The previous post Which Vanguard Money Market Fund Is the Best at Your Tax Rates covered Vanguard money market funds. Vanguard has the best money market funds because they charge the lowest fees in their funds. However, many people — myself included — have a brokerage account at Fidelity Investments. It’s more convenient to keep cash and other investments in one place. A Fidelity money market fund is still quite good enough if you don’t need the absolutely highest yield.

If you prefer to keep your cash and other investments at Charles Schwab, please read Which Schwab Money Market Fund Is the Best at Your Tax Rates.

As I wrote in No FDIC Insurance – Why a Brokerage Account Is Safe, when you keep your cash in a money market fund at a broker, the safety of your money doesn’t depend on the financial health of the broker. The safety comes directly from the safety of the holdings in the money market fund. Your money market fund is safe when the fund’s underlying holdings are safe.

Why Money Market Fund

The reason to keep your cash in a money market fund, as opposed to a high yield savings account, is that you’re not depending on any bank to set its rate competitively. You automatically get the market yield minus the fund manager’s cut, no more, no less, sort of like when you invest in an index fund. You’re not moving to another bank because it’s offering a promotional rate. You’re not moving again when that bank decides to lag behind. See my Guide to Money Market Funds & High Yield Savings Accounts.

Fidelity offers at least 18 money market funds of different types. That’s not counting Institutional funds and funds that are only available in certain account types. These 18 money market funds differ in their underlying holdings and tax treatment at both the federal and the state levels. Which one is slightly better for you than another depends on your preference for convenience and your federal and state tax brackets.

Taxable Money Market Funds

Seven of the 18 Fidelity money market funds are taxable money market funds. You pay federal income tax on the income earned from these funds. A portion of the income earned in some funds is exempt from state income tax in most states.

The quoted yield on any money market fund is always a net yield after the expense ratio is already deducted. You don’t need to deduct it again.

Core-Eligible Money Market Funds

Every Fidelity brokerage account has a core position. You don’t have to do anything extra to buy or sell the core position. Any cash you transfer into your Fidelity brokerage account will automatically land in the core position. Any cash you transfer out of your Fidelity brokerage account will come out of the core position.

Your choices in the core position may include one or more of these money market funds, depending on the account type:

| Fund | Expense Ratio | 2024 State Tax Exemption |

|---|---|---|

| Fidelity Government Cash Reserves (FDRXX) | 0.34% | 57% |

| Fidelity Government Money Market Fund (SPAXX) | 0.42% | 55% |

| Fidelity Treasury Money Market Fund (FZFXX) | 0.42% | 51% (0% in CA, CT, NY) |

The income earned in these funds is fully taxable at the federal level. A percentage of the income is exempt from state income tax. That percentage varies from year to year.

There isn’t much difference among these three core-eligible funds. If Fidelity Government Cash Reserves (FDRXX) is an option, I would choose that one as the core position because it has a lower expense ratio.

If you’d like to see what options you have as your core position, click on your core position marked with two asterisks on the Positions page and then click on the Change Core Position button. If you see FCASH as an option in your account, don’t choose that one because FCASH isn’t a money market fund.

All money market funds, except the core position, require a buy order to get money into them, but you don’t have to sell manually. If your core position isn’t sufficient for a debit, Fidelity will automatically sell from your money market fund to cover the difference.

Prime Money Market Funds

Fidelity Money Market Fund (SPRXX) and Fidelity Money Market Fund Premium Class (FZDXX) are prime money market funds. They invest in repurchase agreements, CDs, and commercial paper. Prime money market funds pay more, but they have a slightly higher risk.

The Premium Class fund (FZDXX) requires a $100,000 minimum investment in a taxable account and a $10,000 minimum investment in an IRA. The minimum is only required to get started. You can drop below the minimum after you have the fund. The regular class fund (SPRXX) doesn’t require a minimum investment, but it pays less than the Premium Class fund because it has a higher expense ratio (0.42% versus 0.36%).

The income earned from these prime money funds is fully taxable at the federal level. A small percentage of the income is exempt from state income tax. That percentage varies from year to year. It was 4% in 2023 (0% in CA, CT, and NY).

Government Money Market Funds

Fidelity Government Money Market Fund Premium Class (FZCXX) and Fidelity Treasury Only Money Market Fund (FDLXX) are government money market funds. They only invest in government securities and repurchase agreements that are collateralized by cash or government securities.

