When you invest a sum of money for a fixed term, buying CDs directly from a bank or credit union used to be the answer but that isn’t necessarily the case today.

Treasuries Beat CDs Now

When the Federal Reserve started raising interest rates, the financial markets responded right away. Banks and credit unions were slow to raise the rates they pay on savings accounts and CDs because they don’t need more deposits and they take advantage of people’s inertia and ignorance of the going rates.

In addition, Treasury securities have low credit risk because they are guaranteed by the full faith and credit of the United States government. They require a low minimum investment of only $1,000. The term can be as short as four weeks. The interest is exempt from state and local income taxes. You can buy them in your existing brokerage account as opposed to having to open a new account at a bank you aren’t familiar with. Why in the world would someone buy CDs from banks and credit unions that pay a lower yield than Treasuries?

Because investors don’t know they can buy Treasuries so easily for a higher yield than CDs.

You may have heard of buying Treasuries through the government website TreasuryDirect, but it’s easier to buy them at a broker. You can buy new-issue Treasuries through major brokerage firms Fidelity, Vanguard, Charles Schwab, TD Ameritrade, and E*Trade with no fee whatsoever. Also, you can buy them in your Traditional or Roth IRA at the broker, whereas TreasuryDirect doesn’t offer IRAs.

Treasury Yield

Although you can buy Treasuries at any time on the secondary market (see How to Buy Treasury Bills & Notes On the Secondary Market), I prefer to buy new-issue Treasuries because you don’t have to pay a bid/ask spread when you buy new issues. While the bid/ask spread may be small, it just isn’t necessary to pay it when you have the opportunity to buy a new issue.

This is the case especially for short-term Treasuries maturing in six months or less because a new issue comes out every week. Paying a bid/ask spread once to buy a 10-year Treasury and holding it for 10 years may be OK but paying a bid/ask spread every month adds up fast.

The yield you’ll receive on a new-issue Treasury is determined by an auction process but you don’t have to make any bids. You only say how much you’d like to buy in your order. The banks will do the competitive bidding and you ride their coattails. You get the same yield for your tiny $1,000 order as a bank buying $100 million.

You can get a feel of where the yield might land by checking Interest Rate Statistics on TreasuryDirect (click on the first heading on the page for Daily Treasury Par Yield Curve Rates).

Treasury bills (“T-Bills”) with a maturity of one year or shorter are sold at a discount to par value. You pay slightly less than $1,000 for each $1,000 bill. You automatically receive the full $1,000 in your brokerage account when the bill matures. The difference is your interest.

Treasury notes (“T-Notes”) and Treasury bonds (“T-Bonds”) with a maturity of two years and above are sold at slightly less than the face value. You receive interest payments in your brokerage account every six months, and the full face value will show up automatically in your brokerage account when it matures. You don’t need to sell or do anything when you hold Treasuries to maturity.

Minimum Order Size

The minimum order for a new-issue Treasury is $1,000 in face value when you buy it in a brokerage account. You can order in $1,000 increments up to $5 million in face value.

The minimum order for a new-issue Treasury is $100 in face value when you buy it at TreasuryDirect. You can order in $100 increments up to $5 million in face value. Because you can’t sell Treasuries in your TreasuryDirect account before they mature (must hold to maturity or transfer to a brokerage account), it’s easier if you buy them in a brokerage account.

Order Window

You only need to know when the U.S. government will sell a new batch of Treasuries next time. Right now the government sells shorter maturities weekly and longer maturities monthly. You won’t have to wait long for the next sale unless you’re buying TIPS.

| Maturity | Sale Frequency |

|---|---|

| 4-week, 6-week, 8-week, 13-week, 17-week, 26-week | Weekly |

| 52-week, 2-year, 3-year, 5-year, 7-year, 10-year, 20-year, 30-year | Monthly |

| 5-year TIPS | Four times a year (April, June, October, December) |

| 10-year TIPS | Six times a year (January, March, May, July, September, November) |

| 30-year TIPS | Twice a year (February, August) |

The exact dates are published in the Tentative Auction Schedule and Upcoming Auctions from the U.S. Treasury. The schedule lists three dates — the Announcement Date, the Auction Date, and the Settlement Date. You only need to pay attention to the first two dates to know the window for placing your order.

You place your order between the afternoon of the Announcement Date and the night before the Auction Date. For example, if you’d like to invest a sum of money for two years, the schedule shows a 2-year note will be announced on a Thursday and it will be auctioned the next Tuesday. You will see it offered at your broker in the afternoon on the Announcement Date (Thursday). You should have your order in by Monday night, before the Auction Date (Tuesday).

So check the sale schedule and set a calendar reminder for yourself to place the order within the order window. If the term you want isn’t available as a new issue or if you don’t want to wait, you’ll have to buy it on the secondary market. See How to Buy Treasury Bills & Notes On the Secondary Market.

When It Matures

If you hold the Treasury to its maturity, you don’t have to do anything extra. The face value will magically appear in your brokerage account as cash when the bond matures.

Some brokers offer an optional “auto roll” feature for reinvestments. If you enable the “auto roll” feature when you buy the Treasury, the broker will automatically use the money from the matured Treasury to buy another new-issue Treasury of the same face value and the same term.

Selling Before Maturity

If you need to sell before the Treasury matures, you can try to sell it online at any time through the broker. The price will be at the market price at that time, which may be higher or lower than your original purchase price.

Sometimes bond dealers aren’t interested in buying from you when you have less than $100,000 in face value to sell. If you see that online prices require a higher minimum than the amount you have, you can wait an hour or two to see if a quote for a lower minimum comes up. Or you can call the broker and ask for help from the fixed income department. They have additional ways to sell the bonds for you. You may have to pay a fee for the broker-assisted trade.

Selling before maturity in a taxable account can make your taxes more complicated. Try to avoid selling before maturity in a taxable account.

Taxes

When you buy Treasuries in a taxable brokerage account, the brokerage firm will send you the necessary tax form for your taxes after the end of the year. The gains are taxed as ordinary income, not as a capital gain. If you do your taxes with tax software such as TurboTax, the tax software will handle the tax calculation. You only pay federal income tax on the interest. The interest income on Treasuries is exempt from state and local taxes.

When you buy Treasuries in a tax-advantaged account such as a Traditional IRA, a Roth IRA, or an HSA, the tax treatment goes by the account type. The interest isn’t immediately taxable. The eventual withdrawals will be subject to the usual rules and restrictions associated with the account type.

Online Brokers

Major online brokers offer new-issue Treasuries without fees. Click on the link to jump directly to the section for the broker you use — Fidelity, Vanguard, Charles Schwab, E*Trade, and Merrill Edge.

Fidelity

Here are the steps for placing an order for new-issue Treasuries with Fidelity.

