[Updated on March 14, 2024.]

Both money market funds and savings accounts are good places for temporary savings that you may deposit and withdraw at any moment. If you can afford to lock up your money for a set period of time — for as short as four weeks — you’ll earn more interest in Treasury Bills. See How To Buy Treasury Bills & Notes Without Fee at Online Brokers. If you can afford to lock up the money for at least a year, consider I Bonds. See How to Buy I Bonds.

When the Federal Reserve kept the short-term interest rate close to zero in 2020 and 2021, pretty much all the money market funds paid an annualized yield of only 0.01%. Some online banks and credit unions were more generous at that time. They paid something like 0.65% annual percentage yield (APY), which wasn’t really “high yield” but it was certainly better than 0.01%.

Now that the Fed has been raising rates, money market funds have become competitive again. As of March 13, 2024, Vanguard Treasury Money Market Fund has a yield of 5.28%, which is also partially exempt from state and local taxes, whereas Ally Bank’s Savings Account pays only 4.35% and it’s fully taxable.

Who Sets the Interest Rate

Money market funds are an investment product. They’re offered by brokers such as Vanguard, Fidelity, or Charles Schwab. Savings accounts are offered by banks and credit unions. A big difference between how much interest a money market fund pays and how much a savings account pays is in who sets the interest rate.

A side note: Some banks and credit unions also offer money market accounts. They’re just a savings account by a different name, perhaps with slightly different features such as check-writing privileges or a debit card for ATM withdrawals. They’re not the same as a money market fund. For the purpose of this post, I treat money market accounts from banks and credit unions the same as savings accounts.

Money market funds invest in very short-term debt securities in the financial market. The fund manager takes a fixed cut (the “expense ratio”) from what they earn in the market before paying the rest to you. If the market yield goes up, the yield you receive automatically goes up. If the market yield goes down, the yield you receive automatically goes down. You’re at the mercy of the market conditions. That’s why they could only pay 0.01% in 2020 and 2021.

The interest rate on a savings account is set by the bank or credit union. Banks and credit unions want deposits as reserves to make loans. They’ll set the rate high if they need to attract more deposits. They’ll set it low if they don’t have a strong loan demand. You’re at the mercy of the bank or credit union. If they decide to stay behind, there’s nothing you can do except jump ship to a different bank, which requires giving your Social Security number, creating new login credentials, opening a new account, linking your checking account, downloading a new mobile app, etc., etc.

Therefore, when you put your money in a savings account, sometimes you get a competitive interest rate, and sometimes you get a below-market interest rate. When you put your money in a money market fund, you’ll get the market yield minus the fund manager’s cut at all times, no more, no less.

If you go with a bank that offers a higher interest rate, be prepared to move when they lag behind. You can see the current rates offered by banks and credit unions at depositaccounts.com.

