[Updated for the 2025 tax year.]

When you earn interest from U.S. Treasuries and other government securities in a taxable account, the interest is exempt from state and local taxes. How to claim the state and local tax exemption depends on whether you hold Treasuries directly or through mutual funds and ETFs.

Treasury Bills and Notes

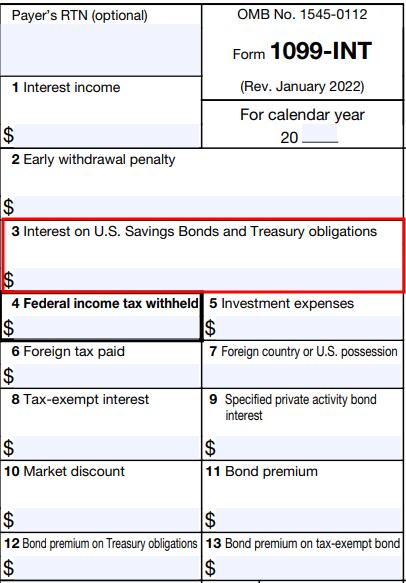

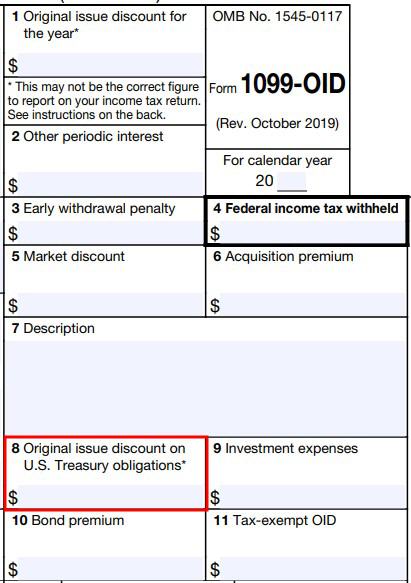

When you buy individual Treasuries in a taxable brokerage account — see How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy Treasury Bills & Notes On the Secondary Market — you’ll see the interest reported on a 1099-INT form and/or a 1099-OID form (for TIPS).

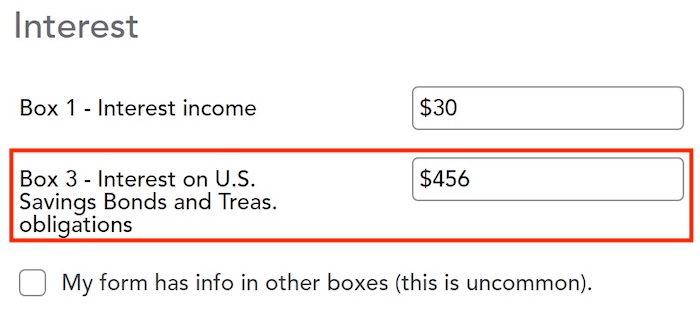

Interest from Treasuries is reported separately in Box 3 on a 1099-INT form.

Inflation adjustment for TIPS is reported separately in Box 8 on a 1099-OID form.

Your tax software knows about these special boxes in the tax forms. Whether you import the tax forms from your broker or enter them manually, the software will automatically mark the interest as exempt from your state income tax.

TurboTax will automatically make the interest in Box 3 of your 1099-INT form state tax-free.

Savings Bonds

TreasuryDirect issues a 1099 form when you cash out savings bonds in your TreasuryDirect account. See Report I Bonds Interest in TurboTax, H&R Block, FreeTaxUSA for how to get the 1099 form and enter the interest in tax software.

Mutual Funds and ETFs

Many money market funds, bond funds, and bond ETFs hold Treasuries and other U.S. government securities. If you have these funds in a taxable brokerage account, a significant portion of the funds’ dividends may have come from Treasuries and other U.S. government securities. The portion of fund dividends attributed to interest from those holdings isn’t qualified dividends. It’s taxed at normal tax rates at the federal level, but it’s exempt from state and local taxes.