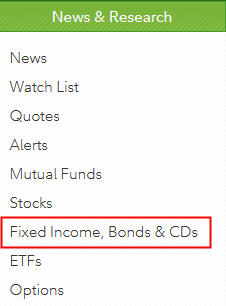

Under News & Research on the top, click on Fixed Income, Bonds & CDs.

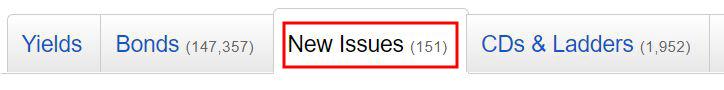

Click on the New Issues tab. You pay no extra fee only when you buy a new issue (you must pay a bid/ask spread when you buy on the secondary market).

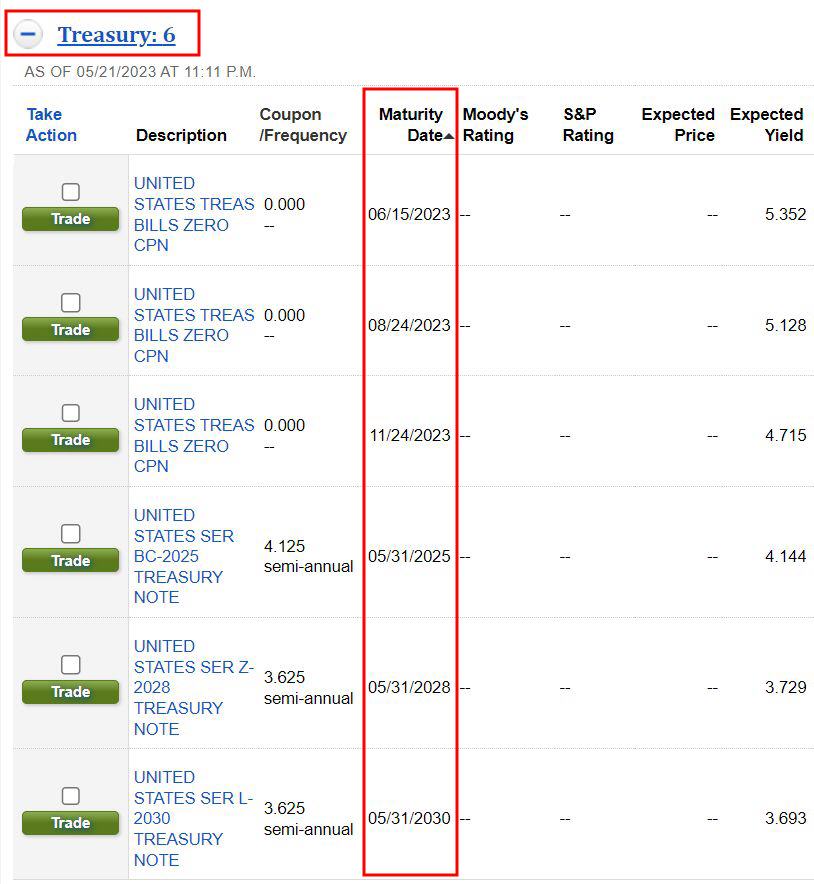

You’ll see a list of upcoming issues in the Treasury section. If you don’t see anything for the term you’d like to buy, check the calendar from U.S. Treasury and come back within your order window. If you don’t see the new Treasury offered on the Announcement Date, wait a few more hours. It’ll show up later in the day.

You’ll see the maturity date of each issue and an expected yield. The expected yield is only an estimate. Ignore the estimate. You’ll get the actual yield from the auction. You won’t know what it is until after your order executes but you can be sure you’ll always get the best yield determined by the market. Click on Trade to buy the issue you are interested in.

You may see either the “old” order entry screen or the “new” order entry screen next. Either one works. Only the look and feel are different.

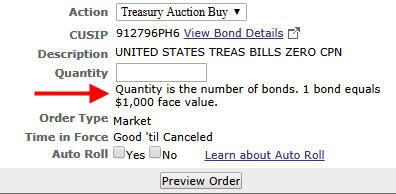

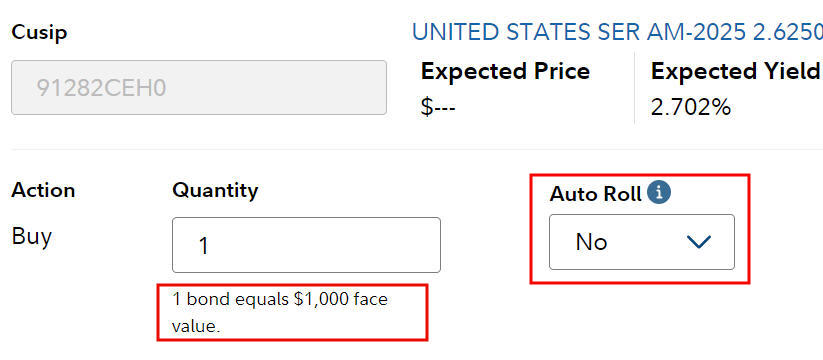

Treasuries are sold in $1,000 increments in a brokerage account. Enter a quantity of 1 if you’d like to buy $1,000 in face value. It will cost slightly less than $1,000 when it’s all said and done. Fidelity lets you set up Auto Roll to automatically buy another Treasury of the same term and the same amount when this Treasury matures. It’s convenient when you’re investing in short-term Treasury Bills.

If you turn on Auto Roll, when it’s time to roll to the next one, you may receive an email saying you don’t have enough cash in your account to cover the new purchase. Don’t worry. The matured Treasury will cover the new purchase just in time. See comments from Mapleton Reader.

Again, there is no fee whatsoever from Fidelity when you buy new-issue Treasuries (you must pay a bid/ask spread when you buy on the secondary market). Have cash ready in your account. You’ll have Treasuries when the auction settles.

Vanguard

Follow these steps to buy new-issue Treasuries in a Vanguard brokerage account.

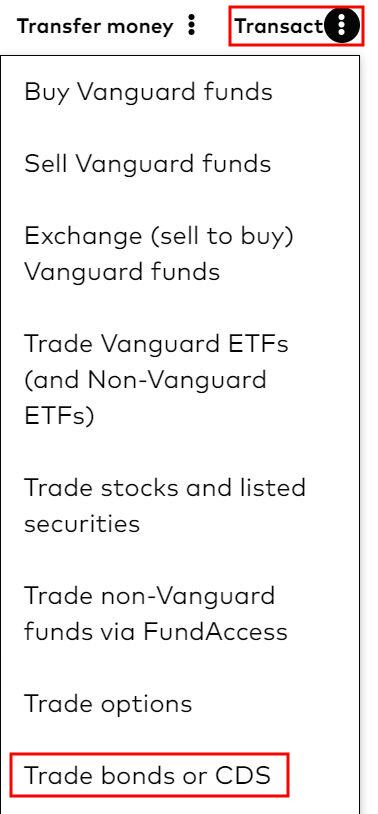

Click on the three dots next to Transact near the top right of your account and scroll toward the bottom. Click on Trade bonds or CDs.

