I showed how to buy new-issue Treasury bills and notes in the previous post How To Buy Treasury Bills & Notes Without Fee at Online Brokers. Buying a new issue is the easiest and the least expensive way for most people. You should try to stay with new issues for the most part.

However, sometimes it’s necessary to buy Treasuries on the secondary market. Major online brokers such as Fidelity, Vanguard, and Charles Schwab don’t charge fees for buying Treasuries on the secondary market either. I show you how to do it in this post.

What Is the Secondary Market

Buying on the secondary market is like buying a used car. Someone bought the Treasuries when the government sold them brand new. Now they’re reselling them. You’re buying these “pre-owned” Treasuries when you buy on the secondary market.

You’re not getting an inferior product when you buy “pre-owned” Treasuries on the secondary market. The U.S. government still guarantees full payments of both principal and interest. As such, you’re not getting a bargain either when you buy on the secondary market as opposed to buying new issues.

Why Secondary Market

Two scenarios make it necessary to buy on the secondary market.

Term Not Available As New Issue

New-issue Treasuries come in these maturities:

- 1-month (4-week)

- 2-month (8-week)

- 3-month (13-week)

- 4-month (17-week)

- 6-month (26-week)

- 1-year (52-week)

- 2-year

- 3-year

- 5-year

- 7-year

- 10-year

- 20-year

- 30-year

If you want a Treasury that matures in 9 months, 18 months, or 4 years, you won’t be able to get it as a new issue. Your only option is to buy it on the secondary market. A 1-year Treasury issued 3 months ago has 9 months to run by now. It’ll be your 9-month Treasury when you buy it on the secondary market.

Don’t Want to Wait

The government sells new-issue Treasuries on a preset schedule. Short-term Treasury Bills come out weekly. Longer maturities (1-year and up) come out only once a month. If you’d like to buy them today and don’t want to wait until the next scheduled sale, your only option is to buy on the secondary market.

For example, as I’m writing this, the next scheduled sale for a 1-year (52-week) Treasury will be on November 29 and the one after that will be on December 27. If you miss the November 29 sale and you don’t want to wait until December 27, you’ll have to buy it on the secondary market.

TIPS

The available terms and the sales schedule especially affect TIPS — the inflation-protected Treasury bonds. New issues of TIPS bonds only come in these maturities and frequencies currently:

| Maturity | New Issue Frequency |

|---|---|

| 5-year | 4 times a year (April, June, October, December) |

| 10-year | 6 times a year (January, March, May, July, September, November) |

| 30-year | Twice a year (February, August) |

If you want a 2-year TIPS or if you want a 5-year TIPS in January, you’ll have to buy it on the secondary market. On the other hand, if the term you want is available and a new issue is coming up soon, it’s not necessary to buy on the secondary market.

Known Price and Yield

When you buy a new issue, you place your order without knowing exactly what the price and yield will be, because the price and yield are determined by an auction (see the previous post How To Buy Treasury Bills & Notes Without Fee at Online Brokers). You’re trusting you’ll get a good price and yield because you’ll pay the same price on your small order as banks buying $100 million. Prices can move between the time you place the order and the time the auction completes. The actual yield you get may be higher or lower than the yield you see when you place the order.

When you buy on the secondary market, you get a quote before you buy. You know exactly what yield you’re getting. Some people prefer this certainty as opposed to not knowing what price and yield they’ll get on new issues.

This third reason to buy on the secondary market is only personal preference. Although you can’t know the price and yield on a new issue ahead of time, the actual yield you end up getting is often better than the yield you can get on the secondary market.

Not All Brokers Offer New Issues

Another reason to buy on the secondary market is that not all brokers offer new-issue Treasuries. Merrill Edge, for example, doesn’t offer new-issue Treasuries online. You have to call to have a representative place the order if you want a new issue, but you can buy on the secondary market online. If you must use Merrill Edge, buying on the secondary market online is more convenient than calling a representative to buy a new issue.

You can buy new-issue Treasuries online without a fee at Vanguard, Fidelity, Charles Schwab, and E*Trade. See detailed steps with screenshots in How To Buy Treasury Bills & Notes Without Fee at Online Brokers.

The Downside

Buying on the secondary market has some disadvantages.

Minimum Order Size

While you can always buy new issues with a minimum of $1,000 in face value, sometimes a Treasury on the secondary market requires a minimum order size of $50,000 or $100,000 in face value. Bond dealers put out a high minimum when they can’t be bothered to sell you a smaller amount regardless of the price. This minimum also depends on which broker you use. Charles Schwab usually has better availability for small orders.

It doesn’t happen all the time in all maturities but you may have trouble finding something to buy on the secondary market when you’re trying to buy a small amount.

Bid/Ask Spread

If the Treasury you want is available for your order size, the biggest disadvantage is the bid/ask spread. You’re buying from bond dealers when you buy Treasuries on the secondary market. The difference between the price you pay when you buy and the price you receive when you sell is the bid/ask spread. The true price is somewhere in between. You’re paying a slightly higher price than the true price when you buy on the secondary market.

For example, here’s a quote for a 1-year Treasury on the secondary market:

| Price | Yield | |

|---|---|---|

| Bid | 95.428 | 4.814% |

| Ask | 95.493 | 4.743% |

You get a yield of 4.74% when you buy (paying the ask price) but you must pay a yield of 4.81% when you sell (receiving the bid price). The fair value is somewhere in between. Suppose it’s 4.77%, which means you’re getting a yield of about 0.03% lower than the fair value when you buy on the secondary market.

Everyone pays the same price and gets the same yield when they buy a new issue. There’s no bid/ask spread. It may be OK if you pay a bid/ask spread once to buy a 10-year bond and hold it for 10 years but if you pay a bid/ask spread every three months, it adds up fast.

Complicates Taxes

When you buy Treasury notes or bonds in a taxable account, buying them on the secondary market adds more complications to your taxes than buying new issues. You’ll need to know what to do with accrued interest and, if applicable, amortizable bond premium (see IRS Schedule B Instructions). They’re not impossible to deal with but it’s still extra work. If you’d like to keep your taxes simple, see Which Treasury to Buy While Keeping Your Taxes Simple.

This tax complication doesn’t apply to Treasury Bills, i.e. those without a coupon and mature within one year of the original issue date. It’s OK to buy Treasury Bills on the secondary market and hold them to maturity.

Selling Treasuries in a taxable account on the secondary market before they mature adds yet more complications to your taxes. If you must buy Treasuries on the secondary market in a taxable account, at least hold them to maturity and don’t sell them on the secondary market.

Buying or selling on the secondary market in an IRA doesn’t affect your taxes.

Must Place Order When the Market Is Open

When you buy a new issue, you need to place your order during an order window but you can do it in the evening or on weekends. You’re good to go as long as your order goes in by the night before the auction date.

