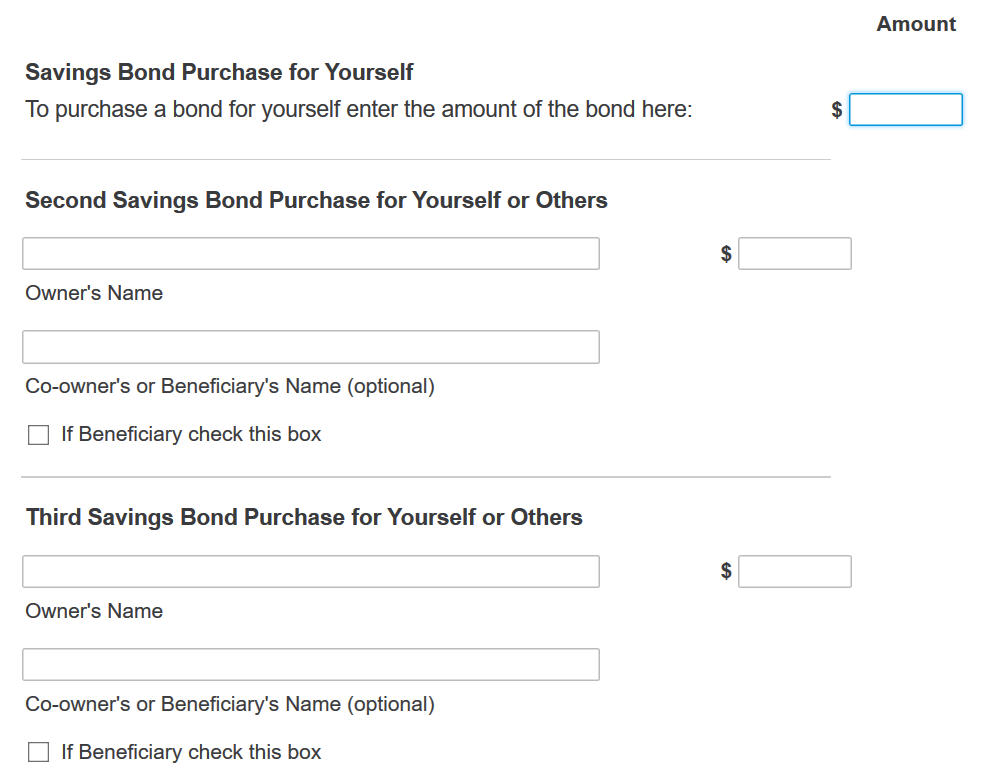

Then you will say how much you’d like to buy and whose name(s) should be on the bonds.

You can split the I Bonds purchase into an amount for yourself plus up to two free-form named recipients. Each owner must receive a multiple of $50 and the total for all three can’t exceed $5,000.

If you put an amount in the first box, you don’t have to give any name. They will automatically copy the name(s) from your tax return. If you’re filing jointly, the bonds will be issued in both of your names as co-owners.

If you’d like to have the bond issued in only one name (yours or someone else’s), put an amount as the Second Savings Bond Purchase. Give the name (and a co-owner or beneficiary if desired). Check the small box if the second name is a beneficiary (not a co-owner) of the owner for this purchase. Repeat for the Third Savings Bond Purchase if you’re buying for another recipient.

H&R Block

H&R Block downloaded tax software has it in the final steps before filing the return. When it asks you whether you want a direct deposit or a check, choose direct deposit. Reduce the amount of your direct deposit by the amount of I Bonds you’d like to buy.

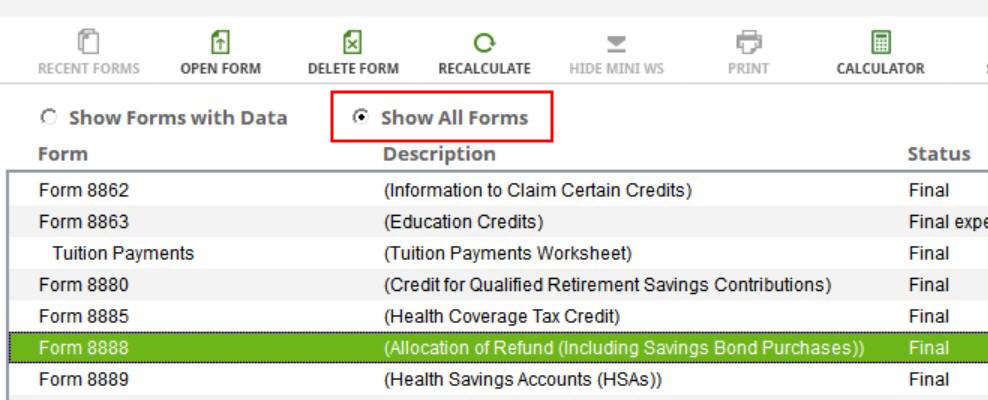

Now, find and open Form 8888:

1. Click Forms at the top of the program.

2. Select the Show All Forms option.

3. Scroll down to find Form 8888.

4. Select and open Form 8888 and fill it out to allocate amounts to savings bonds purchases.

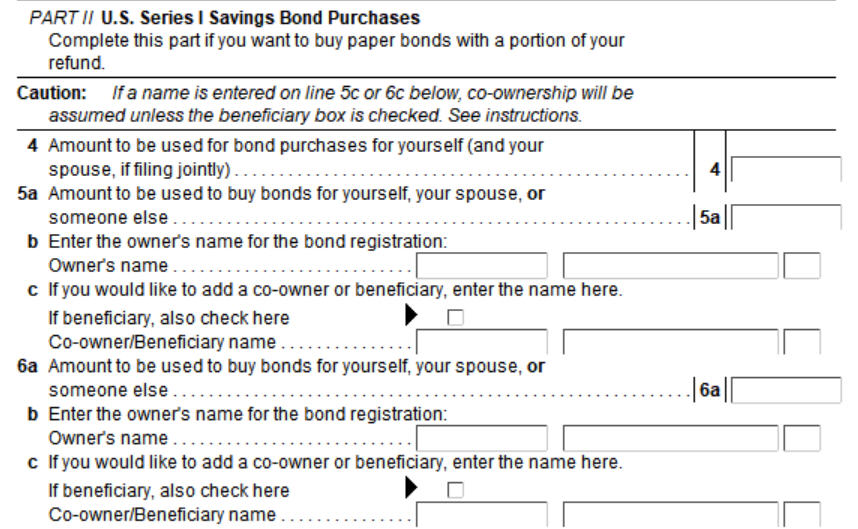

You enter the amount you’d like to buy and the names that should appear on the bonds in Form 8888.

You can split the I Bonds purchase into an amount for yourself plus up to two free-form named recipients. Each owner must receive a multiple of $50 and the total for all three can’t exceed $5,000.

If you put an amount on Line 4, you don’t have to give any name. They will automatically copy the name(s) from your tax return. If you’re filing jointly, the bonds will be issued in both of your names as co-owners.

If you’d like to have the bond issued in only one name (yours or someone else’s), put an amount on Line 5a. Give the name on Line 5b (and a co-owner or beneficiary on Line 5c if desired). Check the small box if the name on Line 5c is a beneficiary (not a co-owner) of the recipient on Line 5b. Repeat for Line 6a, 6b, and 6c if you’re buying for another recipient.

Receive Bonds by Mail

After you file your tax return, if everything goes well, you’ll receive I Bonds by mail. If you asked for $5,000, you may get one $5,000 bond or you may get multiple bonds that add up to $5,000.

If they send multiple bonds, each bond will come in a separate envelope. Because the bonds have your name and address printed on them, it’s just easier for them to put each one into a separate window envelope. Collating multiple bonds into the same envelope increases the risk of a mix-up.

Sometimes the bonds don’t come in one batch. If you receive fewer bonds than you expect, just wait. Most likely additional bonds will show up in the mail in a few days. If they don’t come in two weeks after you receive the first batch, please call TreasuryDirect customer service at 844-284-2676.

Deposit Paper I Bonds to Online Account

You can keep these bonds in paper form if you’d like. Put them in a safe deposit box. When you’d like to cash out, you can take them to your bank or credit union or a major national bank such as Bank of America or Chase. They will look up the current values in their system and deposit the money into your account or give you cash.

I prefer to consolidate the paper bonds with the bonds in my TreasuryDirect online account because it’s more secure and more convenient to have all the bonds in one place. You can mail the paper bonds to the Treasury Department and deposit them into your account. Please read How To Deposit Paper I Bonds to TreasuryDirect Online Account.

If only they ask for your TreasuryDirect account number on the tax return, they won’t have to mail you the bonds and you won’t have to mail them back in. While it is possible to direct deposit part of your tax refund into your TreasuryDirect account using a special routing number, when you use the money to buy I Bonds, you use up part of your $10,000/year quota, which defeats the whole purpose of overpaying taxes to buy additional I Bonds. The government has no incentive to make it easy. If you want more I Bonds, you’ll have to tolerate their process.