Comparing Yield

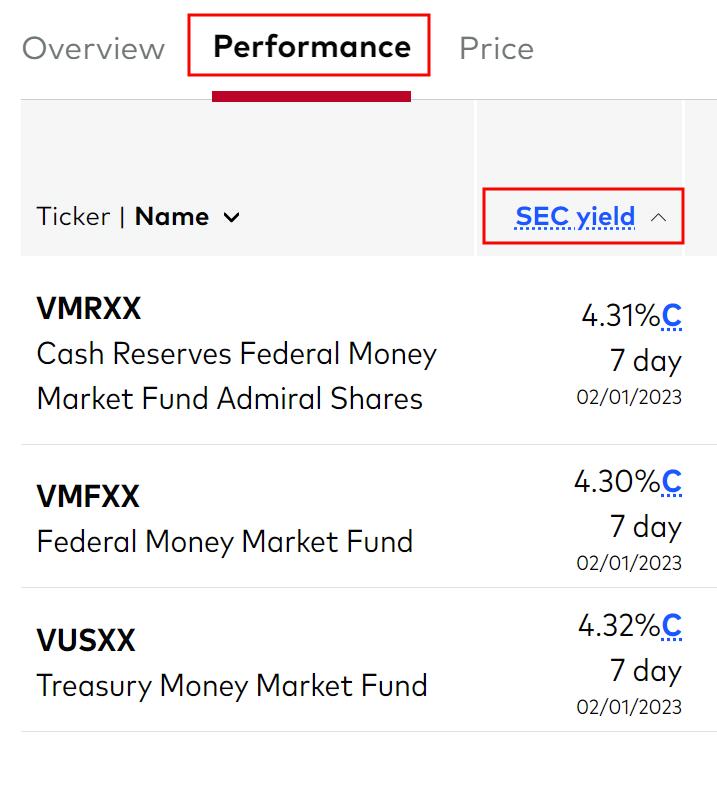

The yield on a money market fund changes with the market daily. A money market fund quotes a 7-day average SEC yield. That’s the average yield of the fund in the past seven days. When the market yield is rising fast, the yield you’ll get when you invest in the money market fund now may be higher than the average yield in the past seven days.

The yield quoted for a money market fund is after subtracting the expense ratio taken by the fund manager. It’s directly comparable with the yield on a high yield savings account. You don’t need to subtract the fund’s expense ratio again from the quoted yield.

The yield on a savings account is fixed until the bank or the credit union decides to change it. It’s completely up to the bank or the credit union as to when they’ll change it and how much they’ll change it.

FDIC Insurance

Money market funds aren’t insured by the Federal Deposit Insurance Corporation (FDIC), National Credit Union Administration (NCUA), or any other government agency. However, if you stick with money market funds offered by large brokers such as Vanguard, Fidelity, or Charles Schwab, they’re generally safe.

A money market fund that wasn’t offered by a top-3 broker did fail during the financial crisis in 2008. If you’re really concerned about safety, you can also use a money market fund that invests only in Treasuries or government debt. The money market fund itself isn’t insured but the underlying investments in the fund are backed by the government.

Savings accounts are insured by the FDIC (or NCUA for credit unions) for up to $250,000. The insurance goes up to $500,000 for a joint account.

Having FDIC or NCUA insurance is nice but I don’t lose sleep over not having it when I use a money market fund from a large broker. When there’s only a small difference in the yields between different types of money market funds, choose one that invests only in Treasuries or government debt for extra safety.

Fees and Minimums

A savings account can have a minimum deposit or monthly fees but the typical good high yield savings accounts don’t have any minimum balance requirement or monthly fees.

A money market fund can also have a minimum investment but many don’t. Many funds that have a minimum investment also have it only as the initial minimum. You need to put that much into the fund to get started but you don’t necessarily need to keep that much in the fund at all times. They don’t kick you out when your balance goes below the initial minimum.

Withdrawal and Transfer Limits

When you need to withdraw from a savings account or a money market fund, you usually just transfer the money to your checking account.

Savings accounts used to allow a maximum of six outgoing transfers per month by Regulation D of the Federal Reserve. The Fed removed that requirement from the banks but some banks are still imposing the old limit on their own. Avoid those banks.

Money market funds don’t have any limit on the number of withdrawals per month.

Each bank or credit union sets the limit on the amount of the transfer on a per-transfer, per-day, or per-month basis. For example, a credit union has an outbound transfer limit of $5,000 per day.

Brokers typically have a higher limit on outgoing transfers than banks and credit unions. If you often transfer large amounts, use a money market fund.

Trust and Beneficiaries

Brokers in general handle trust accounts and beneficiaries better than banks.

A money market fund for a trust account that already owns other assets at the broker is another line item within the same brokerage account. Having a savings account for the trust at a bank involves a whole set of paperwork. Many online banks don’t support trust accounts at all.

Brokers usually have robust support for beneficiary designations. Some banks don’t allow POD beneficiaries on their accounts or don’t allow contingent beneficiaries.

Sweep Funds and Purchased Funds

A broker usually offers several different money market funds. They make some of them available as the default “sweep” fund in a brokerage account, while other money market funds stay as “purchased” funds.

A sweep fund (sometimes called a “core” or “settlement” fund) serves as the default cash position in your brokerage account. The cash you deposit into the account, dividends not automatically reinvested, or any proceeds from selling your investments “sweep” into this fund daily. Withdrawals and cash for new purchases come out of this fund automatically. The broker may designate one money market fund as the default but they may also let you choose among a handful of funds to serve as the sweep/core/settlement fund.

Your choices of a sweep fund are limited. They don’t make all of their money market funds available as a sweep/core/settlement fund. The ones made available as a sweep fund don’t have the best yield because they have higher costs. The higher-yielding money market funds are only available as a “purchased” fund, which requires an extra step to buy or sell just like other mutual funds.