Think of repurchase agreements (“repo”) as a deal with a pawn shop. Entities give collateral to the money market fund for short-term cash. They’ll come back later to buy back (“repurchase”) their collateral at a higher price. If they don’t fulfill the repurchase agreement, the money market fund will sell the collateral. Repurchase agreements aren’t guaranteed by the government. Their safety comes from the collateral.

A government money market fund is safer than a prime money market fund. Fidelity Treasury Only Money Market Fund (FDLXX) is the safest because it invests more in Treasuries. It pays a little less though.

The income earned from these two funds is fully taxable at the federal level. A percentage of the income is exempt from state income tax. That percentage varies from year to year.

| Minimum Investment | 2024 State Tax Exemption | |

|---|---|---|

| Fidelity Government Money Market Fund Premium Class (FZCXX) | $100,000 ($10,000 in IRA) | 55% |

| Fidelity Treasury Only Money Market Fund (FDLXX) | $0 | 97% |

Among the seven taxable money market funds, if you value the convenience of no extra step to buy, you can leave the money in one of the core-eligible funds. If you want a higher yield and you’re not concerned about the slightly higher risk, you can go with one of the prime money market funds (FZDXX or SPRXX). If you want the most solid peace of mind at the cost of a slightly lower yield, you can choose the Treasury Only fund (FDLXX) for extra safety and the additional state income tax savings. Finally, the Government Money Market Fund Premium Class (FZCXX) is a good middle ground with safer holdings than the prime funds and you’re not giving up too much yield. I have my cash in FZCXX.

Remember to claim the state tax exemption when you do your taxes. See how to do it in Make Treasury Interest State Tax-Free in TurboTax, H&R Block, FreeTaxUSA.

Single State Tax-Exempt Money Market Funds

Fidelity offers tax-exempt money market funds specifically for investors in higher tax brackets in California, Massachusetts, New Jersey, and New York. These funds invest in high-quality, short-term municipal securities issued by entities within the state. Income from these funds is tax-exempt from both the federal income tax and the state income tax. They’re sometimes called “double tax-free” funds.

The fund for each state has two share classes — a regular share class and a Premium Class. The Premium Class fund requires a $25,000 minimum investment. The regular class fund has no minimum but it pays a little less because it has a higher expense ratio (0.42% versus 0.30%).

| Regular Share Class ($0 minimum) | Premium Class ($25,000 minimimum) | |

|---|---|---|

| California | FABXX | FSPXX |

| Massachusetts | FAUXX | FMSXX |

| New Jersey | FAYXX | FSJXX |

| New York | FAWXX | FSNXX |

The yield on these single state tax-exempt money market funds is lower than the yield on the seven taxable money market funds but the federal and state tax exemption makes up for it when you’re in a high tax bracket.

Remember to claim the state tax exemption when you do your taxes. See how to do it in State Tax-Exempt Muni Bond Interest from Mutual Funds and ETFs.

National Tax-Exempt Money Market Fund

Fidelity offers three tax-exempt money market funds for investors in higher tax brackets outside of California, Massachusetts, New Jersey, and New York. These funds are more diversified than the eight single-state funds because they invest in short-term, high-quality municipal securities from many states.

| Expense Ratio | Minimum Investment | |

|---|---|---|

| Fidelity Municipal Money Market Fund (FTEXX) | 0.41% | $0 |

| Fidelity Tax-Exempt Money Market Fund (FMOXX) | 0.47% | $0 |

| Fidelity Tax-Exempt Money Market Fund Premium Class (FZEXX) | 0.37% | $25,000 |

Income from these funds is tax-exempt from the federal income tax, but only a small percentage is exempt from state income tax. The yield is lower than the yield on the seven taxable money market funds, but the federal income tax exemption makes up for it when you’re in a high tax bracket. If you live in California, Massachusetts, New Jersey, or New York, you can still invest in these national funds if you don’t mind paying more in state income tax.

Remember to claim the small state tax exemption when you do your taxes. See how to do it in State Tax-Exempt Muni Bond Interest from Mutual Funds and ETFs.

Taxable or Tax-Exempt?

A tax-exempt money market fund offers tax savings, but it pays less. Choose a tax-exempt fund if you’re in a high tax bracket. Choose a taxable fund if you’re in a low tax bracket. If you’re not sure whether your federal and state tax brackets are considered high or low, you can use a calculator to see which fund offers a better yield after taxes.

