When you invest a sum of money for a fixed term, buying CDs directly from a bank or credit union used to be the answer but that isn’t necessarily the case today.

Treasuries Beat CDs Now

When the Federal Reserve started raising interest rates, the financial markets responded right away. Banks and credit unions were slow to raise the rates they pay on savings accounts and CDs because they don’t need more deposits and they take advantage of people’s inertia and ignorance of the going rates.

In addition, Treasury securities have low credit risk because they are guaranteed by the full faith and credit of the United States government. They require a low minimum investment of only $1,000. The term can be as short as four weeks. The interest is exempt from state and local income taxes. You can buy them in your existing brokerage account as opposed to having to open a new account at a bank you aren’t familiar with. Why in the world would someone buy CDs from banks and credit unions that pay a lower yield than Treasuries?

Because investors don’t know they can buy Treasuries so easily for a higher yield than CDs.

You may have heard of buying Treasuries through the government website TreasuryDirect, but it’s easier to buy them at a broker. You can buy new-issue Treasuries through major brokerage firms Fidelity, Vanguard, Charles Schwab, TD Ameritrade, and E*Trade with no fee whatsoever. Also, you can buy them in your Traditional or Roth IRA at the broker, whereas TreasuryDirect doesn’t offer IRAs.

Treasury Yield

Although you can buy Treasuries at any time on the secondary market (see How to Buy Treasury Bills & Notes On the Secondary Market), I prefer to buy new-issue Treasuries because you don’t have to pay a bid/ask spread when you buy new issues. While the bid/ask spread may be small, it just isn’t necessary to pay it when you have the opportunity to buy a new issue.

This is the case especially for short-term Treasuries maturing in six months or less because a new issue comes out every week. Paying a bid/ask spread once to buy a 10-year Treasury and holding it for 10 years may be OK but paying a bid/ask spread every month adds up fast.

The yield you’ll receive on a new-issue Treasury is determined by an auction process but you don’t have to make any bids. You only say how much you’d like to buy in your order. The banks will do the competitive bidding and you ride their coattails. You get the same yield for your tiny $1,000 order as a bank buying $100 million.

You can get a feel of where the yield might land by checking Interest Rate Statistics on TreasuryDirect (click on the first heading on the page for Daily Treasury Par Yield Curve Rates).

Treasury bills (“T-Bills”) with a maturity of one year or shorter are sold at a discount to par value. You pay slightly less than $1,000 for each $1,000 bill. You automatically receive the full $1,000 in your brokerage account when the bill matures. The difference is your interest.

Treasury notes (“T-Notes”) and Treasury bonds (“T-Bonds”) with a maturity of two years and above are sold at slightly less than the face value. You receive interest payments in your brokerage account every six months, and the full face value will show up automatically in your brokerage account when it matures. You don’t need to sell or do anything when you hold Treasuries to maturity.

Minimum Order Size

The minimum order for a new-issue Treasury is $1,000 in face value when you buy it in a brokerage account. You can order in $1,000 increments up to $5 million in face value.

The minimum order for a new-issue Treasury is $100 in face value when you buy it at TreasuryDirect. You can order in $100 increments up to $5 million in face value. Because you can’t sell Treasuries in your TreasuryDirect account before they mature (must hold to maturity or transfer to a brokerage account), it’s easier if you buy them in a brokerage account.

Order Window

You only need to know when the U.S. government will sell a new batch of Treasuries next time. Right now the government sells shorter maturities weekly and longer maturities monthly. You won’t have to wait long for the next sale unless you’re buying TIPS.

| Maturity | Sale Frequency |

|---|---|

| 4-week, 6-week, 8-week, 13-week, 17-week, 26-week | Weekly |

| 52-week, 2-year, 3-year, 5-year, 7-year, 10-year, 20-year, 30-year | Monthly |

| 5-year TIPS | Four times a year (April, June, October, December) |

| 10-year TIPS | Six times a year (January, March, May, July, September, November) |

| 30-year TIPS | Twice a year (February, August) |

The exact dates are published in the Tentative Auction Schedule and Upcoming Auctions from the U.S. Treasury. The schedule lists three dates — the Announcement Date, the Auction Date, and the Settlement Date. You only need to pay attention to the first two dates to know the window for placing your order.

You place your order between the afternoon of the Announcement Date and the night before the Auction Date. For example, if you’d like to invest a sum of money for two years, the schedule shows a 2-year note will be announced on a Thursday and it will be auctioned the next Tuesday. You will see it offered at your broker in the afternoon on the Announcement Date (Thursday). You should have your order in by Monday night, before the Auction Date (Tuesday).

So check the sale schedule and set a calendar reminder for yourself to place the order within the order window. If the term you want isn’t available as a new issue or if you don’t want to wait, you’ll have to buy it on the secondary market. See How to Buy Treasury Bills & Notes On the Secondary Market.

When It Matures

If you hold the Treasury to its maturity, you don’t have to do anything extra. The face value will magically appear in your brokerage account as cash when the bond matures.

Some brokers offer an optional “auto roll” feature for reinvestments. If you enable the “auto roll” feature when you buy the Treasury, the broker will automatically use the money from the matured Treasury to buy another new-issue Treasury of the same face value and the same term.

Selling Before Maturity

If you need to sell before the Treasury matures, you can try to sell it online at any time through the broker. The price will be at the market price at that time, which may be higher or lower than your original purchase price.

Sometimes bond dealers aren’t interested in buying from you when you have less than $100,000 in face value to sell. If you see that online prices require a higher minimum than the amount you have, you can wait an hour or two to see if a quote for a lower minimum comes up. Or you can call the broker and ask for help from the fixed income department. They have additional ways to sell the bonds for you. You may have to pay a fee for the broker-assisted trade.

Selling before maturity in a taxable account can make your taxes more complicated. Try to avoid selling before maturity in a taxable account.

Taxes

When you buy Treasuries in a taxable brokerage account, the brokerage firm will send you the necessary tax form for your taxes after the end of the year. The gains are taxed as ordinary income, not as a capital gain. If you do your taxes with tax software such as TurboTax, the tax software will handle the tax calculation. You only pay federal income tax on the interest. The interest income on Treasuries is exempt from state and local taxes.