When Something Goes Wrong

Sometimes instead of receiving I bonds, you get 100% of your tax refund deposited into your bank account. It’s not clear why this happens to some people.

You can’t do anything about it. Once you receive your tax refund, it’s not possible to have the IRS take it back and buy I Bonds for you. Try your luck again next year. It may help if you make your tax refund not exactly $5,000. Make it say $5,081 and ask for $5,000 in I Bonds and $81 as a direct deposit to your bank account.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Dan A says

Thanks for the detailed explanation!! I remember trying out T-bills after your article (almost) 2 years ago, before the rates dropped. Now that it seems inevitable that we’re going into a Japan-like economy, staying slightly ahead of inflation doesn’t sound so bad.

If my TreasuryDirect acct is setup for a Living Trust, can the I bonds be in my name (as they most likely will be from the IRS), or do they have to in my name as trustee?

Harry Sit says

I don’t have a trust account there. It looks to me that an individual account and a trust account are separate, and all the bonds you buy in the trust account belong to the trust. If you want bonds in your name you’d have to open a separate account as an individual. You can have the bonds in your individual account “reissued” to the trust.

Dan A says

I guess the best option is to use line 5 on Form 8888 to specify myself with a trustee designation, rather than using line 4. They make it so confusing.

Haseung says

Harry,

After reading your article, I purchased $5,000 as I was filing the tax. Yesterday, I received the I-bonds in the mail like you mentioned. However, I only received 5 of the $50, so total $4,950. Is there anything I could do in this case?

Thank you for your help!

Harry Sit says

Haseung – Sometimes the paper bonds come in separate envelopes. Wait a week and see if the missing bond will show up in the mail. See comments #13 and #14 below.

LK says

I use TaxAct to file. Do you have screenshots on how to do this in TaxAct?

Harry Sit says

Sorry, I don’t have TaxACT.

DB says

Great post Harry. Thank you for answering all the questions I had on this topic.

Ames says

Thank you for another timely post, Harry! I just increased my estimated payment to allow for this option. It will be my first time doing this and I will follow your helpful steps when filing.

H says

Thanks Mr. Sit! I just purchased $10k of I Bonds after reading your post and doing some research.

I’d like to ask if I am to make a one-time payment on IRS for tax year 2020, the tax refund that I plan to use to buy another $5k of I Bonds, will that be considered 2020 or 2021?

Harry Sit says

They will be 2021 bonds. Say the IRS processes your tax return in April and sends $5k from your tax refund to the savings bond department. If it’s still before the end of April when they process your bond order, you’ll get April 2021 bonds. If it’s already May, you’ll get May 2021 bonds.

DB says

EThe I-bonds you purchase with your 2020 tax refund will be considered a 2021 purchase. If you file in April 2021, your issue date could be April 1st or May 1st, depending on when IRS processes your return and Treasury Direct issues your refund in the form of I-bonds.

H says

Thanks Harry and DB!

MDF says

Howdy Harry. Thank you for the nice article. We are in our 60s. For the bond side of our portfolio we have Vanguard’s Total Bond Market Index Fund in a Roth IRA. Would think it wise to redeem some of those shares and buy I-Bonds?

Happy trails, MDF

Harry Sit says

Because you can’t buy I Bonds inside a Roth IRA, if you must take money out of the Roth IRA to buy it, it’s probably not worth it. Earnings in a Roth IRA are tax-free. Interest on I Bonds is taxable when you redeem the bonds.

Steve says

If you are filing a joint tax return, the description for Form 8888 line 4 says “(and your spouse, if filing jointly)”. Are these just bonds issues with both spouses as co-owners? Can they then be converted into electronic bonds in either spouse’s TreasuryDirect account?

Harry Sit says

Yes. The bonds will have both spouses as co-owners and they can be converted into either owner’s account.

“If you’re a TreasuryDirect account owner, you can exchange paper savings bonds on which you are the sole owner, a co-owner, or the owner with a beneficiary.”

https://www.treasurydirect.gov/indiv/research/indepth/smartexchangeinfo.htm

EV says

Great post. I had planned to do this before reading your post. We had about $3500 coming back to us this year so I want to add another $1500 to get up to $5000. But I have a very old school question, in case you have the answer.