Yield Swings

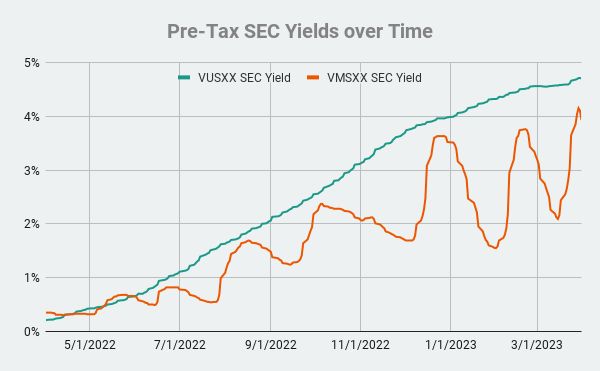

A wrinkle in comparing taxable and tax-exempt money market funds is that the yield on tax-exempt money market funds swings wildly throughout the year. This chart shows the yield on a taxable money market fund and the yield on a tax-exempt money market fund over a 12-month period:

While the yield on the taxable fund (green line) rose steadily over time as the Fed raised interest rates, the yield on the tax-exempt fund (orange line) swung wildly up and down. If you happen to compare the after-tax yields when the yield on the tax-exempt fund is near a top, it would show that the tax-exempt fund is better even in a low tax bracket. If you happen to compare them when the yield on the tax-exempt fund is near a bottom, it would show that the taxable fund is better even in a high tax bracket.

MM Optimizer

So you can’t just adjust for taxes only based on the yields at this moment. You need to look over a longer period to take into account the wild swings in the yield on tax-exempt funds.

User retiringwhen on the Bogleheads forum created a Google Sheet that does this. It’s called MM Optimizer. Although the current version of this tool focuses on Vanguard money market funds, it’s also informative when you use a Fidelity money market fund. If the tool shows that a Vanguard taxable money market fund is better than a Vanguard tax-exempt fund at your tax rates, it’s highly likely that a Fidelity taxable money market fund is also better than a Fidelity tax-exempt fund for you at the same tax rates.

The author of MM Optimizer is considering adding direct support for Fidelity money market funds. It’s possible that a future version of MM Optimizer will include Fidelity money market funds as well.

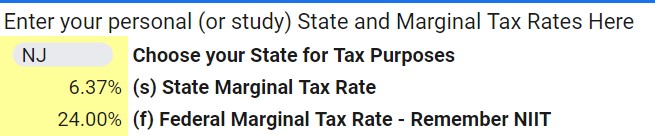

Your Tax Rates

MM Optimizer is shared as View Only. After you make a copy of it to your Google account, you change the tax rates on the My Parameters tab to your tax rates.

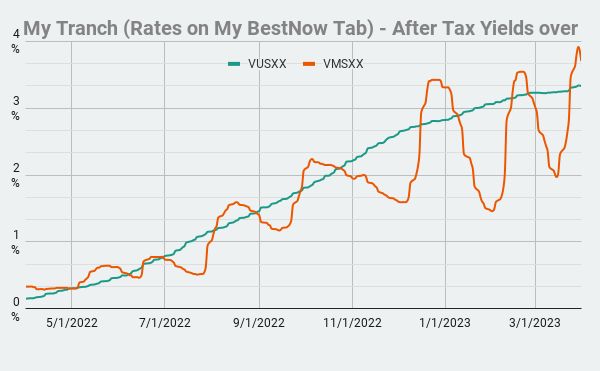

Compare After-Tax Yield

The My Charts tab shows the after-tax yield of different funds over the last 12 months. You can watch the yields and switch back and forth between a taxable fund and a tax-exempt fund, but I wouldn’t bother. The chart shows how many times you would’ve had to switch to catch the temporary swings and how short-lived each switch was.

I would take a look at this chart and see which line is on top most of the time. Choose a Fidelity taxable money market fund and stay with it if the chart shows that the smoother line is on top most of the time. Choose a Fidelity tax-exempt money market fund if the chart shows that the bouncy line is on top most of the time.

When I played with MM Optimizer, it showed that a taxable money market fund was still better for someone in a 35.8% federal income tax bracket (32% plus 3.8% Net Investment Income Tax) and a 9% state income tax bracket. The tax brackets must be higher than those levels for a tax-exempt money market fund to win.