When you buy Treasuries in a tax-advantaged account such as a Traditional IRA, a Roth IRA, or an HSA, the tax treatment goes by the account type. The interest isn’t immediately taxable. The eventual withdrawals will be subject to the usual rules and restrictions associated with the account type.

Online Brokers

Major online brokers offer new-issue Treasuries without fees. Click on the link to jump directly to the section for the broker you use — Fidelity, Vanguard, Charles Schwab, E*Trade, and Merrill Edge.

Fidelity

Here are the steps for placing an order for new-issue Treasuries with Fidelity.

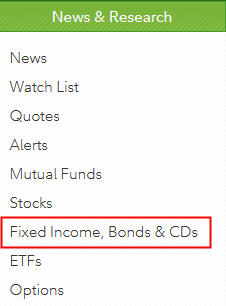

Under News & Research on the top, click on Fixed Income, Bonds & CDs.

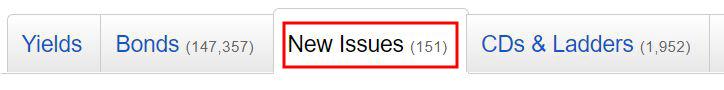

Click on the New Issues tab. You pay no extra fee only when you buy a new issue (you must pay a bid/ask spread when you buy on the secondary market).

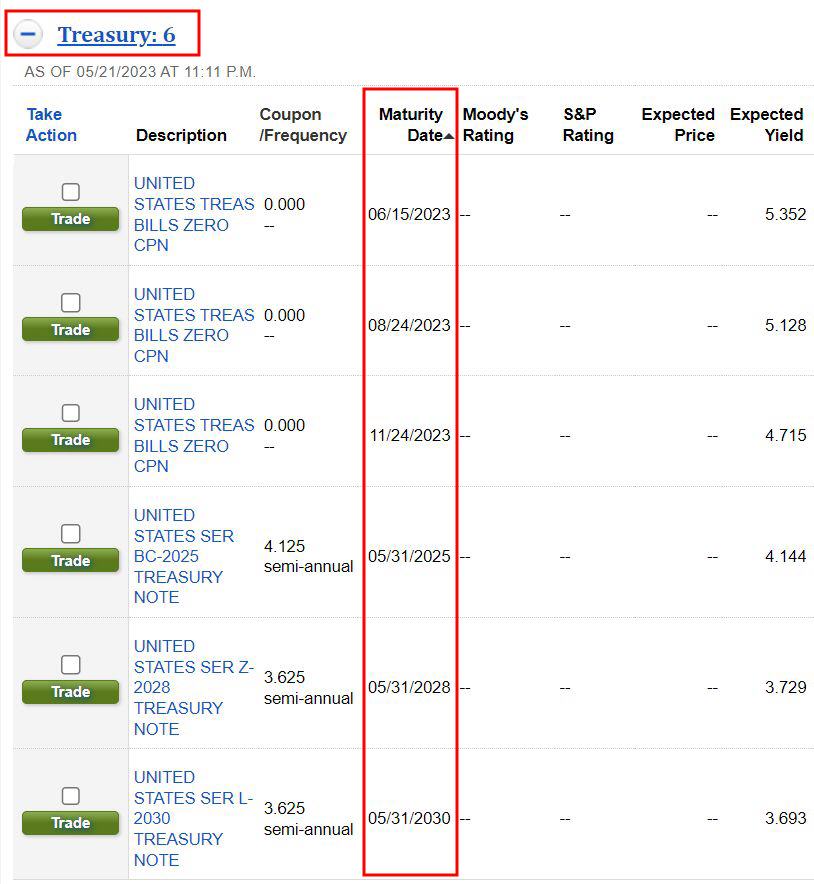

You’ll see a list of upcoming issues in the Treasury section. If you don’t see anything for the term you’d like to buy, check the calendar from U.S. Treasury and come back within your order window. If you don’t see the new Treasury offered on the Announcement Date, wait a few more hours. It’ll show up later in the day.

You’ll see the maturity date of each issue and an expected yield. The expected yield is only an estimate. Ignore the estimate. You’ll get the actual yield from the auction. You won’t know what it is until after your order executes but you can be sure you’ll always get the best yield determined by the market. Click on Trade to buy the issue you are interested in.

You may see either the “old” order entry screen or the “new” order entry screen next. Either one works. Only the look and feel are different.

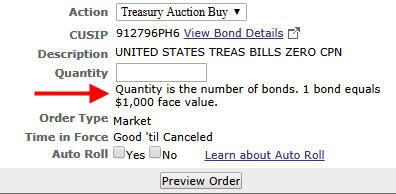

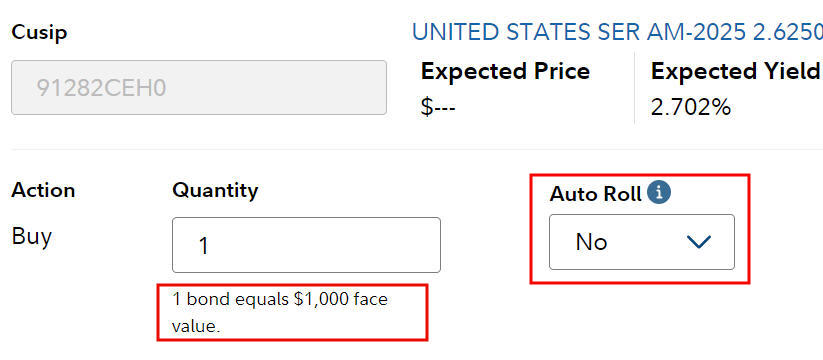

Treasuries are sold in $1,000 increments in a brokerage account. Enter a quantity of 1 if you’d like to buy $1,000 in face value. It will cost slightly less than $1,000 when it’s all said and done. Fidelity lets you set up Auto Roll to automatically buy another Treasury of the same term and the same amount when this Treasury matures. It’s convenient when you’re investing in short-term Treasury Bills.

If you turn on Auto Roll, when it’s time to roll to the next one, you may receive an email saying you don’t have enough cash in your account to cover the new purchase. Don’t worry. The matured Treasury will cover the new purchase just in time. See comments from Mapleton Reader.

Again, there is no fee whatsoever from Fidelity when you buy new-issue Treasuries (you must pay a bid/ask spread when you buy on the secondary market). Have cash ready in your account. You’ll have Treasuries when the auction settles.

