Many people are interested in buying Treasuries but they hesitate because they don’t want to complicate their taxes. That’s a legitimate concern. How much buying Treasuries will complicate your taxes depends on which Treasuries you buy and how you buy them.

We go from the simplest to the most complicated in this post. It’s better to learn how to walk before you run when you aren’t familiar with how taxes on Treasuries work.

No Worries in Tax-Advantaged Accounts

Buying Treasuries in a tax-advantaged account doesn’t affect your taxes. These tax-advantaged accounts include workplace retirement accounts such as 401k or 403b, Traditional IRA, Roth IRA, or HSA. You don’t pay tax when you buy, hold, or sell investments inside a tax-advantaged account. Taxes on withdrawals from these accounts depend only on the account type. It doesn’t matter what investments you buy or how you buy them in tax-advantaged accounts.

It makes no difference in terms of taxes whether you buy Treasury Bills, Notes, or Bonds, whether you buy regular Treasuries or TIPS, whether you buy a new issue through an auction or you buy an existing bond on the secondary market, or whether you hold to maturity or you sell before maturity on the secondary market. Buy or sell to your heart’s content when you’re in a tax-advantaged account. See How To Buy Treasury Bills & Notes Without Fee at Online Brokers and How to Buy Treasury Bills & Notes On the Secondary Market.

Tax treatments are different only when you buy Treasuries outside tax-advantaged accounts.

Hold Treasury Bills to Maturity

Taxes outside tax-advantaged accounts are also easy if you only buy Treasury Bills and hold them to maturity.

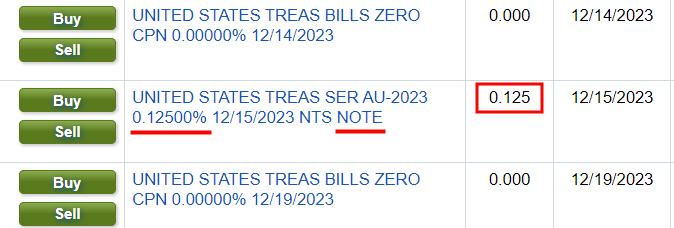

We’re talking about strictly Treasury Bills here. A Treasury Bill has no “coupon,” which means it doesn’t pay any interest while you hold it. A Treasury note with a coupon that was issued some time ago but now has less than one year left to maturity isn’t really a Treasury Bill. The first and the third listings in the screenshot below are Treasury Bills. The middle one isn’t.

Treasury Bills are sold at a discount to the face value. The difference between the purchase price and the face value you receive at maturity is your interest. It doesn’t matter whether you buy Treasury Bills as a new issue at a Treasury auction or on the secondary market as long as you hold them to maturity. Taxes are simple because the purchase price is the only variable.

Your broker will include the difference between the purchase price and the face value as interest on a 1099-INT form. If you buy at TreasuryDirect, make sure to download the 1099-INT form from TreasuryDirect. The specific field on the 1099-INT form says it’s exempt from state and local taxes. Your tax software will calculate both federal and state taxes automatically after you enter the 1099-INT form.

Through a Mutual Fund or an ETF

Buying Treasuries through a mutual fund or an ETF in a regular taxable brokerage account also doesn’t make your taxes too complicated. The dividends from the mutual fund or ETF will be included on a 1099-DIV form. If you sell shares in a mutual fund or an ETF for a capital gain or loss, it will be included on a 1099-B form.

These tax forms aren’t new. You will have them when you buy or sell other mutual funds or ETFs as well. Your tax software will automatically handle the federal taxes without any additional steps.

Extra Step for State Taxes

The extra wrinkle is in state taxes. You’ll need to get a report from the fund manager on what percentage of the fund’s income came from Treasuries. That portion is exempt from state and local taxes. It takes an extra step but it’s not that difficult. Please read how to do that in State Tax-Exempt Treasury Interest from Mutual Funds and ETFs.