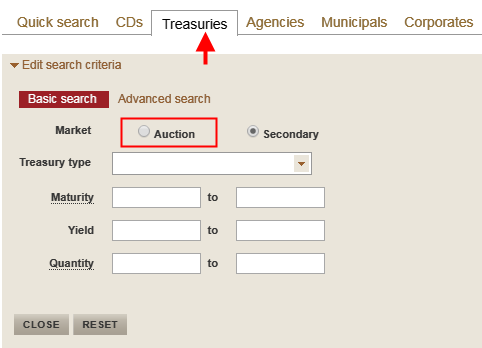

Click on the Treasuries tab and then the Auction radio button. Be sure to select “Auction.” You pay no fee or bid/ask spread only when you buy a new issue (you must pay a bid/ask spread when you buy on the secondary market).

You will see a list. The Treasuries available for accepting orders will have a Buy link. If you don’t see a Buy link for the term you’d like to buy, check the calendar from U.S. Treasury and come back within your order window. If the Buy link isn’t activated yet on the Announcement Date, wait a few more hours. It’ll show up later in the day.

Vanguard shows an Indicative Yield on the right. That’s just an estimate. Ignore the estimate. You’ll get the actual yield from the auction. You won’t know what it is until after your order executes but you can be sure you’ll always get the best yield determined by the market.

Vanguard goes by the face value on the order page. Your order amount must be in $1,000 increments with a minimum of $1,000 and a maximum of $5 million. Vanguard doesn’t offer the Auto Roll feature. Similar to Fidelity, there is no fee whatsoever from Vanguard when you buy new-issue Treasuries (you must pay a bid/ask spread when you buy on the secondary market).

Charles Schwab

You can buy new-issue Treasuries at Charles Schwab as well. There is also no fee whatsoever from Schwab (you must pay a bid/ask spread when you buy on the secondary market). I don’t have an account with Schwab but a reader sent me these screenshots from their account.

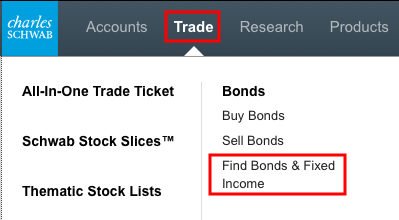

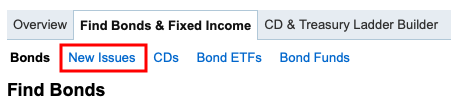

Click on Trade in the top menu and then Find Bonds & Fixed Income.

Click on New Issues.

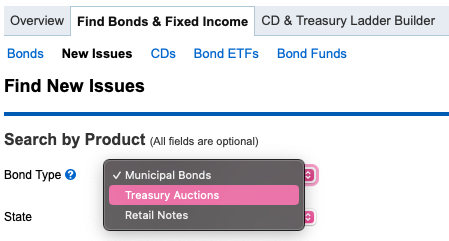

Choose Treasury Auctions in the Bond Type dropdown.

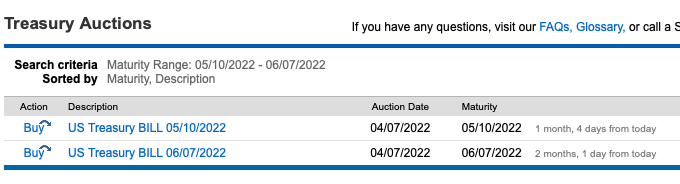

You will see a list of issues available for new orders. If you don’t see anything for the term you’d like to buy, check the calendar from U.S. Treasury and come back within your order window. If you don’t see the new Treasury offered on the Announcement Date, wait a few more hours. It’ll show up later in the day.

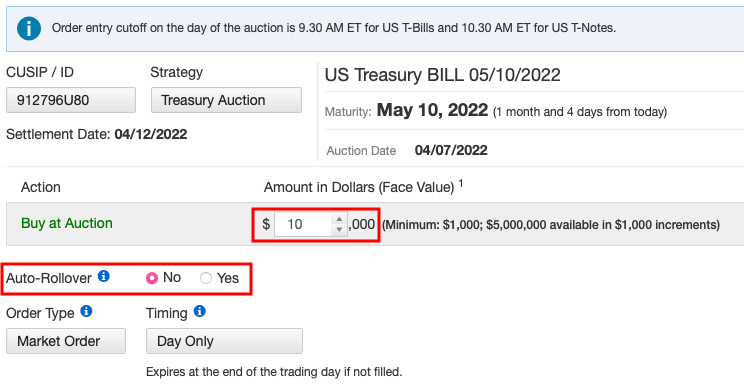

Your order must be in $1,000 increments. If you turn on the Auto-Rollover feature, Schwab will automatically enter a new order for the same term and the same amount when this Treasury matures. If you leave the Auto-Rollover feature off, you’ll just have cash when this Treasury matures.

Charles Schwab limits the Auto-Rollover feature to Treasury Bills with a maturity of six months or shorter. There’s a one-week gap between the maturity of a Treasury Bill and buying a new Treasury Bill with the proceed. Fidelity doesn’t have this six-month limitation or the one-week gap.

E*Trade

E*Trade’s commission schedule says their fee is $0 for buying new-issue Treasuries. Reader Bill found these instructions with screenshots from E*Trade:

Instructions for buying new-issue Treasuries are on page 5 of that document. I don’t know whether those instructions are still current because I don’t have an account with E*Trade.

Merrill Edge

Merrill Edge doesn’t support buying new-issue Treasuries online. Their fee schedule says that placing an order by phone with a representative costs $30 but people have reported not being charged a fee. Please confirm with the representative that you won’t be charged a fee if you decide to have the phone rep place the order for you.

You can buy Treasuries on the secondary market online without a fee at Merrill Edge. See How to Buy Treasury Bills & Notes On the Secondary Market.

Auction Result

Because I know I’ll get the best yield in an auction and it’ll be water under the bridge post-auction anyway, I don’t bother to check what exactly the yield was after the auction. If you’d like to know what you got from your purchase, you can check the auction result after 2 p.m. Eastern Time on the Auction Date on the Announcements, Data & Results page at TreasuryDirect.