When you buy on the secondary market, you must place your order when the bond market is open. That’s typically Monday through Friday, 8:00 a.m. to 5:00 p.m. Eastern Time. This may interfere with your schedule.

No Auto Roll

Some brokers such as Fidelity and Charles Schwab offer an optional “auto roll” feature when you buy new-issue Treasuries. If you enable the feature when you buy, they will automatically place a new order for the same term and face value when this Treasury matures. It’s especially helpful for short-term Treasuries.

This feature is only available for new issues. You can’t “auto roll” when you buy on the secondary market.

Online Brokers

If you have good reasons to buy Treasuries on the secondary market and you understand and accept the downside, here’s how to do it at some major online brokers. Click on the link to jump directly to the section for the broker you use — Fidelity, Vanguard, Charles Schwab, and Merrill Edge.

Fidelity

Here are the steps to buy Treasuries on the secondary market in a Fidelity account. Fidelity doesn’t charge fees for buying Treasuries on the secondary market.

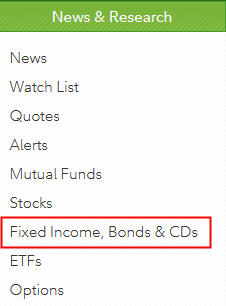

Under News & Research on the top, click on Fixed Income, Bonds & CDs.

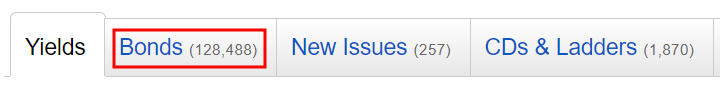

Click on the Bonds tab.

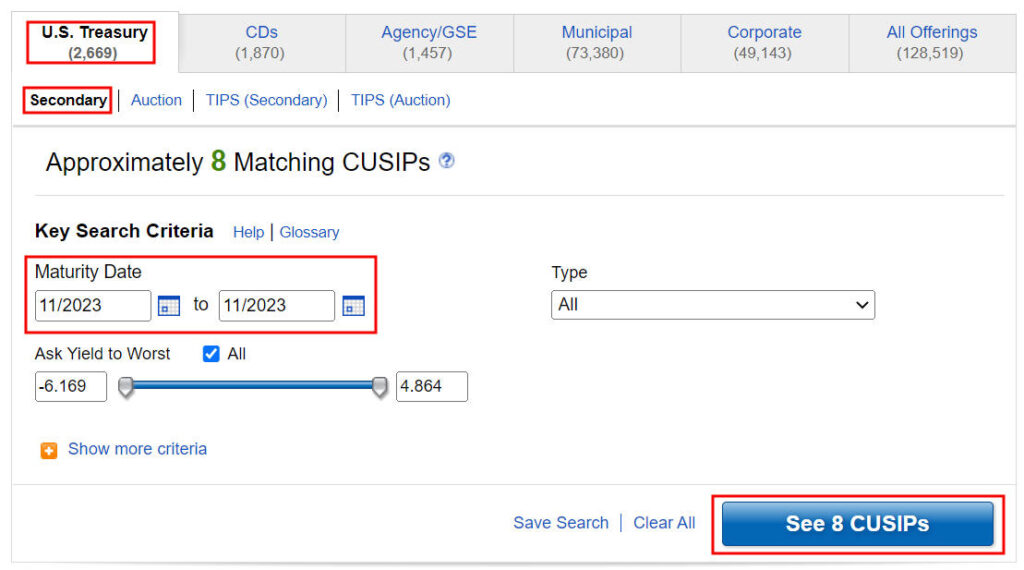

U.S. Treasury and Secondary are selected by default. Suppose you want a Treasury that matures in November 2023. Enter the from-and-to months in the maturity range fields. The button tells you how many Treasuries fit your search. A CUSIP for bonds is like the ticker symbol for stocks.

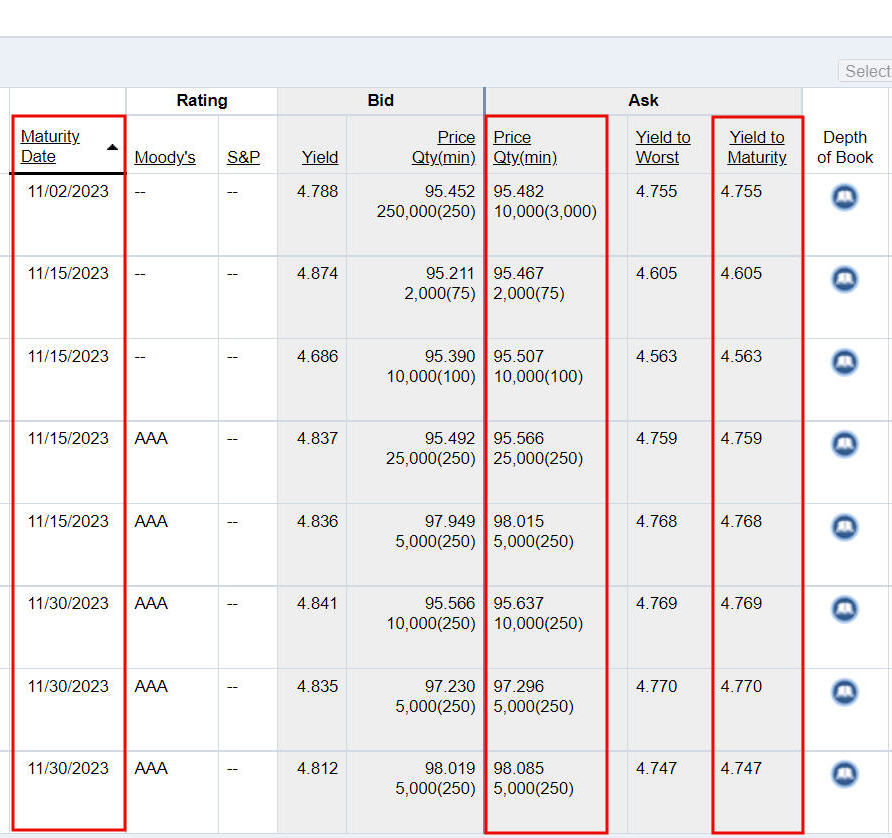

You see a list of Treasuries available. Look at the Ask columns when you’re buying. The Yield to Maturity and Yield to Worst numbers are always the same for Treasuries.

You won’t necessarily get the quoted Yield to Maturity in this table because those yields are for the minimum quantity in the Price | Qty(min) column. For example, you’ll have to buy $3 million of face value in the Treasury Bill maturing on 11/02/2023 to get the 4.755% yield to maturity (3,000 in the parenthesis means $3 million because 1 bond is $1,000 of face value).

The $3 million minimum is only the minimum for the quoted price and yield. You can still buy a smaller quantity. You’ll just have to pay slightly more and get a slightly lower yield than a $3 million order.