Maturity Choices

Buying through a mutual fund or an ETF doesn’t mean that you’re buying long-term Treasuries. You have many choices in funds that invest in different maturities. Choose a fund that only invests in short-term Treasuries if you only want short maturities. Choose a fund that only invests in TIPS if you only want TIPS. The expense ratio is very low in many funds and ETFs.

| TIPS | Mutual Fund or ETF |

|---|---|

| Short-Term | iShares 0-5 Year TIPS Bond ETF (STIP) Vanguard Short-Term Inflation-Protected Securities ETF (VTIP) Vanguard Short-Term Inflation-Protected Securities Index Fund (VTAPX) |

| Broad-Term | Fidelity Inflation-Protected Bond Index Fund (FIPDX) Schwab Treasury Inflation Protected Securities Index Fund (SWRSX) Schwab U.S. TIPS ETF (SCHP) Vanguard Total Inflation-Protected Securities ETF (VTP) Vanguard Inflation-Protected Securities Fund Admiral Shares (VAIPX) |

| Long-Term | PIMCO 15+ Year U.S. TIPS Index ETF (LTPZ) |

With so many choices in funds and ETFs at a very low cost, you really don’t need to get into individual Treasury notes and bonds unless you must withdraw in a short period on a preset schedule or you just prefer the psychological comfort. See Two Types of Bond Ladder: When to Replace a Bond Fund or ETF.

Hold New-Issue Treasury Notes and Bonds to Maturity

New-issue Treasury Notes and Bonds bought at a Treasury auction and held to maturity are a little more complicated, but they’re still not too bad in terms of tax complexity.

Buying at a Treasury auction doesn’t mean you must use TreasuryDirect. You can buy new issues at a Treasury auction in your brokerage account through Fidelity, Charles Schwab, Vanguard, or E*Trade with no fee whatsoever. See How To Buy Treasury Notes Without Fee at Online Brokers.

Avoid Reopenings

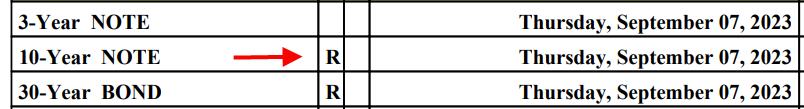

Not all Treasury Notes and Bonds sold at an auction are true new issues though. Some Treasury auctions are reopenings. A reopening happens when the government sells additional quantities of a bond that was already issued some time ago. The tax treatment of buying a reopening is the same as buying on the secondary market, which is more complicated than the tax treatment of buying a true new issue.

Reopenings are marked with the letter “R” in Treasury’s auction schedule. Avoid reopenings if you’d like to keep your taxes simple.

The price of a true new issue from a Treasury auction will be at a slight discount to the face value. You’ll handle this small discount when the bond matures. Treasury Notes and Bonds pay interest every six months. Your broker will report these interest payments in the right place on a 1099-INT form. Your tax software will automatically calculate both federal and state taxes.

Accrued Interest

Usually there’s zero accrued interest on a true new issue. If there is any, it’s very small. The small accrued interest doesn’t show up on the 1099 form. It’s only in the 1099 supplement. You’re allowed to add a negative entry for the accrued interest to offset the coupon payments, but because it’s small, it’s not a big deal even if you don’t know how to do it or you simply forget.

Hold New-Issue TIPS to Maturity

TIPS adds a little more complexity than regular Treasury Notes and Bonds because TIPS receives both interest payments and inflation adjustments. It’s still not too bad if you stay with true new issues (avoid reopenings) and you hold them to maturity.

In addition to the 1099-INT form, the inflation adjustment will be on a 1099-OID form. It’s one extra form, but your tax software knows how to handle it.

Similar to regular Treasuries, the price of a true new issue TIPS from a Treasury auction will be at a slight discount to the face value. You’ll handle this small discount when the bond matures.

A true new issue TIPS has only a small amount of accrued interest. You’ll find it in the 1099 supplement and add a negative entry on your tax return to offset the interest. It’s not a big deal if you can’t figure out how to do it or you simply forget.

Buying a TIPS reopening at a Treasury auction is the same as buying on the secondary market in terms of taxes. It’s more complicated than buying a true new issue.

Sell Treasury Bills Before Maturity

Selling Treasury Bills before maturity adds one variable to the otherwise simple tax treatment of holding them to maturity. Now you can have both interest and a capital gain. Please note we’re still only talking about Treasury Bills that don’t have a coupon. It’s more complicated if you sell a Treasury note, bond, or TIPS that has a coupon.

The concept goes like this. If you bought $10,000 worth of a 13-week Treasury Bill for $9,865, you were supposed to earn $135 in interest in 91 days by holding it to maturity. Suppose you sold it for $9,957 after holding it for 60 days, you do a linear proration to calculate the prorated interest:

( $10,000 – $9,865 ) / 91 * 60 = $89

The difference between the amount you paid and the amount you received was:

$9,957 – $9,865 = $92

Because this is more than the prorated interest, the excess amount is a capital gain.

$92 – $89 = $3

If the difference was less than the prorated interest, then the entire amount is interest income.