When you have multiple mutual funds or ETFs in a taxable brokerage account, the broker reports dividends received from all sources on one 1099-DIV form. The 1099-DIV form doesn’t have a special box to break out dividends attributed to U.S. government securities. Your tax software won’t know how much of the dividends were exempt from state and local taxes purely by the numbers on the 1099-DIV form.

The broker supplies a breakdown of the dividends by source. It’s up to you to determine how much of the dividends from each source came from Treasuries and other U.S. government securities. Suppose you own four funds in a taxable brokerage account that paid $6,500 in total dividends. Your goal is to fill out a table like this with the percentage of dividends from government securities for each fund and calculate your total dividends attributed to government securities:

| Fund | Total Dividend | % from Government Securities | $ from Government Securities |

|---|---|---|---|

| Fund A | $500 | 0% | $0 |

| Fund B | $1,000 | 65% | $650 |

| Fund C | $2,000 | 10% | $200 |

| Fund D | $3,000 | 90% | $2,700 |

| Total | $6,500 | $3,550 |

When you give the result to your tax software, it then knows to exempt that portion of the dividends from state and local taxes.

Government % from Fund Managers

Although the 1099-DIV form and the dividend breakdown by funds are provided by the broker, you’ll have to get the number for the “% from Government Securities” column from the managers of your mutual funds and ETFs.

If you own Vanguard mutual funds or ETFs in a Fidelity brokerage account, you get this information from Vanguard, not from Fidelity. Similarly, if you own iShares ETFs in a Charles Schwab brokerage account, you get the information from iShares, not from Charles Schwab.

Google “[name of fund management company] tax center” to find the information from the fund manager.

Vanguard

Vanguard publishes the information in its Tax Season Calendar. Look for “U.S. government obligations information.”

Fidelity

Fidelity publishes the information in Fidelity Mutual Fund Tax Information. Look for “Percentage of Income From U.S. Government Securities.”

Charles Schwab

Charles Schwab Asset Management publishes the information in its Distributions and tax resources. Look for “2025 Supplementary Tax Information.”

iShares

iShares manages the popular short-term Treasuries ETF SGOV and many other fixed income ETFs. It publishes the information in its Tax Library. Look for “2025 U.S. Government Source Income Information.”

State Street

State Street Investment Management publishes the information under the Document tab of its SPDR ETFs (for example, BIL). Look for “SPDR ICI Tax Summary (Secondary).” It’s an Excel file.

WisdomTree

WisdomTree manages the floating-rate Treasuries ETF USFR. It publishes the information in the Fact Sheets & Reports section of its website. Look for “WisdomTree Fund Distribution 2025 – Tax Supplement” under Fund Reports & Schedules -> Tax Supplement Reports. It’s an Excel file.

BlackRock Liquidity Funds

BlackRock Liquidity Funds: Treasury Trust (TTTXX) is a popular money market fund available at Merrill Edge. BlackRock has the information in its Tax Resources. Look for “BlackRock Liquidity Funds annual tax letter.”

CA, NY, and CT Residents

California, New York, and Connecticut have additional requirements for exempting fund dividends earned from government securities. The fund management company will note in its published information whether a fund met the requirements of CA, NY, and CT. If a fund didn’t meet the requirements, the government securities percentage is treated as 0% for CA, NY, and CT residents.

For example, Vanguard Federal Money Market Fund earned 66.61% of its income from U.S. government obligations in 2025. Because it met the requirements of CA, NY, and CT, investors in these three states, as well as other states, don’t pay state or local income tax on 66.61% of this fund’s dividends.

Enter Into Tax Software

You need to give the result to your tax software after you get the “% from Government Securities” for each fund and calculate your dividend from government securities with a table like this:

| Fund | Total Dividend | % from Government Securities | $ from Government Securities |

|---|---|---|---|

| Fund A | $500 | 0% | $0 |

| Fund B | $1,000 | 65% | $650 |

| Fund C | $2,000 | 10% | $200 |

| Fund D | $3,000 | 90% | $2,700 |

| Total | $6,500 | $3,550 |

It’s easy to miss the entry point for this input in the tax software unless you really look for it.

