When you invest a sum of money for a fixed term, buying CDs directly from a bank or credit union used to be the answer but that isn’t necessarily the case today.

Treasuries Beat CDs Now

When the Federal Reserve started raising interest rates, the financial markets responded right away. Banks and credit unions were slow to raise the rates they pay on savings accounts and CDs because they don’t need more deposits and they take advantage of people’s inertia and ignorance of the going rates.

In addition, Treasury securities have low credit risk because they are guaranteed by the full faith and credit of the United States government. They require a low minimum investment of only $1,000. The term can be as short as four weeks. The interest is exempt from state and local income taxes. You can buy them in your existing brokerage account as opposed to having to open a new account at a bank you aren’t familiar with. Why in the world would someone buy CDs from banks and credit unions that pay a lower yield than Treasuries?

Because investors don’t know they can buy Treasuries so easily for a higher yield than CDs.

You may have heard of buying Treasuries through the government website TreasuryDirect, but it’s easier to buy them at a broker. You can buy new-issue Treasuries through major brokerage firms Fidelity, Vanguard, Charles Schwab, TD Ameritrade, and E*Trade with no fee whatsoever. Also, you can buy them in your Traditional or Roth IRA at the broker, whereas TreasuryDirect doesn’t offer IRAs.

Treasury Yield

Although you can buy Treasuries at any time on the secondary market (see How to Buy Treasury Bills & Notes On the Secondary Market), I prefer to buy new-issue Treasuries because you don’t have to pay a bid/ask spread when you buy new issues. While the bid/ask spread may be small, it just isn’t necessary to pay it when you have the opportunity to buy a new issue.

This is the case especially for short-term Treasuries maturing in six months or less because a new issue comes out every week. Paying a bid/ask spread once to buy a 10-year Treasury and holding it for 10 years may be OK but paying a bid/ask spread every month adds up fast.

The yield you’ll receive on a new-issue Treasury is determined by an auction process but you don’t have to make any bids. You only say how much you’d like to buy in your order. The banks will do the competitive bidding and you ride their coattails. You get the same yield for your tiny $1,000 order as a bank buying $100 million.

You can get a feel of where the yield might land by checking Interest Rate Statistics on TreasuryDirect (click on the first heading on the page for Daily Treasury Par Yield Curve Rates).

Treasury bills (“T-Bills”) with a maturity of one year or shorter are sold at a discount to par value. You pay slightly less than $1,000 for each $1,000 bill. You automatically receive the full $1,000 in your brokerage account when the bill matures. The difference is your interest.

Treasury notes (“T-Notes”) and Treasury bonds (“T-Bonds”) with a maturity of two years and above are sold at slightly less than the face value. You receive interest payments in your brokerage account every six months, and the full face value will show up automatically in your brokerage account when it matures. You don’t need to sell or do anything when you hold Treasuries to maturity.

Minimum Order Size

The minimum order for a new-issue Treasury is $1,000 in face value when you buy it in a brokerage account. You can order in $1,000 increments up to $5 million in face value.

The minimum order for a new-issue Treasury is $100 in face value when you buy it at TreasuryDirect. You can order in $100 increments up to $5 million in face value. Because you can’t sell Treasuries in your TreasuryDirect account before they mature (must hold to maturity or transfer to a brokerage account), it’s easier if you buy them in a brokerage account.

Order Window

You only need to know when the U.S. government will sell a new batch of Treasuries next time. Right now the government sells shorter maturities weekly and longer maturities monthly. You won’t have to wait long for the next sale unless you’re buying TIPS.

| Maturity | Sale Frequency |

|---|---|

| 4-week, 6-week, 8-week, 13-week, 17-week, 26-week | Weekly |

| 52-week, 2-year, 3-year, 5-year, 7-year, 10-year, 20-year, 30-year | Monthly |

| 5-year TIPS | Four times a year (April, June, October, December) |

| 10-year TIPS | Six times a year (January, March, May, July, September, November) |

| 30-year TIPS | Twice a year (February, August) |

The exact dates are published in the Tentative Auction Schedule and Upcoming Auctions from the U.S. Treasury. The schedule lists three dates — the Announcement Date, the Auction Date, and the Settlement Date. You only need to pay attention to the first two dates to know the window for placing your order.

You place your order between the afternoon of the Announcement Date and the night before the Auction Date. For example, if you’d like to invest a sum of money for two years, the schedule shows a 2-year note will be announced on a Thursday and it will be auctioned the next Tuesday. You will see it offered at your broker in the afternoon on the Announcement Date (Thursday). You should have your order in by Monday night, before the Auction Date (Tuesday).

So check the sale schedule and set a calendar reminder for yourself to place the order within the order window. If the term you want isn’t available as a new issue or if you don’t want to wait, you’ll have to buy it on the secondary market. See How to Buy Treasury Bills & Notes On the Secondary Market.

When It Matures

If you hold the Treasury to its maturity, you don’t have to do anything extra. The face value will magically appear in your brokerage account as cash when the bond matures.

Some brokers offer an optional “auto roll” feature for reinvestments. If you enable the “auto roll” feature when you buy the Treasury, the broker will automatically use the money from the matured Treasury to buy another new-issue Treasury of the same face value and the same term.

Selling Before Maturity

If you need to sell before the Treasury matures, you can try to sell it online at any time through the broker. The price will be at the market price at that time, which may be higher or lower than your original purchase price.

Sometimes bond dealers aren’t interested in buying from you when you have less than $100,000 in face value to sell. If you see that online prices require a higher minimum than the amount you have, you can wait an hour or two to see if a quote for a lower minimum comes up. Or you can call the broker and ask for help from the fixed income department. They have additional ways to sell the bonds for you. You may have to pay a fee for the broker-assisted trade.

Selling before maturity in a taxable account can make your taxes more complicated. Try to avoid selling before maturity in a taxable account.

Taxes

When you buy Treasuries in a taxable brokerage account, the brokerage firm will send you the necessary tax form for your taxes after the end of the year. The gains are taxed as ordinary income, not as a capital gain. If you do your taxes with tax software such as TurboTax, the tax software will handle the tax calculation. You only pay federal income tax on the interest. The interest income on Treasuries is exempt from state and local taxes.

When you buy Treasuries in a tax-advantaged account such as a Traditional IRA, a Roth IRA, or an HSA, the tax treatment goes by the account type. The interest isn’t immediately taxable. The eventual withdrawals will be subject to the usual rules and restrictions associated with the account type.

Online Brokers

Major online brokers offer new-issue Treasuries without fees. Click on the link to jump directly to the section for the broker you use — Fidelity, Vanguard, Charles Schwab, E*Trade, and Merrill Edge.

Fidelity

Here are the steps for placing an order for new-issue Treasuries with Fidelity.