Vanguard

Follow these steps to buy new-issue Treasuries in a Vanguard brokerage account.

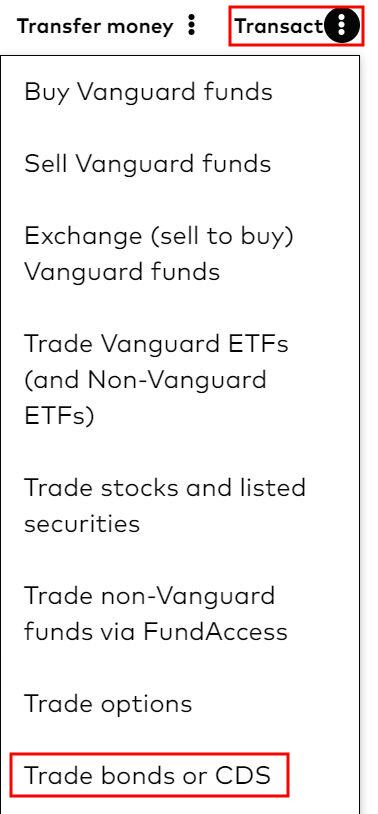

Click on the three dots next to Transact near the top right of your account and scroll toward the bottom. Click on Trade bonds or CDs.

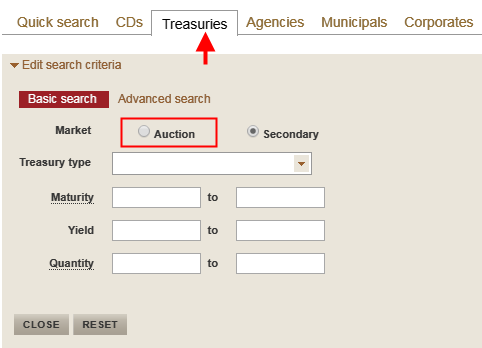

Click on the Treasuries tab and then the Auction radio button. Be sure to select “Auction.” You pay no fee or bid/ask spread only when you buy a new issue (you must pay a bid/ask spread when you buy on the secondary market).

You will see a list. The Treasuries available for accepting orders will have a Buy link. If you don’t see a Buy link for the term you’d like to buy, check the calendar from U.S. Treasury and come back within your order window. If the Buy link isn’t activated yet on the Announcement Date, wait a few more hours. It’ll show up later in the day.

Vanguard shows an Indicative Yield on the right. That’s just an estimate. Ignore the estimate. You’ll get the actual yield from the auction. You won’t know what it is until after your order executes but you can be sure you’ll always get the best yield determined by the market.

Vanguard goes by the face value on the order page. Your order amount must be in $1,000 increments with a minimum of $1,000 and a maximum of $5 million. Vanguard doesn’t offer the Auto Roll feature. Similar to Fidelity, there is no fee whatsoever from Vanguard when you buy new-issue Treasuries (you must pay a bid/ask spread when you buy on the secondary market).

Charles Schwab

You can buy new-issue Treasuries at Charles Schwab as well. There is also no fee whatsoever from Schwab (you must pay a bid/ask spread when you buy on the secondary market). I don’t have an account with Schwab but a reader sent me these screenshots from their account.

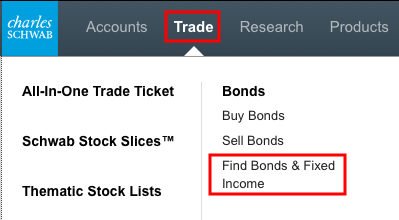

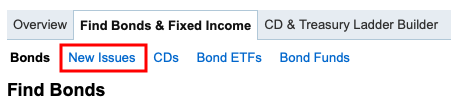

Click on Trade in the top menu and then Find Bonds & Fixed Income.

Click on New Issues.

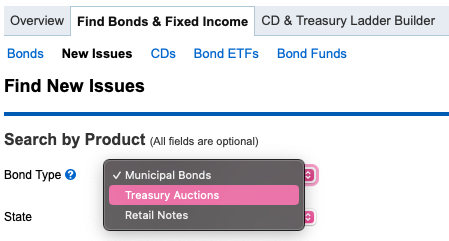

Choose Treasury Auctions in the Bond Type dropdown.

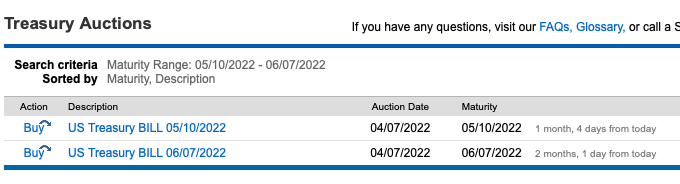

You will see a list of issues available for new orders. If you don’t see anything for the term you’d like to buy, check the calendar from U.S. Treasury and come back within your order window. If you don’t see the new Treasury offered on the Announcement Date, wait a few more hours. It’ll show up later in the day.

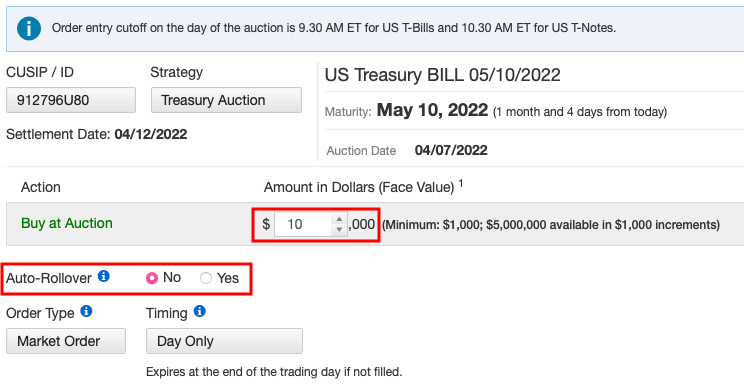

Your order must be in $1,000 increments. If you turn on the Auto-Rollover feature, Schwab will automatically enter a new order for the same term and the same amount when this Treasury matures. If you leave the Auto-Rollover feature off, you’ll just have cash when this Treasury matures.

