[Updated on March 14, 2024 with 2023 state tax exemption percentages.]

As I wrote in No FDIC Insurance – Why a Brokerage Account Is Safe, when you keep your cash in a money market fund at a broker, the safety of your money doesn’t depend on the financial health of the broker. The safety comes directly from the safety of the holdings in the money market fund. Your money market fund is safe when the fund’s underlying holdings are safe.

Why Money Market Fund

The reason to keep your cash in a money market fund, as opposed to a high yield savings account, is that you’re not depending on any bank to set their rate competitively. You automatically get the market yield minus the fund manager’s cut, no more, no less, sort of like when you invest in an index fund. You’re not moving to another bank because it’s offering a promotional rate. You’re not moving again when that bank decides to lag behind. See my Guide to Money Market Funds & High Yield Savings Accounts.

Why Vanguard

Because all money market funds of the same type fish in the same pond, how much the fund manager charges to run the fund (the “expense ratio”) directly affects how much yield you’ll receive. Among the major brokers, Vanguard charges the lowest expense ratio on its money market funds. Even if you do your investing elsewhere, you can still open a Vanguard account just to use its money market fund in the same way you use a high yield savings account — transfer money into it when you have excess cash and transfer money out when you need cash.

If you prefer to keep your cash and investments at Fidelity or Charles Schwab, please read Which Fidelity Money Market Fund Is the Best at Your Tax Rates or Which Schwab Money Market Fund Is the Best at Your Tax Rates.

Vanguard offers six money market funds of three different types. They differ in their underlying holdings and tax treatment at both the federal and the state levels. Which one will be slightly better for you than another depends on your preference for convenience and your federal and state tax brackets.

Taxable Money Market Funds

Three of the six Vanguard money market funds are taxable money market funds. You pay federal income tax on the income earned from these funds. A portion of the income earned is exempt from state income tax.

The yield from any of these three funds is very close to each other. The quoted yield on any money market fund is always a net yield after the expense ratio is already deducted. You don’t need to deduct it again.

Vanguard Federal Money Market Fund

Vanguard Federal Money Market Fund (VMFXX) is the settlement fund in a Vanguard brokerage account. You don’t have to do anything extra to buy or sell this fund. It requires no minimum investment. Any cash you transfer into your Vanguard brokerage account will automatically land in this fund. Any cash you transfer out of your Vanguard brokerage account will come out of this fund by default.

The income earned is fully taxable at the federal level. A percentage of the income is exempt from state income tax. That percentage varies from year to year. It was 49% in 2023 (0% for CA, NY, and CT residents).

This fund invests in government securities and repurchase agreements that are collateralized by government securities. Think of repurchase agreements (“repo”) as a deal with a pawn shop. Entities give government securities to the money market fund as collateral for short-term cash. They’ll come back later to buy back (“repurchase”) their government securities at a higher price. If they don’t fulfill the repurchase agreement, the money market fund will sell those government securities. Repurchase agreements themselves aren’t guaranteed by the government but their safety comes from the safe collateral.

Vanguard Treasury Money Market Fund

Vanguard Treasury Money Market Fund (VUSXX) invests primarily in Treasuries. It’s the safest money market fund at Vanguard. You have to enter a buy or sell order to get money into or out of this fund. It has a $3,000 minimum investment. The $3,000 minimum is only required to get started. You can transfer in and out less than $3,000 after you have the fund.

The income earned from the Treasury Money Market Fund is fully taxable at the federal level. A percentage of the income is exempt from state income tax. That percentage varies from year to year. It was 80% in 2023 because the fund invested a sizable portion in repurchase agreements in some months. Repurchase agreements pay more than Treasuries (and are still safe) but they don’t have state tax exemption.

Vanguard Cash Reserves Federal Money Market Fund

Vanguard Cash Reserves Federal Money Market Fund (VMRXX) is somewhere in between the Federal Money Market Fund and the Treasury Money Market Fund. As in the Treasury Money Market Fund, you have to enter a buy or sell order to get money into or out of this fund. It also has a $3,000 minimum investment.