I plan to file my tax return via paper mail. I was hoping to include that extra $1500 payment with my return as a paper check, having already accounted for that in my 2020 estimated tax payment number on line 26 of form 1040.

Would that be an acceptable approach? I was hoping to be able to determine they had received my paper return once I saw that my check had been cashed. Your opinion on this approach would be appreciated.

Steve says

I’m pretty sure the IRS will only accept a check with an appropriate form, either 4868, a 1040 with taxes due, a quarterly estimated tax form, or similar.

Harry Sit says

EV – I agree with Steve. That doesn’t work. A check that accompanies the 1040 isn’t an estimated tax payment. If you’d like to confirm that your paper return is received, you can mail it certified and track the delivery through USPS. To increase your refund, IRS Direct Pay with automatic 4868 extension is still the easiest way.

EV says

Well, I’m very glad I asked. Thanks Steve and Harry for the quick feedback, and I’ll use that suggested approach. Appreciate it!

Michele says

Thanks for all the great information!

If filing married jointly, is the limit $5000 per individual or total for both?

stannius says

Total for both.

R says

Are you sure? The irs website says $5000 per ssn…

Harry Sit says

It doesn’t say $5000 per SSN. From IRS Form 8888 instructions on page 3:

“You may request up to three different savings bond registrations. However, each

registration must be a multiple of $50, and the total of lines 4, 5a, and 6a can’t be

more than $5,000 (or your refund amount, whichever is smaller).”

Steve says

I just got my paper bonds. Instead of two $100 bonds I got one $200 bond.

Rob says

I made sure to overpay taxes and asked for $5000 in bonds on my Turbotax return. Received a single $500 bond in the mail today. An error? Should I wait to see if the rest arrives separately? I don’t even know whom to contact to fix it.

Scott C says

I too asked for $5,000 in bonds but got a $5,000 denomination bond but that is only valued at $2,500. I can wait a bit but been over two weeks for a second bond. Does anyone have a number to call? Next week is IRS tax week so busy lines I am sure. I am owed another $2,500.

Dougie says

Scott C, last year I sent my $5,000 paper bond back to TreasuryDirect (TD) for them to hold. My TD account says its worth $5,000 plus I have accrued some interest. After 12 months and less than five years, I can redeem it for its full $5,000 plus accrued interest minus 3 months of interest. I think only the EE bonds are worth half their face price when purchased.

Old mariner says

To @Scott C:

A $5,000 denomination paper I-bond is valued at $5,000.

Steven Crisp says

I’d say wait a while. For some reason, they send the bonds separately. Last year I received all but one on a given day, and then 3 or 4 days later, the last one showed up.

Hopefully the reverse for you will occur.

Rob says

Yep, I got some more the next day, and the final $1000 showed up another two days later. Such a silly system…

DB says

Has anyone tried making extra tax payment with extension using a credit card similar to Direct Pay to get paper I-bonds? The table at https://www.irs.gov/payments/frequency-limit-table-by-type-of-tax-payment seems to indicate this can only be done until April 15th, but https://www.irs.gov/newsroom/tax-day-for-individuals-extended-to-may-17-treasury-irs-extend-filing-and-payment-deadline appears to extend that deadline to 5/17/21.

Harry Sit says

The IRS accepts payments with an automatic extension through May 17. The deadline is the same whether you pay by card, Direct Pay, or EFTPS.

Abe says

Is the extension automatic if you use a credit/debit card?

Harry Sit says

Abe – Based on reports from Mike (comments #70-75), if you choose the correct extension payment type, you fill out an electronic equivalent of the Form 4868 when you pay with a credit/debit card via an approved payment processor. You end up with an extension after you make the payment. Mike had problems with some providers but maybe other providers will work OK.

DD says

If I already filed my 2020 return several months ago and it was accepted, am I out of

luck on following the recipe in this article for the 2020 tax year?

How would the recipe be modified to fit this case? Would an amended

return be of use?

Harry Sit says

Too late for the 2020 tax year but there’s always next year. This only gets you the extra $5,000. The regular $10,000 per person through the TreasuryDirect website is still open.

David Galyardt says

Harry,

Many thanks for all of your knowledge sharing! I followed the process you suggested above and received the bonds for my wife and I as you described. My question is in the process of consolidating these into my Treasury Direct account. In your experience is there any issue in sending $2500 worth of bonds in a single USPS mail to the Treasury? I was thinking of doing it in smaller chunks to make the headache of lost/stolen mail less impactful. Also, in your experience, how long does it take before your account gets credited?

Many thanks for all your help!