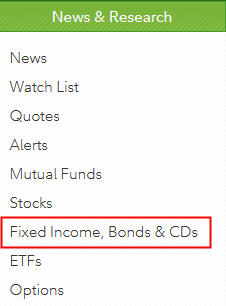

Under News & Research on the top, click on Fixed Income, Bonds & CDs.

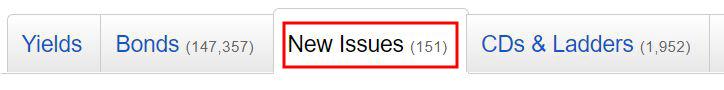

Click on the New Issues tab. You pay no extra fee only when you buy a new issue (you must pay a bid/ask spread when you buy on the secondary market).

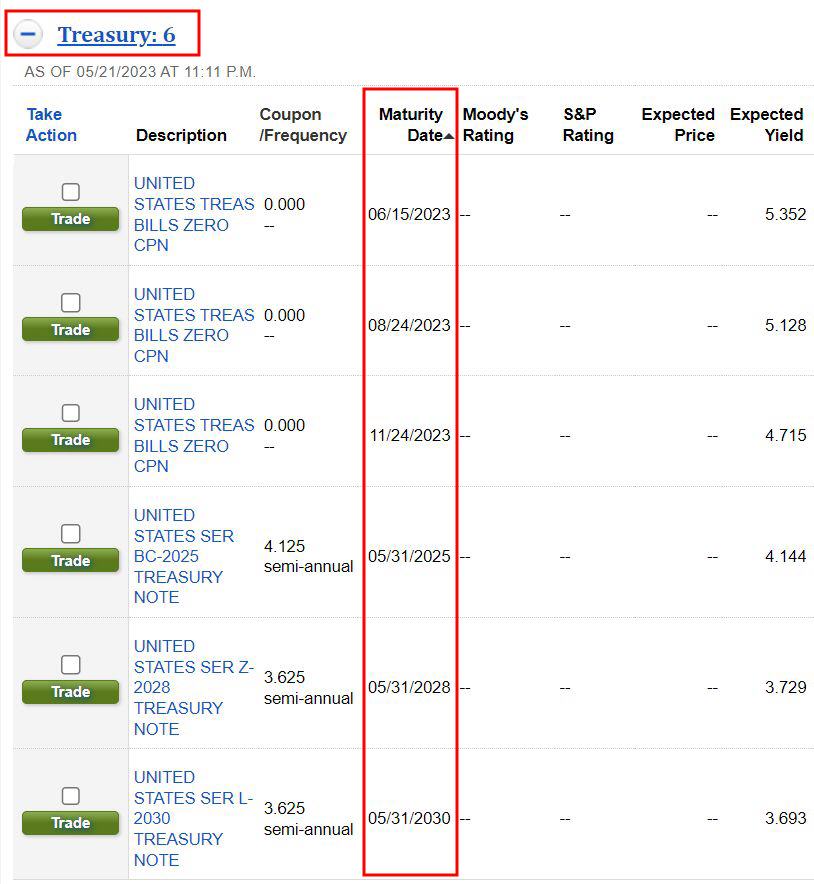

You’ll see a list of upcoming issues in the Treasury section. If you don’t see anything for the term you’d like to buy, check the calendar from U.S. Treasury and come back within your order window. If you don’t see the new Treasury offered on the Announcement Date, wait a few more hours. It’ll show up later in the day.

You’ll see the maturity date of each issue and an expected yield. The expected yield is only an estimate. Ignore the estimate. You’ll get the actual yield from the auction. You won’t know what it is until after your order executes but you can be sure you’ll always get the best yield determined by the market. Click on Trade to buy the issue you are interested in.

You may see either the “old” order entry screen or the “new” order entry screen next. Either one works. Only the look and feel are different.

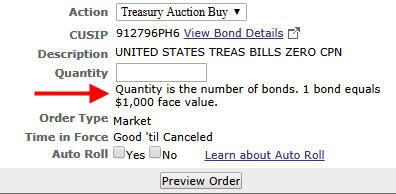

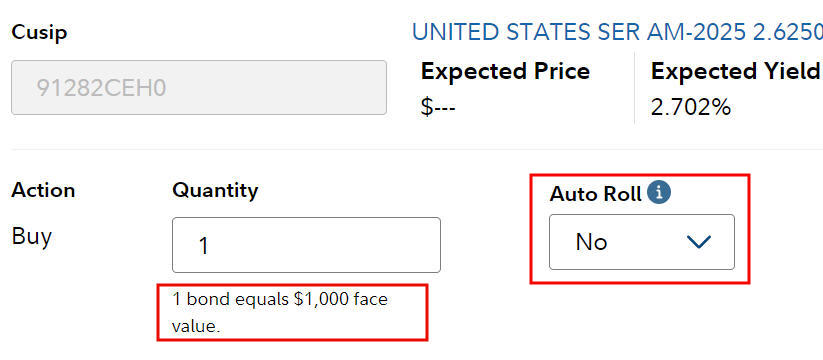

Treasuries are sold in $1,000 increments in a brokerage account. Enter a quantity of 1 if you’d like to buy $1,000 in face value. It will cost slightly less than $1,000 when it’s all said and done. Fidelity lets you set up Auto Roll to automatically buy another Treasury of the same term and the same amount when this Treasury matures. It’s convenient when you’re investing in short-term Treasury Bills.

If you turn on Auto Roll, when it’s time to roll to the next one, you may receive an email saying you don’t have enough cash in your account to cover the new purchase. Don’t worry. The matured Treasury will cover the new purchase just in time. See comments from Mapleton Reader.

Again, there is no fee whatsoever from Fidelity when you buy new-issue Treasuries (you must pay a bid/ask spread when you buy on the secondary market). Have cash ready in your account. You’ll have Treasuries when the auction settles.

Vanguard

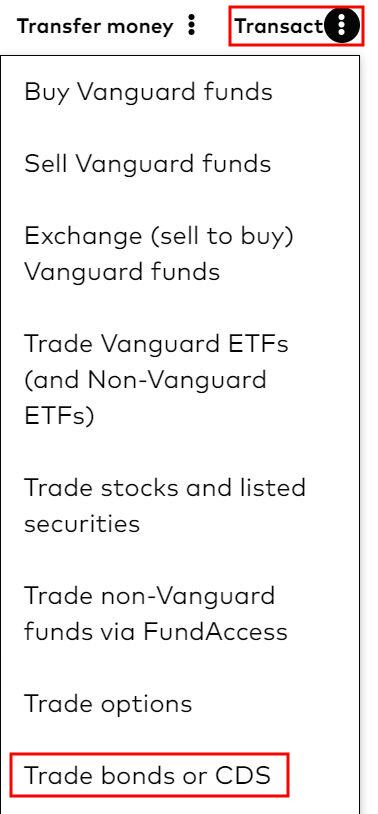

Follow these steps to buy new-issue Treasuries in a Vanguard brokerage account.

Click on the three dots next to Transact near the top right of your account and scroll toward the bottom. Click on Trade bonds or CDs.