This fund invests slightly more in Treasuries than the Federal Money Market Fund but less than the Treasury Money Market Fund. The income earned is fully taxable at the federal level. A percentage of the income is exempt from state income tax. That percentage varies from year to year. It was 52% in 2023 (0% for CA, NY, and CT residents).

| Must Buy/Sell | State Tax Exemption in 2023 | |

|---|---|---|

| Federal Money Market (VMFXX) | no | 49% (0% in CA, NY, CT) |

| Treasury Money Market (VUSXX) | yes | 80% |

| Cash Reserves (VMRXX) | yes | 52% (0% in CA, NY, CT) |

Among these three taxable money market funds, If I value the convenience of no extra step to buy or sell or if I live in a no-tax state, I would choose the Federal Money Market Fund (VMFXX). If I don’t mind the extra step to buy or sell and I live in a high-tax state, I would choose the Treasury Money Market Fund (VUSXX) for extra safety and the additional state income tax savings.

Remember to claim the state tax exemption when you do your taxes. See how to do it in Make Treasury Interest State Tax-Free in TurboTax, H&R Block, FreeTaxUSA.

Single State Tax-Exempt Money Market Funds

Vanguard offers a tax-exempt money market fund specifically for California and New York residents in higher tax brackets. These two funds invest exclusively in high-quality, short-term municipal securities issued by entities within the state. Income from these funds is tax-exempt from both the federal income tax and the California and New York state income tax respectively. They’re sometimes called “double tax-free” funds.

Both Vanguard California Municipal Money Market Fund (VCTXX) and Vanguard New York Municipal Money Market Fund (VYFXX) require a buy or sell order to get money into and out of the fund. Both require a $3,000 minimum investment.

The yield on these funds is lower than the yield on the three taxable money market funds but the federal and state tax exemption makes up for it when you’re in a high tax bracket.

Remember to claim the state tax exemption when you do your taxes. See State Tax-Exempt Muni Bond Interest from Mutual Funds and ETFs.

National Tax-Exempt Money Market Fund

Vanguard Municipal Money Market Fund (VMSXX) is for investors in higher tax brackets outside of California and New York. This fund is more diversified than the California and New York funds because it invests in short-term, high-quality municipal securities from many states. Income from this fund is tax-exempt from the federal income tax but only a small percentage is exempt from state income tax.

It also requires a $3,000 minimum investment and a buy or sell order to get money into and out of the fund. The yield on this fund is lower than the yield on the three taxable money market funds but the federal income tax exemption makes up for it when you’re in a high tax bracket.

Remember to claim the small state tax exemption when you do your taxes. See State Tax-Exempt Muni Bond Interest from Mutual Funds and ETFs.

Taxable or Tax-Exempt?

A tax-exempt money market fund offers tax savings but it pays less. Choose a tax-exempt fund if you’re in a high tax bracket. Choose a taxable fund if you’re in a low tax bracket. If you’re not sure whether your federal and state tax brackets are considered high or low, you can use a calculator to see which fund offers a better yield after taxes.

I created such a calculator back in 2007. I was going to update it but I came across a much more elaborate one created by the user retiringwhen on the Bogleheads forum. It’s a Google Sheet called MM Optimizer.

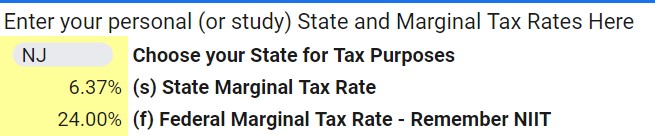

Your Tax Rates

MM Optimizer is shared as View Only. After you make a copy of it to your Google account, you change the tax rates on the My Parameters tab to your tax rates.

Best Right Now

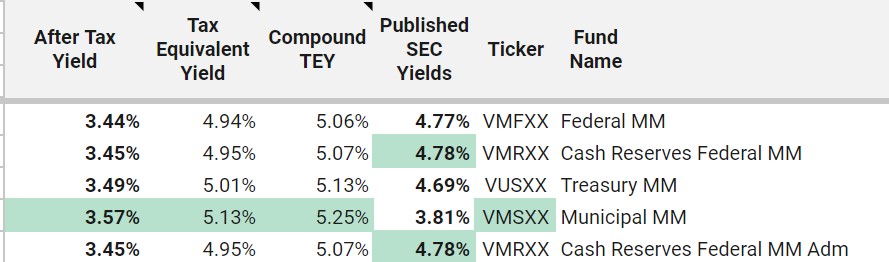

MM Optimizer automatically pulls in the latest yield numbers. The My Best Now tab shows you which fund has the highest after-tax yield right now for the tax rates you entered.