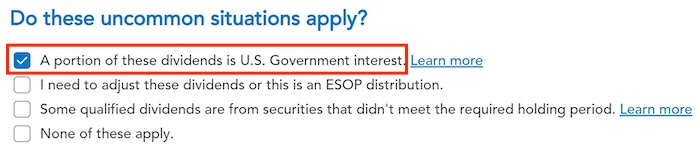

TurboTax

After you import or enter the 1099-DIV form in TurboTax desktop software, you need to check a box to say that a portion of the dividends is U.S. Government interest. It’s easy to miss because TurboTax says it’s uncommon, which isn’t true.

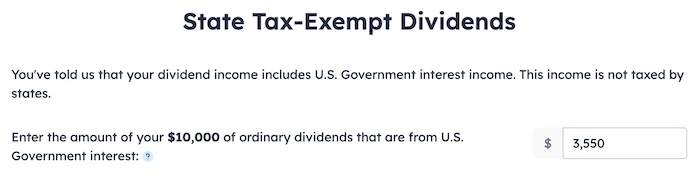

Now you enter the amount you calculated in your table.

Repeat this process for your other 1099-DIV forms.

H&R Block

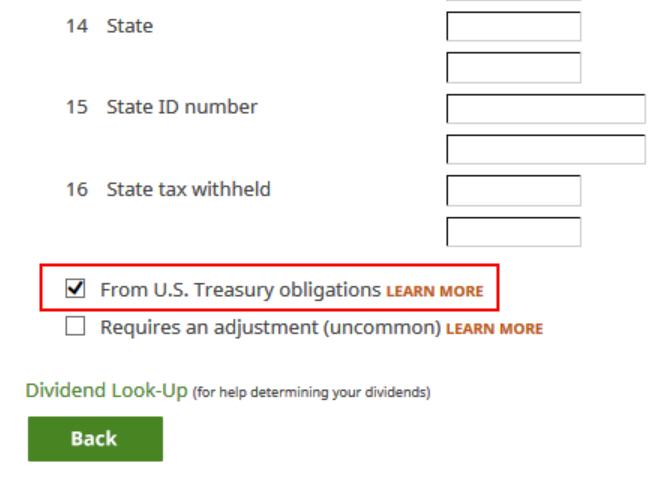

H&R Block desktop software shows a checkbox at the bottom of the 1099-DIV entries. This field doesn’t come in the import. It’s easy to miss because it’s at the bottom of a long form. You have to really look for it.

Although the wording gives the impression of saying 100% of the dividends came from U.S. Treasury obligations, checking the box only says that a portion of the dividends came from U.S. Treasury obligations. Check the box and click on Next.

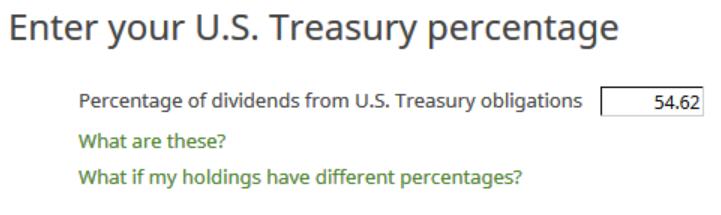

This shows up only if you check that box on the previous screen. Instead of asking for a dollar amount, H&R Block goes by a percentage. It forces you to do a bit of math. In our example, $3,550 from Treasuries divided by $6,500 total ordinary dividends is 54.62%. So we enter 54.62.

Although the on-screen help pop-up says you should split your 1099-DIV form when it includes several funds with different U.S. Treasury percentages, it’s unnecessary to split it. It’s much easier to keep a table on the side and do a bit of simple math, as I’m showing here.

Repeat this process for every 1099-DIV. H&R Block software will keep a tally of your state tax-exempt dividends.

FreeTaxUSA

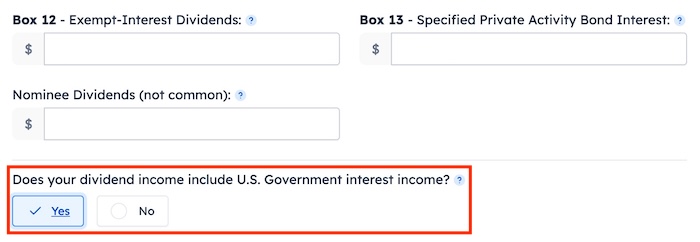

FreeTaxUSA has a radio button at the bottom of the 1099-DIV entries. It’s easy to miss because it’s at the bottom of a long form. You have to really look for it.

