The previous post Opt Out of Underpayment Penalty in TurboTax covered how TurboTax calculates an underpayment penalty that the IRS may not actually assess. You have to take an extra step to decline the penalty calculated by TurboTax. Here’s another example of TurboTax providing unwanted help that requires work to reverse.

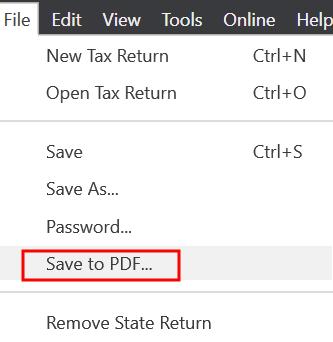

Print or Save to PDF

When you’re done entering everything into TurboTax, it’s a good idea to print the tax forms or create a PDF file with all the forms as a draft. You should review the forms carefully and compare them with the previous year before you file. After you review everything and e-file, you should save the final filing to a PDF file for your records. TurboTax download software has a handy menu option for that: File -> Save to PDF.

Estimated Tax Payment Vouchers

TurboTax automatically includes 4 filled-out estimated tax payment vouchers (Form 1040-ES) when you print or save a PDF. This confuses many people. Most people pay their taxes during the year through withholding. Having the estimated tax payment vouchers printed out or included in the PDF doesn’t mean you must pay estimated taxes now.

The estimated tax payment vouchers are also a relic of the past. Even if you’re required to pay estimated taxes, sending a check with those vouchers by snail mail isn’t the best way to do it anyway. You’re better off paying electronically on the IRS website using either Direct Pay or EFTPS.

Direct Pay doesn’t require setting up an account but you have to verify your identity and enter your bank information every time. EFTPS requires setting up an account but subsequent payments are easier and faster. I use EFTPS.

When you use Direct Pay or ETFPS, you get a confirmation from the IRS of your payment immediately and you know that the payment will be credited to your account accurately. You have more chances of delay and errors if you send a check by mail with one of those estimated tax payment vouchers.

Exclude from Print or PDF

Having estimated tax payment vouchers printed out confuses you. Having them included in your tax filing PDF clutters up your file. If you’d like to avoid confusion, here’s how you can stop TurboTax download software from including them.

Click on Forms on the top right.

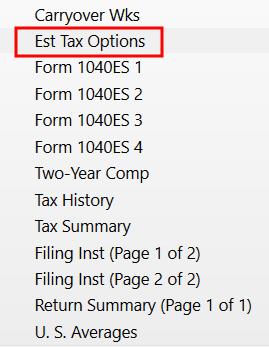

Scroll down and click on “Est Tax Options” near the bottom of the list of forms on the left.

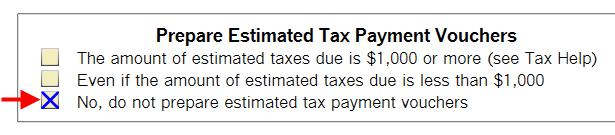

Scroll down on the right to find the heading “Prepare Estimated Tax Payment Vouchers” in the middle of the form. Check the option “No, do not prepare estimated tax payment vouchers.”

Click on Step-by-Step on the top right to get back to where you were.

Now save to PDF or print your forms. It won’t have those useless estimated tax payment vouchers.

Learn the Nuts and Bolts

I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.

Scott Henry says

Harry,

This post was very helpful. I was not aware of the EFTPS payment. I just started the enrollment process. This will make future tax payments quick and easy.

MikeS says

Thanks for the great tips on TurboTax. I would love to see some info on using the What-If abilities that I’ve read about.

Harry Sit says

Thank you for the suggestion. I’ll write about the What-If worksheet shortly.

Paul D says

Be careful with the What-If Worksheet, it does not calculate credits correctly when comparing MFJ and MFS.

Autumn says

Thanks. Those vouchers in the PDF annoy me but I never thought of finding a way to exclude them.

James says

I absolutely love the ES Vouchers. I’ve been using them for over 15 years, but … I calculate my irregular income, so I would save a lot of White Out, if TT would let me print them with name/address stuff, even if my amounts are zero or blank — same for CA.

Laura says

Note that on the linked EFPTS page the box says “ Business Tax Payment”. But if you continue, it will give you an option for individual tax payments.

Harry Sit says

Thank you for the note. I edited the link to EFTPS to make it more clear.

RobI says

Is there a way to get rid of draft W-4 forms created by TurboTax? I don’t have W-4 income but somehow the estimated tax estimator part of Turbotax generated them anyway.

Harry Sit says

Click on Forms on the top right. If you see the draft W-4 form in the list of forms in the left panel, click on it. There’s a Delete Form button on the bottom left of the right panel.

Paula says

I sent my federal and state tax by E-file..after i paid by CC for my Federal taxes. I printed both files.. out came these 1040 V .. I don’t recall requesting these vouchers and I am not going to use them . I hope there are no penalties for this because it should be my say when I’m ready to pay my taxes at the end of the year I don’t need anyone to tell me I have to pay quarterly

Harry Sit says

Those vouchers weren’t included in your e-file. The IRS and the state don’t know you printed them. The vouchers only wasted some paper. You don’t have to use them.