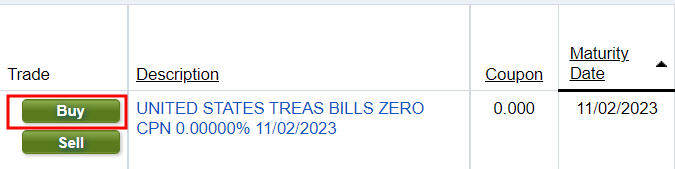

After scanning the results table, suppose you’re interested in the Treasury bill that matures on 11/02/2023. Click on the Buy button next to this Treasury.

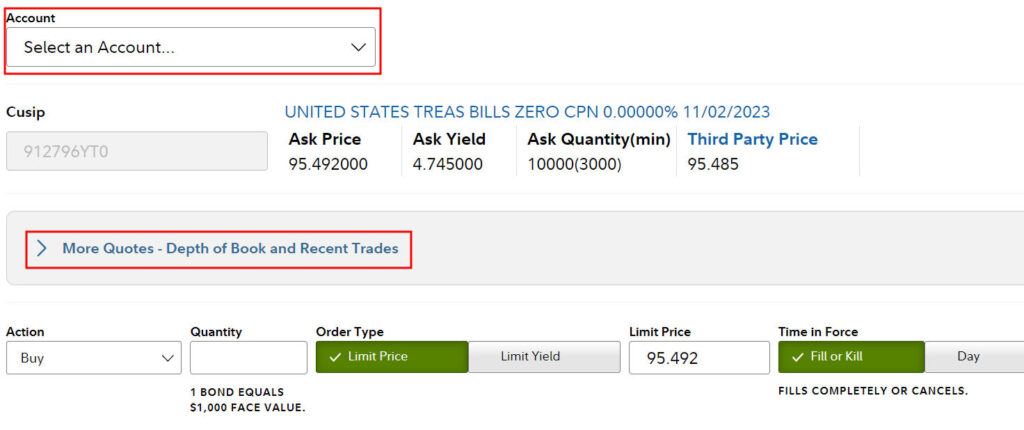

Click on the Account dropdown to select the account in which you will buy this Treasury. Click on More Quotes – Depth of Book and Recent Trades to see the price and yield for the quantity you’ll buy.

Look at the Ask Prices when you’re buying. Find the quote for the minimum quantity you’re buying. If you’re buying $10,000 face value, you won’t get the price and yield for the $3 million minimum or the $250,000 minimum. You’ll pay a slightly higher price and get the yield for a $1,000 minimum order size, which is 4.740% in the screenshot.

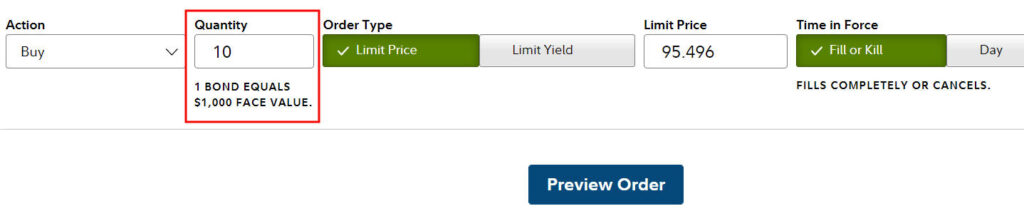

If you’re satisfied with the quoted yield, enter the quantity you’d like to buy. 1 bond is $1,000 face value. To buy $10,000 face value, enter a quantity of 10. The minimum order size is 1 for $1,000 face value.

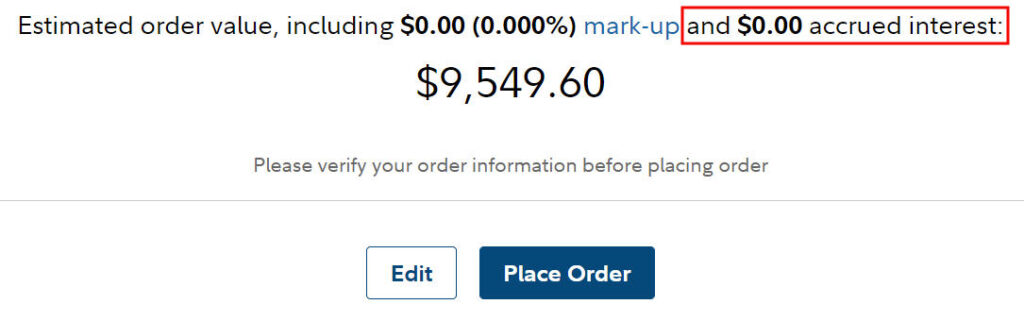

This final screen shows how much you’ll pay for this order. The money will come out of your cash balance and money market funds. Principal and interest payments will automatically go into your cash balance. You can’t “auto-roll” when you buy on the secondary market.

This specific Treasury doesn’t have any accrued interest but some others do. You pay the accrued interest to the current owner and you get it back in the next interest payment. If you’re buying in a taxable account, you’ll have to remember to subtract the accrued interest when you do your taxes. Otherwise you’ll pay more taxes than you really owe.

Vanguard

Follow these steps to buy Treasuries on the secondary market in a Vanguard brokerage account. Vanguard doesn’t charge fees for buying Treasuries on the secondary market.

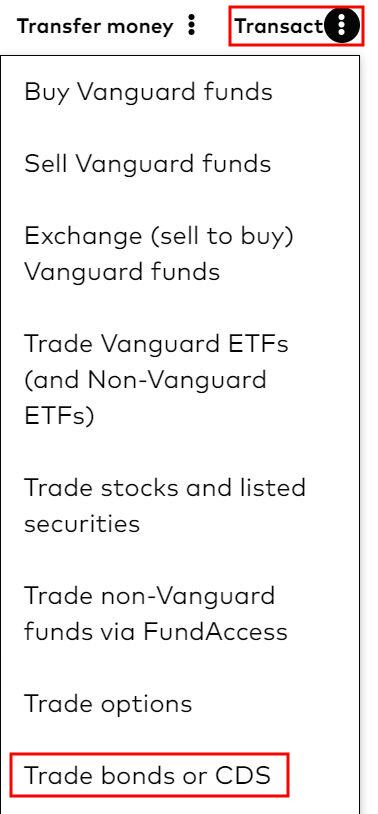

Click on the three dots next to Transact near the top right of your account and scroll toward the bottom. Click on Trade bonds or CDs.