MM Optimizer has a lot more features, but you don’t have to get into those. It’s simple to use if you only look at the places I’m showing here. The author is still adding new features. I hope it will include Fidelity money market funds soon. You’ll find the link to the latest version in this post on the Bogleheads forum.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Jeff says

Hi, is the partial state tax exemption with SPAXX (31%) and FDRXX (29%) already calculated by Fidelity when the end of year tax forms are sent, or do you have to manually enter it?

Harry Sit says

Fidelity publishes the applicable percentages in a separate document. You multiply the total dividend from the fund in the 1099 supplement by that percentage and put the amount in the tax software. See the linked post at the end of that section for how to do it in TurboTax and other tax software.

GaryK says

One caveat on Fidelity’s funds — it appears from looking at the prospectus and annual report that the net expenses are extremely dynamic, due to management of the waivers.

Using the T/E FZEXX as an example:

a) The research page on Fidelity.com shows the 26 bps net you quoted

b) The prospectus dated 12/30/22 shows 30 bps net

c) The annual report for the y/e 10/31/22 shows:

2022 – 26 bps

2021 – 13 bps (ZIRP era, slashed ER to get a positive 0.01% return)

2020 – 31 bps

2019 – 33 bps

I glanced at the Treasury fund FZFXX, and saw a similar pattern. The range over the 4 years has been 8 to 41 bps net, but for this one even though 2022 was 28 bps actual, they’ve apparently already raised it back up to 42 bps per the prospectus, even though the research page is still showing the 28 bps from 10/31/2022.

I am a client of Fidelity (Vanguard and Schwab too), so am not dumping on them, but CAVEAT EMPTOR!!!!

Harry Sit says

Thank you for this information. I updated the post to show only the gross expense ratio. Investors should be prepared to pay the gross expense ratio and treat any waivers and reimbursements as only a nice surprise.

Molly says

Thank you for this information. As an investing novice, I’ve wondered about the “default option” that my transferred funds are put into in Fidelity (SPAXX). Your explanation was great, and now I’m considering whether to keep my emergency savings in high yield savings accounts. More research! Thanks again.

Randy says

In my case, the core position options differ across my accounts at Fidelty.

My ROTH IRA account has these core position options:

SPAXX – currently in this one

FDRXX

FDIC

My ordinary brokerage account has these core options:

SPAXX

FZFXX

FCASH

So it seems the decision-making on which core position to choose may be more complex than the article admits to.

Austin says

Harry,

Thanks for a great article as usual.

Here’s a nice-to-know tidbit from Investopedia:

“Fidelity launched the Fidelity Government Money Market Fund (SPAXX) in 1990, and boasts $219.95 billion in total assets as of May 2021, making it one of the most widely held funds in this category.”

Thanks again.

Harry Sit says

Vanguard’s Federal Money Market Fund (VMFXX) is also huge with $200+ billion in assets.

Dave says

Great article – thank you. A question please if you have time and are inclined.

I own $200,000 in lets say FZDXX for an entire couple of months then, in the last few days of month three decide to buy $150K of MSFT with funds from FZDXX. Will my entire month three Dividend payment be based only on the $50K I have remaining in FZDXX or some pro-ration to account for the fact that I had $200K in FZDXX 90% of the month?

Harry Sit says

Prorated, as you would expect. The dividend in a money market fund is declared daily and paid monthly. The amount declared to you is based on your balance on that day. You get the total from each day at the end of the month.

Jess says

Hi Harry, thank you for this helpful post! I’m interested in investing into the aforementioned FDRXX. If we click on the link you shared for this fund, the webpage stated under the Risk section: “You could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so.”

How likely would we lose money in this fund or that it will not preserve the $1 per share? I’m fairly new to money market fund and would appreciate your insight. Thank you!

Harry Sit says

The fund survived 2008 without losing money or not preserving the $1 share price. Besides, losing or not losing money isn’t that meaningful in light of inflation. We can only spend inflation-adjusted money. Losing or not losing should be compared to inflation. A bank account that doesn’t lose money but loses more to inflation is worse than a fund that loses less to inflation (or better yet beats inflation). Always judge against inflation, not the nominal value that gets eroded by inflation.