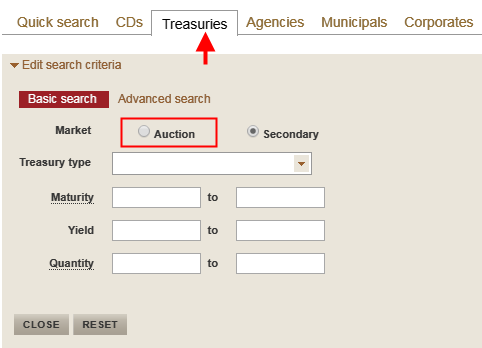

Click on the Treasuries tab and then the Auction radio button. Be sure to select “Auction.” You pay no fee or bid/ask spread only when you buy a new issue (you must pay a bid/ask spread when you buy on the secondary market).

You will see a list. The Treasuries available for accepting orders will have a Buy link. If you don’t see a Buy link for the term you’d like to buy, check the calendar from U.S. Treasury and come back within your order window. If the Buy link isn’t activated yet on the Announcement Date, wait a few more hours. It’ll show up later in the day.

Vanguard shows an Indicative Yield on the right. That’s just an estimate. Ignore the estimate. You’ll get the actual yield from the auction. You won’t know what it is until after your order executes but you can be sure you’ll always get the best yield determined by the market.

Vanguard goes by the face value on the order page. Your order amount must be in $1,000 increments with a minimum of $1,000 and a maximum of $5 million. Vanguard doesn’t offer the Auto Roll feature. Similar to Fidelity, there is no fee whatsoever from Vanguard when you buy new-issue Treasuries (you must pay a bid/ask spread when you buy on the secondary market).

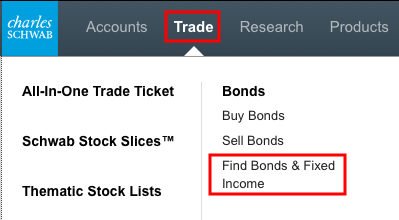

Charles Schwab

You can buy new-issue Treasuries at Charles Schwab as well. There is also no fee whatsoever from Schwab (you must pay a bid/ask spread when you buy on the secondary market). I don’t have an account with Schwab but a reader sent me these screenshots from their account.

Click on Trade in the top menu and then Find Bonds & Fixed Income.

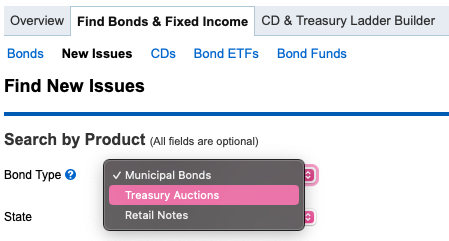

Click on New Issues.

Choose Treasury Auctions in the Bond Type dropdown.

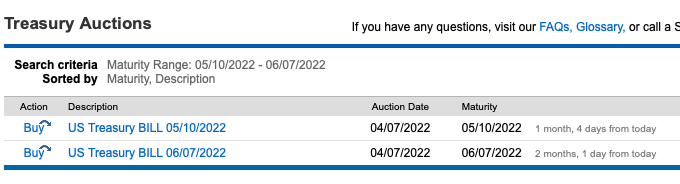

You will see a list of issues available for new orders. If you don’t see anything for the term you’d like to buy, check the calendar from U.S. Treasury and come back within your order window. If you don’t see the new Treasury offered on the Announcement Date, wait a few more hours. It’ll show up later in the day.

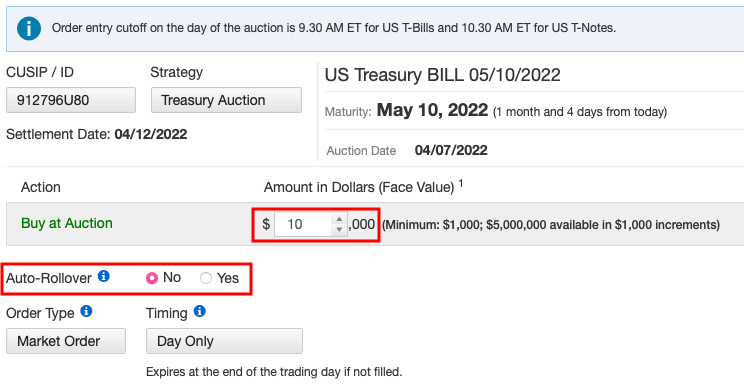

Your order must be in $1,000 increments. If you turn on the Auto-Rollover feature, Schwab will automatically enter a new order for the same term and the same amount when this Treasury matures. If you leave the Auto-Rollover feature off, you’ll just have cash when this Treasury matures.

Charles Schwab limits the Auto-Rollover feature to Treasury Bills with a maturity of six months or shorter. There’s a one-week gap between the maturity of a Treasury Bill and buying a new Treasury Bill with the proceed. Fidelity doesn’t have this six-month limitation or the one-week gap.

E*Trade

E*Trade’s commission schedule says their fee is $0 for buying new-issue Treasuries. Reader Bill found these instructions with screenshots from E*Trade:

Instructions for buying new-issue Treasuries are on page 5 of that document. I don’t know whether those instructions are still current because I don’t have an account with E*Trade.

Merrill Edge

Merrill Edge doesn’t support buying new-issue Treasuries online. Their fee schedule says that placing an order by phone with a representative costs $30 but people have reported not being charged a fee. Please confirm with the representative that you won’t be charged a fee if you decide to have the phone rep place the order for you.

You can buy Treasuries on the secondary market online without a fee at Merrill Edge. See How to Buy Treasury Bills & Notes On the Secondary Market.

Auction Result

Because I know I’ll get the best yield in an auction and it’ll be water under the bridge post-auction anyway, I don’t bother to check what exactly the yield was after the auction. If you’d like to know what you got from your purchase, you can check the auction result after 2 p.m. Eastern Time on the Auction Date on the Announcements, Data & Results page at TreasuryDirect.

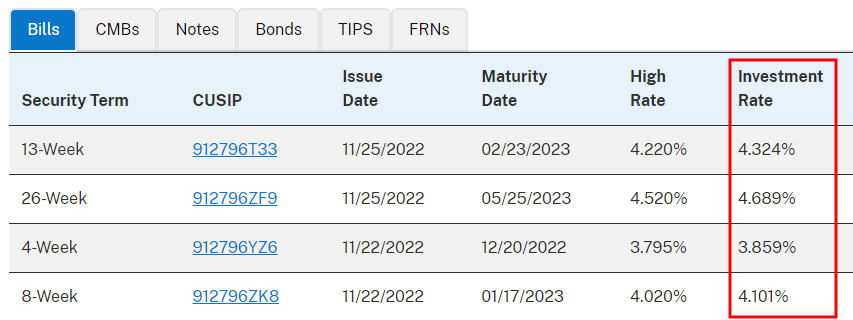

The results for Treasury Bills (1-year or shorter) list a High Rate and an Investment Rate. The two numbers are just different calculations for the same result. The Investment Rate is comparable to the Annualized Percentage Yield (APY) on a commercial CD.