A purchased money market fund isn’t as automatic but you get a higher yield to compensate. If you keep a large balance in a money market fund, it’s worth the extra step to buy and sell manually.

Tax Treatment

You pay both federal income tax and state income tax on the interest earned in a savings account. The tax treatment on the interest earned in a money market fund depends on the underlying investments in the fund.

There are five types of money market funds:

- Prime

- Government

- Treasury

- National Tax-Exempt

- State-Specific Tax-Exempt

The last two types pay a lower yield but are tax-free at the federal level, which can be a good choice if you’re in a high tax bracket depending on the yield difference between tax-exempt funds and taxable funds. The state-specific tax-exempt funds are tax-free at both the federal and the state levels for residents in that state.

| Federal Income Tax | State Income Tax | |

|---|---|---|

| Prime | Yes | Yes |

| Government | Yes | Partial |

| Treasury | Yes | Partial |

| National Tax-Exempt | No | Partial |

| State-Specific Tax-Exempt | No | No |

States don’t tax interest from Treasuries and bonds from their own state. Some states prorate. If 30% of the interest earned by a fund is from Treasuries and in-state bonds, 30% is tax-free for state income tax. Some states require a minimum percentage of interest or a minimum percentage of assets from these tax-free sources to qualify. If the minimum is 50% but the fund only earned 30% from Treasuries and in-state bonds, 100% of the interest is still taxable by that state.

The Best Money Market Funds

The same type of money market funds fish in the same pond, so to speak. The yield you receive from a money market fund depends heavily on the expense ratio the fund charges before paying you.

Among the top-3 retail brokers, Vanguard charges the lowest expense ratios in its money market funds. Even if you use another broker for your investments, you can still use Vanguard just for its money market funds as you do with a bank or a credit union for a high yield savings account.

Vanguard

The default settlement fund in a Vanguard brokerage account is Vanguard Federal Money Market Fund (VMFXX). This fund invests in U.S. government securities. It has an expense ratio of 0.11%. Any cash you add to the brokerage account automatically goes into this fund. There’s no minimum, and you don’t have to do anything extra to buy or sell.

Vanguard also offers some other money market funds for buying and selling manually. All require a minimum initial purchase of $3,000. Please read Which Vanguard Money Market Fund Is the Best at Your Tax Rates for more information on Vanguard money market funds.

For maximum safety, Vanguard Treasury Money Market Fund (VUSXX, expense ratio 0.09%) invests exclusively in Treasuries. Interest from this fund is exempt from state and local taxes.

Fidelity

The default sweep/core fund in a Fidelity account depends on the account type. You can also change the core fund among a few available choices (except in the Cash Management Account).

The funds available as the sweep/core position include:

| Fund | Type | Expense Ratio |

|---|---|---|

| Fidelity Government Cash Reserves (FDRXX) | Government | 0.33% |

| Fidelity Government Money Market Fund (SPAXX) | Government | 0.42% |

| Fidelity Treasury Money Market Fund (FZFXX) | Government | 0.42% |

These core funds don’t require any minimum. As you can see, the expense ratios of these Fidelity money market funds are higher than the expense ratios of Vanguard money market funds, resulting in a lower yield in general.

Fidelity offers additional money market funds for manual purchases. These other money market funds are “semi-automatic” at Fidelity. You must buy them manually but Fidelity will automatically sell them when your core fund is insufficient to cover your withdrawals and trades. This is unique to Fidelity. Both Vanguard and Charles Schwab require manual selling for “purchased” money market funds.

Please read Which Fidelity Money Market Fund Is the Best at Your Tax Rates for more information on Fidelity money market funds. Here are some of them with a higher yield:

| Fund | Minimum | Type | Net Expense Ratio |

|---|---|---|---|

| Fidelity Money Market Fund Premium Class (FZDXX) | $100k; $10K in IRA | Prime | 0.30% |

| Fidelity Money Market Fund (SPRXX) | $0 | Prime | 0.42% |

| Fidelity Treasury Only Money Market Fund (FDLXX) | $0 | Treasury | 0.42% |

Prime money market funds have a higher yield because they invest in corporate debt in addition to government debt. You can earn slightly more by manually buying FZDXX ($100k initial minimum; $10k in an IRA) or SPRXX (no minimum). For extra safety, buy FDLXX because it only invests in Treasuries.