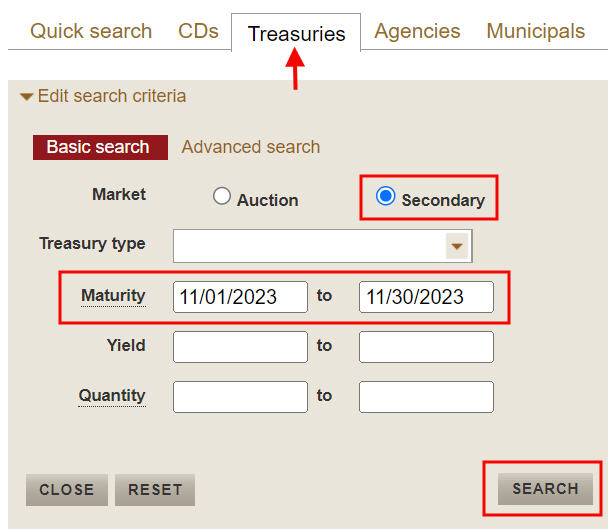

Click on the Treasuries tab. The Secondary radio button is selected by default. Enter the range of maturity dates you’re interested in and click on Search.

You get a list of available Treasuries. You can click on the heading to sort by maturity or yield. Look at the second line in each row when you’re buying.

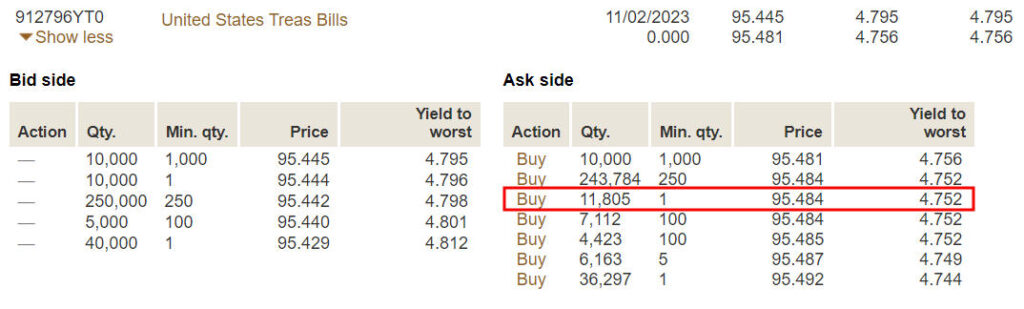

You won’t necessarily get the quoted Yield to Maturity in this table because those yields are for the minimum quantity in the Min. qty column. For example, you’ll have to buy $1 million of face value in the Treasury Bill maturing on 11/02/2023 to get the 4.756% yield to maturity (1,000 means $1 million face value because 1 bond is $1,000 face value).

The $1 million minimum is only the minimum for the quoted price and yield. You can still buy a smaller quantity. You’ll just have to pay slightly more and get a slightly lower yield than a $1 million order.

Suppose you’re interested in the Treasury maturing on 11/02/2023. Click on Show more in that row.

Now you will see the price and yield for smaller orders. Look at the Ask side when you’re buying. Find the quote for the minimum quantity applicable to you. If you’re buying $10,000 face value, you won’t get the price and yield for the $1 million minimum or the $250,000 minimum. You’ll pay a slightly higher price and get the yield for a $1,000 minimum order size, which is 4.752% in the screenshot. Click on the Buy link next to the applicable minimum order size.

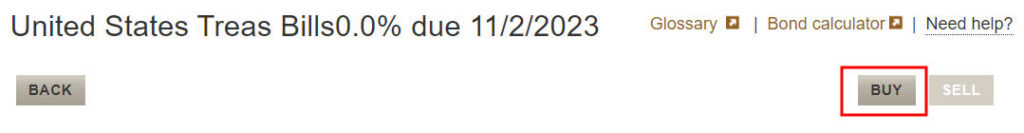

You’ll see a page full of information about this Treasury. Click on the Buy button if you’re still interested in buying it.

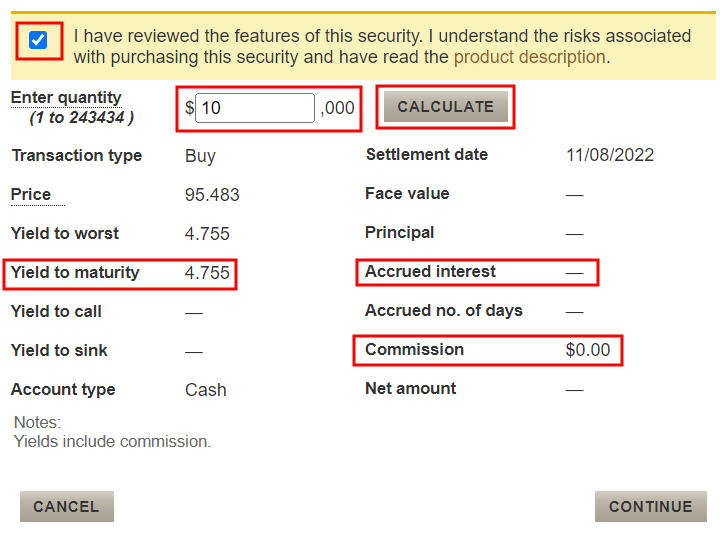

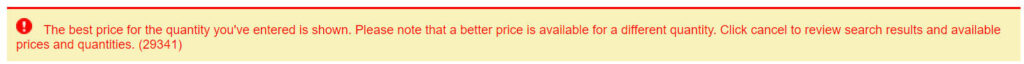

You have to check the box to say you know what you’re doing. Enter a quantity of 10 to buy $10,000 face value. Click on Calculate to see the yield again.

You see a big warning on the top saying you’re paying a higher price for your small order. Nothing you can do here unless you can afford to buy $250,000 or $1 million.

Now comes the final screen before you submit the order or cancel. You see the yield, the accrued interest if applicable, and the net amount that’ll come out of your settlement fund. Principal and interest payments will automatically go into your settlement fund. You’ll have to reinvest those payments on your own.

This specific Treasury doesn’t have any accrued interest but some others do. You pay the accrued interest to the current owner and you get it back in the next interest payment. If you’re buying in a taxable account, you’ll have to remember to subtract the accrued interest when you do your taxes. Otherwise you’ll pay more taxes than you really owe.

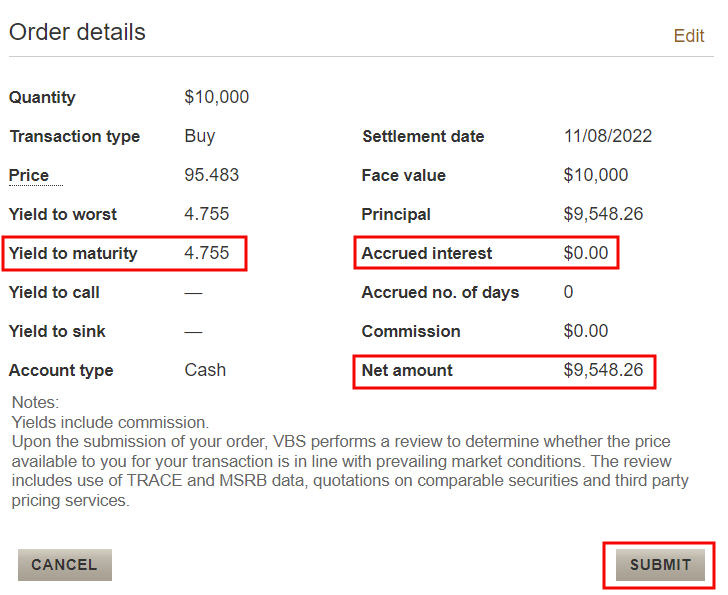

Charles Schwab

You can buy Treasuries on the secondary market in a Charles Schwab account as well. Schwab also doesn’t charge fees for buying Treasuries on the secondary market.