Dave

Harry Sit says

I don’t have any issue with sending all the bonds and the manifest in one envelope. The paper bonds are replaceable when you have the serial numbers (take pictures before sending). If you’d like to test the process by sending only the small denominations first, that’s certainly OK.

I haven’t received my bonds from this year’s refund yet. As I remember from previous submissions, it took a few weeks. Because the issue date won’t change, you still get the same amount of interest. Since you can’t redeem in the first year anyway, it doesn’t matter how long they take to complete the process after they acknowledge the receipt.

Marlene says

I haven’t received my bonds in mail (for 2020 refund) yet either, so thank you for posting.

Steven Crisp says

Question — For tax year 2020 I overpaid by exactly $5000, and requested iBonds be sent to me. Instead I received a $5000 direct deposit. Any idea what I might have done wrong? Anyway you can think of to somehow correct this issue for 2020 or has that ship sailed?

– Note 1: we already purchased $10K iBonds directly for my wife and me last year, and plan to do that again this year, so that’s not a way to make up for this apparent error on the part of the IRS.

– Note 2: I have received iBonds back via mail from IRS in previous years, which is why I’m so surprised it did not work this time.

I welcome your feedback, and assistance with anything I may have done incorrectly.

Harry Sit says

There isn’t anything you can do now. Sometimes it just happens for no good reason. I suggest you make your refund not exactly $5,000 next time. Make it say $5,081 and ask for $5,000 in I Bonds and $81 in direct deposit. Maybe it will help.

Steven F. Crisp says

Thanks very much for the suggestion, Harry. I’ll try it this year. Wishing you the best.

Chris says

Rather than relying on paper bonds delivered by mail, the instructions for the IRS Form 8888 say that you can buy the bonds electronically. Paper bonds are only if you don’t have a TreasuryDirect account.

From the General Instructions for Form 8888:

“U.S. Series I Savings Bonds

You can request that your refund (or part of it) be used to buy up to $5,000 in series I savings bonds. You can buy them electronically by direct deposit into your TreasuryDirect® account. See instructions under Part I for details. Or, if you don’t have a TreasuryDirect® account, you can buy paper savings bonds. See the instructions under Part II for details.”

Harry Sit says

When you use the direct deposit to the TreasuryDirect account to buy I Bonds, you use up part of your $10,000 quota for the year. You get the extra $5,000 on top of your $10,000 per year only when you ask for paper bonds.

Steven F. Crisp says

Thanks Chris … I had already purchased my 2x $10,000 iBonds from Treasury Direct for 2020. Hence my desire to get the paper iBonds through the IRS.

Kelly says

If I want to file an extention for 2021 the option will be made available in 2022?

Harry Sit says

Yes, but not necessarily January 1. Maybe after the IRS opens the filing season to accept returns for the previous year, which usually happens in late January or early February.

Marlene Lodge says

The IRS made a mistake on mine even after I submitted a paper return as requested. I just received a check around October 15 for my 4,557 refund instead of the paper ibonds (included $50 interest); what a disappointment after waiting five months and having to submit paper

Richard Brown says

If I’m not sure what my 2021 tax return will be can I just overpay sending in $5000 in order to get that much in bonds with my return? Thanks.

Harry Sit says

Your tax return has to show enough refund to cover the bonds you request. If your tax return only shows a $1,000 refund, you can’t attach a check for $5,000 and ask for $5,000 in I Bonds in addition to your $1,000 refund.

Steve says

You can send in a payment with a request for extension. I have done this two or three times, once for ibonds and one or more times to get my refund in the form of amazon gift cards with a bonus % added. The IRS hasn’t rejected my overpayment, at least not yet. I have usually sent in the extension request in January and then filed my taxes in February.

Just because you send in a $5k check doesn’t mean you will get to get $5k in ibonds. If you would have owed taxes (if not for the extra payment) then you’d get less than $5k, and if you would have gotten a refund then you will still get $5k ibonds but you’ll also get a monetary refund. So it helps to actually do an estimate or dry run of your taxes and then add $5k to that.

Danny says

My 2021 taxes were filed in April and I got a $3,451 refund which was already direct deposited into my checking account. Did I miss my opportunity to buy I Savings bonds using my $3,450 tax return? Using ones tax return anytime during the calendar year to buy savings bonds (up to 5k) seems within the spirit of the rule but I didn’t know if there was a technicality preventing me from doing this.

Harry Sit says

Too late now. You had to ask for I Bonds when you filed your tax return. Follow the steps here next year.