In this example, it shows that the national tax-exempt fund has the highest after-tax yield, although not by much over the Treasury money market fund (3.57% versus 3.49%, or 5.25% versus 5.13% pre-tax).

Best Last 12 Months

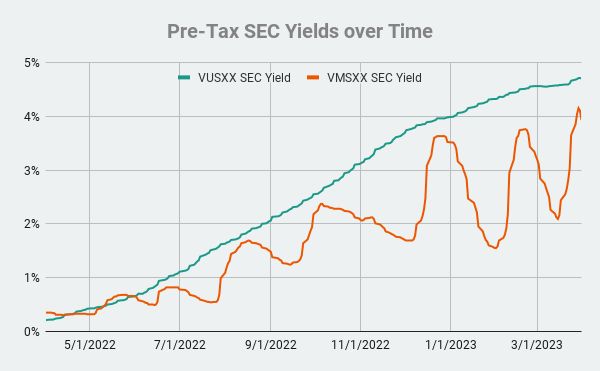

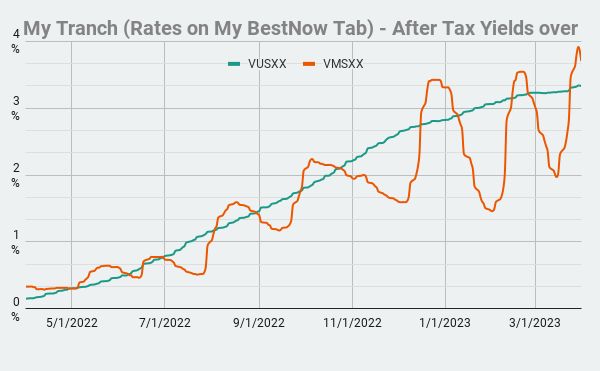

A wrinkle in comparing taxable and tax-exempt money market funds is that the yield on tax-exempt money market funds swings wildly throughout the year. This chart shows the yield on a taxable money market fund and the yield on a tax-exempt money market fund over the last 12 months:

While the yield on the taxable fund (green line) rose steadily over time as the Fed raised interest rates, the yield on the tax-exempt fund (orange line) swung wildly up and down. If you happen to compare the after-tax yields when the yield on the tax-exempt fund is near a top, it would show that the tax-exempt fund is better even in a low tax bracket. If you happen to compare them when the yield on the tax-exempt fund is near a bottom, it would show that the taxable fund is better even in a high tax bracket.

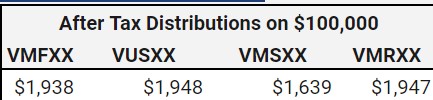

MM Optimizer shows which fund was better at your tax rates if you stuck to it over a full year.

In this case, the Treasury money market fund was better for the full year even though the tax-exempt fund is slightly better at this moment only because the yield on the tax-exempt fund is near a top.

Switching Back and Forth

You can watch the yields and switch back and forth between a taxable fund and a tax-exempt fund but I wouldn’t bother. The My Charts tab shows how many times you would’ve had to switch to catch the temporary swings and how short-lived each switch was. If you’re late going in and late coming out, you negate a large part of the gain from switching.

I would take a look at this chart and see which line is on top most of the time. Choose that fund and stay with it. In this example, it’s the Treasury money market fund (green line).

MM Optimizer has a lot more features but you don’t have to get into those. It’s simple to use if you only look at the places I’m showing here. The author is still adding new features to MM Optimizer. You’ll find the link to the latest version in this post on the Bogleheads forum.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

KD says

Great article! Do funds that need buy/sell have 7-day transaction restriction etc at Vanguard?

Harry Sit says

I have never been subjected to any 7-day transaction restriction. As I understand it, it only applies to withdrawals and buying non-Vanguard products (converting from a Traditional IRA to a Roth IRA counts as a withdrawal because the money is coming out of the Traditional IRA). In addition, money market funds don’t have restrictions on buying within 30 days after selling.