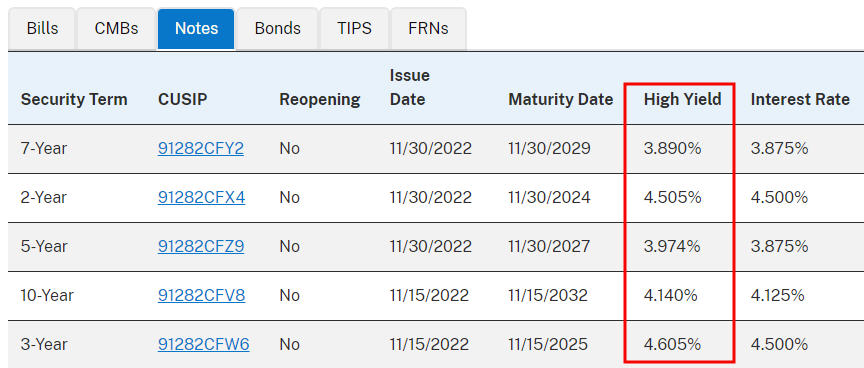

The results for Treasury Notes and Bonds (2-year or longer) list a High Yield and an Interest Rate. The High Yield is the yield you got from your order. The Interest Rate is the annualized rate at which you will receive interest payments every six months. If the Interest Rate is 4%, you will receive $20 in interest for each $1,000 face value every six months ($1,000 * 4% / 2).

***

Buying new-issue Treasuries in a brokerage account comes down to:

- Check the current rates and decide how long you will invest the money.

- Check the auction schedule to see when the next sale for your desired term will come up.

- Set a calendar reminder to place your order within the order window.

- Have cash ready to go in your account.

- Place your order. Wait for the auction and settlement.

- Check the auction result only if you’re curious.

- (2-year Treasury Notes and up) Automatically receive interest as cash in your account every six months.

- Automatically receive the face value when it matures.

You can also buy “pre-owned” Treasuries on the secondary market but you’ll have to pay a bid/ask spread there. You’re better off waiting for a new issue unless the term you want to buy isn’t available as a new issue — for example, no 9-month or 4-year terms are offered as a new issue — or if the next auction for a new issue is too far off in the future. Please read How to Buy Treasury Bills & Notes On the Secondary Market if that’s the case.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Jos says

Excellent, actionable information. Kudos.

Jacquie Traub says

Harry, could you do an article on TIPS (Treasury Inflation Protection Securities)? Why do they have a negative return, with inflation so high? How does one make a return with these? Do you recommend them? Thank you. Love all your articles.

Harry Sit says

Will do. I wrote a whole book on TIPS back in 2010. I have a lot to say about TIPS.

Terri says

I second the request for an article like this one on buying TIPS.

Allison says

Thank you for this excellent resource. I used the original post back in 2018 to guide me through the purchase of Treasuries and now I am referring to it again. A question: on the “Rates in Recent Auctions” page at https://www.treasurydirect.gov/instit/annceresult/annceresult.htm

it shows a High Rate and an Investment Rate. Which is the rate we get on our Treasuries?

Harry Sit says

Both. They reflect the same reality with different methods for annualizing (360 days versus 365/366 days).

Jay says

If buying through Vanguard does the money come directly from your brokerage account, or can you have it deducted from your bank account? And if from the brokerage account, should the money be sitting in money market?

Harry Sit says

It comes from the settlement fund of the brokerage account. I don’t think your order will go through unless you have sufficient balance in the settlement fund (or have margin and sufficient buying power).

Beth says

Can Treasury Notes be purchased in a Schwab Roth account? Thank you.

Harry Sit says

Yes, follow the steps in the “Charles Schwab” section.

Rob I says

Great article. Great alt to Savings.

I checked the process on Vanguard and Fidelity and noticed slightly different estimated rates for the same auction. Fidelity a bit lower than VG. Will both brokers close at the same auction rate?

Harry Sit says

The estimates are only estimates. Everyone gets the same rate when the auction completes.

Brad Freeman says

I am new to purchasing Treasuries and want to thank you for clearly illuminating the process. One large benefit of Treasuries over CDs purchased directly from banks when held in IRAs is avoiding the paperwork and time delays in moving assets between custodial accounts at different trustees. I’m now in the process of transferring IRA HYSAs and CDs from multiple banks to brokerage accounts at Vanguard to purchase Treasuries and it’s taken several weeks so far. The banks have no incentive to speed up the withdrawal of money from their uncompetitive low interest paying accounts! Now that I see how to easily purchase Treasuries from a brokerage account, I won’t be going back to purchasing CDs directly from banks!

Jay says

If bought through Vanguard, the Treasury purchase will show up in my Vanguard Brokerage account once it settles, right?

RobI says

Yes I just did the same and it was very easy following the steps from Harry

Dee says

I have paper ibonds issued from my income tax refund in only my name but they have my spouse’s social security number. Is this a problem?

Harry Sit says

Not a problem. The last four digits of the Social Security Number printed on the paper bond only show which tax return it comes from. It has nothing to do with the bond registration. You can follow the normal process to deposit it into your online account without doing anything extra. See How To Deposit Paper I Bonds to TreasuryDirect Online Account.

Gina says

Just bought a 1 year Treasury bill at auction. I paid $978.77. Does that mean the interest is 2.123% ? Not sure whether to divide by the amount paid or the face amount. Also, if I were to buy at Schwab on the secondary market, what does accrued amount mean?

Thanks,

Gina

Harry Sit says

It doesn’t matter. The bottom line is that you paid $978.77 and you’ll get $1,000 back in a year. Whether you call that 2.123% or 2.169%, it makes little difference and it doesn’t change the bottom line.

Accrued interest is like the prorated property tax when you buy a house. When you’re going to get the interest payment for a full period, you owe a prorated amount to the previous owner. It’s small, but it unnecessarily complicates your taxes if you buy in a taxable account. That’s another reason I suggested sticking to new issues for simplicity.

Frank says

T-Bills, buy now or wait after Fed’s meeting on June 3?

I have to pay my son’s tuition in mid December. Currently the funds are tied in a Age-based mutual fund in 529 plan. I am thinking about withdrawing $25,000 from the 529 plan and buy 6 month T-bills. My question is if I shall buy it next Monday or wait until Fed Discount Rate increase which is most likely to be announced at next Fed’s meeting, June3? Any predication whether the 6 month T-bill interest rate will go up or down then?

