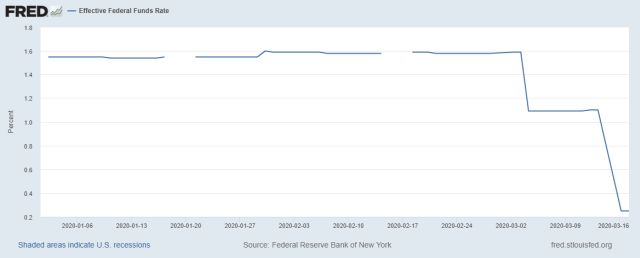

As recent as two weeks ago, the federal funds rate was still 1.5%. In two big moves, the Fed dropped the rate to zero.

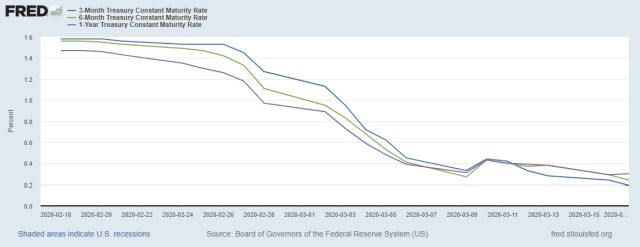

Short-term Treasury yields followed suit. The yield on six-month Treasury bills went from 1.5% a month ago to 0.08% yesterday.

Banks and credit unions are also dropping their rates on savings accounts and CDs but they aren’t reacting as fast as the bond market. Some banks and credit unions are still offering the same rates as they did last year. Because those rates are more likely to go down, you may want to catch them now. Being able to get higher rates after the market conditions already changed dramatically is a unique advantage to retail investors.

I put $50 in a 17-month 2.25% add-on CD with Navy Federal Credit Union. Because the CD allows add-on deposits of up to $75,000, opening the CD now locks in the rate. If you opened a 5-year 3% add-on CD with GTE Financial when I posted about it last year (see Add-On CD As A Hedge For Lower Interest Rates), aren’t you glad you will be able to get that 3% rate on new deposits for another four years?

I also signed up for the Ally Bank promotion, which gives an extra 1% for depositing up to $25,000 of new money. I will put the money in Ally’s 11-month no-penalty CD. Even though the 1.55% rate on $25,000 isn’t much higher than the current rate on their online savings account, the rate on the no-penalty CD is guaranteed not to drop during the CD’s term, whereas the rates on savings accounts and money market funds can go down and down. With the 1% bonus, the total annualized yield on the no-penalty CD over 11 months is about 2.6%. Compare that to the 0.21% yield on 1-year Treasury!

If you have accounts with other banks or credit unions, you may find their rates also haven’t dropped nearly as much as the bond market. Consider locking in some good rates before they disappear.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Anne says

Thanks! I followed your approach just now. Got the bonus on new money and funded the Ally CDs. I figured it was too late! Much appreciated.

mike Foster says

Good info. Thks

Don says

Ally website now states the 1% bonus is capped @$250.

Don says

My bad, got it now $25k max!

Gordon says

It’s probably a bit late to mention this, but I did something related after the first rate cut, with a twist. Back in February, Marcus Bank had a 1% offer for up to $10k in “new funds” if kept in the account for 60 days–into April. I already had money in their 1.7% savings account, so I added $10k to get the $100. Well, then the rate cut happened, and I decided that rather than not withdrawing any money during the 60 day period, I had better give up the $100 and lock in something better than the 1.7% savings account rate that is pretty much guaranteed to evaporate soon. What I did was switch the money into their 11 month, 1.9%, no penalty CD’s–more than one, so that I can withdraw some of the money by breaking a CD if necessary without losing the 1.9% on the rest. I opened 2 CD’s in my account, and 3 in another account I manage for my mother. So, essentially, I’ve got a 1.9% savings account for the next 11 months. Marcus still has the no penalty CD’s, but the rates have already dropped: 1.7% for 7 mo, 1.6% for 11 mo, and 1.5% for 13 mo. No penalty to withdraw, but the entire CD must be cashed out at the time of withdrawal–hence the multiple CD aproach.

Harry Sit says

Thank you Gordon. It’s not late. Even at the reduced rates, these Marcus no-penalty CDs are great for keeping planned spending in the coming months.

Alex says

Thanks Harry! I wanted to stop by let you know how much I value your blog and your recommendations. I opened 2 CDs with NFCU this morning (17 month and 12 month EasyStart).

Todd says

Harry: Really appreciate your insights.

FYI, as of yesterday, to get the stated interest rate on the NFCU 12-month CD it requires both a checking account and a monthly direct deposit. For me, that was more of a hurdle than I wanted so I just funded the 17-month CD instead.

I had already taken advantage of Ally’s 1% bonus (plus, I got Ally’s 11-month “no penalty” CD at 1.9% rate).

Graham says

The Ally cash promotion is no longer in effect.

TJ says

I’m glad i opened up an American Airlines CU 3.15% 5 year add-on CD last summer. $50k max. (Also glad I had the foresight to become an AA CU member when I was eligible) I still haven’t put much in it though because of moving $$$ around for bonuses (marcus 1% earlier this year, Ally 1% currently, Chase $15k for $300, about to put $25k in Webull for a month to get 25 stocks.) Eventually my idle cash will make it’s way in that add-on CD, but as long as these bonus offers keep coming, they just seem to make more sense, especially since they are more liquid.