Charles Schwab limits the Auto-Rollover feature to Treasury Bills with a maturity of six months or shorter. There’s a one-week gap between the maturity of a Treasury Bill and buying a new Treasury Bill with the proceed. Fidelity doesn’t have this six-month limitation or the one-week gap.

E*Trade

E*Trade’s commission schedule says their fee is $0 for buying new-issue Treasuries. Reader Bill found these instructions with screenshots from E*Trade:

Instructions for buying new-issue Treasuries are on page 5 of that document. I don’t know whether those instructions are still current because I don’t have an account with E*Trade.

Merrill Edge

Merrill Edge doesn’t support buying new-issue Treasuries online. Their fee schedule says that placing an order by phone with a representative costs $30 but people have reported not being charged a fee. Please confirm with the representative that you won’t be charged a fee if you decide to have the phone rep place the order for you.

You can buy Treasuries on the secondary market online without a fee at Merrill Edge. See How to Buy Treasury Bills & Notes On the Secondary Market.

Auction Result

Because I know I’ll get the best yield in an auction and it’ll be water under the bridge post-auction anyway, I don’t bother to check what exactly the yield was after the auction. If you’d like to know what you got from your purchase, you can check the auction result after 2 p.m. Eastern Time on the Auction Date on the Announcements, Data & Results page at TreasuryDirect.

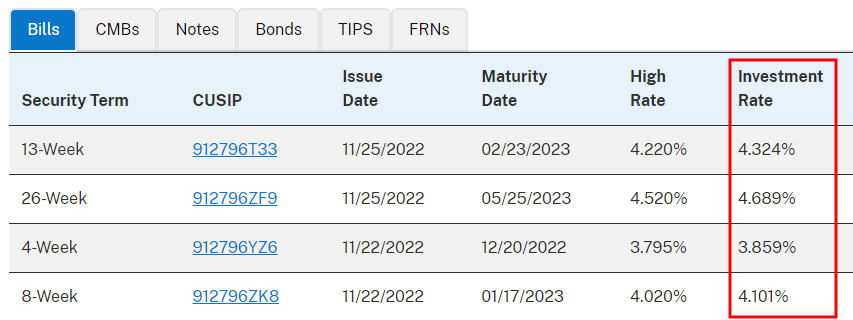

The results for Treasury Bills (1-year or shorter) list a High Rate and an Investment Rate. The two numbers are just different calculations for the same result. The Investment Rate is comparable to the Annualized Percentage Yield (APY) on a commercial CD.

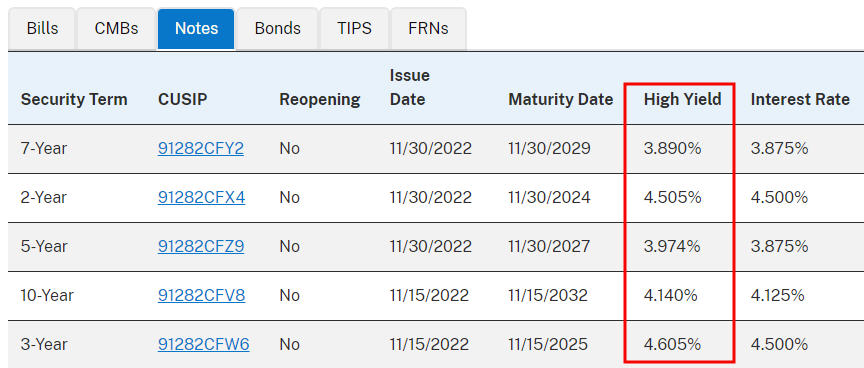

The results for Treasury Notes and Bonds (2-year or longer) list a High Yield and an Interest Rate. The High Yield is the yield you got from your order. The Interest Rate is the annualized rate at which you will receive interest payments every six months. If the Interest Rate is 4%, you will receive $20 in interest for each $1,000 face value every six months ($1,000 * 4% / 2).

***

Buying new-issue Treasuries in a brokerage account comes down to:

- Check the current rates and decide how long you will invest the money.

- Check the auction schedule to see when the next sale for your desired term will come up.

- Set a calendar reminder to place your order within the order window.

- Have cash ready to go in your account.

- Place your order. Wait for the auction and settlement.

- Check the auction result only if you’re curious.

- (2-year Treasury Notes and up) Automatically receive interest as cash in your account every six months.

- Automatically receive the face value when it matures.

You can also buy “pre-owned” Treasuries on the secondary market but you’ll have to pay a bid/ask spread there. You’re better off waiting for a new issue unless the term you want to buy isn’t available as a new issue — for example, no 9-month or 4-year terms are offered as a new issue — or if the next auction for a new issue is too far off in the future. Please read How to Buy Treasury Bills & Notes On the Secondary Market if that’s the case.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Wise Money Tips says

The lower investment minimum and state tax free status can be deciding factors when comparing Treasury bills vs CDs. Not to mention the higher liquidity of the t-bills.

Walt says

I checked Fidelity just now. There are no Treasurys available. They probably sold out. I will contact Fidelity to see when new ones will be available. I am surprised at the attractive yields. Thank you for the information.

Harry Sit says

The U.S. Treasury currently announces new 3-month and 6-month bills on Thursdays for sale on the following Monday. New ones will show up at that time. You place order between Thursday and Sunday.

https://www.treasurydirect.gov/instit/annceresult/press/press.htm

Harry Pierson says

Treasuries NEVER sell out, the order you place through Treasury Direct or a broker for auction are “non-competitive” bids, which are always a tiny fraction of the auction.

As the other Harry said, Fidelity (and Treasury Direct) only accept orders during the period between the auction being announced, and the date of the auction (which usually closed 11AM or earlier)

You can find announcements at this link:

https://www.treasurydirect.gov/instit/annceresult/press/press.htm

Bob Groden says

Thank you for the info. Much appreciated.

DJ says

Thanks for the valuable information — it is certainly more useful than bank CDs.

Is there a way to know when the auctions are being done (or when it goes live), and when they would be available for purchase in the brokerage account? Especially for the 4 week t-bills.

Harry Sit says

See the link in reply to comment #2. I will add it to the post shortly.

Mimoza says

This is great info, thanks for sharing. I hope Schwab is as easy as Fidelity.

Questions: Fidelity will send you 1099-INT or something else? Would this mean the money you paid for the your 6 month bonds were equal to $1k minus 1.873% and Fidelity withdrew your $ AFTER the auction closed on Monday?