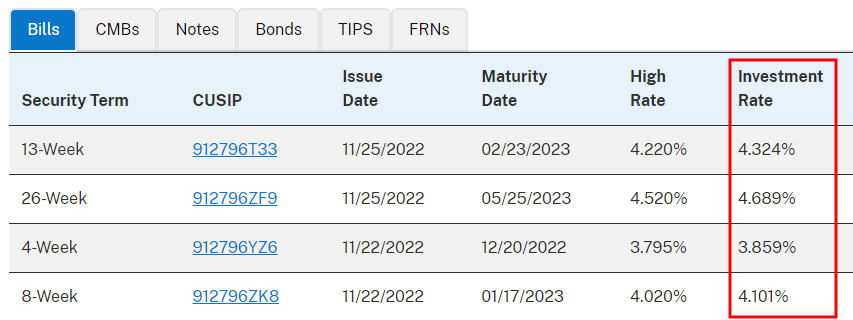

The results for Treasury Bills (1-year or shorter) list a High Rate and an Investment Rate. The two numbers are just different calculations for the same result. The Investment Rate is comparable to the Annualized Percentage Yield (APY) on a commercial CD.

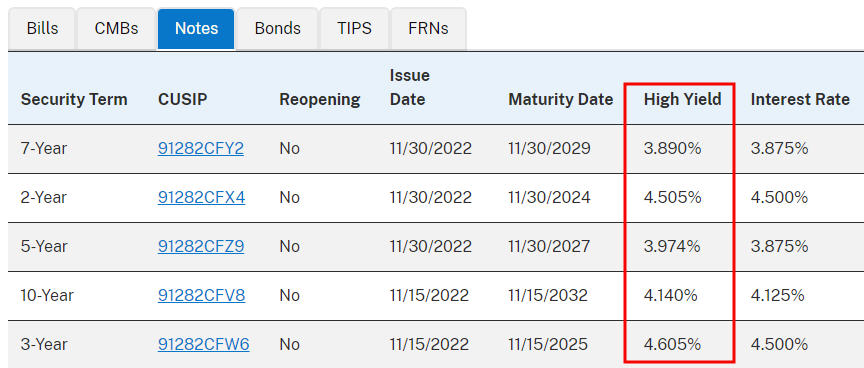

The results for Treasury Notes and Bonds (2-year or longer) list a High Yield and an Interest Rate. The High Yield is the yield you got from your order. The Interest Rate is the annualized rate at which you will receive interest payments every six months. If the Interest Rate is 4%, you will receive $20 in interest for each $1,000 face value every six months ($1,000 * 4% / 2).

***

Buying new-issue Treasuries in a brokerage account comes down to:

- Check the current rates and decide how long you will invest the money.

- Check the auction schedule to see when the next sale for your desired term will come up.

- Set a calendar reminder to place your order within the order window.

- Have cash ready to go in your account.

- Place your order. Wait for the auction and settlement.

- Check the auction result only if you’re curious.

- (2-year Treasury Notes and up) Automatically receive interest as cash in your account every six months.

- Automatically receive the face value when it matures.

You can also buy “pre-owned” Treasuries on the secondary market but you’ll have to pay a bid/ask spread there. You’re better off waiting for a new issue unless the term you want to buy isn’t available as a new issue — for example, no 9-month or 4-year terms are offered as a new issue — or if the next auction for a new issue is too far off in the future. Please read How to Buy Treasury Bills & Notes On the Secondary Market if that’s the case.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Joe says

Can you add how to do this at TD Ameritrade? Thanks.

David says

Trade > Bonds % CDs

Click on any % link. From the left menu select “New Issues”

Under Treasury Auctions, click to show all.

The bills and notes are listed, showing you when the auction date is. You can put in your order the day before or morning of the auction date.

Harry Sit says

Thank you, David. I added these steps to the main post to make them easier to find.

Austin says

What is the interest rate of this T-bill?

17-week, CUSIP 912796Y78, issued on 11/01/2022, maturity 02/28/2023

There seem to be several different types of rates quoted in various places.

Which rate is the agreed official rate?

Where can I find this info?

Thanks

Harry Sit says

That’s an existing bill. You look up the Investment Rate on the day it was issued on the Announcement & Results Press Releases page at TreasuryDirect. Click on the PDF link under Competitive Results.

If you’d like to know the yield if you buy it on the secondary market today, you look for it at your broker. See How to Buy Treasury Bills & Notes On the Secondary Market.

Wogga4eva says

One answer to ‘what is the rate’ on this investment is that it depends on the price of the bond as well as if it might be called away from you by the issuer, the rate on the web live can be figured out by looking at ‘yield to worst’ (worst = if the bond were called away from you or to maturity, whichever is…worse). When the price of the bond is below 100 you will be getting a higher yield than stated in the bond’s issued rate/description. Likewise, if the bond price is higher than 100 you will get a lower yield than the issued rate.

Tom Tucker says

Today (11/23/22) is the announcement date for the 13 week and 26 week T-Bills. It’s currently 3:50 PM ET and Fidelity shows zero New Issue Treasuries available for ordering. In the past, I have typically seen these show up between noon and 1 PM ET. Has anyone else run into this situation with Fidelity? Does this imply that Fidelity may not participate in the offering of all New Issue T-Bills?

Tom Tucker says

No need to reply. These eventually showed up on Fidelity.

Austin says

Harry, thanks for your recent reply re: looking up the Investment Rate on an existing T-bill.

Next question: Trying to find out the actual time-of-day of upcoming auctions (esp. of the 17-week) is a challenge. Also, it appears that the auction window is very tight, just a couple of hours? In fact, when I recently signed onto Fidelity to buy a 17-week T, the auction was already closed that day. If you have any info or links related to actaul time of day of these upcoming auctions, esp. the 17-week, I would appreciate it.

Harry Sit says

The order window for the 17-week bill is shorter but the process is the same. For example, the schedule shows the next 17-week bill will be announced on November 29 and it will be auctioned on November 30. So you make cash ready to go in your account and set a calendar reminder to place your order by the night before the auction date. Use Google Calendar or equivalent, or set an alarm on your phone.

The actual time of day for the auction is for financial institutions. Brokers have their own cutoff time for retail orders. It may be 8:30 or 9:00 a.m. Eastern Time on the auction date, which can be a challenge for people on the west coast. Having your order in by the night before makes sure you won’t miss the broker’s cutoff.

David says

If you’re set on buying the 17-week bill then you can place an order 24 hours in advance from your broker account as long as the money is in your account and ready to go. You can also buy it the morning of when the market opens at 9:30 AM EST. The link for when the bills are available is in Harry’s article. https://home.treasury.gov/system/files/221/Tentative-Auction-Schedule.pdf

Austin says

Great !!! Thank you for your timely replies, Harry and David !!!

Glen says

There are 5 days between the auction and settlement dates for 4 week T Bills. If funding T Bills from a Fidelity MM fund would you know if I continue to receive interest in MM fund for those 5 days? Does the money remain in MM fund until settlement, or is it debited at time of auction, or?