Thanks

Harry Sit says

Look at how the rate changed before and after the last Fed meeting on May 4th when they raised the rate by 0.5%. The yield on six-month Treasury was 1.40% on April 26. It dropped to 1.37% on May 5, the day after the Fed meeting. A 0.1% change makes a difference of $5 per $10,000 invested. If it changes by that much and you predict it correctly, you make $12.50 on your $25k investment. Flip a coin.

dobbs says

hello harry, is it possible to buy 5, 10 year TIPS in an IRA held at Vanguard, via their brokerage, as one does for nominals?

if so any caveats?

PS: just got your book from 2010, still find Bond Calculation comparisions confusing , e.g. YTM for TIPS vs nominals, the “breakeven” percentages, typically used are both “real” or both “nominal” , etc

Do you *still own more TIPS than nominals?

Harry Sit says

Yes, you can buy 5- and 10-year TIPS in an IRA through Vanguard. My book shows the details. If you still find it confusing though, consider buying a TIPS fund or ETF as shown in this post. Let the fund management handle those calculations.

wogga says

Only semi-related comment, but hopefully useful: If any of you here haven’t put your $10,000 per taxpayer per year into I-bonds via treasurydirect — and you are OK not accessing your money for 12 months, seriously consider doing it. I don’t know what I was doing last Dec, or I could have put in $10K then and $10K this year, as rates have gone up. I believe the May+ 6 month rate (guaranteed by the treasury) is 8.62%. The rate could go down when they re-evaluate in the fall, but cannot go below 0%, so even if they didn’t pay you the 2nd half of your year’s I bond rate, you’d still lock in 4.xx% for the year, not bad for a US Gov’t guaranteed rate. The treasurydirect.gov website is clunky, but if you’re already buying other T-bonds and bills direct, you already have an account, which is half the battle.

Terri says

Hi, for 2 year notes, I only see floating rate notes on the auction schedule. Or am I missing something? I was thinking of making a ladder up to 2 or 3 years. Would I use a 2 yr FRN the same way as a fixed rate note? Or does the floating rate mean there’s no need to include shorter notes? Does the yield curve info for 2yr notes apply to the FRN?

terri says

My mistake, I blame it on my glasses! I see that there are both regular and FRN 2 year notes on the calendar.

Matt says

Hi Harry. Can you buy T-bills & notes in an IRA at these brokerages? If yes and I buy in my Roth, does that mean all the interest earned would be tax-free?

Harry Sit says

Yes, the process is the same in any type of account you have at the broker. The tax treatment goes by your account type.

Matt says

Thank you Harry for all your great work & timely responses.

BH says

I had the same question. Thanks Harry! Been following you for years and youre always so helpful and can break down (unnecessarily) complex topics in a way most cannot.

Going to execute this in my Roth IRA as this is a great “risk-fee” way to add more diversification.

John says

I just found out that if you want to buy Treasury Bills through Fidelity at the secondary market, the minimum purchase requirement is extremely high. I don’t know if this is true for other people.

Harry Sit says

Clicking on the Depth of Book icon will show you prices for lower minimums, but it’s just unnecessary to buy Treasury Bills on the secondary market. A new issue comes up every week. The minimum is always only $1,000. There’s never a bid/ask spread when you buy a new issue. At worst you wait until next week. Paying a bid/ask spread on the secondary market every month or every three months adds up fast.

John says

Thank you Harry for the suggestion! I will stick to the new issues.

Jesse Ash says

Thanks Harry for the very good information . I worked for The Federal Reserve Bank, Los Angeles Branch for 26 years. Back in the 70’s the lines would be around the block for for Treasury Bills, it would be nice if we could buy Treasury Bills and Savings Bonds direct from The Federal Reserve Bank.

Se says

The feds just did a rate hike today – 75 basis points. Is it a good time to buy 6-month treAsury bill? It was about 3% before will it be around 3.75% ? Have money waiting on Schwab – never did bond before. Planning to buy ASAP. Don’t want to put a lot of money 💰 and it be the wrong time. Thank you.

Harry Sit says

Check the rates tomorrow using the link in the post. The government sells new 6-month bills every week.

Jacquie Traub says

Hi Harry,

I know you update links and information in your articles at times. Are the rates in this article updated periodically or are these the rates from when the article was posted (April, 2022?) Thank you.

Harry Sit says

Rates in the table aren’t updated because they change daily. There’s a link in the post to check current rates.

SE says

So expected yield on 7/28/2022 for a 6 months is 2.90% ? Is that how it works? Seems like the expected yield is going down even though they just increased it 75 basis points? Thought it would go up. On Schwab it shows a new 6 month t-bill maturity on 2/2/23 that will auction on 8/1/22. From this link: https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2022

Harry Sit says

That’s correct. Rates change daily. It’ll be around that number give or take.

S E says

Thanks. Purchased 6-month t-bill with no fee! Maxed out I-Bond last week. Not sure of any other safe, semi-liquid investments. Wish I could get better than 3% somewhere since inflation is over 9%! Thanks for the info.

Matt S says

Outstanding TBill advice here, Harry. I’ve learned so much from your site–I just ordered your Financial Toolbox book as well. Thanks so much.

joey says

any thoughts on just using money market funds vs. 13/26week treasury bills?

seems the extra basis points, might not be worth the effort for retail 4-5 figure investments ?

Harry Sit says

A money market fund or savings account offers daily withdrawal flexibility but a lower yield. It’s your call which you prefer.

James Bond says

One thing I observed – I am a US citizen, moved to a foreign country for work. In this case, Fidelity doesn’t allow me to buy “New Issues” with following error: “Your order cannot be placed. Because you or someone authorized to act on your account resides outside the United States, you are not eligible to participate in this new issue offering”.

So it seems the only other way for me to buy treasuries is secondary market. Please let me know if there are other ways I could participate

Wogga4eva says

Two ideas: one, call fidelity to get your trading set up in your current country. You may just have to tell them/sign something. If that doesn’t work get a paid VPN service/app like Hot Spot Shield , so you can turn that on, placing your browser / pc back n the USA before logging you into Fidelity.

James Bond says

It’s not about VPN. It’s because my company (it was the same company I was working in the USA) updated my mailing address in the Fidelity system. As the mailing address changed, they detected change in residence and restrict overall activity.

supersunken says

If you have a US address you can create any brokerage account, deposit money in and purchase treasury bonds. You don’t need to stick with Fidelity. Or you can change the address to a US address in your Fidelity account?

Zumwalt says

One issue I found using Schwab is that they insist on sending snail mail notifications of upcoming T-bill/note/bond maturations. There is no way to have these delivered electronically (according to several customer service reps who cite vague “regulatory requirements”).

I know Vanguard does not do this. Can someome let me know what Fidelity does?

Harry Sit says

Fidelity sends notices of maturing bonds electronically.

Kein says

Schwab *requires consent to electronic delivery* for some features. @ Zumwalt Did you ever get that paper firehose turned off?

Electronic delivery is best for me. Some older people I know like paper-only.