Thank you.

Harry Sit says

It’ll be a 1099-OID, which works similarly as a 1099-INT. Tax software will take care of it. 1.873% was the annual yield for a 6-month bill. The actual price paid was $990.74833 for each $1,000 bill. You just make $1,000 available as cash in your account for each $1,000 bill you order. When the auction closes, Fidelity deducts the right amount from your cash. You will have a little bit left over.

Serbeer says

What if for whatever reason you need your money back earlier than maturity time? With CDs, you can pull out losing certain amount.

Harry Sit says

Paying an early withdrawal penalty on a 3-month or 6-month CD would make it really not worth it. So if you can’t commit to 3 months or 6 months you are better off with a savings account or money market fund. You can sell the Treasury bills if you have to. I don’t plan on it but it can be done.

Harry Pierson says

As the other Harry said, if you are worried about having to withdraw your money within 3-6 months of purchase, don’t buy Treasuries, leave it in a money market.

Treasury securities are very liquid, and can be easily sold through any broker. If your Treasury securities were purchased at Treasury Direct, they will transfer them to your broker of choice at your request, for no fee

Mimoza says

Harry,

So if I’m not a tax software user, would I report the treasury bill interest together with CD interest on Schedule B that is carried over to Line 8a of 1040?

Harry Sit says

Yes. Look for 1099-OID in Schedule B instructions and in IRS Publication 550.

Harry Pierson says

If you don’t use tax software, but file state and/or local returns, make sure you find the right place on the state/local forms to deduct the interest paid on Treasury securities.

that interest is NOT taxed by either the state or local governments.

If you use tax software, and you filled out the Federal return properly, that will correctly flow through to you state return

Javier says

I have been looking for a place to “park” some money for a short period of time. This seems to be that vehicle.

Harry Pierson says

You can even purchase 4 week and 8 week Tbills, in addition to the more common 3 month and 6 month

vikash says

Hi Harry

this is great. Thank you!

Can you post one article on which platform to use for IPOs?

Regards

Vikash

Harry Sit says

Sorry, no idea. I never bought one.

Aks says

May I ask why you choose 6 month T-bill vs 4 weeks T-bill with renewal option?

With interest rate on rise, you could have capture future rate hikes by buying renewable 4 weeks T-bill vs 3 or 6 months T-Bill?

Harry Sit says

I would think the smart people who bid millions on these bills know more than I do. Their collective actions determine the current rates. It’s not clear to me how to turn off the auto roll when I need the money. Maybe it’s just an easy phone call. I just chose to keep it simple to match the timeframe when I will need the money. You can try the auto rolling 4-week bills and see what happens in six months. I don’t think there is a clear winner at the outset.

Aks says

Yes, there is not much to loose within your small time horizon.

BTW, you can cancel the auto roll option under the “Positions” tab on Fidelity.com

When you click in the investment in question you will see an option to “Cancel AutoRoll”

Harry Sit says

Thanks! That’s easy. When your timeframe isn’t clearly set, you usually still will know a little bit ahead of time when you will need the money. So you can just set the auto roll on 4-week bills and cancel when necessary. I will try that with some other money.

Mapleton Reader says

I’ve used auto-roll at Fidelity in the past. It worked ok but there is one thing to be aware of (unless it changed since I last used it over a year ago).

If you “park” most of your accessible cash in a treasury bill with auto-roll, Fidelity bids on the next batch of treasuries for you to minimize the lag in time where you receive no interest on your money (this is good). However, Fidelity checks to make sure you have enough money in your account to cover the new order and finds that you don’t – most of your money is still tied up in the existing treasury bill(s). You get a scary sounding notice saying you have insufficient funds to buy the new bill and you should deposit more before a certain date or “bad stuff” happens. If you ignore the letter, all works out in the end because Fidelity gets the money in time from the redemption of the lapsing T-bill just prior to the purchase date for the new one.

Jim Davis says

Well, the 6 month bill pays more NOW, so it will probably be very close to the same return for rolling 4 week bills for 6 months, given some rate increases during that timeframe.

cynicalanddisgusted says

I-bonds currently pay 2.58% and must only be held for one year.

corndog says

Also, I-bonds have a penalty of 3 months interest if you withdraw before 5 years.

https://www.treasurydirect.gov/indiv/products/prod_ibonds_glance.htm

Raj says

What time are the bills available on Monday? I am on west coast and could buy only 4 week bills?

Harry Sit says

Brokers can’t take orders until the Treasury Department officially announces the bills for sale. A recent announcement of the 4-week bill was made on Monday at 11:00 a.m. Eastern Time. So I would give it another hour and try at 12:00 pm Eastern Time (9:00 am Pacific). If you still don’t see it by then, try again shortly before 4:00 pm Eastern Time (1:00 pm Pacific).

Harry Sit says

It’s 8:45 am Pacific Time on Monday. I see the 4-week bill available at both Fidelity and Vanguard.

Raj says

Sorry I meant to be looking to buy 3 month or 6 month bills. Don’t see them just the 4 week bills.

Harry Sit says

The 3-month and 6-month bills come out on Thursdays. You place orders between Thursday and Sunday. By Monday morning it’s usually too late. Check again on Thursday around 9:00 am Pacific Time for the next round.

Raj says

My Thursday order got executed today. Thanks

YK says

Great info! Much appreciated.

Wogga says

Maybe it was mentioned above, but just in case you missed it too:

Tbills and US government obligation income is NOT taxable at your STATE level. This makes them particularly interesting if your alternative is a CD or high yield bank account that you would have to pay tax on in a higher tax state. The interest is still taxable at the federal level, but in MA for example, it means saving the 6.25% (5% for MA banks) income tax on the money you made from your investment.

caray says

Thanks for all the tips. And now I see that I should order my 13 week and 26 week T-bills today (Sunday) and that otherwise they might disappear tomorrow as that is the actual auction day. Never would have known otherwise. I was seeing the issue date (or settlement date shown by Fidelity) of 6/7 (Thursday), thus my confusion.

I was also wondering why I didn’t see any 4-week new issue T-bills, but your article explained that too.

The mechanics looked pretty straightforward, just some things were a bit mysterious so I appreciate your article. BTW – I’m going to turn on the rollover feature. It looks straightforward to stop.