You’ll have to calculate this split between interest and capital gain yourself if your broker doesn’t do it for you. If your broker reports the difference between your purchase amount and your sale amount as 100% interest or 100% capital gain on the 1099 form, you’ll have to correct it on your tax return.

You have this complexity from selling before maturity. You can avoid it if you hold your Treasury Bills to maturity. If you must sell something before maturity though, sell Treasury Bills. It’s still simpler than selling bonds with a coupon before maturity.

Buy or Sell on the Secondary Market

The more complicated tax treatment comes from buying or selling Treasury notes or bonds with a coupon on the secondary market (including buying a reopening through an auction).

The current market rate can be quite different from the coupon rate of an existing bond. This results in a large discount or premium in the price. The large discount or premium makes taxes more complicated. Buying or selling on the secondary market often involves paying or receiving a meaningful amount of accrued interest, which you must also handle on the tax return.

How to handle these complexities is beyond the scope of this already long post. If you can help it, for the sake of keeping your taxes simple in a taxable account, don’t buy Treasury notes or bonds with a coupon on the secondary market, don’t buy them in a reopening, and don’t sell them on the secondary market. Use the secondary market only for Treasury Bills. If you must do those things, do them in a tax-advantaged account.

***

Taxes on Treasuries get progressively more complicated as you move down the list. Learn to walk before you run.

1. Do everything in tax-advantaged accounts. No tax worries there.

2. Buy some Treasury Bills and hold them to maturity. That’s easy too.

3. Use a fund or an ETF. Not too bad there.

4. If you want longer maturities in individual Treasuries (including TIPS) in a regular taxable account, only buy true new issues in an auction, avoid reopenings, and hold them to maturity.

5. Finally, if you must sell something before maturity in a regular taxable account, only sell Treasury Bills.

That’s as far as I would go. Any more complications aren’t worth it to me.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Nicole says

In the case of “Sell Treasury Bills Before Maturity”, does Fidelity calculate the split between interest and capital gain/loss for us or do we have to correct it?

Harry Sit says

I’m not sure how Fidelity reports it. I did a test by selling some Treasury Bills. I’ll find out next year when I get the 1099 forms.

BRENT RUFENACHT says

Another valuable post.

Thank you

Sharon says

Thank you for this post.

Ann says

Thanks for the post, very helpful! Of course I have already broken rules 1 and 4, but at least I know what to look out for 😉

Brad says

I’m curious if most (many, few?) CPAs know these corrections issues if the broker reports them wrong (or omits that detail—or if in fact the brokers simply don’t have the info to report it in a helpful way):

“You’ll have to calculate this split between interest and capital gain/loss yourself if your broker doesn’t do it for you. If your broker reports the difference between your purchase price and your sale price as 100% interest or 100% capital gain/loss on the 1099 form, you’ll have to correct it on your tax return.”

I get that you’re mainly doing your own taxes Harry, but if you happen to have a preparer or CPA look over your taxes in 2024, curious if they’re educated enough to ask the right questions so all of that is dealt with. Thanks for another great post! (I myself do a lot of things for the avoidance of complications at tax time, even though I do have an inexpensive preparer file mine (to avoid needing to rep myself in an audit situation mainly). For example I never reinvest dividends/cap gains in my taxable accounts, just to reduce all the fractional share purchases; though I do it regularly for tax-advantaged retirement accounts.)

Cheers!

Harry Sit says

I suspect that most preparers just use the numbers on the 1099 form as the broker reported. They don’t have any reason to question those numbers unless the client also supplies a spreadsheet to point out the necessary corrections. I doubt that many preparers will dig into the transaction details to double-check the broker’s numbers. I get the impression that most preparers are super busy in the tax season. They’re not getting paid enough to go beyond the 1099’s.

SunAL says

Excellent content, but might be worth expanding on how to handle T-Note/T-bond tax complications in the year of maturation/redemption and TIPS in the year of maturation/redemption in the two case scenarios: purchase as new issue, primary auction and purchase in reopening auction. A nice chart covering what type of 1099 form (B, OID, INT, DIV, etc.) broker should send you each year prior to redemption/maturation with the boxes containing relevant numbers and relevant 1099 form and boxes in year of redemption/maturation might clarify your discussion. Then any added complexities of secondary market purchases even if held to maturity for T Notes/T Bonds and TIPS might be clarified too. What specific numbers need to be considered as tax complication in the year of maturity/redemption that may not appear in the years prior to redemption/maturity when purchased at primary auction versus reopening auction? for T-Notes as opposed to TIPS? Thanks for your thoughtful and excellent work!