Harry Sit says

A pending debit will reduce the amount available to trade and the amount available to withdraw but your money stays in the money market fund and earns interest until the settlement date.

Yuriy says

does interest on 5 or 10 year notes compound?

DB says

I don’t believe so. They are paid out to you and you will have to reinvest them in an ETF/fund yourself. Or buy a new bond when sufficient interest has accrued.

Eric Bowlin says

In my entire adult life I never thought I’d be interested in bonds. That’s because interest rates were continually going down and the returns didn’t justify holding them. That all seems to be changing now as bonds become an attractive alternative to low yield investments that still have moderate risk.

Steve Adler says

Hi Harry,

I learned about your great site from depositaccounts.com, and I was hoping you could answer questions regarding t bills at maturity. I’ve searched on the Internet and treasurydirect.gov without success.

If a 52-week bill with par value of $2,000 is purchased for $1,900 (with an APY a bit more than 5%), I’m wondering what happens at maturity 52 weeks later with various options. In each of the options, the rate at maturity will be assumed to be about 5% and the term of the new bill would again be 52 weeks.

Option 1: the bill is renewed. Would the purchaser get $100 of interest, and the $1,900 principal invested in another 52-week bill with par value of $2,000, or would the $2,000 be invested in a bill with a par value of about $2,100?

Option 2: the bill is renewed for a $1,000 par value bill. Would the purchaser receive $1,050 ($1,000 par value plus $50 interest)? If this is the case, how would the purchaser arrange this? Or would the purchaser receive the $2,000 and have to purchase a different bill for $950 with a par value of $1,000?

Option 3: the bill is renewed for a $3,000 par value. Would the purchaser have to receive $2,000 from the original bill and purchase a separate bill for $2,850 with a par value of $3,000? Is there any way to roll the $2,000 bill over and add an additional $850?

I appreciate any guidance you can provide.

Thank you,

Steve Adler

Harry Sit says

The “auto roll” option offered by Fidelity, Schwab, and TreasuryDirect doesn’t change the principal amount when it’s triggered.

1) You will get $100 interest and have $1,900 invested in a new bill with a face value of $2,000.

2) If you’d like to reinvest a smaller amount, you shouldn’t choose “auto roll.” You’ll receive $2,000 from your original investment and place a separate order manually for $1,000 face value.

3) If you’d like to reinvest a larger amount, you can “auto roll” your original investment and place a separate order manually for the additional face value. You’ll receive $100 interest and pay $950 for your new order of $1,000 face value. Or you don’t choose “auto roll” and place a separate order manually for $3,000 face value (same option 2 as above).

Frank says

Question regarding the lag time between auction date and settlement date on new issue t-bills. Fidelity removes funds from account on auction day, but settlement day is usually a few days later . Do your funds earn interest those few days once removed from core account and t-bill settlement day arrives? If no interest is earned, wouldn’t these non-interest earning days need to be taken into account when calculating the overall yield received from t-bill?

Harry Sit says

Fidelity doesn’t remove funds from the account on the auction date. They enter a negative amount as a pending transaction. The pending transaction reduces the amount available to trade and to withdraw. Your money stays in the money market fund and earns interest until the settlement date.

Jay says

Hi Harry,

I don’t see a way to buy this in IB. Just wanted to confirm…

Jay

Harry Sit says

Interactive Brokers doesn’t offer new-issue Treasuries. It charges a commission when you buy on the secondary market.

Steve Adler says

Good to know, thank you

Coriander says

Now that we’ve technically hit the debt ceiling and Treasury is taking “extraordinary measures” to avoid default, is Treasury Direct still selling debt? Can I buy I bonds or other treasuries through Treasury Direct regardless of the debt limit, as long as we haven’t reached the “x date” when a default may occur?

Harry Sit says

Business as usual until you see something specific.

Matt says

Harry, thanks to your great blog and your book, I’ve learned how to regularly by Treasury bills and notes through auctions. One thing that I’ve noticed, though, is the different yield depending on the bank you use. I’ve bought the same six-month Treasury bills, on the same dates, using funds through Fidelity and Schwab–several times. Buying bills from the same auction, but using funds from different banks. Each time, the expected yield quoted by Fidelity has been slightly lower. And then once the bill is purchased, and placed in my account–the yield is slightly lower. Not a huge difference– like “4.56” for Fidelity to Schwab’s “4.76.” But still noticeable. Is that my imagination, or do these large institutional banks offer different returns, as a practice, on the same Treasury auctions?

Harry Sit says

Your imagination. I put it in red font in this post: Ignore the estimate. The estimate before the auction is just that, an estimate. Everyone gets the same actual yield from the auction. It doesn’t matter which broker you use.

To verify that’s the case, look at the dollar amount deducted from your account per $1,000 of face value in your trade confirmation or account history. You get the same yield for the same Treasury when you pay the same price on the same day.

When you’re holding to maturity, it doesn’t matter what yield is displayed in your account post-auction. Treasury pays the same principal value at maturity regardless of which broker you use.

Steve Adler says

Where can we find the estimated yield for an upcoming auction?

Harry Sit says

You see an estimated yield in the listing before you place an order. The estimate for a new-issue Treasury doesn’t affect anything because it’s just a wild guess.

Jacie Breck says

Now that we’ve reached the debt ceiling is there greater risk investing in T bills? Would sticking to CDs be any safer now? Thanks

Harry Sit says

I’m not worried but obviously this is unprecedented. No one knows what direct and secondary effects it will have.

SSA says

Thank you for this informative post. What are your thoughts on moving money to a treasury fund like VUSXX?

I know that the yield will lag the actual treasury rate – but your funds would be much more liquid.

Is there a difference in the way Vanguard would report the interest earned for directly buying treasuries vs keeping funds in VUSXX? Either way Vanguard would need to indicate that state taxes are exempt, correct?

Harry Sit says

It’s a great option for money that you may need at any moment’s notice. See Guide to Money Market Fund & High Yield Savings Account. Interest earned from direct holdings of Treasury Bills and interest earned through a money market fund that invests in Treasury Bills are reported by the broker on different tax forms but you’ll have supplemental information to help you calculate interest exempt from state and local taxes.

Jim Davis says

T-Bills are 100% liquid. In fact , they are more liquid than the money fund, which can only be sold end of day.

The t-bill sale is intraday , and the funds are available to you

SSA says

@Jim Davis, when you say they are hundred percent liquid – do you man that they could be sold on the secondary market before maturity?

Lefty says

Isn’t it more advantageous to buy treasury bills in a taxable account or Roth IRA versus a traditional IRA since in a traditional IRA the distribution wouldn’t benefit from the exemption from state or local taxes?