Jim W. says

Very informative article. Thanks!

For 3-month bills sold on Monday, “You place your order between Thursday and Sunday.”

Some clarification please…

Does “between” mean excluding or including Thursday and Sunday?

Or, in other words, what is the latest day and time to submit an order?

Thanks.

Jim

Harry Sit says

Including both Thursday and Sunday.

Carey says

Right, you can place your order on Sunday, no problem. The auction occurs on Monday at 11:30am Eastern Time, or around that. Not sure if you have time to place an order first thing on Monday.

DJ says

Hi Harry,

I have seen there are some differences between the prices at auction vs the prices for the same treasury bills in secondary markets. Sometimes, the secondary markets will offer a slightly better price than the one I get at the auction.

Is there a difference in purchasing T-bills directly from auction vs from the secondary markets? Is the T-bill interest still exempt from state taxation if the T-bill is purchased from secondary markets?

Thanks,

DJ

Harry Sit says

Just like stock prices, prices for Treasury bills also change by the minute (or by the second). There will be different prices for different Treasury bills of similar maturity and there will be different prices for the same Treasury bill at different times. Buying at the auction ensures that you pay the same price as big banks pay. On the secondary market, you will pay a higher price than big banks when you buy a tiny quantity. For the amount I buy, I always buy at the auction. The interest is still exempt from state income tax wherever you buy.

DJ says

Thanks for the clarification, Harry!

GO says

If you purchase bills, notes or bonds in the secondary market, I remember reading an article from another source saying you will have to pay State/Local taxes.

Danita L Cronkhite says

Harry,

We are looking to invest a small amount of money $3k for our deceased son’s two children. Would you say that T-bills, bonds or CD’s would be a better investment for them? The oldest child is 10 1/2 the younger is turning 8 in Nov. We would like to avoid them paying as much in taxes on the money as we can, and would like to keep it out of the hands of their mother, who is notorious for taking the money they are sent. Any suggestions?

Harry Sit says

For what purpose and for how long? If for college, you can set up a 529 account with you as the owner and each grandkid as the beneficiary. If for general spending, you can set up a UTMA account with the grandkid as the owner and you as the custodian. The child’s mother doesn’t have any control over these accounts. Within the account you can decide on what to invest in, T-Bills, bonds, CDs, or mutual funds.

Truman Kover says

Harry,

That was a very good article on how to buy Treasury bills. The screenshots were very helpful to explain the practical details.

Question: When it’s time to roll a T-bill, how can I change the principal amount? For example, suppose a $3k bill will mature in a few days, and I want to roll it into a new $2k bill. How do I set that up?

Harry Sit says

I think you will have to disable auto-roll and place a new order. If that’s the only money you have, you will have a gap of one week, which isn’t a big deal. After your $3k bill matures, you place a $2k order for the new bill to be issued in the following week. During the one week gap the money still earns interest in a money market fund.

Rich says

Harry,

I have a question about if/when to construct a TIP ladder. I’m 57 with about $100k recently inherited burning a hole in my pocket. Do I dollar-cost-average that money into my diversified mutual fund holdings (80% Stocks/40% bonds, to simplify) or would it be reasonable for me to build a TIPS ladder (10 year? 15 year?) now for payout when I’m between 67-70 years old? (I am hoping not to collect Social Security until I’m 70)? I have no company pension or other annuity. Is this a reasonable idea? Smart strategy? I’m not sure if the current rising-rates environment lately makes this plan less ideal than a few years ago. Should I just create a CD ladder? I don’t need the money now, by the way. Thanks for your thoughts.

Harry Sit says

That will take a whole new blog post. The short answer is yes a TIPS ladder is reasonable under a “safety first” approach, better than a CD ladder when you are targeting 10-15 years out, but I would try to do it in a tax advantaged account due to nuances of tax reporting when you hold individual TIPS in a taxable account. Simply investing in a diversified portfolio is also reasonable, under a different “probability-based” approach.

Rich says

Thank you! (And I think a whole blog post about this topic would be fantastic!).

I’ve been reading William Bernstein’s books (all of them, lol), but I see some financial blogs showing some TIPS in their asset allocation but not ladders per se.

I’m assuming a TIP ladder is a very conservative approach (and should be included in your total holdings’ bond percentage), so maybe not for everyone. But it sounds appealing to me to be guaranteed some return on my money along with the return of my money.

Does this rising interest rate environment mean I should set up this ladder sooner rather than later, or drag my feet and add a few rungs every year for a few years as I build it out?

So many questions, sorry. And thank you again for your answers.

Rich

Harry Sit says

Today’s bond prices already reflect the market participants’ collective estimates for the future in “this rising interest rate environment” such that no easy actions would be obvious. Otherwise they would take those easy actions and not pay the prices we see today. You and I won’t be able to figure out something more clever. If one way works better than another in hindsight down the road it would only be by chance.

Carolyn says

Thank you so much for this article. It helped me purchase some Treasuries via Fidelity. Your detailed description with graphics really helped!

Steven says

Thank you for this very informative information. I spent most of the day researching high yield savings accounts from online banks, when I read a comment on one site that mentioned looking into rolling short term T Bills as an alternative, due to the (state) tax benefits.

I found your article after a search on the subject, and greatly appreciate your providing this detailed analysis, especially as a fidelity account holder..

I like Fidelity’s customer service, and already receive year end tax statements from them, so this seems like a perfect alternative in this rising interest rate environment.

Jonathan Fox says

I was looking at this issue earlier today. I think I’m right in saying that (as a NYS taxpayer at 6%) I can get the same net return on a 3% CD with a 2.7% T Bill.

James says

Harry, looking at some other platforms, it looks like the bonds you are referring to are also known as Stripped Bonds. Is that accurate?

Thanks for the post!

Harry Sit says

No they are different. Treasury Bills are issued by the government with a maturity in one year or less. Stripped bonds are those originally issued with a longer maturity, that pay interest every six months, but someone took away (“stripped”) the interest payments and only let you have the principal instrument. Treasury Bills are much more straight forward.

Susan says

James and Harry, I think James is right. In your screen shot Harry, you show Treasury Zeros, also known as strips. In my Fidelity account, there are only Zero bills in the list for sale. Plain vanilla conventional coupon treasury notes are sold, but not shorter term bills.