Mark says

Harry,

If the bonds mailed to me get lost in the mail, I assume there is a somewhat painful process available for getting them reissued? This appears to be the form to do it https://www.treasurydirect.gov/forms/sav1048.pdf

If that’s right, then I guess there isn’t a big risk that my refund in I bonds will disappear?

Harry Sit says

I haven’t heard any story of bonds lost in the mail. A delay of some bonds not showing up in the mail on the same day with other bonds happens sometimes, but bonds lost in the mail forever must be very rare. If it happens to you, contact TreasuryDirect customer service. I assume they know the serial numbers and they can cancel the lost bonds and send replacements. That 1048 Form is for bonds you already received and then lost. I used it to have my bonds replaced after burglars stole my paper bonds in a break-in. See Replace Lost Or Stolen Savings Bonds: A Real Life Experience.

Kelly says

Instead of filing an extention do you see any problem just having my employer take out extra withholdings from my paycheck? My employer allows me to make such a change and I could split the $5k over the remaining paychecks I have for this year.

Harry Sit says

That also works. You’ll pay sooner than filing an extension and your tax situation is less clear before the end of the year. It still works if you prefer to do it that way.

Steven H says

I currently will be due a small refund in 2022. I would like to overpay by more than $5,000 and use the refund to buy $5000 in paper I bonds. If possible I would like to make the overpayment in August.

Is this possible if I timely file for an extension without at that time making a payment, then make the overpayment electronically in August and file the return before the extended deadline? Or do I need to make the overpayment by the original deadline of April 15 (or as adjusted due to the pandemic)?

Thanks.

Harry Sit says

The extension has to be filed by the regular filing due date. The payment has to go together with the extension. The last day to pay is April 15 in most years.

Steve Starks says

I do not see extension as an option on the IRS Direct Pay website, is that because it’s not at the end of the year yet? So would I select estimated tax?

Harry Sit says

If you must pay now, select estimated tax. Or you can wait until the IRS opens the next tax season usually at the end of January.

bws92082 says

Hi. The tax software I use doesn’t allow bond purchases on refunds. So would I just print out the tax return on paper (instead of submitting electronically) and mail it in with some sort of additional special manual form indicating I want bonds?

Thx,

Bws92082

Harry Sit says

You can fill out Form 8888 and attach it manually but you also need to make sure your 1040 doesn’t have your direct deposit information already filled in on lines 35a – 35d. Mark the box on Line 35a to indicate you’re attaching Form 8888. The direct deposit information goes on Form 8888. However, a paper return takes a long time to get processed by the IRS. It may cause you to miss the April 30 deadline to get the 7.12% rate on I Bonds for six months. I think you’re better off switching to a different tax software that supports bond purchases with e-file.

bws92082 says

Thx. The only thing I would be concerned about in changing my (free) tax software is that the cost of the new software could take most of the interest gain I would get over the first 6 months of the bond. Is there any cheap tax software you would recommend? Thx.

Harry Sit says

The two software shown in this post aren’t that expensive when you know how to get them. TurboTax Deluxe + State is rumored to go on sale on 12/29 at Amazon for net $30 after a $10 Amazon gift card (net $20 if you don’t need state). H&R Block Deluxe + State is $20 ($10 if you don’t need state) when you follow these instructions from slickdeals.

bws92082 says

One more question…

The TreasuryDirect website says Series I interest payments accrue beginning on the first day of the month after you buy the bond. So if the 1st of the month falls on a weekend and the purchase date falls on, say, the 2nd of the month, does interest not begin to accuse until the beginning of the following month?

Harry Sit says

It goes backwards. The first day of the month in which you buy.

Chris says

If the 8888 form is not part of your tax software, you could just transfer all of your tax information to the IRS Free File Fillable Forms at https://www.irs.gov/e-file-providers/free-file-fillable-forms. This system (available later next month for 2021 tax filing) will allow electronic submission of your taxes. Follow the directions on the 8888 instructions carefully.

Marlene Lodge says

– No state tax return option is available.

– Free File Fillable Forms is the only IRS Free File option available for taxpayers whose 2021 income (AGI) is greater than $73,000.

bws92082 says

OK, I submitted by estimated tax payment ($4,500) thru IRS Direct Pay. If I run into any complications, I’ll add a follow-up post here.

Thx everyone.

Kyle says

Bless you sir for a fabulous article!!!