Now you give the dollar amount from your table.

Agency Bonds

Besides Treasuries, certain government agency bonds are also exempt from state income tax:

- Federal Farm Credit Bank (FFCB)

- Federal Home Loan Bank (FHLB)

If you hold individual bonds (not through a fund) from these agencies, the interest from these bonds is reported on the 1099-INT form, but it’s not included in Box 3, as interest from Treasuries and Savings Bonds does. The 1099-INT form is a federal form. It’s not designed to help you with state tax exemption. You should adjust the interest income in the state program of your tax software to make the interest from FFCB, FHLB, and TVA bonds exempt from the state tax.

Do this after you have entered all the 1099-INT and 1099-DIV forms in the federal program. Where exactly you do it in the state program differs by state. I’m using my state (Utah) as an example. Look for similar spots in the state program for your state.

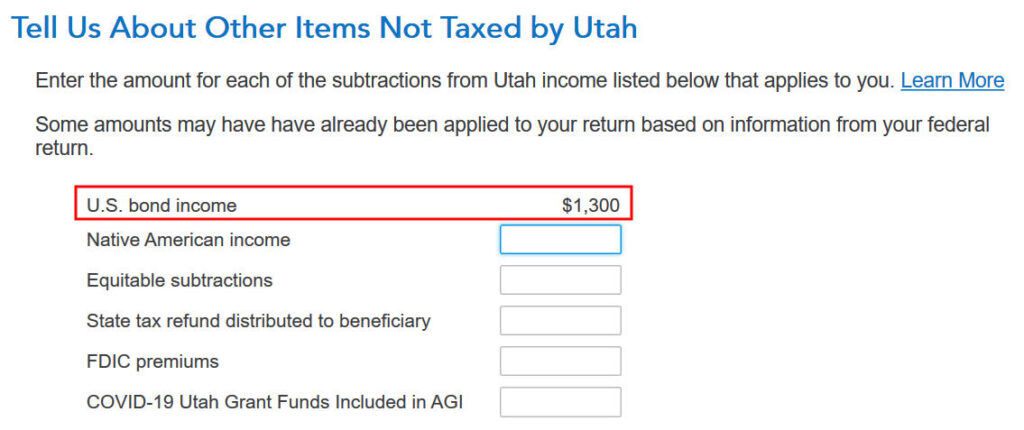

TurboTax

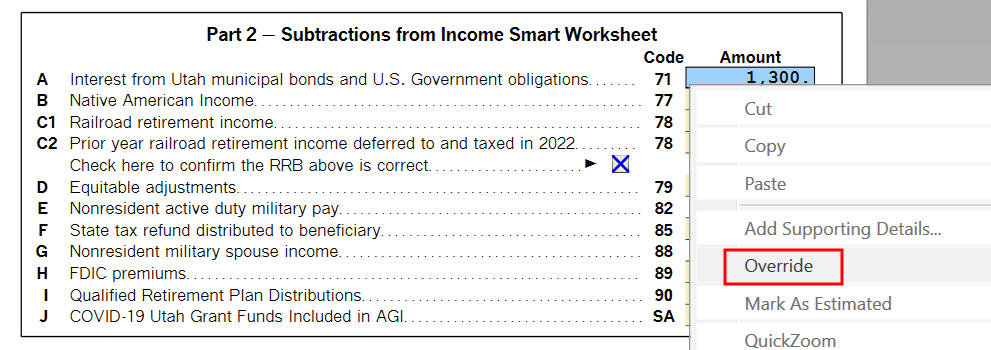

When it comes to adjustments for federal income not taxed by the state (“subtractions”), TurboTax calculates the Treasury interest from the 1099-INT and 1099-DIV entries in the federal program. You can’t change the number here directly, but you can go into the Forms mode and look at it there.

