While looking at 529 plan information, I came across an interesting tidbit. It also tells us something about investing in general.

Every state has a 529 plan. Some states have more than one plan. Which state has the largest 529 plans in terms of total assets?

Is it California, the state with the largest population? No. Many California residents go elsewhere because there isn’t any state tax benefit for using an in-state plan. California’s plan has less money in it than Alaska’s.

Is it New York, a large state where taxes are high and residents are offered a state income tax deduction for 529 plan contributions? No. New York residents are doing their fair share but New York isn’t pulling in big money from other states.

Is it Utah, whose plan is often ranked as the best in the country? No. Utah’s plan is doing quite well relative to Utah’s small population, but it only takes the #6 spot in the country.

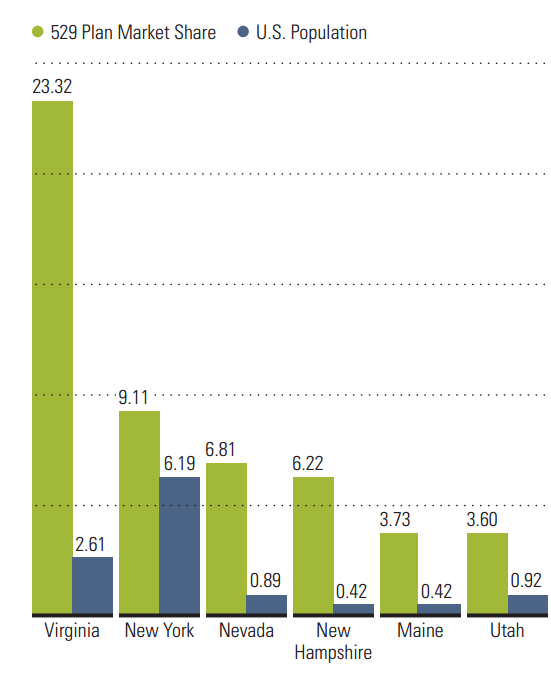

The #1 state in the country with the largest assets in its 529 plans is Virginia, hands down by a mile.

Source: 529 College-Savings Plan Landscape, 27 May 2015, Morningstar

According to Morningstar, Virginia has nearly 1/4 of all 529 plan assets in the country. New York, the #2 state, comes in at less than half of the share taken by Virginia.

Why Virginia? One word: brokers.

Virginia’s market share is driven by its CollegeAmerica 529 plan, which features American Funds, sold by brokers (“advisors”). American Funds pay brokers for selling the plan. Brokers convince parents and grandparents nationwide to open accounts with the Virginia plan. It’s that simple.

Granted there are other funds and plans that also pay brokers, and American Funds and the Virginia plan must compete with those, I’m confident to say that without brokers the Virginia plan would be nowhere close to be #1 in the country.

That’s the power of distribution. Altogether, half of the 529 money in all plans are in broker-sold plans.

To all who think Vanguard Personal Advisor Services just unnecessarily charge 0.3% of assets for putting people in a handful of funds that look like a target-date fund, or that Schwab cheats by requiring a cash allocation in its Schwab Intelligent Portfolio product, or that Wealthfront is evil because their fees in dollars go up as your assets grow, let’s not forget that so many people still invest through brokers and they are paying a lot more.

If robo-advisors win over people from brokers, it’s a big win for the investing public. Just the other day a friend mentioned he had his account managed by someone at a broker branch. I asked him if he was paying a fee. He said he didn’t know. Then he said it was probably 0.1%. I think if he’s lucky it would be more like 1.5% after all is said and done. I won’t be surprised at all if it’s 2.5% or more.

That’s the investing reality. Whoever can reach people and sign them up charge an arm and a leg. That’s how they can afford the time and effort to reach people to begin with. We need all the marketing, PR, slick websites and mobile apps funded by venture capital dollars to change this.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Moira says

NY hasn’t been the #2 population state for ages! Texas overtook us years ago (in 1994) and quite recently Florida also overtook us. We’re #4 now.

https://en.wikipedia.org/wiki/List_of_U.S._states_and_territories_by_population

Harry Sit says

Thank you. Corrected.

Aaron says

At least there’s a choice of 529 plans (I used Utah’s when I had one). My 401k plan is through American funds and the cheapest ER is 1.35%. Even bond funds are in the 1.5% range – some of them show no nominal return after fees for years. It’s pretty disgusting that financial firms can take advantage of captive audiences like this.

Danny says

This is disgusting. The conflicts of interest in the financial advising industry are baffling to me. People looking for professional help to grow and protect their wealth are met by advisors hungry for commissions.

Wai Yip Tung says

Sounds like this is ripe for Silicon Valley FinTech disruption.

Ray says

Virginia’s 529 also has InVEST that’s sold directly to investors. It features mostly Vanguard funds. Curious to know the breakup numbers of InVEST and CollegeAmerica 529 plans.

Brian W says

I would guess 10 to 1 College America to inVEST.

Elise says

The figures are from 2013, but this link indicates College America had almost $39 million vs. VirginiaInvest’s $ 2.3 million. http://www.pionline.com/article/20131223/INTERACTIVE/131219850/the-largest-529-plans

(If link claims you need a subscription, google The Largest 529 plans and it will come up as an article from pionline.com)

Harry Sit says

According to the Morningstar document, as of 12/31/2014, CollegeAmerica had $47.9 billion out of $50.8 billion in all plans sponsored by Virginia.

D says

Interesting that the average account balance is around $18k, with a range by plan average of $2k (Lone Star and Tennessee) to $35k (Nevada). Nevada makes sense in that it probably draws a lot of index investors (Utah, where mine is, is at $27k). I think Texas has a popular prepaid tuition plan (and no state income tax).

New Hampshire is interesting in that it has a lot of accounts 370k (3rd behind the big VA and NY) for a relatively small state. Similar for RI (340k, 5th).

If I still lived in Virginia I would use the state pre-paid tuition plan as they have a nice network of state schools with a range in quality and a good mix of urban vs rural settings.

Elise says

New Hampshire is interesting. I have a 15 year old article from Money magazine about Saving for College in my oldest child’s 529 file, and it endorsed Maine, Massachussetts and New Hampshire 529 plans if you didnt like your own state’s plan. I also have a 2000 brochure and application for New Hampshire’s plan touting their “low costs” (which dont look that great! And we did wind up opening a 529 in our state instead) so for whatever reason NH seemed to be getting a lot of attention in 2000???

The White Coat Investor says

Great article and a terrible indictment of the industry.