The legalese:

https://client.schwab.com/Areas/Trade/FixedIncomeSearch/FISearch.aspx/BondAgreement

an excerpt: “…

Consent to Electronic Delivery of Information

We will be providing you separately a “Municipal and Corporate Bonds New Issue Process Informed Consent to Electronic Delivery of Information”. Please review that consent form carefully and acknowledge your acceptance by clicking on “I consent”. When you click “I consent” in the consent form, you will be consenting to ongoing electronic delivery by Schwab of certain communications relating to use of the System and trading in Bonds, including communications relating to public offerings of Bonds and availability of Offering Documents, notices, regulatory communications, and any other documents needed to participate in electronic trading of securities and/or the offering process for new issue Bonds (collectively, “Information”).

If you do not consent to electronic delivery of Information, you will not be able to participate in new issue Bond offerings in the System. You may still participate in new issue Bond offerings with no additional fee by calling a Charles Schwab Fixed Income Specialist at OOO-OOO-OOO.

…”

alan 68 says

just curious, does this mean 1 snail mail per account, or for each bond ?

I, also have a Schwab brokerage, and was going to try it out for the rollover feature, maybe just at the 4 week auctions, the downside being another account to track, but maybe using Schwab over TD (where I also have an account) has an advantage.

Is it enough to open a fidelity account for this feature you would like, or maybe Fidelity has some benefits over Schwab/TD otherwise?

Josie says

Good day Harry. Thanks a lot for this article. I’m new to Treasuries so I’m sorry if this is a stupid question. I know you suggest new issues because of the zero fees, but if I were to buy them in the secondary market with Fidelity – when I look at the depth of book, I should be looking at the Ask price and if I were to sell I would be looking at the Bid price? Your website is very informative. I will be sure to check out your books later today.

Harry Sit says

That’s correct, and for the minimum number of bonds you will buy or sell. The price quote before going into the depth of book can be for a large minimum quantity.

Josie says

Thank you Harry. You’re right though. I think I will go with the new issue bills.

Allison says

Again, this is an excellent post. I purchased several Treasuries back in April 2022, as rates first began climbing up from ~zero. Obviously, rates are much higher now (Sep 2022). You’ve mentioned that Treasuries are easy to sell. I’m wondering if I should sell my 1+ year term Treasuries so I can buy some current Treasuries and take advantage of the new higher rates. I’m no math wiz so I’d love to have the opinion of someone smarter than I on this.

Question about selling: I found the Buy/Sell (Bid/Ask) page for my CUSIP 912796V48 on Fidelity’s website. Let’s say I purchased 10 Treasuries so I have ~$9,811 invested. Would my sell quantity be 10 (just like when I bought them)?

Harry Sit says

Usually there isn’t much to be gained by selling and rebuying versus only waiting to buy again when your bond matures. In order to profit from a trade, you’d have to have a different view on how it will play out in the future than the prevailing view of the bond market and it turns out you were correct and the market was wrong. You can sell if you need the money for something else but I don’t think trading will help. If you do sell, yes, the quantity will be the same as when you bought them.

Rick Whittington says

Thank you for this article, and your many articles on TIPS! Your straightforward guides gave me the confidence to rotate out of FIPDX and start purchasing individual TIPS. My first 5-year TIPS purchase started with CUSIP 91282CEJ6 re-auction back in April. Although I intend to hold all TIPS to maturity, I’m a little confused about how Fidelity reports cost basis on TIPS. Fidelity reports current market value of 91282CEJ6 as BELOW what I originally invested (which I understand given the dramatic rise in Fed interest rates). However, it also reports a cost basis several thousand dollars ABOVE what I actually invested. So, if this TIPS was maturing today, what would I receive back if the market value was below what I originally invested? Would I receive current market value, what I originally invested, or the Fidelity reported cost basis?

Thanks for helping me understand. You have a real talent for clarifying obscure topics!

Harry Sit says

91282CEJ6 was auctioned as a new-issue in April. It was auctioned again in June as a re-opening. If you bought in April, you should’ve paid $1,027.6745 per quantity of 1, which consists of $1,027.62649 for the bond and $0.04801 as accrued interest. You’ll be reimbursed for the accrued interest when this bond pays interest on October 15. What does Fidelity report as the cost basis? Divide the cost basis you see by the quantity to get the cost basis per bond.

If this bond matured today, you would receive $1,000 per bond times the index ratio plus the last interest payment. The index ratio for this bond as of today, 9/21/2022, is 1.04938. That means you would receive $1,049.38 per bond plus interest. The difference between this and the original $1,000 per bond in April represents the inflation adjustment since then.

Rick Whittington says

Thanks Harry. I purchased at both the April new issue and the June re-auction. I pulled the auction results of both from the Treasury Direct site and followed your instructions. It ties exactly to the Adjusted Prices and Adjusted Accrued Interest shown in the Auction Results, subtracted from today’s Inflation Protected Information tab on the Fidelity site for 91282CEJ6. The “Cost Basis” that Fidelity shows in my portfolio does not match any of this. However, they do have a footnote that says “Adjusted cost basis is calculated based on the IRS default methods or fixed income instructions provided to us. The adjusted cost basis may not reflect all adjustments necessary for tax reporting purposes. Refer to IRS Publication 550, Investment Income and Expenses, or your tax advisor for additional information.” I probably won’t refer to the IRS Publication, because I’m lazy and it’s easier to follow your method. Thanks again for your help, you do have a talent for clarity!

LK says

Hello Harry,

Great article. I am thinking of EARLY withdrawing a 2.5% 18 month CD (I am about 3 months in) to buy a 1 Yr TBill/Note at 4.00%+ yield. I am trying to figure out if this is a good idea? I plan to hold until maturity.

The penalty to withdrawal early is 6months interest. And they indicate what your early redemption total value would be. I am just having trouble doing the math and is this a good idea due to no state/local tax benefits (I live in NYC)?

The way I see it, I figure the forfeit of 6months interest would eventually be recaptured and the tax benefits are a plus for someone in NYC. And it is also 6 months earlier to maturity.

Let’s just say I’m doing $400k, and the total cost to redeem today is $2,840 (they include the forfeiting of the past 3 months interest in that calculation + 3more). I just hate to forfeit ~$2,800+ for doing nothing and realize I would forfeit any interest I that I have accumulated on money in last 3 months. How is this calculated into the equation? I would buy the bond in a brokerage account and hold to maturity. If I hold to maturity, it doesn’t matter if the value goes up or down in the interim right, my YTM will locked in? I see the value fluctuates if I want to sell in the secondary market.

Thanks for your time and advice!

Harry Sit says

If you’re sure you’ll hold to maturity, you will get a little more interest by breaking the CD early. If you do $400k, you’ll end up with about $2,500 more (before tax) versus staying in the CD for the remaining 15 months. It isn’t much percentage-wise (~0.6%) but $2,500 is still $2,500.