The number in the interview comes from a “Subtractions from Income Smart Worksheet.” Right-click on that field and click on “Override.” Add the interest from state tax-exempt agency bonds. Overriding a number in a worksheet doesn’t prevent you from e-filing.

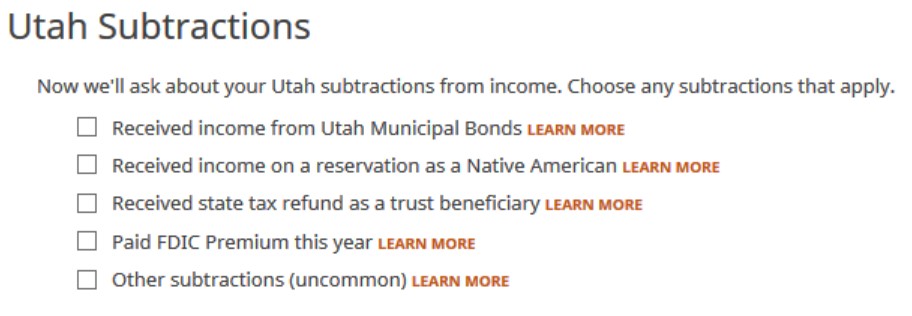

H&R Block

H&R Block software also shows a list of subtractions, but U.S. government bond interest isn’t one of them.

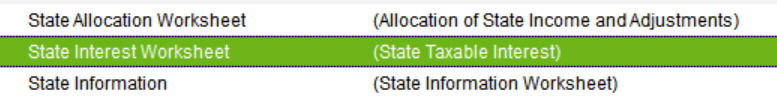

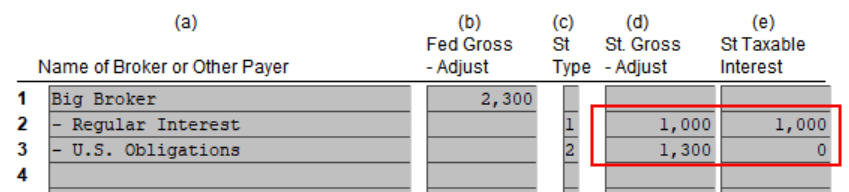

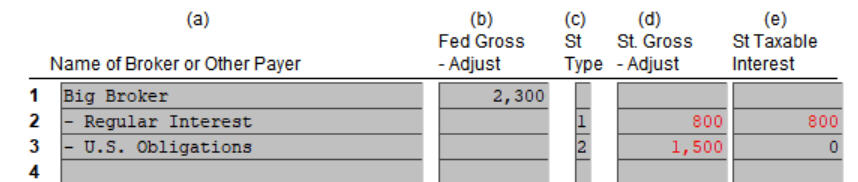

There’s a “State Interest Worksheet” in the list of forms.

The worksheet breaks down the total interest between regular interest (from 1099-INT Box 1) and U.S. Obligations (from 1099-INT Box 3).

You can override the allocation between regular interest and U.S. Obligations. Overriding numbers on a worksheet does not prevent e-filing.

***

Most of the work in calculating the amount of the fund dividends exempt from state and local taxes is in hunting down the percentage of income from U.S. government securities for each fund and ETF in your taxable brokerage account. You need to give the calculated amount to your tax software, which doesn’t make it obvious where the number should go.

A similar process also applies to muni bond funds and ETFs. A portion of the fund dividends is exempt from both federal income tax and state income tax (“double tax-free”). I cover that topic in a separate post State Tax-Exempt Muni Bond Interest from Mutual Funds and ETFs.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Steve says

The Turbotax puzzler for 2025 is: how do you mark the checkbox in the new statement at the top of the Federal form 1040?

“Check here if your main home, and your spouse’s if filing a joint return, was in the U.S. for more than half of 2025.”

And, yes, it can be done on Turbotax.

Adam says

Box 1a of the 1099-DIV is labeled “ordinary dividends” but also includes short-term capital gain distributions from mutual funds. (Long-term capital gain distributions are listed separately in box 2a and are not a factor for this question.)