In Annette Thau’s The Bond Book, she says “investing small sums in zeros can be expensive. Markups are high and vary a great deal from dealer to dealer. If the maturity of the zero is short (under five years), the conventional coupon Treasury may actually be the better buy.”

However, it is difficult to see what the markup is. Harry – do you ever compare the Treasury Direct auction price to the Fidelity auction price?

Thanks for your blog, Harry. Very helpful. Love the step by step.

Harry Sit says

No, the screen shot shows Treasury Bills. Treasury Bills by definition have no coupon. Fidelity is redundant by saying “TREAS BILLS ZERO CPN” in the description but it’s technically correct. These bills don’t have coupons but they’re not Treasury Zeros or strips. Treasury Zeros or strips aren’t sold in Treasury auctions. Only Treasury Bills and coupon notes and bonds are sold in new issue auctions.

The auction price is the same everywhere. Try a $1,000 order on a 4-week Treasury Bill at both Fidelity and TreasuryDirect and see for yourself.

Susan says

I see! Thank you! I misunderstood the title of the product. Thanks for the clarification. That clears up my worry that I had just invested in zeros. 🙂

D says

I bought T-bills at Fidelity and the whole procedure was quite straightforward. I heard that the Treasury Direct online site is quite clunky. I also do not like to open/keep too many accounts. Is there any way to buy I-bonds at a brokerage house such as Fidelity?

Harry Sit says

No, only TreasuryDirect or paper bonds from tax refund.

David says

Thanks for putting up this how to page. I noticed in your screen shots for purchaing tbills at Vanguard it does not show the expected yield. How would someone know what the expected yeidl would be at the time of the purchase?

Harry Sit says

The Daily Treasury Yield Curve Rates link in the fifth paragraph.

MC says

Very useful information. Thank you for taking your time posting this.

Andy says

Thank you for this extremely useful information. I am very grateful to your work.

DR says

Why is the percentage rate earned 0n 3 month bills purchased thru your brokerage account less (around 1.6%) than the current published rates of which are around 2.4% for 3 month bills?

Harry Sit says

Because the rate was lower when I bought last year.

DR says

Thanks for your responce. If I buy 3 month treasury bills thru broker now will I get the current published rate (around 2.4%)?

Harry Sit says

Yes.

Tom says

What is wrong with buying BROKERED T-notes and T-bills from Vanguard? There is no fee involved and you can ladder them very easily since there is many different maturity dates. True you could lose money if forced to sell before maturity in a down interest market but if you ladder efficiently, this should not be a problem. I mention this because you talk about only buying NEW Treasuries as opposed to BROKERED Treasuries. Maybe I’m missing the point. Please enlighten me if so.

Thanks…

Harry Sit says

What you call “brokered” Treasury Notes and Treasury Bills are usually referred to as buying on the secondary market. When you buy on the secondary market, you pay a slightly higher price than the true value. For instance, the market is open now and I’m looking at price quotes from Vanguard for a Treasury note maturing in six months on 10/31/2019. If I buy it now, I will have to pay $9,941.40 per $10k in face value. If I own it and I’d like to sell now, I will receive $9,936.30 per $10k in face value. The true value is somewhere in between. Let’s say you pay $2 extra for every $10k in face value. If that extra $2 per $10k is small enough for you, you can certainly buy on the secondary market through Vanguard.

When you buy new Treasury notes or Treasury bills at the initial auction, you pay the same price for your $10k order as financial institutions for their $100 million order. If we are talking about 3-month and 6-month Treasury bills, a new auction comes up every week. You never have to wait long. That makes it unnecessary to pay extra to buy on the secondary market unless you absolutely must buy today versus next week.

Auctions for longer maturities come up less frequently, and they don’t sell any new 8-year notes. If you don’t want to wait and you don’t mind paying a small markup, or you must have a specific maturity to build a ladder, buying on the secondary market is certainly an option.

Tom says

Thank you. I knew a small markup was factored into Brokered Treasuries but didn’t know how much. $2/10k is worth it to me to set up the laddering I wish. Appreciate your response.

Jesse says

I have a note due to me in August, 2019 for $1,000,000.00 what is the maximum amount you can buy in T-Bills?

Harry Sit says

You can buy up to $5 million with the steps outlined here.

Ramona says

Second week of June 2020 i will have around 60k to invest in bonds. I am considering building a 4 week Fidelity auto rolling tbill ladder. How do I purchase new auction tbills so 20k matures weekly? (Or perhaps 8week tbills maturing every two weeks?

Thank you!

Harry Sit says

With $60k you can have $15k mature weekly or every two weeks, not $20k. You need to place orders for 15 bills four times, every week or every two weeks on Wednesdays. For example:

June 17 – buy 15 bills

June 24 – buy 15 bills

July 1 – buy 15 bills

July 8 – buy 15 bills

Jim Willis says

When I look at the listing of new-issue T-Bills on the Fidelity website, I see 13-week bills and 26-week bills. I do not see 4 or 8 week bills.

However, the 4 and 8 week bills are available at the Treasury Direct site.

Harry Sit says

Look again on Tuesday afternoon or Wednesday after Treasury makes the official announcement.

Ramona says

I called Fidelity yesterday, dividends move to the sweep account rather than compounding on the tbill. Also, I asked about the past 12 months rate of return, sadly it’s was only 1.something. Now I’m reconsidering initiating the tbill ladder. What are the positives moving forward with the ladder?

Harry Sit says

As an alternative to money market, online savings, or CDs for short-term savings:

– Guaranteed by the U.S. government; Can buy up to $5 million without worrying about FDIC insurance limit

– No state income tax

– Never falls behind the market rate

– Don’t need to open new account

At 1.x% yield, for short-term savings, compounding or not compounding makes little difference. Interest compounds in the money market fund in the sweep account.

Hoa Truong says

Is it tax efficient to hold Treasury Bills in a taxable account?

Harry Sit says

It’s slightly more tax efficient than holding CDs or leaving the money in a savings account because you don’t pay state and local taxes.

Bob says

Thanks! Another great article. If I’m reading the current rates correctly, it looks like the sweet spot is either 2 or 3-month treasuries. It gives you the flexibility to renew at higher rates. Currently, 1Y+ rates he longer terms are not attractive enough for the time commitment. Is it worth building a ladder out of 1m, 2m, 3m, and 6m treasuries?