Alex says

Don’t see I-bond option in freetaxusa :((

bws92082 says

I used FreeTaxUSA and they don’t have I-Bond option available—I confirmed this with the Customer Support team. I requested that they add this feature next year and they said they would consider it.

Harry Sit says

H&R Block Deluxe software at $20 with state ($10 without) isn’t that much more expensive than FreeTaxUSA. The instructions in comment #31 still work for me even though the deal site says it expired.

Domenick says

Damn, was hoping FreeTaxUSA offered this for 2022.

Alex says

What is the difference if I overpay my tax via Form 1040 Series vs Form 4868 Automatic Extension of Time to File?

Harry Sit says

The last estimated tax payment counting toward the previous year is due on January 15. You can pay as late as April when you file a 4868 automatic extension. If you’re paying before January 15, the 1040-ES also works. It needs to be accounted for in the tax software a little differently than this post showed.

bws92082 says

Yes, Harry, I just purchase HR Block Fed-only for $10 (and I see form 8888 with I-Bond purchase option exists). Thx!!

Alex says

Thanks Harry.

I will use “4868 automatic extension” then. I am planning to open new credit card with spending bonus and pay with it. I hope it will work. Bank of America Business Cash Rewards has $500 Signup Bonus for 5k spending (http://bankofamerica.com/sbcashrewards500).

Steven H says

I recently bought the TurboTax Deluxe Federal + State download from Amazon for $40; it’s still at that price. State filing is another $20.

Alex says

One more question. If I overpay taxes with “4868 automatic extension” will software (HR Block, TurboTax, etc.) include it to my expected refund automatically, or should I add it manually in some field?

Harry Sit says

Software won’t know you paid extra unless you tell it. This post shows how.

Alex says

Harry,

I read the post but it is still not clear for me. So let’s assume I overpaid taxes with form 4868. For example $5000. Now I am starting to file a tax return with TurboTax. Should I use form 4868 in TurboTax (put $5000 in field 5 of this form) so TurboTax will correctly show my tax refund?

Harry Sit says

No, that’s not the right place. In TurboTax software, you click on Federal Taxes on the top, and then Deductions & Credits in the next level of menus. Next you scroll through the topics to find the “Estimates and Other Taxes Paid” heading and “Other Income Taxes” under it, as the screenshot shows. Use the Start button next to the topic.

Alex says

Thanks, but I am not sure if you get my question. Actually I found that on 1040 Schedule 3 Line 10 says “Amount paid with request for extension to file (see instructions)”.

If you go to instructions for 1040 here is the instruction for line 10:

“If you got an automatic extension of time to file Form 1040, 1040-SR, or 1040-NR by filing Form 4868 or by making a payment, enter the amount of the payment or any amount you paid with Form 4868. If you paid by debit or credit card, don’t include on line 10 the convenience fee you were charged. Also, include any amounts paid with Form 2350.”

So it looks like I need to add paid amount with Extension 4868 on Schedule 3 Line 10. After that tax software should show expected return correctly.

bws92082 says

Regarding the 8888 form lines 4 and 5a, why are they asking the same question twice? Am I supposed to duplicate my answer (I’m single and “yourself” applies to both lines)?

Harry Sit says

You only need to fill in line 4 if you buy just for yourself. Lines 5a and 6a are provided as free-form entries for buying for someone else or yourself with a co-owner, yourself with a beneficiary, etc. You can split the $5,000 up to three ways if you’d like.

kurph says

Hi thanks for the write-up!

Is it possible to do estimated quarterly tax now with credit card (by 1/15)(I have already did once on Sept 24 2021). And then pay extra (using extension) on end of Jan? Because I usually ended up owed tax on the return, so wondering if I could do both to achieve 5k over (minus what’s owed).

Thanks again!

Harry Sit says

It doesn’t matter how you pay the taxes (withholding, estimated taxes, payment with extension). As long as you have a refund in the end, you can use up to $5,000 of it to buy I Bonds.

Estimated taxes are accounted for in the tax software slightly differently than the screenshots showed here in this post. Just find the right place to report them when you do your taxes.

Mighty Investor says

This was super handy. Thanks!

Lynn says

Thank you so much for your article! I have a question. When I register on treasurydirect do I and my husband both need an account to max the $10,000 each? How about two kids? Can each of us add them as minor’s account?

Harry Sit says

Each adult needs a separate account. If both parents open an account for the same kid, the kid still has the same total limit in two accounts combined.