Harry Sit says

It’s all relative. If you’re going to put Treasury Bills in a taxable account or Roth IRA versus a Traditional IRA, what will you put into a Traditional IRA? If you’ll put stocks in a Traditional IRA, you lose the favorable tax rates on long-term capital gains, which affects you more than losing the exemption from state and local taxes. Between these two assets, you’d rather put Treasury Bills in a Traditional IRA.

Leighton says

Losing interest on weekends and market holidays when buying T-bills. My learning experience to consider:

My brokerage money market (MM) fund pays 4.48%, but a cash position pays nothing. When I buy T-bills, the brokerage company will not take the money directly from my MM to buy the T-bill. I must sell the MM the BUSINESS day before settlement of the T-bill, so I lose at least a day of 4.48% there. The same happens in reverse on maturity – I lose another day of 4.48%.

In addition, 1, 2, & 4 mo bills settle on Tuesday, so I got caught once where the Monday before was a market holiday. So, I had to sell my MM on the prior Friday, losing 3 days of 4.48% (Sat, Sun, Mon), so that the cash will be there to settle on Tuesday.

On maturity, the money is put back into cash. If that happens to be on a Friday, then my trading that back to my MM wouldn’t happen until the following Monday, losing interest for Sat, Sun, & Mon. (God forbid if Monday is another market holiday.)

Naturally, the shorter term the treasury, the greater impact this has. Just a thought.

Harry Sit says

That sounds like a problem specific to your broker, not an attribute of T-Bills. A better broker like Vanguard or Fidelity automatically sells money market fund shares on the settlement date for the purchase and drops the money into the money market fund on maturity.

There must be other reasons that you use this broker. Losing interest before and after settlement and having to manually buy and sell money market fund are just prices you pay for the other benefits you get from this broker.

Leighton says

Right; thanks for that. I didn’t know if brokers other than Schwab did it differently. Apparently Fidelity and Vanguard do what Jack White Co. did 25 years ago already, “sweeping” the proceeds from sales directly into your chosen MM fund. And when buying, they take it out of the MM fund – all as you indicated for Fidelity and Vanguard.

Jack White Co was bought by TD Waterhouse long ago, who then bought Ameritrade. I switched to Schwab 10 years ago, and somewhere along the line that “sweep” feature was lost, as acknowledged by their rep by phone a couple of hours ago.

Matt F says

Harry: When I buy a T-Bill on the secondary market & hold to maturity, is my interest earned = what I get at maturity minus the secondary market price I paid? Or is part of that considered capital gain for tax purposes?

Harry Sit says

All interest. No capital gain.

Joe says

Good Day, My account will be moving to Schwab from TDAmeritrade later this year. I noticed on the Schwab site that the fee for buying Treasuries is listed as $0 + $25 service charge. Curious if anyone in your group using Schwab would know what the $25 service charge is? Is that per treasury bought, an annual fee, etc. Thanks…

Harry Sit says

Schwab’s fee schedule has two columns. The first column shows $0 for online trades. The second column shows $0 + $25 service charge for broker-assisted trades.

Allan says

Talked to Vanguard’s Fixed Income desk on Monday. Vanguard’s cut-off time to put in bids for T-Bills on the Auction Date is 9:30am. He said many people wait until just before the 9:30am cut-off time to get the most accurate “indicative yield” on the auction.

Alex says

Hi Harry,

First question

Regarding auto roll feature. I am getting 1) interest payments every six months + 2) full face value when the note matures

Does auto roll feature take care of 1) and 2)? Or do I need to use those interest from 1) and 2) and buy new bills manually?

Second question

Is there any way to buy a fractional bill for $1500 instead of $1000? How would I spend $500 if I want to buy a bill with this?

Harry Sit says

The auto roll only kicks in at maturity. Interest payments will get credited to the default cash position, which is a money market fund at Fidelity. You can only buy in $1,000 increments in a brokerage account. An amount less than $1,000 stays in the money market fund. You can add it to a mutual fund or use it to buy an ETF.

Alex says

As best I can tell, the major virtue of Treasury Direct is the reinvestment process: it’s usually seamless at Treasury Direct; there’s usually no gap between when the old security matures and the the one is issued. But the Treasury Direct web site takes getting used to, and Treasury Direct no longer provides help via e-mail; you have to call them early in the day.

I’m new at this, but at Schwab there can be significant issues with the “autorollover” process for reinvestments. Most importantly, it’s only available at Schwab for short term T-bills, 6-months or less is duration. Also, it’s not available at all for Schwab Alliance accounts; these are accounts opened through a financial advisor. I don’t know whether or not there would be gaps between the maturity date and the new issue, but if so beware: the money will be in Schwab bank during the gap, which last time I checked doesn’t pay much interest, and also I don’t believe Schwab bank records any beneficiaries you may have recorded for your Schwab brokerage account, which SUBSTANTIALLY reduces FDIC protection while the money is sitting in Schwab bank. Schwab: if you’re listening, and I’ve made any mistakes please correct!

Harry Sit says

There’s a one-week gap during auto roll at Schwab. Zero gap at Fidelity.

Donald says

Aside from auto-rolls, but still regarding the Schwab bank account as a “middleman,” between your high interest MM fund, and the T-bills:

Does Fidelity also have their bank as a “go-between,” out of which Treasury purchases are settled, and into which maturing Treasures are deposited?

If one keeps his money in a high yielding MM fund, then the Schwab bank account middleman always delays settling, since one must sell the MM fund the previous day.

And again on maturity, as one can only buy back the MM fund AFTER the Treasury money appears on one’s Schwab bank account.

And God forbid that a weekend or holiday falls between these actions, or one loses even more days of interest.

Harry Sit says

Fidelity uses a money market fund as the core position for settlement (or at least you can choose a money market fund as your core position if it’s not the current default). This money market fund doesn’t have the highest yield but you don’t lose much. We’re talking about a difference of maybe 0.25%.

Sammy says

Since the US never has defaulted before the theatrics in Washington makes me as the following questions:

– What do holders of Treasuries lose exactly?

– Do they lose interest only for a certain period of time or the whole value of treasury bill/note?

– Can government return the full value of bonds and full interest at a later date?

These question may sound foolish, but since we’ve never had the US default in the past, I’m not sure what questions/concerns I should consider before buying a T-Bill. OTOH, I also hold bond funds so I would be fleeced either way I bet :-(.

Thanks

Harry Sit says

No one knows what will happen this time. We know that during previous government shutdowns, non-essential federal government employees were furloughed without pay. They received back pay after the government opened again. The employees basically had paid time off. If I have a bill maturing during a standoff, I expect to be paid in full with interest when it’s all said and done.

Nan says

Thank you for the detailed guide, Harry. I’ve been trying to find out the price advantage of buying a new issue vs buying in the secondary market ever since I read your statement that buyers can’t get a bargain by buying in the secondary market.