Harry Sit says

Everyone sees the same rates. The rate curve is steep from one month to two years for that reason. I doubt you can gain much by targeting a sweet spot, but if you’d like to retain your option and only invest in 1-month through 6-month, you sure can.

DB says

Thanks for updating this post, Harry. What a re the advantages of buying in a brokerage compared to Treasury Direct account apart from Fidelity’s auto roll feature? Does Treasury Direct issue the necessary tax forms to help with the taxes?

BTW the link to auction schedule is out of date. The correct one appears to be https://www.treasurydirect.gov/instit/annceresult/press/press.htm

Harry Sit says

Thank you for telling me the problem with the auction schedule link. I had double-pasted the URL. Fixed now. The link you posted only lists upcoming sales in the next week. The link in the post includes schedules for the next few months.

TreasuryDirect issues the 1099 form if you buy regular Treasuries there. The advantages of buying in a brokerage account:

– Can buy in an IRA (not possible at TreasuryDirect).

– Can sell before maturity if necessary.

– One pool of money, not transferring back and forth.

– One consolidated 1099.

When you pay no fee and get the same yield, it’s just easier to keep everything in one place.

DB says

Thanks for enumerating the advantages of buying T Bills in a brokerage account compared to TreasuryDirect. Do T bills count towards the $500,000 SIPC coverage limit for a brokerage account? Can a brokerage mismanagement result in loss of T Bills in addition to other brokerage holdings? I ask because you mention the ability to buy up to 5M T Bills without worrying about FDIC coverage in response to one of the comments above.

Harry Sit says

Everything you hold in a brokerage account counts toward the SIPC coverage limit. I don’t worry about SIPC coverage when I use a mainstream broker such as the three mentioned in the post. If you feel safer with TreasuryDirect, use TreasuryDirect.

Fred says

Thank you for the article Harry. How do you look at Short Term TIPs such as VTIP (https://investor.vanguard.com/etf/profile/VTIP ) compared to T-bills in a taxable account that you plan on starting to deplete in about 12 months and it will be fully depleted over the course of the next 4 years? I have VTIP and, trying to keep things super simple, trying to see it it would make sense to sell VTIP and buy T-bills instead?

Harry Sit says

They’re not directly comparable. VTIP has inflation protection. Regular Treasury bills/notes don’t. You can switch to 1-, 2-, 3-, and 4-year TIPS if you want predictability in the values when you sell, but you’ll have to buy them on the secondary market. New-issue TIPS are 5-year and up. Or you can take your chance and stay in VTIP. It isn’t possible to tell which way will turn out better.

Cathy says

Harry,

Thank you for the super helpful article. I currently have my “cash” parked in Vanguard short term inflation protected security fund (VTAPX). With interest rates rising I have been loosing money. I am thinking about moving all into Tbills. What are the advantages? The cash is in a taxable account. I do not need the cash for a few years. Is it best to set up a ladder? Thank you for your insights!

Harry Sit says

You should probably just stay in the fund if you don’t have a set schedule to liquidate. See reply to Fred in comment #42.

Cathy says

Harry,

Thank you for the reply. Interest earned on my short term tips fund is not deductible from my state tax I must hold them directly. Would this change your recommendation?

Harry Sit says

Interest earned on a short-term TIPS fund is exempt from state and local taxes in the same way as directly held TIPS and regular Treasuries.

Cathy says

Harry,

Thank you! My tax preparer in Illinois told me it’s not. Can you point me to a publication I can take to him? Thank you!!

Harry Sit says

Fire this tax preparer because they don’t know the basics. You wonder what else they don’t know. If you must educate them on what’s taxable by the state and what’s not, they should pay you.

Anita says

Hello. I’m at Fidelity wishing to buy a 3 year treasury available yesterday, but when I try to buy, the CUSIP is grayed out. Any idea what that means? Thanks

Harry Sit says

It means you already selected it on the previous page and you can’t change it to something else on the order page. If that’s not the one you want, exit and select a different one.

ANITA says

Thanks Harry. Got it. I just place my order and all went well. Also learned that I’m able to invest my HSA in the treasury as well. Done. Now wondering if Merrill Edge is equally friendly. Long ago, I took your advice and invested in Merrill Edge in order to become Platinum Honors at B of A and get 75% bump on their credit cards. All that has been great. But wondering if I can buy treasuries at ME for 0 trade cost similar to Fidelity. Your advice is always great. Thanks, Anita

Harry Sit says

Merrill Edge doesn’t offer buying new-issue Treasuries online. $30 charge per trade if you do it through a phone rep.

ANITA says

Answering my own question. Merrill Edge charges $0 to buy treasuries, both initial auctions and secondaries, IF it is an online self-trade, i.e. not assisted by a broker. I started to make a buy out of my IRA account at ME and my only option was a secondary treasury. Since I don’t have a non-IRA there, I can’t test to see if they offer auction purchases for non-IRA account.

Do you have an opinion about buying initial vs secondary? eg. I see a 3-year treasury available on secondary, that was issued just 2 weeks ago. I’d like some of my IRA money to go to treasuries.

Thanks much, Anita

Anita says

sorry, my 2nd comment re: Merrill Edge crossed with your reply. (thanks for the reply). I looked at the Vanguard cost chart and it says $0 fee for BOTH initial auction and secondary, where your article says only initial. Is this a new cost chart, or am I looking in the wrong place?

Harry Sit says

This post is only about new issues, aka initial auctions. Buying on the secondary market gets more complicated. When a broker doesn’t charge a commission for a bond on the secondary market, the price they quote still includes a markup. Different brokers have different markups, whereas there’s no markup in new issues.

Anita says

Thanks much Harry… lots to learn here. I appreciate your great advice.

Anita

Pierre says

Hello, I am new into buying treasury bills. Once you reach the 12 moths of maturity , do you have to sell it? Or you are automatically paid your money back and receive your tax forms?

Harry Sit says

You’re automatically paid when the Treasury matures. The interest will be included on your tax form together with your other investment income.

abcd says

Please add Ally Invest to this excellent resource.

Harry Sit says

Ally Invest doesn’t appear to offer new-issue Treasuries.