Allan says

Thanks for the great article.

Why will the Treasury Fund only be 70% tax exempt at the state level in 2023 vs 2022?

Harry Sit says

Because it started investing a sizable portion in repurchase agreements. Repurchase agreements pay more than Treasuries (and are still safe) but they don’t have state tax exemption. The percentage of the fund invested in repurchase agreements was about 25% at the end of January and February. It increased to about 40% at the end of March. If the percentage invested in repurchase agreements stays at 40%, the state tax exemption may go lower than 70%.

Steve says

Thank you for the article. The part about tax-exempt funds yields swinging wildly during the year was eye-opening.

I know it depends on rates of state taxation, but have you come to any conclusions or rules-of-thumb about what federal tax brackets make the taxable vs tax-exempt decision for MM funds a no-brainer?

My related learning about “treasury” money market funds is that the Fidelity Treasury Money Market Fund (FZFXX) I own provided only 30% US govt securities income in 2022. The majority of the fund was in repurchase agreements. At Fidelity, to get the investments and state tax exemption I thought I was getting in FZFXX, I should have owned Fidelity Treasury Only MM Fund (FDLXX). In my mind, Fidelity’s name for FZFXX is misleading. at best.

Harry Sit says

With a 5% state tax rate, the federal tax rate has to be 35% or above to make a tax-exempt fund beat the Treasury fund in the last 12 months. In a no-tax state, the federal tax rate can be 32%. It would be a no-brainer to use a taxable fund at lower tax rates. Of course we don’t know whether this relationship will hold in the future.

Kevin says

Harry, if you play the “Switching Back and Forth” game between Fund A and Fund B, what happens to the Fund A monthly dividends if you are no longer invested in Fund , if anything? I am not sure how the ex-dividend date and record date work for money market funds. Thanks for another great article!

Harry Sit says

Ex-dividend and record dates don’t matter for money market funds. Dividends on money market funds are declared daily and paid monthly. When you exit a fund on the 18th of the month, you will still be paid for the days when the money was in the fund.

Kevin says

CORRECTION: …invested in Fund *A*, if anything?

DB says

Thank you for this very useful article.

While Repurchase agreements themselves aren’t guaranteed by the government, their safety comes from the safe collateral. So why do you rate VUSXX as safer than VMFXX or VMRXX?

Thanks.

Harry Sit says

It’s all relative. Holding more Treasuries directly eliminates the middle steps of someone failing to fulfill the repurchase agreements and the fund having to sell their collateral.

RobI says

I wonder how much in March SVB created conditions for increasing Repo agreement percentage in VUSXX Treasury fund. The sudden huge demand for MMkt funds starting around March 13 /14 and the simultaneous drop in Treasury yields combined to created a need to prop up VUSXX rates very rapidly by adding Repo for higher returns. VUSSX daily do yields appear to be holding up despite the T-bill market yield drop in March. I hope that this is a temp phenomenon and will reverse now that T-Bill yields have risen again.

scoothome says

MM Optimizer version 7 has been released with big improvements to usability. https://www.bogleheads.org/forum/viewtopic.php?t=401821

RetiringWhen says

Harry, thanks for the shout out on the MM Optimizer Tool.

There is a newer version, v8 that has a number of usability feedback items incorporated. Your screenshots are pretty close so no worries there, but your readers may wish to pull the latest version. There is a link in the Instructions tab of the version you published to version 8. I don’t think I can put links in comments on your site.

Harry Sit says

Thank you for the great work! I updated the links to version 8. Maybe consider creating a persistent shortened URL that always points to the latest version?

RetiringWhen says

That is a good idea. Not sure I can do that directly to Google Sheets links though (a downside of the “live” nature of Sheets). I will research. In the meantime, folks could bookmark the Bogleheads thread where I publish updates (available in the Instructions tab).

Scott says

Thank you for all your great information and guidance in the blog – it is much appreciated! There are some things I can’t get through my thick head in trying to understand how all of these investments work, e.g., why should I care that the VFMXX 7-day yield is 4.77%, when interest rate risk results in YTD returns of 1.18%?

This is why I use the high-yield savings accounts, but I’m probably missing something – ugh!