Jon Wilson says

Thank you for the detailed instructions. I’m an early retiree with no earned income and have $0 withholding and a $0 tax bill for 2021 (I still need to file due to investment income and a small roth conversion). Do you see any issues with me using your instructions and sending in the $5000 with Direct Pay in order for me to get my extra paper bonds this year?

Harry Sit says

No issues.

Jeff says

Thanks so much for this outstanding article! This works when filing form 1040 for one’s individual taxes, but is it also possible to purchase $5000 in I-Bonds if there is a >$5000 over payment when filing form 1041 (tax return for a trust)? Or is this option only available when filing form 1040?

Harry Sit says

The tax refund option is only for individuals. A trust can open an online account and buy $10,000. See Buy More I Bonds in a Revocable Living Trust, which applies to an irrevocable trust as well.

Dave H in Yuma, AZ says

Many thanks for the detailed explanation. I just did a dry run through the whole process of overpaying by $5K, and specifying the bond purchase using TurboTax 2021. The only think different from the instructions is that on the page “How do you want your $xxx Refund” there is no box that says “split it.” To get to that screen, you have to choose the option “Direct Deposit to a New Bank Account.” Then, a new screen appears that asks for the new account info, and it has a “split it” box.

Trevor H. says

Thanks much for the great article! Quick question: my spouse and I are filing jointly for 2020. Can we have the bond issued to one of us instead of both, i.e., can we just put my or my spouse’s name on the owner’s line or the bond automatically gets issued to both of us because we’re filing a joint return? Also, what’s the difference between line 4 or 5a on form 8888? They seem to say the same thing.

Harry Sit says

If you’d like to have the bonds in only one name, put the amount in line 5a and give the name. If you use line 4 they don’t ask for any name — they just automatically copy the name(s) from the tax return.

Ryan says

My accountant thinks that I can get 5k per social security number on my return (including kids). Can you double check and opine on this?

Harry Sit says

See the reply to comment #11 with a link to the IRS instructions.

Old mariner says

The IRS website specifically states: “This calendar year, you can buy up to a total of $5,000 in paper series I savings bonds with your refund.” That’s $5,000 maximum per refund (not per SSN or per person or per entity).

Source: https://www.irs.gov/refunds/using-your-income-tax-refund-to-save-by-buying-us-savings-bonds

Old mariner says

To Harry Sit: Thank you so much for this informative, well-written, well-organized, and detailed article as well as your answers to all the questions. I read it all. Really excellent. I followed the path you laid out in the article and used Direct Pay (1st time user) to top up my tax payment so I’d have enough refund for the whole $5,000. I’ve already maxxed out on electronic I-bonds for 2022.

Ryan says

Check this out:

https://www.treasurydirect.gov/indiv/research/faq/annualpurchaselimitchangeqa.htm#:~:text=The%20limit%20is%20applied%20per,limit%20is%20%245%2C000%20per%20SSN.

“The limit is applied per Social Security Number (SSN) or Taxpayer Identification Number (TIN). For paper Series I Savings Bonds purchased through IRS tax refunds, the purchase limit is $5,000 per SSN.”

Harry Sit says

If you’d like to test it, go ahead and ask for more than $5,000 with your tax return. Be forewarned you’ll receive no I Bonds that way.

Old mariner says

That’s an interesting article. It was dated Jan. 3, 2012. I don’t know if that’s how the $5,000 limit was interpreted by the Treasury Department back then or even now, but that’s not the way it is interpreted by the IRS currently.

IRS form 8888 (Rev. November 2021) , page 3, Part II states:

“You may request up to three different savings bond registrations. However, each registration must be a multiple of $50, and the total of lines 4, 5a, and 6a can’t be more than $5,000 (or your refund amount, whichever is smaller).”

Old mariner says

It took me a while, but I finally figured out what the above-referenced Treasury Direct article is trying to say. And even though it was written in 2012, the article is still technically correct in 2022.

It’s stating the truth that for paper I-bonds purchased through IRS tax refunds, there is a purchase limit of $5,000 per SSN (per year). What that comprises is bonds you buy for yourself through your own tax refund and bonds somebody else purchases for you through their tax refund. The total of those two purchases cannot exceed $5,000 per the SSN of the bondholder (per year). The article would be clearer if it stated “the SSN of the bondholder.”

That should not be conflated with the IRS limit of $5,000 per refund. The IRS limit regulates how many bonds can be purchased per refund and for how many people. The Treasury Direct limit regulates the total of those IRS refund purchases not exceeding $5,000 per the SSN of the bondholder (per year). They are actually two different limits that work in tandem.