When you buy FZDXX or SPRXX manually, you can receive a yield close to the yield on a Vanguard money market fund while staying in the same account at Fidelity. Fidelity will automatically sell FZDXX or SPRXX when you don’t have enough money in the core fund to cover withdrawals and trades.

Charles Schwab

Charles Schwab doesn’t offer a money market fund as the default sweep in its brokerage accounts. It uses a “bank sweep” as the default, which pays a much lower interest rate.

Schwab offers money market funds only as “purchased” money market funds. You’ll have to buy and sell these funds manually. Please read Which Schwab Money Market Fund Is the Best at Your Tax Rates for more information on Schwab money market funds. Here are some of the available funds:

| Fund | Type | Net Expense Ratio |

|---|---|---|

| Schwab Value Advantage Money Fund (SWVXX) | Prime | 0.34% |

| Schwab Government Money Fund (SNVXX) | Government | 0.34% |

| Schwab U.S. Treasury Money Fund (SNSXX) | Treasury | 0.34% |

You can receive a yield close to the yield on a Vanguard money market fund while staying in the same account at Charles Schwab but you will have to buy and sell a money market fund manually. For extra safety, buy SNSXX because it only invests in Treasuries.

Merrill Edge

Similar to Charles Schwab, Merrill Edge also only offers a “bank sweep” as the default cash option, which pays a low interest rate.

However, you can buy and sell a number of money market funds manually. See the full list on Merrill Edge’s website. Here are some higher yielding funds:

| Fund | Type | Net Expense Ratio |

|---|---|---|

| BlackRock Liquidity Funds: Treasury Trust (TTTXX) | Treasury | 0.17% |

| Federated Hermes U.S. Treasury Cash Reserves (UTIXX) | Treasury | 0.20% |

| Fidelity Investments Money Market Treasury Only Class I (FSIXX) | Treasury | 0.18% |

Although these institution-class funds normally require a very large minimum investment, you can buy them at Merrill Edge with only a minimum of $1,000.

***

Both a high yield savings account and a money market fund work for temporary savings. A money market fund has the benefit of automatically adjusting to the current market yield (minus the fund’s expense ratio). You aren’t at the mercy of a bank’s decision to catch up or stay behind. If you’re in a high-tax state, using a Treasury money market fund gives you the highest safety, and the interest is exempt from state and local taxes.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Rick says

Fidelity has been offering a fee waiver (at least on SPAXX) for some time. current net expense ration is .18%. this can go back to the .42% at any time obviously.

Leni says

I am very glad I found out about your website and get your emails. I also have your book. Thanks for sharing such high quality information people like me can use.

After reading this post, I am wondering why money market mutual funds are a good idea at this time. Per Capital One website, they say that they pay 2.15% on Capital One 360 savings account. And there’s no expense ratio. That’s a lot better than, for example, the Vanguard Federal Money Market Fund at 0.64% and and 0.11% expense ratio. (I haven’t checked out the other money market funds listed in this post, but I imagine they’re in line with the Vanguard money market fund.) Of course, you do say that money market funds reflect current interest rates (with some lag) and bank interest rates reflect what the bank decides is best for their business. So the interest rate difference between a bank savings account, and a money market fund could flip to be in favor of the money market fund. Good to know.

I would like to learn how to ladder treasury bonds and buy them through Vanguard or another brokerage firm. I hope you will write a post about this.

Thank you!

Leni

Harry Sit says

You looked at the wrong column. 0.64% is what Vanguard Federal Money Market Fund earned year-to-date in 2022. It’s not annualized, and it includes the months when the rate was a lot lower earlier this year. The average yield in the last 7 days was 2.58%. This is the number to compare with the 2.15% on Capital One 360 savings account. As the market adjusts to the Fed, this rate increases automatically, whereas you have to rely on Capital One’s good will to get a decent rate in the savings account.

The post on how to buy treasury bonds through Vanguard is in the first paragraph of this post.