Harry Sit says

The calendar, not interest rate risk, resulted in a YTD return of 1.18%. YTD means year-to-date. 1.18% is the amount that the fund actually earned in a little over three months since January 1. $10,000 balance in the fund on January 1 earned $118 so far. 4.77% and whatever rate quoted by your high yield savings account is an annual rate. Divide by 4 to compare it with the actual return in three months. I bet $10,000 in a high yield savings account didn’t earn $118 since January 1.

Frank says

Great article, thank you! My question is about VUSXX, it appears that in CA, VUSXX would be state tax exempt. Do you think that with more repurchase agreements in that fund, say 30% and 70% treasuries, would that then make the fund not CA state tax exempt? In other words, was it CA state tax exempt where the other funds are not, because it was 100% treasuries, and now that the mix is changing, would that disqualify it? Or is there some other reason why VUSXX is CA state tax exempt where the other funds mentioned are not? Thanks so much!

Harry Sit says

CA, CT, and NY have a higher bar for state tax exemption. The percentage of state tax exemption drops to 0% if a pre-requisite isn’t met. VUSXX met that pre-requisite while the other funds didn’t. I speculate that the fund managers will make sure that the fund will continue to meet the requirement. Only the percentage of income exempt from state income tax will drop from 100% to maybe 70% or 60%.

Art says

Vanguard adds a caveat on VUSXX :

Important Note: Income generated from investments in repurchase agreements with the federal reserve are generally subject to state and local income taxes.

I had been considering moving some bank cash there to minimize DC tax, but at the moment I think Fdlxx (despite higher expense ratio) might work better for me, in part because I already invest at Fidelity, but also because it’s a “treasury only” fund and the Vanguard one seems to be adding lots of repurchase agreements. I didn’t realize my core fidelity did the same, but I will be moving most of that to “treasury only” vs “treasury” or “government”. Tricky business – we have to pay close attention with these similar nomenclatures!

John Bertram says

Thank you for all your interesting and informative articles and valuable guidance. I inevitably find them interesting — even when I thought they wouldn’t apply to me!

I have a question regarding the 7-day SEC yield and expense ratios for Money Market Funds.

Checking the Money Market Fund page on Vanguard’s website:

https://investor.vanguard.com/investment-products/money-markets,

they prominently display the Exp. Ratio right next to the 7-day SEC Yield, from which I infer that the expense ratio info is important.

So, I called the Investment Department at Vanguard, asking whether MMFs/7-day SEC/exp ratios were a special case, and was told, no, as with a “regular fund” to ascertain the net yield on their Money Market Funds one DOES need to subtract the expense ratio from the yield.

So I find myself confused. Could you tell me more about the info under the first figure in the article where it says the 7-day SEC yield includes the expense ratio? I obviously don’t want to subtract it twice. Thanks very much.

Harry Sit says

Charging a low expense ratio is a selling point for Vanguard. That’s why Vanguard prominently displays the expense ratio on every fund. It isn’t any special case. All SEC yields are calculated after subtracting the expenses. You didn’t have to call Vanguard. Just look up “7-day SEC yield” on Wikipedia.

“The calculation is performed as follows:

– Take the net interest income earned by the fund over the last 7 days and subtract 7 days of management fees.

– Divide that dollar amount by the average size of the fund’s investments over the same 7 days.

– Multiply by 365/7 to give the 7-day SEC yield.”

Jack Shen says

Hello Harry,

I enjoy reading your informative article.

My question is

Do both VYFXX & VFMXX have AMT tax consequence for higher income earner ?

Thank you in advance.

Jack

Harry Sit says

Vanguard New York Municipal Money Market Fund (VYFXX) had 13% of its income from private activity bonds subject to the AMT in 2022. If by VFMXX you meant Vanguard Federal Money Market Fund (VMFXX), it’s 100% taxable for both the regular federal income tax and AMT.

Jack says

Hi Harry,

Thanks for your prompt reply.

But what I really like to find out about VYFXX & VMSXX AMT % ending 6-30-23, since I already knew 2022 AMT %.

btw, I think VMFXX is AMT not applicable .

Harry Sit says

I don’t think Vanguard reports AMT percentages more than once a year. You’ll have to ask Vanguard.