Is it necessary to subtract the short-term capital gain distribution amount from box 1a before multiplying by the USGO percentage provided by the fund company?

For sake of example, let’s say that my Vanguard 1099-DIV box 1a lists $1000 of “ordinary dividends”. However, on the “Detail for Dividends and Distributions” page later in the document, it breaks that $1000 down into $750 of dividend distributions and $250 of short-term capital gain distributions. The USGO percentage for that fund is listed as 60%. Do I take 60% of $1000, or 60% of $750, as my state tax exempt amount?

Steve says

No. Do not subtract STCG distribution from box 1a amount before multiplying by USGO %.

Adam says

Steve, can you provide a source or rationale for that? Are you saying that the STCG distributions count as income on US government obligations? If that is the case, the why don’t the LTCG distributions count?

Steve says

STCG and LTCG distributions of US govt. securities are not exempt from income in most states. (They are exempt in some states.)

–The following applies to US govt income from mutual funds, not from individually held US govt obligations–

The question is how the financial company holding your mutual fund directs you to compute the amount of the exempt income. Fidelity’s instructions for its funds in 2025 specifically provide a percentage to multiply against the “ordinary dividends” from the fund.

On a 2025 Fidelity 1099-DIV supplemental info sheet I have, the box 1a amount (labeled “ordinary distributions”) has 2 additional sub amounts: “dividend distributions” and “short term capital gains”. Fidelity instructs you to multiply its percentage times “ordinary distributions”.

In 2025 instructions from VG regarding US govt security income, it says for VG mutual fund accounts, use box 1a. For VG brokerage fund accounts it says subtract from the Total Dividends and distributions any Long-term capital gains, or any Nondividend distributions, or both.

I believe the links for the 2025 US govt info sheets are shown in Harry’s post above.

Steve says

Correction to my post above.

The box 1a amount on Fidelity supplemental information is labeled “ordinary dividends”, not “ordinary distributions”.

Adam says

If you go back a few years, Vanguard’s USGO instructions said to only apply the percentage to dividend income, not STCG distributions or LTCG distributions. Now they only say to excluded LTCG distributions and nondividend distributions. No mention of STCG distributions. I am curious why their guidance changed.

From their USGO instructions for tax year 2021: “The percentages provided apply only to income distributions (dividends); they don’t apply to capital gains distributions (whether long-term or short-term)”

Harry Sit says

It depends on how the fund manager reports the percentage. If a fund distributed $750 in dividends and $250 in short-term capital gains, and 100% of the dividends were from US government obligations, do they report 100% or 75%? It sounds like Vanguard used to report 100% and now they report 75%. 100% would be against only income dividends, and 75% would be against ordinary distributions including short-term gains. In your case, if you use the reported percentage against the total 1a amount, does it exceed the income dividends? If not, I would go with the assumption that the reported percentage was already calculated off of the total amount.

Steve says

@adam: I would assume that if Vanguard does not believe/report STCG from US govt obligations counts as ‘exempt US income’, the percentage Vanguard provides to use with Box 1a Income Dividends has been adjusted for that assumption.

Posts from earlier years in this comments thread indicate that some states do exempt gains from sale of US govt obligations, as well as interest.

Adam says

I have considered the possibility that the percentage already accounts for the fact that some portion of box 1a consists of STCG income rather than dividend income, however that fails when you consider the possibility that a shareholder of the fund could have received dividend distributions between January and November, then sold their shares of the fund before the STCG distribution in December. Their box 1a would consist solely of dividend income, but the USGO percentage is published as a constant for all shareholders.

In the end, I guess I will just take the current instructions at face value and not subtract the STCG income from the box 1a amount. It’s not like my state would have any way of really verifying that short of a fairly thorough audit.