1. Why would bid-ask spread matter if you’re just buying and not selling? Wouldn’t it be a point of concern only if the ask price is higher than the original price at auction, which isn’t always the case?

2. If the YTM of a T-bill in the secondary market is higher than the estimated yields of upcoming new issues, isn’t it better than to buy the one in the secondary market? Isn’t YTM at ask all I need to care about price-wise when making the purchase decision? And even then, are people just banking on the hope that the actual yield for the new issue ends up being higher than the secondary’s YTM?

3. I’ve also been told that the price/yield of a T-bill is the same whether I buy it at auction or in the secondary market. How is this possible when a bond price goes down in a rising interest environment, which will make the secondary offering cheaper?

Looking forward to learning from the knowledge you share and finally getting some clear answers! Thank you so much in advance.

Harry Sit says

First of all, if you prefer the immediacy and the certainty of knowing your yield, you can buy on the secondary market. See How to Buy Treasury Bills & Notes On the Secondary Market. You have a wider choice of maturities when you buy on the secondary market.

1) The bid-ask spread isn’t huge but it always exists. No one works for free. Bond dealers make money when they trade with you. It doesn’t matter whether you’re buying or selling. Think of the currency exchange shops at airports. They always quote two prices. They make money regardless of which way you’re exchanging. I showed an actual example of a secondary market quote in the post linked above. The spread may be small enough that you don’t care but it still exists.

2) An estimate is just that, an estimate. It means nothing when the yield in the secondary market is higher than any estiamte. The actual yield may end up higher or lower than the yield you saw at one point in the secondary market but it isn’t predicted by the estimate. People aren’t banking on the hope that the actual yield ends up higher. They are banking on not paying the bid-ask spread every time.

3) You’ve been told wrong. The yield isn’t the same. It can’t be because the yield in the secondary market changes by the minute. A rising interest environment doesn’t mean that the yield must rise every single day. Even if it does rise every single day, there’s always another auction on the horizon and the price will be cheaper again. By that logic you’d be waiting forever for it to go cheaper and cheaper.

In the end, if you only buy one time for a small amount, it doesn’t matter much how you buy. If you buy frequently in large amounts, the spread adds up. In addition, the auto-roll feature is only available when you buy new issues. Auto roll saves you time from tracking maturities and placing new orders.

Alex says

In today’s world, marketable Treasury securities are a very reasonable investment for the fixed income portion of a portfolio. They pay more interest than bank accounts, and are backed by the full faith and credit of the Federal government (no sarcasm, please!). The interest is not subject to state and local income taxes, though it is Federally taxed. Treasury securities are liquid, due to the robust secondary market (they are subject to interest rate risk, of course).

The downside is that Treasuries mature, at which point the money stops earning interest, until it is reinvested. As Mr. Sit has noted, reinvestments require either watching maturity dates and making reinvestments manually, or taking advantage of the secondary markets and “auto-rollover” services from some brokers, such as Fidelity. Usually such reinvestments involve a small transfer cost in the form of the buy-sell spread. This isn’t high, but it is certainly real. I’ve heard the figure 10-20 basis points (0.1 to 0.2 percent). If someone has better or more accurate estimates, please post!

The only practical way of avoiding this inconvenience and expense is by opening a Treasury Direct account. These can automate reinvestments, and avoid gaps during which the investment doesn’t earn interest. The Treasury tries to time new issues such that the settlement date for a new issue matches the date for a corresponding maturing security. But there are limits on how many reinvestments one can do. Right now, in my opinion, the major downside of Treasury Direct is that the accounts can be complicated for a newbie to master, and the Treasury is not providing good customer support – they no longer accept most email, for example. Also, Treasury Direct does not provide a means for selling securities prior to maturity on the secondary market; one has to transfer the securities “in kind” to a broker. (They used to provide a convenient mechanism for selling on the secondary market, but they closed down this feature years ago, which is unfortunate). You can easily open a Treasury Direct account, but the lack of good customer support is a hindrance. Your tax money at work!

Harry Sit says

Fidelity’s auto roll works similarly to TreasuryDirect’s reinvestments. It uses the money from a maturing issue to buy a new issue of the same term. The auto roll uses Treasury auctions, not the secondary market. The dates line up well and there’s no bid-ask spread. Charles Schwab does the same with new issues except they only do it for Treasury Bills with a maturity of six months or less and they delay the purchase by one week after an existing bill matures.

Sammy says

@Alex,

I’m not sure what exactly the point you are trying to make with your comment. This info has been known for a long while. I personally will say that Treasuries are risk-free fixed income investments after the comedy in Washington ends. Even Harry said above that we’re OK to buy 1 or 2-mo treasuries… Well, I had eyes on 6 month, 1 year and 2 year, but now I think I will wait before I buy them. And it’s so irritating (to me at least) that these threats of US gov’t default have become a more frequent topic during the last 10 years.

Alex says

Harry,

Thanks very much for your comment. I didn’t know that about Fidelity’s autoroll facility. In the past, I’ve used Treasury Direct to hold my Treasuries, but it sounds like Fidelity would be a better bet. They’re easier to reach than Treasury Direct if there are questions.

RobI says

First time buying a 2 year bond (vs a Tbills) and trying to understand how bonds work. I see this in my Vanguard account after yesterdays auction

U S TREASURY NOTE 4.625% 06/30/25 06/30/23 at $99.92

I have 2 questions.

1. Why is the purchase price $99.92 vs $100?

2. Will the interest be paid out 6 monthly into my Vanguard brokerage account?

Harry Sit says

The coupon rate (the 4.625% part) is only set in increments of 0.125%. When the auction results in a yield between two increments, in your case 4.67%, which is above 4.625% but below 4.75%, the additional yield above the coupon rate is given in the form of a small discount in the price. Paying 99.92 gives you a yield of 4.67%.

Interest is based on the face value and the coupon rate. You’ll receive $1,000 * 4.625% / 2 = $23.125 per $1,000 in face value every six months as a cash deposit in your brokerage account.

RayK says

Hi Harry,

I am in the learning curve buying treasuries, so can you please explain “set in increments of 0.125%” in last post?

I get confused understanding the difference between the coupon rate 4.625% and where the 0.125% fits in? How is it calculated?

Thank you!

Harry Sit says

It means the coupon rate must be an integer multiple of 0.125%. It can be 4.5%, 4.625%, 4.75%, or 4.875% but it can’t be 4.60%, 4.70%, or 4.80%. The coupon rate is set from the yield rounded down to the nearest integer multiple of 0.125%. When the yield is 4.67%, the coupon rate is set to 4.625% because that’s the first number you hit as you go down from the yield to the possible values. If the auction had resulted in a yield of 4.61%, the coupon would’ve been set to 4.5%.

