[Updated on February 9, 2026 for the 2025 tax year.]

The previous post, Claim State Tax-Free Interest from Mutual Funds and ETFs, covered how to get the state income tax exemption on the portion of mutual fund and ETF dividends attributed to interest from U.S. government securities. This post covers how to do the same on the portion of fund dividends attributed to muni bond interest.

Muni Bond Funds and ETFs

Investors in higher tax brackets often invest in muni bonds in their taxable accounts. Although muni bonds typically have a lower yield than Treasuries and corporate bonds, they often still pay more after-tax when the investor is in a high tax bracket.

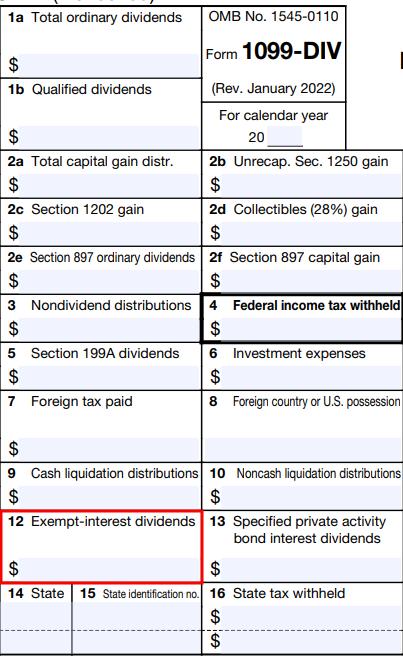

Most people invest in muni bonds through muni bond funds and ETFs. The broker reports fund dividends attributed to muni bond interest separately in Box 12 on a 1099-DIV form.

Your tax software knows about this special box. Whether you import your 1099 forms or enter them manually, the tax software will automatically mark the amount as tax-exempt for federal income tax.

Federal Tax-Free vs. State Tax-Free

It’s a different story for state income tax.

How a state taxes muni bond interest varies by state. Some jurisdictions, such as Washington DC, exempt interest from all muni bonds. Most states exempt interest only from muni bonds issued by entities within the state or in U.S. territories (Puerto Rico, Guam, Virgin Islands, and American Samoa). Some states have a reciprocal arrangement — “We don’t tax interest from your muni bonds if you don’t tax interest from our muni bonds.”

You need to know how much of the federally tax-exempt dividends on the 1099-DIV form is also state tax-exempt. Your tax software doesn’t know it only by the number on the form.

The broker supplies a breakdown of the tax-exempt dividends by source. It’s up to you to determine how much of the federal tax-exempt dividends from each source came from state tax-exempt muni bonds.

Suppose you own two funds in a taxable brokerage account that paid $2,500 in total tax-exempt dividends as reported in Box 12 of the 1099-DIV form. Your goal is to fill out a table like this with the percentage of state tax-exempt dividends for each fund and calculate your total state tax-exempt dividends:

| Fund | Total Tax-Free Dividend | % State Tax-Free | State Tax-Free Dividend |

|---|---|---|---|

| Fund A | $1,500 | 100% | $1,500 |

| Fund B | $1,000 | 25% | $250 |

| Total | $2,500 | $1,750 |

When you give the result to your tax software, it then knows to exempt that portion of federal tax-exempt dividends from state income tax.

State % from Fund Managers

Although the 1099-DIV form and the dividend breakdown by funds are provided by the broker, you’ll have to get the number for the “% State Tax-Free” column from the managers of your mutual funds and ETFs.

If you own Vanguard mutual funds or ETFs in a Fidelity brokerage account, you get this information from Vanguard, not from Fidelity. Similarly, if you own iShares ETFs in a Charles Schwab brokerage account, you get the information from iShares, not from Charles Schwab.

Google “[name of fund management company] tax center” to find the information from the fund manager.

For instance, the Vanguard document shows that dividends from the Vanguard New York Municipal Money Market Fund are 100% tax-exempt in New York in 2025, and 24.64% of the dividends from the Vanguard Tax-Exempt Bond Index Fund came from New York muni bonds.

Vanguard

Vanguard publishes the information in its Tax Season Calendar. Look for “Tax-exempt interest dividends by state for Vanguard Municipal Bond funds and Vanguard Tax-Managed Balanced Fund.”

Fidelity

Fidelity publishes the information in Fidelity Mutual Fund Tax Information. Look for “Tax-Exempt Income From Fidelity Funds.”

Charles Schwab

Charles Schwab Asset Management publishes the information in its Distributions and Tax Center. Look for “2025 Supplementary Tax Information.”

iShares

iShares publishes the information in its Tax Library. Look for “2025 Tax Exempt Interest by State.”

State-Specific Requirements

Be sure to read the fine print. Just because a fund lists a percentage for your state doesn’t mean the fund’s dividends are state tax-exempt. Some states have additional requirements before you can claim the tax exemption.

For instance, the Vanguard tax-exempt income document includes these footnotes:

California and Minnesota require funds to meet in-state minimum threshold to be exempt from state tax. The funds in Table 2 do not meet this criteria [sic].

Illinois does not exempt the portion of dividends from state or local obligations held indirectly through a mutual fund.

This means even though the table shows that a portion of the dividends from the Vanguard Tax-Exempt Bond Index Fund came from California muni bonds, California exempts none of it because the fund didn’t meet the state’s additional requirements. If you live in Illinois, you can’t claim any Illinois tax exemption on muni fund dividends, period.