Barry says

Harry, in your comments about H&R Block you wrote: “Although the on-screen help pop-up says you should split your 1099-DIV form when it includes several funds with different U.S. Treasury percentages, it’s unnecessary to split it. It’s much easier to keep a table on the side and do a bit of simple math, as I’m showing here.” I may be misunderstanding, but I don’t think this is true in cases such as mine: My US Treasury obligations percentage of total dividends is less than 50%, let’s call it 40%, coming from VUSXX, and I live in California with its 50% or more rule. So my assumption has been that if entered 40% as you suggest, it would tell my CA state program not to exempt any portion of my dividends. So that’s why I’ve followed H&R Block’s advice and reported VUSXX as a standalone fund with, this year, 100% coming from Treasuries.

Harry Sit says

That’s not the right assumption. Try entering 40% and jump over to the CA program to see what happens there. You can always back out the 40% and do the split.

It’s not that bad to split a 1099-DIV into two if you have only one fund that distributes state tax-exempt income. It gets unwieldy when your one form covers five funds.

Barry says

Harry – So I am having problems with the 2025 H&R Block download version, last updated today, Feb 20, 2025. While the CA tax return is properly picking up and exempting Interest Income generated by a 1 yr US Treasury bonds held to maturity, it is not picking up ANY of my Dividend Income attributable to Treasury bond mutual funds properly entered as separate funds, with the US obligations box checked, and then the proper 100% entered on the next page. I went back and checked my 2024 return where I had the same funds and entered the same way, and this was picked up on the CA return. I asked H&R Block’s new AI Help, and it was no help other than to say I could manually override if I was sure I had not made an entry mistake. Any suggestions before I take that maybe complicated step of manual override? VERY frustrating.

Barry says

Correction: I updated on Feb 20, 2026.

Di says

Regarding the non-taxable portion of dividends which are attributable to US government obligations, does anyone know how to apply the percentages to the income from a Roth conversion? In NJ, I understand that a portion would be considered non-taxable. Also, does this apply to an RMD from the TSP?

shygamer says

In this year’s H&R block download version, you have the option of entering the exact amount of U.S. obligations sold under the state income subtractions section by checking the “Gain from the sale of U.S. obligations box”. This was an option years ago that they dropped (at least I couldn’t find it the past few years) but is again available this year. With this option you don’t have to do any math and enter a percentage in the federal income section. Depending on your data with the percentage method, you may not be able to enter the exact federal obligations dollar amount due to rounding because they only allow you to enter the percentage to a maximum of 2 decimal places.

Harry Sit says

Which state? We can’t say for sure that every state program has this direct input.

shygamer says

Virginia.

Di says

Thank you for sharing this. I did find that section for the dividends from our taxable accounts and included their respective federal obligation percentages in the software. My problem is that I don’t know what to do with dividends from the RMD from the TSP and the income from a Roth Conversion.

Harry Sit says

RMD and Roth conversion aren’t dividends. RMD from TSP is a retirement plan distribution, similar to a pension. Roth conversion is treated as an IRA withdrawal. How a state taxes income from a pension or IRA withdrawal varies by the specifics of state law.

Di says

Thank you.

In NJ, where we live, a portion of the dividends from IRA withdrawals are considered non-taxable when the dividends are derived from federal obligations. We just don’t know how to calculate the portion. I realize what a TSP, but don’t know if the dividends that were from the G-Fund are considered non-taxable upon withdrawal.

Steve says

In page 9 of this NJ tax publication: https://www.nj.gov/treasury/taxation/pdf/pubs/tgi-ee/git1&2.pdf the guidance about the exemption of US govt income from retirement distributions seems confusing and contradictory to me. In one portion it mentions interest from US govt obligations directly owned in the IRA. In another portion it mentions income from interest and GAINS from US govt obligations held by the fund.

I’m not a NJ resident. Maybe there is a worksheet that shows how NJ wants retirement distributions adjusted on NJ tax returns for such US govt income.

Good luck!

Di says

Even email communication from the Regulatory Services at the Division of Taxation in NJ is vague. I wish the worksheet helped, but it doesn’t. Thanks for your reply.

Walter says

The link for Vanguard is pointing to the 2025 PDF instead of the 2026 version:

https://advisors.vanguard.com/content/dam/fas/pdfs/USGO_012025.pdf

should be https://advisors.vanguard.com/content/dam/fas/pdfs/USGO_012026.pdf