Jess says

Thank you, Harry, for explaining that point on judging against inflation. I’m not familiar with Government Money Market Funds. Please excuse my ignorance. 🙂 I had wondered if that line on Risk meant it could possibly go to near $0 per share or that we could lose all money in the fund. Clarifying: are you saying that investing in Government Money Market Funds such as FDRXX will likely/always perform better than putting money in bank account (due to losing less than inflation or beating inflation)? Thank you in advance.

Harry Sit says

It is the case now but hardly anything will “always” perform better. There’s no minimum holding period. It doesn’t take much effort to move when things change.

PRS says

Hello Sir,

I have two questions –

1. The article mentions that for year 2022 FDRXX, SPAXX & FZFXX have some percentage of State Tax Exemption. But I was going through lists given at https://www.fidelity.com/tax-information/fidelity-mutual-fund-tax-information and I can only see FDRXX listed there.

SPAXX, FZFXX are nowhere to be seen. From where did you get these numbers for last year ? I somewhere read SPAXX invests repo, so its not eligible for state exemptions.

2. Article mentions one should select a fund with least expense ratio. But my assumption is returns are calculated after deducting expenses from returns. Isn’t is correct ?

So in above case SPAXX has 0.42% expense. But its 7 days yield is also maximum. So shouldn’t one select it over the other 2 options ? I am from a different country and we have mutual fund NAV calculated after reducing all expenses. And growth in NAV gives return percent.

I applied same logic with 7 days yield here.

TIA

Harry Sit says

The 2022 state tax-exempt information came from the “Percentage of Income From U.S. government securities” document from the link you posted. SPAXX falls under “Fidelity® Government Money Market Fund – All Classes*” on page 4. The ticker symbol isn’t specifically listed because this fund has multiple share classes and the percentage applies to all share classes. Similarly, FZFXX falls under “Fidelity® Treasury Money Market Fund – All Classes*” on page 5.

It’s correct that returns are calculated after deducting expenses. Among the three funds you mentioned, FDRXX has highest 7-day yield as of 10/18/2023 according to Fidelity’s website (5.01% versus 4.98%). It’s a small difference though. If you can select SPAXX as the core position in an account but you can’t select FDRXX as the core position in that account, you may still prefer SPAXX for convenience.

PRS says

Ok thank you Harry.

I just wanted to clarify – From Money Market fund perspective, one should give more importance to less exp ratio or more yield / return ? Because yields vary with a small percentage point and might be changing over the time.

Also another question, assuming I am IL resident and income is taxed at rate of 4.95%.

So using Treasury Only Money Market Fund with 90% state tax exemption will be best suited for me. Correct ?

PRS says

Also, I could not find Fidelity® Money Market Fund (SPRXX) in the list of state tax exemption list. Does it qualify ? I tried finding it with code as well as its name.

Harry Sit says

The percentage for SPRXX and FZDXX were 0% in 2022. That’s why they aren’t in the list.

Glen says

Does FISXX have a portion of state tax exempt?

Harry Sit says

It had 24% in 2022 according to the “Percentage of Income From U.S. government securities” document at the link in comment #8.

Jim says

I’m interested in the FZEXX fund and I live in the state of Virginia. How do I find out if it is tax exempt?

Harry Sit says

FZEXX is listed in the “National Tax-Exempt Money Market Fund” section of this post. Click on the link there to the fund information page on Fidelity’s website.

It says so in the name – Fidelity Tax-Exempt Money Market Fund Premium Class. It is tax exempt at the federal level. A negligible percentage of the income is exempt from Virginia tax.

Fleischman says

Hello Harry,

We live in Florida and our federal tax bracket is high. We have some savings allocated to a house purchase with a ≤ 3 year horizon.

Is “FTCXX Fidelity Investments Money Market Tax Exempt – Class I” in your opinion a good choice for this bucket?

Thank you.

F

Harry Sit says

FTCXX normally requires a minimum initial investment of $1 million. It’s a good choice if you’re keeping that much in a money market fund or if you can get into that fund in other ways.

Fleischman says

Harry, I appreciate your opinion on FTCXX.

Your answer sounds like your choice would be other than a Money Market Fund for a $1M+ for a house purchase in ≤ 3 years. Can you please elaborate some? Thank you.

Harry Sit says

This post is only about selecting a fund among the available money market funds after you already decided to use a money market fund. Whether to use a money market fund to begin with is a whole different sidebar conversation. I’ll take it offline and send you an email.