This is calculated quickly by the extra 1.5% interest being 60% more than the current 2.5% rate on the CD. So over the remaining 15 months, you’ll get 15 * 60% = 9 extra months’ worth of interest at the original 2.5% rate. After subtracting the penalty of 6 months, you have 3 extra months left. $400k * 2.5% * 3 / 12 = $2,500. This doesn’t include the difference in state and local taxes, which adds some more benefit to Treasury bills.

Yes, your yield is locked in if you hold to maturity. It doesn’t matter how the market value changes before then.

Wondering says

It’s a great explanation to LK’s inquiry. I have a further question. Is there an online calculator that would allow to perform such quick comparisons? I think it can be easily created on the Excel spreadsheet or Google Sheet. Your explanation actually gives an idea on how to possibly create it.

This article and comment thread will be a great study guide for me. I have always had regular CD’s (and I-Bonds) but with banks being either very slow or stingy to increase interest rates nowadays, I must learn about Treasury bonds/bills and brokerage CD’s that seem to offer higher rates. If I feel comfortable, I might start breaking my 5-year CDs that have been earning 3%, but they still have 1 or 2 years to go (so like LK I must calculate when it’s worth it to break my old CD’s, though luckily I’m not anywhere close to having $400k in cash).

Are there pros and cons between these two categories? I think one pro for Treasuries is that people don’t pay taxes on the state level, only to the IRS, but with CD’s, one must pay taxes on interest to both federal and state governments. Am I correct?

A month or so ago while exploring my taxable account at Schwab, I managed to find Fixed Income section, but I was surprised to see a brokered CD in USD from some Israel bank (it was in the title of the CD), but when I clicked on it, it said “FDIC Insured.” How can it be? If I bought it, would I also get entangled in some paperwork complexities and pay taxes to Israel as well?

Since people are feeling a rush to jump to bonds, Treasuries, and CD’s (brokered or regular), what should they be concerned about to prevent mistakes? Any advice?

For example, as I found this CD from Israel (almost 4% for 1 year), it sounds great, but heck, if I get more paperwork to do or file something in another country, etc. I don’t think the little extra interest earned on it overweighs the hassle of filing taxes. I could be wrong, so I’m wondering now.

Harry Sit says

If the remaining terms match exactly, i.e. 2 years left on the CD, replacing with a 2-year Treasury, you can use the “break CD calculator” from depositaccounts.com:

https://www.depositaccounts.com/tools/break-cd-calculator.aspx

It doesn’t account for the difference in tax treatment. Yes, you must pay both federal and state (and local, if applicable) taxes on the interest from both direct CDs and brokered CDs. You only pay federal tax on the interest from Treasuries.

A brokered CD from an Israeli bank is from the U.S. subsidiary of the bank in Israel. That’s why it still has FDIC insurance. You don’t pay tax to Israel. However, almost 4% for 1 year is no longer a good rate when 1-year Treasury yield is already above 4%. Treasuries are directly guaranteed by the U.S. government. You also save on state and local taxes.

Bill says

Hi Harry

Where I can see that 1 year above 4% for treasuries ?

Thanks

Harry Sit says

The “Current Yield On New-Issue Treasuries” section in this post.

Frank says

I-Bond or 1-year treasury

I know it is still too early to know the upcoming I-Bond yield. There are two rate increase cycles for the this year. Is it possible that 1 -year treasury yield reach 5% by Jan 2023? If that is the case, does it make more sense to invest in 1-year treasury than I-Bond assuming inflation peaked in August? Any educated guess?

Harry Sit says

Buy both?

Nancy says

Thank you so much for this post! I had some cash in IRAs at Schwab and Vanguard that I wanted to put to work safely and short-term, and Googling brought me here. Thank you for making it so easy to understand, and for giving the step-by-step instructions at each brokerage. It’s easy once you know how, but having your instructions made it go so much more quickly.

Frank says

3 month Treasury vs. 3 month CD?

I noticed on Fidelity site the 3 month CD rate offered by banks is higher than the Treasury? The only consideration is Treasury is state tax exempt. Has anyone done calculation to see which to buy?

Frank

Harry Sit says

To get the fully taxable equivalent yield of Treasuries, multiple the Treasury yield by this factor:

(1 – f ) / (1 – f – s)

where f is the federal marginal tax rate and s is the state marginal tax rate. For example, when the Treasury yield is 3.4% and you have a 24% federal marginal tax rate and a 6% state tax rate, a fully taxable CD has to have a yield of

3.4% * (1 – .24) / (1 – .24 – .06) = 3.69%

to beat the Treasury yield. And that’s considering holding both to maturity. If there’s any chance you will sell before maturity, you’ll take a much larger haircut in selling a brokered CD than selling Treasuries.

Jacob Olman says

Thank you for this – I am going to check on Fidelity tomorrow. What are your thoughts on laddering versus buying a 2 year fixed rate note with interest rates rising?

Harry Sit says

Buy whichever term you’re comfortable committing to holding to maturity. If you’re sure you don’t need the money for two years, buy the two-year note. If you’d like to retain the flexibility to do something else, buy a shorter term and see if any other needs come up when it matures.

Marc says

Hi Harry,

I’ve commented on your I Bond Article and now I’d like to ask a question about treasuries. In this article, you state: “When you already have a TreasuryDirect account for I Bonds, you can use the same account to buy regular Treasuries but it’s easier to buy them at a broker.” Why is it easier to buy them at a broker? Are there any disadvantages to buying them from TreasuryDirect? And last question. Will TreasuryDirect issue a 1099 for the interest to you and how is that done, somewhere within the site or will they email it to you?

Thanks,

Marc

Old mariner says

Hi, take a look at Harry’s reply to #41 above.

Marc says

Thank you, Old Mariner. I’m not sure the last two reasons are significant, but the first two are valid for certain folks and situations.

The advantages of buying in a brokerage account:

– Can buy in an IRA (not possible at TreasuryDirect).

– Can sell before maturity if necessary.

– One pool of money, not transferring back and forth.

– One consolidated 1099.

Matt says

Harry – How does the 7-day SEC yield on a money market fund compare to the investment rate on a T-Bill? Are they comparable? I have an account with Vanguard and I’m wondering if the 7-day yield is the appropriate comparison relative to a 4 or 8 week bill. Thank you.

Harry Sit says

They’re comparable. See Guide to Money Market Fund & High Yield Savings Account.

Ken says

Hi Harry,

I have a SDIRA LLC. I want to purchase 6 month Tbills for the time being. Can I open an IRA account at Schwab under the LLC name, fund it from my check book authority and buy the Tbills?

Also, am I able to roll the funds eventually from this Schwab account back to my SDIRA LLC to take advantage of the housing market at a later time?

Thanks,

Ken

Ken says

Bueller?…Bueller?…Bueller?…

Harry Sit says

An IRA can only be opened by an individual. You can open an IRA under your own name at Schwab and work with the custodian of your self-directed IRA to transfer part of your IRA to Schwab. This is the reverse of how you transferred your personal IRA into your self-directed IRA when you first created the self-directed IRA. When you’re done with the Schwab IRA, you can move it into the self-directed IRA again as you did it before.