Michael says

Excellent article–clear and straightforward. Another option for cash right now is CDs, if you are able to tie up your money for a fixed term. These rate for Vanguard brokered CDs are currently posted (when the term ends, I believe the money goes back into your sweep account, or maybe you can have it rolled automatically into a new CD):

1-3 months 3.35%

4-6 months 3.75%

7-9 months 3.95%

10-12 months 4.15%

Harry Sit says

These brokered CDs aren’t as good as Treasuries of comparable terms when you take into account the state income tax exemption on Treasuries. See the link in the opening paragraph for how to buy Treasuries with no fee at Vanguard.

Dave S. says

If I were to start investing some cash at this moment, still not sure why would I buy money market funds such as VMFXX, which has a YTD of 0.92% (as plainly stated on the Vanguard website), while I can get 3%+ now for savings accounts at a bank.

Also MMFs carry no guarantee of principal, in additional to charging an expense ratio!

Harry Sit says

The YTD of 0.92% looks backward. It includes returns from months earlier this year when interest rates were lower. Banks that offer 3%+ now didn’t offer 3%+ earlier this year either. Banks don’t tell you what you would’ve earned year-to-date had you had an account with them since January 1 but I doubt it’s any higher than 0.92%.

The more relevant number is the 7-day average SEC yield. Scroll down to the Price section on Vanguard’s website to see it. It’s 2.90% for VMFXX and 3.12% for VUSXX. The interest from VUSXX is also exempt from state and local taxes. When interest rates are rising, the yield you get today may be higher than the average in the previous 7 days. The quoted yield numbers are already net of the expense ratio.

Although the fund itself isn’t guaranteed by the government, the underlying holdings in VMFXX and VUSXX are government obligations or backed by government obligations. VUSXX holds only Treasuries.

anon says

Great post! A couple of thoughts about comparing interest and/or dividend rates:

Vanguard displays 7-day SEC yield for MMFs. I don’t know where to find 1-day SEC yield, but you can calculate it if you hold the fund at Vanguard and look at “Balances by date” and then “accrued dividends” on consecutive dates, then you can deduce the dividend rate for that one day.

For example if you had $100k in VMFXX and the accrued dividends went up by $11.51 in one day, then you could deduce that the dividend for that one day was 1.151bp (per day).

If you watch this when the Fed raises rates on a Wednesday, this 1-day yield abruptly jumps the next day. For example, if the Fed raises rates by 75bp, and the fund (e.g. VMFXX) holds about 60% repos, then the (annual) yield abruptly jumps by about 45bp=60%*75bp. You could deduce this if, on $100k in VMFXX, you got an extra $1.23=45bp*$100k/365 in daily dividends on Thursday compared to Wednesday. (Other holdings in the fund change yield gradually.)

The 7-day SEC yield is a rolling average for the past 7 days, so it smears out this jump over a week, so during the week after a Fed raise, the 7-day SEC yield is markedly lower than the 1-day yield, by tens of basis points, so if comparing rates on various cash options, then the displayed 7-day SEC yield sizeably understates the yield.

Another difference is that online savings accounts typically list the compounded rate APY (for example as listed at depositaccounts.com). But I believe that SEC yield is more akin to an APR, in that if the 1-day dividend is, say, 1.151bp (per day), then the SEC yield would be quoted as 1.151bp*365=4.2% (per year). But the compounded rate would be 1.0001151^365-1=4.29%, and this would be number to compare quoted APYs of online savings accounts.

So these are two ways the (7-day) SEC yield understates the actual return compared to listed APYs of online savings accounts. Compounding (e.g. APY vs APR) makes about 0.1% difference at current rates. And for the week after a Fed raise, the underquote can be even bigger. So someone comparing MMFs to OSAs might not realize that MMFs are currently even better than they look.

In fact MMFs currently beat almost all OSAs (which is made even clearer by a true rate comparison), and at this time it’s not even worth rate chasing with OSAs. Just keep monthly spending in an OSA (with unlimited withdrawals) and park the rest of one’s cash position in MMFs.

Harry Sit says

I agree. When rates are rising, the 7-day average yield understates the latest yield of a money market fund.

Mel Chase says

Hi, and thanks for all of your excellent blogs!

