[Updated on March 14, 2024 with 2023 state tax exemption percentages.]

After reading my previous posts Which Vanguard Money Market Fund Is the Best at Your Tax Rates and Which Fidelity Money Market Fund Is the Best at Your Tax Rates, a reader asked me to do the same for Charles Schwab. Many people have a brokerage account with Schwab or TD Ameritrade. It’s more convenient to keep cash and other investments in one place. Although Vanguard charges the lowest fees on its money market funds, a Schwab money market fund is still quite good enough if you don’t need absolutely the highest yield.

As I wrote in No FDIC Insurance – Why a Brokerage Account Is Safe, when you keep your cash in a money market fund at a broker, the safety of your money doesn’t depend on the financial health of the broker. The safety comes directly from the safety of the holdings in the money market fund. Your money market fund is safe when the fund’s underlying holdings are safe.

Why Money Market Fund

The reason to keep your cash in a money market fund, as opposed to a high yield savings account, is that you’re not depending on any bank to set their rate competitively. You automatically get the market yield minus the fund manager’s cut, no more, no less, sort of like when you invest in an index fund. You’re not moving to another bank because it’s offering a promotional rate. You’re not moving again when that bank decides to lag behind. See my Guide to Money Market Funds & High Yield Savings Accounts.

Schwab offers eight money market funds of different types. These funds are also available in a TD Ameritrade account. Each fund has an Investor Shares class and an Ultra Shares class. Ultra Shares pay more but they require a $1,000,000 minimum. Investor Shares require no minimum. I will only talk about Investor Shares in this post.

These eight money market funds differ in their underlying holdings and tax treatment at both the federal and the state levels. Which one is slightly better for you than another depends on your preference for convenience and your federal and state tax brackets.

Taxable Money Market Funds

Four of the eight Schwab money market funds are taxable money market funds. You pay federal income tax on the income earned from these funds. A portion of the income earned in some funds is exempt from state income tax in most states.

The quoted yield on any money market fund is always a net yield after the expense ratio is already deducted. You don’t need to deduct it again.

Unlike Vanguard and Fidelity, Charles Schwab doesn’t sweep uninvested cash to a money market fund (except in some legacy accounts). The default “cash sweep” pays much less than a money market fund. You have to buy a money market fund yourself if you want to earn more on your cash. Charles Schwab doesn’t automatically liquidate from a money market fund to cover trades or transfers either. You have to sell a money market fund manually.

Prime Money Market Funds

Schwab Value Advantage Money Fund (SWVXX) is a prime money market fund. It invests in repurchase agreements, CDs, time deposits, and commercial paper. Prime money market funds pay more but they have a slightly higher risk.

The income earned from a prime money fund is fully taxable at the federal level. A small percentage of the income may be exempt from state income tax. That percentage varies from year to year. It was 0% in 2023.

Government Money Market Funds

Schwab Government Money Fund (SNVXX), Schwab Treasury Obligations Money Fund (SNOXX), and Schwab U.S. Treasury Money Fund (SNSXX) are government money market funds. They only invest in government securities and repurchase agreements that are collateralized by cash or government securities.

Think of repurchase agreements (“repo”) as a deal with a pawn shop. Entities give collaterals to the money market fund for short-term cash. They’ll come back later to buy back (“repurchase”) their collaterals at a higher price. If they don’t fulfill the repurchase agreement, the money market fund will sell those collaterals. Repurchase agreements aren’t guaranteed by the government. Their safety comes from the collaterals.

A government money market fund is safer than a prime money market fund. Schwab U.S. Treasury Money Fund (SNSXX) is the safest of the three because it invests only in Treasuries. It pays a little less though.

The income earned from these three funds is fully taxable at the federal level. A percentage of the income is exempt from state income tax. That percentage varies from year to year.

| State Tax Exemption in 2023 | |

|---|---|

| Schwab Government Money Fund (SNVXX) | 24% (0% in CA, NY, CT) |

| Schwab Treasury Obligations Money Fund (SNOXX) | 11% (0% in CA, NY, CT) |

| Schwab U.S. Treasury Money Fund (SNSXX) | 100% |

The expense ratio is the same across all four taxable money market funds. If you want a higher yield and you’re not concerned about the slightly higher risk, you can go with the prime money market fund (SWVXX). If you want the most solid peace of mind at the cost of a slightly lower yield, you can choose the U.S. Treasury fund (SNSXX) for extra safety and additional state income tax savings.

The other two funds — Schwab Government Money Fund (SNVXX) and Schwab Treasury Obligations Money Fund (SNOXX) — are good middle ground with safer holdings than the prime fund and you’re not giving up too much yield. Schwab Treasury Obligations Money Fund (SNOXX) limits the repurchase agreements to being backed by Treasuries only. Schwab Government Money Fund (SNVXX) includes repurchase agreements backed by both Treasuries and government agency debts.

Remember to claim the state tax exemption when you do your taxes. See how to do it in Make Treasury Interest State Tax-Free in TurboTax, H&R Block, FreeTaxUSA.