Mary says

Why do you say to “ignore the estimate” given by Fidelity on new auction treasuries. I am looking at 2 month treasury at auction with a 3.37 estimate. I can buy today on the secondary market a 2 month treasury almost identical for 3.58 interest. That lower estimate concerns me. Any help appreciated. TIA

Harry Sit says

Because the estimate is far off from the actual result when the auction completes. The actual result may be higher or lower than the yield you see today on the secondary market but the estimate can’t tell you anything about which way it will go. Ignore the estimate. It’s woefully inaccurate.

Allan says

I have $1.0319 million to put into 6 month or 1 yr T-Bills in my IRA act. I would like to invest the complete amount with only a small fraction left over (<$1,000), but don't want to go over that amount. Vanguard requires $1000 increments. I don't want to purchase 1,031 T-bills because that will leave me with approx. $15K balance. Without knowing the exact amount of the T-Bill until the auction concludes, is there a way to make this purchase and end up with less than a $1000 balance?

Or, will Vanguard only allow me to order 1,031 T-Bills with the amount I have in my IRA settlement account?

Thanks.

Harry Sit says

You can buy 1,031 T-Bills at the auction and see how much money you have left when the auction completes. Then you can use the remaining money to buy into the same T-Bill on the secondary market. The bid/ask spread you’ll pay on this residual order will be small because the quantity is much smaller.

Yuriy says

Can I add my wife’s name to New Treasure notes?

How to add beneficiary?

Thank you.

Aks says

1. Follow Add beneficiary by following Add Registration steps below. Do NOT check “This is a Gift” box.

https://thefinancebuff.com/buy-i-bonds-as-gift.html

2. Then Edit your Treasure notes under current holding and select newly added beneficiary.

My question is how to add a beneficiary who is not a us citizen and does not have SSN? Is it possible?

Harry Sit says

I don’t know how it works for non-citizens. If it doesn’t work when you use an ITIN, please contact TreasuryDirect.

Harry Sit says

If you bought new Treasury notes in a brokerage account, all holdings in the brokerage account go by the ownership and the beneficiary set at the account level. You can’t and don’t need to add a joint owner or designate a beneficiary for each holding separately.

If you bought new Treasury notes in TreasuryDirect, the process is similar to adding a second owner or a beneficiary to I Bonds. See How to Add a Joint Owner or Change Beneficiary on I Bonds.

sudhir says

Thank you for very informative post. Can you please comment on pros and cons of bying 10 year treasury notes Our goal is to get 5-6% returns on our investment and live off those returns when we retire in few years. what happens to 10 year treasury note when fed lowers the interest rates?

william baldw says

any thoughts on just buying TBIL ETF , with expense ratio of 0.15%

instead of manually buying ST bills? VG doesn’t have the rollover feature, not sure if Schwab does (my other brokerage).

Harry Sit says

Schwab has the auto-rollover feature. See the Charles Schwab section in the post.

Jen T says

Hi, I have a Roth that I haven’t been able to contribute into for the last couple years due to a household income being over the allowed limit. Does that income limit apply when wanting to purchase treasury notes through a Roth? I gather from your article we aren’t held to the $6,000 contribution limit for an IRA either when it comes to buying bills and notes either? So I could buy a $10,000 treasury note in my Roth despite being a higher earner? Thank you for your great article.

Harry Sit says

The income limit stops you from contributing new money to your Roth IRA but it doesn’t limit how you invest the money already in your account.

David says

Hi Harry,

Great post. I wish I knew about treasuries years ago, I can’t imagine how much I have lost over years especially considering the tax savings!!!

With respect to taxes do you know if buying a treasury at discount and keeping it till maturity of over a year, would the gain be considered ordinary income or capital gain?

DB says

The discount would be reported as interest and is treated as ordinary income.

Marc says

Quick question, Harry:

Slightly off-topic but on a related matter, what’s the difference between the “High Rate” and the “Investment Rate” columns on the TD site that shows the last 20 treasury auction results? On the surface, the “High Rate” seems to be a misnomer since it’s the lower of the two posted auction result rates. What do they each mean and which do I get when I place an order for a give. treasury bill?

Thanks…

Marc

Harry Sit says

You get both. They are the results of different calculations based on the same reality, similar to how you measure the volume of liquid in liters or quarts. The Investment Rate is comparable to the APY number on commercial CDs.

Susan says

Did you post answer to:

“sudhir says November 1, 2022 at 11:52 am : question on pros and cons of buying 10 years treasuries?”

sudhir

November 1, 2022 at 11:52 am

Thank you for very informative post. Can you please comment on pros and cons of buying 10 year treasury notes Our goal is to get 5-6% returns on our investment and live off those returns when we retire in few years. what happens to 10 year treasury note when fed lowers the interest rates?

Appreciate you answer: What are your thoughts on buying laddered treasuries for cash position in Traditional IRAs vs. brokered CDs ? (We are are 71 & 77 yrs. old — have accounts at Vanguard and Fidelity)

DB says

>> what happens to 10 year treasury note when fed lowers the interest rates?

Their price will likely increase and they can be sold in the secondary market for a gain. If you hold them to maturity, then the interest changes do not matter and you will receive the full face value and the final interest payment.

Harry Sit says

Pros – You’ll have a Treasury note that pays a fixed interest every six months for 10 years plus the principal repayment on the maturity date. The displayed market value in your account will fluctuate during the 10 years but the principal and interest payments won’t change. You know exactly what you’ll get.

Cons – The interest payments and the final principal payment will be affected by inflation. You don’t know how much purchasing power the money will deliver. If you need more than the interest payments before the note matures, you’ll have to sell. The amount you’ll get from the sale may be more or less than the price you paid originally.

Brokered CDs don’t pay meaningfully more than Treasuries of the same term at this moment. Stay with Treasuries.

Allan says

On a 26-week T-Bill, what happens if you try to purchase the bills at Vanguard between 12:01am and 11:00am Monday morning, (auction day)?

Does Vanguard lock you out from submitting the order or does the order not go thru?

Harry Sit says

I’ve never tried entering an order that late. Pushing it down to the wire adds stress. Brokers have a cutoff time earlier in the morning than Treasury’s cutoff time to give themselves time to gather the orders and submit them to the Treasury. You won’t need to worry about making the cutoff if you put in your order the night before. If you must enter your order on the auction day, do it early in the morning and hope for the best.

Secilia says

I read this all a few times, but I cannot understand how to buy and T bonds. I tried, I really tried, so I will go to bank for some CDs

Harry Sit says

Something must be unclear. I’m trying to see what it is. What maturity are you interested in buying (3-month, 1-year, 2-year, …)? Do you have an account with one of the brokers mentioned here – Fidelity, Vanguard, or Charles Schwab?