Given the possibility of reaching the debt ceiling in June 2023, does that change any of your blog above? Are Treasury Money Market Funds still the safest? Or are they safe from now until say, May 2023, and then I should be prepared to move out of them? Or is another type of Money Market Fund preferred to buy now (Jan. 2023)? I am looking to use Fidelity or Vanguard. (BTW: I live in NYC, and am in the 22% Federal tax bracket.) I am looking to move cash from Alliant Credit Union which is earning just 2.6%. I could also put some at CapitalOne at 3.3% and OneFinance at 3% where I already have accounts. (I will also try to buy a 3 month Treasury, and a 1 year and 3 year CD at Alliant (earning 4.6% each in Jan. 2023.) Are there any other factors I should consider about where to put parts of my Emergency Fund and “safe” part of my portfolio? Thank you for your helpful site!

Jeff Mason says

If I have VMFXX as my Vanguard settlement account, is there any reason by buy it as a purchased money market fund? Is there any difference? I’ll be funding auto investments over time from that fund.

Thanks, Jeff

Harry Sit says

No reason. Buying it separately only adds more work and creates confusion and difficulty.

Sam says

Is there any way to transfer funds from a vanguard money market to a fidelity money market directly or does it have to go through a bank first (in which case there could be a few days of wait)?

Harry Sit says

Assuming you are talking about a regular taxable account, not an IRA, every Fidelity account has a routing number and an account number for fund transfer. You can add the Fidelity account as a bank account in your Vanguard account and then initiate a sale or a transfer at Vanguard.

Sam says

Thanks. Can this transfer be done directly from any money market fund like VUSXX or does it have to be from a settlement fund like VMFXX.

Harry Sit says

Try it. When you sell VUSXX, see if you can choose a bank as the destination.

Anonymous says

I notice there’s no mention of Edward Jones funds. Do you have an opinion of them to share? Thanks…

Harry Sit says

Edward Jones offers a money market fund. The ticker symbols are JNSXX for Investment Shares and JRSXX for Retirement Shares. The expense ratio is in the ~0.7% range according to the summary prospectus I found on their website. A higher expense ratio in general results in lower returns.

Anonymous says

Update on E. Jones MM funds. Mine is investment at 4 times the interest of FDIC protected banks. My concern was protection given recent collapses. Today my Rep told me that these funds are protected by SIPC (Security Investor Protection Corporation, see https://www.sipc.org/). I need to research this further as time permits but thought I’d share what I know.

Harry Sit says

SIPC doesn’t protect the *value* of any money market fund. It only protects when your account says you have a certain number of shares but the broker actually doesn’t have them in the case of accounting errors or fraud and theft. The value of a money market fund depends on its underlying holdings. Their money market fund is a government money market fund. Other than having a higher expense ratio, which makes it pay less than other similar funds, it’s still safe. See No FDIC Insurance – Why a Brokerage Account Is Safe.

Wade shanley says

Can you comment on the safety of “repurchase agreements”? I see these are a significant portion (25%) of Vanguard Treasury MM fund. I did some searching but am still unclear on if these are technically treasuries or some other lending instrument.

Harry Sit says

Repurchase agreements aren’t technically Treasuries. Think of a pawn shop. Someone has Treasuries they don’t want to sell but they need short-term cash. So they pawn their Treasuries to the money market fund for some cash with an agreement to buy back on a later date with interest. The safety to the money market fund is assured by the Treasuries held as collateral. The upside to the money market fund is that these repurchase agreements pay a little more than buying straight Treasuries. The downside is that the interest doesn’t qualify for state and local tax exemption.

Jeff says

Great post Harry!

Do you know if FDLXX (Fidelity Treasury only MMF) is “semi-automatic” or is it just FZDXX and SPRXX? I had trouble researching this on Fidelitys website.

Harry Sit says

All non-core Fidelity money market funds are “semi-automatic.”

sam says

I see VMFXX has surpassed VUSSX now in yield.

If I sell VUSSX in middle of the month (to buy VMFXX), will I still receive a pro rated dividend for VUSSX at the end of the month even though UI don’t own it at time of distribution??

Harry Sit says

You will still receive a pro-rated dividend. If you exit a fund completely, you get the pro-rated dividend right away. If you only reduce the balance, you get it at the end of the month.

Zeb says

Thanks Harry! If I buy VMFXX, will I get a 1099 (or similar) whether I withdraw any funds or not? Just like a savings account?

Harry Sit says

The dividends earned from the money market fund will be included on a 1099-DIV form in a consolidated 1099 package from Vanguard. It doesn’t matter whether you withdraw funds or not.