RayK says

AS I try to understand this, am I correct to pay more attention to the YTM when buying a bond with the coupon being part of the total yield payout?

Thank you much Harry!

Harry Sit says

Between the coupon and the yield, yes, but I would say pay more attention to the maturity you want. The yield is determined by the market. It is what it is. No one knows how it will change. It isn’t possible to pick a “sweet spot.”

ustaad says

Very surprised by today’s 26-week auction result. The results for the CUSIP 912797GE1 is identical to the one-week ago auction for CUSIP 912796ZY8. In both cases, the rate settled at 97.335722. Is this a normal occurrence? It appears much like a rate manipulated by big players particularly in light of the fact that today’s auction is after the Fed raised the rate by 25 basis points!

Harry Sit says

It’s normal. You see the prices from past auctions here when you filter for the 26-week term.

https://treasurydirect.gov/auctions/auction-query/

The same 97.335722 price also happened on 7/10. If you’re not looking at too many digits after the decimal point, the price has been $97.3X since 5/22. Last week’s price already anticipated the Fed’s move.

Ustaad says

Thanks, Harry!

RobI says

Harry

Can you help explain how to correctly compare yields between Tbills and money market funds. In particular, for Vanguard Money mkt funds, is compound yield the correct comparison to Tbill yield rather than 7 day yield.

Secondly are the historical yield quoted on the Treasury site all compound yields? …. see here

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202308

Harry Sit says

There’s a technically correct answer but we don’t need to get into it. The Vanguard Federal Money Market Fund has a 7-day SEC yield of 5.26% and a compound yield of 5.39% as of 8/11/2023. The small difference between the two numbers is secondary to other considerations between T-Bills and a money market fund. The T-Bill yield is locked in for the full term. The yield on a money market fund changes daily. If the daily yield goes up during the term of a T-Bill, a money market fund that starts with a lower yield will catch up. If the daily yield goes down during the term of a T-Bill, a money market fund that starts with a higher yield will lose its lead. We don’t know whether the daily yield will go up or down and by how much. We can’t make decision based on whether the T-Bill yield is higher or lower than the average yield on the money market fund in the last seven days.

The different terms of T-Bills and a money market fund make them not directly comparable. Buy T-Bills if you want a rate fixed for the term and you can commit to holding for the full term. Buy a money market fund if you need to take the money out on unpredictable dates. I have both. Money I know I don’t need until a certain date is in T-Bills. Money I may need at any moment is in a money market fund. I don’t know which part had or will have better returns.

Leroy says

Thank you so much for this article, Harry. I’m just dipping my toe into buying t-bills for the first time (through Fidelity.) I just want to double check my understanding of the risk in Zero Coupon Bond (ZCB) — if interest rates rise higher than the ZCB, then it loses value ONLY in the secondary market??? As long as I hold the ZCB to maturity, then I won’t lose the interest rate I bought the bond for?

Thanks,

L

Harry Sit says

Treasury Bills by definition have no coupon but they’re not the same as Zero Coupon Bond. See comment #23. You get the guaranteed face value back if you hold the Treasury Bill to maturity. Price fluctuations after you buy don’t affect you when you don’t sell.

Leighton says

Harry, the “Daily Treasury Par Yield Curve Rates” you mentioned to get a feel for the T-bill auction are given in months, whereas Tbills are sold in weeks. This led me to click and compare the “Daily Treasury Bill Rates” selection, where I saw those values are indeed given in weeks.

I’ve noticed for the same dates, the Tbill rate range is always lower than the “Par Yield Curve Rate,” and is much closer to the subsequent auction rate.

For example on Oct 5, 2023:

Daily Treasury Par Yield Curve Rates was 5.57%

Daily Treasury Bill Rates: “Bank Discount” was 5.30, and “Coupon Equivilent” was 5.41%

The Oct 5 auction result was: 5.39%, which is very close to the “Coupon Equivilent” of 5.41%. So, would this be a better estimate for the auction than “Daily Treasury Par Yield Curve Rates”?

(Fidelity’s “expectation” on it’s purchasing page was 5.35% – also very close to the resulting auction result).

Harry Sit says

I use the Daily Treasury Par Yield Curve Rates because this post covers all maturities. Daily Treasury Bill Rates also works if you only care about bills. Both are good enough to get a feel. I would just call the rate mid-5%. The small differences in the data sources shouldn’t affect your decision in whether to buy or which maturity to buy.

Bill W says

“E*Trade

E*Trade’s commission schedule says their fee is $0 for buying new-issue Treasuries but I don’t have screenshots of how to do it because I don’t have an account with E*Trade.”

Here are instructions with screenshots of how to purchase Treasury bills at E*Trade:

https://content.etrade.com/etrade/estation/pdf/trading-treasury-bonds.pdf

Harry Sit says

Thank you, Bill. I added the link to the E*Trade section.

BWS92082 says

I am having a hell of a time finding out what “indicative yield” (on a TIPS) means. I spent 20 minutes on google and found nothing definitive. AI provides contradictory definitions. Vanguard uses the term frequently but defines it nowhere. Does this term mean inflation-adjusted return? Could you please let me know? Thx.

Harry Sit says

It means a guess of the yield for an upcoming auction. It’s just a guess. It has no effect on the actual yield, which will be determined in the auction. Just ignore it.

Easy2u says

I cant see the latest comment in this thread, but received a new notice to look in?

Harry Sit says

I made a fix last night. The link in this new comment notification email should work correctly now. Just scroll up a little to see the previous comments.

Maria K. Nikolova says

Dear Harry,

Thanks a lot for your very informative article. I have a question regarding SPDR Blmbg 1-3 Mth T-Bill ETF BIL. Can you explain why the this ETF is taxed at the state level if it contains treasury bills? I have Charles Schwab brokerage account and I wonder if I should keep cash in BIL ETF (30 day SEC yield is 5.18%) or in Schwab MM fund SNSXX ( I live in NY so I do not want to pay state tax).

Harry Sit says

98% of the income from BIL last year is not taxed at the state level. See how to tell your tax software in Make Treasury Interest State Tax-Free in TurboTax, H&R Block, FreeTaxUSA.

John G. says

Thank you, Harry, for providing such a well-written and useful step-by-step guide! It saved me a lot of time over figuring this out on my own.

Alex says

Harry made this observation in one of his comments above, but I think it’s worth repeating.

There’s a signficant “gotcha” is Fidelity’s autoroll feature. You don’t need to have cash in your sweep account when an autoroll take place. But if you do, Fidelity will lock an amount equal to the amount of the autoroll between the auction and settlement date. You won’t be able to withdraw or reinvest this money for the several day period between auction and settlement. Fidelity’s website obscures this lock; it isn’t shown on the positions page, only on the balance page. Otherwise, Fidelity’s autoroll is a very nice feature of their account.