Tax Software

You need to give the result to your tax software after you get the “% State Tax-Exempt” for each fund and calculate your State Tax-Exempt dividend with a table like this:

| Fund | Total Tax-Free Dividend | % State Tax-Free | State Tax-Free Dividend |

|---|---|---|---|

| Fund A | $1,500 | 100% | $1,500 |

| Fund B | $1,000 | 25% | $250 |

| Total | $2,500 | | $1,750 |

TurboTax

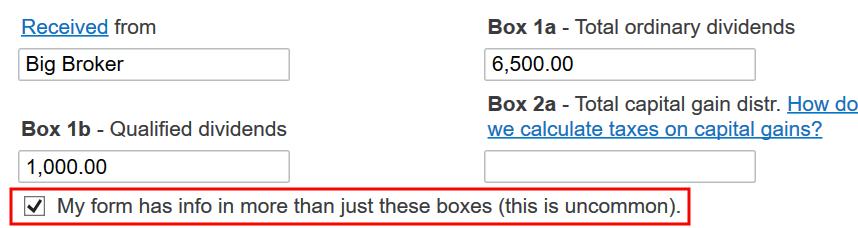

If you enter your 1099-DIV form manually, be sure to check the box for additional inputs to enter tax-exempt dividends in Box 12.

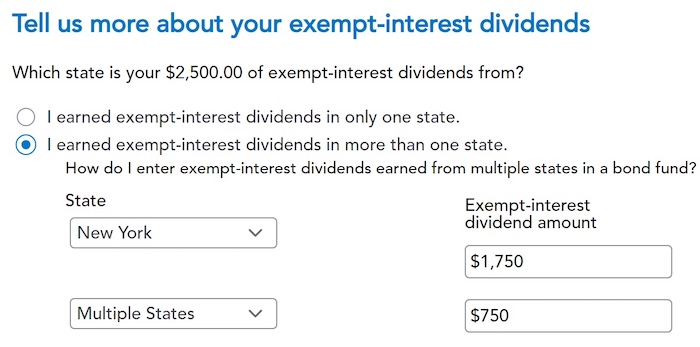

Unless your tax-exempt dividends came from a state-specific fund that’s 100% tax-exempt in your state, choose “I earned exempt-interest dividends in more than one state” and break it down between your state and “Multiple States.” TurboTax will exempt the portion for your state on your state income tax return.

H&R Block

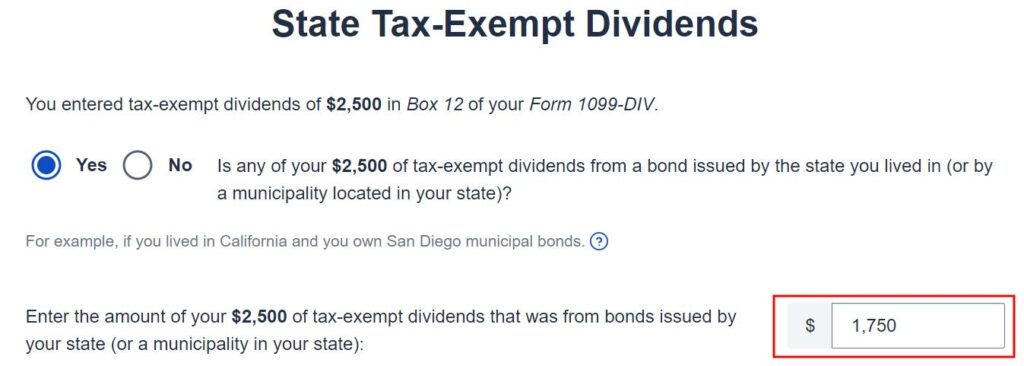

After you enter the tax-exempt dividends in Box 12 of a 1099-DIV form, H&R Block asks you how much of it is also state tax-exempt.

FreeTaxUSA

After you enter the amount of tax-exempt dividends in Box 12 of a 1099-DIV form, FreeTaxUSA asks how much of it is also state tax-exempt.

***

Most of the work in calculating the amount of fund dividends exempt from state taxes is in hunting down the percentage of state tax-exempt income for each fund and ETF in your taxable brokerage account. Tax software doesn’t know it only from the tax forms.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

CH says

I’m in California. I often buy SWKXX which is Schwab California Municipal Money Fund and pays an interest rate of 2.98% at the moment. This is exempt from federal and CA taxes. However there’s also SWYXX which is Schwab New York Municipal Money Fund and pays 3.44% at the moment. Is SWYXX also exempt from federal and CA taxes? If so, seems like I should rather invest in it vs SWKXX.

Harry Sit says

Look at the supplemental information from Schwab. Schwab New York Municipal Money Fund is 100% New York. It’s exempt from federal income tax but not from CA taxes.

Steve says

Thank you for the article.

A learning I have had on this subject:

In some states, capital gains from the sale of federally-exempt securities, including those from a mutual fund, may also be exempt from income in the state. Fidelity, on its page of “Tax Exempt Income from Fidelity Mutual Funds”, provides state-specific information detailing the percentage of municipal fund cap gains distributions that are exempt in the state.

Vanguard provides information about exempt percentages of ordinary dividends, but not exempt percentages of its municipal funds cap gain distributions.

Also, for Fidelity mutual funds held in Fidelity brokerage accounts, amounts of state exempt municipal ordinary dividends for your state of residence are included in the 1099 supplemental information.

Val says

Unfortunately, IL doesn’t allow for such deduction.