Single State Tax-Exempt Money Market Funds

Schwab offers tax-exempt money market funds specifically for investors in higher tax brackets in California and New York. Schwab California Municipal Money Fund (SWKXX) and Schwab New York Municipal Money Fund (SWYXX) invest in high-quality, short-term municipal securities issued by entities within the state. Income from these funds is tax-exempt from both the federal income tax and the state income tax. They’re sometimes called “double tax-free” funds.

The yield on these single state tax-exempt money market funds is lower than the yield on the four taxable money market funds but the federal and state tax exemption makes up for it when you’re in a high tax bracket.

Remember to claim the state tax exemption when you do your taxes. See how to do it in State Tax-Exempt Muni Bond Interest from Mutual Funds and ETFs.

National Tax-Exempt Money Market Fund

Schwab offers two tax-exempt money market funds for investors in higher tax brackets outside of California and New York. Schwab Municipal Money Fund (SWTXX) and Schwab AMT Tax-Free Money Fund (SWWXX) are more diversified than the two single-state funds because they invest in short-term, high-quality municipal securities from many states. The two funds are similar. AMT tax-free or not makes a difference when you’re subject to the Alternative Minimum Tax but a lot fewer people are affected by it now than before.

Income from these two national tax-exempt money market funds is tax-exempt from the federal income tax but only a small percentage is exempt from state income tax. The yield is lower than the yield on the four taxable money market funds but the federal income tax exemption makes up for it when you’re in a high tax bracket. If you live in California or New York, you can still invest in these national funds if you don’t mind paying more in state income tax.

Remember to claim the small state tax exemption when you do your taxes. See how to do it in State Tax-Exempt Muni Bond Interest from Mutual Funds and ETFs.

Taxable or Tax-Exempt?

A tax-exempt money market fund offers tax savings but it pays less. Choose a tax-exempt fund if you’re in a high tax bracket. Choose a taxable fund if you’re in a low tax bracket. If you’re not sure whether your federal and state tax brackets are considered high or low, you can use a calculator to see which fund offers a better yield after taxes.

Yield Swings

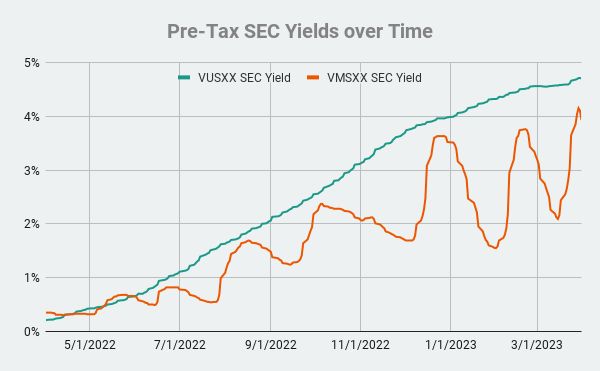

A wrinkle in comparing taxable and tax-exempt money market funds is that the yield on tax-exempt money market funds swings wildly throughout the year. This chart shows the yield on a taxable money market fund and the yield on a tax-exempt money market fund over a 12-month period:

While the yield on the taxable fund (green line) rose steadily over time as the Fed raised interest rates, the yield on the tax-exempt fund (orange line) swung wildly up and down. If you happen to compare the after-tax yields when the yield on the tax-exempt fund is near a top, it would show that the tax-exempt fund is better even in a low tax bracket. If you happen to compare them when the yield on the tax-exempt fund is near a bottom, it would show that the taxable fund is better even in a high tax bracket.

MM Optimizer

So you can’t just adjust for taxes only based on the yields at this moment. You need to look over a longer period to take into account the wild swings in the yield on tax-exempt funds.

User retiringwhen on the Bogleheads forum created a Google Sheet that does this. It’s called MM Optimizer. Although this tool only backtests Vanguard money market funds, it’s also informative when you use a Schwab money market fund. If the tool shows that a Vanguard taxable money market fund is better than a Vanguard tax-exempt fund at your tax rates, it’s highly likely that a Schwab taxable money market fund is also better than a Schwab tax-exempt fund for you at the same tax rates.

Your Tax Rates

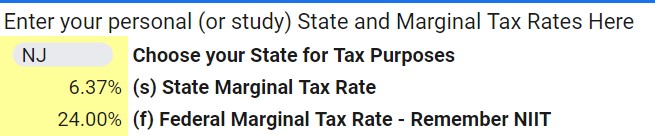

MM Optimizer is a shared as View Only. After you make a copy of it to your Google account, you change the tax rates on the My Parameters tab to your tax rates.