Click on Trade in the top menu and then Find Bonds & Fixed Income.

I don’t have more screenshots for Charles Schwab at this moment but the process should be similar to Fidelity and Vanguard. I’ll add screenshots here when I have them.

Merrill Edge

Buying new-issue Treasuries at Merrill Edge requires a phone call and a $30 fee but you can buy Treasuries on the secondary market online without a fee.

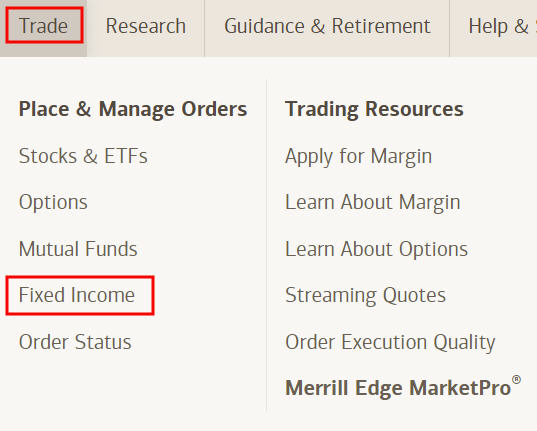

Click on Trade in the top menu and then Fixed Income.

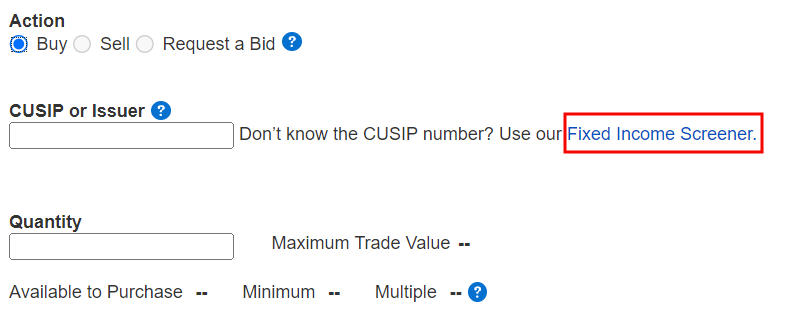

Click on the Fixed Income Screener link to find the CUSIP for the Treasury you want. The CUSIP for a bond is like the ticker symbol for a stock.

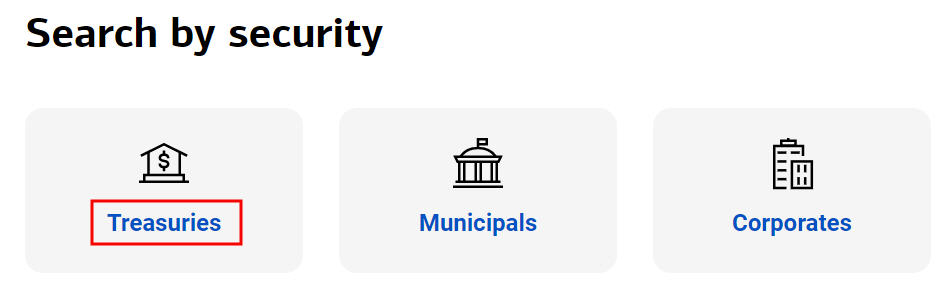

Click on Treasuries.

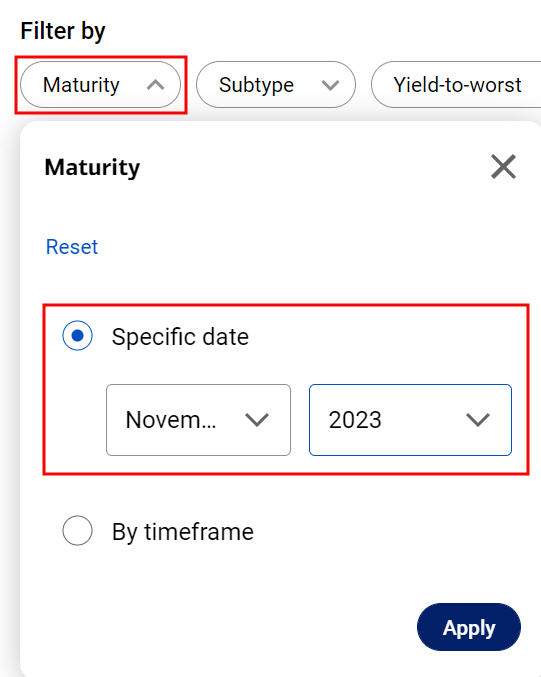

Suppose you want a Treasury that matures in November 2023. Click on Maturity and then choose the month and the year.

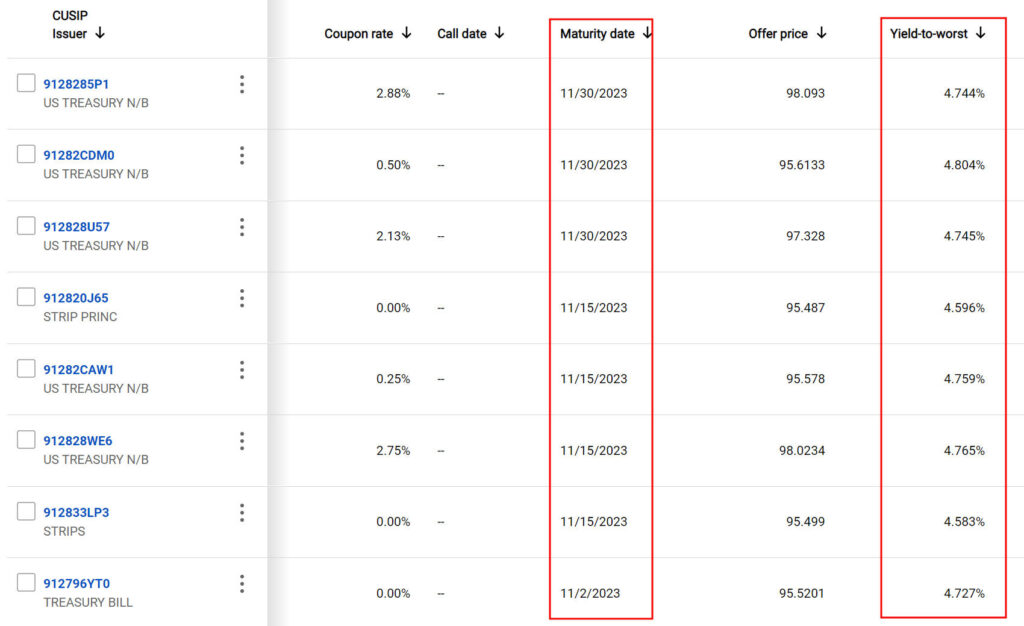

You get a list of Treasuries that mature in that month. Click on any heading to sort by that column. Yield-to-worst is the always same as yield-to-maturity for Treasuries.

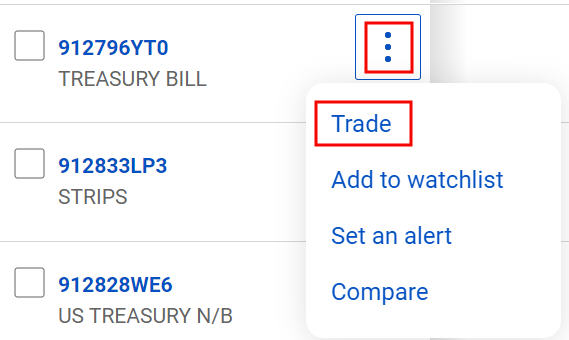

Suppose you picked one based on the maturity date and the yield. Click on the three dots next to that Treasury and then click on Trade.

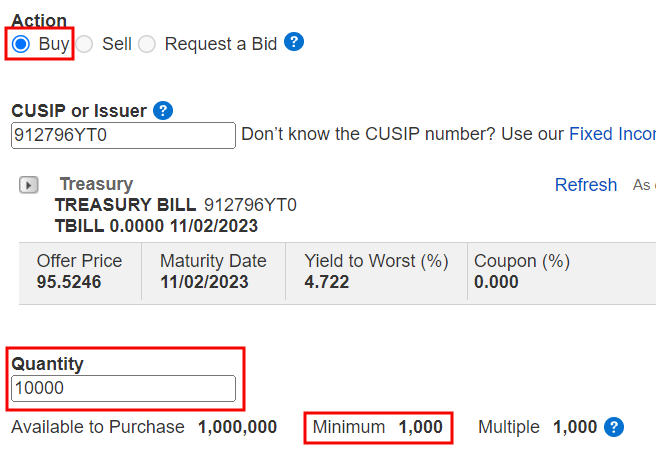

You’re back to the order entry page. Enter the face value you’d like to buy under Quantity. For example, enter 10000 if you’d like to buy $10,000 face value. The minimum order is $1,000 face value for this one but sometimes the minimum can be higher.

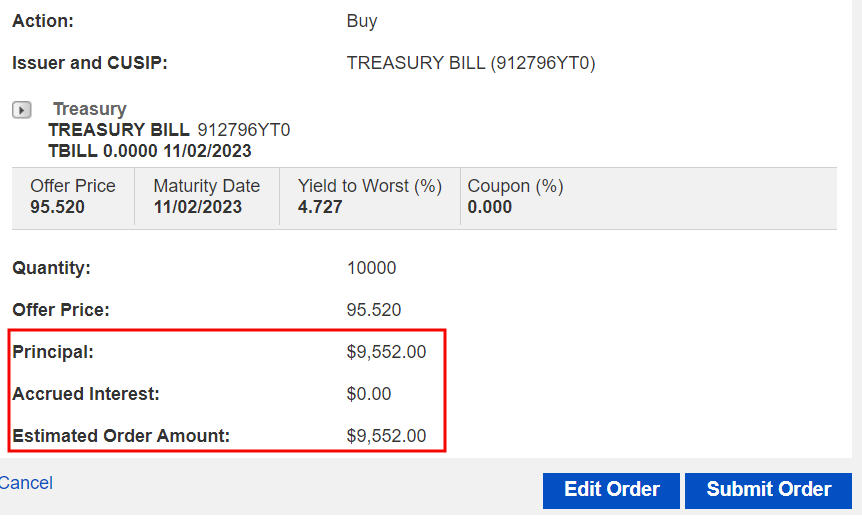

The final review page shows how much you’ll pay for this order. You see the yield, the accrued interest if applicable, and the net amount that’ll come out of your cash balance.

This specific Treasury doesn’t have any accrued interest but some others do. You pay the accrued interest to the current owner and you get it back in the next interest payment. If you’re buying in a taxable account, you’ll have to remember to subtract the accrued interest when you do your taxes. Otherwise you’ll pay more taxes than you really owe.

***

Buying Treasuries on the secondary market fills gaps when the term you want isn’t available as a new issue or when the next new-issue auction is too far ahead in the future. It’s a viable option if you understand and accept the downside of buying on the secondary market. Buying them in an IRA removes the tax complications.

The need to buy on the secondary market is especially applicable to TIPS because new-issue TIPS don’t come in as many maturities as nominal Treasuries and they come out much less frequently.

Bond prices change by the minute. New issues won’t always have a higher yield. If a new issue is coming out shortly, you may decide to wait, but you can buy on the secondary market now and lock in the current yield if the auction for the next new issue is quite far ahead.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Allan says

Good article. Thanks for posting.

Gina says

Great article. Thanks!! And timely too for me, a newbie to the secondary bond market.

In Fidelity, is there a way to know if a bond on the secondary market has “accrued interest” before going through all the motions of buying? Trying to avoid tax time drama. Was not aware of this critical information as it is not mentioned as clearly anywhere else.

Also, sometimes I see a better interest rate on the secondary market vs. the new issue for the same term. (I am not sure if I am misreading something.) So why would one not buy on the secondary market if the rate is better? What am I missing here?

Again, Thanks for all the clear explanations in your articles.

Harry Sit says

Before you go into the deep end, please read the “Why Secondary Market” section again to see if you have a compelling reason to buy on the secondary market. Thinking you will get a better rate isn’t one of the reasons to buy on the secondary market. The yield on a new issue is unknowable ahead of time. Any estimates you see are pure guesses and totally unreliable. You should simply ignore the estimates.

Any bond with a positive number in the “coupon” column has accrued interest.

Gina says

Ok. Thanks for the good advice!

Jim says

Mr. Sit:

Does Exploring TIPS delve into the specifics of buying TIPS on the sec mrkt? On Vanguard, I find bonds of the same maturity date but with significantly different coupons, inflation factors and purchase prices. It’s confusing which to buy.

Thanks,

Jim

Harry Sit says

It does. If the yield is comparable between two bonds of the same or similar maturity date, the one with a lower coupon has lower reinvestment risk.

Paul F. says

Who (or what entity) determines/establishes the price of the new issues? Likewise on secondary market who sets price?