Compare After-Tax Yield

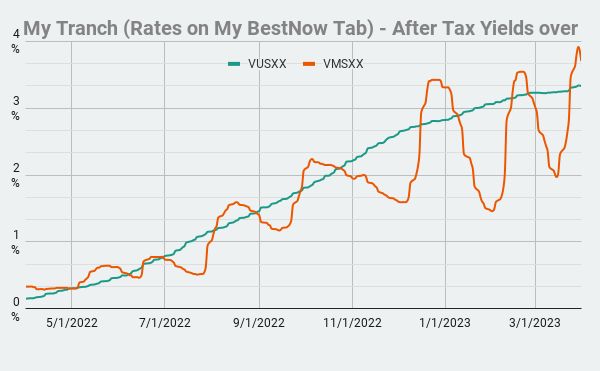

The My Charts tab shows the after-tax yield of different funds over the last 12 months. You can watch the yields and switch back and forth between a taxable fund and a tax-exempt fund but I wouldn’t bother. The chart shows how many times you would’ve had to switch to catch the temporary swings and how short-lived each switch was.

I would take a look at this chart and see which line is on top most of the time. Choose a Schwab taxable money market fund and stay with it if the chart shows that the smoother line is on top most of the time. Choose a Schwab tax-exempt money market fund if the chart shows that the bouncy line is on top most of the time.

When I played with MM Optimizer, it showed that a taxable money market fund was still better for someone in a 35.8% federal income tax bracket (32% plus 3.8% Net Investment Income Tax) and a 9% state income tax bracket. The tax brackets must be higher than those levels for a tax-exempt money market fund to win.

MM Optimizer has a lot more features but you don’t have to get into those. It’s simple to use if you only look at the places I’m showing here. The author is still adding new features. You’ll find the link to the latest version in this post on the Bogleheads forum.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Dan says

“Unlike Vanguard and Fidelity, Charles Schwab doesn’t sweep uninvested cash to a money market fund (except in some legacy accounts). The default “cash sweep” pays much less than a money market fund. You have to buy a money market fund yourself if you want to earn more on your cash. Charles Schwab doesn’t automatically liquidate from a money market fund to cover trades or transfers either. You have to sell a money market fund manually.”

and that’s what makes Schwab a bad choice right now.

Frank J Reedy says

Baloney. Manage your accounts. I’ve used Schwab for decades and move cash to and from SWVXX daily. It takes a click. I’m an investor but I’m not a pawn. I earned over $x0,000 in interest over the past 12 months by tending to my accounts, investments and cash deposits.

Mark says

Really helpful and perfect timing. Great article. Thanks!

Frank Wang says

For those who is considering investing money market funds, SWVXX’s yield is slightly higher than Fidelity’s SPAXX due to the differential expense ratio.

Harry Sit says

And also prime versus government (with partial state tax exemption). Fidelity’s directly comparable prime funds are FZDXX and SPRXX.

Art says

I’m a bit unsure how (or whether) these money fund exemptions factor in when it comes to retirement accounts. Do these investments have the same tax exemption if held in a traditional IRA? I imagine there’s no reason to do so in a Roth, since earnings are not subject to tax, but do custodians separate out the “treasury” investments vs the taxable ones when you take a distribution from an IRA? Would required minimum distributions, for example, get the state tax exemption benefit ? My federal retirement account is not calculated that way, but I could transfer it ( or perhaps just the cash portion of it) to a traditional IRA if the state tax exemption on RMD withdrawals made it worthwhile.

Harry Sit says

Earnings in an IRA are not taxed until you take the money out of the IRA. Distributions from an IRA follow the rules of the account type. Some states exempt IRA withdrawals up to a certain amount. The type of investments you hold in the IRA doesn’t give you any extra exemption.

Paul says

Off-topic comments deleted.

SFGiantsFan says

For those in CA, it’s interesting that the difference between the taxable fund and state tax free is only .1% difference at Vanguard (VMRXX: 4.78% v. VUSXX: 4.68%) while it’s .38% at Schwab (SWVXX: 4.67% v. SNSXX: 4.29).

Harry Sit says

Vanguard’s Treasury fund (VUSXX) held 42% in repurchase agreements as of March 31, 2023. It won’t be 100% state tax free as it was in 2022. If it goes in the direction of Schwab’s Treasury Obligation fund (SNOXX, 90%+ in repurchase agreements), it may lose the tax exemption in CA altogether, whereas Schwab’s Treasury fund (SNSXX) still had 100% in pure Treasuries.

Craig says

I can’t find the published yield percentage on Schwab’s site, but calculating the amount of interest I earned in the past month on the cash sweep in a Schwab Intelligent Portfolio account shows about 4.3% annually. (I have my risk profile set to minimize the cash holdings to about 6% of the portfolio – acceptable to me given the mix of Schwab funds and the automatic tax loss harvesting it performs.)

Harry Sit says

Schwab discloses the cash sweep for Schwab Intelligent Portfolios here:

https://www.schwab.com/legal/sip-sweep-current-interest-rates

This special rate only applies to Schwab Intelligent Portfolios. Regular Schwab brokerage accounts still receive a low rate for the default cash sweep.

Byron says

Such a good explanation of the differences, which choice make a good “middle ground” etc. Thank you! I was staring at the Schwab list, viewing different yields, and was unsure why certain funds yielded more and why they were more risky. Thanks for the bookmark-worthy article.