On Fidelity I found that the seller adds minimum quantity and other specifics on price or sale is not accepted. Can you explain?

Great overview of the process.

PF

Harry Sit says

Bidding from banks and other institutions determines the price of a new issue. Those who bid too low won’t receive any bonds. They’re motivated to bid a higher price (lower yield) if they want bonds. Everyone pays the same price when the auction ends. Retail investors don’t bid. They only tag along and receive the same final price as the institutions.

Bond dealers and brokers set the price on the secondary market. Prices on the secondary market are different by the minimum quantity and they may be different at different brokers, in the same way as the same toaster is sold for different prices at different stores and you get a volume discount if you buy 1,000 of them.

Sun AL says

Many thanks for all your articles which always contain clear, accurate, reliable, & actionable information. All your articles are exceptional contributions to investment education and democratization. Specifics of bid-ask mechanics/screenshots are “pix worth 1000 words.” I hear newbie message: first try secondary market T notes/T bills to buy & hold to maturity, but what if we have to do it in taxable account?

Practical mechanics remain a barrier to secondary market participation. Without providing tax advice, could you write about the handling of tax complications from purchase of T Bills & T Notes on the secondary market in the situation of holding multiple years until maturity, e.g. when purchasing in 2023 and maturing in 2024? What numbers do we need to track and report, what boxes do these appear in on the composite 1099 from brokerage, in what year to report, etc. Where is “Amortizable Bond Premium” on the 1099? Differences for T Bill vs Note? Can we assume that everything that needs to be reported in 2023 occurs as a number/box on the 2023 composite 1099 and everything needing to be reported in 2024 occurs as number/box on the 2024 composite 1099? Will we need to track “2023” numbers into “2024”/year of maturation? Are there any numbers/calculations which don’t appear on any 1099 which need tracking/reporting?

Harry Sit says

Thank you for suggesting these follow-up topics. The degree of tax complications varies by new-issue versus secondary, bills versus notes and bonds, discounted versus premium, nominal versus TIPS, and held to maturity versus selling before maturity. Bills held to maturity are the easiest.

Don S says

Have been a fan for years, Harry. This article and the primary market one are recent examples why. Thanks a ton for doing this.

Harry Sit says

Glad to hear they’re helpful. Happy Holidays!

Funda says

I’ve been researching auto-rolling ladders using T-Bills bought at auction and wish I had come across this article earlier since it would have saved me a lot of time.

One interesting tidbit about Schwab is that they will not auto-roll T-Bills of 52-week duration, only shorter ones. No one at Schwab had an explanation as to why.

Fidelity will do it.

Funda says

And now a question. I’m considering buying Treasuries in the secondary market and lining up their maturities so that they feed into auctions in the future where I will make auto-rolling purchases.

The bid-ask prices for a given Treasury CUSIP (and even the spread) seem to be different across brokers at any time and they all seem to want you to place limit-at-market fill-or-kill orders. Is there a recommended strategy to try and get some price improvement?

Harry Sit says

They are different from day to day and from CUSIP to CUSIP but I haven’t observed meaningfully large differences or patterns of which broker has consistently better prices. It comes down to where you have the cash and where you want to make your auto-rolling purchases when these secondary market purchases mature. Either buy where you have the cash now and transfer to where you will auto-roll or transfer now and buy where you’ll eventually auto-roll.

SteveinPa says

A note about taxes. If you buy a note on the secondary market at a discount price and hold it for more than a year, the gain in price (profit) is not a long term capital gain as one would expect. The increase in value is taxed as interest income.

Is this correct ?

Harry Sit says

That’s correct but it shouldn’t be a surprise. You are quoted a higher yield than the coupon rate when you buy at a discount. You should expect to pay tax on the quoted yield as interest income.

SteveinPa says

I am surprised. Since my YTM is compromised of two sources of income, the interest income component and capital appreciation component.

Neel says

Great article!

Can you discuss the “risk of failing” for the secondary treasury market? Everyone says it’s regulated, but…

I’ve asked several brokers, but haven’t gotten a definitive answer.

Thank you.

SteveinPa says

What do you mean by “failing” ?

Neel says

As I understand the treasury market (secondary or Treasury Direct) neither are insured. I get that. But, when I’m buying treasuries on the secondary market through Schwab, VG, or Fidelity, I would like to understand how that market is regulated. Is there any over site?

Harry Sit says

If you worry that Schwab, Vanguard, or Fidelity says they bought Treasuries for you but they only put a false record in your account (Madoff-style), you can’t know for sure. If you worry that they bought Treasuries for you but then lent your Treasuries to someone who can’t pay them back (FTX-style), you can’t know for sure either. Brokers have audits once a year but they can go rogue between audits.

This worry doesn’t only apply to Treasuries though. If you bought 100 shares of Microsoft stock and the broker says so in your account, did they really buy 100 shares of Microsoft for you? You don’t know for sure. If you don’t trust the broker, the only way to avoid the worry is not to do business with them, as in to avoid Madoff and FTX. SIPC insures up to $500,000 (per customer or per account?) but many people have more than $500,000 with Schwab, Vanguard, or Fidelity. It’ll take a long time for SIPC to recover a failure at this scale (Google “SIPC MF Global”).

I can’t think of a broker more reputable than Schwab, Vanguard, or Fidelity. Only you can decide how comfortable you are with these brokers.

SteveinPa says

Buying on the secondary is no different than buying a stock or bond from a brokerage firm. As you know, you can buy NEW ISSUES of CDs, Treasuries, Agencies and Corporate bonds from these brokers along with secondary offerings in each of these categories. The nice part of that is you can buy anytime you want and park your money in a money market account if you don’t want to buy anything. The brokers are regulated like the banks. That’s the least of your worries especially the big ones you listed. I have a Treasury Direct account but only used it for I-Bonds. The brokers are regulated more than banks since they have a hundred more different products than banks do and the assets they have are staggering. The fact that brokers offer checking accounts with lower or no fees at all makes it a huge plus. I don’t use a bank account.

Neel says

Great conversation. I’m steadily moving away from banks for sure.

I’m participating in the secondary treasury market, but the phrase “too big to fail,” keeps rattling around in my head.

Thanks for your great article.

SteveinPa says

When the major brokers fail, you can assume the banks have failed and you can assume the United States government failed. Everything will be worthless. So is the US govt too big to fail ? That should be your thought when considering the viability of the US banking and brokerage system.

Neel says

Great discussion.

Thanks

Christian Walenta says

Harry, thanks for the good info, I am a bit confused on how to understand the YTM when buying TIPS on the secondary market. As TIPS have a fixed intrest rate PLUS inflation adjustment. If I buy TIPS with maturity lets say in 2030, how would I know the real yield, as future inflation rates are not yet known? So what does the displayed YTM rates really mean on the brokerage sites?

Harry Sit says

The best way to think of TIPS is to forget about US dollars for a moment and treat TIPS as denominated in a different currency. Call it “Dineros.” Dineros don’t have inflation. They always have the same purchasing power. The displayed YTM rates are interest paid on Dineros. Thinking in Dinero terms, TIPS are the same as any other bond. You pay the price in Dineros today and you get back 1,000 Dineros when the bond matures. You’re paid a fixed interest rate while you hold the bond. Everything is in Dineros, however much they happen to be worth in US Dollars at the time.

Barry says

Harry – Will Turbo Tax and/or H&R Block software automatically calculate all tax aspects of a secondary market purchase or sale? If so, can I then then assume that the tax complications of the secondary bond market is not really a reason to avoid buying or selling there.

Harry Sit says

Purchase – It depends. Sale – no.

The software will handle it easily if you only buy Bills (no interest payments) and hold them to maturity. Notes (original maturity longer than one year) with interest payments will have accrued interest. You’ll have to dig it up from the 1099 supplement. It’s not automatic. The software can handle premium amortization easily but the market discount requires manual handling.

If you sell before maturity, you always have to tease out how much is interest and how much is capital gain or loss. It’s not automatic.

Christopher Vu says

Are there risks of losing money buying 3-month treasury bills on the secondary market at Fidelity? Can you lose your principal? If yes, in which situation?

Harry Sit says

You won’t lose money if you hold until U.S. Treasury pays you back. You might lose money if you sell before that.

SteveinPa says

Only if rates jump up quickly and significantly. If you buy a 3 month treasury lets say yielding 4% and lets say interest rates increase within a short period of time to 5%, you might lose a bit of principle to attract someone to buy your treasury bill. Of course if you hold it to maturity, you lose nothing.

The only wild idea of losing money on any treasury bills, bond or note is the collapse of the US Government. Silly as it sounds, the US debt is so huge and can never be repaid no matter what. Yet we continue to increase debt as long as people are willing to buy more US Debt. (think ponzi scheme). How does it end ? No politician cares or wants to talk about it. After all “it will be someone elses problem in the future.”

RobI says

Question on tax timing in the case where yield to maturity is higher than the coupon.

Is the interest payment in years before maturity calculated from the coupon rate or maturity yield rate? In other words, is some of the ‘interest’ over the life of the bond deferred until a higher maturity payout in a future tax year? (In part this relates to estimated interest payouts driving up an IRMAA income band in a given tax year).

Thanks for a great article. Do you have a similar article on secondary market CD purchases?

Harry Sit says

When the yield to maturity is higher than the coupon, you pay a lower price than the face value (“par”) of the bond. The difference between the two is called a “market discount.”

The bond pays interest based on the coupon rate. While you can elect to amortize the market discount each year and add it to the coupon interest, you aren’t required to do so. By default, the market discount is deferred until the bond matures or when you sell the bond. The accrued market discount is taxed at that time as interest, not as capital gain.

I wrote about secondary market brokered CDs back in 2009. I’ll have to update them. Please stay tuned.

KP says

how about a detailed sample calculation how the pricing works with US treasuries on the secondary market. I get it more or less, but can not get to the exact numbers for coupon, coupon dates, purchase price and interest payments. I would like to know exactly how these calculations work,

Harry Sit says

Look up the YIELD function in Microsoft Excel. Use 1 (actual/actual) for the Basis input. The broker’s computer already did the math. You can trust that it’s correct.

DB says

Harry,

Thank you for an excellent blog post.

A few questions related to purchasing treasury bonds in secondary market in a taxable accounts to help my understanding of Treasury securities:

1) If treasury bonds are purchased in a taxable account, the interest that is paid out each year is taxable that year, correct?

2) Is accrued interest paid at the time of purchase deducted from the interest income received for the same tax year? What if this bond already paid out interest for the year before the date of purchase and the next interest isn’t paid out until the following year? Do you still deduct accrued interest from other interest income for the year of purchase on line 1 of Schedule B?

3) If a bond is purchased at discount (coupon is less than the quoted yield at purchase) AND you sell the bond subsequently in secondary market, the difference between cost basis and the sale proceeds is reported as interest income on line 1 of Schedule B, correct?

Thank you.

Harry Sit says

1) Yes, the interest received during the year is taxable that year.

2) Accrued interest paid is a negative offset against the first interest payment received. If the first interest isn’t received until the next year, you have to carry it forward and remember to add the offset next year.

3) The market discount accrues little by little through the maturity date. If you sell before maturity, the amount accrued until that point is taxed as interest. The sales proceeds minus the purchase cost minus the accrued market discount is capital gain.

Tracking these accrued interest and market discount adds complexity. If there’s no compelling reason to buy or sell on the secondary market, it’s simpler to buy new issues in a taxable account. See Which Treasury to Buy While Keeping Your Taxes Simple.

DB says

Thanks Harry. It’s educational to understand the tax implications of purchasing bonds in a taxable account.

If a Treasury bond is purchased at discount to face value in secondary market, are interest income over life of the bond, accrued interest paid at the time of purchase, and market discount accrued over life of the bond are the only taxable items?

Does Original issue discount come into play for a treasury bond?

A bond can only have market discount or bond premium depending on whether the purchase price is lower or higher than the face value, but not both, correct?

LZ says

Harry,

I think you may have answered this but I want to make sure I’m understanding correctly.

You said:

“2) Accrued interest paid is a negative offset against the first interest payment received. If the first interest isn’t received until the next year, you have to carry it forward and remember to add the offset next year.”

Does this negative offset have to come against the first interest payment received on that specific treasury note or bond for which you paid the accrued interest? Or can it be used to offset other interest?

For example, if you buy a Treasury Note in 2024 and pay some accrued interest for it that shows up on your 2024 1099 as “Taxable accrued Treasury interest paid” and you have interest on various T-Bills in 2024, but that particular Treasury Note doesn’t pay a coupon until 2025, can you use the accrued interest paid in 2024 to offset the T-Bill interest on your 2024 taxes? Or do you have to wait, remember the accrued interest from the 2024 1099, and then claim it in 2025 specifically against the coupon payment from that particular T-Note?

Harry Sit says

It has to come against the first interest payment received on that specific treasury note or bond. Some people don’t wait. It’s hard to catch because the IRS doesn’t know whether that specific bond has paid the first coupon yet but you’re supposed to wait if you follow the rules.

LZ says

And when you say “you have to carry it forward and remember to add the offset next year” is that carry forward something you actually do formally (as in filling in some sort of “carry forward” slot on the taxes for the year you are not claiming the accrued interest and then picking up that “carry forward” on the next year’s taxes)? Or is “carry forward” just a figure of speech in this case, meaning you simply do nothing with that accrued interest on that first year’s taxes and then you claim it on the second year’s taxes.

Harry Sit says

No formal filing. Just put a note in your next year’s folder to remember to claim the accrued interest paid as a negative line item against the interest received.